CSW (CSW)

We’re bullish on CSW. Its rare blend of high growth, robust profitability, and a strong outlook makes it a wonderful asset.― StockStory Analyst Team

1. News

2. Summary

Why We Like CSW

With over two centuries of combined operations manufacturing and supplying, CSW (NASDAQ:CSW) offers special chemicals, coatings, sealants, and lubricants for various industries.

- Annual revenue growth of 20.6% over the last five years was superb and indicates its market share increased during this cycle

- Performance over the past five years shows its incremental sales were extremely profitable, as its annual earnings per share growth of 23.4% outpaced its revenue gains

- Demand for the next 12 months is expected to accelerate above its two-year trend as Wall Street forecasts robust revenue growth of 31.3%

We have an affinity for CSW. The valuation seems fair based on its quality, and we believe now is a prudent time to invest in the stock.

Why Is Now The Time To Buy CSW?

High Quality

Investable

Underperform

Why Is Now The Time To Buy CSW?

CSW’s stock price of $299.85 implies a valuation ratio of 27.3x forward P/E. Many industrials names may carry a lower valuation multiple, but CSW’s price is fair given its business quality.

By definition, where you buy a stock impacts returns. Still, our extensive analysis shows that investors should worry much more about business quality than entry price if the ultimate goal is long-term returns.

3. CSW (CSW) Research Report: Q4 CY2025 Update

Industrial products company CSW (NASDAQ:CSW) missed Wall Street’s revenue expectations in Q4 CY2025, but sales rose 20.3% year on year to $233 million. Its non-GAAP profit of $1.42 per share was 24.3% below analysts’ consensus estimates.

CSW (CSW) Q4 CY2025 Highlights:

- Revenue: $233 million vs analyst estimates of $251.2 million (20.3% year-on-year growth, 7.3% miss)

- Adjusted EPS: $1.42 vs analyst expectations of $1.87 (24.3% miss)

- Adjusted EBITDA: $44.81 million vs analyst estimates of $53.77 million (19.2% margin, 16.7% miss)

- Operating Margin: 7.4%, down from 15.9% in the same quarter last year

- Free Cash Flow Margin: 9.8%, up from 4.4% in the same quarter last year

- Market Capitalization: $4.95 billion

Company Overview

With over two centuries of combined operations manufacturing and supplying, CSW (NASDAQ:CSW) offers special chemicals, coatings, sealants, and lubricants for various industries.

CSW was formed in 2015 through the merger of three distinct companies: Whitmore Manufacturing, Strathmore Products, and Jet-Lube.

Since its inception, the company has targeted the acquisition of various companies, primarily targeting small- to medium-sized companies that can add new product offerings to its portfolio. For example, the acquisition of Greco Aluminum Railings in 2020 marked its entry into the architectural railing systems market. Its railings are used today in residential and commercial projects to create barriers along elevated areas to prevent accidents.

More broadly, CSW offers special chemicals, coatings, sealants, lubricants, and other products to protect machines and systems. These offerings prevent wear and tear, reduce friction, seal leaks, and provide a protective barrier against damage and rust. For example, its sealants and lubricants are used in the plumbing industry to prevent leaks and keep pipes working well. Additionally, the coatings provide a protective shield against environmental factors like corrosion and abrasion, preserving the structural integrity of components over time.

The company engages in long-term contracts with distributors that often range from three to five years. It also offers volume discounts that include lower per-unit costs to incentivize companies to make larger purchases.

4. HVAC and Water Systems

Many HVAC and water systems companies sell essential, non-discretionary infrastructure for buildings. Since the useful lives of these water heaters and vents are fairly standard, these companies have a portion of predictable replacement revenue. In the last decade, trends in energy efficiency and clean water are driving innovation that is leading to incremental demand. On the other hand, new installations for these companies are at the whim of residential and commercial construction volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates.

Competitors offering similar products include 3M (NYSE:MMM), Sherwin-Williams (NYSE:SHW), and PPG (NYSE:PPG).

5. Revenue Growth

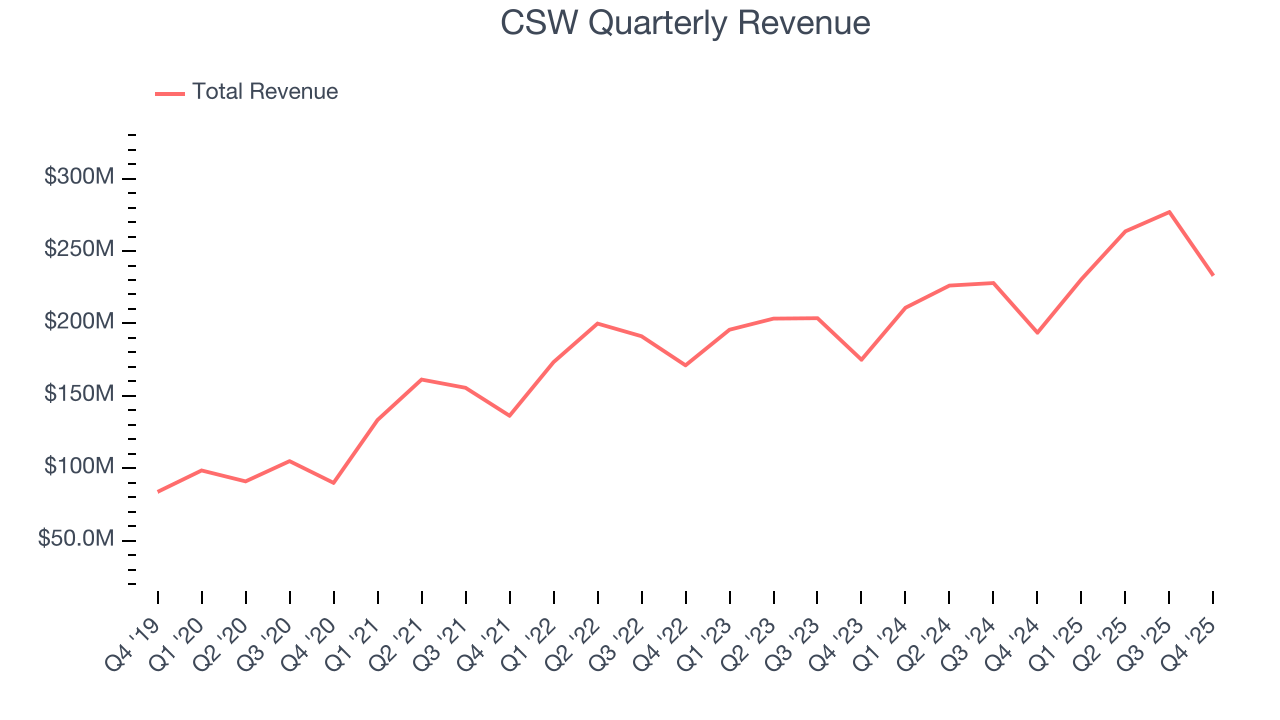

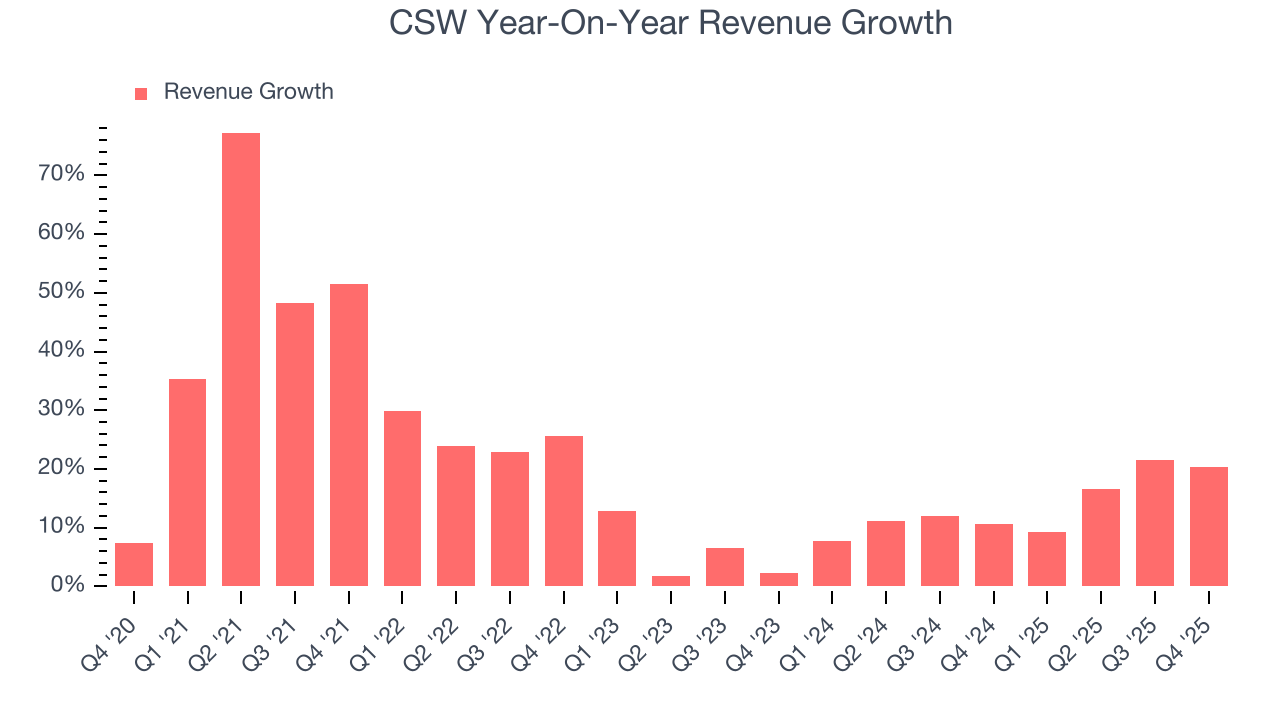

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Luckily, CSW’s sales grew at an incredible 21.2% compounded annual growth rate over the last five years. Its growth surpassed the average industrials company and shows its offerings resonate with customers, a great starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. CSW’s annualized revenue growth of 13.6% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, CSW generated an excellent 20.3% year-on-year revenue growth rate, but its $233 million of revenue fell short of Wall Street’s high expectations.

Looking ahead, sell-side analysts expect revenue to grow 29.1% over the next 12 months, an improvement versus the last two years. This projection is eye-popping and indicates its newer products and services will fuel better top-line performance.

6. Gross Margin & Pricing Power

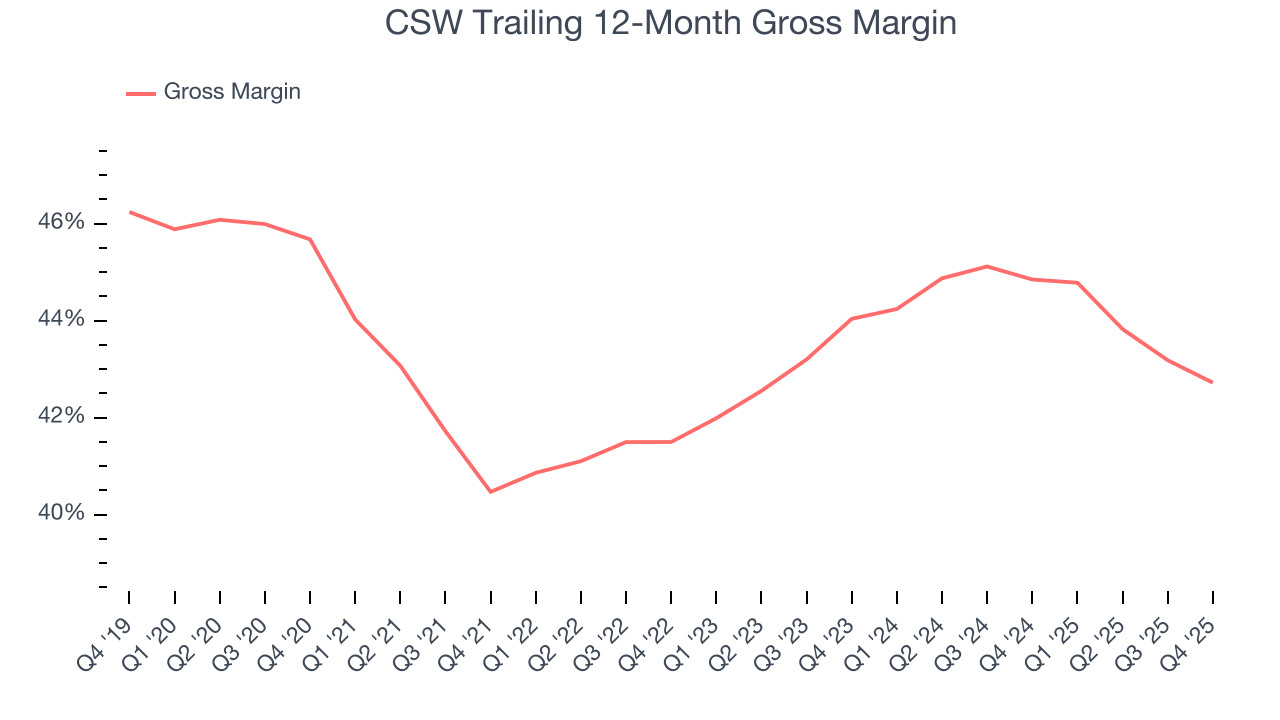

CSW has best-in-class unit economics for an industrials company, enabling it to invest in areas such as research and development. Its margin also signals it sells differentiated products, not commodities. As you can see below, it averaged an elite 42.9% gross margin over the last five years. Said differently, roughly $42.88 was left to spend on selling, marketing, R&D, and general administrative overhead for every $100 in revenue.

CSW produced a 39.7% gross profit margin in Q4, marking a 1.7 percentage point decrease from 41.4% in the same quarter last year. CSW’s full-year margin has also been trending down over the past 12 months, decreasing by 2.1 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs (such as raw materials and manufacturing expenses).

7. Operating Margin

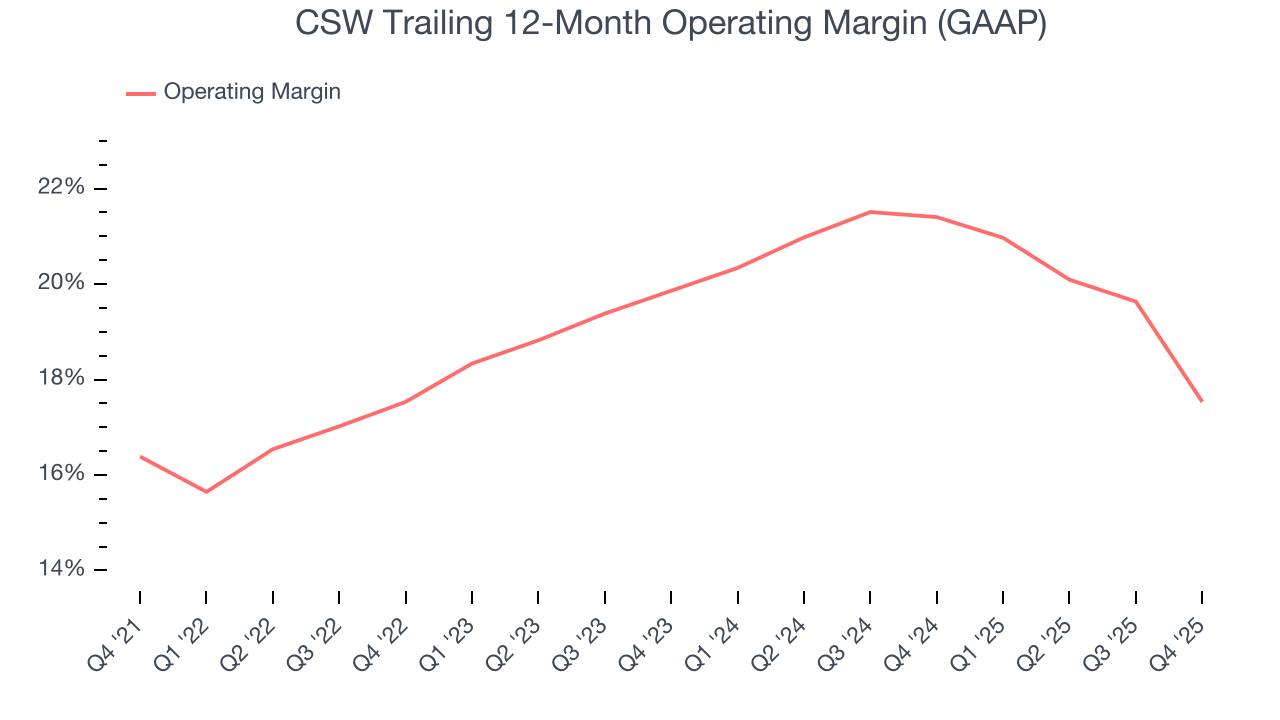

CSW has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 18.7%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, CSW’s operating margin rose by 1.1 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q4, CSW generated an operating margin profit margin of 7.4%, down 8.4 percentage points year on year. Since CSW’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

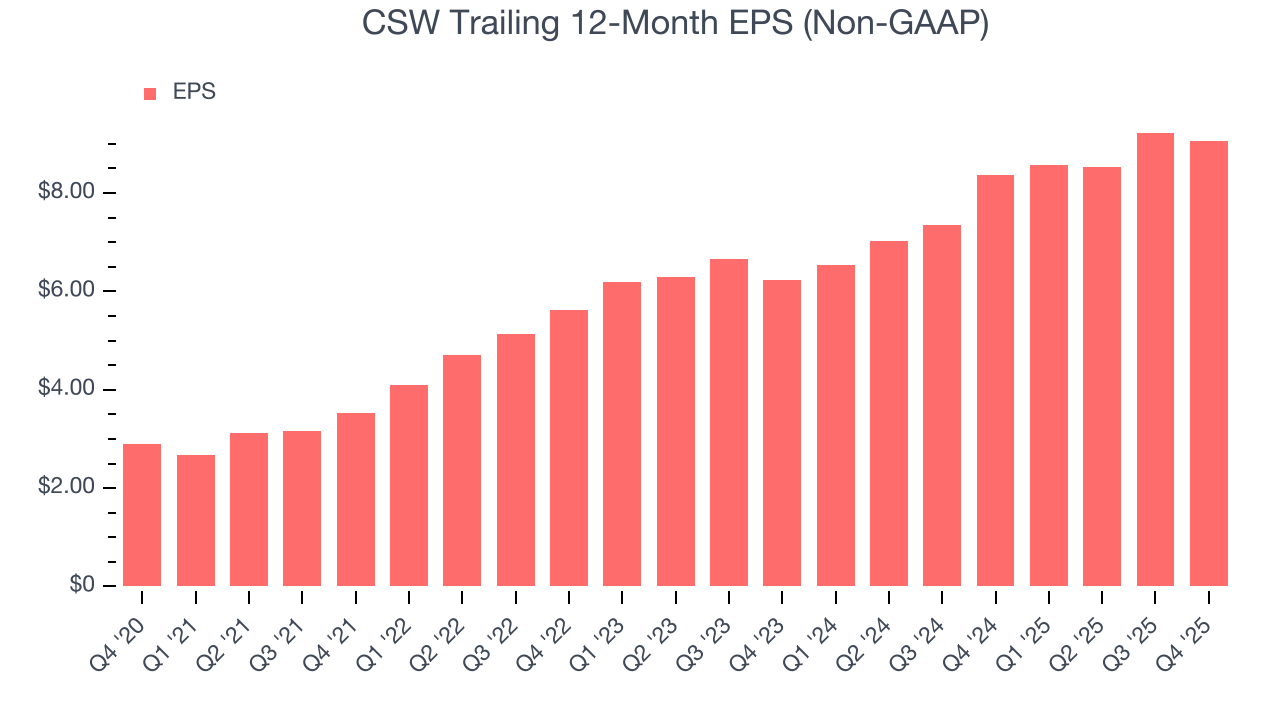

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

CSW’s EPS grew at an astounding 25.6% compounded annual growth rate over the last five years, higher than its 21.2% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into CSW’s earnings quality to better understand the drivers of its performance. As we mentioned earlier, CSW’s operating margin declined this quarter but expanded by 1.1 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For CSW, its two-year annual EPS growth of 20.5% was lower than its five-year trend. We still think its growth was good and hope it can accelerate in the future.

In Q4, CSW reported adjusted EPS of $1.42, down from $1.60 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term adjusted EPS growth than short-term movements. Over the next 12 months, Wall Street expects CSW’s full-year EPS of $9.05 to grow 28.6%.

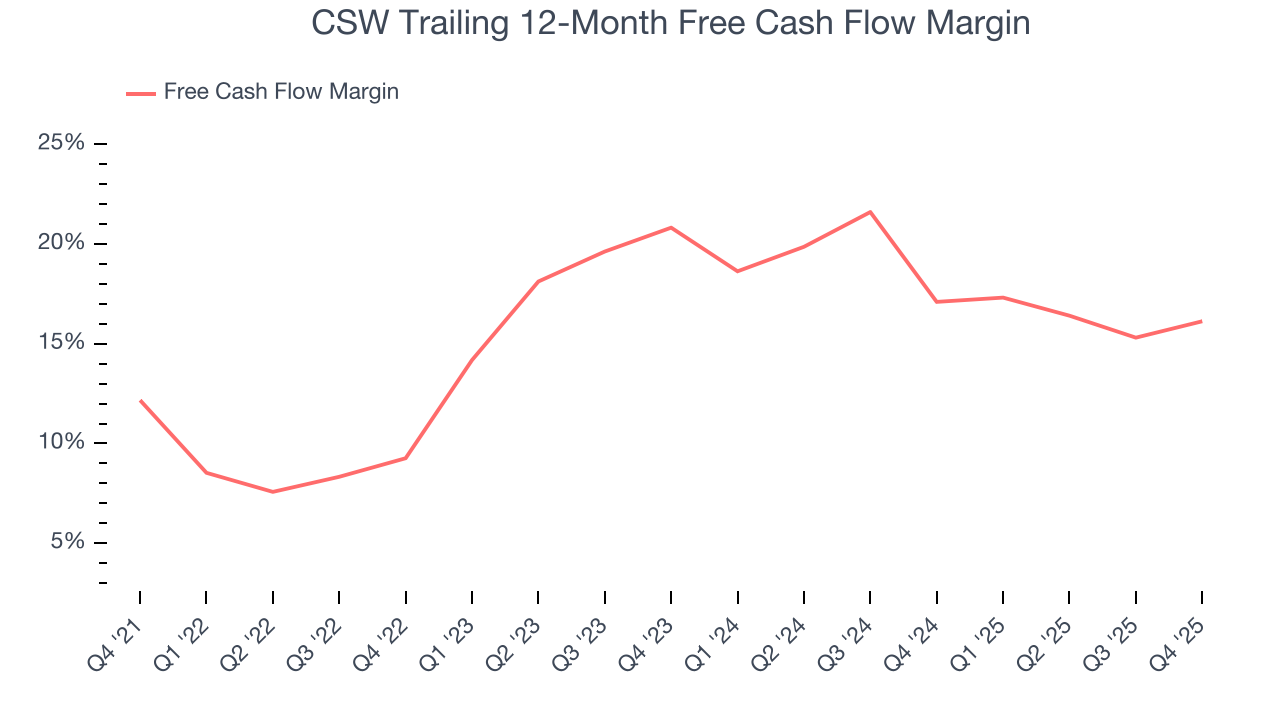

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

CSW has shown terrific cash profitability, putting it in an advantageous position to invest in new products, return capital to investors, and consolidate the market during industry downturns. The company’s free cash flow margin was among the best in the industrials sector, averaging 15.4% over the last five years.

Taking a step back, we can see that CSW’s margin expanded by 4 percentage points during that time. This shows the company is heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

CSW’s free cash flow clocked in at $22.72 million in Q4, equivalent to a 9.8% margin. This result was good as its margin was 5.4 percentage points higher than in the same quarter last year, building on its favorable historical trend.

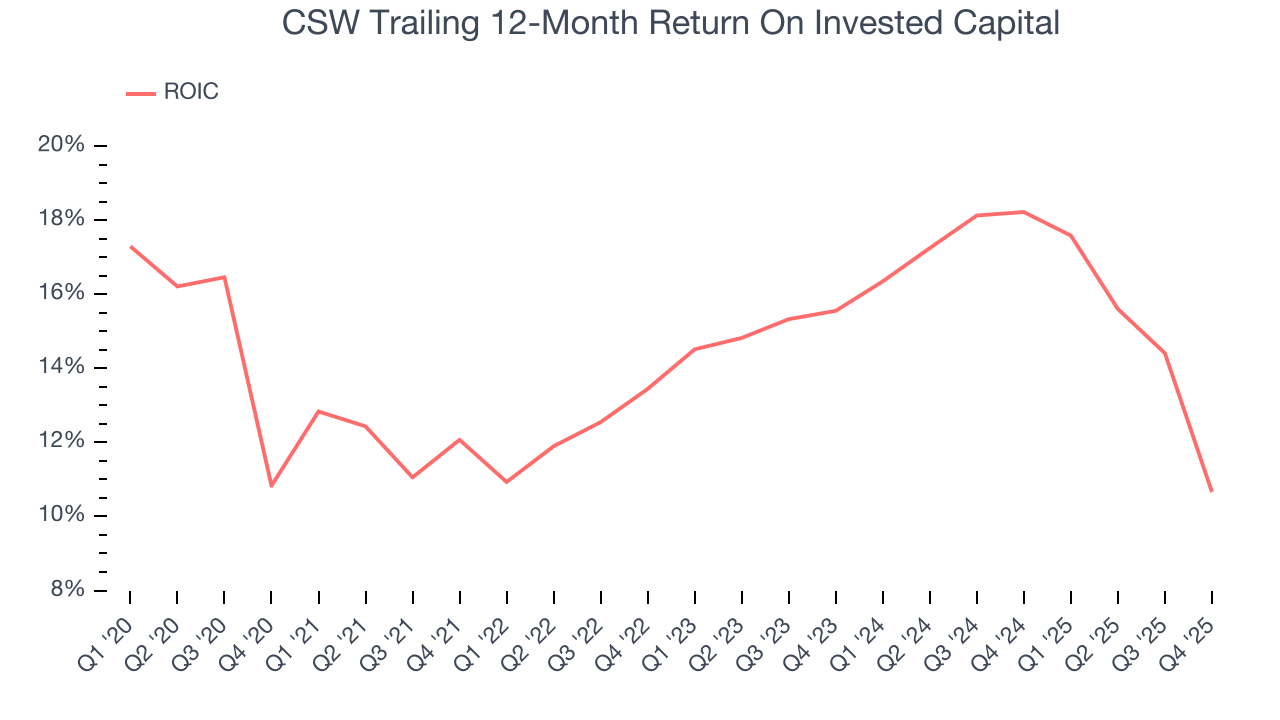

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

CSW’s five-year average ROIC was 14%, higher than most industrials businesses. This illustrates its management team’s ability to invest in profitable growth opportunities and generate value for shareholders.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, CSW’s ROIC averaged 1.7 percentage point increases each year. This is a great sign when paired with its already strong returns. It could suggest its competitive advantage or profitable growth opportunities are expanding.

11. Balance Sheet Assessment

CSW reported $40.24 million of cash and $797.8 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $240.4 million of EBITDA over the last 12 months, we view CSW’s 3.2× net-debt-to-EBITDA ratio as safe. We also see its $8.85 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from CSW’s Q4 Results

We struggled to find many positives in these results. Its revenue missed and its EBITDA fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 3.3% to $290 immediately following the results.

13. Is Now The Time To Buy CSW?

Updated: January 29, 2026 at 7:06 AM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in CSW.

CSW is an amazing business ranking highly on our list. For starters, its revenue growth was exceptional over the last five years and is expected to accelerate over the next 12 months. On top of that, its powerful free cash flow generation enables it to stay ahead of the competition through consistent reinvestment of profits, and its impressive operating margins show it has a highly efficient business model.

CSW’s P/E ratio based on the next 12 months is 25.8x. Scanning the industrials landscape today, CSW’s fundamentals clearly illustrate that it’s an elite business, and we like it at this price.

Wall Street analysts have a consensus one-year price target of $321.17 on the company (compared to the current share price of $290), implying they see 10.7% upside in buying CSW in the short term.