Oracle (ORCL)

Oracle is in for a bumpy ride. Its poor revenue growth shows demand is soft and its cash burn makes us question its business model.― StockStory Analyst Team

1. News

2. Summary

Why We Think Oracle Will Underperform

Starting as a database company in 1977 and now powering mission-critical systems across the globe, Oracle (NYSE:ORCL) provides enterprise software and hardware products and services that help businesses manage their information technology needs.

- Cash burn makes us question whether it can achieve sustainable long-term growth

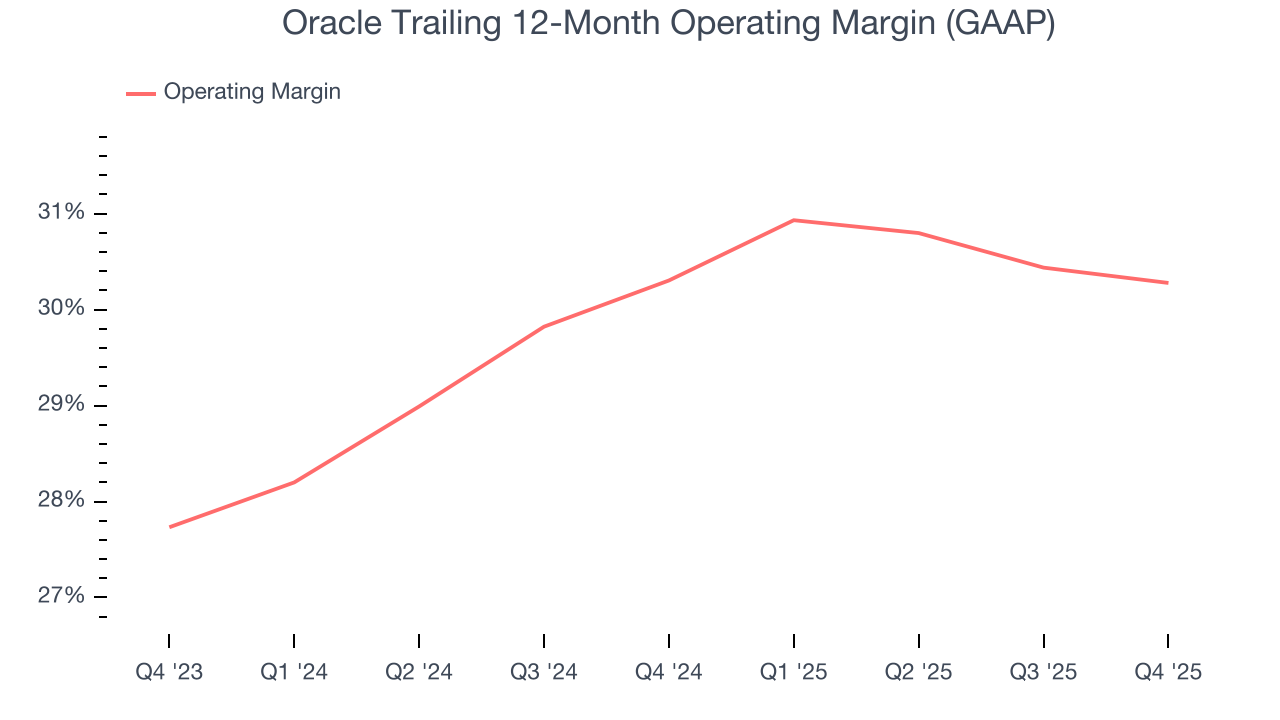

- Operating margin was unchanged over the last year, suggesting it failed to gain leverage on its fixed costs

- Unfavorable liquidity position could lead to additional equity financing that dilutes shareholders

Oracle’s quality isn’t great. Better businesses are for sale in the market.

Why There Are Better Opportunities Than Oracle

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Oracle

Oracle’s stock price of $147.65 implies a valuation ratio of 6.1x forward price-to-sales. This multiple is quite expensive for the quality you get.

Paying up for elite businesses with strong earnings potential is better than investing in lower-quality companies with shaky fundamentals. That’s how you avoid big downside over the long term.

3. Oracle (ORCL) Research Report: Q4 CY2025 Update

Enterprise software giant Oracle (NYSE:ORCL) fell short of the markets revenue expectations in Q4 CY2025, but sales rose 14.2% year on year to $16.06 billion. Its non-GAAP profit of $2.26 per share was 38% above analysts’ consensus estimates.

Oracle (ORCL) Q4 CY2025 Highlights:

- Revenue: $16.06 billion vs analyst estimates of $16.19 billion (14.2% year-on-year growth, 0.8% miss)

- Adjusted EPS: $2.26 vs analyst estimates of $1.64 (38% beat)

- Adjusted Operating Income: $6.72 billion vs analyst estimates of $6.81 billion (41.9% margin, 1.3% miss)

- Operating Margin: 29.5%, in line with the same quarter last year

- Free Cash Flow was -$13.18 billion compared to -$362 million in the previous quarter

- Market Capitalization: $631.5 billion

Company Overview

Starting as a database company in 1977 and now powering mission-critical systems across the globe, Oracle (NYSE:ORCL) provides enterprise software and hardware products and services that help businesses manage their information technology needs.

Oracle organizes its business into three main segments: cloud and license, hardware, and services. The cloud and license segment is its largest, offering both cloud-based subscription services and traditional software licenses with support. This includes database management systems, middleware, and enterprise applications like ERP, HCM, and SCM that help organizations run their operations.

Oracle Cloud Infrastructure (OCI) is the company's cloud computing platform, designed to compete with Amazon Web Services, Microsoft Azure, and Google Cloud. It includes computing, storage, networking, and database services, with Oracle's Autonomous Database as a flagship offering that uses machine learning to automate routine database administration tasks.

A typical Oracle customer might be a large financial institution using Oracle Fusion Cloud ERP to manage its financial operations, Oracle Database to store customer information, and Oracle Exadata hardware to power its data center. The bank would pay Oracle through subscription fees for cloud services, license fees for software, support fees for maintenance, and possibly consulting fees for implementation services.

The company has been transitioning its business model from traditional on-premise software licenses to cloud subscriptions, allowing customers flexibility in deployment options – public cloud, hybrid cloud, or on-premise. Oracle generates revenue through initial license sales or subscription fees, ongoing support contracts, hardware sales, and professional services. With operations spanning 175 countries, Oracle serves businesses across all major industries, government agencies, and educational institutions.

4. Data Infrastructure

Generating insights from system level data is an increasing priority for most businesses, but to do so requires connecting and analyzing piles of data stored and siloed in separate databases. This is the demand driver for cloud based data infrastructure software providers, who can more readily integrate, distribute and process information vs. legacy on-premise software providers.

Oracle competes with major technology providers including Microsoft (NASDAQ:MSFT), Amazon Web Services (NASDAQ:AMZN), Google Cloud (NASDAQ:GOOGL), IBM (NYSE:IBM), and SAP (NYSE:SAP) in enterprise software and cloud services. In healthcare IT, following its Cerner acquisition, Oracle also competes with Epic Systems, Allscripts (NASDAQ:MDRX), and athenahealth.

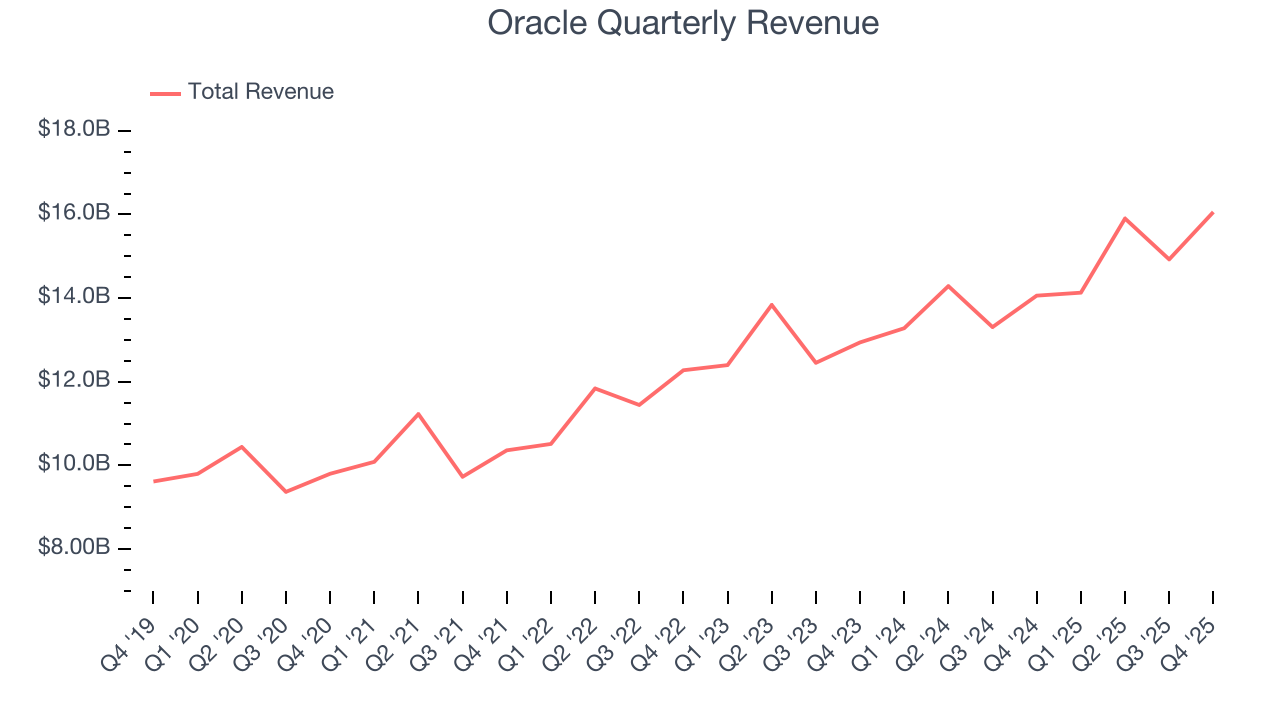

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Regrettably, Oracle’s sales grew at a sluggish 9.1% compounded annual growth rate over the last five years. This was below our standard for the software sector and is a poor baseline for our analysis.

Long-term growth is the most important, but within software, a half-decade historical view may miss new innovations or demand cycles. Oracle’s annualized revenue growth of 8.7% over the last two years aligns with its five-year trend, suggesting its demand was consistently weak.

This quarter, Oracle’s revenue grew by 14.2% year on year to $16.06 billion but fell short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 21.8% over the next 12 months, an improvement versus the last two years. This projection is particularly healthy for a company of its scale and indicates its newer products and services will catalyze better top-line performance.

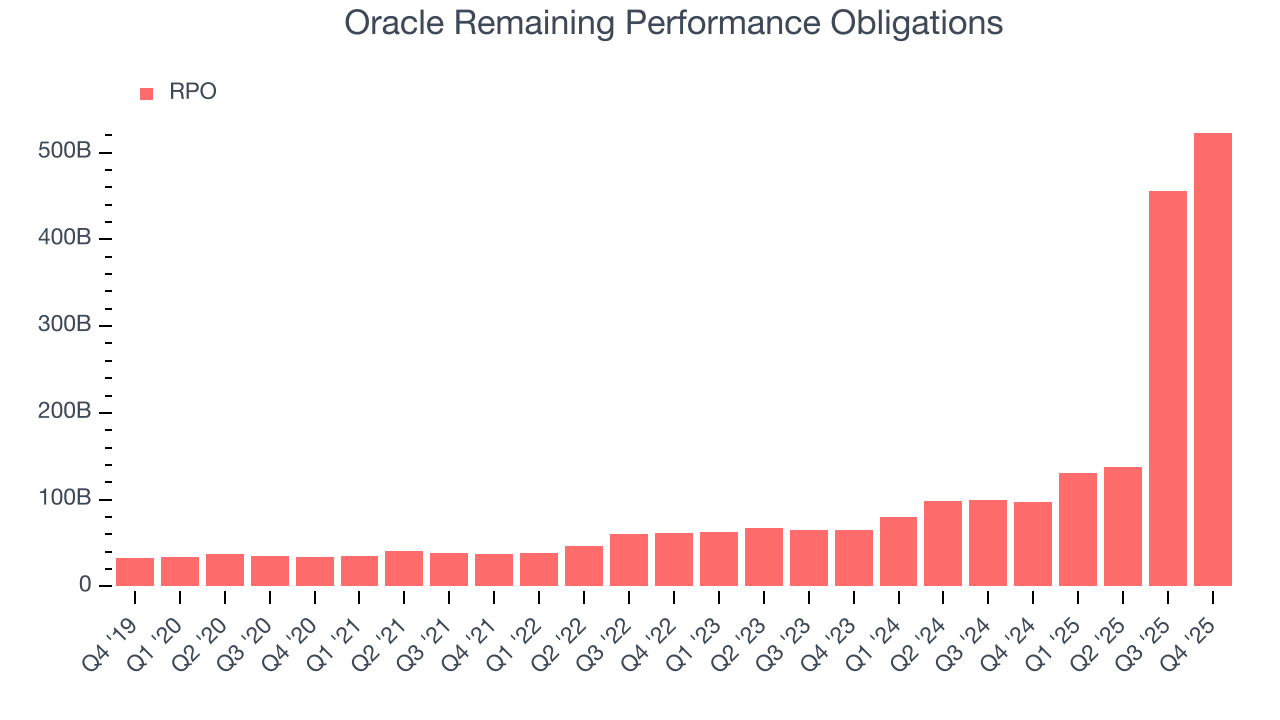

6. Remaining Performance Obligations

In addition to reported revenue, it is useful to analyze RPO, or remaining performance obligations, for Oracle because it shows the value of contracted services to be delivered in the future. It therefore gives visibility into future revenue.

Oracle’s RPO punched in at $523 billion in Q4, and over the last four quarters, its growth was fantastic as it averaged 225% year-on-year increases. This alternate topline metric grew faster than total sales, which likely means contracted services not yet delivered are growing faster than services already delivered (the criteria for revenue recognition). That could be a good sign for future revenue growth.

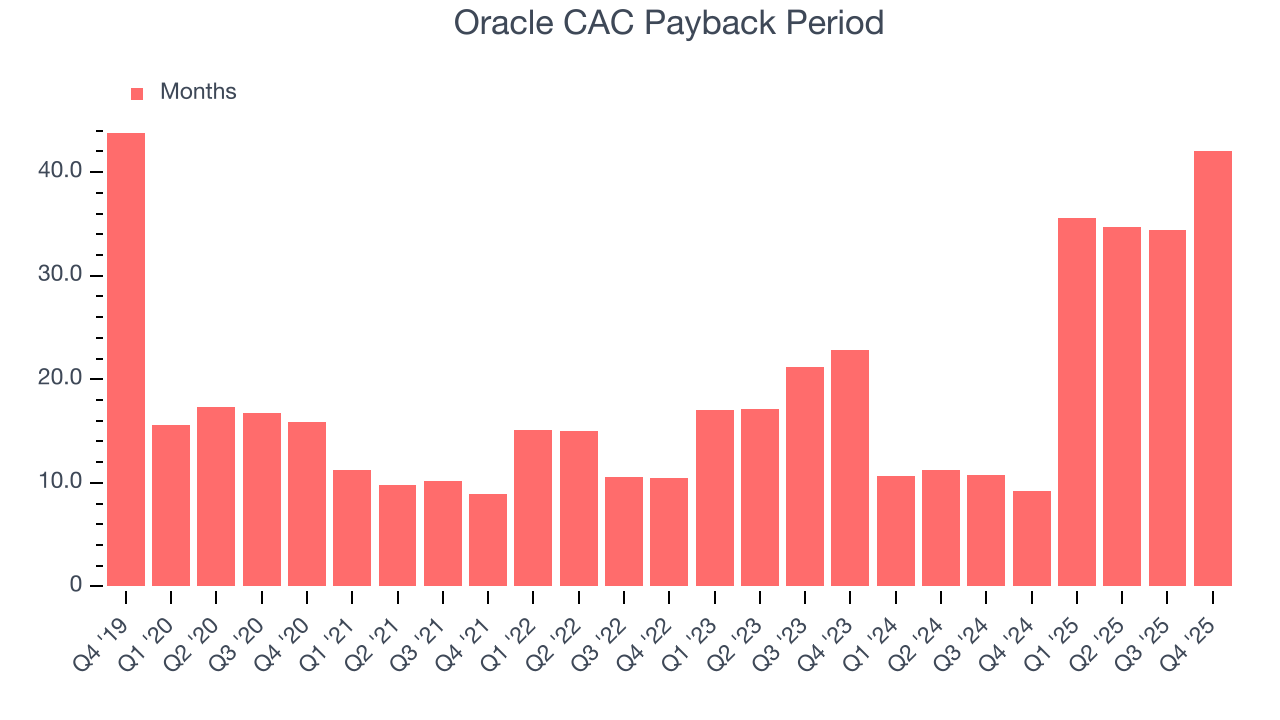

7. Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Oracle is efficient at acquiring new customers, and its CAC payback period checked in at 42.1 months this quarter. The company’s relatively fast recovery of its customer acquisition costs gives it the option to accelerate growth by increasing its sales and marketing investments.

8. Gross Margin & Pricing Power

For software companies like Oracle, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

Oracle’s gross margin is worse than the software industry average, giving it less room than its competitors to hire new talent that can expand its products and services. As you can see below, it averaged a 69.3% gross margin over the last year. Said differently, Oracle had to pay a chunky $30.74 to its service providers for every $100 in revenue.

9. Operating Margin

Oracle has been a well-oiled machine over the last year. It demonstrated elite profitability for a software business, boasting an average operating margin of 30.3%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Analyzing the trend in its profitability, Oracle’s operating margin might fluctuated slightly but has generally stayed the same over the last two years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q4, Oracle generated an operating margin profit margin of 29.5%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

10. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

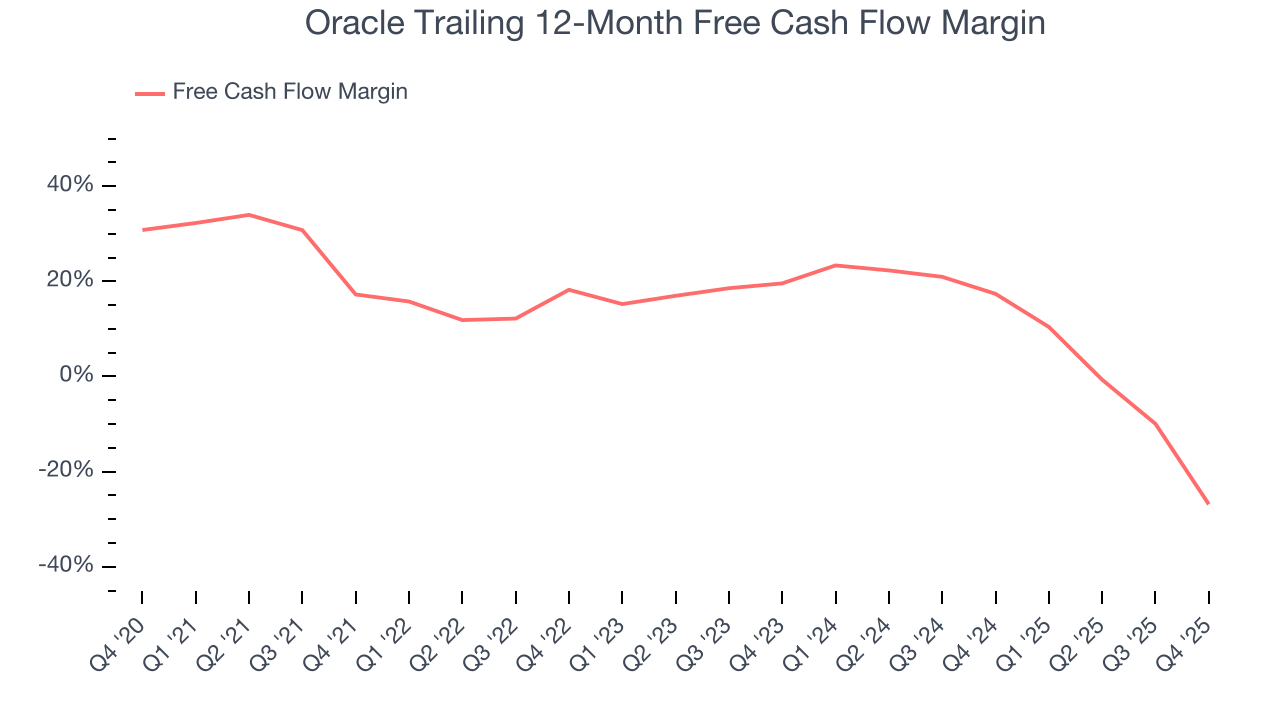

Oracle’s demanding reinvestments have drained its resources over the last year, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 26.9%, meaning it lit $26.87 of cash on fire for every $100 in revenue. This is a stark contrast from its operating margin, and its investments (i.e., stocking inventory, building new facilities) are the primary culprit.

Oracle burned through $13.18 billion of cash in Q4, equivalent to a negative 82.1% margin. The company’s cash burn increased from $2.67 billion of lost cash in the same quarter last year.

Over the next year, analysts predict Oracle will continue burning cash, albeit to a lesser extent. Their consensus estimates imply its free cash flow margin of negative 26.9% for the last 12 months will increase to negative 9.2%.

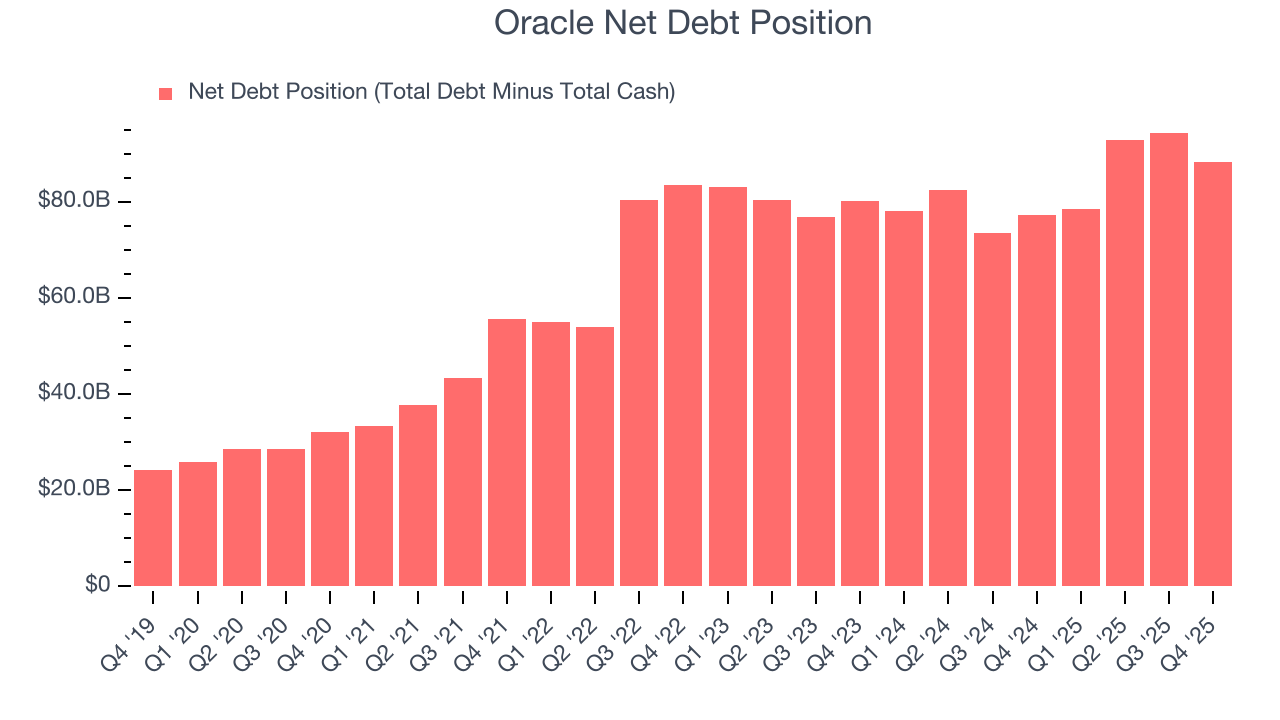

11. Balance Sheet Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Oracle burned through $13.18 billion of cash over the last year, and its $108.1 billion of debt exceeds the $19.77 billion of cash on its balance sheet. This is a deal breaker for us because indebted loss-making companies spell trouble.

Unless the Oracle’s fundamentals change quickly, it might find itself in a position where it must raise capital from investors to continue operating. Whether that would be favorable is unclear because dilution is a headwind for shareholder returns.

We remain cautious of Oracle until it generates consistent free cash flow or any of its announced financing plans materialize on its balance sheet.

12. Key Takeaways from Oracle’s Q4 Results

We struggled to find many positives in these results. Its revenue slightly missed and its remaining performance obligation fell slightly short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 5.3% to $211.95 immediately following the results.

13. Is Now The Time To Buy Oracle?

Updated: February 22, 2026 at 12:36 AM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

We cheer for all companies solving complex business issues, but in the case of Oracle, we’ll be cheering from the sidelines. For starters, its revenue growth was weak over the last five years. While its impressive operating margins show it has a highly efficient business model, the downside is its operating margin hasn't moved over the last year. On top of that, its growth is coming at the cost of significant cash burn.

Oracle’s price-to-sales ratio based on the next 12 months is 6.1x. This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think there are better opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $272.89 on the company (compared to the current share price of $147.65).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.