Domino's (DPZ)

We see potential in Domino's. Despite its slow growth, its highly profitable model gives it a margin of safety during times of stress.― StockStory Analyst Team

1. News

2. Summary

Why Domino's Is Interesting

Founded by two brothers in Michigan, Domino’s (NYSE:DPZ) is a globally recognized pizza chain known for its creative marketing and fast delivery.

- Rapid rollout of new restaurants to capitalize on market opportunities makes sense given its strong same-store sales performance

- Powerful free cash flow generation enables it to reinvest its profits or return capital to investors consistently, and its recently improved profitability means it has even more resources to invest or distribute

- A blemish is its lackluster 5.3% annual revenue growth over the last six years indicates the company is losing ground to competitors

Domino's shows some potential. If you believe in the company, the price seems reasonable.

Why Is Now The Time To Buy Domino's?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Domino's?

Domino's is trading at $407.82 per share, or 20.3x forward P/E. Many restaurant companies feature higher valuation multiples than Domino's. Regardless, we think Domino’s current price is appropriate given the quality you get.

This could be a good time to invest if you think there are underappreciated aspects of the business.

3. Domino's (DPZ) Research Report: Q4 CY2025 Update

Fast-food pizza chain Domino’s (NYSE:DPZ) reported Q4 CY2025 results beating Wall Street’s revenue expectations, with sales up 6.4% year on year to $1.54 billion. Its GAAP profit of $5.35 per share was 0.7% below analysts’ consensus estimates.

Domino's (DPZ) Q4 CY2025 Highlights:

- Revenue: $1.54 billion vs analyst estimates of $1.52 billion (6.4% year-on-year growth, 1.2% beat)

- EPS (GAAP): $5.35 vs analyst expectations of $5.39 (0.7% miss)

- Adjusted EBITDA: $336.3 million vs analyst estimates of $316.3 million (21.9% margin, 6.3% beat)

- Operating Margin: 19.3%, in line with the same quarter last year

- Free Cash Flow Margin: 11.5%, up from 9.4% in the same quarter last year

- Locations: 22,142 at quarter end, up from 21,366 in the same quarter last year

- Same-Store Sales rose 3.7% year on year (1.6% in the same quarter last year)

- Market Capitalization: $12.99 billion

Company Overview

Founded by two brothers in Michigan, Domino’s (NYSE:DPZ) is a globally recognized pizza chain known for its creative marketing and fast delivery.

The legendary brand was started in 1960 when Tom and James Monaghan purchased a small pizza store called DomiNick's. To fund the acquisition, Tom, an avid car collector and college student, raised capital by selling his prized collection.

Since then, Domino’s has evolved into a pizza powerhouse and expanded its menu to include specialty pizzas, lava cakes, and its delicious Bread Twists, which are “the best thing since sliced bread”.

Its success can be attributed to its innovative marketing and focus on delivering pizzas quickly. Some iconic stunts include its infamous “The Noid” mascot, the antihero and saboteur of quality, and delivery promise of “30 minutes or less”, which became a hallmark of the company's commitment to speed and customer satisfaction.

Domino’s true differentiator, however, is its dense network of stores and technology. The company’s “fortressing” strategy, which involves opening many stores in a concentrated area, improves delivery times and brand awareness, while its advanced computerized system streamlines ordering, empowering customers to know exactly when a pizza is assembled, put in the oven, and ultimately ready for pickup or delivery in their mobile app. These investments have enabled Domino’s to become the number one pizza brand by market share.

4. Traditional Fast Food

Traditional fast-food restaurants are renowned for their speed and convenience, boasting menus filled with familiar and budget-friendly items. Their reputations for on-the-go consumption make them favored destinations for individuals and families needing a quick meal. This class of restaurants, however, is fighting the perception that their meals are unhealthy and made with inferior ingredients, a battle that's especially relevant today given the consumers increasing focus on health and wellness.

Fast-food pizza competitors include public companies Papa John’s (NASDAQ:PZZA) and Pizza Hut (owned by Yum! Brands, NYSE:YUM) as well as private company Little Caesars.

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $4.94 billion in revenue over the past 12 months, Domino's is one of the larger restaurant chains in the industry and benefits from a well-known brand that influences consumer purchasing decisions. However, its scale is a double-edged sword because there are only a finite of number places to build restaurants, making it harder to find incremental growth. For Domino's to boost its sales, it likely needs to adjust its prices, launch new chains, or lean into foreign markets.

As you can see below, Domino’s sales grew at a tepid 5.3% compounded annual growth rate over the last six years, but to its credit, it opened new restaurants and increased sales at existing, established dining locations.

This quarter, Domino's reported year-on-year revenue growth of 6.4%, and its $1.54 billion of revenue exceeded Wall Street’s estimates by 1.2%.

Looking ahead, sell-side analysts expect revenue to grow 5.9% over the next 12 months, similar to its six-year rate. This projection is underwhelming and implies its newer menu offerings will not accelerate its top-line performance yet.

6. Restaurant Performance

Number of Restaurants

Domino's sported 22,142 locations in the latest quarter. Over the last two years, it has opened new restaurants at a rapid clip by averaging 3.5% annual growth, among the fastest in the restaurant sector. Furthermore, one dynamic making expansion more seamless is the company’s franchise model, where franchisees are primarily responsible for opening new restaurants while Domino's provides support.

When a chain opens new restaurants, it usually means it’s investing for growth because there’s healthy demand for its meals and there are markets where its concepts have few or no locations.

Same-Store Sales

A company's restaurant base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales is an industry measure of whether revenue is growing at those existing restaurants and is driven by customer visits (often called traffic) and the average spending per customer (ticket).

Domino’s demand has been healthy for a restaurant chain over the last two years. On average, the company has grown its same-store sales by a robust 2.7% per year. This performance suggests its rollout of new restaurants could be beneficial for shareholders. When a chain has demand, more locations should help it reach more customers and boost revenue growth.

In the latest quarter, Domino’s same-store sales rose 3.7% year on year. This performance was more or less in line with its historical levels.

7. Gross Margin & Pricing Power

Gross profit margins tell us how much money a restaurant gets to keep after paying for the direct costs of the meals it sells, like ingredients, and indicate its level of pricing power.

Domino’s unit economics are higher than the typical restaurant company, giving it the flexibility to invest in areas such as marketing and talent to reach more consumers. As you can see below, it averaged a decent 28.5% gross margin over the last two years. That means for every $100 in revenue, roughly $28.54 was left to spend on selling, marketing, and general administrative overhead.

Domino’s gross profit margin came in at 28.5% this quarter, in line with the same quarter last year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting its input costs (such as ingredients and transportation expenses) have been stable and it isn’t under pressure to lower prices.

8. Operating Margin

Domino’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 19% over the last two years. This profitability was top-notch for a restaurant business, showing it’s an well-run company with an efficient cost structure.

Looking at the trend in its profitability, Domino’s operating margin might fluctuated slightly but has generally stayed the same over the last year. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Domino's generated an operating margin profit margin of 19.3%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

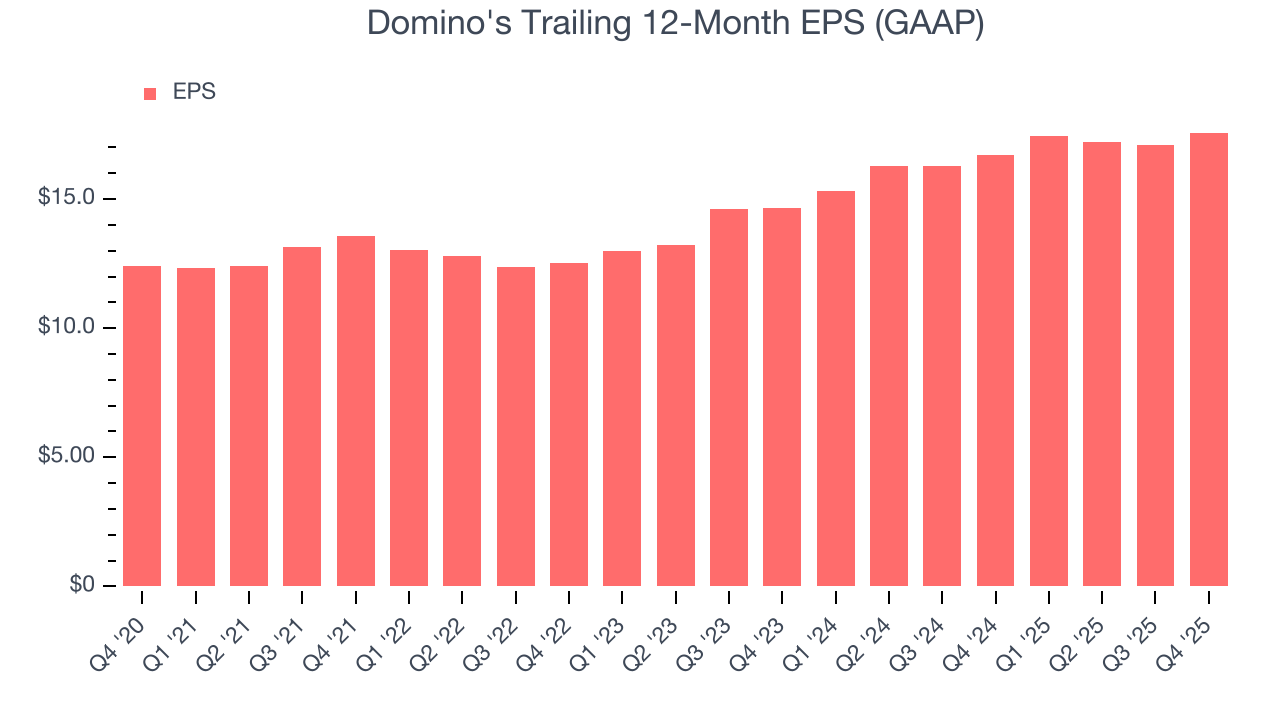

9. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Domino’s EPS grew at a decent 10.7% compounded annual growth rate over the last six years, higher than its 5.3% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

In Q4, Domino's reported EPS of $5.35, up from $4.89 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects Domino’s full-year EPS of $17.57 to grow 11.4%.

10. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Domino's has shown robust cash profitability, giving it an edge over its competitors and the ability to reinvest or return capital to investors. The company’s free cash flow margin averaged 12.3% over the last two years, quite impressive for a restaurant business.

Taking a step back, we can see that Domino’s margin expanded by 2.7 percentage points over the last year. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability was flat.

Domino’s free cash flow clocked in at $175.9 million in Q4, equivalent to a 11.5% margin. This result was good as its margin was 2 percentage points higher than in the same quarter last year, building on its favorable historical trend.

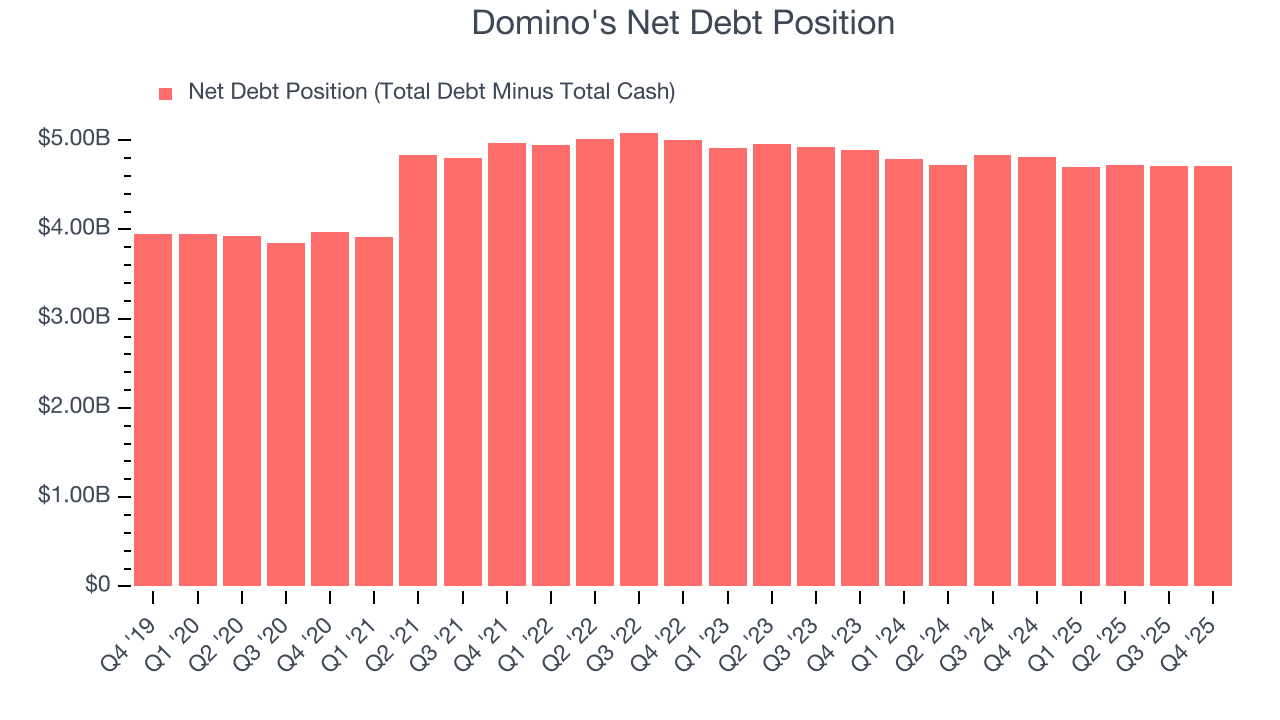

11. Balance Sheet Assessment

Domino's reported $341.8 million of cash and $5.05 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $1.06 billion of EBITDA over the last 12 months, we view Domino’s 4.5× net-debt-to-EBITDA ratio as safe. We also see its $181.1 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Domino’s Q4 Results

We were impressed by how significantly Domino's blew past analysts’ same-store sales expectations this quarter. We were also glad its EBITDA outperformed Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. The stock traded up 4.1% to $400.50 immediately following the results.

13. Is Now The Time To Buy Domino's?

Updated: March 8, 2026 at 10:54 PM EDT

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Domino's.

Domino's possesses a number of positive attributes. Although its revenue growth was a little slower over the last six years, its growth over the next 12 months is expected to be higher. And while Domino’s projected EPS for the next year is lacking, its new restaurant openings have increased its brand equity. On top of that, its powerful free cash flow generation enables it to stay ahead of the competition through consistent reinvestment of profits.

Domino’s P/E ratio based on the next 12 months is 20.3x. Looking at the restaurant landscape right now, Domino's trades at a pretty interesting price. If you’re a fan of the business and management team, now is a good time to scoop up some shares.

Wall Street analysts have a consensus one-year price target of $478.58 on the company (compared to the current share price of $407.82), implying they see 17.4% upside in buying Domino's in the short term.