Commerce (CMRC)

Commerce is up against the odds. Its growth has decelerated and its failure to generate meaningful free cash flow makes us question its prospects.― StockStory Analyst Team

1. News

2. Summary

Why We Think Commerce Will Underperform

As a founding member of the MACH Alliance advocating for modern tech standards, Commerce (NASDAQ:CMRC) provides a SaaS platform that enables businesses to build and manage online stores, connect with marketplaces, and integrate with point-of-sale systems.

- ARR growth averaged a weak 2.7% over the last year, suggesting that competition is pulling some attention away from its software

- Estimated sales growth of 3.1% for the next 12 months implies demand will slow from its two-year trend

- Annual revenue growth of 5.2% over the last two years was well below our standards for the software sector

Commerce doesn’t meet our quality criteria. We’re hunting for superior stocks elsewhere.

Why There Are Better Opportunities Than Commerce

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Commerce

At $2.87 per share, Commerce trades at 0.6x forward price-to-sales. This sure is a cheap multiple, but you get what you pay for.

Cheap stocks can look like great bargains at first glance, but you often get what you pay for. These mediocre businesses often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Commerce (CMRC) Research Report: Q4 CY2025 Update

E-commerce software company Commerce (NASDAQ:CMRC) fell short of the market’s revenue expectations in Q4 CY2025 as sales rose 2.9% year on year to $89.52 million. Next quarter’s revenue guidance of $83 million underwhelmed, coming in 3.5% below analysts’ estimates. Its non-GAAP profit of $0.07 per share was in line with analysts’ consensus estimates.

Commerce (CMRC) Q4 CY2025 Highlights:

- Revenue: $89.52 million vs analyst estimates of $90.26 million (2.9% year-on-year growth, 0.8% miss)

- Adjusted EPS: $0.07 vs analyst estimates of $0.07 (in line)

- Adjusted Operating Income: $7.42 million vs analyst estimates of $7.08 million (8.3% margin, 4.8% beat)

- Revenue Guidance for Q1 CY2026 is $83 million at the midpoint, below analyst estimates of $85.99 million

- Operating Margin: -7.4%, down from -0.9% in the same quarter last year

- Free Cash Flow was -$266,000, down from $7.59 million in the previous quarter

- Annual Recurring Revenue: $359.1 million vs analyst estimates of $361.9 million (2.7% year-on-year growth, miss)

- Market Capitalization: $222.7 million

Company Overview

As a founding member of the MACH Alliance advocating for modern tech standards, Commerce (NASDAQ:CMRC) provides a SaaS platform that enables businesses to build and manage online stores, connect with marketplaces, and integrate with point-of-sale systems.

Commerce's platform serves businesses of all sizes through a multi-tenant SaaS model that combines enterprise-grade functionality with user-friendly interfaces. The company offers tiered subscription plans: Enterprise plans for large businesses with annual online sales over $50 million, and Essentials plans (Standard, Plus, and Pro) for mid-market and small businesses. What distinguishes Commerce is its "Open SaaS" approach, providing extensive API endpoints that allow for customization and integration with third-party services.

The platform handles all critical e-commerce functions including store design, catalog management, hosting, checkout, order management, and reporting. Through its "composable commerce" strategy, businesses can adapt the platform to their specific needs by selecting from pre-integrated best-of-breed services for payments, shipping, marketing, and more. This approach differs from competitors that operate complex software stacks competing across multiple categories.

Following its acquisition of Feedonomics in 2021, Commerce enhanced its omnichannel capabilities, enabling merchants to advertise and sell through over 100 channels including Amazon, Facebook/Instagram, Google, and Walmart. The platform also supports "headless commerce," allowing businesses to integrate BigCommerce's backend with separate frontend experiences created in content management systems or design frameworks. Commerce recently introduced Catalyst, its next-generation storefront technology designed specifically for development teams to build customized stores using composable architecture.

4. E-commerce Software

While e-commerce has been around for over two decades and enjoyed meaningful growth, its overall penetration of retail still remains low. Only around $1 in every $5 spent on retail purchases comes from digital orders, leaving over 80% of the retail market still ripe for online disruption. It is these large swathes of the retail where e-commerce has not yet taken hold that drives the demand for various e-commerce software solutions.

Commerce's primary competitors in the mid-market and enterprise segments include Adobe's Magento, Salesforce Commerce Cloud, Commercetools, and Shopify Plus, while in the small business market, they compete mainly with Shopify and WooCommerce.

5. Revenue Growth

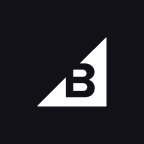

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Commerce grew its sales at a decent 17.6% compounded annual growth rate. Its growth was slightly above the average software company and shows its offerings resonate with customers.

Long-term growth is the most important, but within software, a half-decade historical view may miss new innovations or demand cycles. Commerce’s recent performance shows its demand has slowed as its annualized revenue growth of 5.2% over the last two years was below its five-year trend. We’re wary when companies in the sector see decelerations in revenue growth, as it could signal changing consumer tastes aided by low switching costs.

This quarter, Commerce’s revenue grew by 2.9% year on year to $89.52 million, falling short of Wall Street’s estimates. Company management is currently guiding for flat sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 4.3% over the next 12 months, similar to its two-year rate. This projection is underwhelming and indicates its newer products and services will not lead to better top-line performance yet.

6. Annual Recurring Revenue

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

Commerce’s ARR came in at $359.1 million in Q4, and over the last four quarters, its growth was underwhelming as it averaged 2.7% year-on-year increases. This performance mirrored its total sales and suggests that increasing competition is causing challenges in securing longer-term commitments.

7. Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Commerce is efficient at acquiring new customers, and its CAC payback period checked in at 39 months this quarter. The company’s relatively fast recovery of its customer acquisition costs means it can attempt to spur growth by increasing its sales and marketing investments.

8. Gross Margin & Pricing Power

For software companies like Commerce, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

Commerce’s robust unit economics are better than the broader software industry, an output of its asset-lite business model and pricing power. They also enable the company to fund large investments in new products and sales during periods of rapid growth to achieve outsized profits at scale. As you can see below, it averaged an excellent 78.7% gross margin over the last year. Said differently, roughly $78.75 was left to spend on selling, marketing, and R&D for every $100 in revenue.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. Commerce has seen gross margins improve by 2.7 percentage points over the last 2 year, which is very good in the software space.

Commerce’s gross profit margin came in at 78.3% this quarter, in line with the same quarter last year. Zooming out, Commerce’s full-year margin has been trending up over the past 12 months, increasing by 2.1 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as servers).

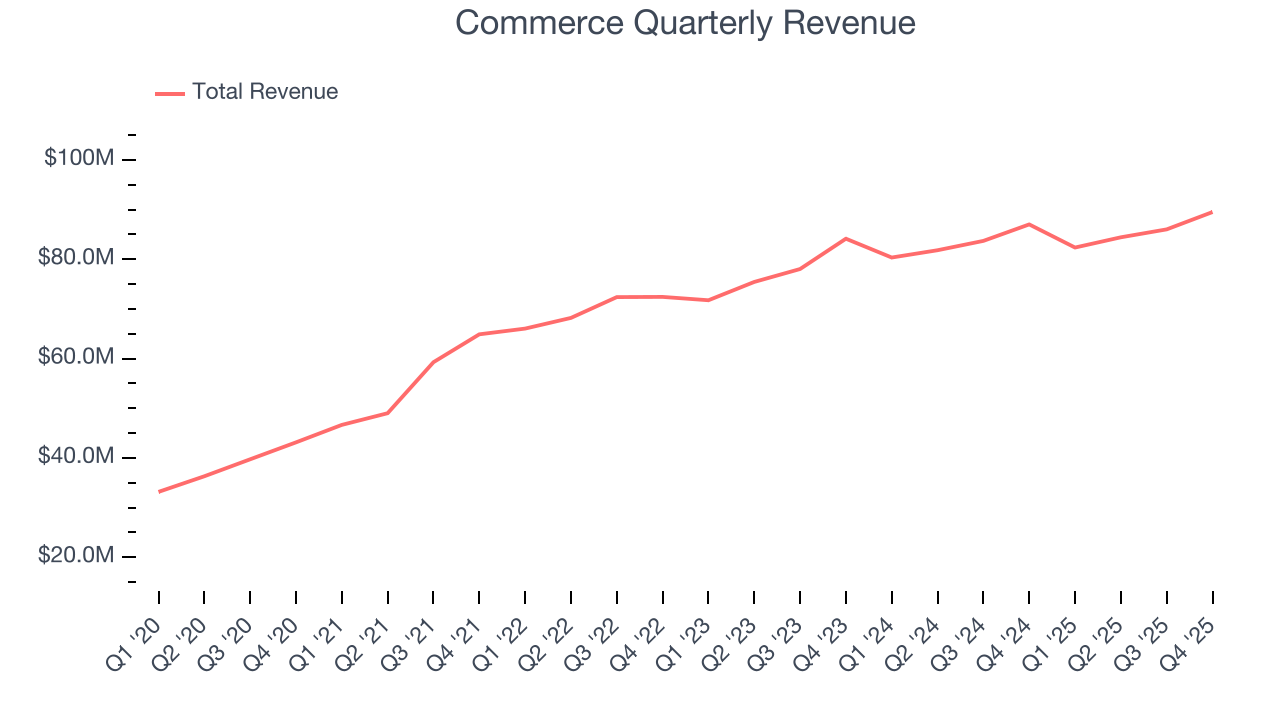

9. Operating Margin

Commerce’s expensive cost structure has contributed to an average operating margin of negative 4.7% over the last year. Unprofitable, high-growth software companies require extra attention because they spend heaps of money to capture market share. As seen in its fast historical revenue growth, this strategy seems to have worked so far, but it’s unclear what would happen if Commerce reeled back its investments. Wall Street seems to think it will face some obstacles, and we tend to agree.

Over the last two years, Commerce’s expanding sales gave it operating leverage as its margin rose by 7.8 percentage points. Still, it will take much more for the company to reach long-term profitability.

This quarter, Commerce generated a negative 7.4% operating margin.

10. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Commerce has shown poor cash profitability over the last year, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 4.8%, lousy for a software business.

Commerce broke even from a free cash flow perspective in Q4. The company’s cash profitability regressed as it was 13.6 percentage points lower than in the same quarter last year, prompting us to pay closer attention. Short-term fluctuations typically aren’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

Over the next year, analysts predict Commerce’s cash conversion will improve. Their consensus estimates imply its free cash flow margin of 4.8% for the last 12 months will increase to 9.3%, giving it more flexibility for investments, share buybacks, and dividends.

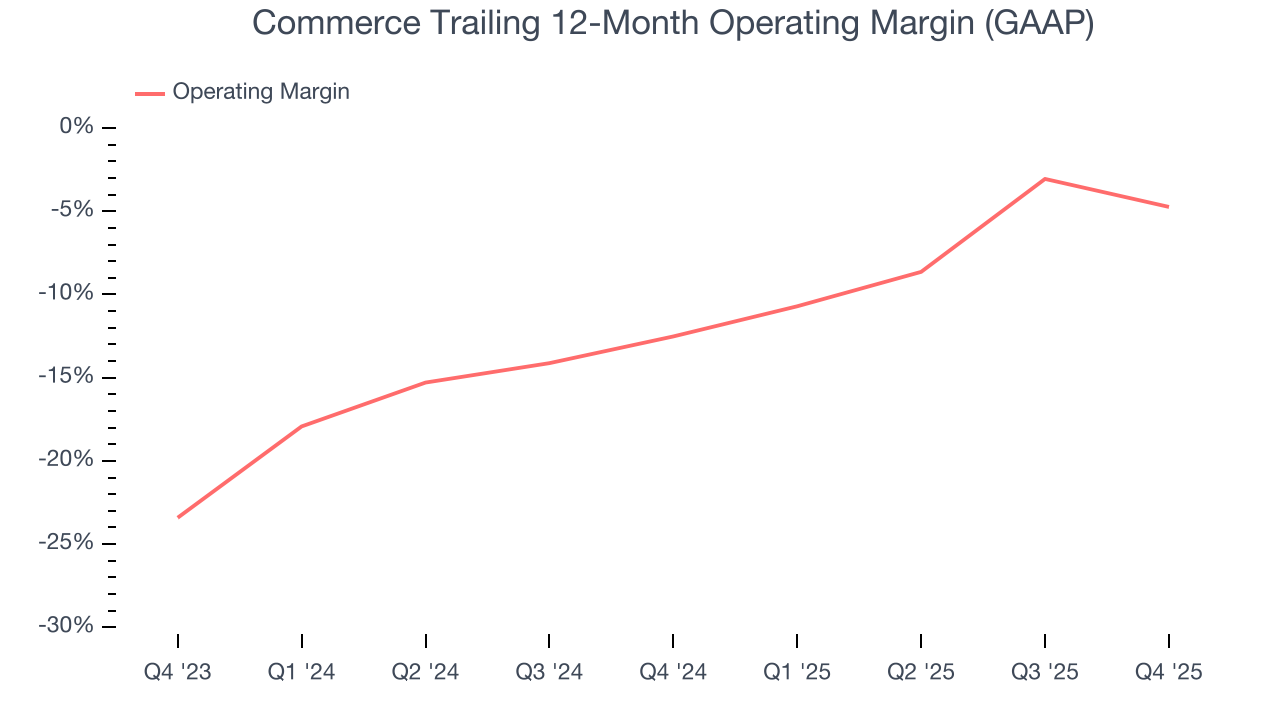

11. Balance Sheet Assessment

Commerce reported $143 million of cash and $165.5 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $31.72 million of EBITDA over the last 12 months, we view Commerce’s 0.7× net-debt-to-EBITDA ratio as safe. We also see its $5.21 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Commerce’s Q4 Results

It was great to see Commerce expecting revenue growth to accelerate next year. We were also happy its EBITDA narrowly outperformed Wall Street’s estimates. On the other hand, its revenue guidance for next quarter missed and its revenue fell slightly short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 5.8% to $2.59 immediately following the results.

13. Is Now The Time To Buy Commerce?

Updated: February 24, 2026 at 9:23 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Commerce.

Commerce falls short of our quality standards. Although its revenue growth was solid over the last five years, it’s expected to deteriorate over the next 12 months and its ARR has disappointed and shows the company is having difficulty retaining customers and their spending. And while the company’s gross margin suggests it can generate sustainable profits, the downside is its low free cash flow margins give it little breathing room.

Commerce’s price-to-sales ratio based on the next 12 months is 0.6x. While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $4.96 on the company (compared to the current share price of $2.87).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.