Confluent (CFLT)

Confluent is intriguing. Its growth in billings suggests its market share is rising, highlighting the value its offerings provide.― StockStory Analyst Team

1. News

2. Summary

Why Confluent Is Interesting

Built by the original creators of Apache Kafka, the popular open-source messaging system, Confluent (NASDAQ:CFLT) provides a data infrastructure platform that enables organizations to connect their applications, systems, and data layers around real-time data streams.

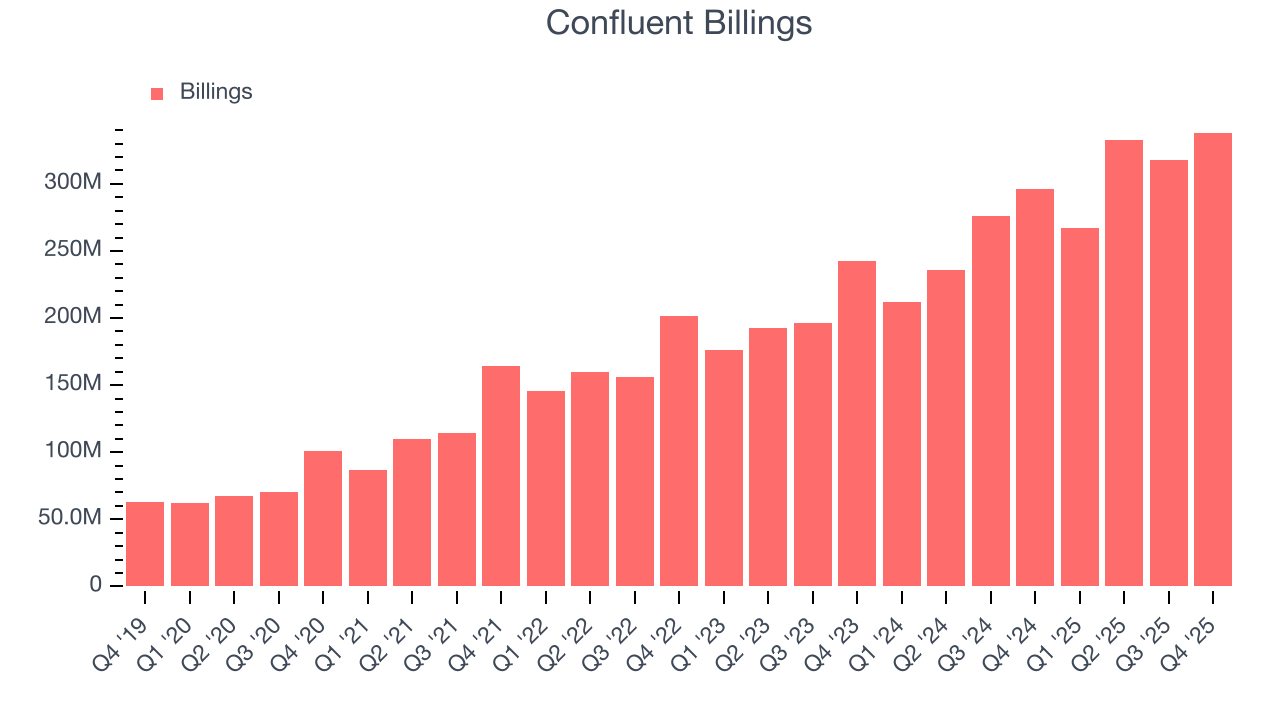

- Average billings growth of 24.2% over the last year enhances its liquidity and shows there is steady demand for its products

- Annual revenue growth of 37.6% over the past five years was outstanding, reflecting market share gains

- One pitfall is its track record of operating margin losses stem from its decision to pursue growth instead of profits

Confluent shows some potential. If you like the company, the valuation seems fair.

Why Is Now The Time To Buy Confluent?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Confluent?

Confluent’s stock price of $30.48 implies a valuation ratio of 7.8x forward price-to-sales. While Confluent’s valuation is higher than that of many in the software space, we still think the valuation is fair given the top-line growth.

If you think the market is not giving the company enough credit for its fundamentals, now could be a good time to invest.

3. Confluent (CFLT) Research Report: Q4 CY2025 Update

Data streaming platform provider Confluent (NASDAQ:CFLT) reported Q4 CY2025 results exceeding the market’s revenue expectations, with sales up 20.5% year on year to $314.8 million. Its non-GAAP profit of $0.12 per share was 21.1% above analysts’ consensus estimates.

Confluent (CFLT) Q4 CY2025 Highlights:

- As announced on December 8, 2025, Confluent and International Business Machines Corporation (“IBM”) (NYSE: IBM) have entered into a definitive agreement under which IBM will acquire Confluent for $31.00 per share in cash, representing an enterprise value of $11 billion. The transaction is expected to close by the middle of 2026, subject to approval by Confluent shareholders, regulatory approvals, and other customary closing conditions.

- Revenue: $314.8 million vs analyst estimates of $307.9 million (20.5% year-on-year growth, 2.2% beat)

- Adjusted EPS: $0.12 vs analyst estimates of $0.10 (21.1% beat)

- Adjusted Operating Income: $27.6 million vs analyst estimates of $21.96 million (8.8% margin, 25.7% beat)

- Operating Margin: -31.5%, up from -40.5% in the same quarter last year

- Free Cash Flow Margin: 11.3%, up from 8.2% in the previous quarter

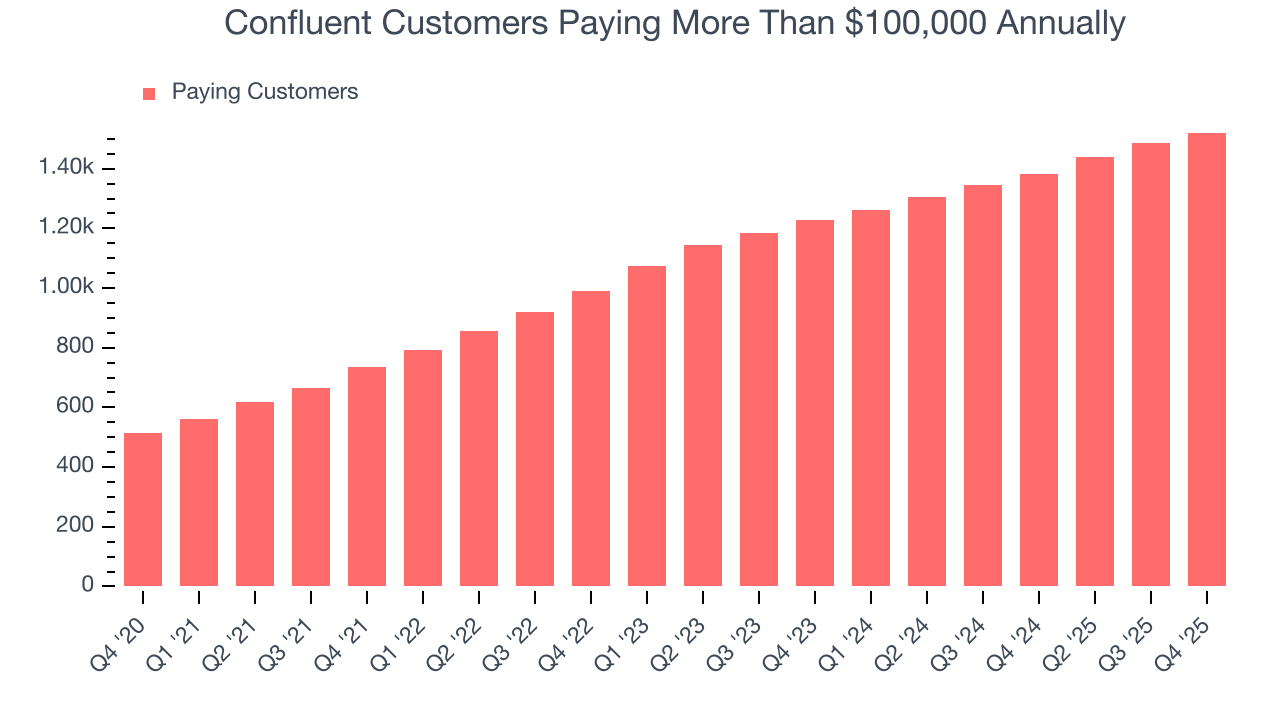

- Customers: 1,521 customers paying more than $100,000 annually

- Market Capitalization: $10.9 billion

Company Overview

Built by the original creators of Apache Kafka, the popular open-source messaging system, Confluent (NASDAQ:CFLT) provides a data infrastructure platform that enables organizations to connect their applications, systems, and data layers around real-time data streams.

Confluent's platform acts as a "central nervous system" for enterprise data, allowing information to flow in real-time between different parts of an organization. The company offers two main deployment options: Confluent Platform, a self-managed software solution for on-premises environments, and Confluent Cloud, a fully-managed cloud-native service available on all major cloud providers (AWS, Microsoft Azure, and Google Cloud).

At its core, Confluent specializes in technology for "data in motion" - continuously streaming information that can be processed and acted upon immediately, rather than static data stored in databases. This capability is critical for modern use cases like real-time fraud detection, instant inventory management, and personalized customer experiences.

A bank might use Confluent to process credit card transactions in real-time, flagging suspicious activities before fraudulent charges complete. Retailers could leverage it to maintain accurate inventory counts across hundreds of stores by instantly processing purchase and restocking data. The platform includes tools for connecting diverse data sources, processing streams with SQL-like commands (via ksqlDB), and governing data quality and access.

Confluent generates revenue through subscription licenses for its platform and professional services. The company operates on both pay-as-you-go and committed contract models, with customers typically starting with specific use cases before expanding adoption across their organizations as they realize value.

4. Data Infrastructure

Generating insights from system level data is an increasing priority for most businesses, but to do so requires connecting and analyzing piles of data stored and siloed in separate databases. This is the demand driver for cloud based data infrastructure software providers, who can more readily integrate, distribute and process information vs. legacy on-premise software providers.

Confluent competes with cloud provider services like Amazon Managed Streaming for Apache Kafka, Microsoft's Azure Event Hubs, and Google Cloud Pub/Sub. On-premises competitors include Cloudera Dataflow, TIBCO Messaging, and Red Hat AMQ Streams.

5. Revenue Growth

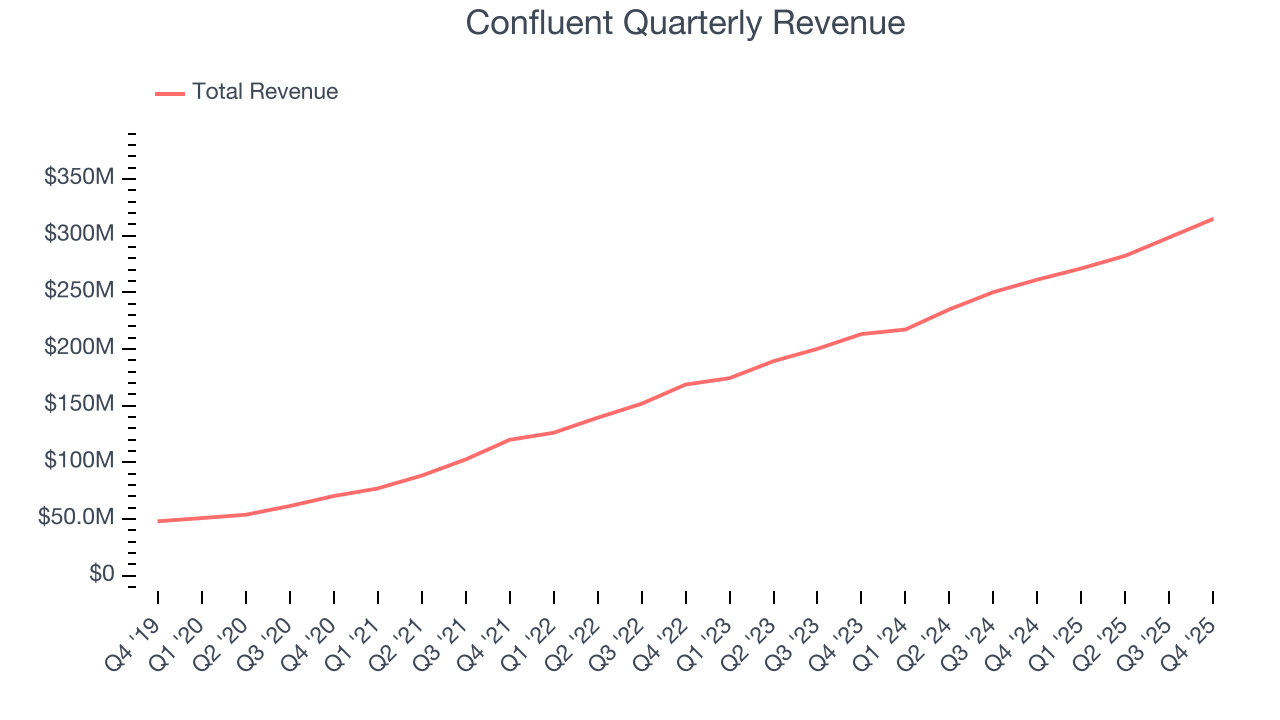

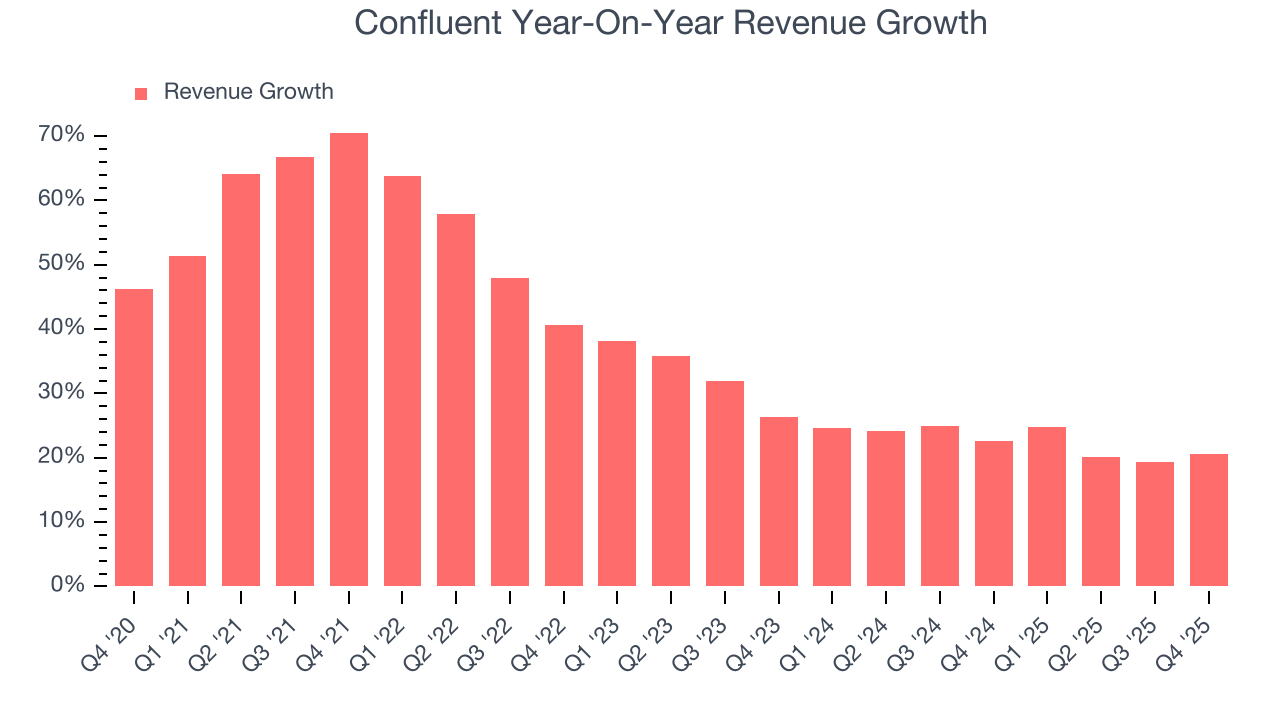

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years. Luckily, Confluent’s sales grew at an exceptional 37.6% compounded annual growth rate over the last five years. Its growth beat the average software company and shows its offerings resonate with customers, a helpful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within software, a half-decade historical view may miss recent innovations or disruptive industry trends. Confluent’s annualized revenue growth of 22.5% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Confluent reported robust year-on-year revenue growth of 20.5%, and its $314.8 million of revenue topped Wall Street estimates by 2.2%.

Looking ahead, sell-side analysts expect revenue to grow 15.8% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is above average for the sector and implies the market is forecasting some success for its newer products and services.

6. Billings

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Confluent’s billings punched in at $338.2 million in Q4, and over the last four quarters, its growth was fantastic as it averaged 24.2% year-on-year increases. This alternate topline metric grew faster than total sales, meaning the company collects cash upfront and then recognizes the revenue over the length of its contracts - a boost for its liquidity and future revenue prospects.

7. Enterprise Customer Base

This quarter, Confluent reported 1,521 enterprise customers paying more than $100,000 annually, an increase of 34 from the previous quarter. That’s a bit fewer contract wins than last quarter and quite a bit below what we’ve observed over the previous year, suggesting its sales momentum with new enterprise customers is slowing. It also implies that Confluent will likely need to upsell its existing large customers or move down market to accelerate its top-line growth.

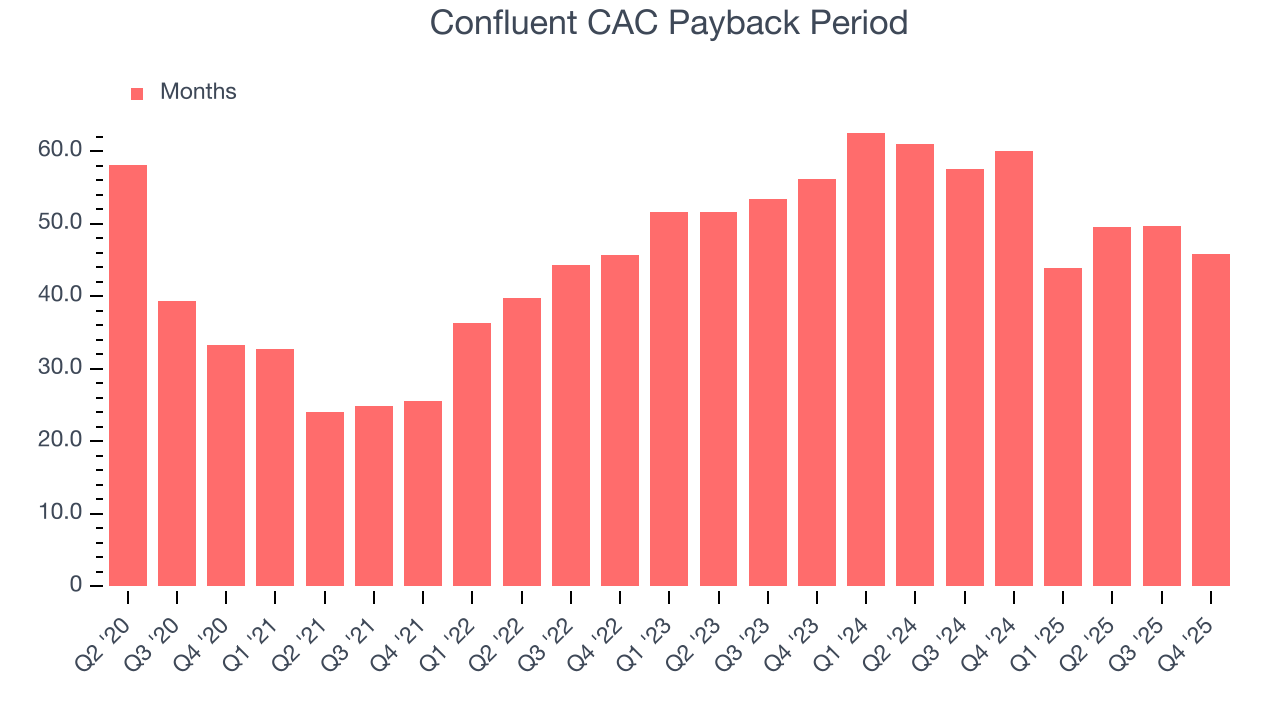

8. Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Confluent does a decent job acquiring new customers, and its CAC payback period checked in at 45.8 months this quarter. The company’s relatively fast recovery of its customer acquisition costs gives it the option to accelerate growth by increasing its sales and marketing investments.

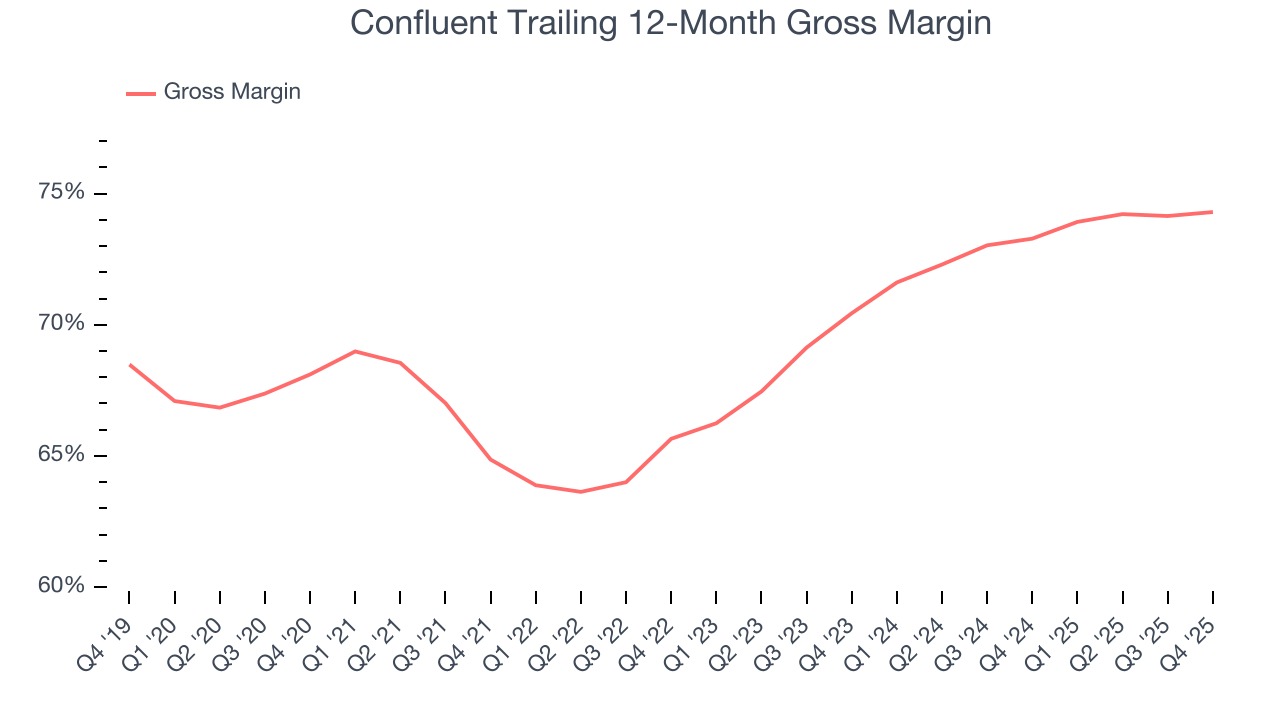

9. Gross Margin & Pricing Power

What makes the software-as-a-service model so attractive is that once the software is developed, it usually doesn’t cost much to provide it as an ongoing service. These minimal costs can include servers, licenses, and certain personnel.

Confluent’s gross margin is better than the broader software industry and signals it has solid unit economics and competitive products. As you can see below, it averaged a decent 74.3% gross margin over the last year. That means for every $100 in revenue, roughly $74.30 was left to spend on selling, marketing, and R&D.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. Confluent has seen gross margins improve by 3.9 percentage points over the last 2 year, which is very good in the software space.

Confluent’s gross profit margin came in at 74.7% this quarter, in line with the same quarter last year. Zooming out, Confluent’s full-year margin has been trending up over the past 12 months, increasing by 1 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as servers).

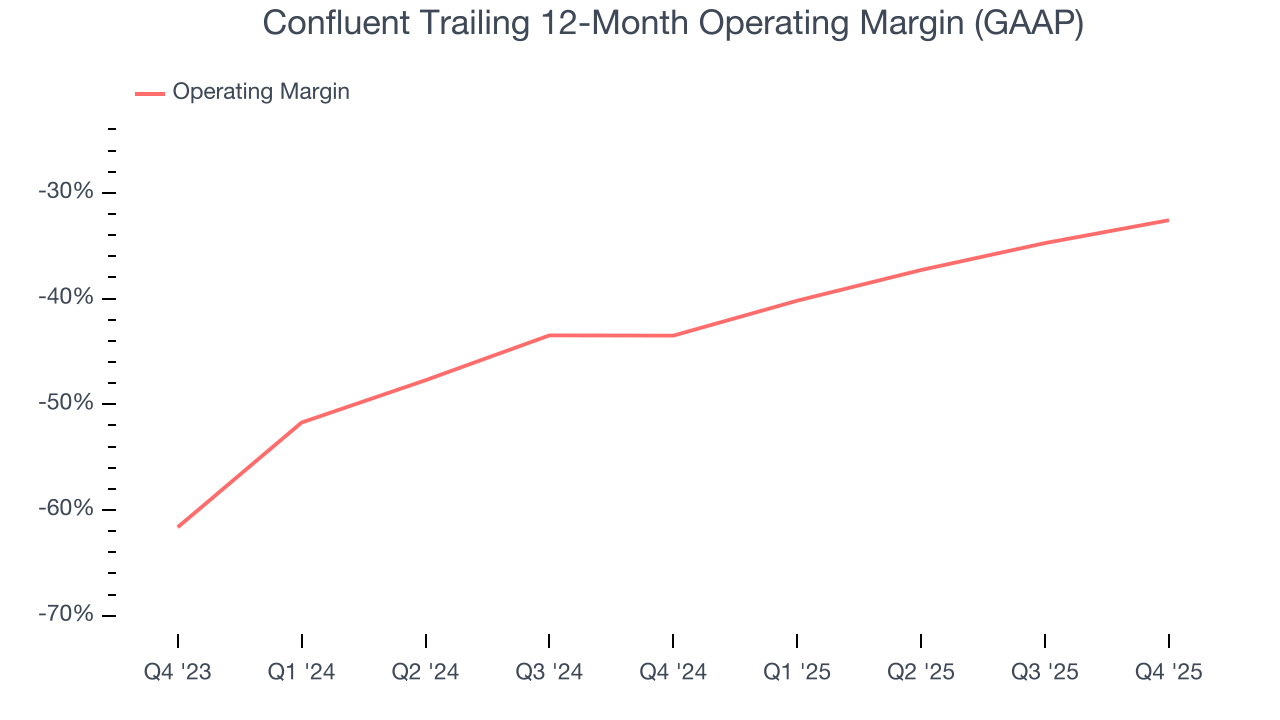

10. Operating Margin

Many software businesses adjust their profits for stock-based compensation (SBC), but we prioritize GAAP operating margin because SBC is a real expense used to attract and retain engineering and sales talent. This is one of the best measures of profitability because it shows how much money a company takes home after developing, marketing, and selling its products.

Confluent’s expensive cost structure has contributed to an average operating margin of negative 32.6% over the last year. This happened because the company spent loads of money to capture market share. As seen in its fast revenue growth, the aggressive strategy has paid off so far, and Wall Street’s estimates suggest the party will continue. We tend to agree and believe the business has a good chance of reaching profitability upon scale.

Over the last two years, Confluent’s expanding sales gave it operating leverage as its margin rose by 10.9 percentage points. Still, it will take much more for the company to reach long-term profitability.

Confluent’s operating margin was negative 31.5% this quarter.

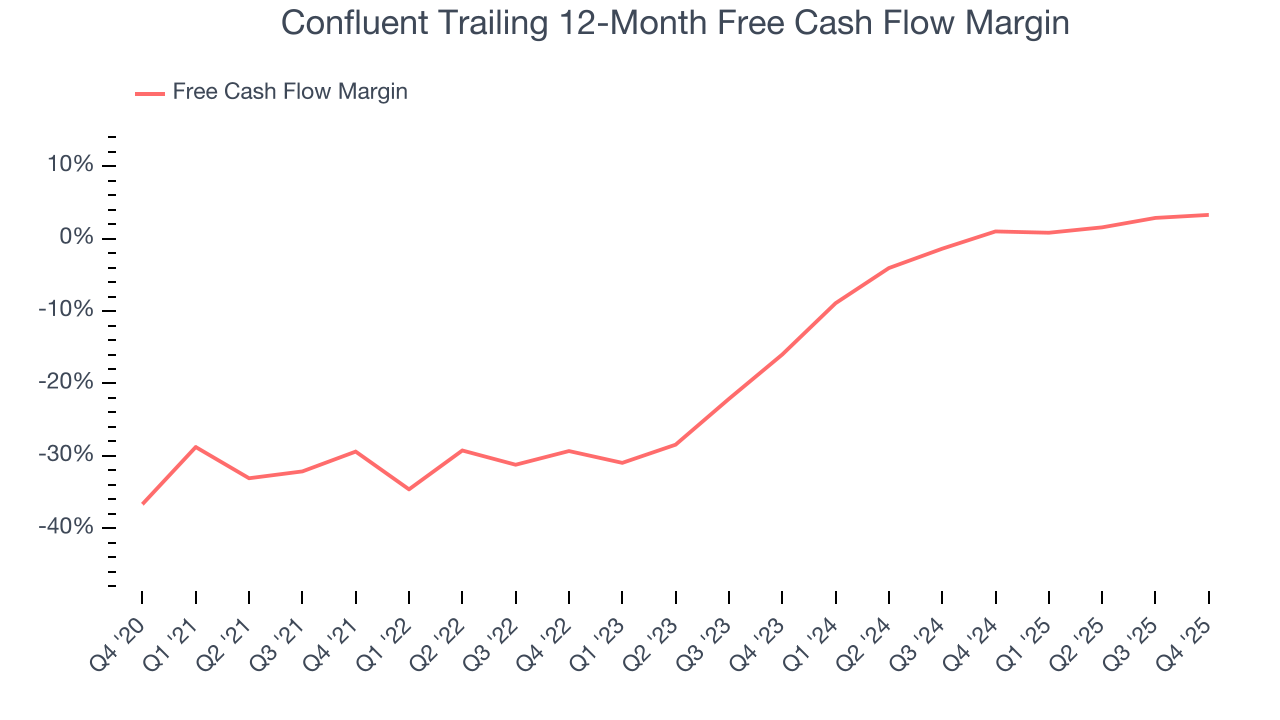

11. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Confluent has shown poor cash profitability over the last year, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 3.3%, lousy for a software business.

Confluent’s free cash flow clocked in at $35.52 million in Q4, equivalent to a 11.3% margin. This cash profitability was in line with the comparable period last year and above its one-year average.

Over the next year, analysts predict Confluent’s cash conversion will improve. Their consensus estimates imply its free cash flow margin of 3.3% for the last 12 months will increase to 9%, it options for capital deployment (investments, share buybacks, etc.).

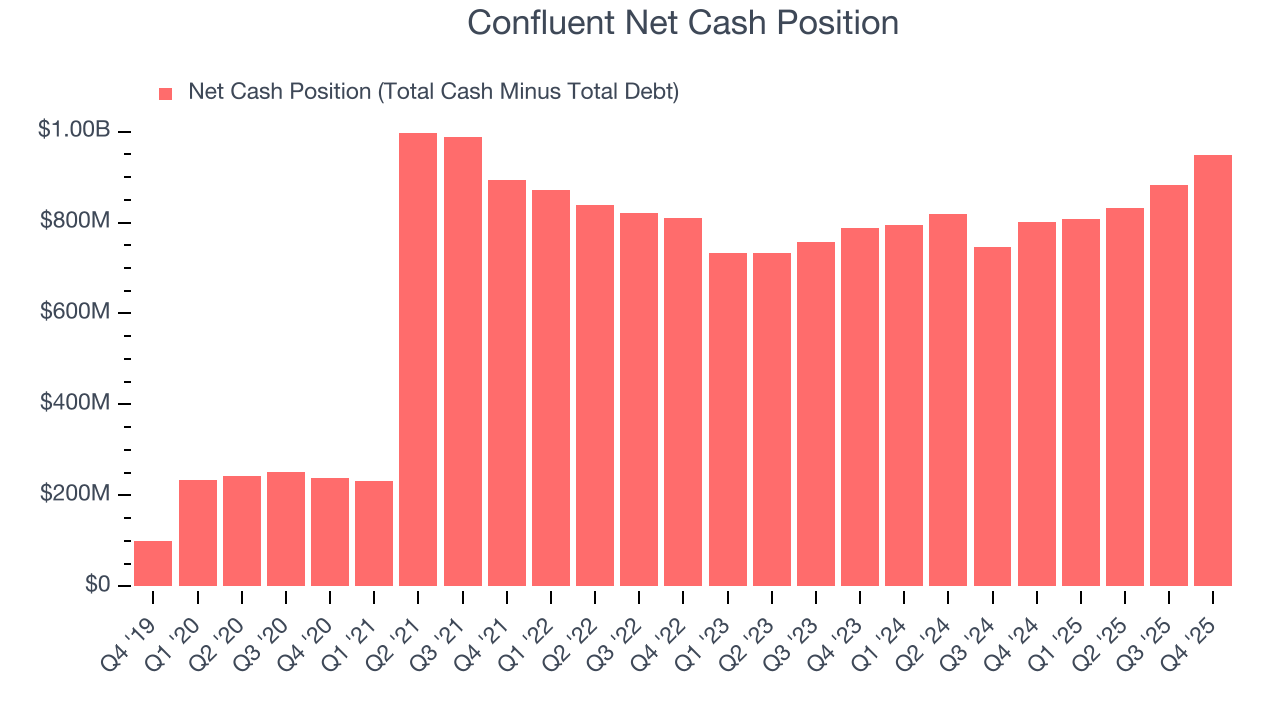

12. Balance Sheet Assessment

Companies with more cash than debt have lower bankruptcy risk.

Confluent is a well-capitalized company with $2.05 billion of cash and $1.11 billion of debt on its balance sheet. This $948.6 million net cash position is 8.7% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

13. Key Takeaways from Confluent’s Q4 Results

It was encouraging to see Confluent beat analysts’ revenue expectations this quarter. The company also beat adjusted operating profit and adjusted EPS estimates. Overall, this was a solid quarter. The stock remained flat at $30.43 immediately following the results.

As announced on December 8, 2025, Confluent and International Business Machines Corporation (“IBM”) (NYSE: IBM) have entered into a definitive agreement under which IBM will acquire Confluent for $31.00 per share in cash, representing an enterprise value of $11 billion. The transaction is expected to close by the middle of 2026, subject to approval by Confluent shareholders, regulatory approvals, and other customary closing conditions.

14. Is Now The Time To Buy Confluent?

Updated: February 11, 2026 at 9:18 PM EST

Before making an investment decision, investors should account for Confluent’s business fundamentals and valuation in addition to what happened in the latest quarter.

There are definitely a lot of things to like about Confluent. To kick things off, its revenue growth was exceptional over the last five years. And while its operating margins reveal poor profitability compared to other software companies, its gross margin suggests it can generate sustainable profits. On top of that, its products are easy to integrate into existing workflows.

Confluent’s price-to-sales ratio based on the next 12 months is 7.8x. When scanning the software space, Confluent trades at a fair valuation. If you’re a fan of the business and management team, now is a good time to scoop up some shares.

Wall Street analysts have a consensus one-year price target of $30.89 on the company (compared to the current share price of $30.48).