Lantheus (LNTH)

Lantheus is interesting. Its fusion of high growth and profitability makes it an asset with nice upside.― StockStory Analyst Team

1. News

2. Summary

Why Lantheus Is Interesting

Pioneering the "Find, Fight and Follow" approach to disease management, Lantheus Holdings (NASDAQGM:LNTH) develops and commercializes radiopharmaceuticals and other imaging agents that help healthcare professionals detect, diagnose, and treat diseases.

- Impressive 35.5% annual revenue growth over the last five years indicates it’s winning market share this cycle

- Healthy adjusted operating margin shows it’s a well-run company with efficient processes

- A drawback is its forecasted revenue decline of 5.6% for the upcoming 12 months implies demand will fall off a cliff

Lantheus is close to becoming a high-quality business. If you believe in the company, the price seems fair.

Why Is Now The Time To Buy Lantheus?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Lantheus?

Lantheus’s stock price of $75.07 implies a valuation ratio of 14.5x forward P/E. A number of healthcare companies feature higher multiples, but that doesn’t make Lantheus a bargain. In fact, we think the current price justly reflects the top-line growth.

Now could be a good time to invest if you believe in the story.

3. Lantheus (LNTH) Research Report: Q4 CY2025 Update

Radiopharmaceutical company Lantheus Holdings (NASDAQ:LNTH) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 4% year on year to $406.8 million. On the other hand, the company’s full-year revenue guidance of $1.43 billion at the midpoint came in 4.6% below analysts’ estimates. Its non-GAAP profit of $1.67 per share was 42.9% above analysts’ consensus estimates.

Lantheus (LNTH) Q4 CY2025 Highlights:

- Revenue: $406.8 million vs analyst estimates of $366.4 million (4% year-on-year growth, 11% beat)

- Adjusted EPS: $1.67 vs analyst estimates of $1.17 (42.9% beat)

- Adjusted EBITDA: $111.2 million vs analyst estimates of $121 million (27.3% margin, 8.1% miss)

- Adjusted EPS guidance for the upcoming financial year 2026 is $5.13 at the midpoint, missing analyst estimates by 6.9%

- Operating Margin: 19%, down from 29.1% in the same quarter last year

- Free Cash Flow Margin: 20%, down from 36.1% in the same quarter last year

- Market Capitalization: $5.02 billion

Company Overview

Pioneering the "Find, Fight and Follow" approach to disease management, Lantheus Holdings (NASDAQGM:LNTH) develops and commercializes radiopharmaceuticals and other imaging agents that help healthcare professionals detect, diagnose, and treat diseases.

Lantheus operates through three main product categories: Radiopharmaceutical Oncology, Precision Diagnostics, and Strategic Partnerships. The company's flagship products include PYLARIFY, an F-18 labeled imaging agent used to detect prostate-specific membrane antigen (PSMA) in men with prostate cancer, and DEFINITY, the leading ultrasound enhancing agent in the U.S. used in echocardiography to improve visualization of the heart.

In the Precision Diagnostics category, Lantheus also produces TechneLite, a generator that provides essential nuclear material for various imaging procedures, along with other diagnostic agents like NEUROLITE and CARDIOLITE. These products are primarily sold to radiopharmacies, hospitals, and clinics throughout North America and internationally.

Beyond its commercial products, Lantheus is advancing several clinical development programs. A key focus is PNT2002, a therapeutic radiopharmaceutical for metastatic castration-resistant prostate cancer that has shown positive Phase 3 results. The company is also developing PNT2003 for neuroendocrine tumors and MK-6240, an imaging agent for Alzheimer's disease.

Lantheus maintains strategic partnerships with pharmaceutical companies and academic centers to expand its portfolio. For example, the company collaborates with Curium for European commercialization of PYLARIFY (branded as PYLCLARI), and with GE Healthcare for the development of flurpiridaz, a PET imaging agent for coronary artery disease.

The company's business model relies on its manufacturing capabilities, intellectual property portfolio, and distribution network. Lantheus has built a diverse supply chain for its radiopharmaceuticals, including a network of manufacturing facilities and partnerships with radioisotope suppliers. For PYLARIFY specifically, the company has established a nationwide network of production sites to ensure reliable access across the United States.

4. Medical Devices & Supplies - Imaging, Diagnostics

The medical devices and supplies industry, particularly those specializing in imaging and diagnostics, operates with a comparatively stable yet capital-intensive business model. Companies in this space benefit from consistent demand driven by the essential nature of diagnostic tools in patient care, as well as recurring revenue streams from consumables, service contracts, and equipment maintenance. However, the industry faces challenges such as significant upfront development costs, stringent regulatory requirements, and pricing pressures from hospitals and healthcare systems, which are increasingly focused on cost containment. Looking ahead, the industry should enjoy tailwinds from advancements in technology, including the integration of artificial intelligence to enhance diagnostic accuracy and workflow efficiency, as well as rising demand for imaging solutions driven by aging populations. On the other hand, headwinds could arise from a rethinking of healthcare costs potentially resulting in reimbursement cuts and slower capital equipment purchasing. Additionally, cybersecurity concerns surrounding connected medical devices could introduce new risks and complexities for manufacturers.

Lantheus Holdings competes with several companies in the radiopharmaceutical and medical imaging space. In the PSMA-PET imaging market, its competitors include Telix Pharmaceuticals, Novartis AG, and Blue Earth Diagnostics (a Bracco subsidiary). For its DEFINITY ultrasound enhancing agent, Lantheus competes with GE Healthcare and Bracco. In the SPECT radiopharmaceutical market, competitors include Curium, GE Healthcare, Bracco, Jubilant Life Sciences, and potentially BWXT Medical.

5. Revenue Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With just $1.54 billion in revenue over the past 12 months, Lantheus is a small company in an industry where scale matters. This makes it difficult to build trust with customers because healthcare is heavily regulated, complex, and resource-intensive. On the bright side, Lantheus’s smaller revenue base allows it to grow faster if it can execute well.

6. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Luckily, Lantheus’s sales grew at an incredible 35.3% compounded annual growth rate over the last five years. Its growth beat the average healthcare company and shows its offerings resonate with customers, a helpful starting point for our analysis.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Lantheus’s annualized revenue growth of 9% over the last two years is below its five-year trend, but we still think the results were respectable.

This quarter, Lantheus reported modest year-on-year revenue growth of 4% but beat Wall Street’s estimates by 11%.

Looking ahead, sell-side analysts expect revenue to decline by 4.3% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and indicates its products and services will face some demand challenges. At least the company is tracking well in other measures of financial health.

7. Operating Margin

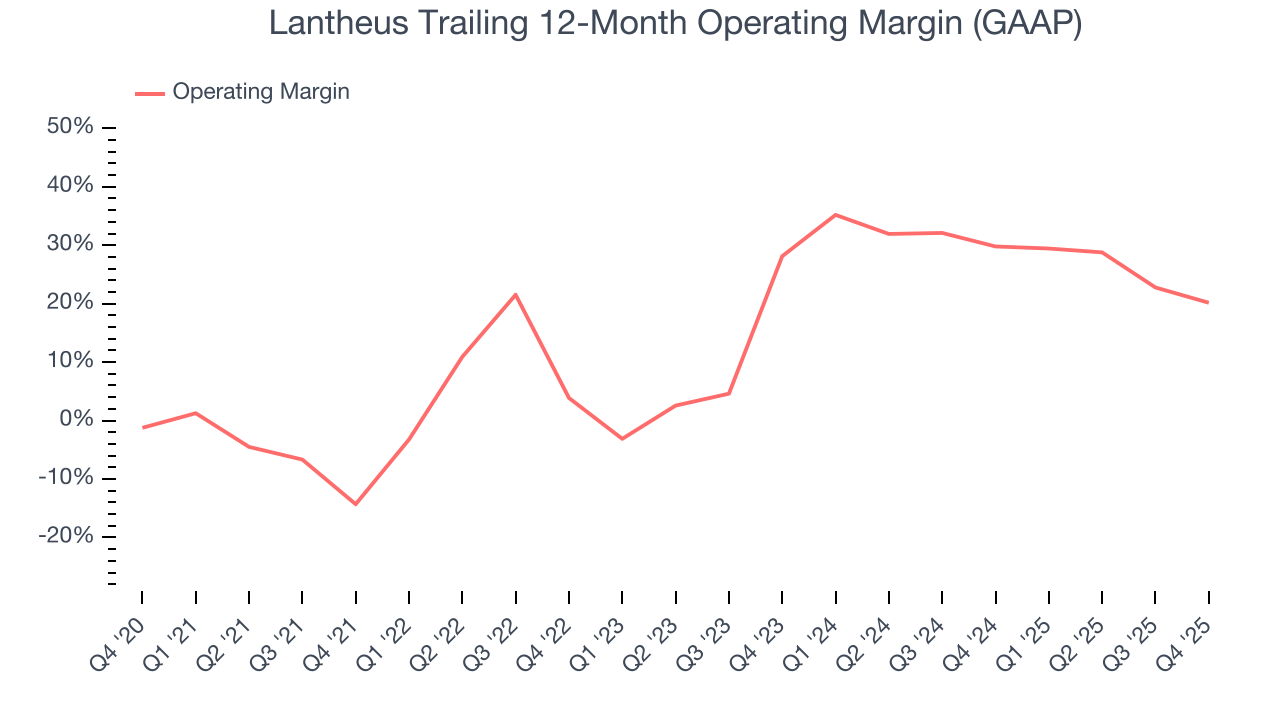

Lantheus has managed its cost base well over the last five years. It demonstrated solid profitability for a healthcare business, producing an average operating margin of 19.3%.

Analyzing the trend in its profitability, Lantheus’s operating margin rose by 34.5 percentage points over the last five years, as its sales growth gave it immense operating leverage. Zooming into its more recent performance, however, we can see the company’s margin has decreased by 8 percentage points on a two-year basis. Given its business quality, we’re optimistic that Lantheus can correct course and return to expansion.

This quarter, Lantheus generated an operating margin profit margin of 19%, down 10.1 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

8. Earnings Per Share

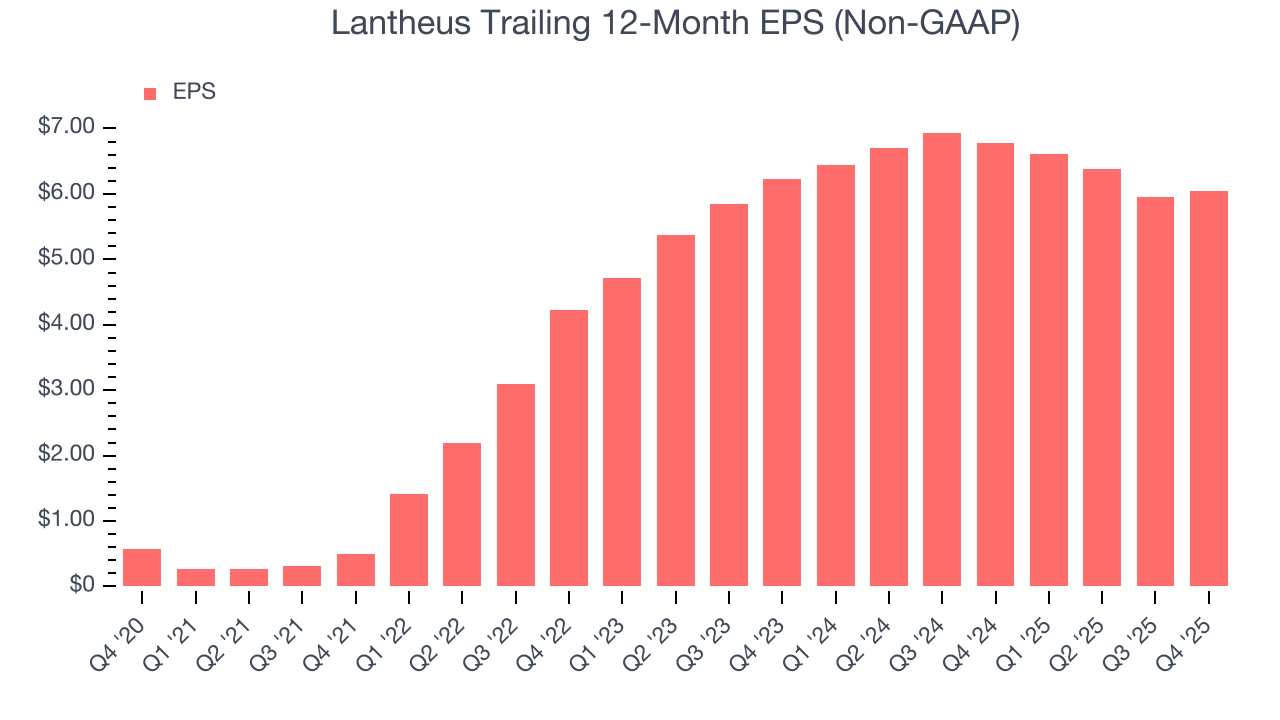

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Lantheus’s EPS grew at an astounding 60.3% compounded annual growth rate over the last five years, higher than its 35.3% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into Lantheus’s earnings quality to better understand the drivers of its performance. As we mentioned earlier, Lantheus’s operating margin declined this quarter but expanded by 34.5 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, Lantheus reported adjusted EPS of $1.67, up from $1.59 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Lantheus’s full-year EPS of $6.04 to shrink by 7.7%.

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Lantheus has shown robust cash profitability, giving it an edge over its competitors and the ability to reinvest or return capital to investors. The company’s free cash flow margin averaged 24.6% over the last five years, quite impressive for a healthcare business.

Taking a step back, we can see that Lantheus’s margin expanded by 13.1 percentage points during that time. This is encouraging because it gives the company more optionality.

Lantheus’s free cash flow clocked in at $81.39 million in Q4, equivalent to a 20% margin. The company’s cash profitability regressed as it was 16.1 percentage points lower than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, leading to temporary swings. Long-term trends carry greater meaning.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Lantheus’s five-year average ROIC was 12.2%, higher than most healthcare businesses. This illustrates its management team’s ability to invest in profitable growth opportunities and generate value for shareholders.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Lantheus’s ROIC has increased. This is a great sign when paired with its already strong returns, but we also recognize its lack of profitable growth during the COVID era was the primary reason for the change.

11. Balance Sheet Assessment

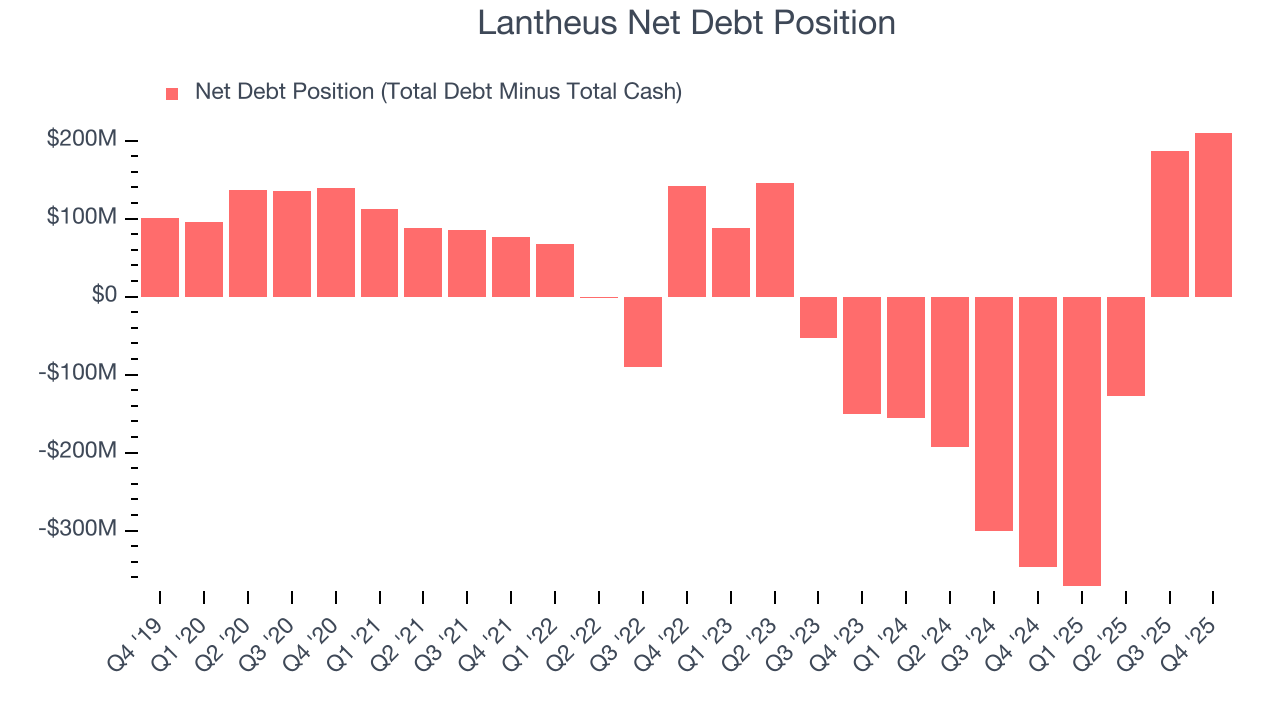

Lantheus reported $359.1 million of cash and $569.4 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $543.2 million of EBITDA over the last 12 months, we view Lantheus’s 0.4× net-debt-to-EBITDA ratio as safe. We also see its $10.73 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Lantheus’s Q4 Results

It was good to see Lantheus beat analysts’ EPS expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. On the other hand, its full-year revenue guidance missed and its full-year EPS guidance fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 2.9% to $73.50 immediately after reporting.

13. Is Now The Time To Buy Lantheus?

Updated: February 26, 2026 at 11:21 PM EST

Before deciding whether to buy Lantheus or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

Lantheus doesn’t top our investment wishlist, but we understand that it’s not a bad business. First off, its revenue growth was exceptional over the last five years. And while Lantheus’s subscale operations give it fewer distribution channels than its larger rivals, its impressive operating margins show it has a highly efficient business model.

Lantheus’s P/E ratio based on the next 12 months is 13.7x. While this valuation is fair, the upside isn’t great compared to the potential downside. We're fairly confident there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $85.38 on the company (compared to the current share price of $75.47).