Cogent (CCOI)

Cogent keeps us up at night. Its weak sales growth and declining returns on capital show its demand and profits are shrinking.― StockStory Analyst Team

1. News

2. Summary

Why We Think Cogent Will Underperform

Operating a massive network spanning 20,000 miles of fiber optic cable and connecting to over 3,200 buildings worldwide, Cogent Communications (NASDAQ:CCOI) provides high-speed Internet access, private network services, and data center colocation to businesses and bandwidth-intensive organizations across 54 countries.

- Performance over the past five years shows its incremental sales were much less profitable, as its earnings per share fell by 42.4% annually

- Historical adjusted operating margin losses point to an inefficient cost structure

- Short cash runway increases the probability of a capital raise that dilutes existing shareholders

Cogent is skating on thin ice. You should search for better opportunities.

Why There Are Better Opportunities Than Cogent

Why There Are Better Opportunities Than Cogent

Cogent is trading at $18.35 per share, or 9.6x forward EV-to-EBITDA. Cogent’s valuation may seem like a bargain, especially when stacked up against other business services companies. We remind you that you often get what you pay for, though.

It’s better to pay up for high-quality businesses with higher long-term earnings potential rather than to buy lower-quality stocks because they appear cheap. These challenged businesses often don’t re-rate, a phenomenon known as a “value trap”.

3. Cogent (CCOI) Research Report: Q4 CY2025 Update

Internet service provider Cogent Communications (NASDAQ:CCOI) missed Wall Street’s revenue expectations in Q4 CY2025, with sales falling 4.7% year on year to $240.5 million. Its GAAP loss of $0.64 per share was 34.1% above analysts’ consensus estimates.

Cogent (CCOI) Q4 CY2025 Highlights:

- Revenue: $240.5 million vs analyst estimates of $243.5 million (4.7% year-on-year decline, 1.2% miss)

- EPS (GAAP): -$0.64 vs analyst estimates of -$0.97 (34.1% beat)

- Adjusted EBITDA: $76.74 million vs analyst estimates of $77.32 million (31.9% margin, 0.7% miss)

- Operating Margin: -4.7%, up from -13% in the same quarter last year

- Free Cash Flow was -$43.02 million compared to -$31.57 million in the same quarter last year

- Total Connections: 117.6 million

- Market Capitalization: $1.25 billion

Company Overview

Operating a massive network spanning 20,000 miles of fiber optic cable and connecting to over 3,200 buildings worldwide, Cogent Communications (NASDAQ:CCOI) provides high-speed Internet access, private network services, and data center colocation to businesses and bandwidth-intensive organizations across 54 countries.

Cogent's network is specifically designed for transmitting packet-routed data, making it ideal for businesses requiring reliable, high-capacity internet connections. The company offers services at speeds ranging from 100 megabits per second up to 400 gigabits per second, depending on customer needs.

The company serves three main customer segments. Corporate customers, typically small and medium-sized businesses located in multi-tenant office buildings, purchase dedicated internet access and private network services. Net-centric customers are bandwidth-intensive users like content delivery networks, web hosting companies, and application providers that need robust connectivity to deliver their services. Enterprise customers, often Fortune 500 companies, use Cogent's services for wide area networks connecting dozens or hundreds of locations.

For example, a media streaming company might use Cogent's high-capacity connections to ensure viewers can access content without buffering, while a law firm might rely on Cogent's services for secure, reliable access to cloud-based document management systems.

Cogent's infrastructure includes metropolitan optical networks, inter-city transport facilities, and data centers. The company owns and operates 68 data centers across the United States and Europe, offering not just connectivity but also rack space and power for customers' equipment. In 2023, Cogent significantly expanded its network by acquiring Sprint's long-haul fiber network, adding approximately 20,000 fiber miles and extending its reach to enterprise customers.

Cogent maintains its status as a Tier 1 Internet Service Provider (ISP), directly connecting with nearly 8,000 networks. This designation means Cogent can exchange traffic with other major ISPs on a settlement-free basis, reducing costs and improving network performance for its customers.

4. Terrestrial Telecommunication Services

Terrestrial telecommunication companies face an uphill battle, as they mostly sell into a deflationary market, where the price of moving a bit tends to decrease over time with better technology. Without dependable volume growth, revenue growth could be challenged. Unfortunately, broadband penetration in their core US market is quite high already. On the other hand, data consumption from streaming entertainment and 5G expansion could provide a floor on growth for the next number of years. As if that wasn't enough to worry about, competition is intense, with larger telecom providers and hyperscalers expanding their own networks.

Cogent Communications competes with major telecommunications providers like AT&T (NYSE:T), Verizon (NYSE:VZ), and Lumen Technologies (NYSE:LUMN), as well as specialized fiber network operators such as Zayo Group (private) and GTT Communications (private).

5. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $975.8 million in revenue over the past 12 months, Cogent is a small player in the business services space, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and numerous distribution channels. On the bright side, it can grow faster because it has more room to expand.

As you can see below, Cogent’s sales grew at an excellent 11.4% compounded annual growth rate over the last five years. This shows it had high demand, a useful starting point for our analysis.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. Cogent’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 1.8% over the last two years was well below its five-year trend.

This quarter, Cogent missed Wall Street’s estimates and reported a rather uninspiring 4.7% year-on-year revenue decline, generating $240.5 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 3% over the next 12 months, similar to its two-year rate. Although this projection indicates its newer products and services will catalyze better top-line performance, it is still below the sector average.

6. Operating Margin

Cogent’s high expenses have contributed to an average operating margin of negative 4.7% over the last five years. Unprofitable business services companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

Looking at the trend in its profitability, Cogent’s operating margin decreased by 30.6 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Cogent’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

In Q4, Cogent generated a negative 4.7% operating margin.

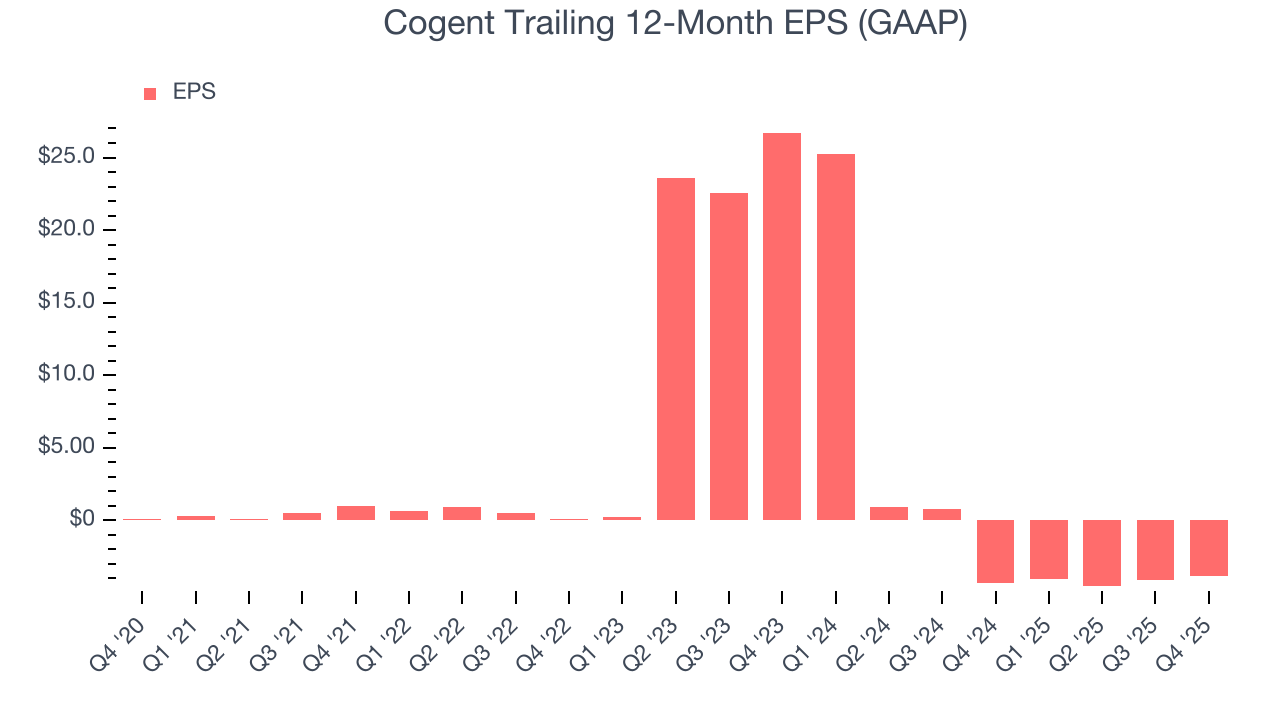

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Cogent, its EPS declined by 99.2% annually over the last five years while its revenue grew by 11.4%. This tells us the company became less profitable on a per-share basis as it expanded.

Diving into the nuances of Cogent’s earnings can give us a better understanding of its performance. As we mentioned earlier, Cogent’s operating margin expanded this quarter but declined by 30.6 percentage points over the last five years. Its share count also grew by 4%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Cogent, its two-year annual EPS declines of 46.4% show it’s still underperforming. These results were bad no matter how you slice the data.

In Q4, Cogent reported EPS of negative $0.64, up from negative $0.91 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Cogent to improve its earnings losses. Analysts forecast its full-year EPS of negative $3.82 will advance to negative $3.59.

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Cogent’s demanding reinvestments have drained its resources over the last five years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 7.7%, meaning it lit $7.70 of cash on fire for every $100 in revenue.

Taking a step back, we can see that Cogent’s margin dropped by 37.3 percentage points during that time. Almost any movement in the wrong direction is undesirable because it is already burning cash. If the trend continues, it could signal it’s becoming a more capital-intensive business.

Cogent burned through $43.02 million of cash in Q4, equivalent to a negative 17.9% margin. The company’s cash burn was similar to its $31.57 million of lost cash in the same quarter last year.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Although Cogent hasn’t been the highest-quality company lately because of its poor bottom-line (EPS) performance, it historically found a few growth initiatives that worked out well. Its five-year average ROIC was 19%, impressive for a business services business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Cogent’s ROIC has decreased significantly over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

10. Balance Sheet Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Cogent burned through $198.1 million of cash over the last year, and its $2.06 billion of debt exceeds the $205.1 million of cash on its balance sheet. This is a deal breaker for us because indebted loss-making companies spell trouble.

Unless the Cogent’s fundamentals change quickly, it might find itself in a position where it must raise capital from investors to continue operating. Whether that would be favorable is unclear because dilution is a headwind for shareholder returns.

We remain cautious of Cogent until it generates consistent free cash flow or any of its announced financing plans materialize on its balance sheet.

11. Key Takeaways from Cogent’s Q4 Results

It was good to see Cogent beat analysts’ EPS expectations this quarter. On the other hand, its revenue slightly missed. Overall, we think this was a mixed quarter. Investors were likely hoping for more, and shares traded down 1.7% to $25.86 immediately following the results.

12. Is Now The Time To Buy Cogent?

Updated: February 23, 2026 at 11:53 PM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own Cogent, you should also grasp the company’s longer-term business quality and valuation.

We cheer for all companies making their customers lives easier, but in the case of Cogent, we’ll be cheering from the sidelines. Although its revenue growth was impressive over the last five years, it’s expected to deteriorate over the next 12 months and its diminishing returns show management's prior bets haven't worked out. And while the company’s market-beating ROIC suggests it has been a well-managed company historically, the downside is its projected EPS for the next year is lacking.

Cogent’s EV-to-EBITDA ratio based on the next 12 months is 9.6x. This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think there are better opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $26.64 on the company (compared to the current share price of $18.35).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.