MongoDB (MDB)

MongoDB piques our interest. Its ARR growth highlights the stickiness of its business model and suggests it’s winning market share.― StockStory Analyst Team

1. News

2. Summary

Why MongoDB Is Interesting

Named after "humongous database," reflecting its ability to handle massive data loads, MongoDB (NASDAQ:MDB) provides a flexible document-based database platform that helps developers build, deploy, and maintain modern applications more efficiently.

- Customers view its software as mission-critical to their operations as its ARR has averaged 25.6% growth over the last year

- Annual revenue growth of 33.7% over the last five years was superb and indicates its market share is rising

- On the other hand, its historical operating margin losses show it had an inefficient cost structure while scaling

MongoDB almost passes our quality test. If you like the company, the price looks fair.

Why Is Now The Time To Buy MongoDB?

High Quality

Investable

Underperform

Why Is Now The Time To Buy MongoDB?

MongoDB is trading at $327.78 per share, or 9.9x forward price-to-sales. This multiple is higher than that of most software companies, sure, but we still think the valuation is fair given the revenue growth.

If you think the market is not giving the company enough credit for its fundamentals, now could be a good time to invest.

3. MongoDB (MDB) Research Report: Q3 CY2025 Update

Database platform company MongoDB (NASDAQ:MDB) reported revenue ahead of Wall Streets expectations in Q3 CY2025, with sales up 18.7% year on year to $628.3 million. On top of that, next quarter’s revenue guidance ($667.5 million at the midpoint) was surprisingly good and 6.5% above what analysts were expecting. Its non-GAAP profit of $1.32 per share was 66.2% above analysts’ consensus estimates.

MongoDB (MDB) Q3 CY2025 Highlights:

- Revenue: $628.3 million vs analyst estimates of $594.3 million (18.7% year-on-year growth, 5.7% beat)

- Adjusted EPS: $1.32 vs analyst estimates of $0.79 (66.2% beat)

- Adjusted Operating Income: $123.1 million vs analyst estimates of $70.72 million (19.6% margin, 74.1% beat)

- Revenue Guidance for Q4 CY2025 is $667.5 million at the midpoint, above analyst estimates of $626.9 million

- Management raised its full-year Adjusted EPS guidance to $4.78 at the midpoint, a 29.7% increase

- Operating Margin: -2.9%, up from -5.3% in the same quarter last year

- Free Cash Flow Margin: 22.3%, up from 11.8% in the previous quarter

- Customers: 62,500, up from 59,900 in the previous quarter

- Billings: $687.3 million at quarter end, up 34.4% year on year

- Market Capitalization: $27.04 billion

Company Overview

Named after "humongous database," reflecting its ability to handle massive data loads, MongoDB (NASDAQ:MDB) provides a flexible document-based database platform that helps developers build, deploy, and maintain modern applications more efficiently.

MongoDB's platform bridges the gap between traditional relational databases and newer non-relational approaches, offering the flexibility developers need for modern applications while maintaining the reliability businesses demand. Its document-based architecture allows information to be stored in JSON-like formats that more naturally align with how developers work with data in their code.

Customers can deploy MongoDB in multiple ways: as a fully-managed cloud service (MongoDB Atlas), which MongoDB operates across major cloud providers like AWS, Google Cloud, and Microsoft Azure, or as self-managed software (MongoDB Enterprise Advanced) that organizations can run themselves in the cloud or on-premises.

The company has expanded beyond its core database functionality to offer an integrated developer data platform with capabilities for search, vector search for AI applications, time series data processing, data lifecycle management, and edge computing. This comprehensive approach allows organizations to reduce the number of specialized data technologies they need to maintain.

A typical MongoDB customer might be a retail company using the platform to power its e-commerce application, storing product information, customer profiles, and transaction data while leveraging Atlas Vector Search to enable AI-powered product recommendations based on customer behavior patterns.

4. Data Storage

Data is the lifeblood of the internet and software in general, and the amount of data created is accelerating. As a result, the importance of storing the data in scalable and efficient formats continues to rise, especially as its diversity and associated use cases expand from analyzing simple, structured datasets to high-scale processing of unstructured data such as images, audio, and video.

MongoDB competes with established legacy database providers like Oracle (NYSE:ORCL), Microsoft (NASDAQ:MSFT), and IBM (NYSE:IBM), as well as cloud providers offering database services including Amazon Web Services (NASDAQ:AMZN), Google Cloud (NASDAQ:GOOGL), and Microsoft Azure. Other competitors include specialized database vendors like Couchbase (NASDAQ:BASE) and Redis (NASDAQ:REDI).

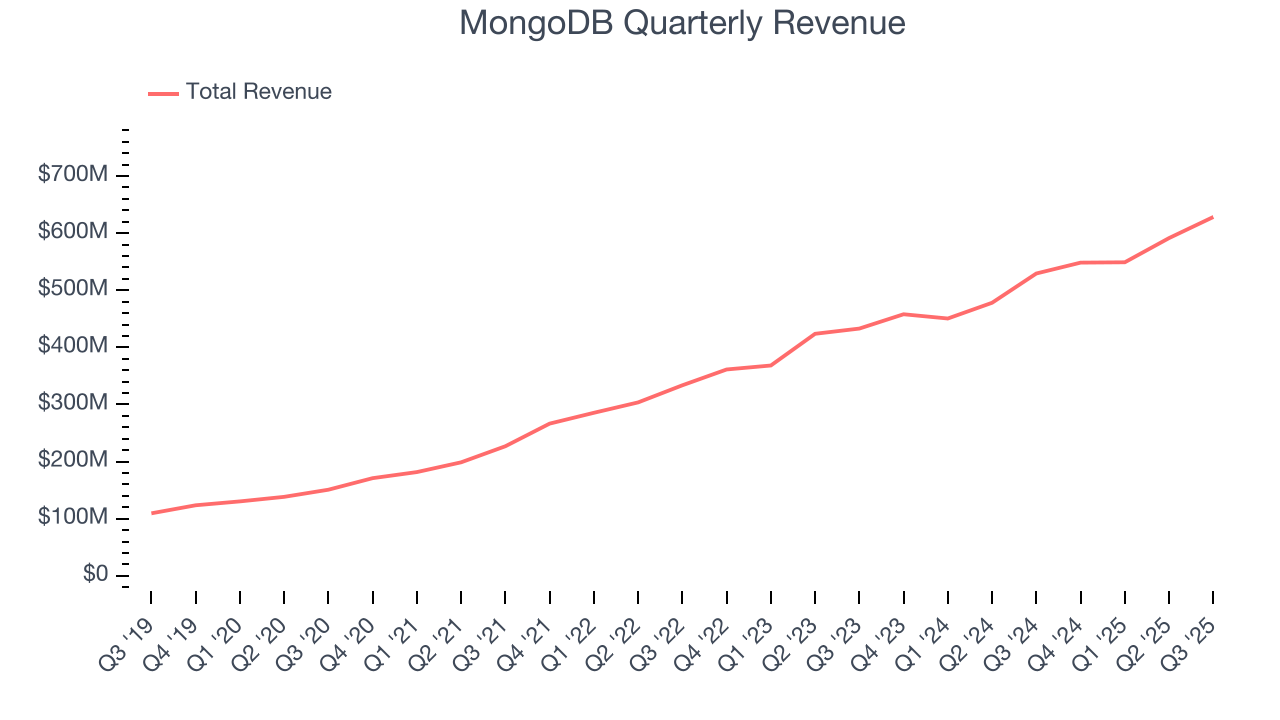

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, MongoDB grew its sales at an excellent 33.7% compounded annual growth rate. Its growth beat the average software company and shows its offerings resonate with customers, a helpful starting point for our analysis.

Long-term growth is the most important, but within software, a half-decade historical view may miss new innovations or demand cycles. MongoDB’s annualized revenue growth of 20.9% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, MongoDB reported year-on-year revenue growth of 18.7%, and its $628.3 million of revenue exceeded Wall Street’s estimates by 5.7%. Company management is currently guiding for a 21.7% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 14.6% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and suggests its products and services will see some demand headwinds. At least the company is tracking well in other measures of financial health.

6. Billings

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

MongoDB’s billings punched in at $687.3 million in Q3, and over the last four quarters, its growth was fantastic as it averaged 25.2% year-on-year increases. This alternate topline metric grew faster than total sales, meaning the company collects cash upfront and then recognizes the revenue over the length of its contracts - a boost for its liquidity and future revenue prospects.

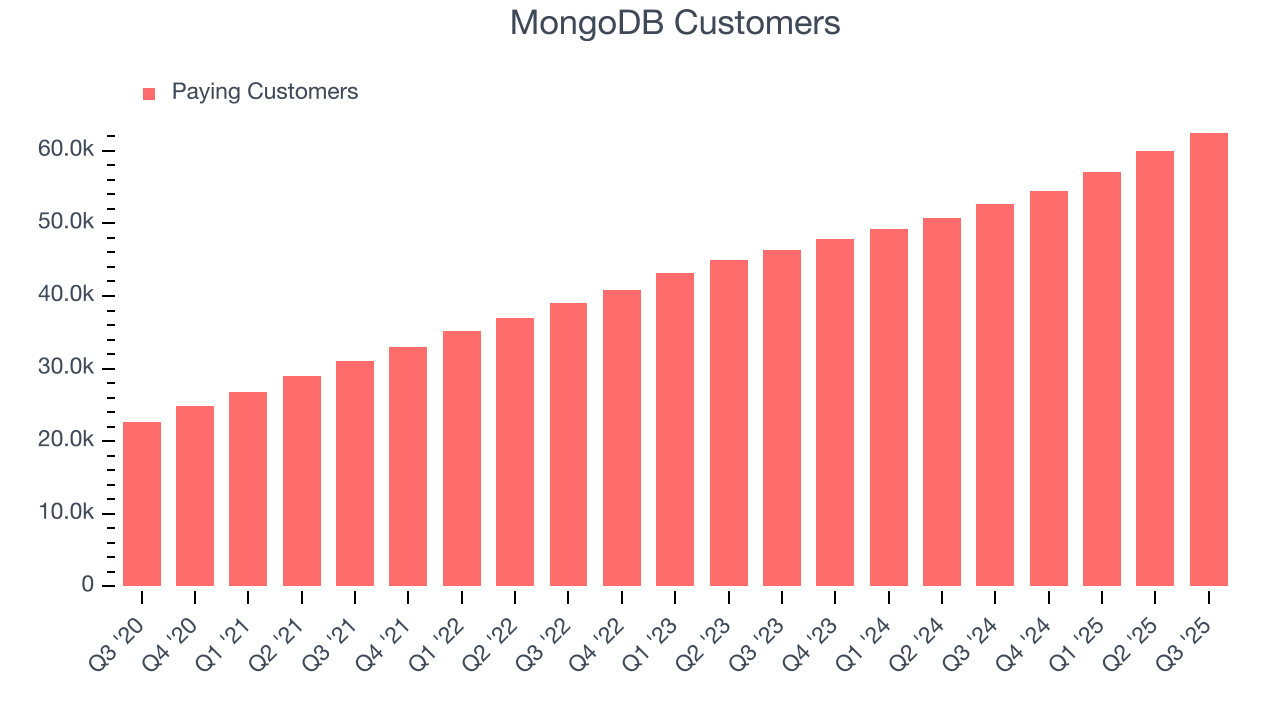

7. Customer Base

MongoDB reported 62,500 customers at the end of the quarter, a sequential increase of 2,600. That’s roughly in line with what we observed last quarter and quite a bit above what we’ve seen over the previous year, confirming that the company is maintaining its sales momentum.

8. Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

It’s relatively expensive for MongoDB to acquire new customers as its CAC payback period checked in at 387.1 months this quarter. The company’s slow recovery of its sales and marketing expenses indicates it operates in a competitive market. A silver lining is that once it acquires its customers, they typically don’t leave and increase their spending - a sign of high switching costs.

9. Gross Margin & Pricing Power

For software companies like MongoDB, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

MongoDB’s gross margin is slightly below the average software company, giving it less room than its competitors to invest in areas such as product and sales. As you can see below, it averaged a 71.6% gross margin over the last year. That means MongoDB paid its providers a lot of money ($28.38 for every $100 in revenue) to run its business.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. MongoDB has seen gross margins decline by 3.2 percentage points over the last 2 year, which is among the worst in the software space.

MongoDB produced a 71.5% gross profit margin in Q3, down 3 percentage points year on year. MongoDB’s full-year margin has also been trending down over the past 12 months, decreasing by 2.2 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs.

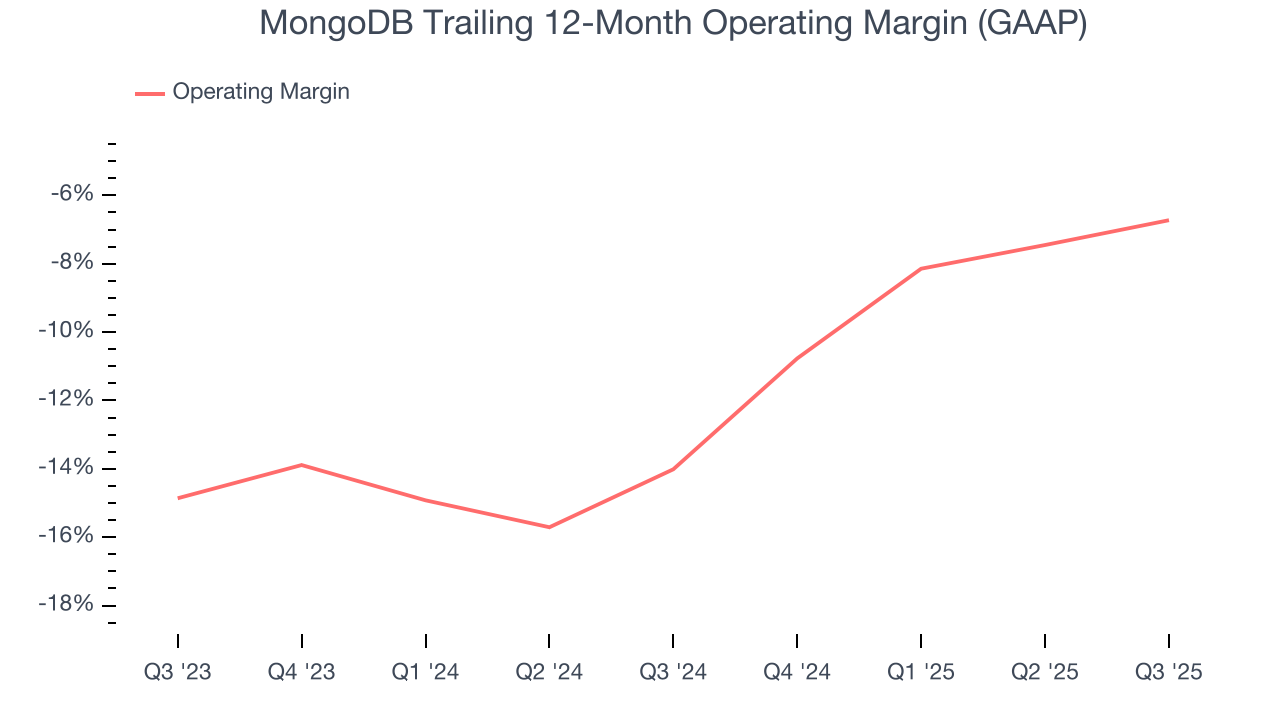

10. Operating Margin

MongoDB’s expensive cost structure has contributed to an average operating margin of negative 6.7% over the last year. This happened because the company spent loads of money to capture market share. As seen in its fast revenue growth, the aggressive strategy has paid off so far, but it’s unclear what would happen if MongoDB reeled back its investments. Still, we’re optimistic the business can continue growing and reach profitability upon scale.

Over the last two years, MongoDB’s expanding sales gave it operating leverage as its margin rose by 7.3 percentage points. Still, it will take much more for the company to reach long-term profitability.

This quarter, MongoDB generated a negative 2.9% operating margin.

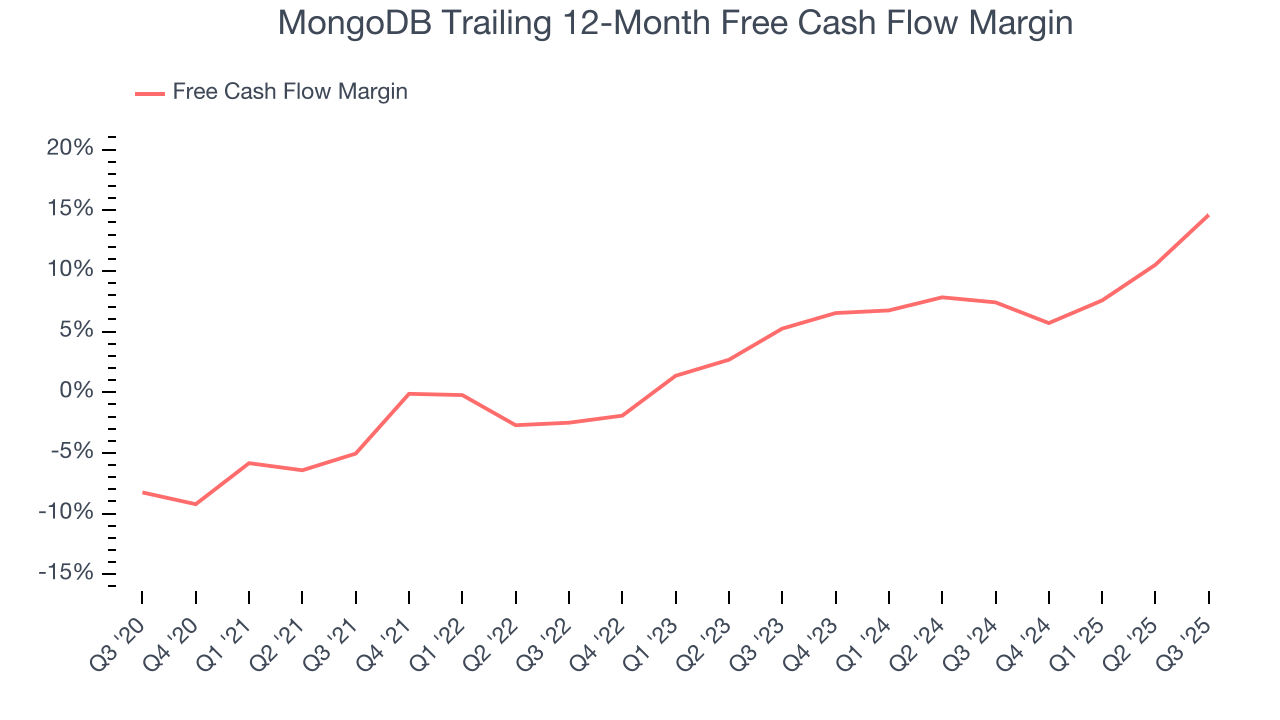

11. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

MongoDB has shown mediocre cash profitability over the last year, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 14.6%, subpar for a software business.

MongoDB’s free cash flow clocked in at $140.1 million in Q3, equivalent to a 22.3% margin. This result was good as its margin was 15.8 percentage points higher than in the same quarter last year. Its cash profitability was also above its one-year level, and we hope the company can build on this trend.

Over the next year, analysts predict MongoDB’s cash conversion will fall. Their consensus estimates imply its free cash flow margin of 14.6% for the last 12 months will decrease to 11.3%.

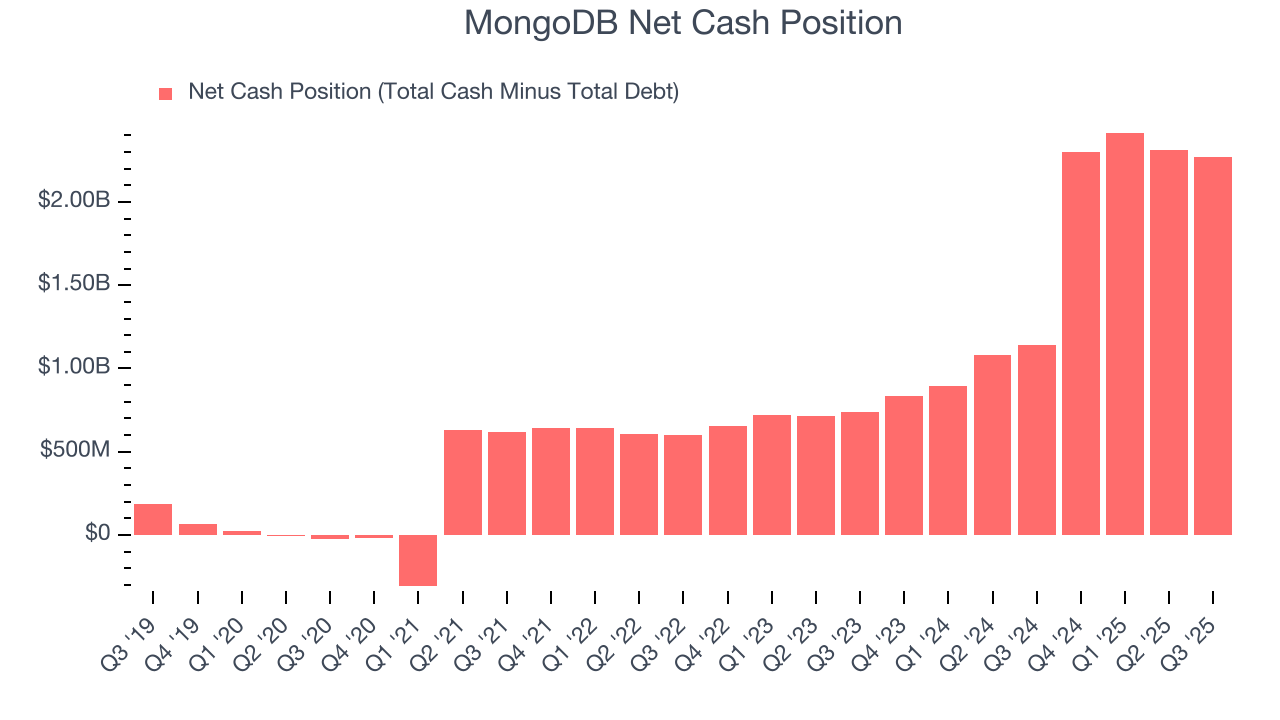

12. Balance Sheet Assessment

One of the best ways to mitigate bankruptcy risk is to hold more cash than debt.

MongoDB is a well-capitalized company with $2.31 billion of cash and $34.63 million of debt on its balance sheet. This $2.27 billion net cash position is 7% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

13. Key Takeaways from MongoDB’s Q3 Results

We were impressed by how significantly MongoDB blew past analysts’ billings expectations this quarter. We were also glad its EPS guidance for next quarter trumped Wall Street’s estimates. Zooming out, we think this was a solid print. The stock traded up 8.4% to $356.77 immediately after reporting.

14. Is Now The Time To Buy MongoDB?

Updated: February 27, 2026 at 9:22 PM EST

Before deciding whether to buy MongoDB or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

There are definitely a lot of things to like about MongoDB. To kick things off, its revenue growth was impressive over the last five years. And while its operating margins are low compared to other software companies, its surging ARR shows its fundamentals and revenue predictability are improving.

MongoDB’s price-to-sales ratio based on the next 12 months is 9.9x. When scanning the software space, MongoDB trades at a fair valuation. If you believe in the company and its growth potential, now is an opportune time to buy shares.

Wall Street analysts have a consensus one-year price target of $446.61 on the company (compared to the current share price of $327.78), implying they see 36.3% upside in buying MongoDB in the short term.