Papa John's (PZZA)

Papa John's is up against the odds. Its weak sales growth shows demand is soft and its low margins are a cause for concern.― StockStory Analyst Team

1. News

2. Summary

Why We Think Papa John's Will Underperform

Founded by the eclectic John “Papa John” Schnatter, Papa John’s (NASDAQ:PZZA) is a globally recognized pizza delivery and carryout chain known for “better ingredients” and “better pizza”.

- Estimated sales decline of 2.8% for the next 12 months implies a challenging demand environment

- Gross margin of 12.1% is below its competitors, leaving less money for marketing and promotions

- Lagging same-store sales over the past two years suggest it might have to change its pricing and marketing strategy to stimulate demand

Papa John’s quality doesn’t meet our bar. We see more favorable opportunities in the market.

Why There Are Better Opportunities Than Papa John's

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Papa John's

Papa John's is trading at $33.88 per share, or 19.7x forward P/E. This multiple is lower than most restaurant companies, but for good reason.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Papa John's (PZZA) Research Report: Q3 CY2025 Update

Fast-food pizza chain Papa John’s (NASDAQ:PZZA) fell short of the markets revenue expectations in Q3 CY2025, with sales flat year on year at $508.2 million. Its non-GAAP profit of $0.32 per share was 21.4% below analysts’ consensus estimates.

Papa John's (PZZA) Q3 CY2025 Highlights:

- Revenue: $508.2 million vs analyst estimates of $523.2 million (flat year on year, 2.9% miss)

- Adjusted EPS: $0.32 vs analyst expectations of $0.41 (21.4% miss)

- Adjusted EBITDA: $47.76 million vs analyst estimates of $51.46 million (9.4% margin, 7.2% miss)

- EBITDA guidance for the full year is $195 million at the midpoint, below analyst estimates of $211.7 million

- Operating Margin: 3.2%, down from 12.9% in the same quarter last year

- Free Cash Flow was $22.65 million, up from -$3.85 million in the same quarter last year

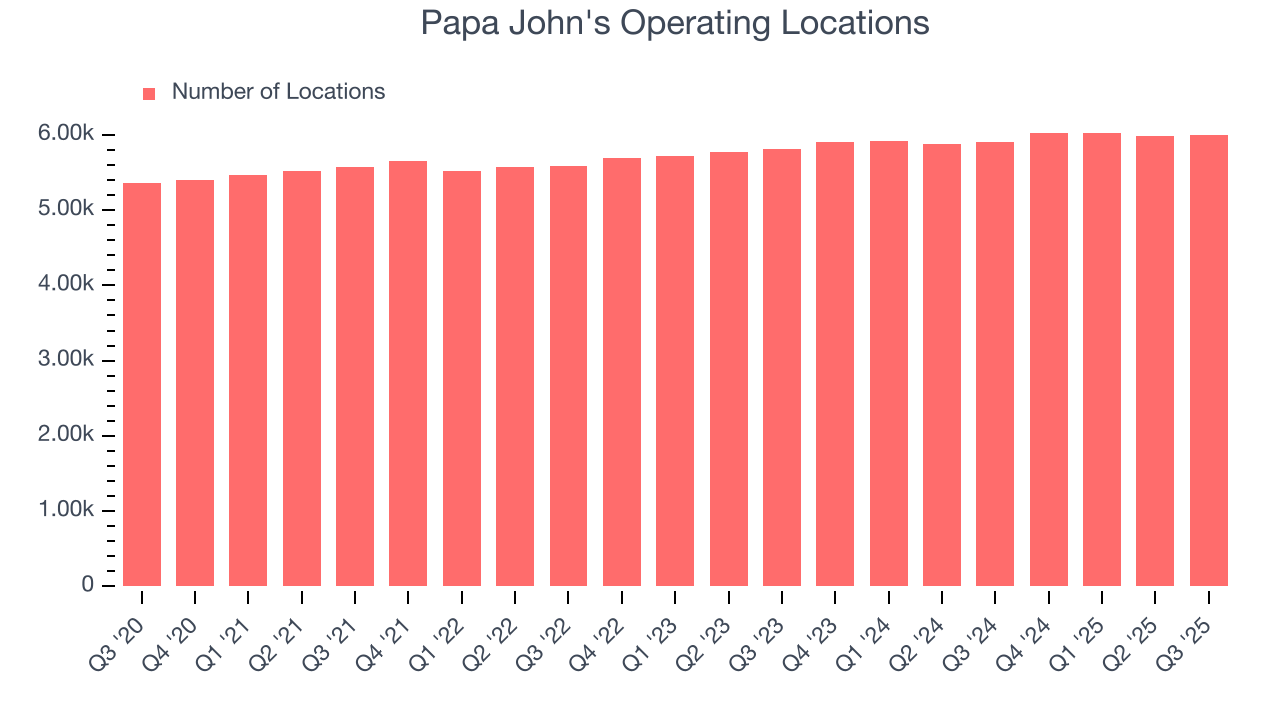

- Locations: 5,994 at quarter end, up from 5,908 in the same quarter last year

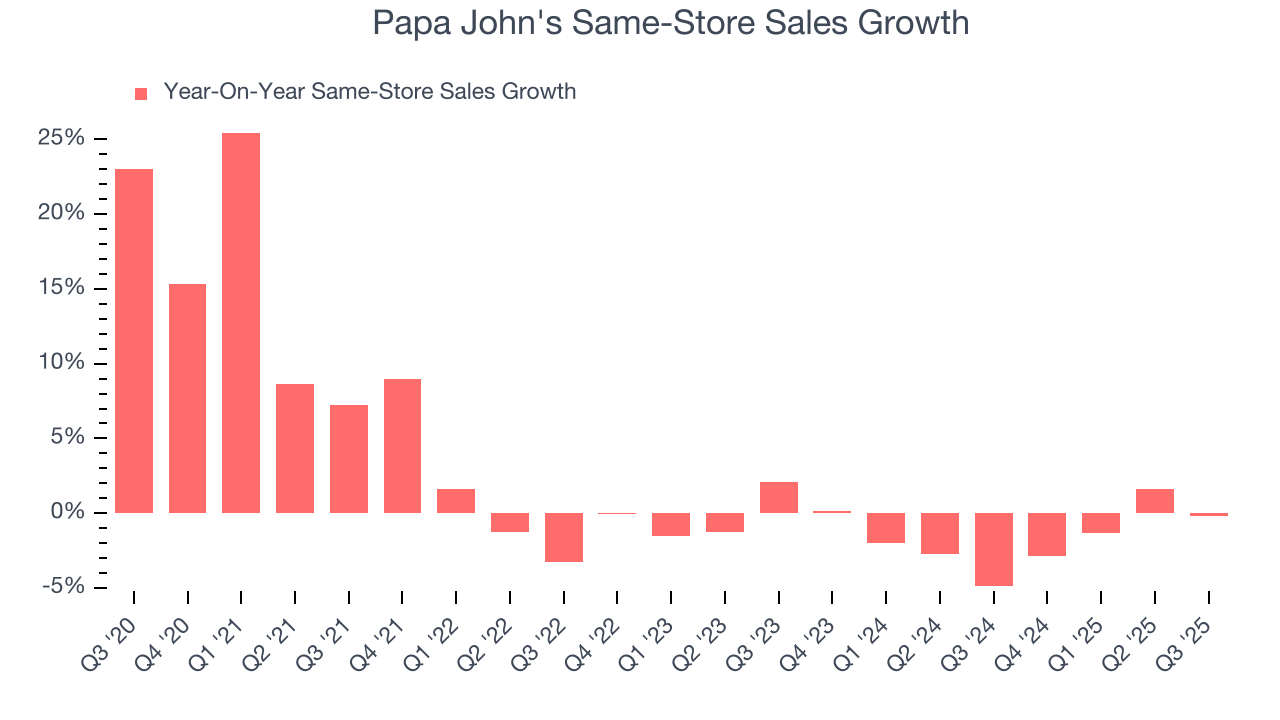

- Same-Store Sales were flat year on year (-4.9% in the same quarter last year)

- Market Capitalization: $1.35 billion

Company Overview

Founded by the eclectic John “Papa John” Schnatter, Papa John’s (NASDAQ:PZZA) is a globally recognized pizza delivery and carryout chain known for “better ingredients” and “better pizza”.

John started the company in 1984 when he converted a broom closet in his father's struggling Indiana tavern into a pizza-making station. To pay for the necessary equipment, he sold his 1971 Camaro for $1,600.

John eventually got his Camaro back for $250,000 in 2009, but that wasn’t the only asset that grew in value. From its humble beginnings, Papa John’s now boasts over 5,700 stores around the world and is one of the most popular pizza brands in the United States.

At the heart of Papa John's success lies its dedication to using fresh, high-quality ingredients in its wide range of menu items, which include creative specials like its Doritos Cool Ranch Papadias and Cinnamon Pull Aparts to traditional classics such as pepperoni pizza, cheesy breadsticks, and healthy salads.

Convenience is a key focus at the company, and like other national pizza chains, Papa John’s uses smaller carry-out-centric storefronts to fulfill its orders. Most customers order online or via its mobile app to better customize pizzas and avoid wait times while others opt for delivery either through Papa John’s directly or popular third-party platforms such as DoorDash, Seamless, or Uber Eats.

4. Traditional Fast Food

Traditional fast-food restaurants are renowned for their speed and convenience, boasting menus filled with familiar and budget-friendly items. Their reputations for on-the-go consumption make them favored destinations for individuals and families needing a quick meal. This class of restaurants, however, is fighting the perception that their meals are unhealthy and made with inferior ingredients, a battle that's especially relevant today given the consumers increasing focus on health and wellness.

Fast-food pizza competitors include public companies Domino’s (NYSE:DPZ) and Pizza Hut (owned by Yum! Brands, NYSE:YUM) as well as private company Little Caesars.

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years.

With $2.09 billion in revenue over the past 12 months, Papa John's is a mid-sized restaurant chain, which sometimes brings disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale.

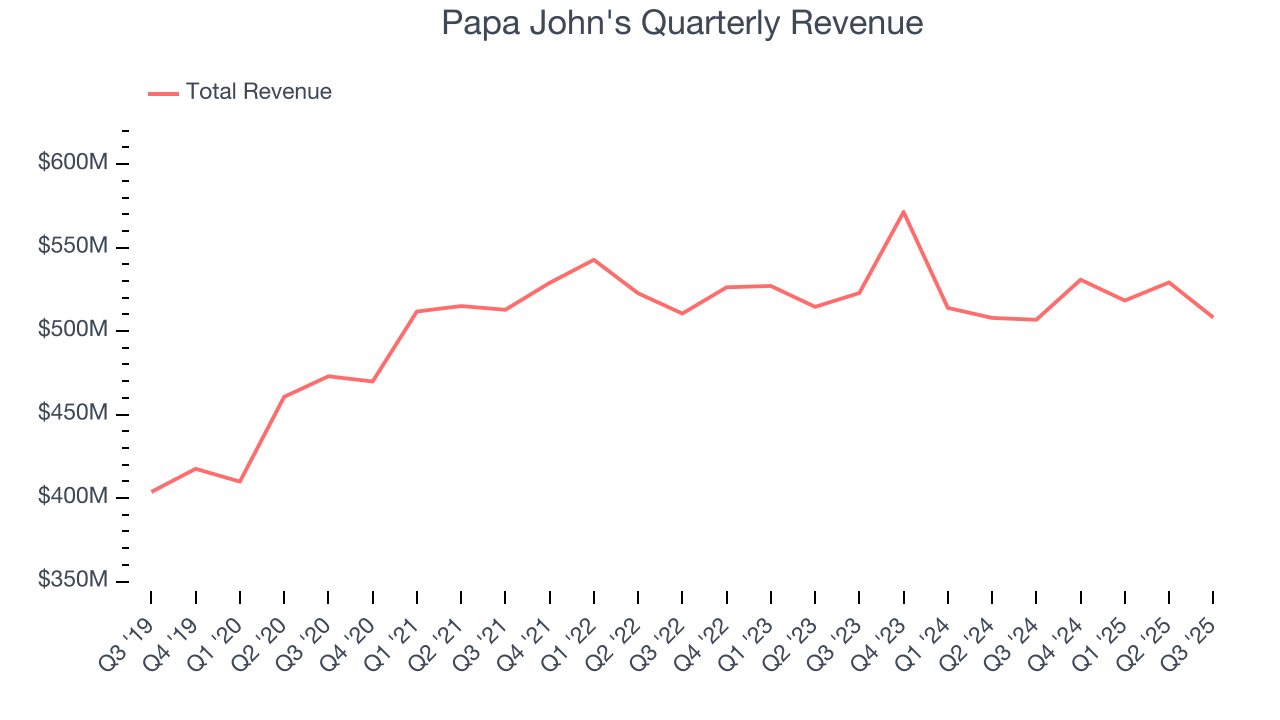

As you can see below, Papa John’s 4.8% annualized revenue growth over the last six years (we compare to 2019 to normalize for COVID-19 impacts) was sluggish.

This quarter, Papa John’s $508.2 million of revenue was flat year on year, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 1.6% over the next 12 months, a deceleration versus the last six years. This projection is underwhelming and suggests its menu offerings will face some demand challenges.

6. Restaurant Performance

Number of Restaurants

The number of dining locations a restaurant chain operates is a critical driver of how quickly company-level sales can grow.

Papa John's sported 5,994 locations in the latest quarter. Over the last two years, it has opened new restaurants quickly, averaging 2.2% annual growth. This was faster than the broader restaurant sector. Additionally, one dynamic making expansion more seamless is the company’s franchise model, where franchisees are primarily responsible for opening new restaurants while Papa John's provides support.

When a chain opens new restaurants, it usually means it’s investing for growth because there’s healthy demand for its meals and there are markets where its concepts have few or no locations.

Same-Store Sales

The change in a company's restaurant base only tells one side of the story. The other is the performance of its existing locations, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales gives us insight into this topic because it measures organic growth at restaurants open for at least a year.

Papa John’s demand has been shrinking over the last two years as its same-store sales have averaged 1.5% annual declines. This performance is concerning - it shows Papa John's artificially boosts its revenue by building new restaurants. We’d like to see a company’s same-store sales rise before it takes on the costly, capital-intensive endeavor of expanding its restaurant base.

In the latest quarter, Papa John’s year on year same-store sales were flat. This performance was a well-appreciated turnaround from its historical levels, showing the business is improving.

7. Gross Margin & Pricing Power

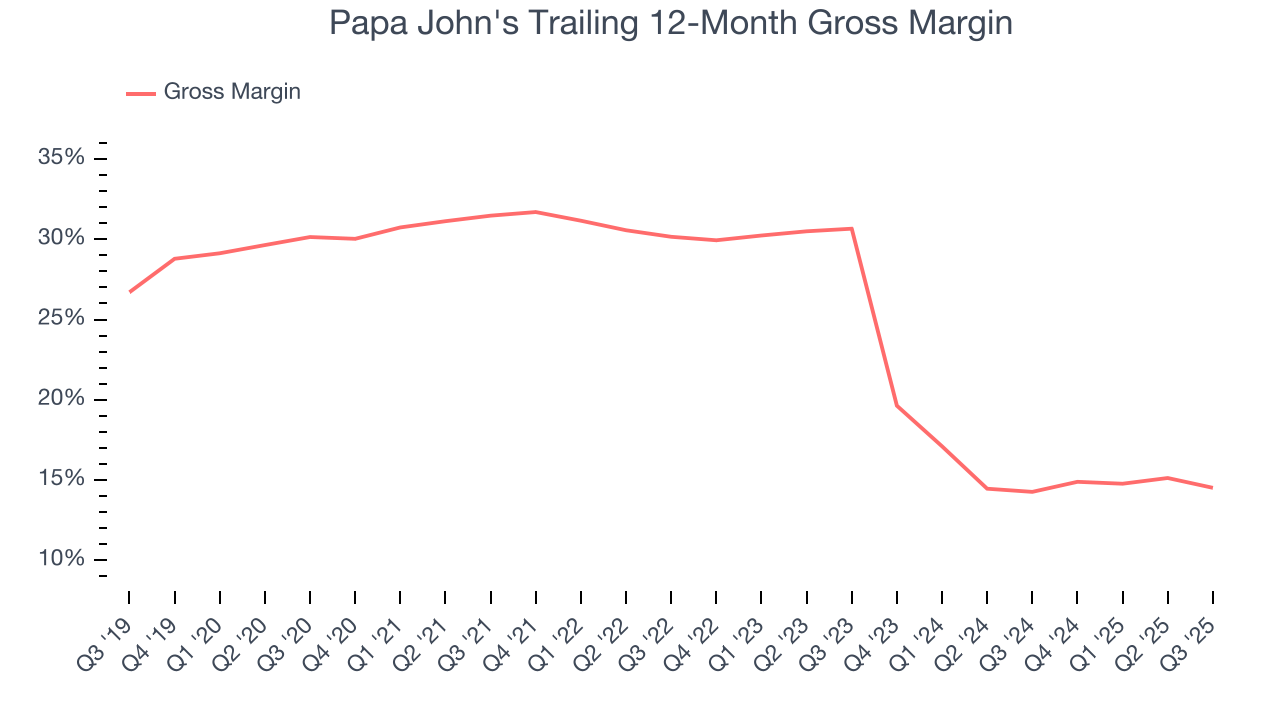

Papa John's has bad unit economics for a restaurant company, signaling it operates in a competitive market and has little room for error if demand unexpectedly falls. As you can see below, it averaged a 14.4% gross margin over the last two years. That means Papa John's paid its suppliers a lot of money ($85.61 for every $100 in revenue) to run its business.

Papa John’s gross profit margin came in at 27.4% this quarter, marking a 2.6 percentage point decrease from 29.9% in the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs (such as ingredients and transportation expenses) have been stable and it isn’t under pressure to lower prices.

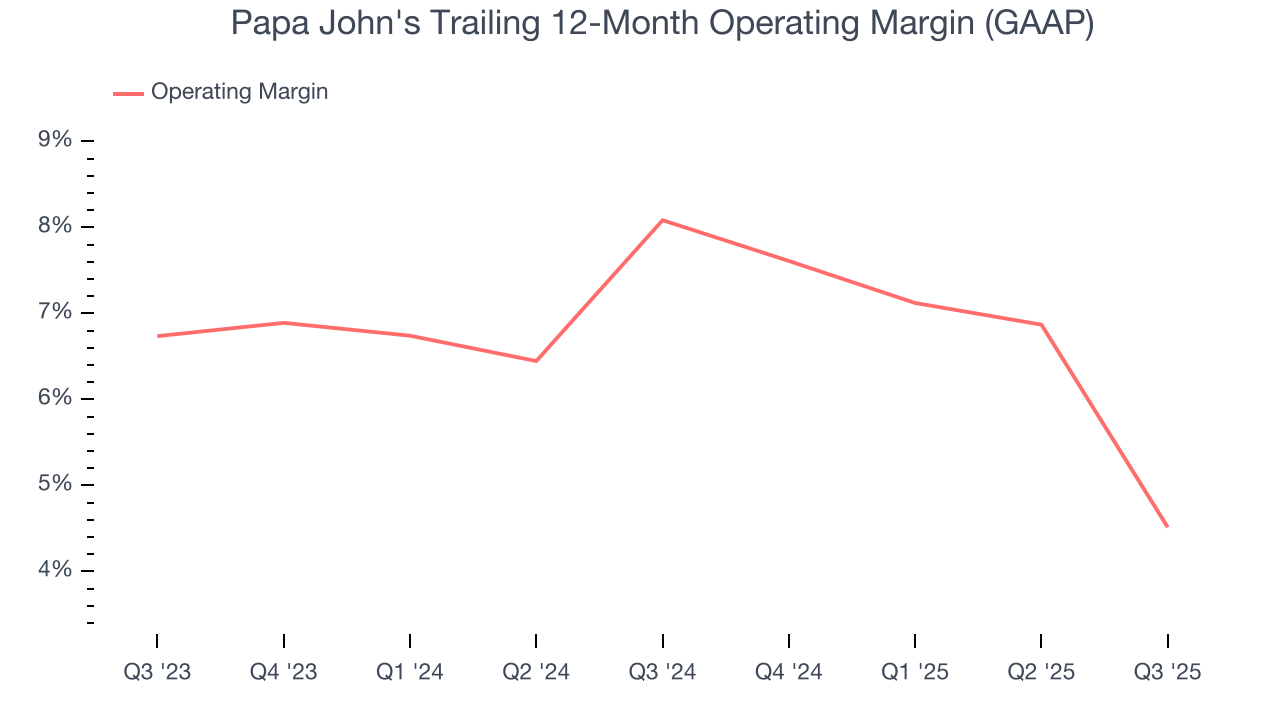

8. Operating Margin

Operating margin is a key profitability metric because it accounts for all expenses keeping the business in motion, including food costs, wages, rent, advertising, and other administrative costs.

Papa John's was profitable over the last two years but held back by its large cost base. Its average operating margin of 6.3% was weak for a restaurant business. This result isn’t too surprising given its low gross margin as a starting point.

Looking at the trend in its profitability, Papa John’s operating margin decreased by 3.6 percentage points over the last year. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Papa John’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

This quarter, Papa John's generated an operating margin profit margin of 3.2%, down 9.7 percentage points year on year. Since Papa John’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, and administrative overhead increased.

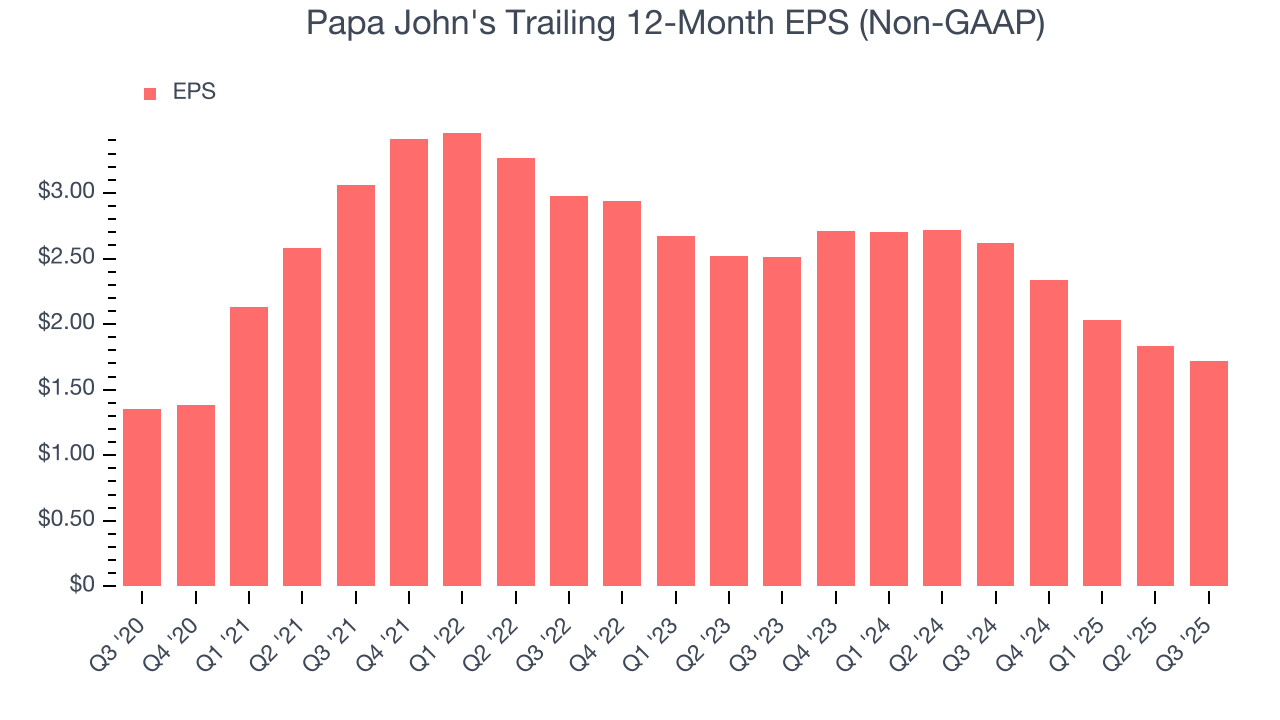

9. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Papa John’s EPS grew at a decent 10.4% compounded annual growth rate over the last six years, higher than its 4.8% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

In Q3, Papa John's reported adjusted EPS of $0.32, down from $0.43 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term adjusted EPS growth than short-term movements. Over the next 12 months, Wall Street expects Papa John’s full-year EPS of $1.72 to grow 23.7%.

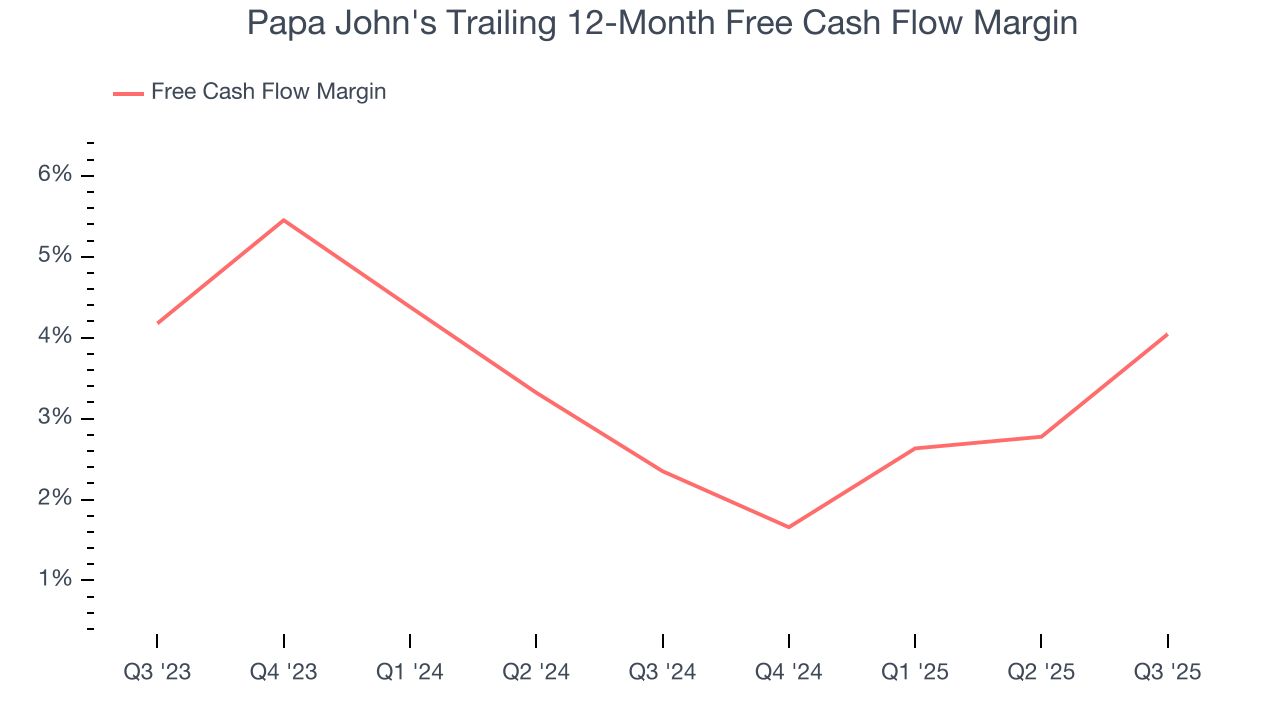

10. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Papa John's has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 3.2% over the last two years, slightly better than the broader restaurant sector.

Taking a step back, we can see that Papa John’s margin expanded by 1.7 percentage points over the last year. This shows the company is heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability fell.

Papa John’s free cash flow clocked in at $22.65 million in Q3, equivalent to a 4.5% margin. This result was good as its margin was 5.2 percentage points higher than in the same quarter last year, building on its favorable historical trend.

11. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Although Papa John's hasn’t been the highest-quality company lately because of its poor top-line performance, it found a few growth initiatives in the past that worked out wonderfully. Its five-year average ROIC was 34.6%, splendid for a restaurant business.

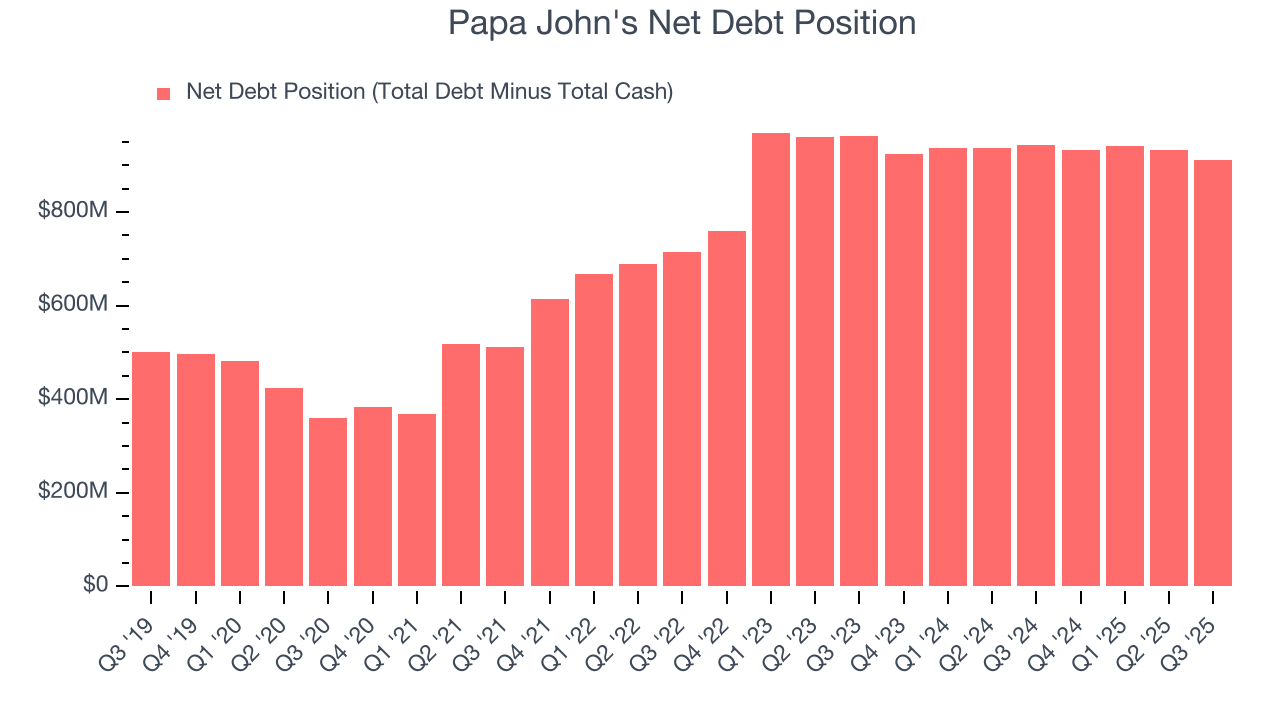

12. Balance Sheet Assessment

Papa John's reported $38.97 million of cash and $950.2 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $195.8 million of EBITDA over the last 12 months, we view Papa John’s 4.7× net-debt-to-EBITDA ratio as safe. We also see its $40.6 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

13. Key Takeaways from Papa John’s Q3 Results

We struggled to find many positives in these results. Its full-year EBITDA guidance missed and its EBITDA fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 6.2% to $38.70 immediately following the results.

14. Is Now The Time To Buy Papa John's?

Updated: February 3, 2026 at 9:49 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Papa John's.

We see the value of companies helping consumers, but in the case of Papa John's, we’re out. To begin with, its revenue growth was a little slower over the last six years, and analysts expect its demand to deteriorate over the next 12 months. And while its stellar ROIC suggests it has been a well-run company historically, the downside is its gross margins make it more challenging to reach positive operating profits compared to other restaurant businesses. On top of that, its projected EPS for the next year is lacking.

Papa John’s P/E ratio based on the next 12 months is 19.7x. While this valuation is reasonable, we don’t see a big opportunity at the moment. There are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $46.73 on the company (compared to the current share price of $33.88).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.