Copart (CPRT)

We see solid potential in Copart. Its rare ability to win market share while pumping out profits is a feature many competitors envy.― StockStory Analyst Team

1. News

2. Summary

Why We Like Copart

Starting as a single salvage yard in California in 1982, Copart (NASDAQ:CPRT) operates an online auction platform that connects sellers of damaged and salvage vehicles with buyers ranging from dismantlers and rebuilders to used car dealers and exporters.

- Annual revenue growth of 15.1% over the past five years was outstanding, reflecting market share gains this cycle

- Incremental sales over the last five years have been highly profitable as its earnings per share increased by 17.5% annually, topping its revenue gains

- Successful business model is illustrated by its impressive adjusted operating margin

We’re fond of companies like Copart. The price seems reasonable relative to its quality, so this could be an opportune time to buy some shares.

Why Is Now The Time To Buy Copart?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Copart?

Copart is trading at $34.95 per share, or 22.2x forward P/E. While this multiple is higher than most business services companies, we think the valuation is fair given its quality characteristics.

By definition, where you buy a stock impacts returns. Still, our extensive analysis shows that investors should worry much more about business quality than entry price if the ultimate goal is long-term returns.

3. Copart (CPRT) Research Report: Q4 CY2025 Update

Online vehicle auction company Copart (NASDAQ:CPRT) fell short of the market’s revenue expectations in Q4 CY2025, with sales falling 3.6% year on year to $1.12 billion. Its GAAP profit of $0.36 per share was 7.5% below analysts’ consensus estimates.

Copart (CPRT) Q4 CY2025 Highlights:

- Revenue: $1.12 billion vs analyst estimates of $1.18 billion (3.6% year-on-year decline, 5% miss)

- EPS (GAAP): $0.36 vs analyst expectations of $0.39 (7.5% miss)

- Adjusted EBITDA: $434.9 million vs analyst estimates of $479.1 million (38.8% margin, 9.2% miss)

- Operating Margin: 34.7%, down from 36.6% in the same quarter last year

- Free Cash Flow Margin: 5.2%, similar to the same quarter last year

- Market Capitalization: $36.54 billion

Company Overview

Starting as a single salvage yard in California in 1982, Copart (NASDAQ:CPRT) operates an online auction platform that connects sellers of damaged and salvage vehicles with buyers ranging from dismantlers and rebuilders to used car dealers and exporters.

Copart's business revolves around its proprietary Virtual Bidding Third Generation (VB3) online auction technology, which allows registered buyers worldwide to bid on vehicles regardless of their location. The company primarily serves as an intermediary, earning revenue through auction and transaction fees rather than by owning the vehicles themselves.

Insurance companies represent Copart's largest source of vehicle supply, accounting for over 80% of the vehicles processed. When an insurer determines a vehicle is a total loss after an accident, flood, or other damage, Copart steps in to handle the entire remarketing process—from vehicle pickup and transportation to storage, auction, and eventual delivery to the buyer.

For example, after a severe hailstorm damages hundreds of vehicles in Texas, an insurance company might engage Copart to collect these vehicles from various locations, transport them to a nearby Copart facility, photograph and catalog them, and then sell them through its online auction platform to the highest bidders.

Copart offers several service models to sellers, including its Percentage Incentive Program where it earns a portion of the final sale price, incentivizing the company to maximize returns. In some markets, particularly the United Kingdom, Copart also purchases vehicles outright and resells them for its own account.

Beyond its core vehicle auction business, Copart has expanded into related services including dismantled parts sales through its Green Parts Specialist in the UK, powersport vehicle auctions through National Powersport Auctions, and heavy equipment and agricultural machinery auctions through Purple Wave.

The company operates a global network of vehicle storage facilities across the United States, Canada, Brazil, the United Kingdom, Germany, Spain, Finland, the United Arab Emirates, Oman, Ireland, and Bahrain. This extensive footprint allows Copart to respond quickly to catastrophic events like hurricanes or floods, which typically generate large numbers of salvage vehicles.

4. Asset Management & Auction Services

Like in other industries, the shift to online platforms can lower transaction costs and improve liquidity for sellers. Increasing digitization, AI-driven pricing analytics, and automation in logistics can enhance efficiency for operators who invest in technology and software. On the other hand, challenges include potential regulatory scrutiny on auction transparency, data privacy concerns with AI-driven valuation models, and shifting environmental policies that could impact the resale market for internal combustion vehicles. Additionally, supply chain volatility in new car production may create unpredictable swings in used vehicle supply, impacting auction volumes.

Copart's primary competitor is IAA, Inc. (NYSE:IAA), which also operates in the salvage vehicle auction market. Other competitors include KAR Auction Services (NYSE:KAR), which focuses more on whole car auctions, and regional or local salvage auction companies in various markets.

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $4.61 billion in revenue over the past 12 months, Copart is one of the larger companies in the business services industry and benefits from a well-known brand that influences purchasing decisions.

As you can see below, Copart’s sales grew at an incredible 15.1% compounded annual growth rate over the last five years. This is a great starting point for our analysis because it shows Copart’s demand was higher than many business services companies.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. Copart’s annualized revenue growth of 6.6% over the last two years is below its five-year trend, but we still think the results were respectable.

Copart also breaks out the revenue for its most important segments, Service and Vehicle Sales, which are 84.9% and 15.1% of revenue. Over the last two years, Copart’s Service revenue (processing and selling cars) averaged 5.6% year-on-year growth while its Vehicle Sales revenue was flat.

This quarter, Copart missed Wall Street’s estimates and reported a rather uninspiring 3.6% year-on-year revenue decline, generating $1.12 billion of revenue.

Looking ahead, sell-side analysts expect revenue to grow 6% over the next 12 months, similar to its two-year rate. This projection is above average for the sector and implies its newer products and services will help sustain its recent top-line performance.

6. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Copart has been a well-oiled machine over the last five years. It demonstrated elite profitability for a business services business, boasting an average operating margin of 37.9%.

Looking at the trend in its profitability, Copart’s operating margin decreased by 4.9 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q4, Copart generated an operating margin profit margin of 34.7%, down 2 percentage points year on year. This reduction is quite minuscule and indicates the company’s overall cost structure has been relatively stable.

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Copart’s astounding 16.6% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Copart, its two-year annual EPS growth of 6.7% was lower than its five-year trend. This wasn’t great, but at least the company was successful in other measures of financial health.

In Q4, Copart reported EPS of $0.36, down from $0.40 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects Copart’s full-year EPS of $1.59 to grow 7.9%.

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Copart has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the business services sector, averaging 23.9% over the last five years.

Taking a step back, we can see that Copart’s margin expanded by 8.1 percentage points during that time. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability fell.

Copart’s free cash flow clocked in at $57.88 million in Q4, equivalent to a 5.2% margin. This cash profitability was in line with the comparable period last year but below its five-year average. We wouldn’t put too much weight on it because investment needs can be seasonal, causing short-term swings. Long-term trends trump temporary fluctuations.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Copart’s five-year average ROIC was 32.1%, placing it among the best business services companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Copart’s ROIC averaged 4.9 percentage point decreases each year. Only time will tell if its new bets can bear fruit and potentially reverse the trend.

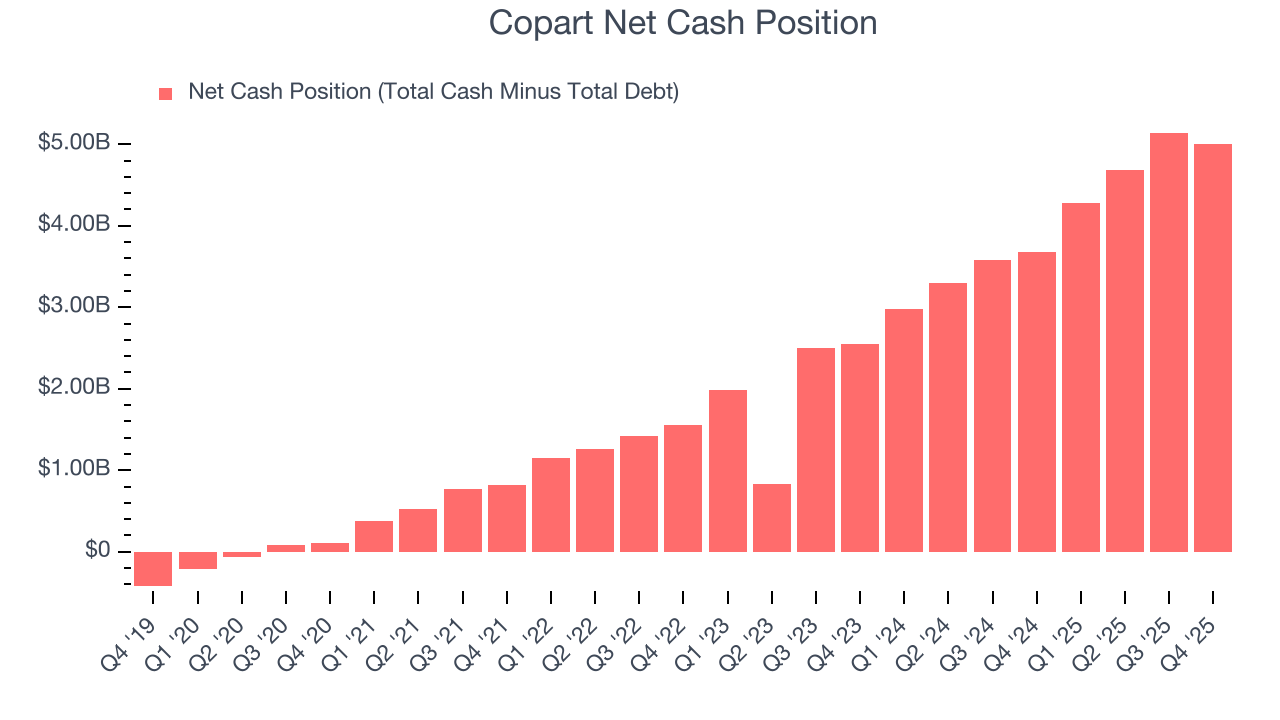

10. Balance Sheet Assessment

Companies with more cash than debt have lower bankruptcy risk.

Copart is a profitable, well-capitalized company with $5.10 billion of cash and $96.14 million of debt on its balance sheet. This $5.01 billion net cash position is 13.7% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

11. Key Takeaways from Copart’s Q4 Results

We struggled to find many positives in these results. Its revenue missed and its EPS fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 10.8% to $33.58 immediately following the results.

12. Is Now The Time To Buy Copart?

Updated: February 20, 2026 at 9:44 PM EST

Before investing in or passing on Copart, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

There are multiple reasons why we think Copart is an amazing business. For starters, its revenue growth was exceptional over the last five years. And while its declining adjusted operating margin shows the business has become less efficient, its powerful free cash flow generation enables it to stay ahead of the competition through consistent reinvestment of profits. On top of that, Copart’s impressive operating margins show it has a highly efficient business model.

Copart’s P/E ratio based on the next 12 months is 22.9x. Scanning the business services space today, Copart’s fundamentals really stand out, and we like it at this price.

Wall Street analysts have a consensus one-year price target of $47.56 on the company (compared to the current share price of $36.47), implying they see 30.4% upside in buying Copart in the short term.