CDW (CDW)

We’re wary of CDW. Its weak sales growth and declining returns on capital show its demand and profits are shrinking.― StockStory Analyst Team

1. News

2. Summary

Why We Think CDW Will Underperform

Serving as a crucial bridge between technology manufacturers and end users since 1984, CDW (NASDAQ:CDW) is a multi-brand provider of information technology solutions that helps businesses and public sector organizations select, implement, and manage hardware, software, and IT services.

- Estimated sales growth of 1.7% for the next 12 months is soft and implies weaker demand

- Annual sales growth of 4.1% over the last five years lagged behind its business services peers as its large revenue base made it difficult to generate incremental demand

- On the plus side, its enormous revenue base of $22.1 billion provides significant distribution advantages

CDW is in the penalty box. We’re looking for better stocks elsewhere.

Why There Are Better Opportunities Than CDW

High Quality

Investable

Underperform

Why There Are Better Opportunities Than CDW

CDW’s stock price of $126.08 implies a valuation ratio of 12.5x forward P/E. This multiple is cheaper than most business services peers, but we think this is justified.

Cheap stocks can look like great bargains at first glance, but you often get what you pay for. These mediocre businesses often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. CDW (CDW) Research Report: Q4 CY2025 Update

IT solutions provider CDW (NASDAQGS:CDW) reported Q4 CY2025 results beating Wall Street’s revenue expectations, with sales up 6.3% year on year to $5.51 billion. Its non-GAAP profit of $2.57 per share was 5.1% above analysts’ consensus estimates.

CDW (CDW) Q4 CY2025 Highlights:

- Revenue: $5.51 billion vs analyst estimates of $5.34 billion (6.3% year-on-year growth, 3.1% beat)

- Adjusted EPS: $2.57 vs analyst estimates of $2.44 (5.1% beat)

- Operating Margin: 7.8%, in line with the same quarter last year

- Free Cash Flow Margin: 7.2%, up from 6.1% in the same quarter last year

- Market Capitalization: $16.43 billion

Company Overview

Serving as a crucial bridge between technology manufacturers and end users since 1984, CDW (NASDAQ:CDW) is a multi-brand provider of information technology solutions that helps businesses and public sector organizations select, implement, and manage hardware, software, and IT services.

CDW operates as a technology advisor and procurement partner for organizations of all sizes. The company doesn't manufacture products itself but instead curates offerings from over 1,000 technology vendors—including industry giants like Microsoft, Cisco, Dell, and Apple—and helps customers navigate the complex landscape of IT options to find solutions that fit their specific needs.

The company's customer base spans across private businesses, government agencies, educational institutions, and healthcare organizations throughout the United States, United Kingdom, and Canada. When a school district needs to deploy laptops for students, a hospital requires secure data storage solutions, or a corporation wants to upgrade its network infrastructure, CDW's specialists help design appropriate solutions, source the necessary components, and often assist with implementation.

For example, a mid-sized manufacturing company looking to improve cybersecurity might work with CDW to assess vulnerabilities, select appropriate security software and hardware from multiple vendors, and implement a comprehensive protection system that integrates with their existing infrastructure.

CDW's business model generates revenue primarily through the sale of products and services. The company is organized into segments serving different markets: Corporate (serving U.S. businesses), Small Business, Public (government, education, and healthcare), and international operations in the UK and Canada. This segmentation allows CDW to develop specialized expertise in each sector's unique technology needs and regulatory requirements.

Beyond simply selling products, CDW provides value-added services including solution design, implementation support, and ongoing management. The company has thousands of technical specialists and engineers who help customers integrate various technologies, migrate to cloud environments, and optimize their IT operations.

4. IT Distribution & Solutions

IT Distribution & Solutions will be buoyed by the increasing complexity of IT ecosystems, rising cloud adoption, and demand for cybersecurity solutions. Enterprises are less likely than ever to embark on these complicated journeys solo, and companies in the sector boast expertise and scale in these areas. However, cloud migration also means less need for hardware, which could dent demand for large portions of the product portfolio and hurt margins. Additionally, planning for potentially supply chain disruptions is ongoing, as the COVID-19 pandemic showed how damaging a pause in global trade could be in areas like semiconductor procurement.

CDW's competitors include other IT solutions providers and value-added resellers such as Insight Enterprises (NASDAQ:NSIT), Connection (NASDAQ:CNXN), and SHI International, as well as direct sales from major technology manufacturers and cloud service providers like Dell Technologies (NYSE:DELL) and Microsoft (NASDAQ:MSFT).

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $22.42 billion in revenue over the past 12 months, CDW is a behemoth in the business services sector and benefits from economies of scale, giving it an edge in distribution. This also enables it to gain more leverage on its fixed costs than smaller competitors and the flexibility to offer lower prices. However, its scale is a double-edged sword because finding new avenues for growth becomes difficult when you already have a substantial market presence. To expand meaningfully, CDW likely needs to tweak its prices, innovate with new offerings, or enter new markets.

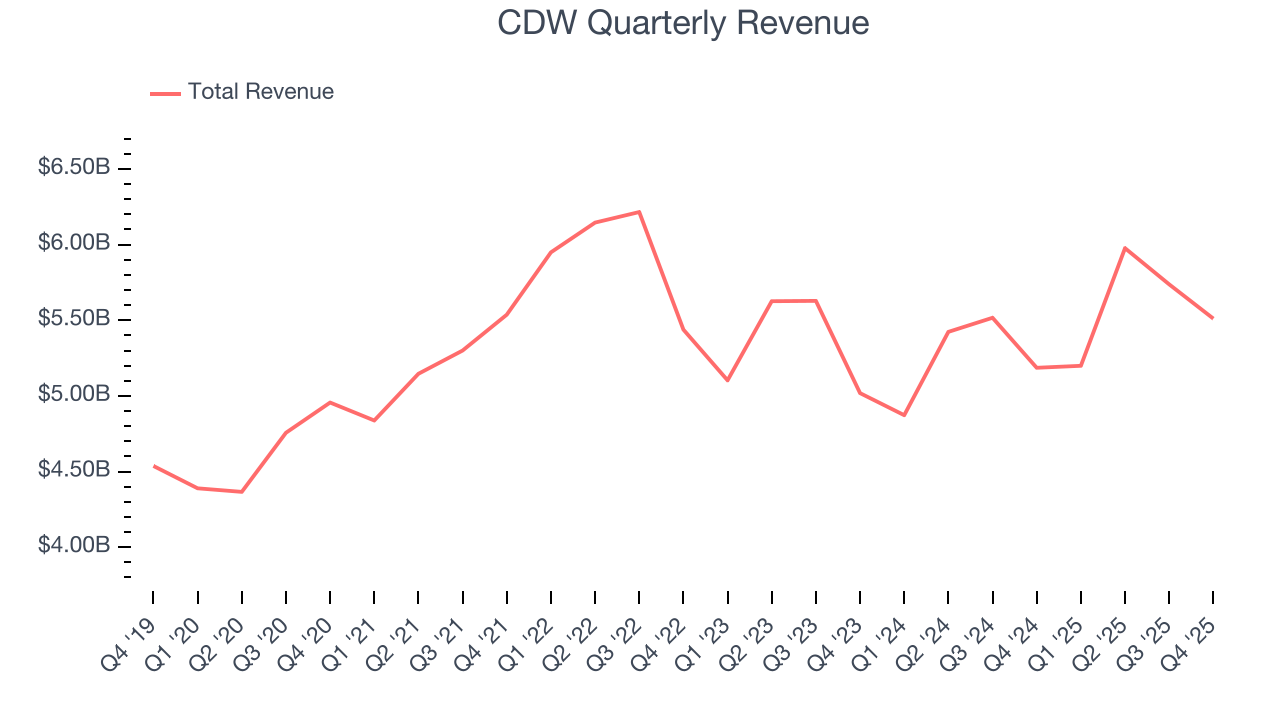

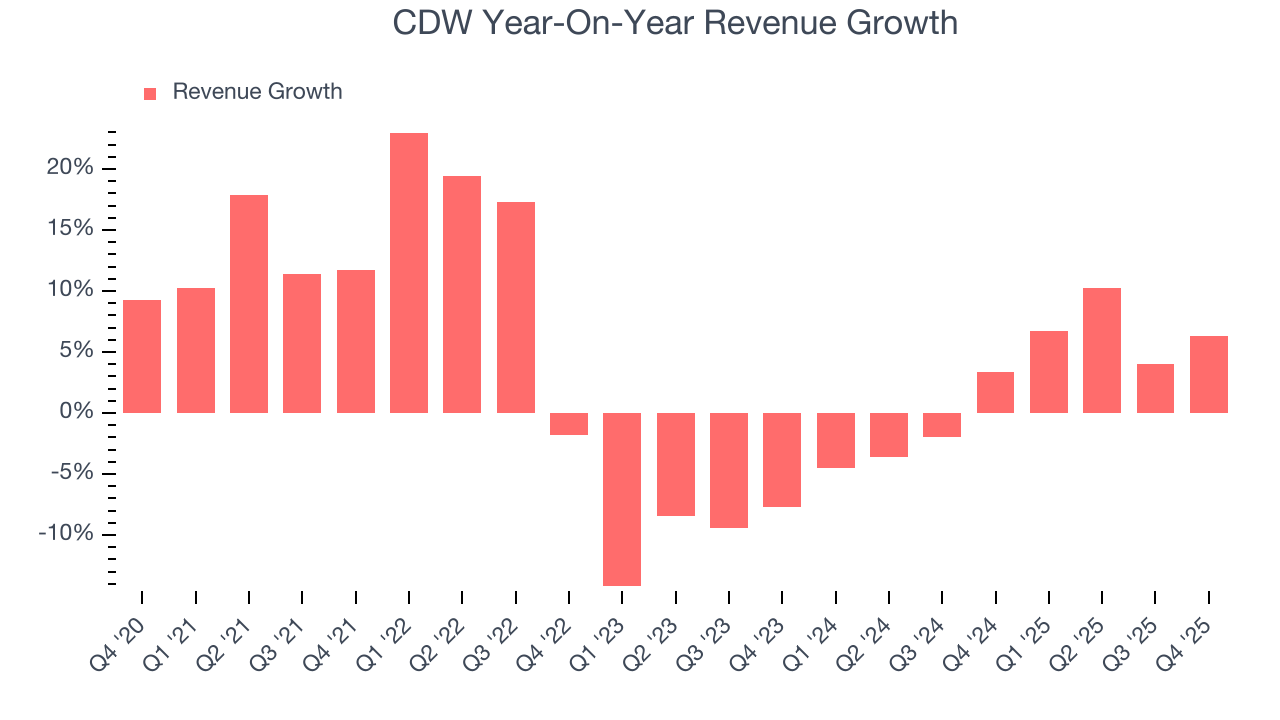

As you can see below, CDW’s 4% annualized revenue growth over the last five years was tepid. This shows it failed to generate demand in any major way and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. CDW’s recent performance shows its demand has slowed as its annualized revenue growth of 2.4% over the last two years was below its five-year trend.

This quarter, CDW reported year-on-year revenue growth of 6.3%, and its $5.51 billion of revenue exceeded Wall Street’s estimates by 3.1%.

Looking ahead, sell-side analysts expect revenue to grow 1.6% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and implies its newer products and services will not lead to better top-line performance yet.

6. Operating Margin

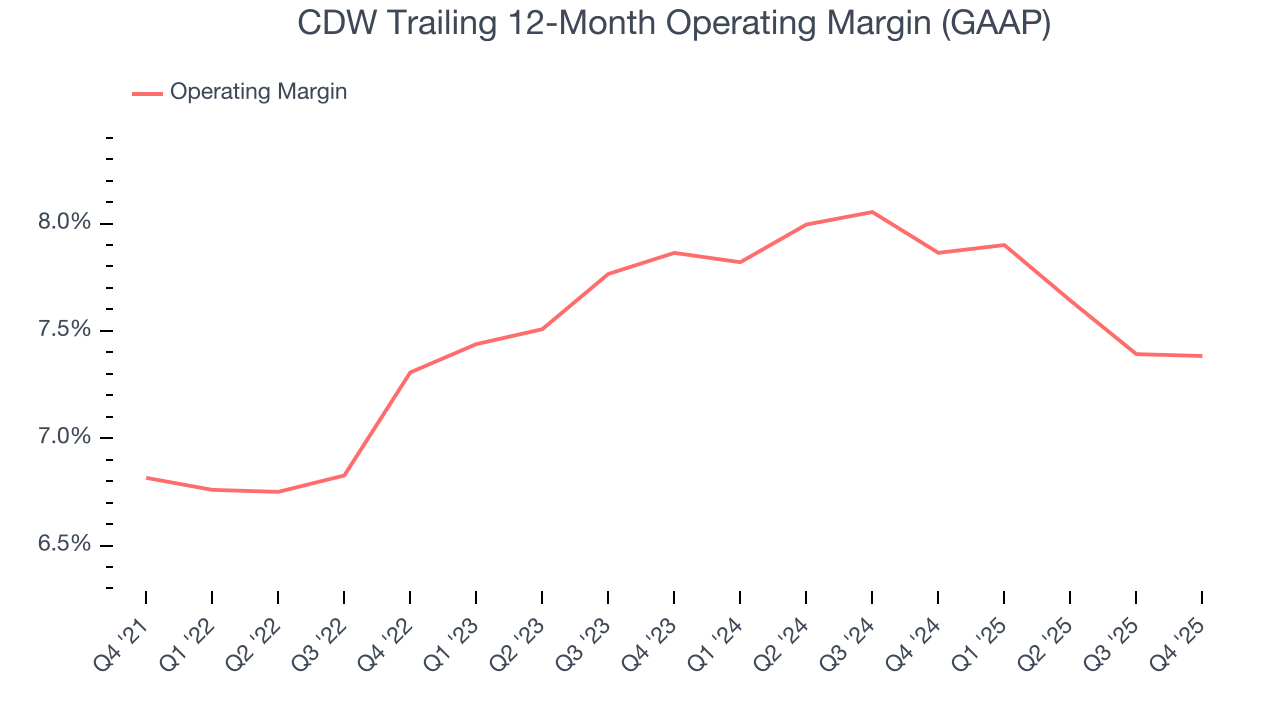

CDW’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 7.4% over the last five years. This profitability was paltry for a business services business and caused by its suboptimal cost structure.

Looking at the trend in its profitability, CDW’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q4, CDW generated an operating margin profit margin of 7.8%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

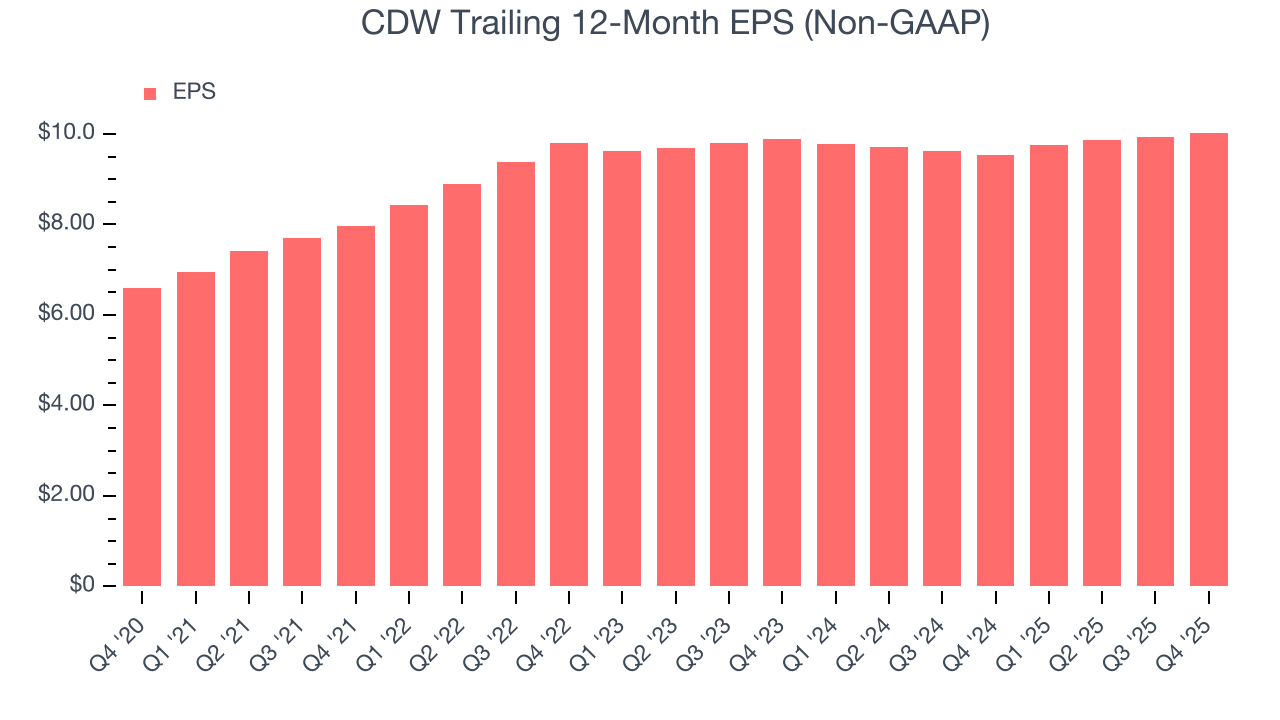

CDW’s EPS grew at a decent 8.8% compounded annual growth rate over the last five years, higher than its 4% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For CDW, EPS didn’t budge over the last two years, a regression from its five-year trend. We hope it can revert to earnings growth in the coming years.

In Q4, CDW reported adjusted EPS of $2.57, up from $2.48 in the same quarter last year. This print beat analysts’ estimates by 5.1%. Over the next 12 months, Wall Street expects CDW’s full-year EPS of $10.03 to grow 4.8%.

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

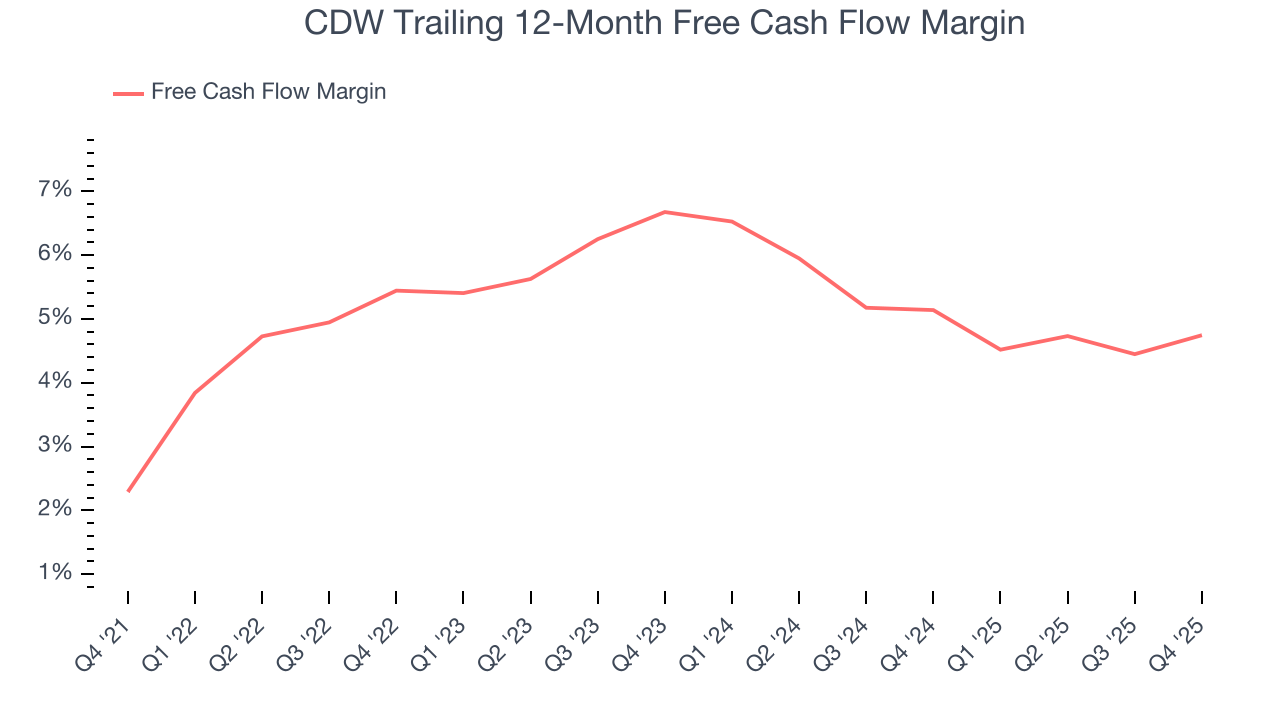

CDW has shown mediocre cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 4.9%, subpar for a business services business.

Taking a step back, an encouraging sign is that CDW’s margin expanded by 2.5 percentage points during that time. The company’s improvement shows it’s heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability was flat.

CDW’s free cash flow clocked in at $395.9 million in Q4, equivalent to a 7.2% margin. This result was good as its margin was 1.1 percentage points higher than in the same quarter last year, building on its favorable historical trend.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

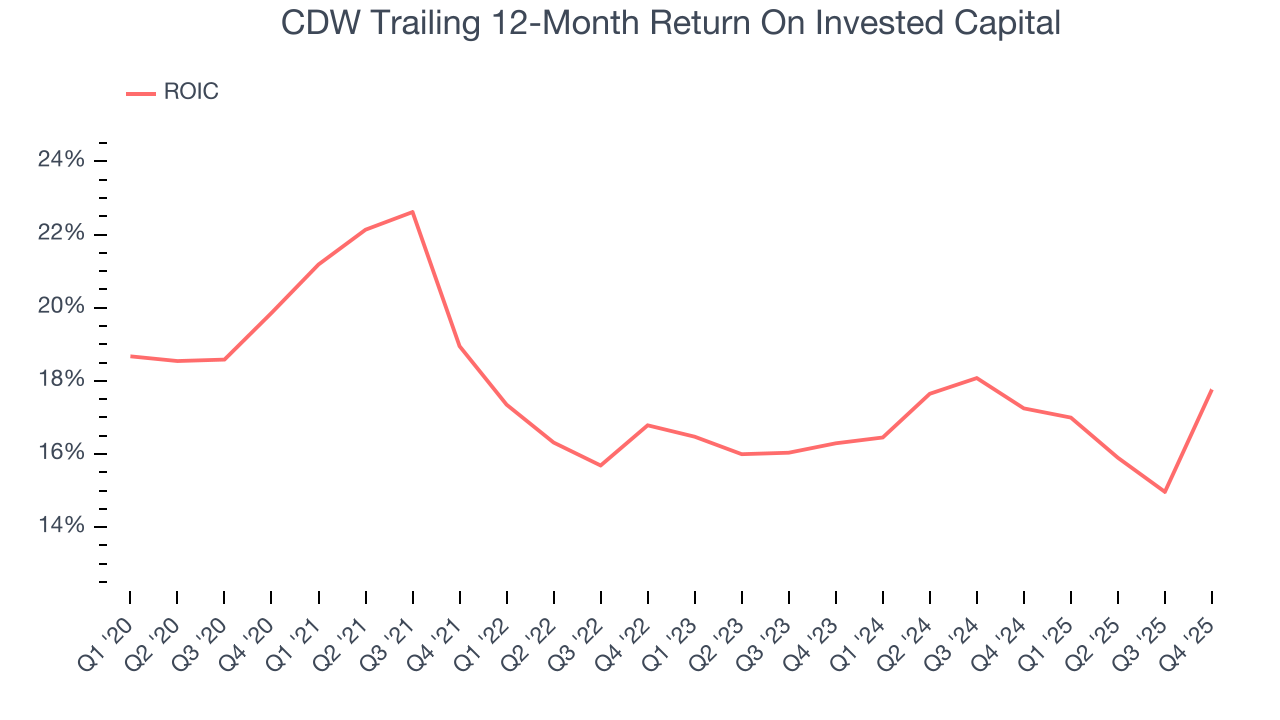

Although CDW hasn’t been the highest-quality company lately, it historically found a few growth initiatives that worked out well. Its five-year average ROIC was 17.4%, impressive for a business services business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Uneventfully, CDW’s ROIC has stayed the same over the last few years. Given the company’s underwhelming financial performance in other areas, we’d like to see its returns improve before recommending the stock.

10. Key Takeaways from CDW’s Q4 Results

We enjoyed seeing CDW beat analysts’ revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Overall, we think this was a solid quarter with some key areas of upside. The stock traded up 5% to $132.52 immediately after reporting.

11. Is Now The Time To Buy CDW?

Updated: February 4, 2026 at 8:14 AM EST

When considering an investment in CDW, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

CDW’s business quality ultimately falls short of our standards. To begin with, its revenue growth was uninspiring over the last five years, and analysts expect its demand to deteriorate over the next 12 months. And while CDW’s scale makes it a trusted partner with negotiating leverage, its operating margins are low compared to other business services companies.

CDW’s P/E ratio based on the next 12 months is 12x. This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're fairly confident there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $173.80 on the company (compared to the current share price of $132.52).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.