CooperCompanies (COO)

We’re skeptical of CooperCompanies. Its low returns on capital raise concerns about its ability to deliver profits, a must for quality companies.― StockStory Analyst Team

1. News

2. Summary

Why CooperCompanies Is Not Exciting

With a history dating back to 1958 and a portfolio spanning two distinct healthcare segments, Cooper Companies (NASDAQ:COO) develops and manufactures medical devices focused on vision care through contact lenses and women's health including fertility products and services.

- Below-average returns on capital indicate management struggled to find compelling investment opportunities

- On the plus side, its earnings per share grew by 11.4% annually over the last five years and topped the peer group average

CooperCompanies is skating on thin ice. There are more rewarding stocks elsewhere.

Why There Are Better Opportunities Than CooperCompanies

High Quality

Investable

Underperform

Why There Are Better Opportunities Than CooperCompanies

CooperCompanies is trading at $81.29 per share, or 18.4x forward P/E. CooperCompanies’s multiple may seem like a great deal among healthcare peers, but we think there are valid reasons why it’s this cheap.

We’d rather pay up for companies with elite fundamentals than get a bargain on weak ones. Cheap stocks can be value traps, and as their performance deteriorates, they will stay cheap or get even cheaper.

3. CooperCompanies (COO) Research Report: Q3 CY2025 Update

Medical device company CooperCompanies (NASDAQ:COO) met Wall Streets revenue expectations in Q3 CY2025, with sales up 4.6% year on year to $1.07 billion. The company expects next quarter’s revenue to be around $1.02 billion, coming in 0.6% above analysts’ estimates. Its non-GAAP profit of $1.15 per share was 3.2% above analysts’ consensus estimates.

CooperCompanies (COO) Q3 CY2025 Highlights:

- Revenue: $1.07 billion vs analyst estimates of $1.06 billion (4.6% year-on-year growth, in line)

- Adjusted EPS: $1.15 vs analyst estimates of $1.11 (3.2% beat)

- Revenue Guidance for Q4 CY2025 is $1.02 billion at the midpoint, roughly in line with what analysts were expecting

- Adjusted EPS guidance for the upcoming financial year 2026 is $4.53 at the midpoint, beating analyst estimates by 3.1%

- Operating Margin: 13.2%, down from 19.5% in the same quarter last year

- Organic Revenue rose 3% year on year vs analyst estimates of 2.8% growth (19.6 basis point beat)

- Market Capitalization: $15.11 billion

Company Overview

With a history dating back to 1958 and a portfolio spanning two distinct healthcare segments, Cooper Companies (NASDAQ:COO) develops and manufactures medical devices focused on vision care through contact lenses and women's health including fertility products and services.

Cooper operates through two primary business segments: CooperVision and CooperSurgical. CooperVision is a global manufacturer of contact lenses, offering products in various modalities including single-use and frequent replacement lenses. The division produces spherical lenses for basic vision correction as well as specialized lenses for more complex conditions like astigmatism and presbyopia. Its flagship brands include Biofinity, MyDay, and clariti 1 day. CooperVision also markets MiSight, the first FDA-approved contact lens designed to slow myopia progression in children.

CooperSurgical focuses on fertility and women's health products and services. This division offers medical devices used in gynecology and obstetrics, fertility treatments, and contraception. Its product portfolio includes tools for in vitro fertilization (IVF), micro-tools for embryologists, and laboratory equipment for fertility clinics. CooperSurgical also provides services like donor gamete programs, cryostorage for reproductive tissues, and genetic testing. The division markets Paragard, a hormone-free copper intrauterine device (IUD) that prevents pregnancy for up to ten years.

A healthcare provider might use CooperVision's toric lenses to help a patient with astigmatism achieve clearer vision, or a fertility specialist might utilize CooperSurgical's embryo culture media and incubators during an IVF procedure to optimize conditions for embryo development.

Cooper generates revenue through direct sales to eye care professionals, hospitals, surgery centers, and fertility clinics. The company also sells through distributors and retail chains in certain markets. Cooper maintains manufacturing facilities across multiple countries including the United States, United Kingdom, Costa Rica, and Hungary, allowing it to serve customers globally while maintaining regional expertise.

4. Medical Devices & Supplies - Diversified

The medical devices industry operates a business model that balances steady demand with significant investments in innovation and regulatory compliance. The industry benefits from recurring revenue streams tied to consumables, maintenance services, and incremental upgrades to the latest technologies. However, the capital-intensive nature of product development, coupled with lengthy regulatory pathways and the need for clinical validation, can weigh on profitability and timelines. In addition, there are constant pricing pressures from healthcare systems and insurers maximizing cost efficiency. Over the next several years, one tailwind is demographic–aging populations means rising chronic disease rates that drive greater demand for medical interventions and monitoring solutions. Advances in digital health, such as remote patient monitoring and smart devices, are also expected to unlock new demand by shortening upgrade cycles. On the other hand, the industry faces headwinds from pricing and reimbursement pressures as healthcare providers increasingly adopt value-based care models. Additionally, the integration of cybersecurity for connected devices adds further risk and complexity for device manufacturers.

Cooper Companies' vision care segment, CooperVision, competes primarily with Johnson & Johnson Vision Care, Alcon Inc., and Bausch + Lomb in the contact lens market. In the women's health and fertility segment, CooperSurgical faces competition from Vitrolife Group, FujiFilm-Irvine Scientific, and Hamilton Thorne, as well as larger medical device companies like Johnson & Johnson, Medtronic, and Hologic.

5. Economies of Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $4.09 billion in revenue over the past 12 months, CooperCompanies has decent scale. This is important as it gives the company more leverage in a heavily regulated, competitive environment that is complex and resource-intensive.

6. Revenue Growth

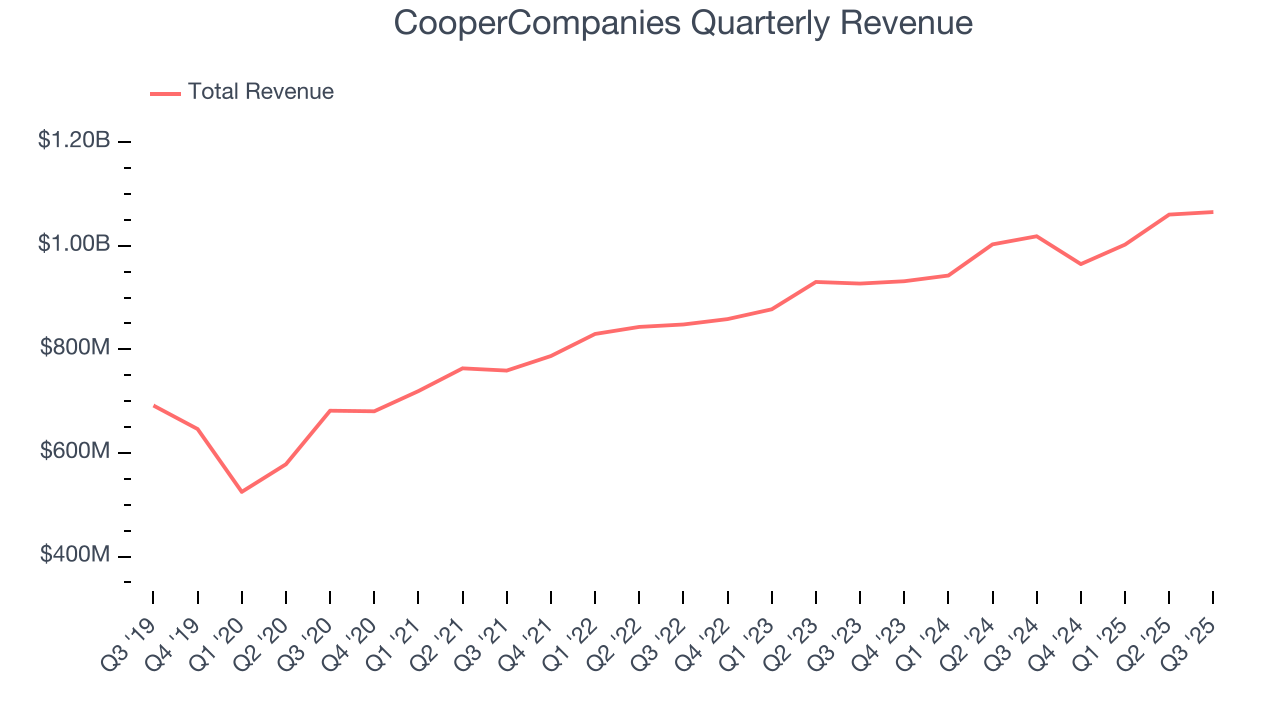

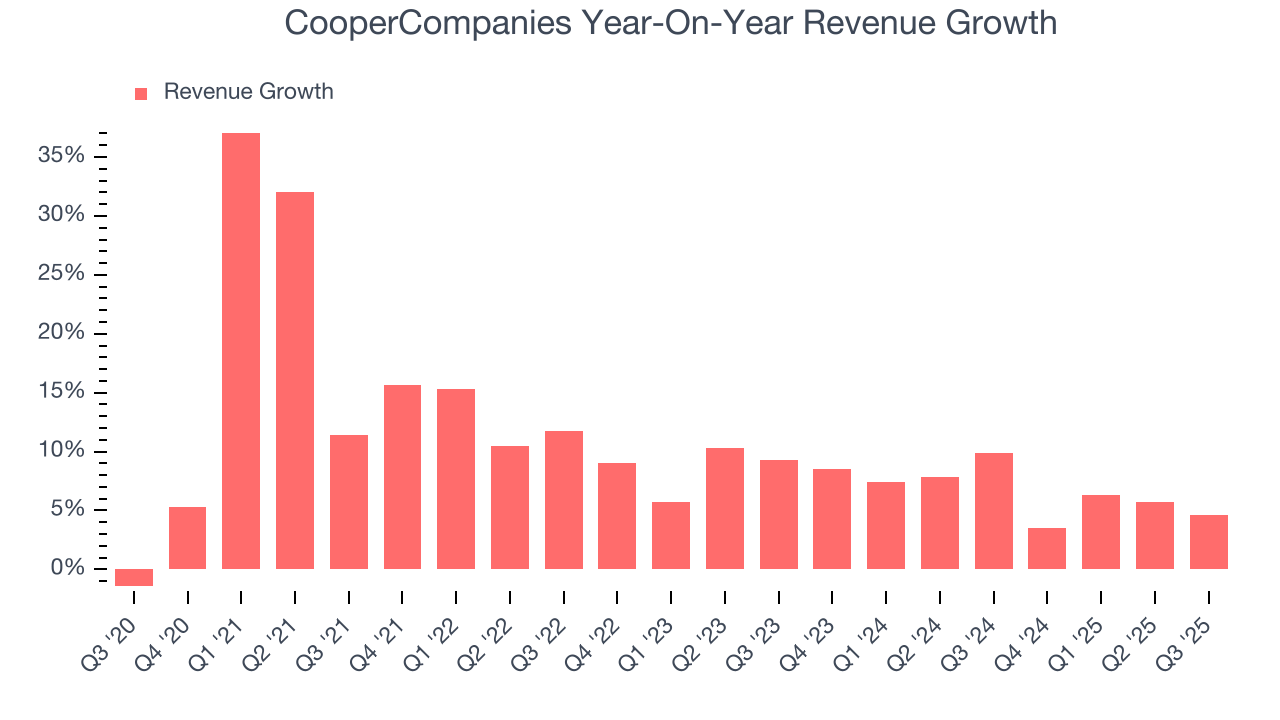

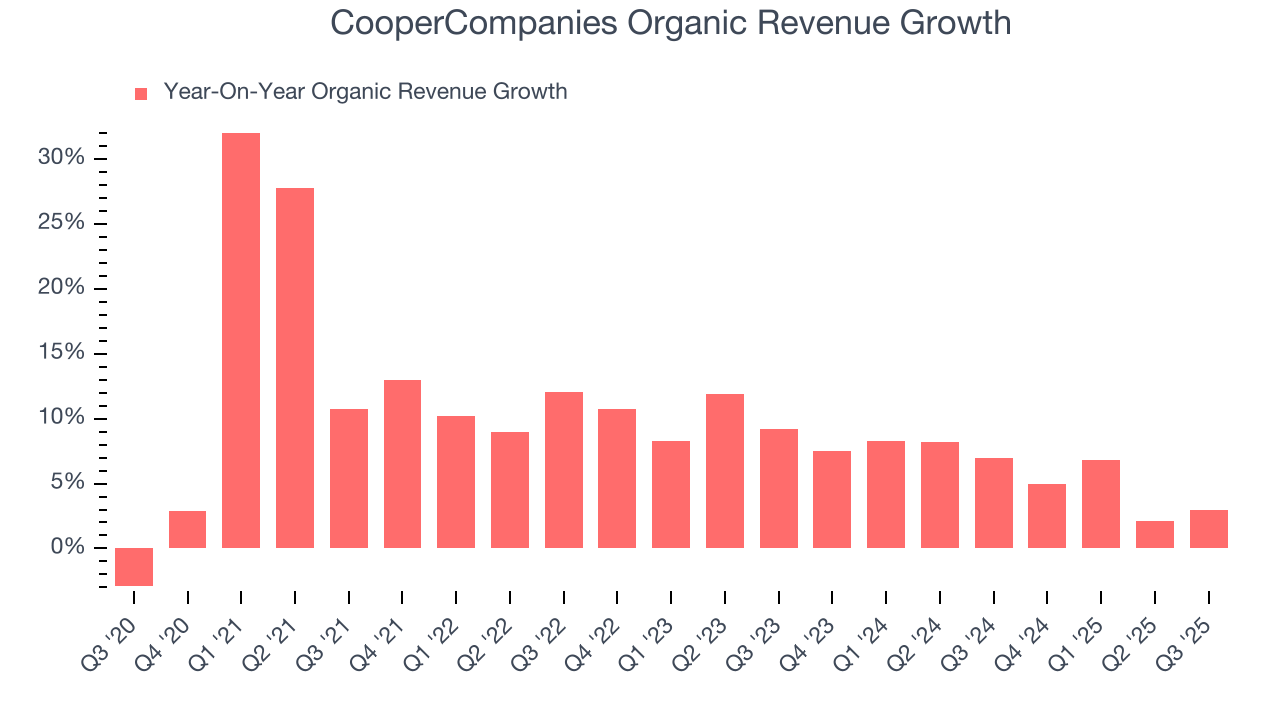

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Luckily, CooperCompanies’s sales grew at a decent 11% compounded annual growth rate over the last five years. Its growth was slightly above the average healthcare company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. CooperCompanies’s recent performance shows its demand has slowed as its annualized revenue growth of 6.7% over the last two years was below its five-year trend.

We can dig further into the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, CooperCompanies’s organic revenue averaged 6% year-on-year growth. Because this number aligns with its two-year revenue growth, we can see the company’s core operations (not acquisitions and divestitures) drove most of its results.

This quarter, CooperCompanies grew its revenue by 4.6% year on year, and its $1.07 billion of revenue was in line with Wall Street’s estimates. Company management is currently guiding for a 6.2% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 5% over the next 12 months, a slight deceleration versus the last two years. Still, this projection is above the sector average and indicates the market is baking in some success for its newer products and services.

7. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

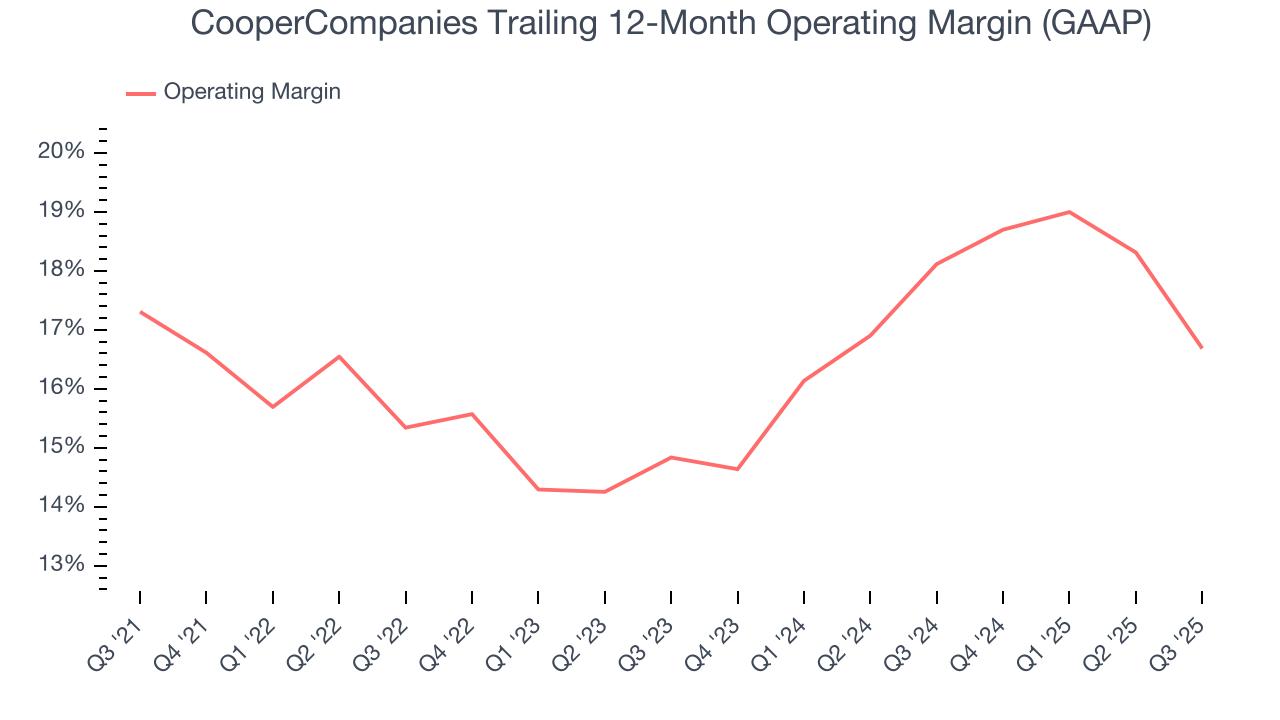

CooperCompanies’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 16.5% over the last five years. This profitability was solid for a healthcare business and shows it’s an efficient company that manages its expenses well.

Looking at the trend in its profitability, CooperCompanies’s operating margin of 16.7% for the trailing 12 months may be around the same as five years ago, but it has increased by 1.9 percentage points over the last two years.

This quarter, CooperCompanies generated an operating margin profit margin of 13.2%, down 6.3 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

8. Earnings Per Share

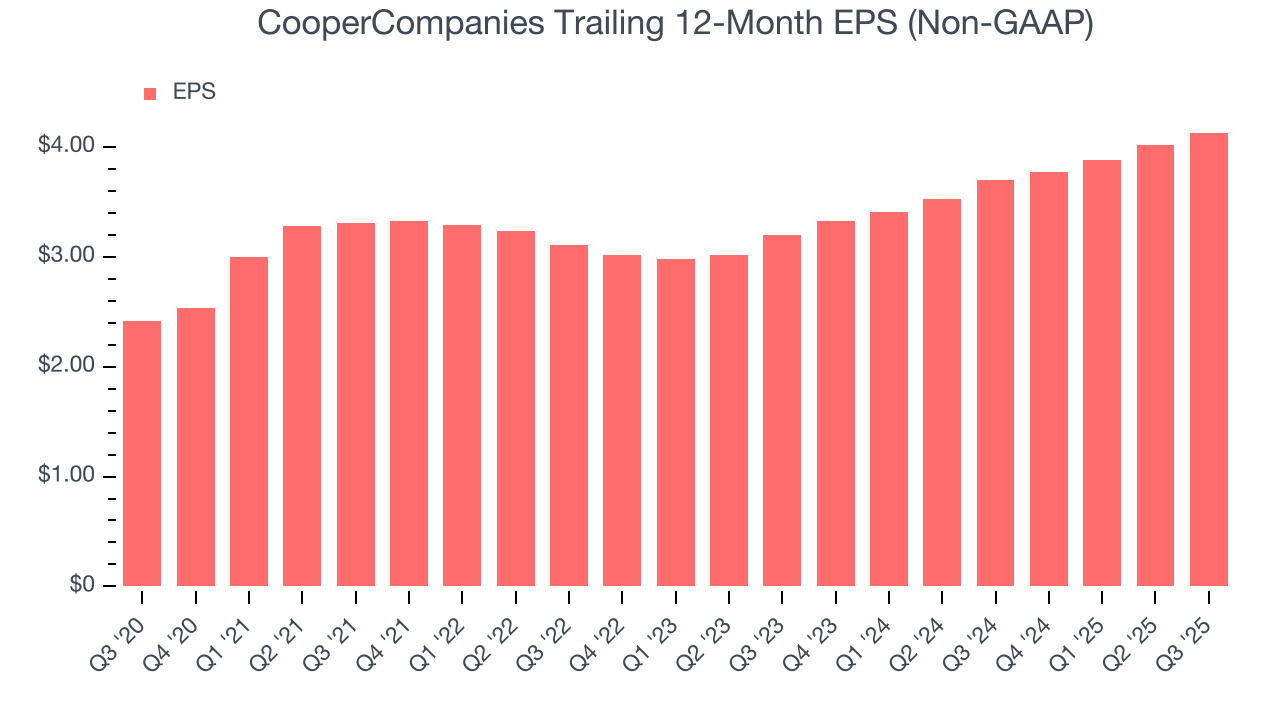

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

CooperCompanies’s remarkable 11.4% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

In Q3, CooperCompanies reported adjusted EPS of $1.15, up from $1.04 in the same quarter last year. This print beat analysts’ estimates by 3.3%. Over the next 12 months, Wall Street expects CooperCompanies’s full-year EPS of $4.13 to grow 5.5%.

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

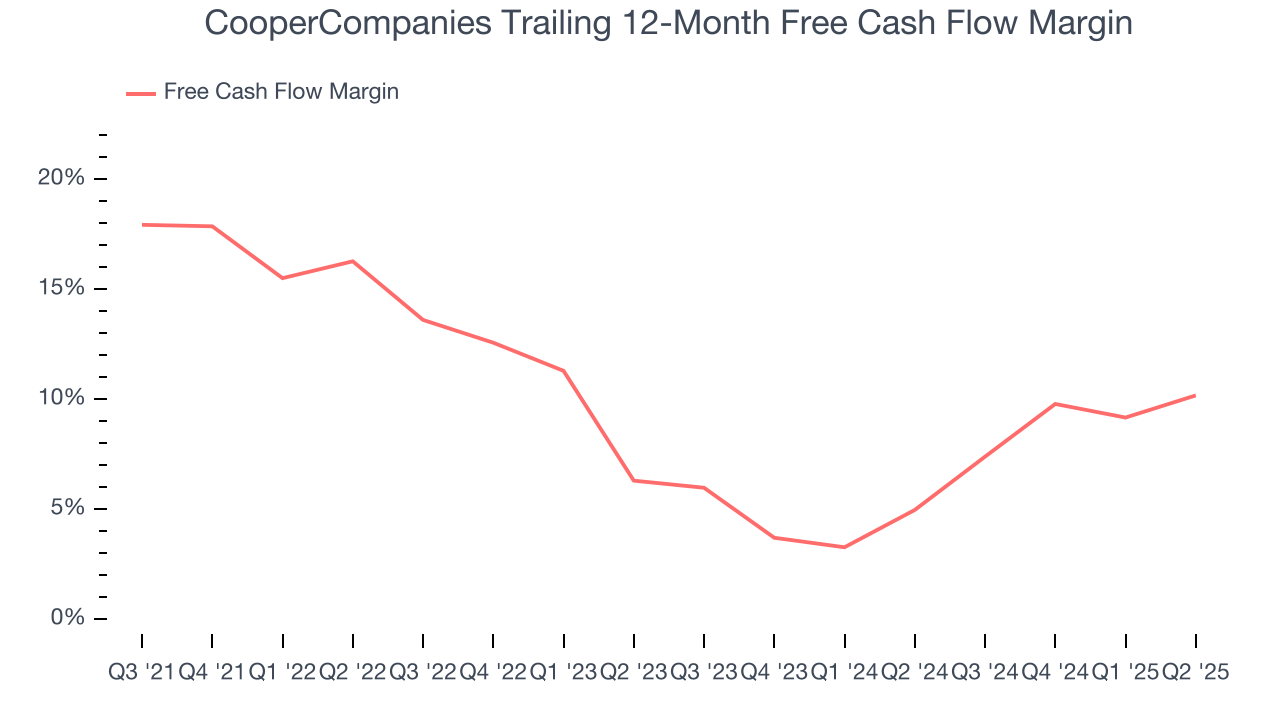

CooperCompanies has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 10.5% over the last five years, better than the broader healthcare sector.

Taking a step back, we can see that CooperCompanies’s margin dropped by 9.8 percentage points during that time. If its declines continue, it could signal increasing investment needs and capital intensity.

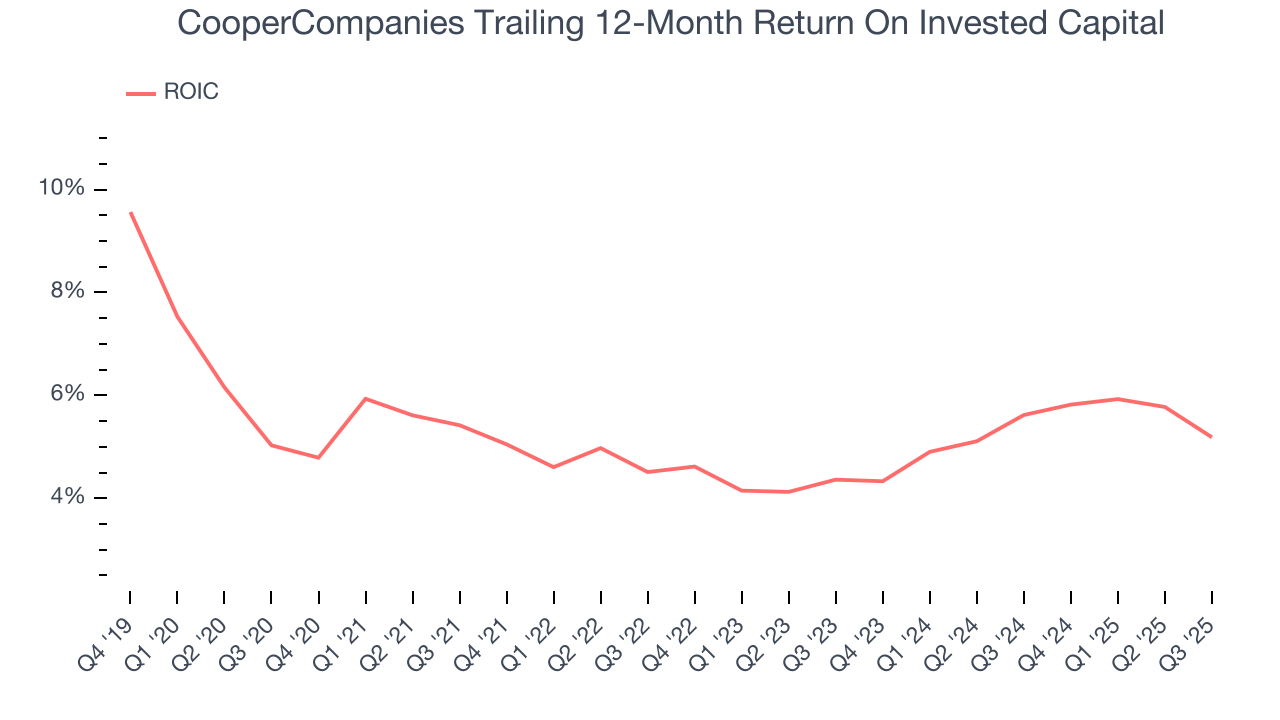

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

CooperCompanies historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 5%, somewhat low compared to the best healthcare companies that consistently pump out 20%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, CooperCompanies’s ROIC has stayed the same over the last few years. If the company wants to become an investable business, it must improve its returns by generating more profitable growth.

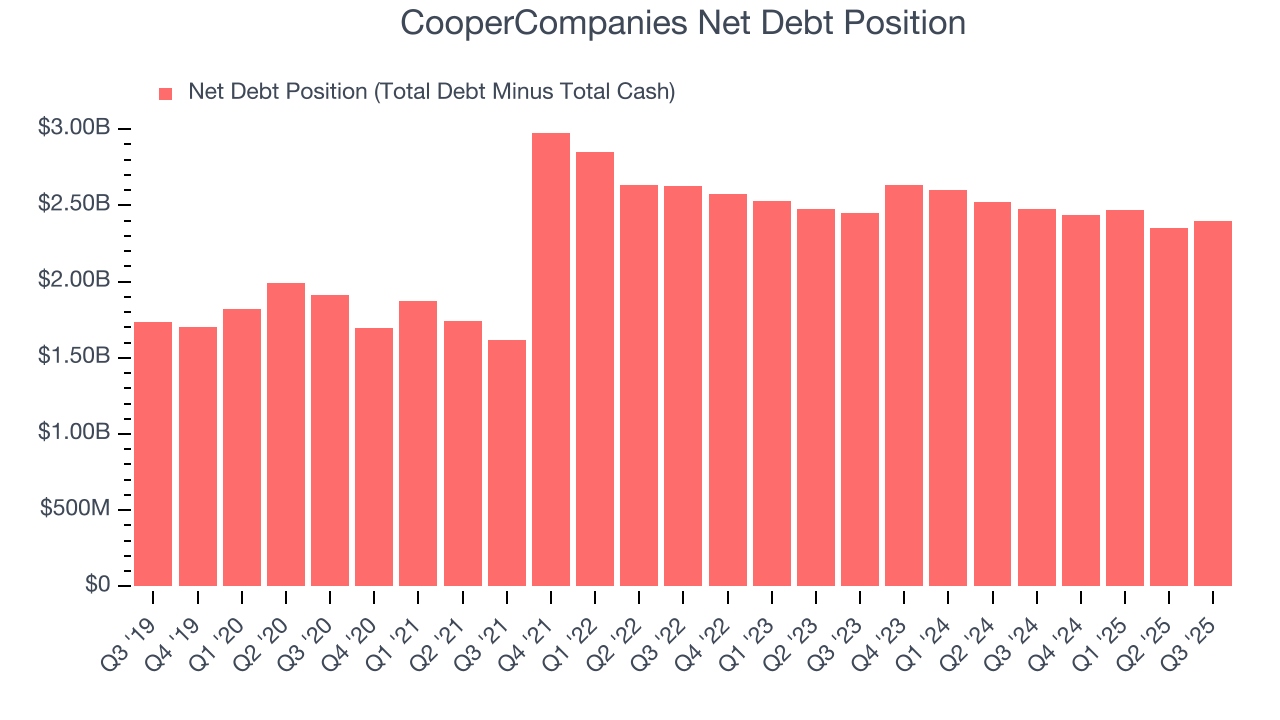

11. Balance Sheet Assessment

CooperCompanies reported $110.6 million of cash and $2.51 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $1.32 billion of EBITDA over the last 12 months, we view CooperCompanies’s 1.8× net-debt-to-EBITDA ratio as safe. We also see its $100 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from CooperCompanies’s Q3 Results

We enjoyed seeing CooperCompanies beat analysts’ full-year EPS guidance expectations this quarter. We were also glad its EPS guidance for next quarter outperformed Wall Street’s estimates. Overall, this print had some key positives. The stock traded up 5% to $81.17 immediately following the results.

13. Is Now The Time To Buy CooperCompanies?

Updated: January 24, 2026 at 10:47 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in CooperCompanies.

CooperCompanies isn’t a terrible business, but it doesn’t pass our quality test. Although its revenue growth was good over the last five years, it’s expected to deteriorate over the next 12 months and its cash profitability fell over the last five years. And while the company’s remarkable EPS growth over the last five years shows its profits are trickling down to shareholders, the downside is its mediocre ROIC lags the market and is a headwind for its stock price.

CooperCompanies’s P/E ratio based on the next 12 months is 18.4x. While this valuation is fair, the upside isn’t great compared to the potential downside. We're fairly confident there are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $91.06 on the company (compared to the current share price of $81.29).