Zimmer Biomet (ZBH)

We’re skeptical of Zimmer Biomet. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think Zimmer Biomet Will Underperform

With a history dating back to 1927 and a presence in over 100 countries worldwide, Zimmer Biomet (NYSE:ZBH) designs and manufactures orthopedic products including knee and hip replacements, surgical tools, and robotic technologies for joint reconstruction and spine surgeries.

- ROIC of 4.1% reflects management’s challenges in identifying attractive investment opportunities

- 5.3% annual revenue growth over the last five years was slower than its healthcare peers

- On the plus side, its excellent adjusted operating margin highlights the strength of its business model

Zimmer Biomet doesn’t meet our quality standards. There are more profitable opportunities elsewhere.

Why There Are Better Opportunities Than Zimmer Biomet

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Zimmer Biomet

Zimmer Biomet is trading at $100.32 per share, or 11.9x forward P/E. Zimmer Biomet’s multiple may seem like a great deal among healthcare peers, but we think there are valid reasons why it’s this cheap.

We’d rather pay up for companies with elite fundamentals than get a bargain on weak ones. Cheap stocks can be value traps, and as their performance deteriorates, they will stay cheap or get even cheaper.

3. Zimmer Biomet (ZBH) Research Report: Q4 CY2025 Update

Medical device company Zimmer Biomet (NYSE:ZBH) reported Q4 CY2025 results exceeding the market’s revenue expectations, with sales up 10.9% year on year to $2.24 billion. Its non-GAAP profit of $2.42 per share was 0.9% above analysts’ consensus estimates.

Zimmer Biomet (ZBH) Q4 CY2025 Highlights:

- Revenue: $2.24 billion vs analyst estimates of $2.22 billion (10.9% year-on-year growth, 0.9% beat)

- Adjusted EPS: $2.42 vs analyst estimates of $2.40 (0.9% beat)

- Adjusted EPS guidance for the upcoming financial year 2026 is $8.38 at the midpoint, missing analyst estimates by 1.1%

- Operating Margin: 6.9%, down from 19.2% in the same quarter last year

- Free Cash Flow Margin: 16.4%, down from 19.9% in the same quarter last year

- Constant Currency Revenue rose 9.2% year on year (4.9% in the same quarter last year)

- Market Capitalization: $17.79 billion

Company Overview

With a history dating back to 1927 and a presence in over 100 countries worldwide, Zimmer Biomet (NYSE:ZBH) designs and manufactures orthopedic products including knee and hip replacements, surgical tools, and robotic technologies for joint reconstruction and spine surgeries.

The company's product portfolio spans several categories, with knee and hip replacements forming its core business. These implants are used in both primary procedures (first-time replacements) and revision surgeries when existing implants need replacement. Zimmer Biomet's flagship products include the Persona Knee system and the Taperloc Hip System, designed to improve patient mobility and quality of life.

Beyond joint replacements, Zimmer Biomet offers a comprehensive range of Sports Medicine, Extremities, and Trauma (S.E.T.) products. These include devices for repairing soft tissue injuries in knees and shoulders, biologics for joint preservation, implants for foot, ankle, shoulder, elbow, and wrist conditions, and trauma products that stabilize broken bones.

Surgeons use Zimmer Biomet's products to treat patients suffering from arthritis, sports injuries, traumatic injuries, and congenital disorders. For example, an active 65-year-old with severe knee osteoarthritis might receive a Persona Knee implant to reduce pain and restore mobility, allowing them to return to daily activities.

The company has embraced digital innovation through its ZBEdge Platform, which connects robotic technologies like the ROSA Robot with digital tools to collect data throughout the surgical journey. This helps surgeons make more informed decisions about patient care.

Zimmer Biomet sells its products through two main channels: directly to healthcare institutions like hospitals and ambulatory surgery centers, and through distributors and dealers. The company maintains a global presence with operations divided into three segments: Americas (primarily the United States), Europe/Middle East/Africa, and Asia Pacific, with Japan being its largest Asian market.

4. Surgical Equipment & Consumables - Diversified

The surgical equipment and consumables industry provides tools, devices, and disposable products essential for surgeries and medical procedures. These companies therefore benefit from relatively consistent demand, driven by the ongoing need for medical interventions, recurring revenue from consumables, and long-term contracts with hospitals and healthcare providers. However, the high costs of R&D and regulatory compliance, coupled with intense competition and pricing pressures from cost-conscious customers, can constrain profitability. Over the next few years, tailwinds include aging populations, which tend to need surgical interventions at higher rates. The increasing integration of AI and robotics into surgical procedures could also create opportunities for differentiation and innovation. However, the industry faces headwinds including potential supply chain vulnerabilities, evolving regulatory requirements, and more widespread efforts to make healthcare less costly.

Zimmer Biomet's main competitors in the orthopedic medical device market include Johnson & Johnson's DePuy Synthes division, Stryker Corporation, and Smith & Nephew plc, all of which compete across similar product categories including joint replacements and surgical technologies.

5. Economies of Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $8.23 billion in revenue over the past 12 months, Zimmer Biomet has decent scale. This is important as it gives the company more leverage in a heavily regulated, competitive environment that is complex and resource-intensive.

6. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Zimmer Biomet’s 6.1% annualized revenue growth over the last five years was mediocre. This was below our standard for the healthcare sector and is a poor baseline for our analysis.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Zimmer Biomet’s annualized revenue growth of 5.5% over the last two years aligns with its five-year trend, suggesting its demand was consistently weak.

We can dig further into the company’s sales dynamics by analyzing its constant currency revenue, which excludes currency movements that are outside their control and not indicative of demand. Over the last two years, its constant currency sales averaged 5.3% year-on-year growth. Because this number aligns with its normal revenue growth, we can see that Zimmer Biomet has properly hedged its foreign currency exposure.

This quarter, Zimmer Biomet reported year-on-year revenue growth of 10.9%, and its $2.24 billion of revenue exceeded Wall Street’s estimates by 0.9%.

Looking ahead, sell-side analysts expect revenue to grow 4.7% over the next 12 months, similar to its two-year rate. This projection is underwhelming and suggests its newer products and services will not accelerate its top-line performance yet.

7. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

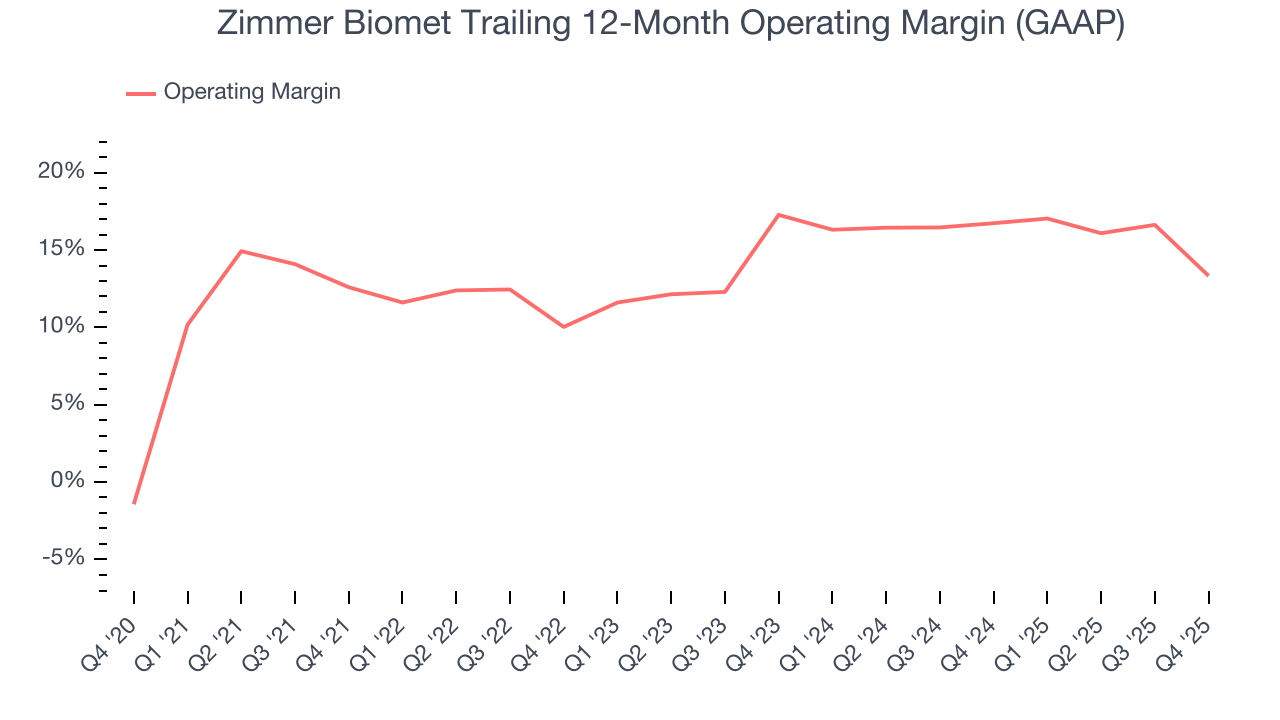

Zimmer Biomet’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 14.1% over the last five years. This profitability was higher than the broader healthcare sector, showing it did a decent job managing its expenses.

Looking at the trend in its profitability, Zimmer Biomet’s operating margin of 13.3% for the trailing 12 months may be around the same as five years ago, but it has decreased by 3.9 percentage points over the last two years.

In Q4, Zimmer Biomet generated an operating margin profit margin of 6.9%, down 12.3 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Zimmer Biomet’s solid 7.7% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

In Q4, Zimmer Biomet reported adjusted EPS of $2.42, up from $2.31 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects Zimmer Biomet’s full-year EPS of $8.20 to grow 3%.

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Zimmer Biomet has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 13.8% over the last five years, better than the broader healthcare sector.

Zimmer Biomet’s free cash flow clocked in at $368.3 million in Q4, equivalent to a 16.4% margin. The company’s cash profitability regressed as it was 3.5 percentage points lower than in the same quarter last year, but it’s still above its five-year average. We wouldn’t read too much into this quarter’s decline because investment needs can be seasonal, leading to short-term swings. Long-term trends trump temporary fluctuations.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Zimmer Biomet historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 4.2%, lower than the typical cost of capital (how much it costs to raise money) for healthcare companies.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Fortunately, Zimmer Biomet’s ROIC averaged 2.1 percentage point increases each year over the last few years. This is a good sign, and we hope the company can continue improving.

11. Balance Sheet Assessment

Zimmer Biomet reported $591.9 million of cash and $7.52 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $2.78 billion of EBITDA over the last 12 months, we view Zimmer Biomet’s 2.5× net-debt-to-EBITDA ratio as safe. We also see its $292.8 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Zimmer Biomet’s Q4 Results

It was good to see Zimmer Biomet narrowly top analysts’ revenue expectations this quarter. On the other hand, its full-year EPS guidance slightly missed. Overall, this quarter could have been better. The stock remained flat at $89.35 immediately after reporting.

13. Is Now The Time To Buy Zimmer Biomet?

Updated: February 26, 2026 at 11:36 PM EST

Before making an investment decision, investors should account for Zimmer Biomet’s business fundamentals and valuation in addition to what happened in the latest quarter.

Zimmer Biomet isn’t a terrible business, but it doesn’t pass our bar. To begin with, its revenue growth was mediocre over the last five years, and analysts expect its demand to deteriorate over the next 12 months. And while Zimmer Biomet’s strong operating margins show it’s a well-run business, its mediocre ROIC lags the market and is a headwind for its stock price.

Zimmer Biomet’s P/E ratio based on the next 12 months is 11.9x. This valuation multiple is fair, but we don’t have much faith in the company. We're pretty confident there are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $102.65 on the company (compared to the current share price of $100.99).