Solventum (SOLV)

Solventum keeps us up at night. Its forecasted demand is demand over the next 12 months, suggesting a rocky road for its share price.― StockStory Analyst Team

1. News

2. Summary

Why We Think Solventum Will Underperform

Founded in 1985, Solventum (NYSE:SOLV) develops, manufactures, and commercializes a portfolio of healthcare products and services addressing critical customer and therapeutic patient needs.

- Estimated sales decline of 5.2% for the next 12 months implies a challenging demand environment

- 1.4% annual revenue growth over the last two years was slower than its healthcare peers

- Absence of organic revenue growth over the past two years suggests it may have to lean into acquisitions to drive its expansion

Solventum falls short of our expectations. We’re redirecting our focus to better businesses.

Why There Are Better Opportunities Than Solventum

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Solventum

Solventum’s stock price of $72.64 implies a valuation ratio of 11.7x forward P/E. Yes, this valuation multiple is lower than that of other healthcare peers, but we’ll remind you that you often get what you pay for.

Cheap stocks can look like great bargains at first glance, but you often get what you pay for. These mediocre businesses often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Solventum (SOLV) Research Report: Q3 CY2025 Update

Healthcare solutions provider Solventum (NYSE:SOLV) reported Q3 CY2025 results topping the market’s revenue expectations, but sales were flat year on year at $2.10 billion. Its non-GAAP profit of $1.50 per share was 4.7% above analysts’ consensus estimates.

Solventum (SOLV) Q3 CY2025 Highlights:

- Revenue: $2.10 billion vs analyst estimates of $2.07 billion (flat year on year, 1.3% beat)

- Adjusted EPS: $1.50 vs analyst estimates of $1.43 (4.7% beat)

- Management raised its full-year Adjusted EPS guidance to $5.96 at the midpoint, a 7.3% increase

- Operating Margin: 80.6%, up from 13.2% in the same quarter last year

- Free Cash Flow was -$22 million, down from $76 million in the same quarter last year

- Organic Revenue rose 2.7% year on year vs analyst estimates of flat growth (178.6 basis point beat)

- Market Capitalization: $11.74 billion

Company Overview

Founded in 1985, Solventum (NYSE:SOLV) develops, manufactures, and commercializes a portfolio of healthcare products and services addressing critical customer and therapeutic patient needs.

Key offerings include advanced drug delivery systems, which are devices designed to ensure precise and controlled administration of medications as well as therapeutic devices such as dialysis and respiratory machines.

Services include clinical trial services to assist pharmaceutical companies or healthcare providers in designing and managing development of new drugs and therapies. The company serves hospitals, clinics, and specialty care providers, generating revenue through product sales and service contracts.

4. Surgical Equipment & Consumables - Diversified

The surgical equipment and consumables industry provides tools, devices, and disposable products essential for surgeries and medical procedures. These companies therefore benefit from relatively consistent demand, driven by the ongoing need for medical interventions, recurring revenue from consumables, and long-term contracts with hospitals and healthcare providers. However, the high costs of R&D and regulatory compliance, coupled with intense competition and pricing pressures from cost-conscious customers, can constrain profitability. Over the next few years, tailwinds include aging populations, which tend to need surgical interventions at higher rates. The increasing integration of AI and robotics into surgical procedures could also create opportunities for differentiation and innovation. However, the industry faces headwinds including potential supply chain vulnerabilities, evolving regulatory requirements, and more widespread efforts to make healthcare less costly.

Healthcare industry competitors include Baxter International (NYSE:BAX), Becton Dickinson (NYSE:BDX), Edwards Lifesciences (NYSE:EW), and Medtronic (NYSE:MDT).

5. Economies of Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $8.40 billion in revenue over the past 12 months, Solventum has decent scale. This is important as it gives the company more leverage in a heavily regulated, competitive environment that is complex and resource-intensive.

6. Revenue Growth

A company’s top-line performance is one signal of its overall business quality. Strong growth can indicate it’s riding a successful new product or emerging trend. Solventum’s annualized revenue growth rate of 1.4% over the last two years was tepid for a healthcare business.

Solventum also reports organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Solventum’s organic revenue averaged 1.9% year-on-year growth. Because this number aligns with its two-year revenue growth, we can see the company’s core operations (not acquisitions and divestitures) drove most of its results.

This quarter, Solventum’s $2.10 billion of revenue was flat year on year but beat Wall Street’s estimates by 1.3%.

Looking ahead, sell-side analysts expect revenue to decline by 5.7% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and indicates its products and services will see some demand headwinds.

7. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Solventum has been an efficient company over the last four years. It was one of the more profitable businesses in the healthcare sector, boasting an average operating margin of 21%.

Looking at the trend in its profitability, Solventum’s operating margin rose by 11.1 percentage points over the last four years. Zooming in on its more recent performance, we can see the company’s trajectory is intact as its margin has also increased by 5.6 percentage points on a two-year basis.

This quarter, Solventum generated an operating margin profit margin of 80.6%, up 67.4 percentage points year on year. This increase was a welcome development and shows it was more efficient.

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Solventum has shown robust cash profitability, giving it an edge over its competitors and the ability to reinvest or return capital to investors. The company’s free cash flow margin averaged 16.3% over the last four years, quite impressive for a healthcare business.

Taking a step back, we can see that Solventum’s margin dropped by 18.1 percentage points during that time. If its declines continue, it could signal increasing investment needs and capital intensity.

Solventum burned through $22 million of cash in Q3, equivalent to a negative 1% margin. The company’s cash flow turned negative after being positive in the same quarter last year, suggesting its historical struggles have dragged on.

9. Balance Sheet Assessment

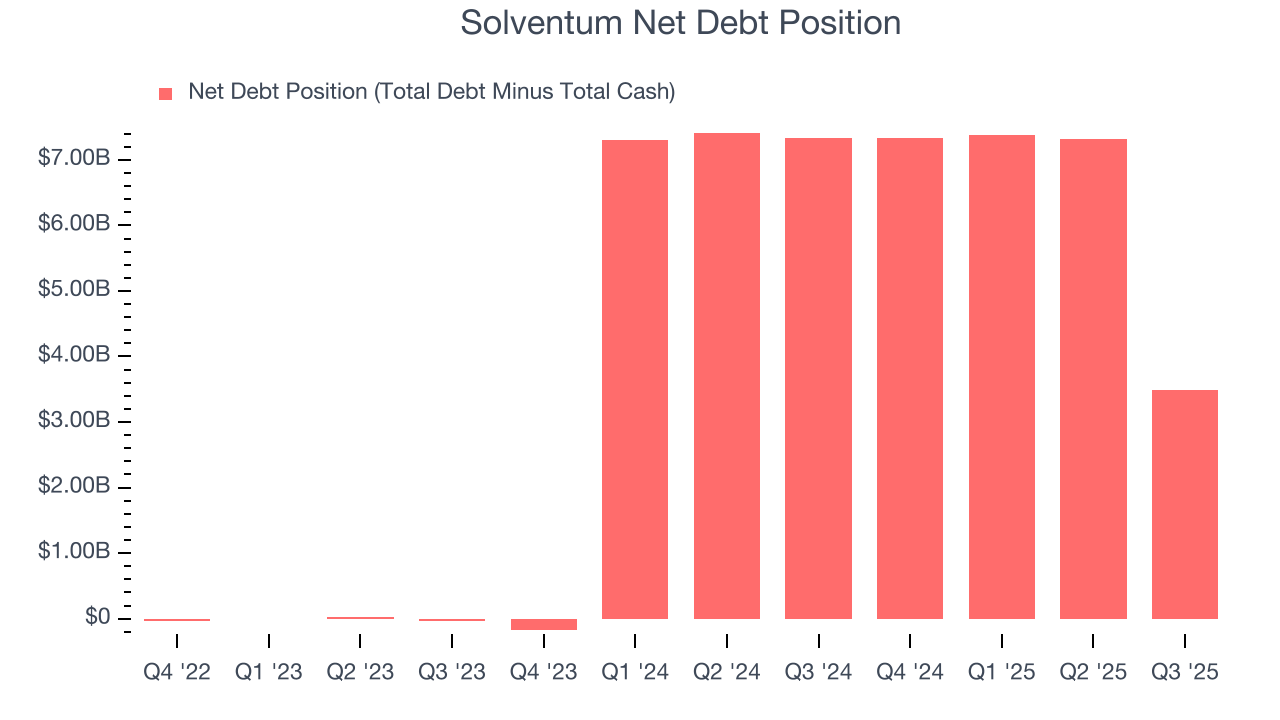

Solventum reported $1.64 billion of cash and $5.14 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $2.02 billion of EBITDA over the last 12 months, we view Solventum’s 1.7× net-debt-to-EBITDA ratio as safe. We also see its $225 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

10. Key Takeaways from Solventum’s Q3 Results

We enjoyed seeing Solventum beat analysts’ organic revenue expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street’s estimates. Overall, this print had some key positives. The stock traded up 1.4% to $67.23 immediately after reporting.

11. Is Now The Time To Buy Solventum?

Updated: February 23, 2026 at 11:26 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Solventum.

Solventum falls short of our quality standards. Although the company’s strong operating margins show it’s a well-run business, the downside is its cash profitability fell over the last four years. On top of that, the company’s declining adjusted operating margin shows the business has become less efficient.

Solventum’s P/E ratio based on the next 12 months is 11.7x. This valuation is reasonable, but the company’s shaky fundamentals present too much downside risk. There are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $89.25 on the company (compared to the current share price of $72.64).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.