Hologic (HOLX)

Hologic is in for a bumpy ride. Its plummeting sales and returns on capital show its profits are shrinking as demand fizzles out.― StockStory Analyst Team

1. News

2. Summary

Why We Think Hologic Will Underperform

As a pioneer in 3D mammography technology that has revolutionized breast cancer detection, Hologic (NASDAQ:HOLX) develops and manufactures diagnostic products, medical imaging systems, and surgical devices focused primarily on women's health and wellness.

- Performance over the past five years shows each sale was less profitable as its earnings per share dropped by 7.3% annually, worse than its revenue

- Sales tumbled by 1.9% annually over the last five years, showing market trends are working against its favor during this cycle

- Anticipated sales growth of 2.6% for the next year implies demand will be shaky

Hologic’s quality is inadequate. Better businesses are for sale in the market.

Why There Are Better Opportunities Than Hologic

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Hologic

Hologic’s stock price of $75.36 implies a valuation ratio of 16.7x forward P/E. This multiple is cheaper than most healthcare peers, but we think this is justified.

Cheap stocks can look like great bargains at first glance, but you often get what you pay for. These mediocre businesses often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Hologic (HOLX) Research Report: Q4 CY2025 Update

Medical technology company Hologic (NASDAQ:HOLX) missed Wall Street’s revenue expectations in Q4 CY2025 as sales rose 2.5% year on year to $1.05 billion. Its non-GAAP profit of $1.04 per share was 5.4% below analysts’ consensus estimates.

Hologic (HOLX) Q4 CY2025 Highlights:

- Revenue: $1.05 billion vs analyst estimates of $1.07 billion (2.5% year-on-year growth, 2.1% miss)

- Adjusted EPS: $1.04 vs analyst expectations of $1.10 (5.4% miss)

- Adjusted EBITDA: $330.4 million vs analyst estimates of $330.5 million (31.5% margin, in line)

- Operating Margin: 22.6%, in line with the same quarter last year

- Free Cash Flow Margin: 20.5%, up from 15.4% in the same quarter last year

- Constant Currency Revenue rose 1.3% year on year, in line with the same quarter last year

- Market Capitalization: $16.74 billion

Company Overview

As a pioneer in 3D mammography technology that has revolutionized breast cancer detection, Hologic (NASDAQ:HOLX) develops and manufactures diagnostic products, medical imaging systems, and surgical devices focused primarily on women's health and wellness.

Hologic operates through four main segments: Diagnostics, Breast Health, GYN Surgical, and Skeletal Health. Each segment offers specialized technologies that address different aspects of women's healthcare needs.

The Diagnostics segment features molecular diagnostic systems like the Panther and Panther Fusion platforms, which run a variety of tests for sexually transmitted infections, respiratory diseases, and viral load monitoring. The company's ThinPrep system has become the standard for cervical cancer screening in the U.S., replacing conventional Pap smears with a liquid-based method that preserves cell samples more effectively. Hologic also offers the Genius Digital Diagnostics System, which uses artificial intelligence to assist healthcare providers in detecting pre-cancerous lesions and cervical cancer cells.

In Breast Health, Hologic's 3D mammography technology (tomosynthesis) produces multiple slice images that allow radiologists to see breast tissue in greater detail than traditional 2D mammography. This technology has been clinically proven to improve cancer detection while reducing false positives. The company's breast health portfolio also includes biopsy guidance systems, tissue removal devices, and localization solutions that help surgeons precisely target breast lesions during procedures.

The GYN Surgical segment offers minimally invasive solutions for women's health issues. The MyoSure system removes fibroids and polyps from the uterus while preserving tissue for testing. The NovaSure endometrial ablation system treats abnormal uterine bleeding without hormones or hysterectomy. Other products include the Fluent fluid management system for hysteroscopic procedures and the Acessa ProVu system, which uses radiofrequency ablation to treat fibroids.

Hologic's Skeletal Health segment provides bone densitometry systems that measure bone density to diagnose osteoporosis and other metabolic bone diseases, as well as mini C-arm imaging systems used in orthopedic surgeries.

The company sells its products through direct sales forces and distributors worldwide, with service teams providing installation, training, and maintenance. Hologic's business model includes both equipment sales and recurring revenue from consumables, service contracts, and software upgrades.

4. Medical Devices & Supplies - Imaging, Diagnostics

The medical devices and supplies industry, particularly those specializing in imaging and diagnostics, operates with a comparatively stable yet capital-intensive business model. Companies in this space benefit from consistent demand driven by the essential nature of diagnostic tools in patient care, as well as recurring revenue streams from consumables, service contracts, and equipment maintenance. However, the industry faces challenges such as significant upfront development costs, stringent regulatory requirements, and pricing pressures from hospitals and healthcare systems, which are increasingly focused on cost containment. Looking ahead, the industry should enjoy tailwinds from advancements in technology, including the integration of artificial intelligence to enhance diagnostic accuracy and workflow efficiency, as well as rising demand for imaging solutions driven by aging populations. On the other hand, headwinds could arise from a rethinking of healthcare costs potentially resulting in reimbursement cuts and slower capital equipment purchasing. Additionally, cybersecurity concerns surrounding connected medical devices could introduce new risks and complexities for manufacturers.

Hologic's competitors vary by segment. In Diagnostics, the company primarily competes with Roche Diagnostics and Becton Dickinson. In Breast Health, major competitors include Siemens Healthineers and GE Healthcare. The GYN Surgical segment faces competition from Johnson & Johnson and Medtronic, while numerous smaller companies compete in specific niches across all segments.

5. Economies of Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $4.13 billion in revenue over the past 12 months, Hologic has decent scale. This is important as it gives the company more leverage in a heavily regulated, competitive environment that is complex and resource-intensive.

6. Revenue Growth

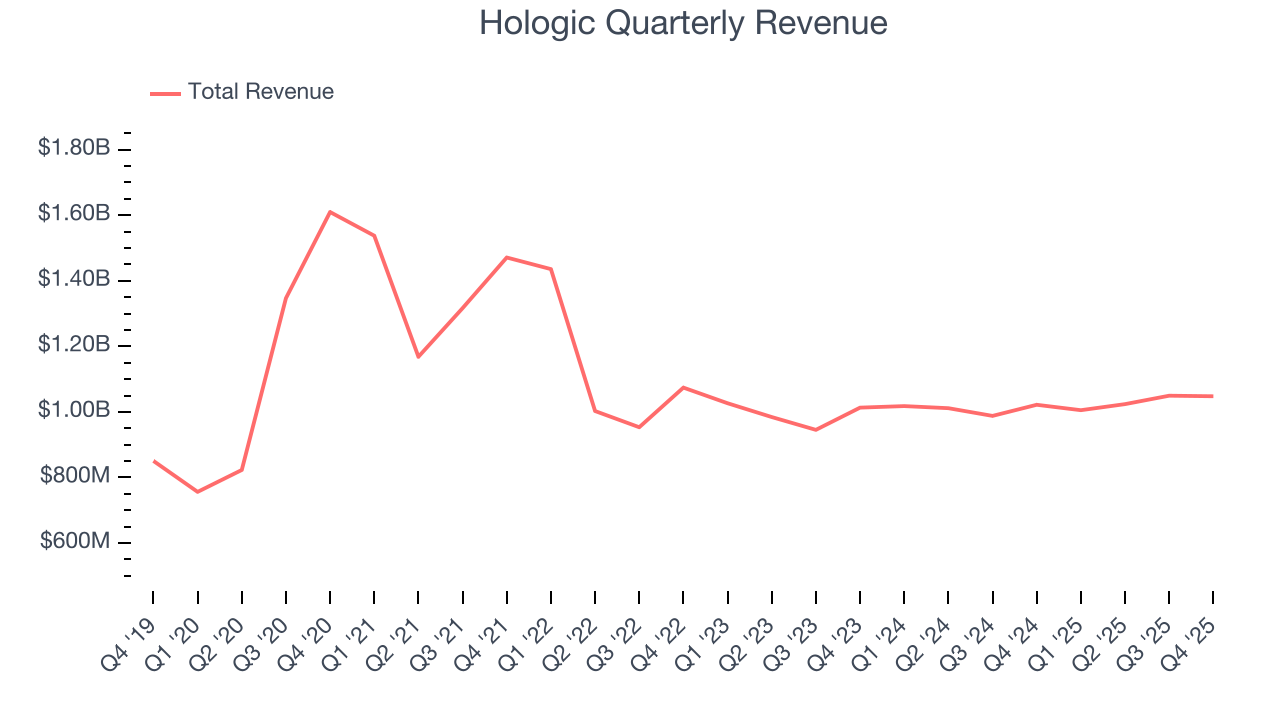

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Hologic’s demand was weak and its revenue declined by 1.9% per year. This wasn’t a great result and is a sign of lacking business quality.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Hologic’s annualized revenue growth of 2% over the last two years is above its five-year trend, but we were still disappointed by the results.

Hologic also reports sales performance excluding currency movements, which are outside the company’s control and not indicative of demand. Over the last two years, its constant currency sales averaged 1.7% year-on-year growth. Because this number aligns with its normal revenue growth, we can see that Hologic has properly hedged its foreign currency exposure.

This quarter, Hologic’s revenue grew by 2.5% year on year to $1.05 billion, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 5.1% over the next 12 months, an improvement versus the last two years. This projection is above the sector average and implies its newer products and services will fuel better top-line performance.

7. Operating Margin

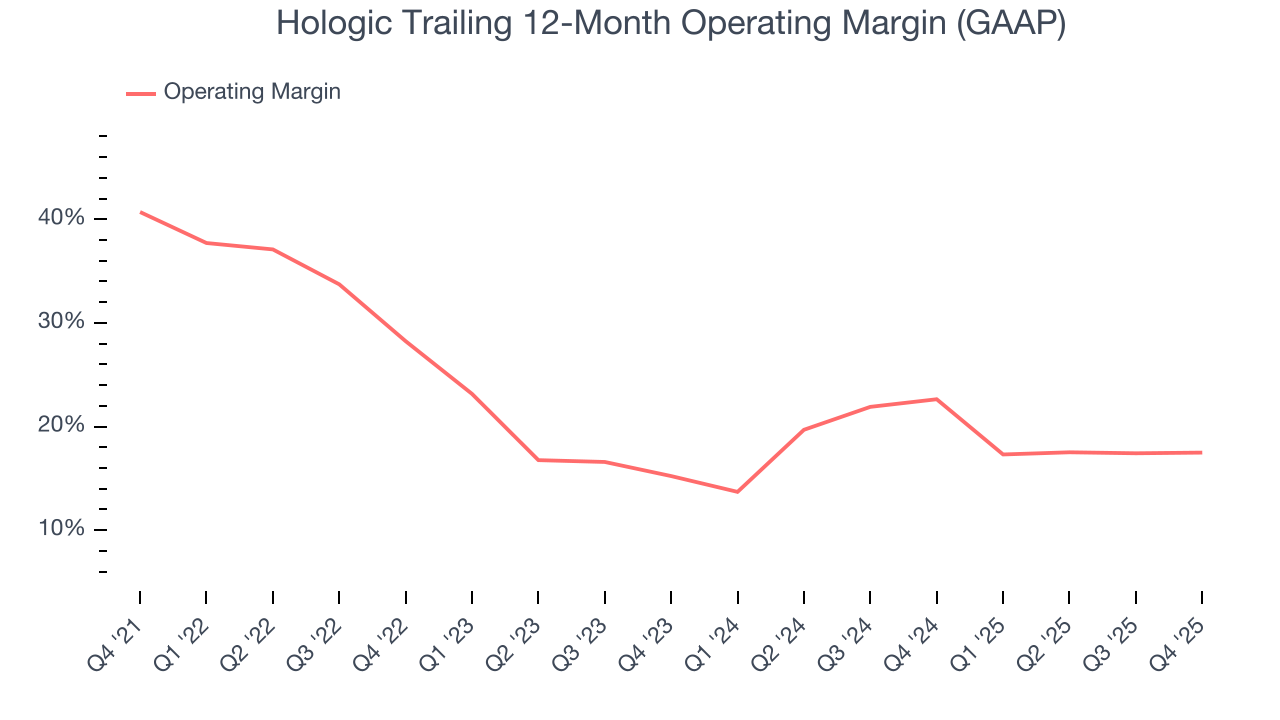

Hologic has been an efficient company over the last five years. It was one of the more profitable businesses in the healthcare sector, boasting an average operating margin of 26%.

Looking at the trend in its profitability, Hologic’s operating margin decreased by 23.2 percentage points over the last five years, but it rose by 2.3 percentage points on a two-year basis. Still, shareholders will want to see Hologic become more profitable in the future.

This quarter, Hologic generated an operating margin profit margin of 22.6%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

8. Earnings Per Share

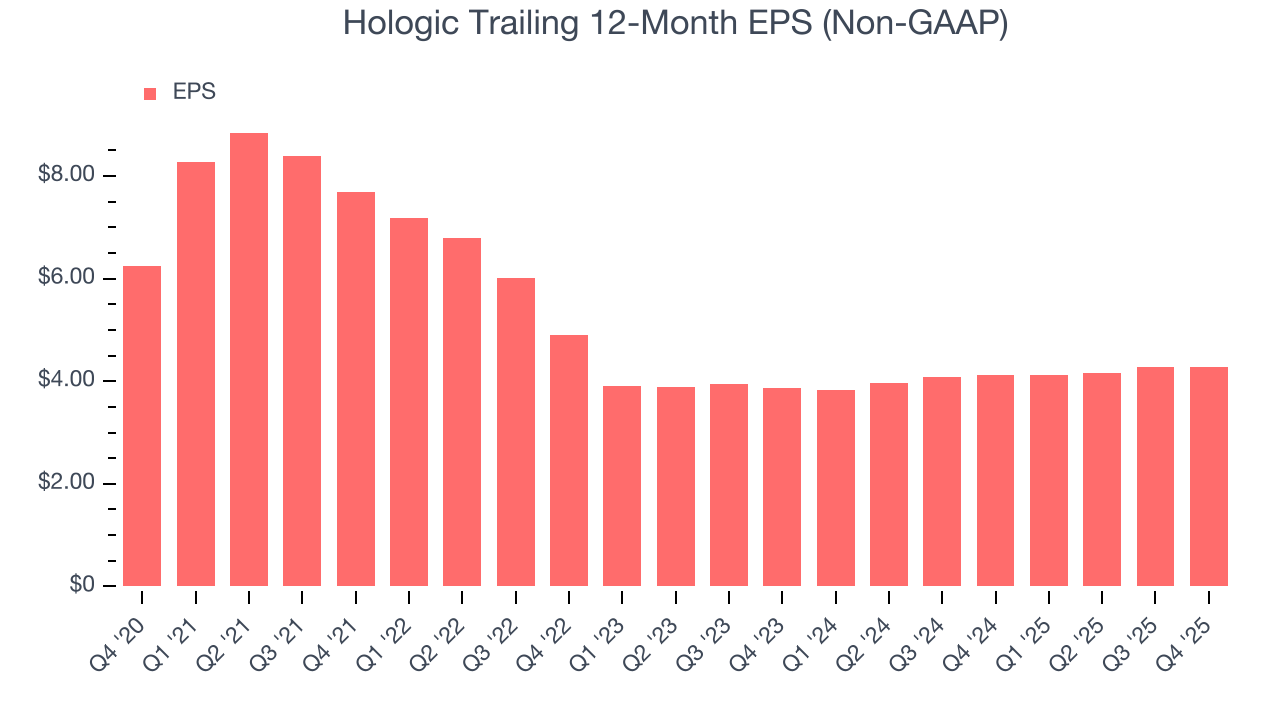

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Hologic, its EPS declined by 7.3% annually over the last five years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

We can take a deeper look into Hologic’s earnings to better understand the drivers of its performance. As we mentioned earlier, Hologic’s operating margin was flat this quarter but declined by 23.2 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, Hologic reported adjusted EPS of $1.04, up from $1.03 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street expects Hologic’s full-year EPS of $4.28 to grow 9.5%.

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Hologic has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the healthcare sector, averaging an eye-popping 30.2% over the last five years.

Taking a step back, we can see that Hologic’s margin dropped by 18.9 percentage points during that time. Continued declines could signal it is in the middle of an investment cycle.

Hologic’s free cash flow clocked in at $215.2 million in Q4, equivalent to a 20.5% margin. This result was good as its margin was 5.1 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, causing temporary swings. Long-term trends are more important.

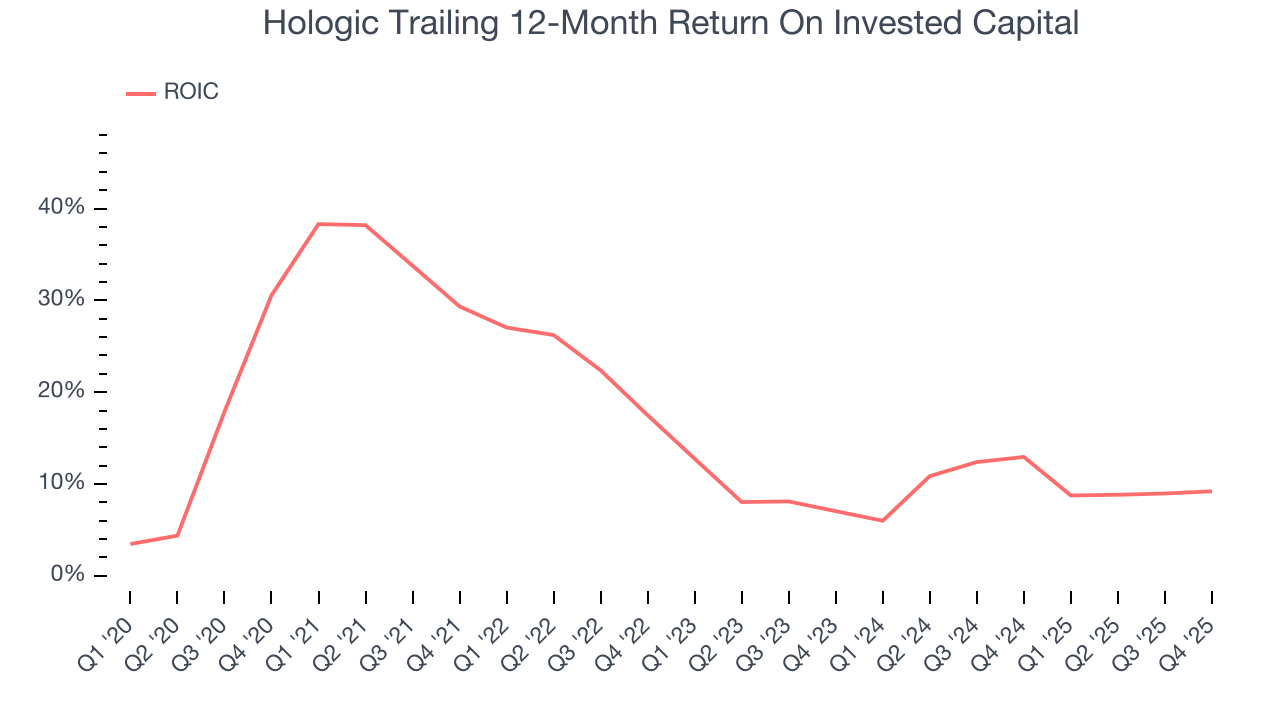

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Although Hologic hasn’t been the highest-quality company lately because of its poor revenue and EPS performance, it historically found a few growth initiatives that worked out well. Its five-year average ROIC was 15.2%, impressive for a healthcare business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Hologic’s ROIC has unfortunately decreased significantly. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

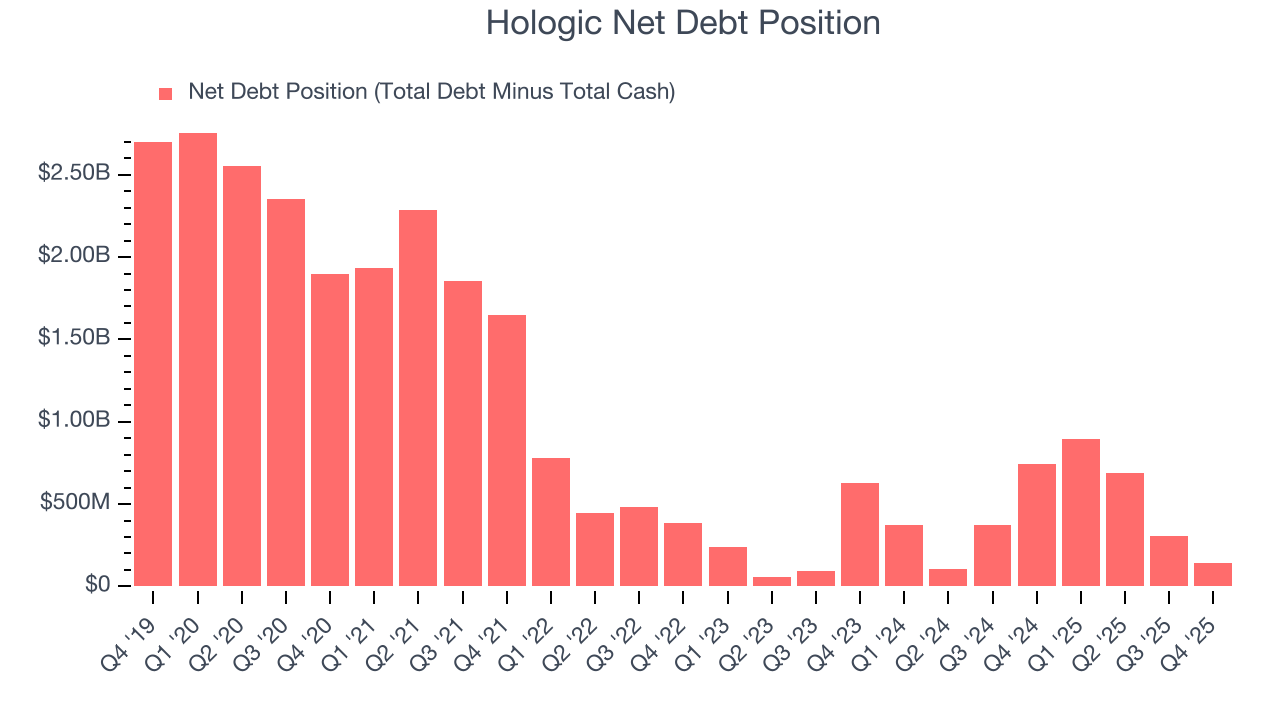

11. Balance Sheet Assessment

Hologic reported $2.36 billion of cash and $2.51 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $1.34 billion of EBITDA over the last 12 months, we view Hologic’s 0.1× net-debt-to-EBITDA ratio as safe. We also see its $28.5 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Hologic’s Q4 Results

We struggled to find many positives in these results. Its revenue missed and its EPS fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock remained flat at $74.89 immediately after reporting.

13. Is Now The Time To Buy Hologic?

Updated: February 25, 2026 at 11:27 PM EST

When considering an investment in Hologic, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

Hologic falls short of our quality standards. To begin with, its revenue has declined over the last five years. While its powerful free cash flow generation enables it to stay ahead of the competition through consistent reinvestment of profits, the downside is its declining EPS over the last five years makes it a less attractive asset to the public markets. On top of that, its declining adjusted operating margin shows the business has become less efficient.

Hologic’s P/E ratio based on the next 12 months is 16.7x. This valuation tells us a lot of optimism is priced in - you can find more timely opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $76.60 on the company (compared to the current share price of $75.37).