Commvault (CVLT)

We see potential in Commvault. It’s not only a customer acquisition machine but also sports robust unit economics, a deadly combo.― StockStory Analyst Team

1. News

2. Summary

Why Commvault Is Interesting

Born from the need to create ironclad protection in an increasingly dangerous digital world, Commvault (NASDAQ:CVLT) provides data protection and cyber resilience software that helps organizations secure, back up, and recover their data across on-premises, hybrid, and multi-cloud environments.

- Software platform has product-market fit given the rapid recovery of its customer acquisition costs

- Billings have averaged 26.6% growth over the last year, showing it’s securing new contracts that could potentially increase in value over time

- A drawback is its operating margin failed to increase over the last year, indicating the company couldn’t optimize its expenses

Commvault shows some signs of a high-quality business. If you like the story, the price looks fair.

Why Is Now The Time To Buy Commvault?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Commvault?

At $86.25 per share, Commvault trades at 3.1x forward price-to-sales. This valuation is quite compelling when considering its quality characteristics.

It could be a good time to invest if you see something the market doesn’t.

3. Commvault (CVLT) Research Report: Q4 CY2025 Update

Data protection software company Commvault (NASDAQ:CVLT) reported Q4 CY2025 results exceeding the market’s revenue expectations, with sales up 19.5% year on year to $313.8 million. The company expects next quarter’s revenue to be around $306.5 million, close to analysts’ estimates. Its non-GAAP profit of $1.17 per share was 19.2% above analysts’ consensus estimates.

Commvault (CVLT) Q4 CY2025 Highlights:

- Revenue: $313.8 million vs analyst estimates of $299.1 million (19.5% year-on-year growth, 4.9% beat)

- Adjusted EPS: $1.17 vs analyst estimates of $0.98 (19.2% beat)

- Adjusted Operating Income: $61.46 million vs analyst estimates of $55.71 million (19.6% margin, 10.3% beat)

- Revenue Guidance for Q1 CY2026 is $306.5 million at the midpoint, roughly in line with what analysts were expecting

- Operating Margin: 6.3%, up from 5.2% in the same quarter last year

- Free Cash Flow Margin: 0.6%, down from 26.6% in the previous quarter

- Annual Recurring Revenue: $1.09 billion vs analyst estimates of $1.08 billion (22% year-on-year growth, in line)

- Billings: $369.4 million at quarter end, up 24.1% year on year

- Market Capitalization: $5.70 billion

Company Overview

Born from the need to create ironclad protection in an increasingly dangerous digital world, Commvault (NASDAQ:CVLT) provides data protection and cyber resilience software that helps organizations secure, back up, and recover their data across on-premises, hybrid, and multi-cloud environments.

Commvault's platform addresses the growing challenge of ransomware and other cyber threats through a comprehensive suite of solutions organized into three main packages: Operational Recovery for basic backup and recovery, Autonomous Recovery for automated disaster recovery, and Cyber Recovery for advanced threat detection and clean data restoration. These solutions can be deployed as customer-managed software, Software-as-a-Service (SaaS), or as integrated appliances.

The company's specialized offerings include Cleanroom Recovery, which provides isolated recovery environments in the cloud; HyperScale X, a scale-out integrated data protection solution; Air Gap Protect for secure cloud storage; and Compliance tools to meet regulatory requirements. Customers range from small businesses to large global enterprises across industries like banking, healthcare, government, and technology.

Commvault generates revenue through software licensing, subscription services, and professional support services. Its global support infrastructure operates 24/7, with technical consultants providing implementation, architecture design, and recovery services. The company maintains an extensive partner ecosystem, working with hardware vendors, cloud providers, and cybersecurity firms to enhance its capabilities and market reach.

4. Data Storage

Data is the lifeblood of the internet and software in general, and the amount of data created is accelerating. As a result, the importance of storing the data in scalable and efficient formats continues to rise, especially as its diversity and associated use cases expand from analyzing simple, structured datasets to high-scale processing of unstructured data such as images, audio, and video.

Commvault competes in the data protection software market with players like Cohesity, Dell-EMC, Rubrik, Veeam, Veritas, IBM, Druva, and Avepoint, all offering products that overlap with portions of Commvault's comprehensive solution suite.

5. Revenue Growth

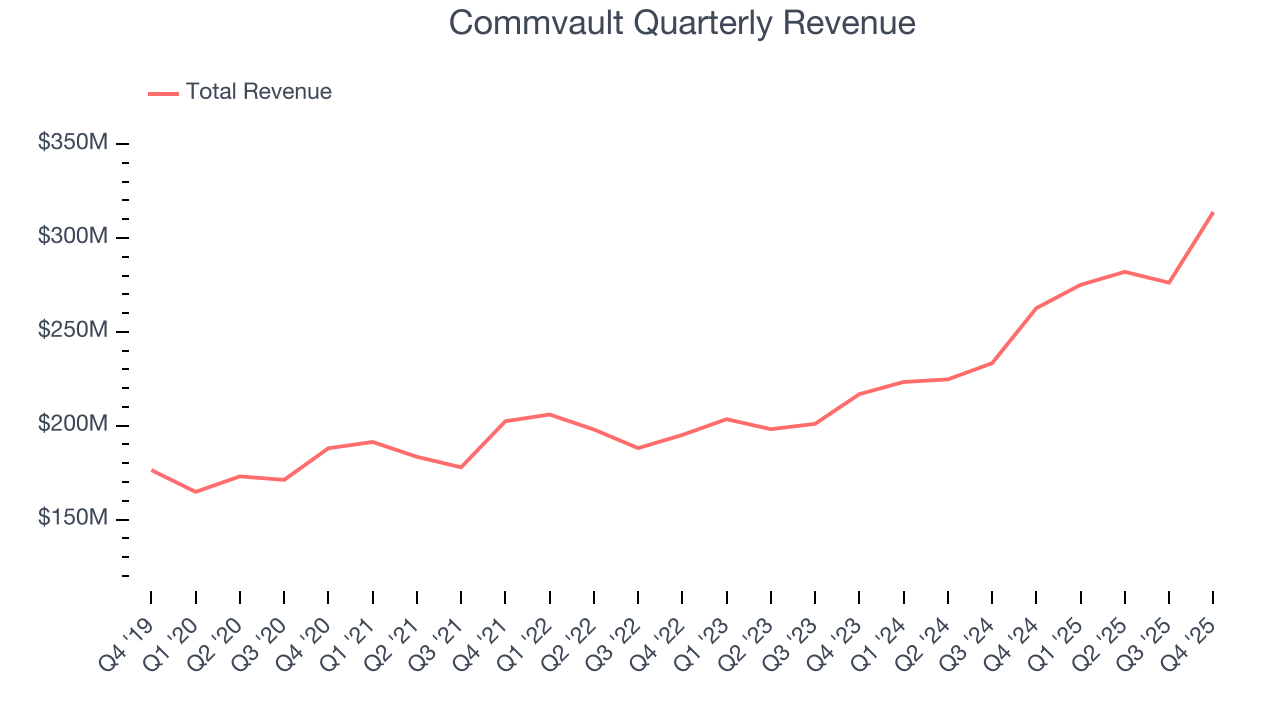

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Commvault grew its sales at a 10.5% compounded annual growth rate. Although this growth is acceptable on an absolute basis, it fell short of our standards for the software sector, which enjoys a number of secular tailwinds. Luckily, there are other things to like about Commvault.

Long-term growth is the most important, but within software, a half-decade historical view may miss new innovations or demand cycles. Commvault’s annualized revenue growth of 18.3% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

This quarter, Commvault reported year-on-year revenue growth of 19.5%, and its $313.8 million of revenue exceeded Wall Street’s estimates by 4.9%. Company management is currently guiding for a 11.4% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 10.2% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and suggests its products and services will see some demand headwinds. At least the company is tracking well in other measures of financial health.

6. Annual Recurring Revenue

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

Commvault’s ARR punched in at $1.09 billion in Q4, and over the last four quarters, its growth was impressive as it averaged 22.3% year-on-year increases. This performance aligned with its total sales growth and shows that customers are willing to take multi-year bets on the company’s technology. Its growth also makes Commvault a more predictable business, a tailwind for its valuation as investors typically prefer businesses with recurring revenue.

7. Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

Commvault is extremely efficient at acquiring new customers, and its CAC payback period checked in at 7.5 months this quarter. The company’s rapid recovery of its customer acquisition costs indicates it has a highly differentiated product offering and a strong brand reputation. These dynamics give Commvault more resources to pursue new product initiatives while maintaining the flexibility to increase its sales and marketing investments.

8. Gross Margin & Pricing Power

Software is eating the world. It’s one of our favorite business models because once you develop the product, it usually doesn’t cost much to provide it as an ongoing service. These minimal costs can include servers, licenses, and certain personnel.

Commvault’s robust unit economics are better than the broader software industry, an output of its asset-lite business model and pricing power. They also enable the company to fund large investments in new products and sales during periods of rapid growth to achieve higher profits in the future. As you can see below, it averaged an excellent 81.4% gross margin over the last year. That means Commvault only paid its providers $18.56 for every $100 in revenue.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. Commvault has seen gross margins decline by 0.6 percentage points over the last 2 year, which is slightly worse than average for software.

In Q4, Commvault produced a 81.1% gross profit margin, in line with the same quarter last year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting its input costs have been stable and it isn’t under pressure to lower prices.

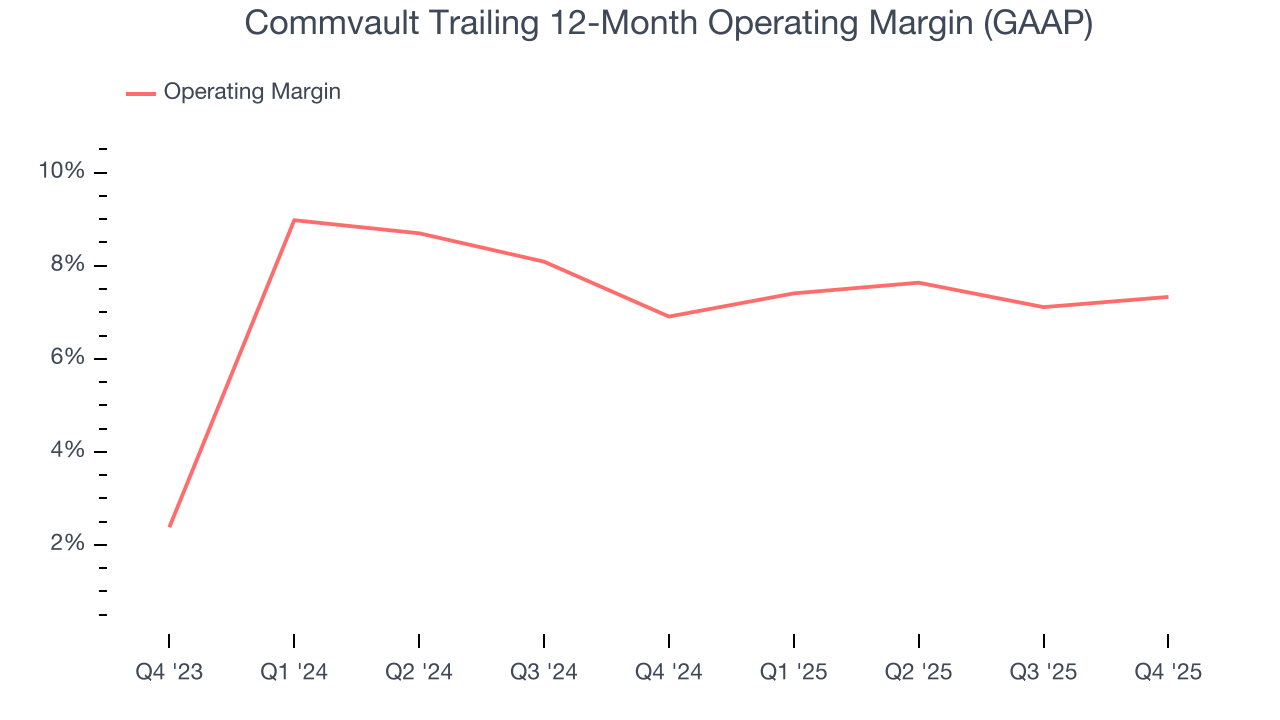

9. Operating Margin

While many software businesses point investors to their adjusted profits, which exclude stock-based compensation (SBC), we prefer GAAP operating margin because SBC is a legitimate expense used to attract and retain talent. This metric shows how much revenue remains after accounting for all core expenses – everything from the cost of goods sold to sales and R&D.

Commvault has managed its cost base well over the last year. It demonstrated solid profitability for a software business, producing an average operating margin of 7.3%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Commvault’s operating margin might fluctuated slightly but has generally stayed the same over the last two years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q4, Commvault generated an operating margin profit margin of 6.3%, up 1.1 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

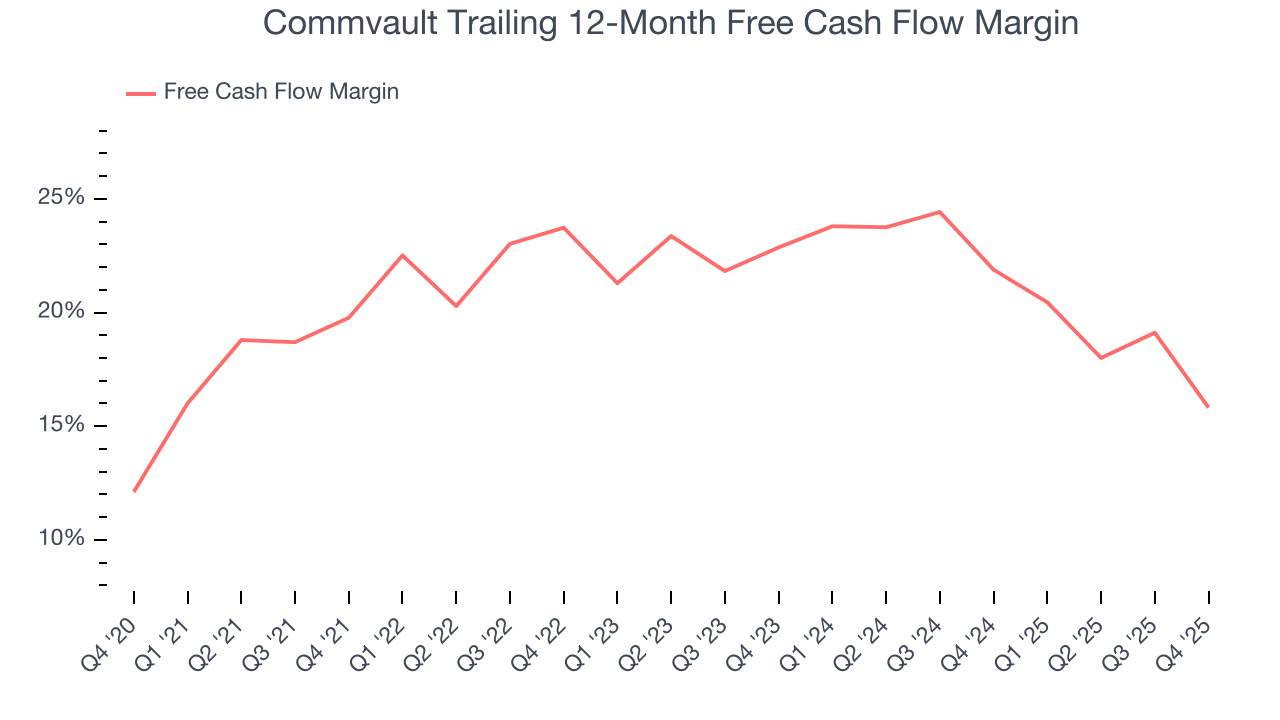

10. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Commvault has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 15.8% over the last year, slightly better than the broader software sector.

Commvault broke even from a free cash flow perspective in Q4. The company’s cash profitability regressed as it was 10.8 percentage points lower than in the same quarter last year, but we wouldn’t put too much weight on the short term because investment needs can be seasonal, causing temporary swings. Long-term trends carry greater meaning.

Over the next year, analysts predict Commvault’s cash conversion will improve. Their consensus estimates imply its free cash flow margin of 15.8% for the last 12 months will increase to 20.3%, it options for capital deployment (investments, share buybacks, etc.).

11. Balance Sheet Assessment

Companies with more cash than debt have lower bankruptcy risk.

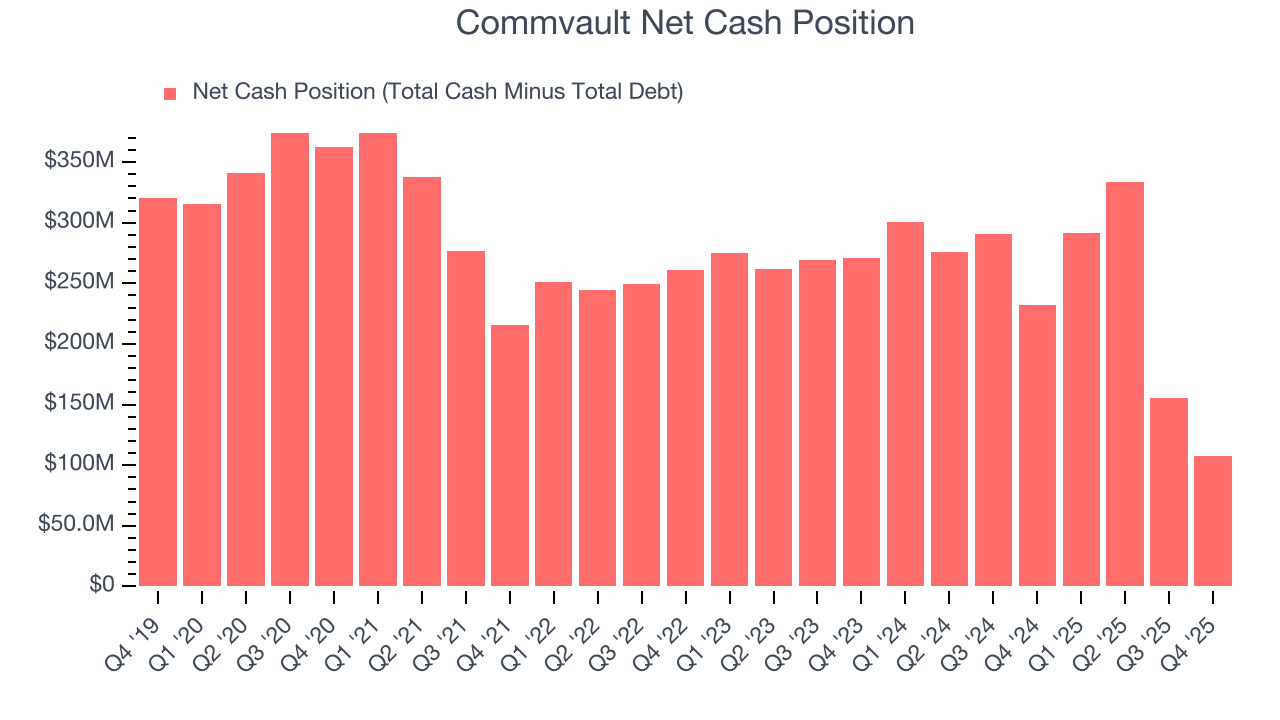

Commvault is a profitable, well-capitalized company with $1.03 billion of cash and $918.6 million of debt on its balance sheet. This $107.7 million net cash position is 2.7% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from Commvault’s Q4 Results

We were impressed by how significantly Commvault blew past analysts’ billings expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. Overall, we think this was still a solid quarter with some key areas of upside. The market seemed to be hoping for more, and the stock traded down 8.7% to $118.10 immediately after reporting.

13. Is Now The Time To Buy Commvault?

Updated: February 26, 2026 at 9:40 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Commvault.

There are definitely a lot of things to like about Commvault. Although its revenue growth was uninspiring over the last five years, its efficient sales strategy allows it to target and onboard new users at scale. And while its operating margin hasn't moved over the last year, its splendid ARR growth shows it’s securing more long-term contracts and becoming a more predictable business.

Commvault’s price-to-sales ratio based on the next 12 months is 3x. Looking at the software space right now, Commvault trades at a compelling valuation. If you’re a fan of the business and management team, now is a good time to scoop up some shares.

Wall Street analysts have a consensus one-year price target of $140.33 on the company (compared to the current share price of $87.98), implying they see 59.5% upside in buying Commvault in the short term.