Amdocs (DOX)

We aren’t fans of Amdocs. Its weak sales growth and declining returns on capital show its demand and profits are shrinking.― StockStory Analyst Team

1. News

2. Summary

Why We Think Amdocs Will Underperform

Powering the digital experiences of approximately 400 communications companies worldwide, Amdocs (NASDAQ:DOX) provides software and services that help telecommunications and media companies manage customer relationships, monetize services, and automate network operations.

- Muted 1.7% annual revenue growth over the last five years shows its demand lagged behind its business services peers

- Demand will likely be soft over the next 12 months as Wall Street’s estimates imply tepid growth of 3.2%

- A bright spot is that its healthy adjusted operating margin shows it’s a well-run company with efficient processes

Amdocs is in the penalty box. Our attention is focused on better businesses.

Why There Are Better Opportunities Than Amdocs

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Amdocs

Amdocs is trading at $67.24 per share, or 8.9x forward P/E. This is a cheap valuation multiple, but for good reason. You get what you pay for.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Amdocs (DOX) Research Report: Q4 CY2025 Update

Telecom software provider Amdocs (NASDAQ:DOX) met Wall Streets revenue expectations in Q4 CY2025, with sales up 4.1% year on year to $1.16 billion. Its non-GAAP profit of $1.81 per share was 3% above analysts’ consensus estimates.

Amdocs (DOX) Q4 CY2025 Highlights:

- Revenue: $1.16 billion vs analyst estimates of $1.15 billion (4.1% year-on-year growth, in line)

- Adjusted EPS: $1.81 vs analyst estimates of $1.76 (3% beat)

- Adjusted EBITDA: $281.5 million vs analyst estimates of $292.6 million (24.4% margin, 3.8% miss)

- Operating Margin: 17.9%, in line with the same quarter last year

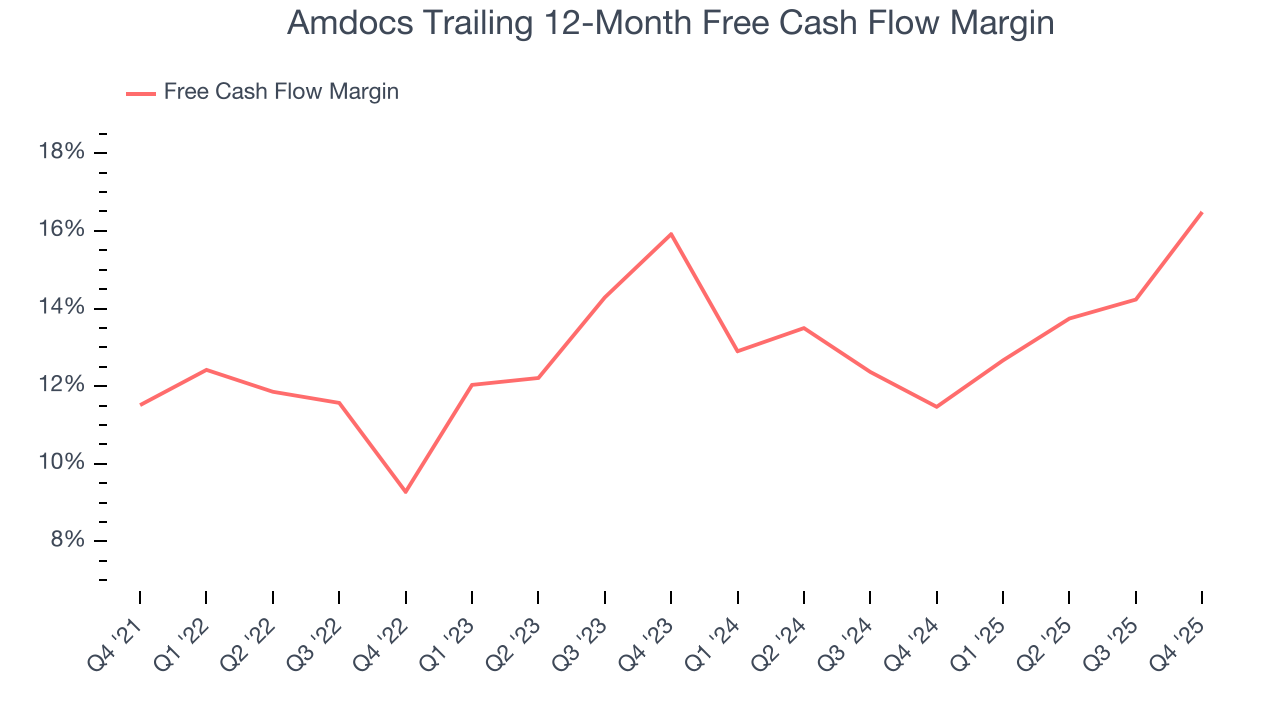

- Free Cash Flow Margin: 16.3%, up from 7% in the same quarter last year

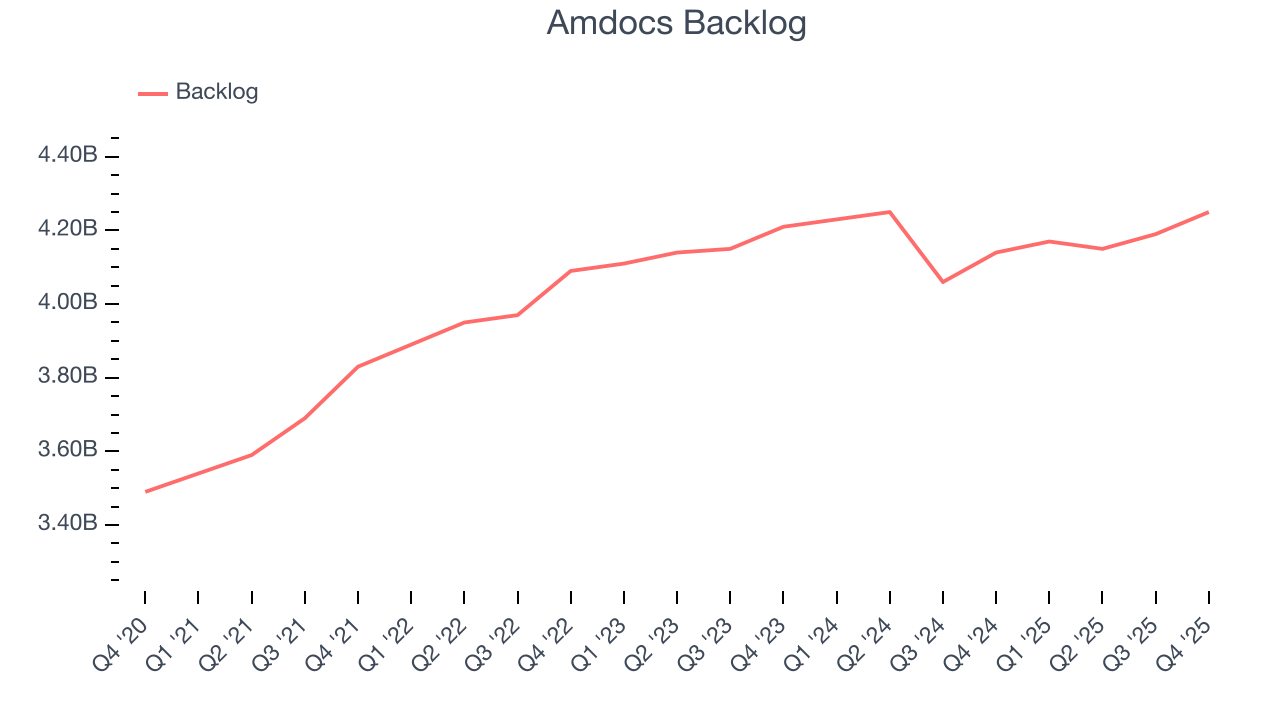

- Backlog: $4.25 billion at quarter end, up 2.7% year on year

- Market Capitalization: $8.74 billion

Company Overview

Powering the digital experiences of approximately 400 communications companies worldwide, Amdocs (NASDAQ:DOX) provides software and services that help telecommunications and media companies manage customer relationships, monetize services, and automate network operations.

Amdocs operates at the intersection of telecommunications, software, and services, offering a comprehensive suite of solutions designed specifically for the communications industry. The company's products span multiple domains including customer engagement, monetization, network automation, and cloud services, all tailored to help service providers transform into digital businesses.

The company's flagship offering, Amdocs CES (Customer Experience Suite), is a cloud-native platform that enables telecom operators to manage everything from customer interactions to billing and network operations. This suite includes tools for customer relationship management, service ordering, billing, network orchestration, and artificial intelligence-powered automation. For example, when a customer signs up for a new mobile plan with bundled streaming services, Amdocs' systems handle the entire process from initial order to activation and billing.

Amdocs serves major telecommunications providers across the globe, including industry giants like AT&T, Verizon, Vodafone, Comcast, and T-Mobile. These companies rely on Amdocs' solutions to handle millions of customer interactions and transactions daily. The company generates revenue through software licensing, implementation services, and ongoing managed services where it operates and maintains systems on behalf of its customers.

Beyond software, Amdocs provides extensive professional services including consulting, systems integration, and managed operations. The company's experts help telecom operators design digital experiences, implement new technologies like 5G and cloud computing, and optimize their operations. Amdocs also offers specialized services for network deployment, quality engineering, and data intelligence.

With development and support facilities across multiple countries including India, Israel, the United States, and the United Kingdom, Amdocs maintains a global presence that allows it to serve customers in approximately 90 countries. This international footprint enables the company to provide localized support while leveraging its global expertise in telecommunications software and services.

4. Enterprise Networking

The Enterprise Networking subsector is poised for growth as businesses accelerate cloud adoption, AI-driven network automation, and edge computing deployments. While these seem like big, nebulous trends, they require very real products and services like switches, firewalls, and datacenter hosting services. On the other hand, challenges on the horizon include intensifying competition from cloud-native networking providers, regulatory scrutiny over data privacy and cybersecurity, and potential supply chain constraints for networking hardware. While AI and automation will enhance network efficiency and security, they also introduce risks related to algorithmic bias, compliance complexity, and increased energy consumption.

Amdocs competes with a diverse set of companies across different segments of its business, including telecom software specialists like CSG International, Netcracker, and Optiva; enterprise software giants such as Oracle, Salesforce, and SAP; IT service providers including Accenture, Infosys, and Tata Consultancy Services; and network equipment vendors like Ericsson, Nokia, and Huawei.

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $4.58 billion in revenue over the past 12 months, Amdocs is one of the larger companies in the business services industry and benefits from a well-known brand that influences purchasing decisions. However, its scale is a double-edged sword because it’s challenging to maintain high growth rates when you’ve already captured a large portion of the addressable market. To expand meaningfully, Amdocs likely needs to tweak its prices, innovate with new offerings, or enter new markets.

As you can see below, Amdocs’s sales grew at a sluggish 1.7% compounded annual growth rate over the last five years. This shows it failed to generate demand in any major way and is a rough starting point for our analysis.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. Amdocs’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 3.8% annually.

We can better understand the company’s revenue dynamics by analyzing its backlog, or the value of its outstanding orders that have not yet been executed or delivered. Amdocs’s backlog reached $4.25 billion in the latest quarter and was flat over the last two years. Because this number is better than its revenue growth, we can see the company accumulated more orders than it could fulfill and deferred revenue to the future. This could imply elevated demand for Amdocs’s products and services but raises concerns about capacity constraints.

This quarter, Amdocs grew its revenue by 4.1% year on year, and its $1.16 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 3.1% over the next 12 months. While this projection implies its newer products and services will spur better top-line performance, it is still below average for the sector.

6. Operating Margin

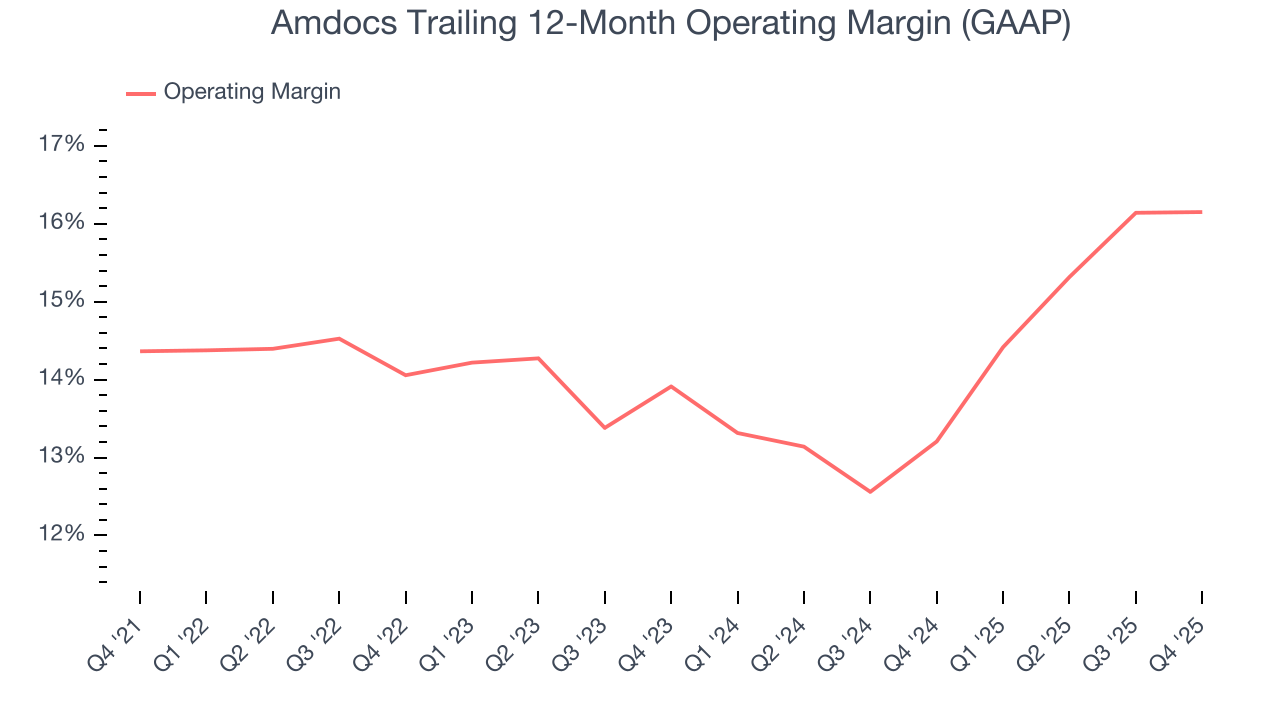

Amdocs has been an efficient company over the last five years. It was one of the more profitable businesses in the business services sector, boasting an average operating margin of 14.3%.

Analyzing the trend in its profitability, Amdocs’s operating margin rose by 1.8 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, Amdocs generated an operating margin profit margin of 17.9%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

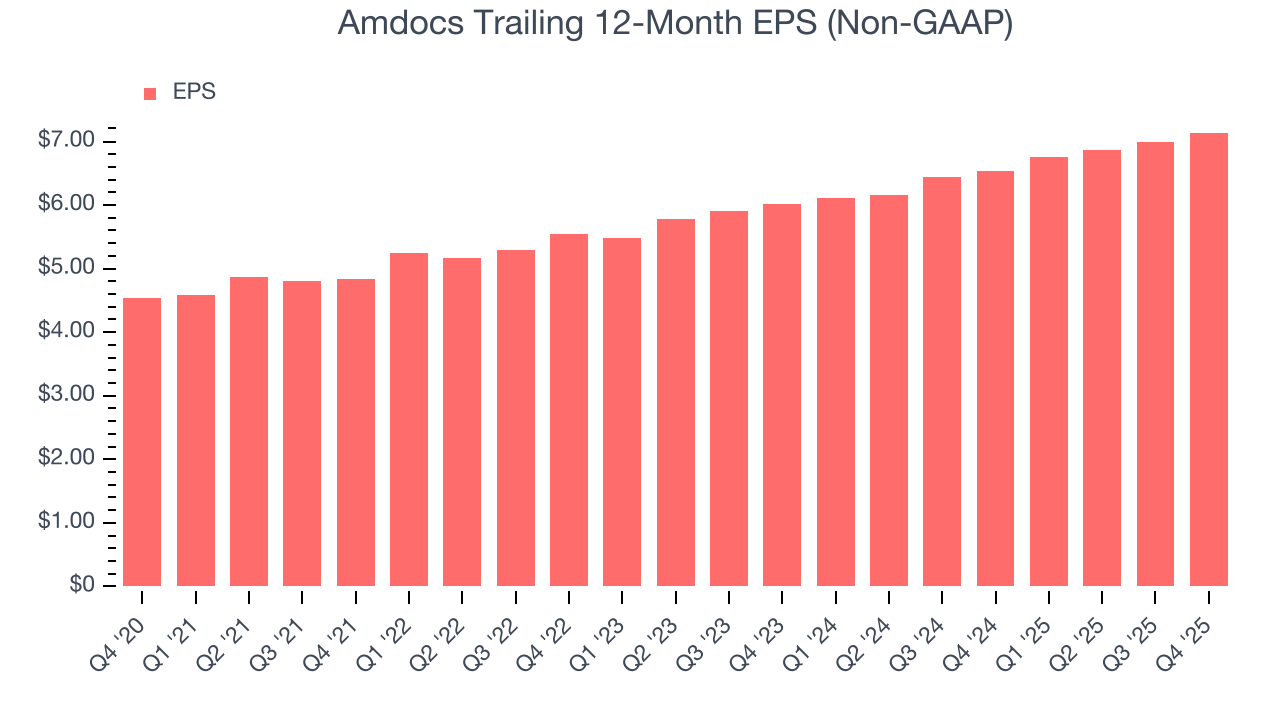

Amdocs’s EPS grew at a solid 9.5% compounded annual growth rate over the last five years, higher than its 1.7% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

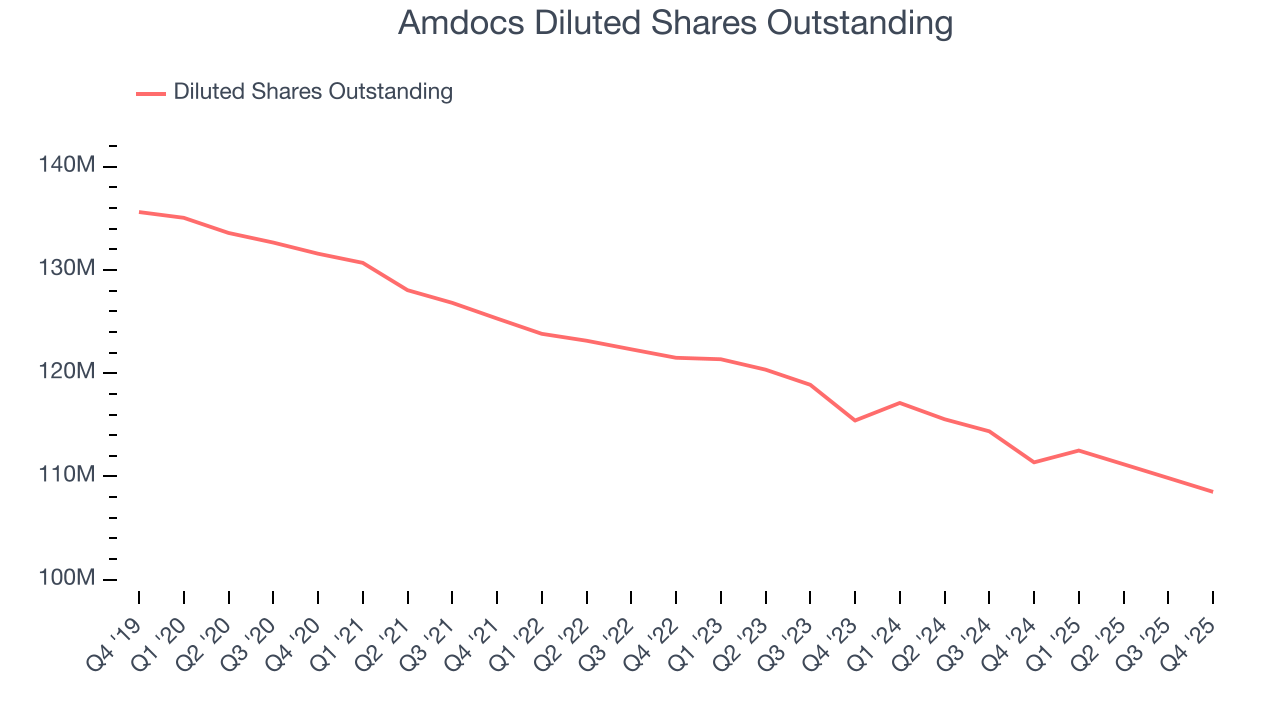

We can take a deeper look into Amdocs’s earnings quality to better understand the drivers of its performance. As we mentioned earlier, Amdocs’s operating margin was flat this quarter but expanded by 1.8 percentage points over the last five years. On top of that, its share count shrank by 17.5%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Amdocs, its two-year annual EPS growth of 8.9% is similar to its five-year trend, implying stable earnings.

In Q4, Amdocs reported adjusted EPS of $1.81, up from $1.66 in the same quarter last year. This print beat analysts’ estimates by 3%. Over the next 12 months, Wall Street expects Amdocs’s full-year EPS of $7.14 to grow 6.7%.

8. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Amdocs has shown robust cash profitability, giving it an edge over its competitors and the ability to reinvest or return capital to investors. The company’s free cash flow margin averaged 13% over the last five years, quite impressive for a business services business.

Taking a step back, we can see that Amdocs’s margin expanded by 5 percentage points during that time. This shows the company is heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

Amdocs’s free cash flow clocked in at $187.9 million in Q4, equivalent to a 16.3% margin. This result was good as its margin was 9.2 percentage points higher than in the same quarter last year, building on its favorable historical trend.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

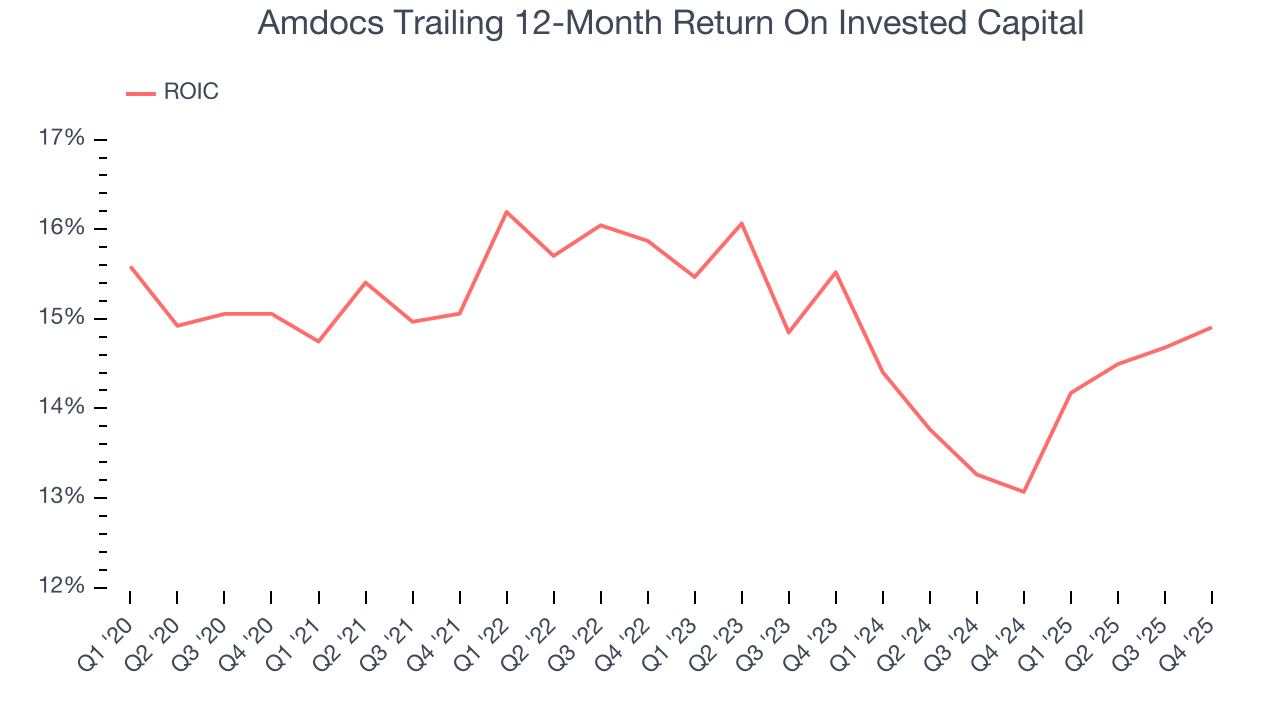

Although Amdocs hasn’t been the highest-quality company lately because of its poor top-line performance, it historically found a few growth initiatives that worked. Its five-year average ROIC was 14.9%, higher than most business services businesses.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Amdocs’s ROIC averaged 1.5 percentage point decreases over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

10. Balance Sheet Assessment

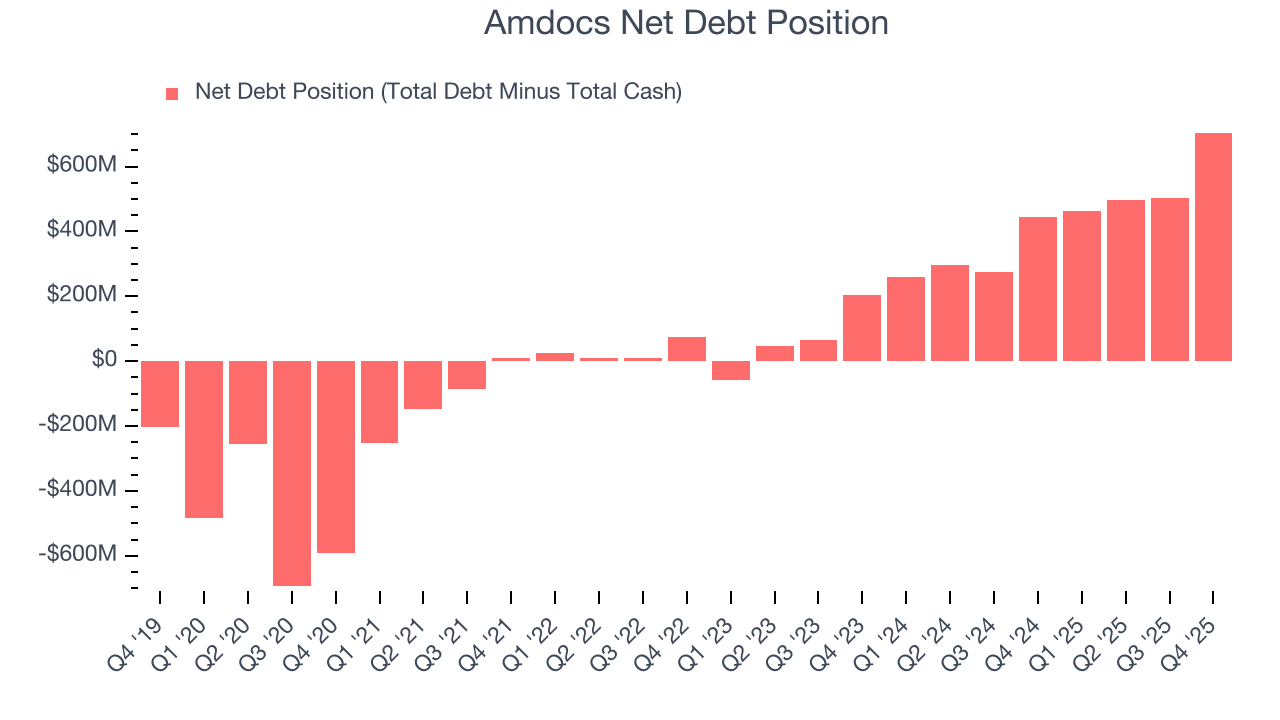

Amdocs reported $247.9 million of cash and $952.4 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $1.12 billion of EBITDA over the last 12 months, we view Amdocs’s 0.6× net-debt-to-EBITDA ratio as safe. We also see its $22.84 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Amdocs’s Q4 Results

It was good to see Amdocs narrowly top analysts’ backlog expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Overall, this print had some key positives. The stock traded up 2.9% to $76.16 immediately after reporting.

12. Is Now The Time To Buy Amdocs?

Updated: February 25, 2026 at 12:01 AM EST

Before making an investment decision, investors should account for Amdocs’s business fundamentals and valuation in addition to what happened in the latest quarter.

Amdocs’s business quality ultimately falls short of our standards. To kick things off, its revenue growth was weak over the last five years.

Amdocs’s P/E ratio based on the next 12 months is 8.9x. While this valuation is optically cheap, the potential downside is big given its shaky fundamentals. We're pretty confident there are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $93.82 on the company (compared to the current share price of $67.24).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.