CSG (CSGS)

We’re skeptical of CSG. Its weak sales growth and declining returns on capital show its demand and profits are shrinking.― StockStory Analyst Team

1. News

2. Summary

Why We Think CSG Will Underperform

Powering billions of critical customer interactions annually, CSG Systems (NASDAQ:CSGS) provides cloud-based software platforms that help companies manage customer interactions, process payments, and monetize their services.

- Projected sales growth of 2.3% for the next 12 months suggests sluggish demand

- Annual revenue growth of 2.5% over the last five years was below our standards for the business services sector

- The good news is that its successful business model is illustrated by its impressive adjusted operating margin

CSG lacks the business quality we seek. There are superior stocks for sale in the market.

Why There Are Better Opportunities Than CSG

High Quality

Investable

Underperform

Why There Are Better Opportunities Than CSG

At $79.92 per share, CSG trades at 16.4x forward P/E. This multiple is quite expensive for the quality you get.

We’d rather pay up for companies with elite fundamentals than get a decent price on a poor one. High-quality businesses often have more durable earnings power, helping us sleep well at night.

3. CSG (CSGS) Research Report: Q3 CY2025 Update

Customer experience software company CSG Systems (NASDAQ:CSGS) met Wall Streets revenue expectations in Q3 CY2025, with sales up 2.9% year on year to $303.6 million. Its non-GAAP profit of $1.31 per share was 17.3% above analysts’ consensus estimates.

CSG (CSGS) Q3 CY2025 Highlights:

- Revenue: $303.6 million vs analyst estimates of $304.3 million (2.9% year-on-year growth, in line)

- Adjusted EPS: $1.31 vs analyst estimates of $1.12 (17.3% beat)

- Adjusted EBITDA: $68.98 million vs analyst estimates of $62.33 million (22.7% margin, 10.7% beat)

- Operating Margin: 10%, in line with the same quarter last year

- Free Cash Flow Margin: 14.5%, up from 10.8% in the same quarter last year

- Market Capitalization: $2.04 billion

Company Overview

Powering billions of critical customer interactions annually, CSG Systems (NASDAQ:CSGS) provides cloud-based software platforms that help companies manage customer interactions, process payments, and monetize their services.

CSG Systems operates at the intersection of customer experience and revenue management, offering SaaS platforms that serve multiple industries. The company's solutions are organized into three main categories: revenue management, customer experience, and payments processing.

The revenue management platforms help businesses monetize their services throughout the customer lifecycle. These systems handle everything from initial service activation to billing and collections, enabling companies to launch new digital services quickly and manage complex pricing models. For example, a telecommunications provider might use CSG's platform to bundle traditional cable services with streaming options and mobile plans, creating a unified billing experience for customers.

In the customer experience arena, CSG leverages artificial intelligence to help businesses deliver personalized interactions across digital channels. The company's analytics tools track customer behavior across websites, emails, and other touchpoints, creating detailed profiles that companies use to tailor their communications. A retail bank might employ these capabilities to send targeted offers based on a customer's financial activity and digital engagement patterns.

CSG's payments platform processes tens of billions of dollars annually for approximately 114,000 merchants. The system accepts various payment methods including electronic checks, ACH transfers, and credit cards. Government agencies use this platform to collect property taxes and fees, while businesses integrate it to manage recurring subscriptions and one-time purchases.

While CSG serves multiple industries, telecommunications remains a core market, with Charter and Comcast accounting for approximately 40% of the company's revenue. Beyond telecom, CSG works with financial services companies, pharmacy retailers, property management firms, and government entities across North America, Europe, and Asia-Pacific regions.

4. Data & Business Process Services

A combination of increasing reliance on data and analytics across various industries and the desire for cost efficiency through outsourcing could mean that companies in this space gain. As functions such as payroll, HR, and credit risk assessment rely on more digitization, key players in the data & business process services industry could be increased demand. On the other hand, the sector faces headwinds from growing regulatory scrutiny on data privacy and security, with laws like GDPR and evolving U.S. regulations potentially limiting data collection and monetization strategies. Additionally, rising cyber threats pose risks to firms handling sensitive personal and financial information, creating outsized headline risk when things go wrong in this area.

CSG Systems competes with custom software providers like Amdocs and NEC Netcracker, customer experience platforms including Salesforce, Adobe, and Pegasystems, and payment processors such as FIS, Fiserv, Stripe, and Nuvei/Paya.

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $1.22 billion in revenue over the past 12 months, CSG is a small player in the business services space, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and numerous distribution channels.

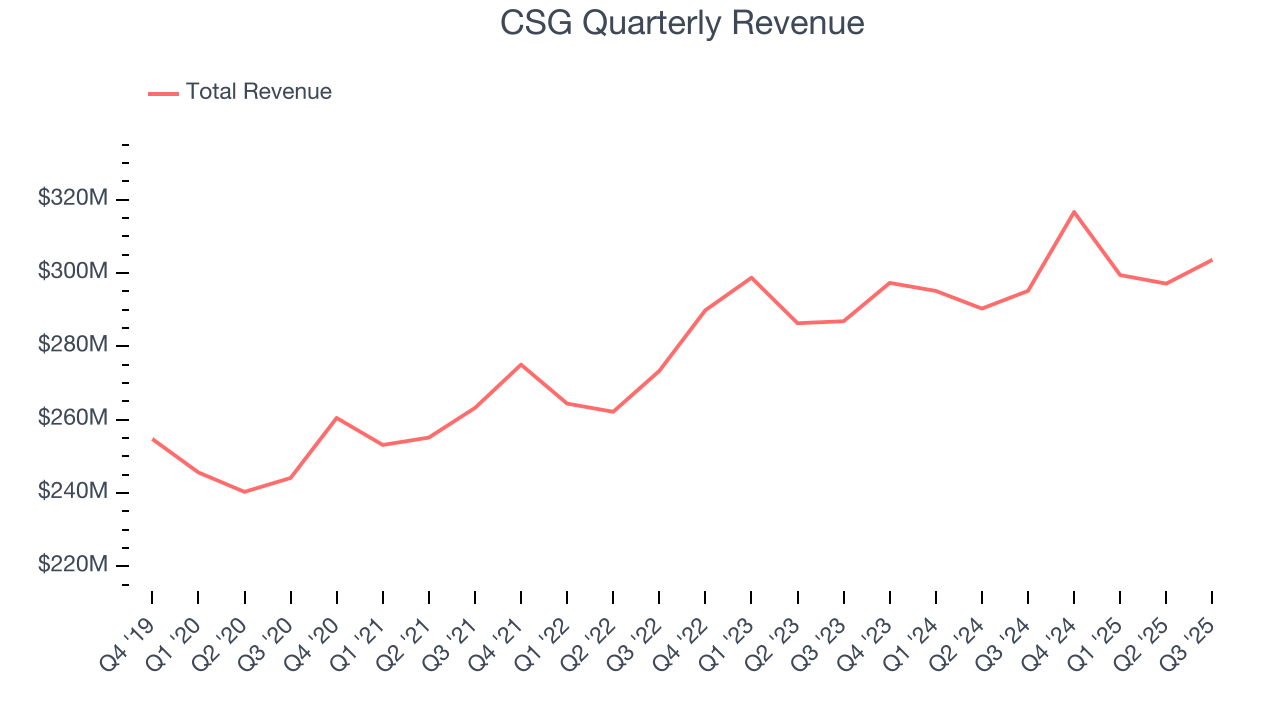

As you can see below, CSG’s sales grew at a mediocre 4.3% compounded annual growth rate over the last five years. This shows it couldn’t generate demand in any major way and is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. CSG’s recent performance shows its demand has slowed as its annualized revenue growth of 2.3% over the last two years was below its five-year trend.

This quarter, CSG grew its revenue by 2.9% year on year, and its $303.6 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 3.2% over the next 12 months, similar to its two-year rate. This projection is underwhelming and indicates its newer products and services will not accelerate its top-line performance yet.

6. Operating Margin

CSG has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 10.3%, higher than the broader business services sector.

Analyzing the trend in its profitability, CSG’s operating margin decreased by 2.1 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q3, CSG generated an operating margin profit margin of 10%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

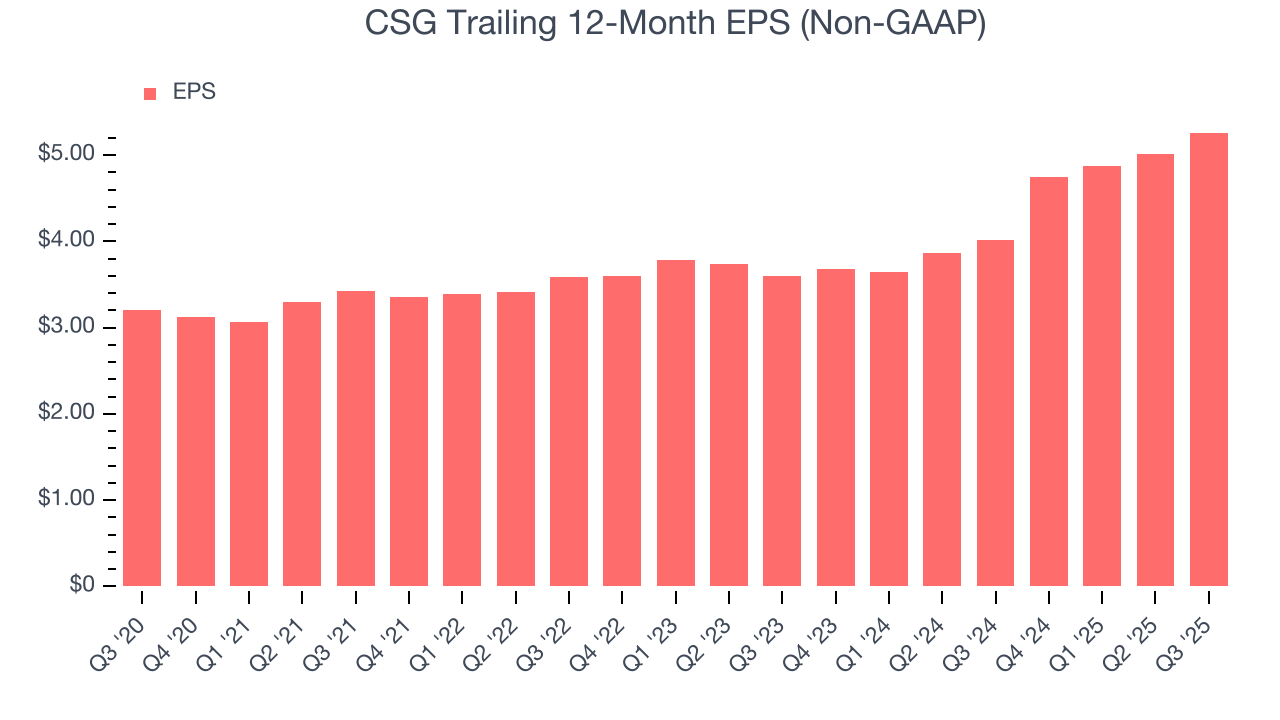

CSG’s EPS grew at a solid 10.5% compounded annual growth rate over the last five years, higher than its 4.3% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its operating margin didn’t improve.

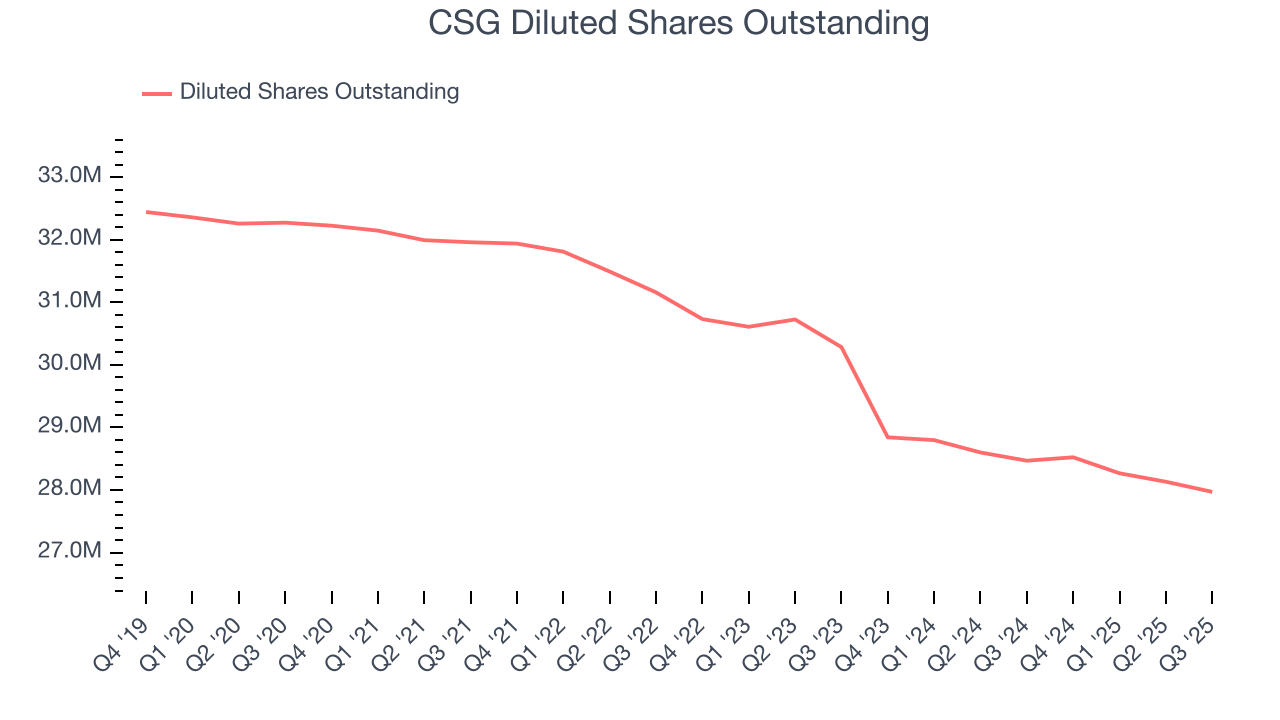

Diving into CSG’s quality of earnings can give us a better understanding of its performance. A five-year view shows that CSG has repurchased its stock, shrinking its share count by 13.3%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For CSG, its two-year annual EPS growth of 20.9% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q3, CSG reported adjusted EPS of $1.31, up from $1.06 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects CSG’s full-year EPS of $5.26 to shrink by 4.8%.

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

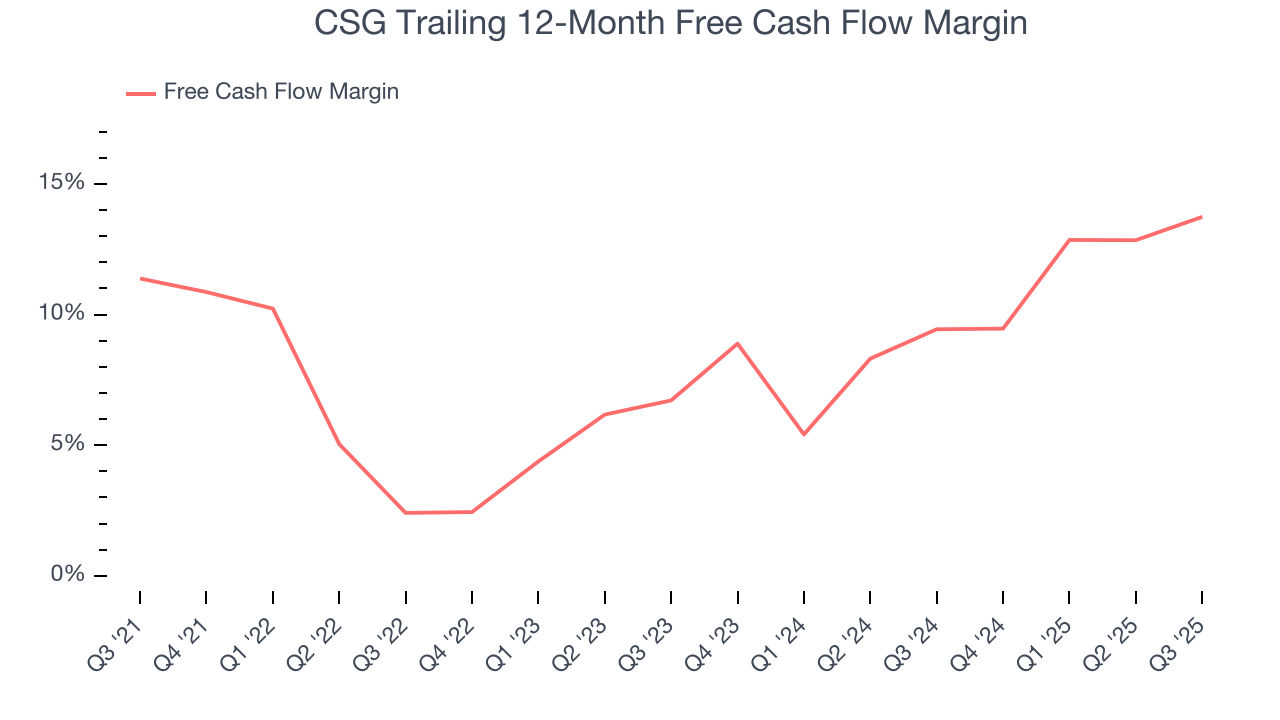

CSG has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 8.8% over the last five years, better than the broader business services sector.

Taking a step back, we can see that CSG’s margin expanded by 2.4 percentage points during that time. This shows the company is heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability fell.

CSG’s free cash flow clocked in at $43.94 million in Q3, equivalent to a 14.5% margin. This result was good as its margin was 3.6 percentage points higher than in the same quarter last year, building on its favorable historical trend.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

CSG historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 13.8%, somewhat low compared to the best business services companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, CSG’s ROIC averaged 2.9 percentage point decreases over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

10. Balance Sheet Assessment

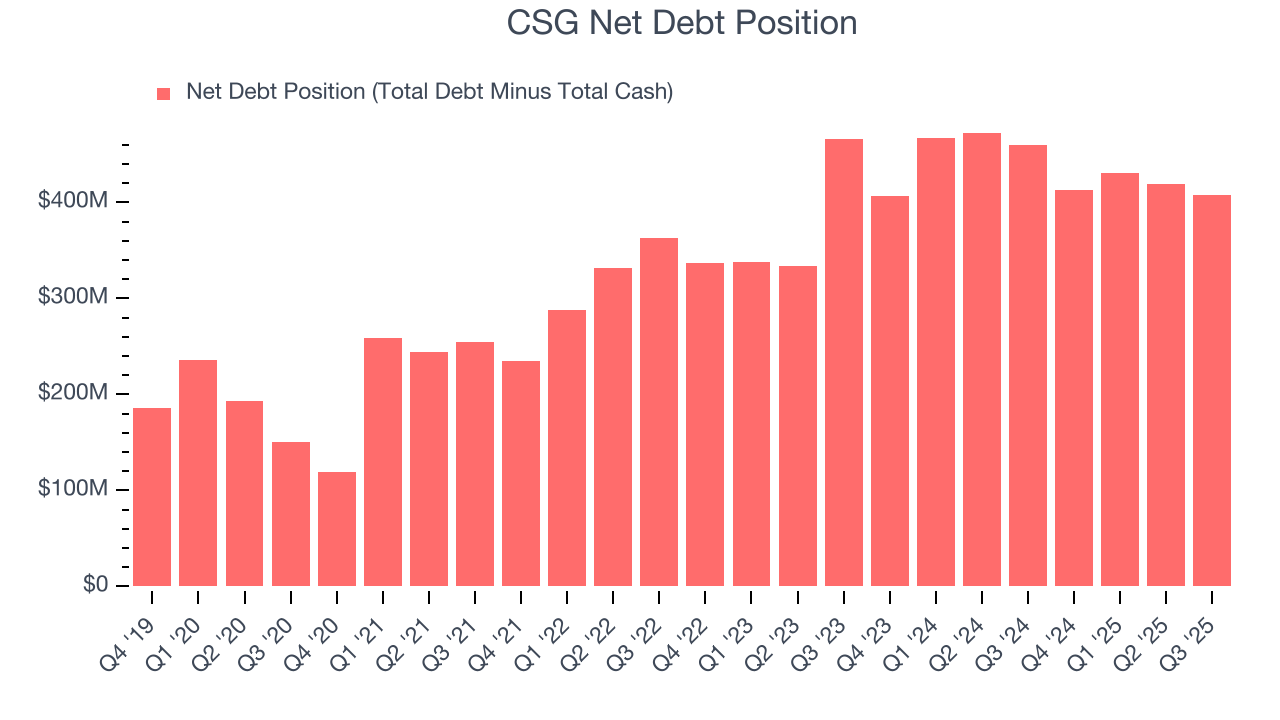

CSG reported $158.4 million of cash and $566.3 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $273.2 million of EBITDA over the last 12 months, we view CSG’s 1.5× net-debt-to-EBITDA ratio as safe. We also see its $9.69 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from CSG’s Q3 Results

It was good to see CSG beat analysts’ EPS expectations this quarter. On the other hand, its revenue was in line. Zooming out, we think this quarter was fine. The stock remained flat at $78.78 immediately after reporting.

12. Is Now The Time To Buy CSG?

Updated: February 27, 2026 at 11:57 PM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

CSG’s business quality ultimately falls short of our standards. For starters, its revenue growth was weak over the last five years, and analysts don’t see anything changing over the next 12 months. While its impressive operating margins show it has a highly efficient business model, the downside is its projected EPS for the next year is lacking. On top of that, its diminishing returns show management's prior bets haven't worked out.

CSG’s P/E ratio based on the next 12 months is 16.4x. Beauty is in the eye of the beholder, but we don’t really see a big opportunity at the moment. We're fairly confident there are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $80.70 on the company (compared to the current share price of $79.92).