Celsius (CELH)

Celsius doesn’t excite us. Its low returns on capital raise concerns about its ability to deliver profits, a must for quality companies.― StockStory Analyst Team

1. News

2. Summary

Why Celsius Is Not Exciting

With its proprietary MetaPlus formula as the basis for key products, Celsius (NASDAQ:CELH) offers energy drinks that feature natural ingredients to help in fitness and weight management.

- Underwhelming 2.3% return on capital reflects management’s difficulties in finding profitable growth opportunities

- Smaller revenue base of $2.52 billion means it hasn’t achieved the economies of scale that some industry juggernauts enjoy

- A silver lining is that its market share has increased over the last three years as its 56.7% annual revenue growth was exceptional

Celsius’s quality doesn’t meet our hurdle. We’ve identified better opportunities elsewhere.

Why There Are Better Opportunities Than Celsius

Why There Are Better Opportunities Than Celsius

At $53.39 per share, Celsius trades at 33.5x forward P/E. Not only does Celsius trade at a premium to companies in the consumer staples space, but this multiple is also high for its fundamentals.

We prefer to invest in similarly-priced but higher-quality companies with superior earnings growth.

3. Celsius (CELH) Research Report: Q4 CY2025 Update

Energy drink company Celsius (NASDAQ:CELH) announced better-than-expected revenue in Q4 CY2025, with sales up 117% year on year to $721.6 million. Its non-GAAP profit of $0.26 per share was 36.9% above analysts’ consensus estimates.

Celsius (CELH) Q4 CY2025 Highlights:

- Revenue: $721.6 million vs analyst estimates of $636.1 million (117% year-on-year growth, 13.5% beat)

- Adjusted EPS: $0.26 vs analyst estimates of $0.19 (36.9% beat)

- Adjusted EBITDA: $134.1 million vs analyst estimates of $115.9 million (18.6% margin, 15.7% beat)

- Operating Margin: 3.6%, up from -5.6% in the same quarter last year

- Market Capitalization: $13.05 billion

Company Overview

With its proprietary MetaPlus formula as the basis for key products, Celsius (NASDAQ:CELH) offers energy drinks that feature natural ingredients to help in fitness and weight management.

The MetaPlus formulation includes natural ingredients such as green tea extract, ginger, and guarana seed. Backed by clinical studies, the company states that this combination can enhance thermogenesis, a process that boosts energy and your body's metabolic rate.

Combining the MetaPlus cocktail with athlete and fitness influencer partnerships as well as fun flavors like ‘Arctic Vibe’ and ‘Prickly Pear Lime’, Celsius targets younger, health-conscious individuals who have sworn off soda because of its sugar content and who may be skeptical of more established energy drinks. Fitness enthusiasts, athletes, and those seeking to maintain or lose weight are core customers.

Celsius products can be found in major grocery stores, convenience stores, fitness centers, and nutrition retailers. Popular online marketplaces such as Amazon (NASDAQ:AMZN) sell Celsius products, and the company has its own official e-commerce site, launched in 2015. Consumers can not only buy Celsius products on the site but can locate stores that sell products, learn about the science behind the drinks, or apply to be a brand ambassador (the more Instagram followers, the better!).

4. Beverages, Alcohol, and Tobacco

These companies' performance is influenced by brand strength, marketing strategies, and shifts in consumer preferences. Changing consumption patterns are particularly relevant and can be seen in the rise of cannabis, craft beer, and vaping or the steady decline of soda and cigarettes. Companies that spend on innovation to meet consumers where they are with regards to trends can reap huge demand benefits while those who ignore trends can see stagnant volumes. Finally, with the advent of the social media, the cost of starting a brand from scratch is much lower, meaning that new entrants can chip away at the market shares of established players.

Competitors that offer energy drinks or alternatives to energy drinks include Monster Beverage (NASDAQ:MNST), Rockstar Energy from PepsiCo (NASDAQ:PEP), and Coca-Cola Energy and Full Throttle from Coca-Cola (NYSE:KO).

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $2.52 billion in revenue over the past 12 months, Celsius carries some recognizable products but is a mid-sized consumer staples company. Its size could bring disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale. On the bright side, it can still flex high growth rates because it’s working from a smaller revenue base.

As you can see below, Celsius grew its sales at an incredible 56.7% compounded annual growth rate over the last three years. This is an encouraging starting point for our analysis because it shows Celsius’s demand was higher than many consumer staples companies.

This quarter, Celsius reported magnificent year-on-year revenue growth of 117%, and its $721.6 million of revenue beat Wall Street’s estimates by 13.5%.

Looking ahead, sell-side analysts expect revenue to grow 28.5% over the next 12 months, a deceleration versus the last three years. Still, this projection is commendable and indicates the market sees success for its products.

6. Gross Margin & Pricing Power

All else equal, we prefer higher gross margins because they usually indicate that a company sells more differentiated products, has a stronger brand, and commands pricing power.

Celsius has great unit economics for a consumer staples company, giving it ample room to invest in areas such as marketing and talent to grow its brand. As you can see below, it averaged an excellent 50.9% gross margin over the last two years. That means Celsius only paid its suppliers $49.13 for every $100 in revenue.

This quarter, Celsius’s gross profit margin was 47.4%, down 2.8 percentage points year on year. Zooming out, however, Celsius’s full-year margin has been trending up over the past 12 months, increasing by 1.1 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as manufacturing expenses).

7. Operating Margin

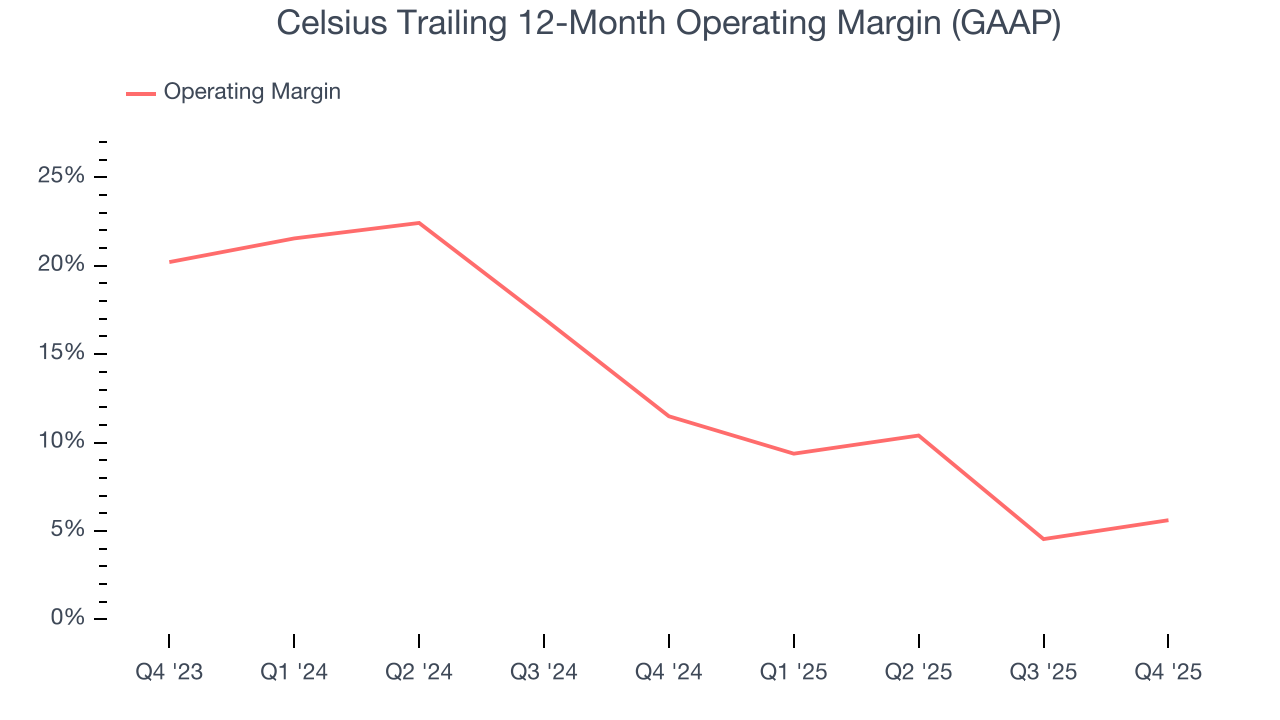

Celsius has done a decent job managing its cost base over the last two years. The company has produced an average operating margin of 7.7%, higher than the broader consumer staples sector.

Analyzing the trend in its profitability, Celsius’s operating margin decreased by 5.9 percentage points over the last year. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Celsius generated an operating margin profit margin of 3.6%, up 9.2 percentage points year on year. The increase was solid, and because its gross margin actually decreased, we can assume it was more efficient because its operating expenses like marketing, and administrative overhead grew slower than its revenue.

8. Earnings Per Share

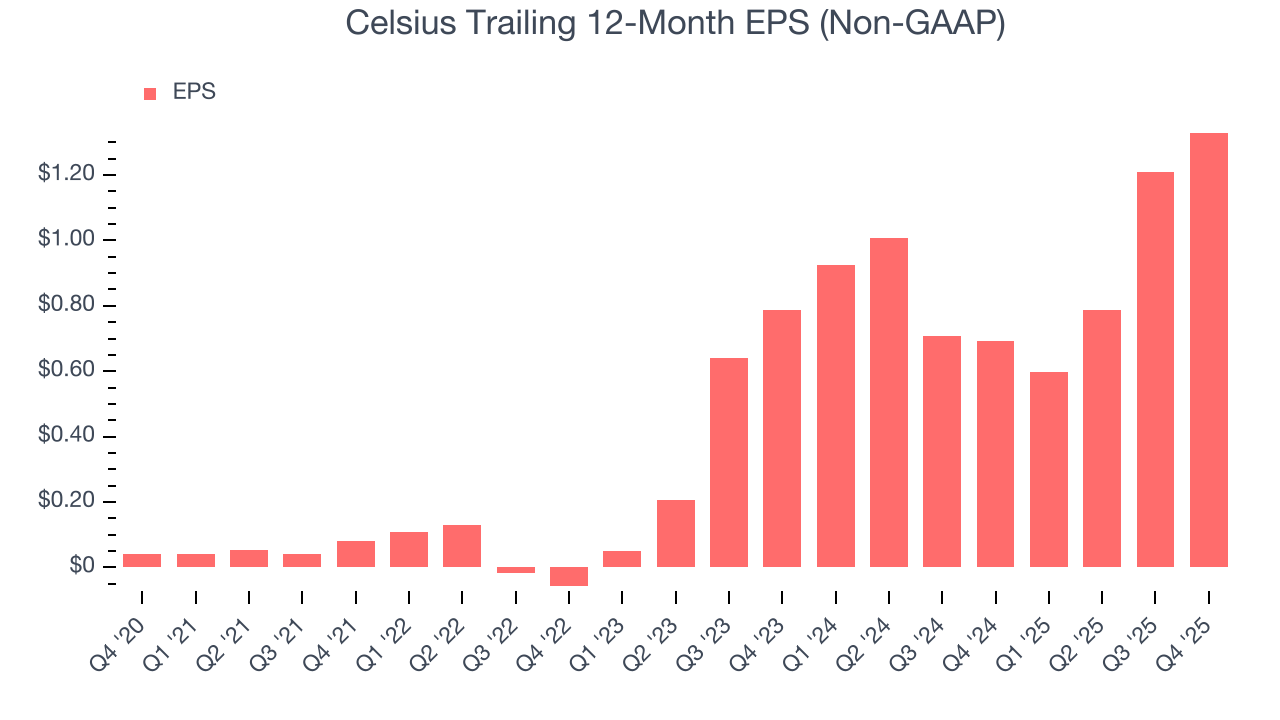

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Celsius’s full-year EPS flipped from negative to positive over the last three years. This is encouraging and shows it’s at a critical moment in its life.

In Q4, Celsius reported adjusted EPS of $0.26, up from $0.14 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Celsius’s full-year EPS of $1.33 to grow 16.4%.

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Celsius has shown terrific cash profitability, driven by its lucrative business model that enables it to reinvest, return capital to investors, and stay ahead of the competition. The company’s free cash flow margin was among the best in the consumer staples sector, averaging 22% over the last two years.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Although Celsius has shown solid fundamentals lately, it historically did a mediocre job investing in profitable growth initiatives. Its four-year average ROIC was 2.9%, lower than the typical cost of capital (how much it costs to raise money) for consumer staples companies.

11. Balance Sheet Assessment

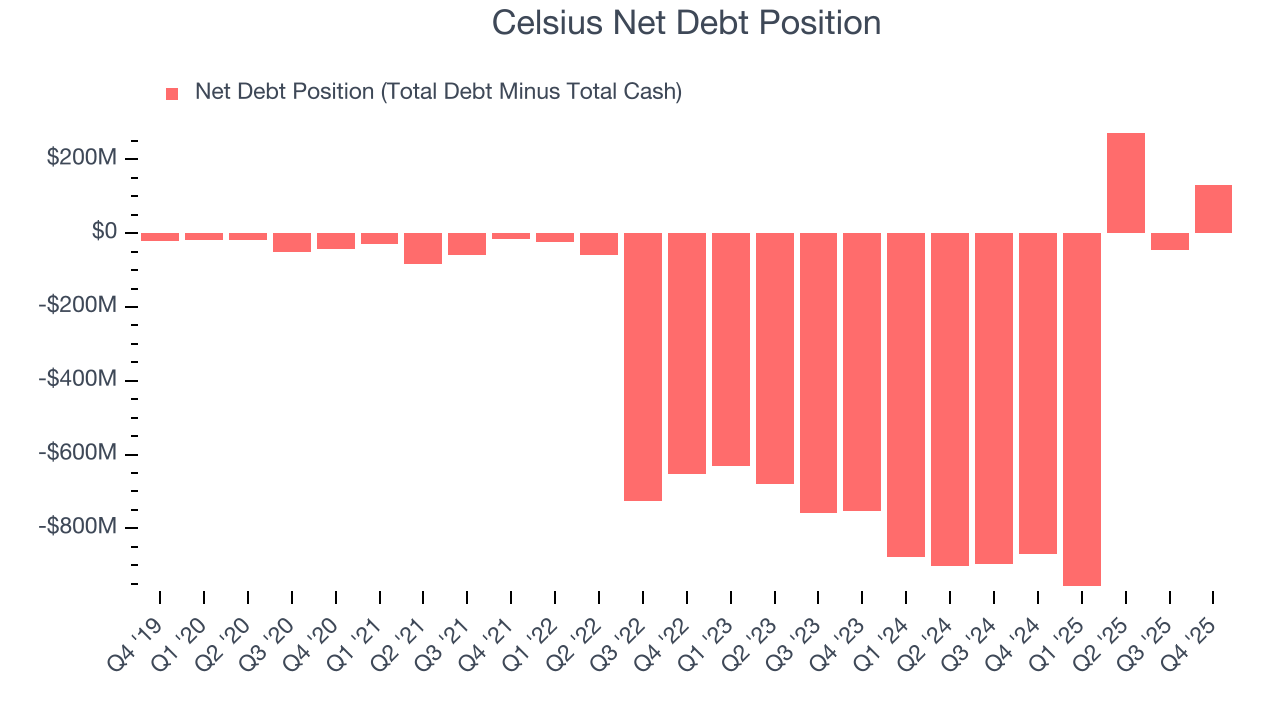

Celsius reported $540 million of cash and $669.9 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $619.6 million of EBITDA over the last 12 months, we view Celsius’s 0.2× net-debt-to-EBITDA ratio as safe. We also see its $32.25 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Celsius’s Q4 Results

We were impressed by how significantly Celsius blew past analysts’ EBITDA expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. On the other hand, its gross margin missed. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 17% to $59.21 immediately after reporting.

13. Is Now The Time To Buy Celsius?

Updated: February 27, 2026 at 10:06 PM EST

Before deciding whether to buy Celsius or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

Celsius isn’t a bad business, but we’re not clamoring to buy it here and now. To kick things off, its revenue growth was exceptional over the last three years. And while Celsius’s declining operating margin shows the business has become less efficient, its EPS growth over the last three years has been fantastic.

Celsius’s P/E ratio based on the next 12 months is 33.5x. This valuation tells us it’s a bit of a market darling with a lot of good news priced in - you can find more timely opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $66.30 on the company (compared to the current share price of $53.39).