Datadog (DDOG)

Datadog is an amazing business. Its fast sales growth, strong unit economics, and bright outlook position it as a market-beating winner.― StockStory Analyst Team

1. News

2. Summary

Why We Like Datadog

Named after a database the founders had to painstakingly look after at their previous company, Datadog (NASDAQ:DDOG) provides a software platform that helps organizations monitor and secure their cloud applications, infrastructure, and services.

- Impressive 41.5% annual revenue growth over the last five years indicates it’s winning market share

- ARR trends over the last year show it’s maintaining a steady flow of long-term contracts that contribute positively to its revenue predictability

- Well-designed software integrates seamlessly with other workflows, enabling swift payback periods on marketing expenses and customer growth at scale

Datadog is a no-brainer. The valuation looks reasonable based on its quality, and we think now is a good time to buy.

Why Is Now The Time To Buy Datadog?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Datadog?

Datadog is trading at $125.10 per share, or 11.2x forward price-to-sales. Most companies in the software sector may feature a cheaper multiple, but we think Datadog is priced fairly given its fundamentals.

By definition, where you buy a stock impacts returns. But according to our work on the topic, business quality is a much bigger determinant of market outperformance over the long term compared to entry price.

3. Datadog (DDOG) Research Report: Q4 CY2025 Update

Cloud monitoring platform Datadog (NASDAQ:DDOG) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 29.2% year on year to $953.2 million. Guidance for next quarter’s revenue was optimistic at $956 million at the midpoint, 2.3% above analysts’ estimates. Its non-GAAP profit of $0.59 per share was 6.3% above analysts’ consensus estimates.

Datadog (DDOG) Q4 CY2025 Highlights:

- Revenue: $953.2 million vs analyst estimates of $918.2 million (29.2% year-on-year growth, 3.8% beat)

- Adjusted EPS: $0.59 vs analyst estimates of $0.55 (6.3% beat)

- Adjusted Operating Income: $230.1 million vs analyst estimates of $220.2 million (24.1% margin, 4.5% beat)

- Revenue Guidance for Q1 CY2026 is $956 million at the midpoint, above analyst estimates of $934.8 million

- Adjusted EPS guidance for the upcoming financial year 2026 is $2.12 at the midpoint, missing analyst estimates by 9.5%

- Operating Margin: 1%, in line with the same quarter last year

- Free Cash Flow Margin: 30.5%, up from 24.2% in the previous quarter

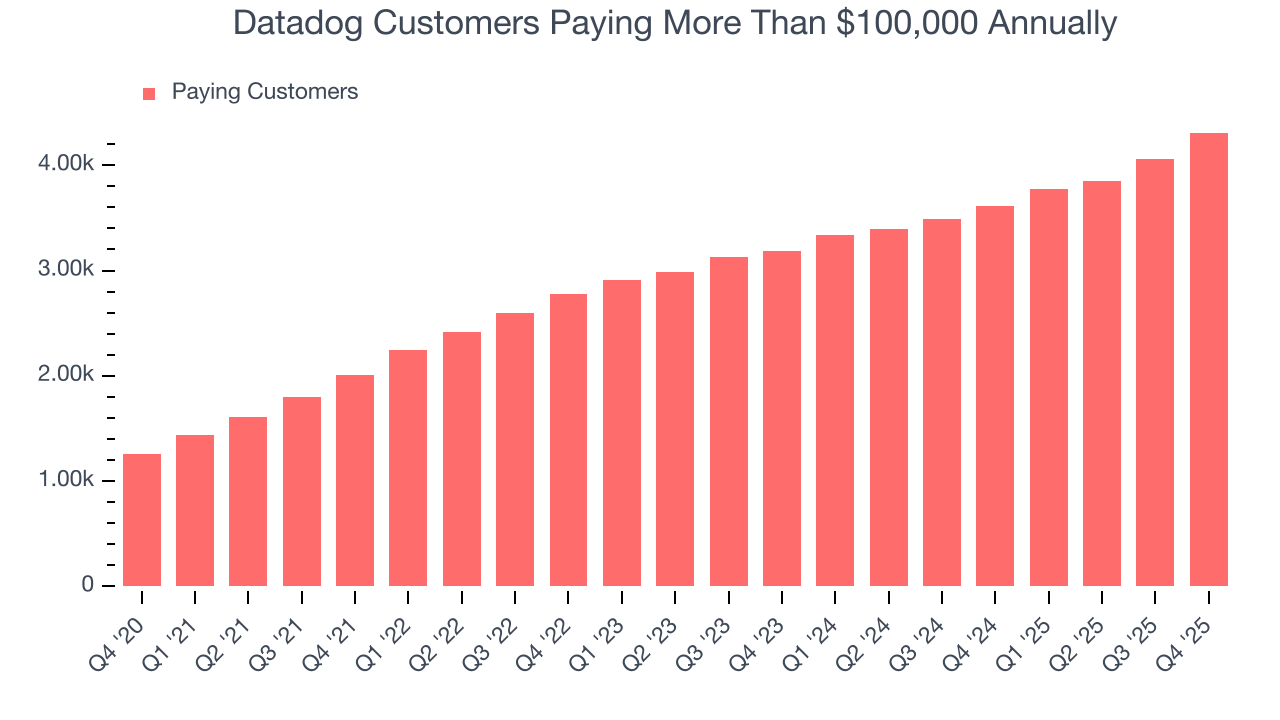

- Customers: 4,310 customers paying more than $100,000 annually

- Billings: $1.21 billion at quarter end, up 33.5% year on year

- Market Capitalization: $39.98 billion

Company Overview

Named after a database the founders had to painstakingly look after at their previous company, Datadog (NASDAQ:DDOG) provides a software platform that helps organizations monitor and secure their cloud applications, infrastructure, and services.

Datadog's platform integrates multiple monitoring functions that were traditionally separate products, including infrastructure monitoring, application performance monitoring, log management, and security tools. This integration allows engineering, operations, and security teams to work from a single dashboard rather than switching between different tools. The platform collects and analyzes trillions of data points daily through a lightweight agent installed on servers, containers, and cloud services.

For example, when an e-commerce company experiences a slowdown in their checkout process, Datadog can simultaneously track server performance, application code efficiency, database queries, and user experience metrics to quickly identify the root cause—whether it's an overloaded database, inefficient code, or network bottleneck.

Datadog generates revenue through subscription-based pricing, with customers paying based on the number of hosts monitored, data volume processed, and which products they use. The company operates on a land-and-expand model, where customers often start with one product and gradually adopt additional offerings. Customers include organizations of all sizes across industries, from tech startups to large enterprises, all seeking better visibility into increasingly complex cloud environments.

The platform supports more than 700 integrations with popular services and technologies from AWS, Microsoft Azure, Google Cloud, Kubernetes, and many others, making it adaptable to diverse technology stacks.

4. Cloud Monitoring

Software is eating the world, increasing organizations’ reliance on digital-only solutions. As more workloads and applications move to the cloud, the reliability of the underlying cloud infrastructure becomes ever more critical and ever more complex. To solve this challenge, companies and their engineering teams have turned to a range of cloud monitoring tools that provide them with the visibility to troubleshoot issues in real-time.

Datadog competes with infrastructure monitoring vendors like SolarWinds and IBM, application performance monitoring companies such as New Relic and Dynatrace, log management providers Splunk and Elastic, and cloud providers' native monitoring solutions from AWS, Microsoft Azure, and Google Cloud.

5. Revenue Growth

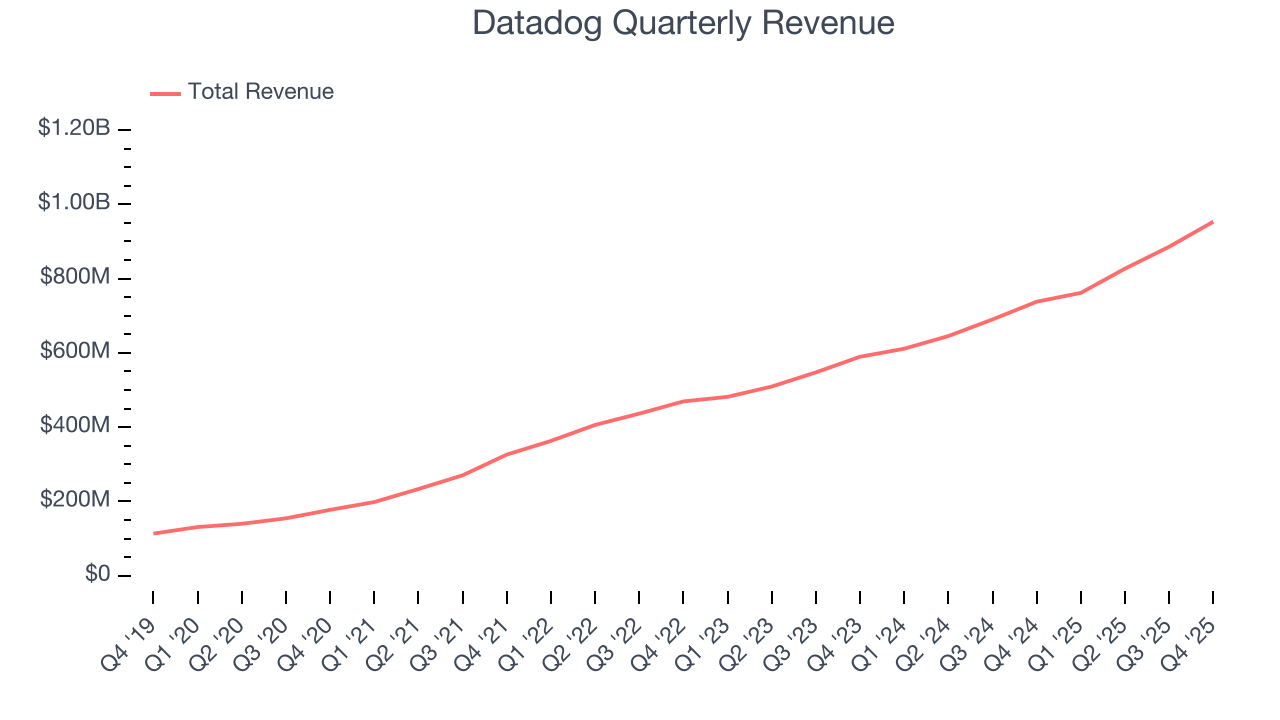

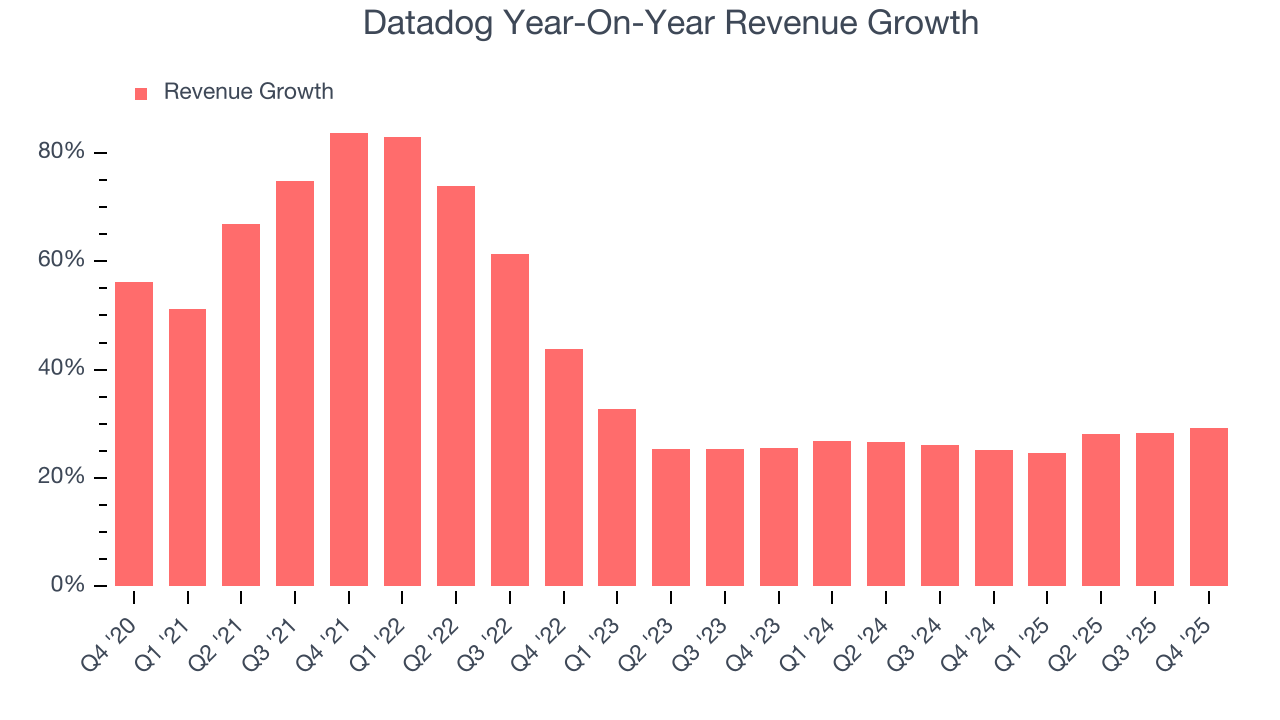

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. Luckily, Datadog’s sales grew at an incredible 41.5% compounded annual growth rate over the last five years. Its growth surpassed the average software company and shows its offerings resonate with customers, a great starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within software, a half-decade historical view may miss recent innovations or disruptive industry trends. Datadog’s annualized revenue growth of 26.9% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Datadog reported robust year-on-year revenue growth of 29.2%, and its $953.2 million of revenue topped Wall Street estimates by 3.8%. Company management is currently guiding for a 25.5% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 19.3% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is noteworthy and indicates the market is baking in success for its products and services.

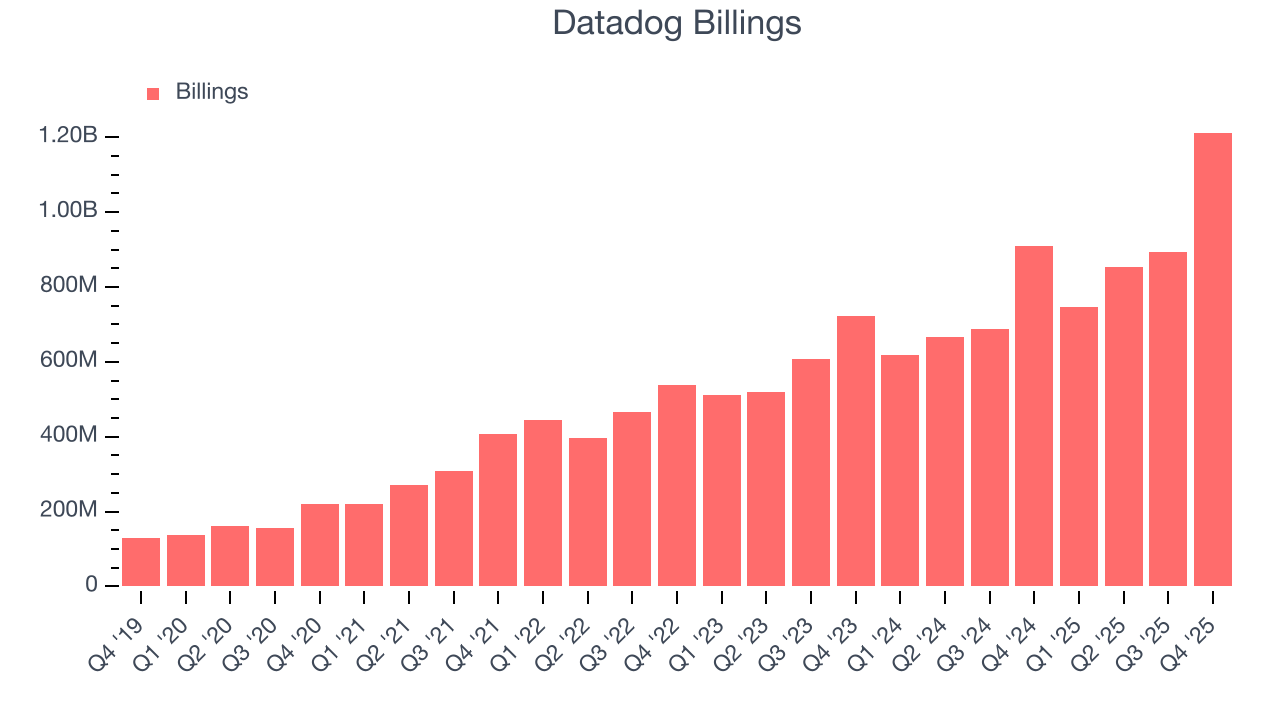

6. Billings

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Datadog’s billings punched in at $1.21 billion in Q4, and over the last four quarters, its growth was fantastic as it averaged 28% year-on-year increases. This performance aligned with its total sales growth, indicating robust customer demand. The high level of cash collected from customers also enhances liquidity and provides a solid foundation for future investments and growth.

7. Enterprise Customer Base

This quarter, Datadog reported 4,310 enterprise customers paying more than $100,000 annually, an increase of 250 from the previous quarter. That’s quite a bit more contract wins than last quarter and quite a bit above what we’ve observed over the previous year. Shareholders should take this as an indication that Datadog’s go-to-market strategy is working well.

8. Customer Acquisition Efficiency

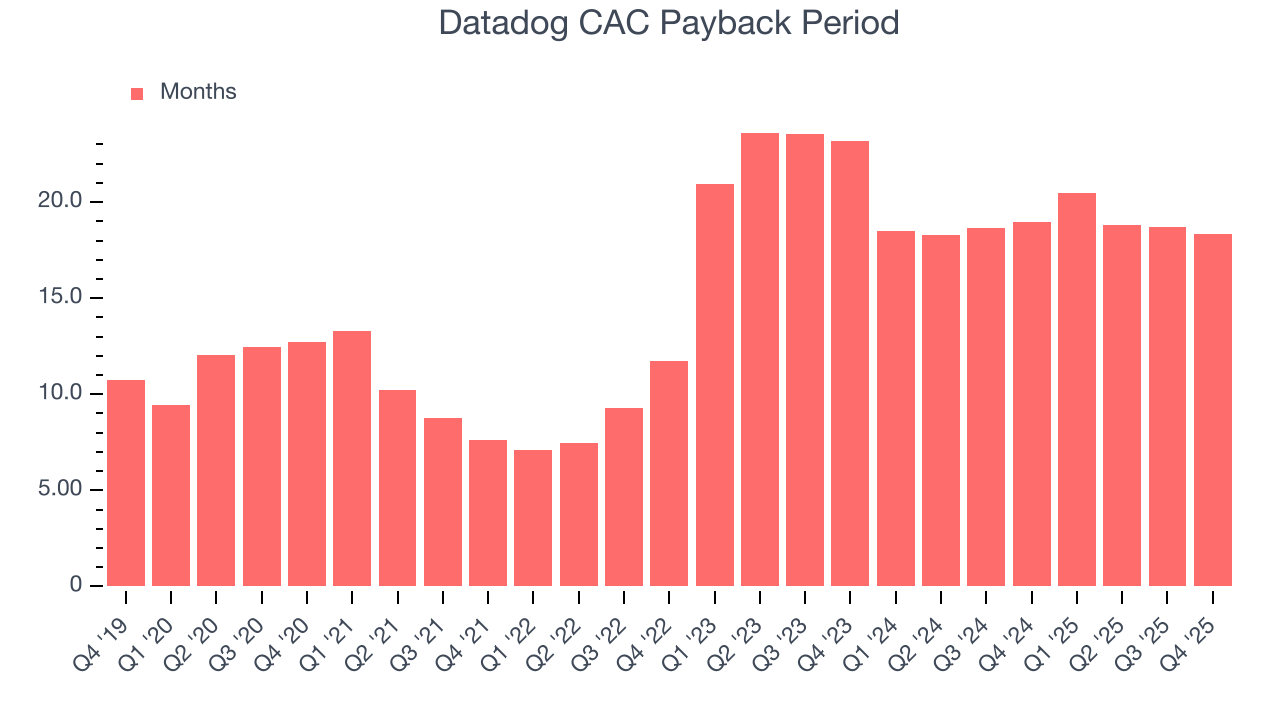

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Datadog is extremely efficient at acquiring new customers, and its CAC payback period checked in at 18.3 months this quarter. The company’s rapid recovery of its customer acquisition costs indicates it has a highly differentiated product offering and a strong brand reputation. These dynamics give Datadog more resources to pursue new product initiatives while maintaining the flexibility to increase its sales and marketing investments.

9. Gross Margin & Pricing Power

What makes the software-as-a-service model so attractive is that once the software is developed, it usually doesn’t cost much to provide it as an ongoing service. These minimal costs can include servers, licenses, and certain personnel.

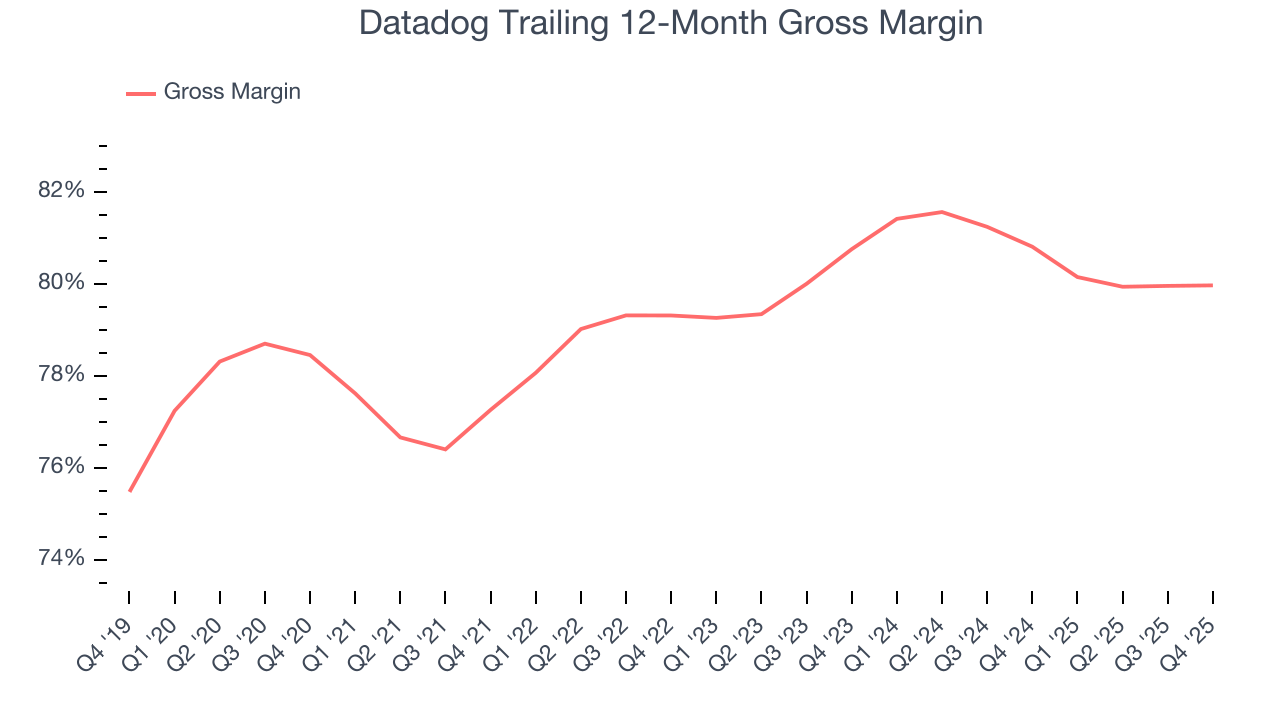

Datadog’s robust unit economics are better than the broader software industry, an output of its asset-lite business model and pricing power. They also enable the company to fund large investments in new products and sales during periods of rapid growth to achieve outsized profits at scale. As you can see below, it averaged an excellent 80% gross margin over the last year. Said differently, roughly $79.97 was left to spend on selling, marketing, and R&D for every $100 in revenue.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. Datadog has seen gross margins decline by 0.8 percentage points over the last 2 year, which is slightly worse than average for software.

Datadog produced a 80.4% gross profit margin in Q4, in line with the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs have been stable and it isn’t under pressure to lower prices.

10. Operating Margin

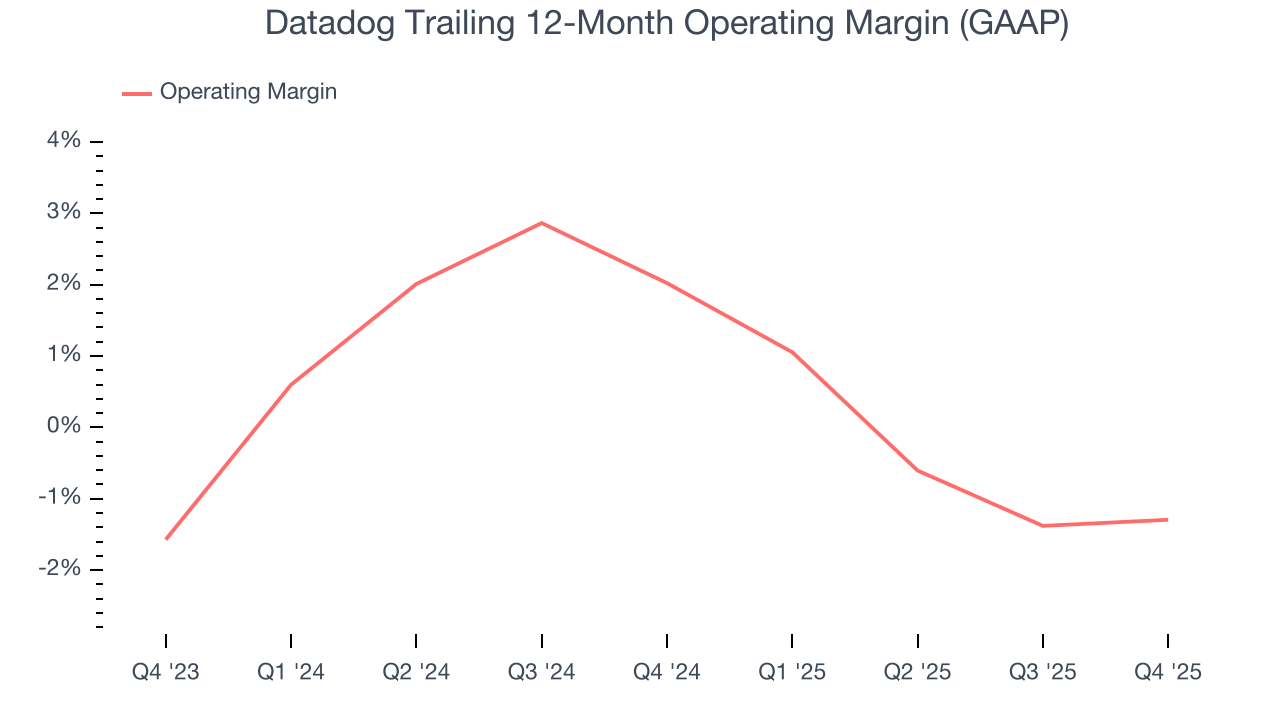

While many software businesses point investors to their adjusted profits, which exclude stock-based compensation (SBC), we prefer GAAP operating margin because SBC is a legitimate expense used to attract and retain talent. This is one of the best measures of profitability because it shows how much money a company takes home after developing, marketing, and selling its products.

Although Datadog broke even this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 1.3% over the last year. Unprofitable, high-growth software companies require extra attention because they spend heaps of money to capture market share. This happened because the company spent loads of money to capture market share. As seen in its fast revenue growth, the aggressive strategy has paid off so far, and Wall Street’s estimates suggest the party will continue. We tend to agree and believe the business has a good chance of reaching profitability upon scale.

Looking at the trend in its profitability, Datadog’s operating margin decreased by 3.3 percentage points over the last two years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Datadog’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

In Q4, Datadog’s breakeven margin was 1%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

11. Cash Is King

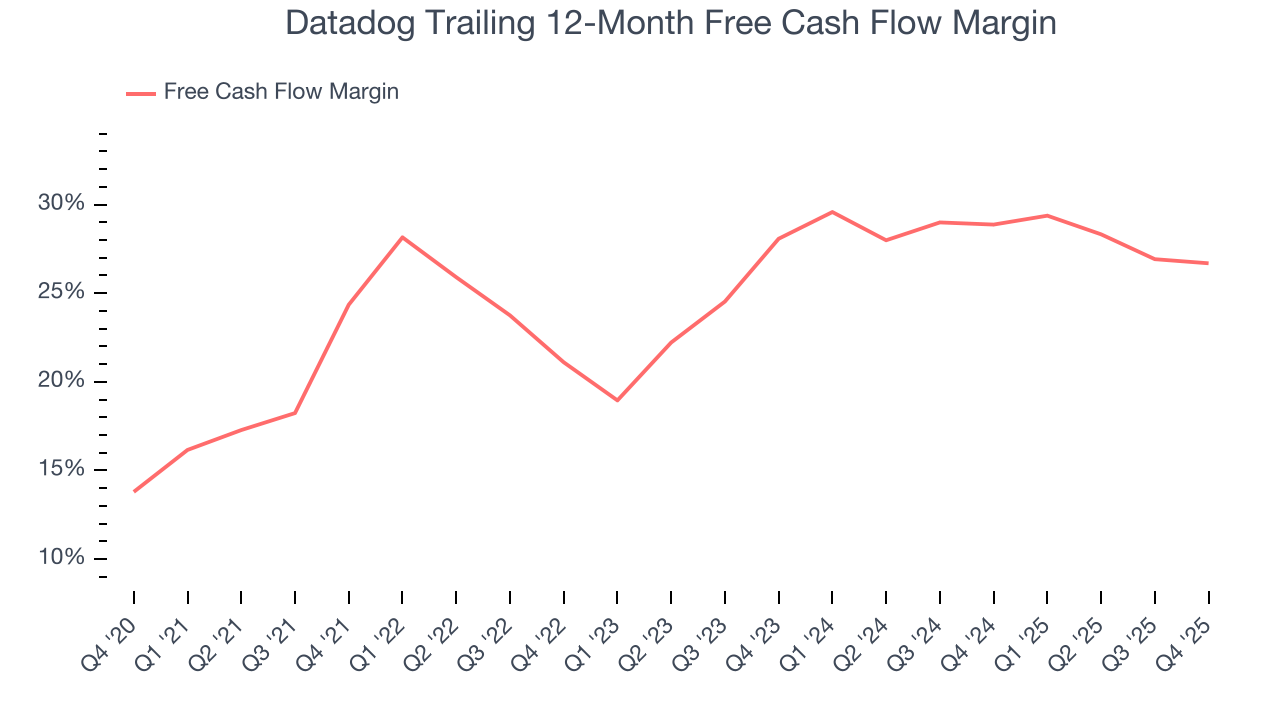

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Datadog has shown robust cash profitability, driven by its attractive business model and cost-effective customer acquisition strategy that enable it to invest in new products and services rather than sales and marketing. The company’s free cash flow margin averaged 26.7% over the last year, quite impressive for a software business. The divergence from its underwhelming operating margin stems from the add-back of non-cash charges like depreciation and stock-based compensation. GAAP operating profit expenses these line items, but free cash flow does not.

Datadog’s free cash flow clocked in at $291 million in Q4, equivalent to a 30.5% margin. The company’s cash profitability regressed as it was 2.1 percentage points lower than in the same quarter last year, but it’s still above its one-year average. We wouldn’t put too much weight on this quarter’s decline because investment needs can be seasonal, causing short-term swings. Long-term trends carry greater meaning.

Over the next year, analysts’ consensus estimates show they’re expecting Datadog’s free cash flow margin of 26.7% for the last 12 months to remain the same.

12. Balance Sheet Assessment

Businesses that maintain a cash surplus face reduced bankruptcy risk.

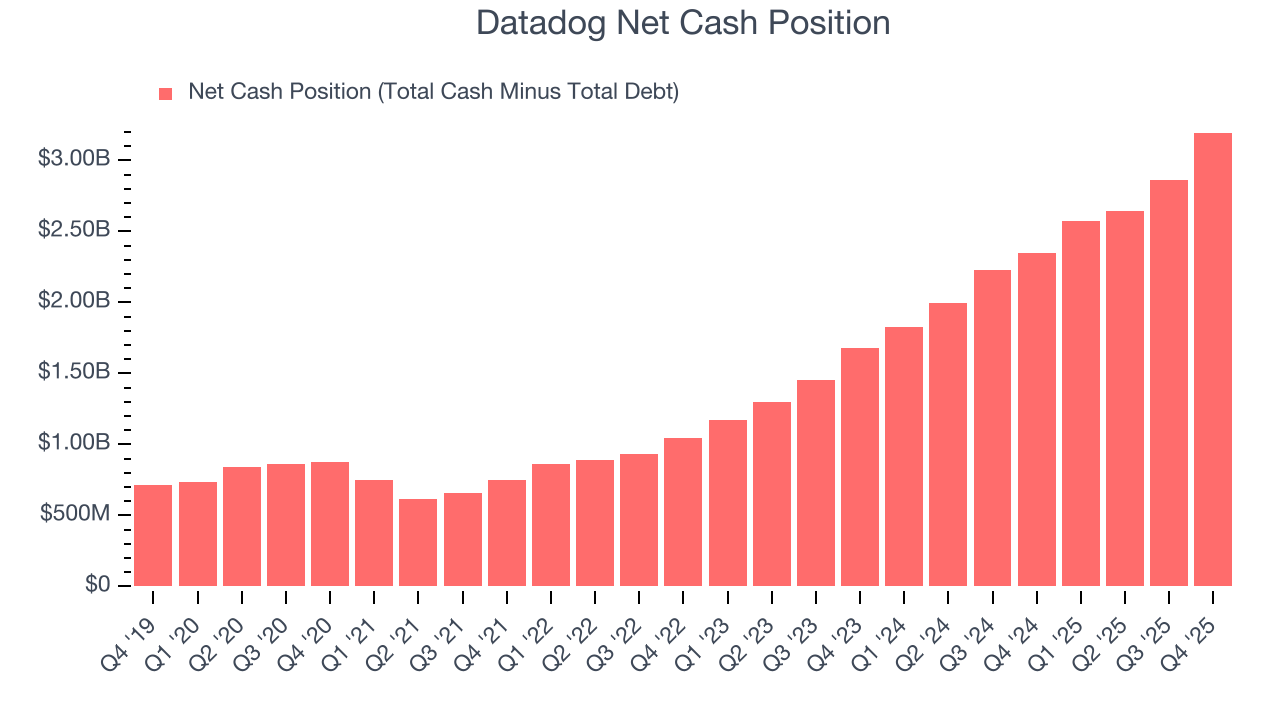

Datadog is a well-capitalized company with $4.47 billion of cash and $1.28 billion of debt on its balance sheet. This $3.20 billion net cash position is 7% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

13. Key Takeaways from Datadog’s Q4 Results

We were impressed by how significantly Datadog blew past analysts’ billings expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. On the other hand, its full-year EPS guidance missed and its EPS guidance for next quarter fell short of Wall Street’s estimates. Overall, this was a mixed quarter, but it seems like this quarter was good enough. The stock traded up 8.7% to $124.35 immediately after reporting.

14. Is Now The Time To Buy Datadog?

Updated: February 16, 2026 at 9:15 PM EST

When considering an investment in Datadog, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

Datadog is a cream-of-the-crop software company. For starters, its revenue growth was exceptional over the last five years. And while its declining operating margin shows it’s becoming less efficient at building and selling its software, its surging ARR shows its fundamentals and revenue predictability are improving. Additionally, Datadog’s efficient sales strategy allows it to target and onboard new users at scale.

Datadog’s price-to-sales ratio based on the next 12 months is 11.2x. Looking across the spectrum of software businesses, Datadog’s fundamentals clearly illustrate it’s a special business. We like the stock at this price.

Wall Street analysts have a consensus one-year price target of $182.43 on the company (compared to the current share price of $125.10), implying they see 45.8% upside in buying Datadog in the short term.