Dropbox (DBX)

We wouldn’t buy Dropbox. Its sluggish sales growth shows demand is soft, a worrisome sign for investors in high-quality stocks.― StockStory Analyst Team

1. News

2. Summary

Why We Think Dropbox Will Underperform

Originally named after the founders' tendency to "drop" files into a shared folder, Dropbox (NASDAQ:DBX) provides a content collaboration platform that helps individuals and teams store, organize, share, and work on files from anywhere.

- Sales were flat over the last two years, indicating it’s failed to expand its business

- Challenges in acquiring and retaining long-term customers were reflected in its average ARR declines of 1.2% over the last year

- Demand will likely be weak over the next 12 months as Wall Street expects flat revenue

Dropbox falls short of our quality standards. There are better opportunities in the market.

Why There Are Better Opportunities Than Dropbox

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Dropbox

Dropbox’s stock price of $26.73 implies a valuation ratio of 2.7x forward price-to-sales. This sure is a cheap multiple, but you get what you pay for.

It’s better to pay up for high-quality businesses with higher long-term earnings potential rather than to buy lower-quality stocks because they appear cheap. These challenged businesses often don’t re-rate, a phenomenon known as a “value trap”.

3. Dropbox (DBX) Research Report: Q4 CY2025 Update

Cloud storage company Dropbox (NASDAQ:DBX) announced better-than-expected revenue in Q4 CY2025, but sales fell by 1.1% year on year to $636.2 million. Its non-GAAP profit of $0.68 per share was 1.6% above analysts’ consensus estimates.

Dropbox (DBX) Q4 CY2025 Highlights:

- Revenue: $636.2 million vs analyst estimates of $629.1 million (1.1% year-on-year decline, 1.1% beat)

- Adjusted EPS: $0.68 vs analyst estimates of $0.67 (1.6% beat)

- Adjusted Operating Income: $243 million vs analyst estimates of $232.4 million (38.2% margin, 4.6% beat)

- Operating Margin: 25.5%, up from 13.7% in the same quarter last year

- Free Cash Flow Margin: 35.4%, down from 46.3% in the previous quarter

- Customers: 18.08 million, up from 18.07 million in the previous quarter

- Annual Recurring Revenue: $2.53 billion vs analyst estimates of $2.52 billion (1.9% year-on-year decline, in line)

- Billings: $624.9 million at quarter end, down 1% year on year

- Market Capitalization: $6.39 billion

Company Overview

Originally named after the founders' tendency to "drop" files into a shared folder, Dropbox (NASDAQ:DBX) provides a content collaboration platform that helps individuals and teams store, organize, share, and work on files from anywhere.

The company's platform serves as a unified digital workspace where users can create, access, share, and collaborate on content across devices and operating systems. Dropbox offers a range of tools beyond simple file storage, including document scanning, file version history, password management, and secure file transfer capabilities. For businesses, it provides advanced features like administrative controls, audit logs, and team management tools.

Dropbox monetizes through tiered subscription plans. Its Basic plan is free, while Personal and Business plans offer premium features at various price points. Over 90% of Dropbox's revenue comes from self-serve channels where users purchase subscriptions directly through its app or website.

The platform integrates with popular productivity applications including Microsoft Office, Zoom, Slack, and Google Workspace, allowing users to seamlessly incorporate Dropbox into their existing workflows. Through acquisitions, Dropbox has expanded its capabilities to include electronic signatures (Dropbox Sign), secure document sharing with analytics (DocSend), visual communication tools (Capture), and document automation (FormSwift).

Security is a core focus, with features including 256-bit encryption for stored files, secure data transfer protocols, remote device wiping capabilities, and compliance with regulations like HIPAA. The platform's collaborative tools enable real-time commenting, annotations, file activity tracking, and notifications that keep team members connected without switching between different applications.

4. Document Management

The catch phrase "digital transformation" originally referred to the digitization of documents within enterprises. The growth of digital documents has spurred an explosion of collaboration within and between businesses, which in turn is driving the demand for e-signature and content management platforms.

Dropbox competes with major tech companies in the cloud storage market, including Microsoft OneDrive, Google Drive, Apple iCloud, and Amazon Drive. In the content collaboration space, it faces competition from Microsoft SharePoint, Google Workspace, and Atlassian products. For enterprise deployments, Box (NYSE:BOX) is a direct competitor, while DocuSign (NASDAQ:DOCU) and Adobe (NASDAQ:ADBE) compete with Dropbox's e-signature offerings.

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Regrettably, Dropbox’s sales grew at a weak 5.7% compounded annual growth rate over the last five years. This fell short of our benchmark for the software sector and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within software, a half-decade historical view may miss recent innovations or disruptive industry trends. Dropbox’s recent performance shows its demand has slowed as its revenue was flat over the last two years.

This quarter, Dropbox’s revenue fell by 1.1% year on year to $636.2 million but beat Wall Street’s estimates by 1.1%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. This projection doesn't excite us and indicates its products and services will face some demand challenges.

6. Annual Recurring Revenue

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

Dropbox’s ARR came in at $2.53 billion in Q4, and it averaged 1.2% year-on-year declines over the last four quarters. This performance mirrored its total sales, showing the company lost long-term deals and renewals. It also suggests there may be increasing competition or market saturation.

7. Customer Base

Dropbox reported 18.08 million customers at the end of the quarter, a sequential increase of 10,000. That’s a little better than last quarter and quite a bit above the typical growth we’ve seen over the previous year. However, the increase in customers wasn’t backed by an equivalent increase in annualized recurring revenue (ARR), suggesting that Dropbox is disproportionately winning smaller customers.

8. Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

It’s relatively expensive for Dropbox to acquire new customers as its CAC payback period checked in at 137.5 months this quarter. The company’s slow recovery of its sales and marketing expenses indicates it operates in a highly competitive market and must invest to stand out, even if the return on that investment is low.

9. Gross Margin & Pricing Power

For software companies like Dropbox, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

Dropbox’s robust unit economics are better than the broader software industry, an output of its asset-lite business model and pricing power. They also enable the company to fund large investments in new products and sales during periods of rapid growth to achieve higher profits in the future. As you can see below, it averaged an excellent 80.2% gross margin over the last year. Said differently, roughly $80.15 was left to spend on selling, marketing, and R&D for every $100 in revenue.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. Dropbox has seen gross margins decline by 0.8 percentage points over the last 2 year, which is poor compared to software peers.

Dropbox produced a 79.2% gross profit margin in Q4 , marking a 2.4 percentage point decrease from 81.6% in the same quarter last year. Dropbox’s full-year margin has also been trending down over the past 12 months, decreasing by 2.5 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs.

10. Operating Margin

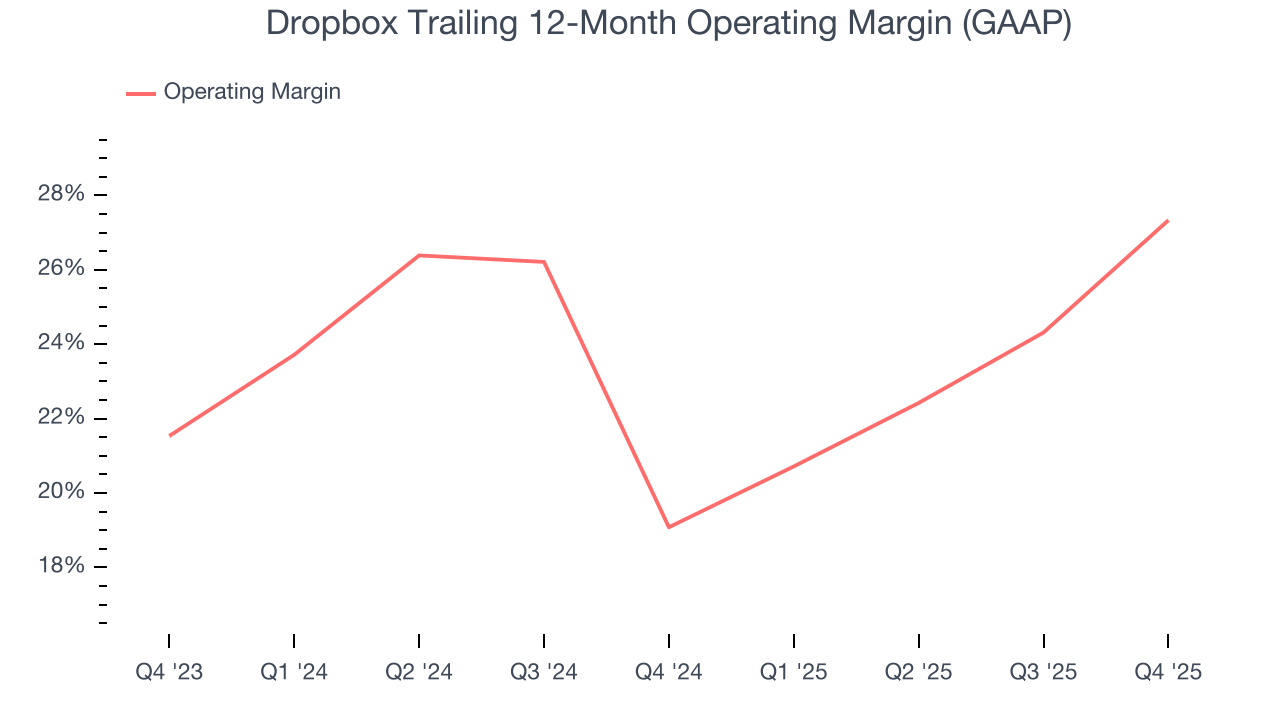

Dropbox has been a well-oiled machine over the last year. It demonstrated elite profitability for a software business, boasting an average operating margin of 27.3%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Dropbox’s operating margin rose by 8.3 percentage points over the last two years, as its sales growth gave it operating leverage.

This quarter, Dropbox generated an operating margin profit margin of 25.5%, up 11.8 percentage points year on year. The increase was solid, and because its revenue and gross margin actually decreased, we can assume it was more efficient because it trimmed its operating expenses like marketing, R&D, and administrative overhead.

11. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

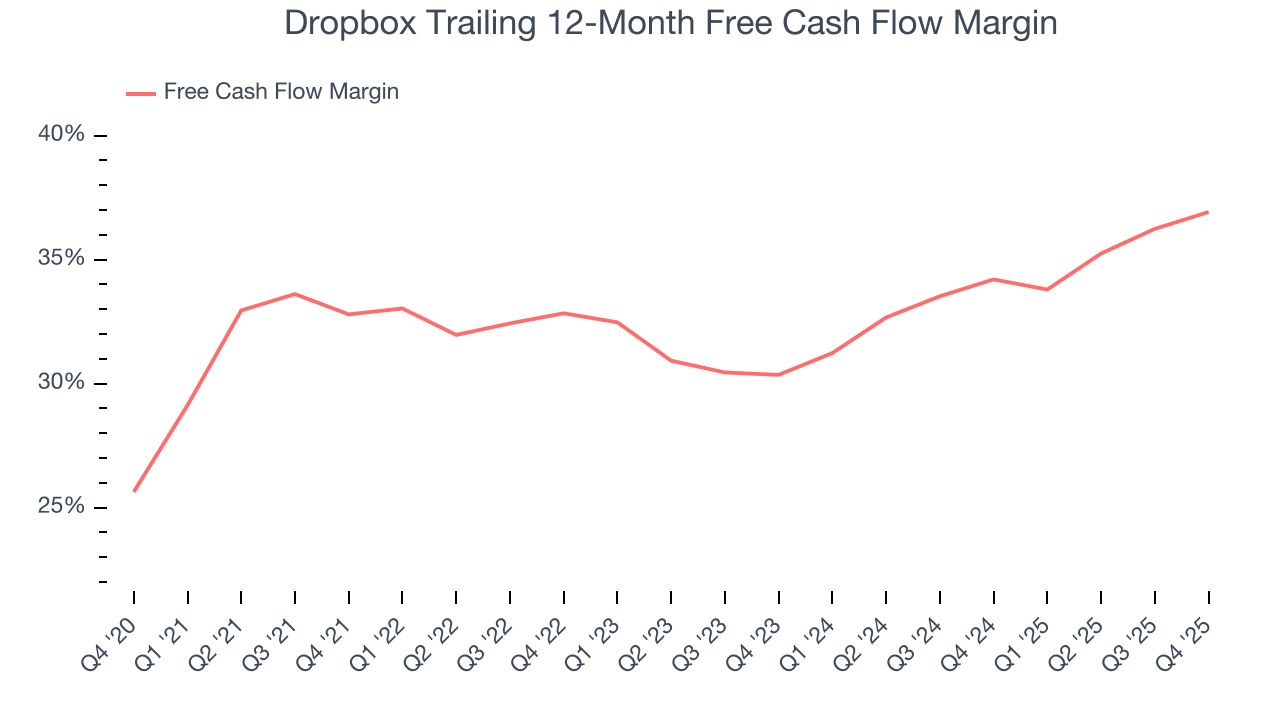

Dropbox has shown terrific cash profitability, driven by its lucrative business model that enables it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the software sector, averaging an eye-popping 36.9% over the last year.

Dropbox’s free cash flow clocked in at $224.9 million in Q4, equivalent to a 35.4% margin. This result was good as its margin was 2.6 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, causing temporary swings. Long-term trends trump fluctuations.

Over the next year, analysts’ consensus estimates show they’re expecting Dropbox’s free cash flow margin of 36.9% for the last 12 months to remain the same.

12. Balance Sheet Assessment

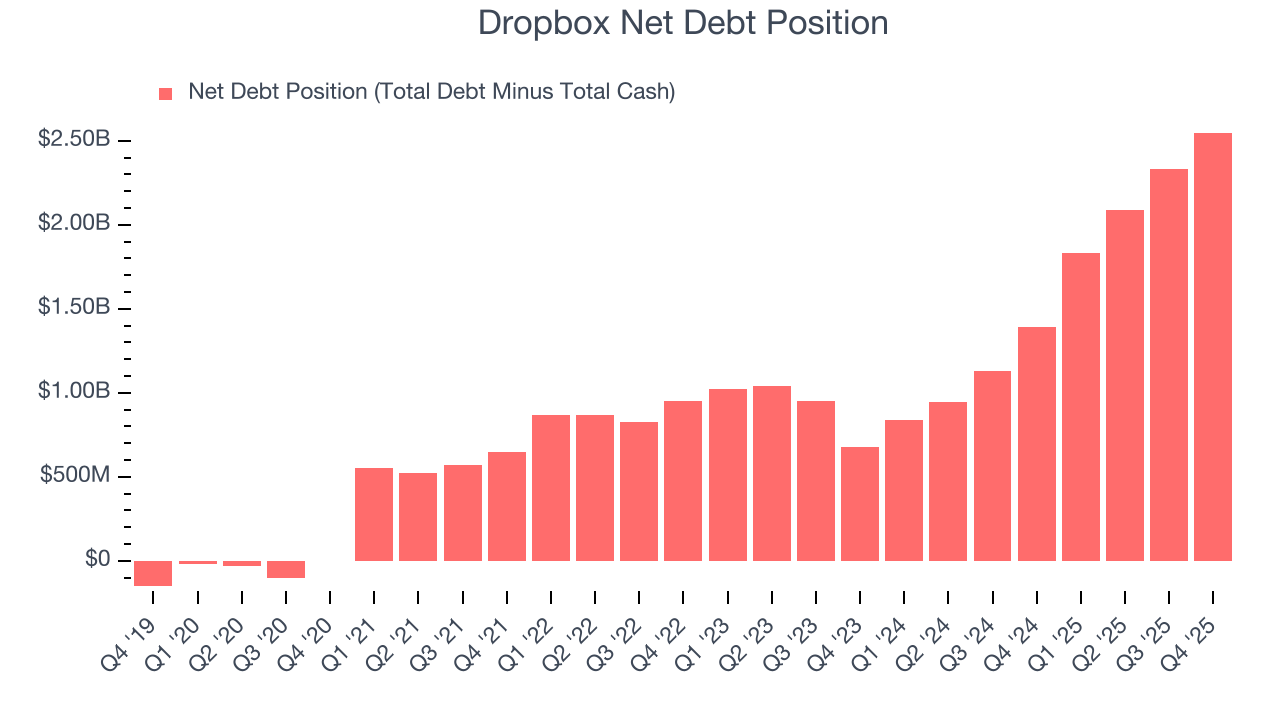

Dropbox reported $1.04 billion of cash and $3.59 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $1.18 billion of EBITDA over the last 12 months, we view Dropbox’s 2.2× net-debt-to-EBITDA ratio as safe. We also see its $78.6 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

13. Key Takeaways from Dropbox’s Q4 Results

We were impressed by Dropbox’s strong growth in customers this quarter. We were also happy its revenue narrowly outperformed Wall Street’s estimates. However, ARR was just in line and billings saw a 1% year-on-year decline, a poor omen for future revenue. Overall, this print was mixed. Guidance will be given on the earnings call, and that could move the stock further. So far, investors were likely hoping for more, and shares traded down 1.8% to $24.43 immediately after reporting.

14. Is Now The Time To Buy Dropbox?

Updated: March 7, 2026 at 9:13 PM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own Dropbox, you should also grasp the company’s longer-term business quality and valuation.

Dropbox doesn’t pass our quality test. First off, its revenue growth was weak over the last five years, and analysts expect its demand to deteriorate over the next 12 months. While its bountiful generation of free cash flow empowers it to invest in growth initiatives, the downside is its ARR has disappointed and shows the company is having difficulty retaining customers and their spending. On top of that, its expanding operating margin shows it took many unnecessary costs out of the business.

Dropbox’s price-to-sales ratio based on the next 12 months is 2.7x. This valuation is reasonable, but the company’s shaky fundamentals present too much downside risk. There are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $25.50 on the company (compared to the current share price of $26.73).