Clarus (CLAR)

We wouldn’t recommend Clarus. Not only has its sales growth been weak but also its negative returns on capital show it destroyed value.― StockStory Analyst Team

1. News

2. Summary

Why We Think Clarus Will Underperform

Initially a financial services business, Clarus (NASDAQ:CLAR) designs, manufactures, and distributes outdoor equipment and lifestyle products.

- Lackluster 4.2% annual revenue growth over the last five years indicates the company is losing ground to competitors

- Earnings per share fell by 16.4% annually over the last five years while its revenue grew, showing its incremental sales were much less profitable

- Persistent operating margin losses suggest the business manages its expenses poorly

Clarus doesn’t satisfy our quality benchmarks. Better businesses are for sale in the market.

Why There Are Better Opportunities Than Clarus

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Clarus

Clarus is trading at $3.49 per share, or 21.6x forward P/E. Not only is Clarus’s multiple richer than most consumer discretionary peers, but it’s also expensive for its revenue characteristics.

There are stocks out there similarly priced with better business quality. We prefer owning these.

3. Clarus (CLAR) Research Report: Q3 CY2025 Update

Outdoor lifestyle and equipment company Clarus (NASDAQ:CLAR) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 3.3% year on year to $69.35 million. Its non-GAAP profit of $0.05 per share was in line with analysts’ consensus estimates.

Clarus (CLAR) Q3 CY2025 Highlights:

- Revenue: $69.35 million vs analyst estimates of $66.51 million (3.3% year-on-year growth, 4.3% beat)

- Adjusted EPS: $0.05 vs analyst estimates of $0.06 (in line)

- Adjusted EBITDA: $4.73 million vs analyst estimates of $2.70 million (6.8% margin, 74.9% beat)

- Operating Margin: -4.4%, up from -8% in the same quarter last year

- Market Capitalization: $131.7 million

Company Overview

Initially a financial services business, Clarus (NASDAQ:CLAR) designs, manufactures, and distributes outdoor equipment and lifestyle products.

The company was founded in 1991, but after recognizing the potential of the outdoor equipment market, pivoted to meet the needs of adventure enthusiasts in 2002.

Today, Clarus offers products across several brands, including Black Diamond Equipment, Sierra Bullets, PIEPS, and SKINourishment. Its brands sell goods such as advanced climbing gear, ski equipment, precision ammunition, and skincare products tailored for outdoor environments.

Clarus generates revenue through a multi-faceted approach, leveraging a direct salesforce, extensive retail partnerships, and an e-commerce platform to sell its products. This strategy allows the company to reach a diverse and global consumer base.

4. Leisure Products

Leisure products cover a wide range of goods in the consumer discretionary sector. Maintaining a strong brand is key to success, and those who differentiate themselves will enjoy customer loyalty and pricing power while those who don’t may find themselves in precarious positions due to the non-essential nature of their offerings.

Select competitors in the outdoor and recreation space include The North Face (owned by NYSE:VFC), Johnson Outdoors (NASDAQ:JOUT), and Smith & Wesson (NASDAQ:SWBI).

5. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Clarus grew its sales at a sluggish 4.2% compounded annual growth rate. This fell short of our benchmark for the consumer discretionary sector and is a poor baseline for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Clarus’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 4.9% annually.

This quarter, Clarus reported modest year-on-year revenue growth of 3.3% but beat Wall Street’s estimates by 4.3%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. Although this projection suggests its newer products and services will spur better top-line performance, it is still below average for the sector.

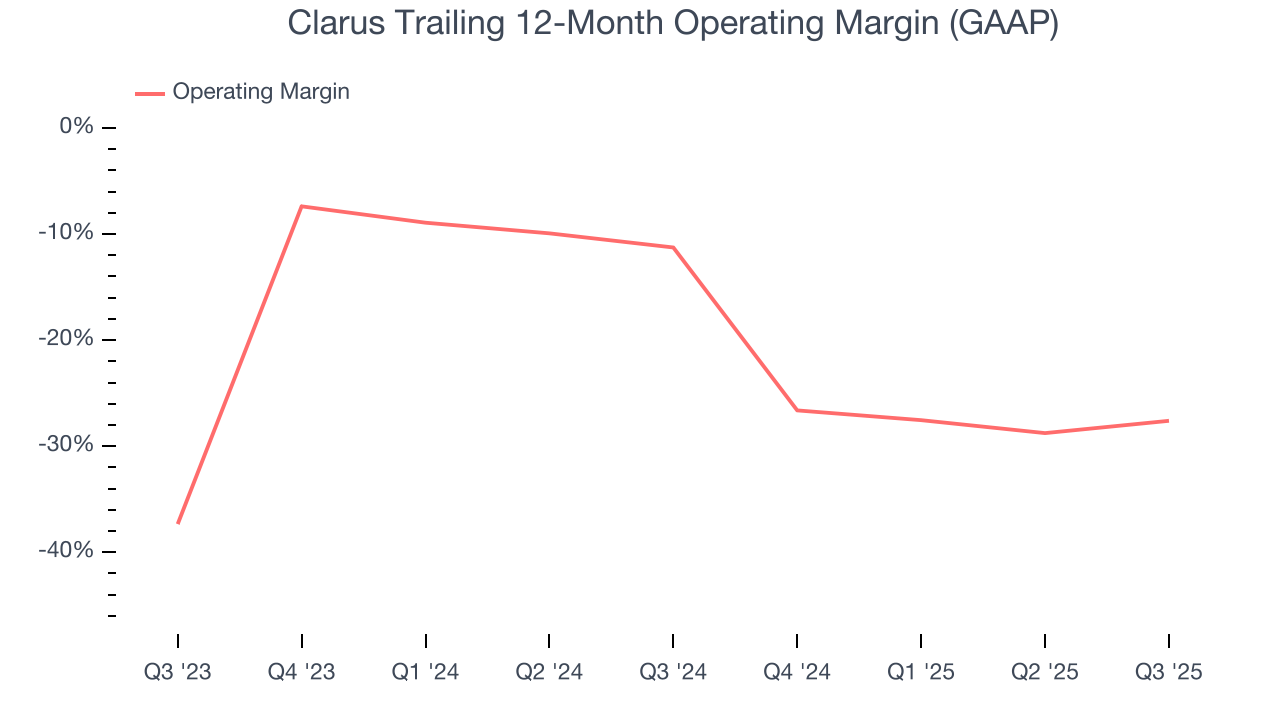

6. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Clarus’s operating margin has shrunk over the last 12 months and averaged negative 19.2% over the last two years. Unprofitable consumer discretionary companies with falling margins deserve extra scrutiny because they’re spending loads of money to stay relevant, an unsustainable practice.

In Q3, Clarus generated a negative 4.4% operating margin. The company's consistent lack of profits raise a flag.

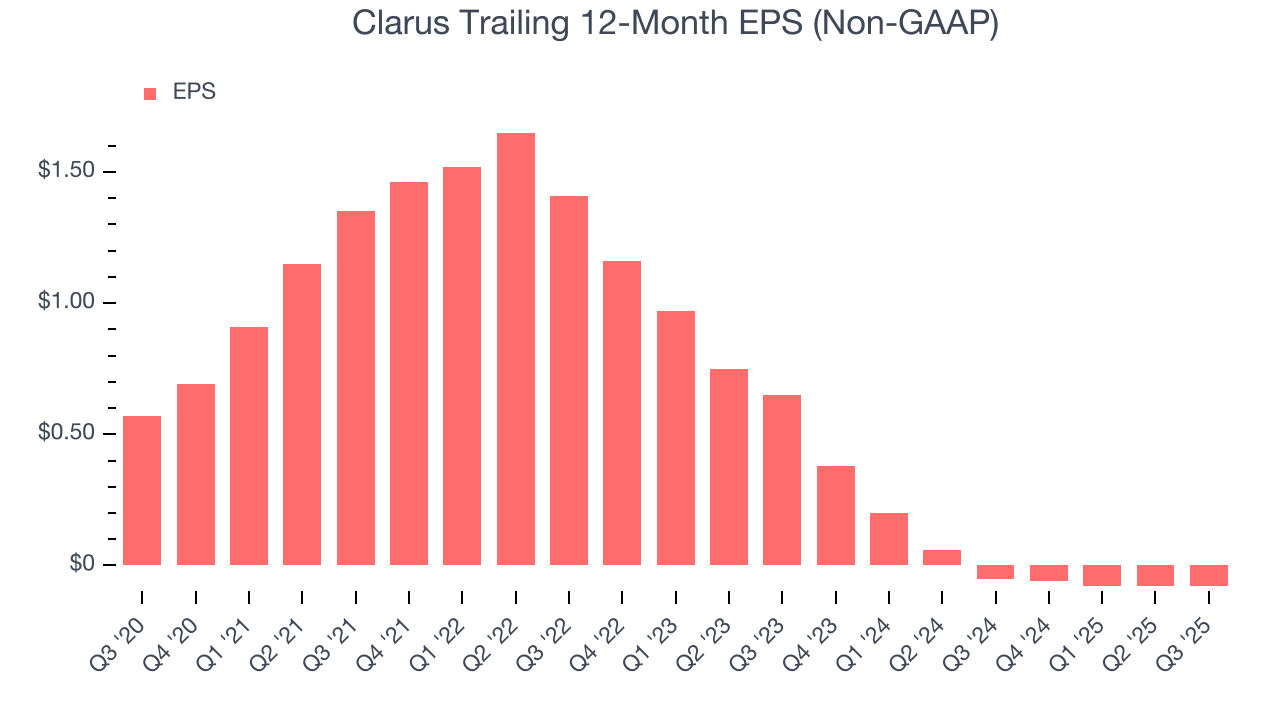

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Clarus, its EPS declined by 16.4% annually over the last five years while its revenue grew by 4.2%. This tells us the company became less profitable on a per-share basis as it expanded.

In Q3, Clarus reported adjusted EPS of $0.05, in line with the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Clarus’s full-year EPS of negative $0.08 will flip to positive $0.18.

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Over the last two years, Clarus’s demanding reinvestments to stay relevant have drained its resources, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 3.4%, meaning it lit $3.35 of cash on fire for every $100 in revenue.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Clarus’s five-year average ROIC was negative 10.2%, meaning management lost money while trying to expand the business. Its returns were among the worst in the consumer discretionary sector.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Clarus’s ROIC has decreased significantly over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

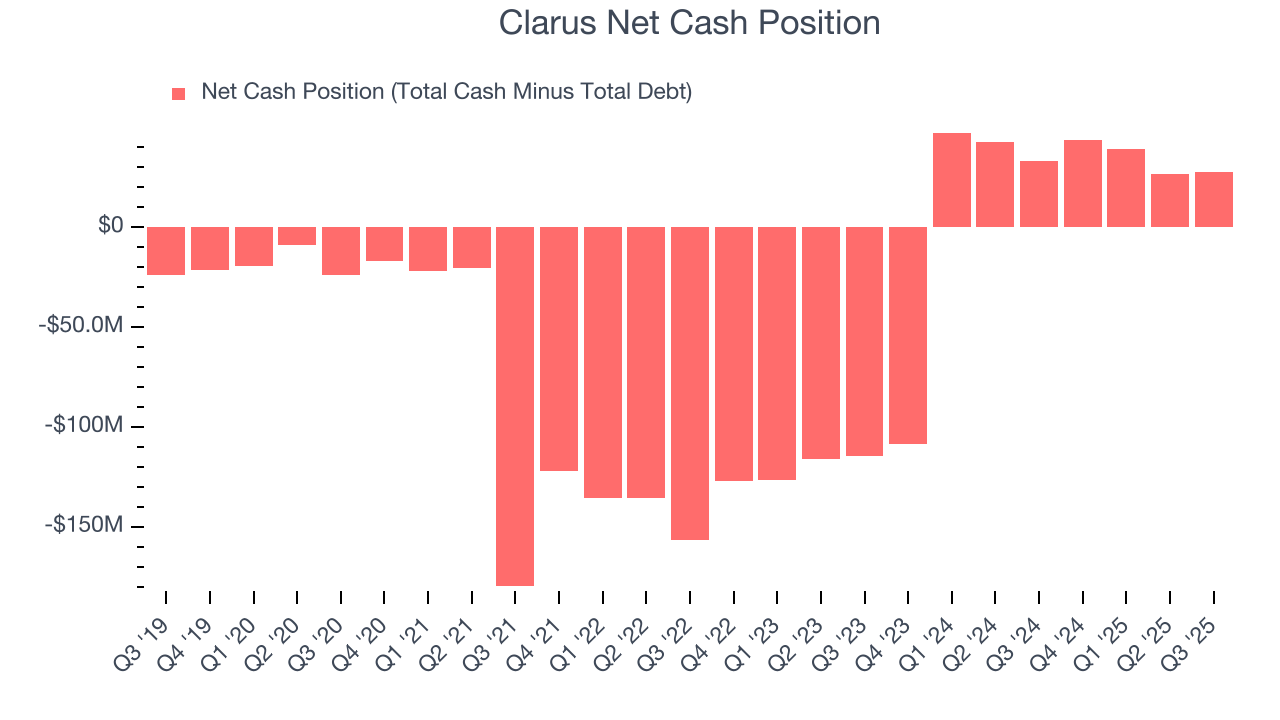

10. Balance Sheet Assessment

One of the best ways to mitigate bankruptcy risk is to hold more cash than debt.

Clarus is a well-capitalized company with $29.51 million of cash and $1.98 million of debt on its balance sheet. This $27.53 million net cash position is 19.5% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

11. Key Takeaways from Clarus’s Q3 Results

We were impressed by how significantly Clarus blew past analysts’ EBITDA expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. On the other hand, its EPS was in line. Overall, this print had some key positives. The stock traded up 4.1% to $3.39 immediately after reporting.

12. Is Now The Time To Buy Clarus?

Updated: February 21, 2026 at 9:18 PM EST

Before deciding whether to buy Clarus or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

Clarus falls short of our quality standards. While its projected EPS for the next year implies the company’s fundamentals will improve, the downside is its declining EPS over the last five years makes it a less attractive asset to the public markets. On top of that, its relatively low ROIC suggests management has struggled to find compelling investment opportunities.

Clarus’s P/E ratio based on the next 12 months is 21.6x. This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think other companies feature superior fundamentals at the moment.

Wall Street analysts have a consensus one-year price target of $4.15 on the company (compared to the current share price of $3.49).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.