DexCom (DXCM)

We love companies like DexCom. Its elite revenue growth and returns on capital demonstrate it can grow rapidly and profitably.― StockStory Analyst Team

1. News

2. Summary

Why We Like DexCom

Founded in 1999 and receiving its first FDA approval in 2006, DexCom (NASDAQ:DXCM) develops and sells continuous glucose monitoring systems that allow people with diabetes to track their blood sugar levels without repeated finger pricks.

- Earnings growth has massively outpaced its peers over the last five years as its EPS has compounded at 17.5% annually

- Stellar returns on capital showcase management’s ability to surface highly profitable business ventures, and its rising returns show it’s making even more lucrative bets

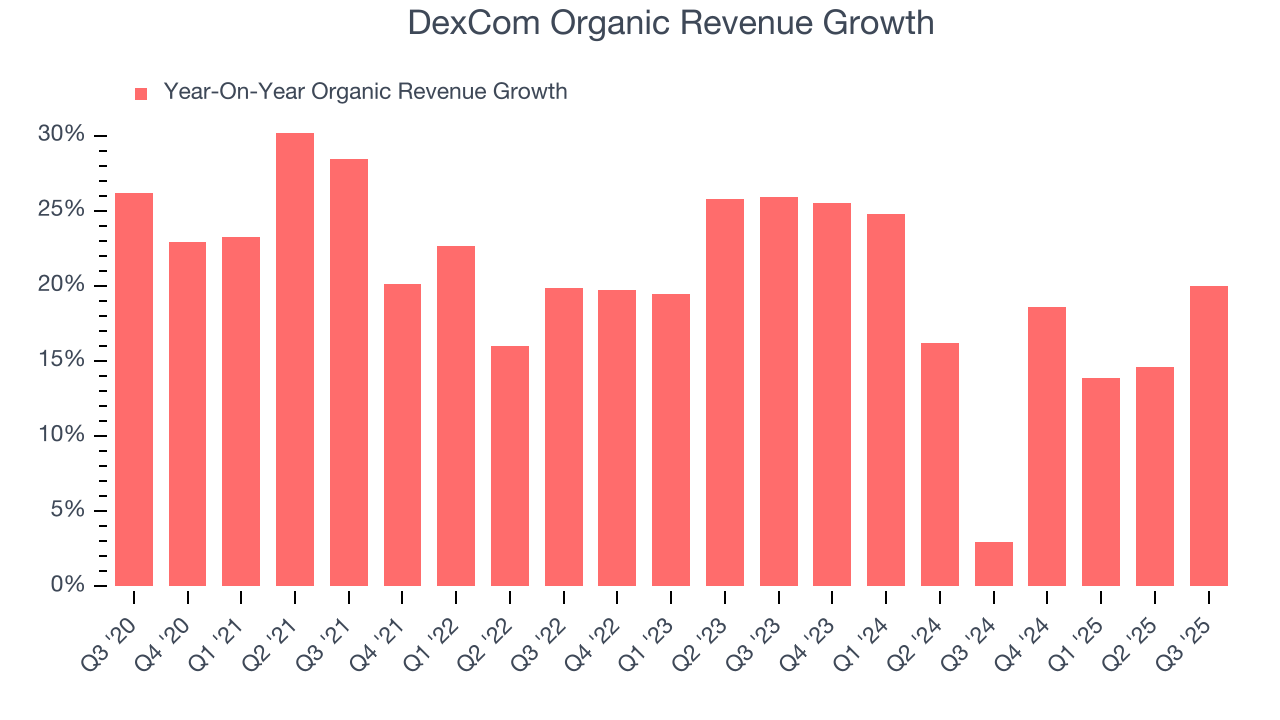

- Existing business lines can expand without risky acquisitions as its organic revenue growth averaged 16.4% over the past two years

We expect great things from DexCom. The price seems reasonable relative to its quality, so this could be a prudent time to invest in some shares.

Why Is Now The Time To Buy DexCom?

High Quality

Investable

Underperform

Why Is Now The Time To Buy DexCom?

DexCom’s stock price of $72.87 implies a valuation ratio of 30.8x forward P/E. While this multiple is higher than most healthcare companies, we think the valuation is fair given its quality characteristics.

Our analysis and backtests consistently tell us that buying high-quality companies and holding them for many years leads to market outperformance. Over the long term, entry price doesn’t matter nearly as much as business fundamentals.

3. DexCom (DXCM) Research Report: Q3 CY2025 Update

Medical device company DexCom (NASDAQ:DXCM) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 21.6% year on year to $1.21 billion. The company expects the full year’s revenue to be around $4.64 billion, close to analysts’ estimates. Its non-GAAP profit of $0.61 per share was 7.5% above analysts’ consensus estimates.

DexCom (DXCM) Q3 CY2025 Highlights:

- Revenue: $1.21 billion vs analyst estimates of $1.18 billion (21.6% year-on-year growth, 2.5% beat)

- Adjusted EPS: $0.61 vs analyst estimates of $0.57 (7.5% beat)

- The company slightly lifted its revenue guidance for the full year to $4.64 billion at the midpoint from $4.61 billion

- Operating Margin: 20.1%, up from 15.3% in the same quarter last year

- Organic Revenue rose 20% year on year vs analyst estimates of 19.6% growth (43.5 basis point beat)

- Market Capitalization: $26.74 billion

Company Overview

Founded in 1999 and receiving its first FDA approval in 2006, DexCom (NASDAQ:DXCM) develops and sells continuous glucose monitoring systems that allow people with diabetes to track their blood sugar levels without repeated finger pricks.

DexCom's continuous glucose monitoring (CGM) technology consists of a small sensor inserted under the skin, a transmitter that sends data wirelessly, and a display device that shows real-time glucose readings. Unlike traditional glucose meters that provide only periodic snapshots of blood sugar levels, DexCom's systems track glucose levels continuously throughout the day and night, providing users with trend information and alerts for high or low readings.

The company's flagship products include the G6 and newer G7 systems, which are classified as integrated continuous glucose monitoring systems (iCGMs) by the FDA. These devices can communicate directly with compatible smartphones and smartwatches, allowing users to discreetly monitor their glucose levels. The data can also be shared with healthcare providers or family members through DexCom's Share remote monitoring system, enabling caregivers to receive alerts about a patient's glucose levels.

A person with Type 1 diabetes might use a DexCom CGM to monitor how their glucose levels respond to meals, exercise, and insulin doses throughout the day. The system would alert them before their glucose reaches dangerously high or low levels, allowing them to take corrective action before experiencing symptoms.

DexCom generates revenue primarily through the recurring sale of disposable sensors, which are replaced every 10 days, while transmitters are replaced approximately every three months. The company's products are covered by Medicare, Medicaid, and most commercial insurers in the United States for people with both Type 1 and Type 2 diabetes who meet certain eligibility criteria.

Beyond its core products, DexCom is expanding its offerings with Dexcom ONE, a simplified CGM system launched in several European countries, and Dexcom Stelo, designed specifically for people with Type 2 diabetes who don't use insulin. The company has also established partnerships with insulin delivery system manufacturers to integrate its CGM technology with insulin pumps and pens, supporting the development of automated insulin delivery systems.

4. Patient Monitoring

Patient monitoring companies within the healthcare equipment industry offer devices and technologies that track chronic conditions and support real-time health management, such as continuous glucose monitors (CGMs) and sleep apnea machines. These businesses benefit from recurring revenue from consumables and software subscriptions tied to device sales (razor, razor blade model). The rising prevalence of chronic diseases like diabetes and respiratory disorders due to an aging population as well as growing adoption of digitization are good for the industry. However, these companies face challenges from high R&D costs and reliance on regulatory approvals. Looking ahead, the sector is positioned for growth due to tailwinds like the rising burden of chronic diseases from an aging population, the shift toward value-based care, and increased adoption of digital health solutions. Innovations in AI and machine learning are expected to enhance device accuracy and functionality, improving patient outcomes and driving demand. However, there are headwinds such as pricing pressures as healthcare costs are a key focus, especially in the US. An evolving regulatory landscape and competition from more tech-forward new entrants could present additional challenges.

DexCom's primary competitors in the continuous glucose monitoring market include Abbott Laboratories' Diabetes Care division (NYSE:ABT) with its FreeStyle Libre system, Medtronic's Diabetes Group (NYSE:MDT), and privately-held companies like LifeScan and Ascensia Diabetes Care.

5. Economies of Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $4.52 billion in revenue over the past 12 months, DexCom has decent scale. This is important as it gives the company more leverage in a heavily regulated, competitive environment that is complex and resource-intensive.

6. Revenue Growth

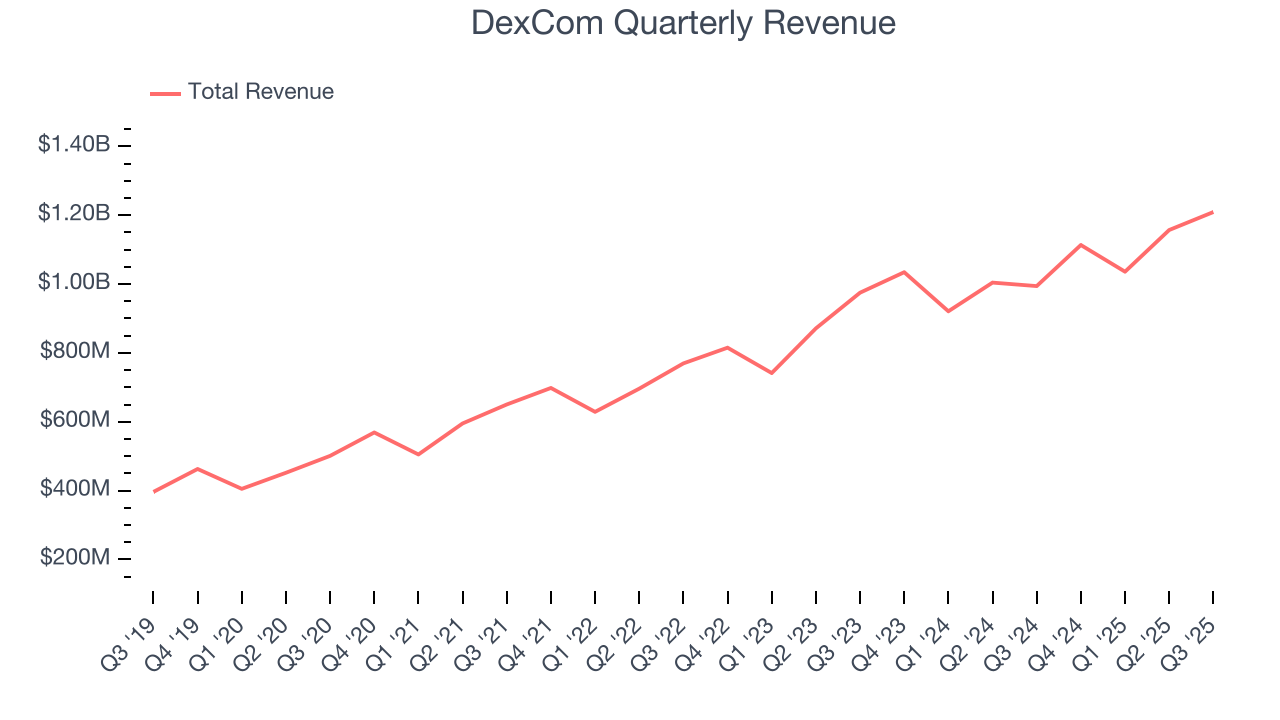

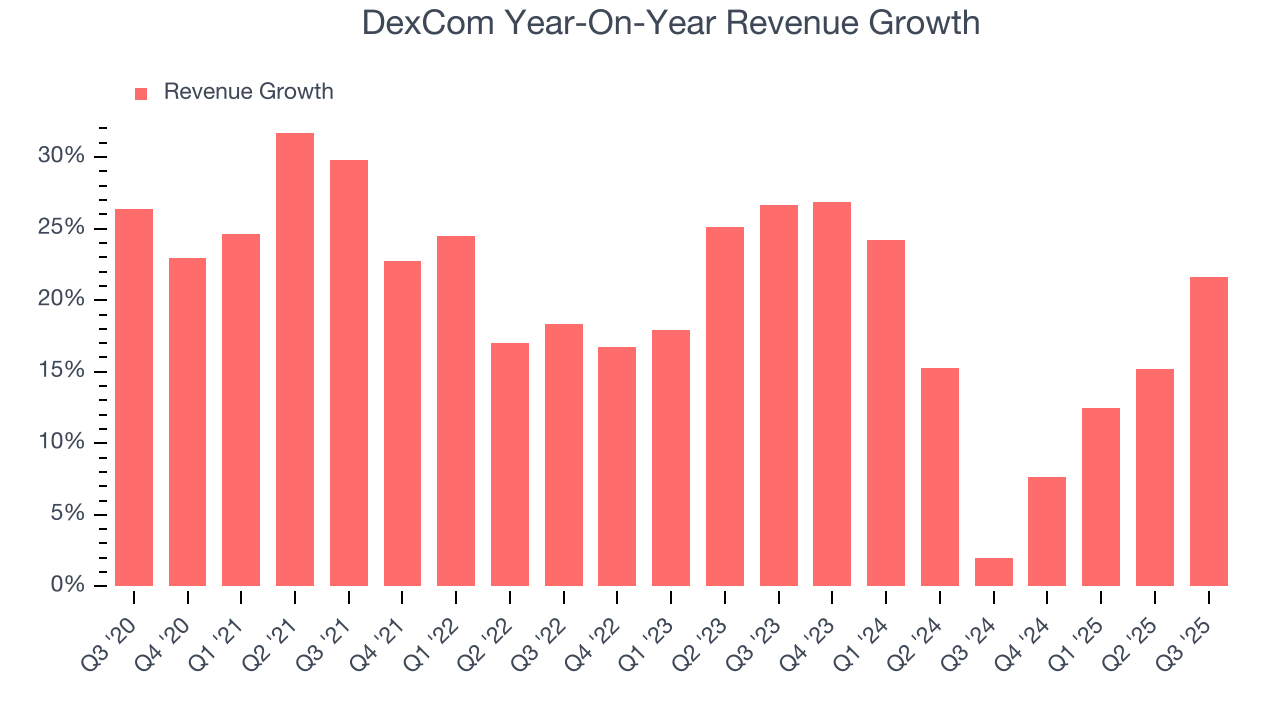

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, DexCom grew its sales at an impressive 19.9% compounded annual growth rate. Its growth surpassed the average healthcare company and shows its offerings resonate with customers, a great starting point for our analysis.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. DexCom’s annualized revenue growth of 15.2% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

DexCom also reports organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, DexCom’s organic revenue averaged 17.1% year-on-year growth. Because this number is better than its two-year revenue growth, we can see that some mixture of divestitures and foreign exchange rates dampened its headline results.

This quarter, DexCom reported robust year-on-year revenue growth of 21.6%, and its $1.21 billion of revenue topped Wall Street estimates by 2.5%.

Looking ahead, sell-side analysts expect revenue to grow 13.9% over the next 12 months, similar to its two-year rate. Still, this projection is healthy and implies the market sees success for its products and services.

7. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

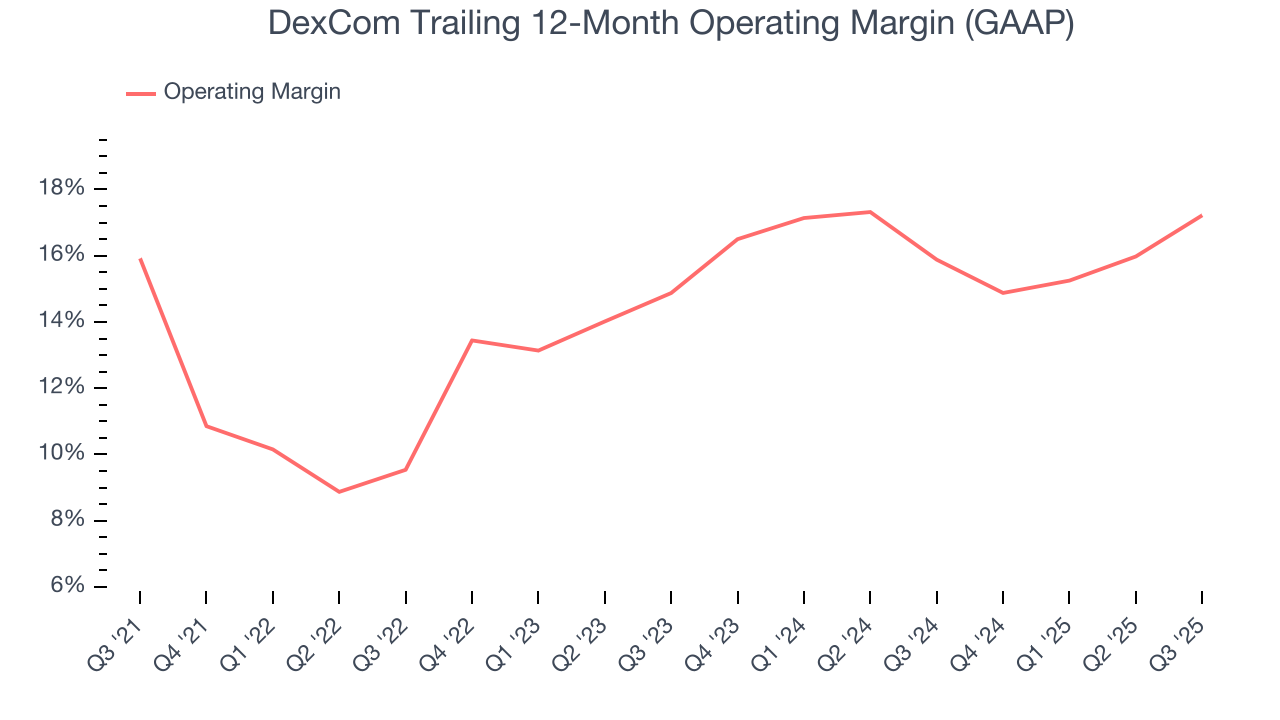

DexCom has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 15%, higher than the broader healthcare sector.

Analyzing the trend in its profitability, DexCom’s operating margin rose by 1.3 percentage points over the last five years, as its sales growth gave it operating leverage. This performance was mostly driven by its recent improvements as the company’s margin has increased by 2.3 percentage points on a two-year basis. These data points are very encouraging and show momentum is on its side.

In Q3, DexCom generated an operating margin profit margin of 20.1%, up 4.8 percentage points year on year. This increase was a welcome development and shows it was more efficient.

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

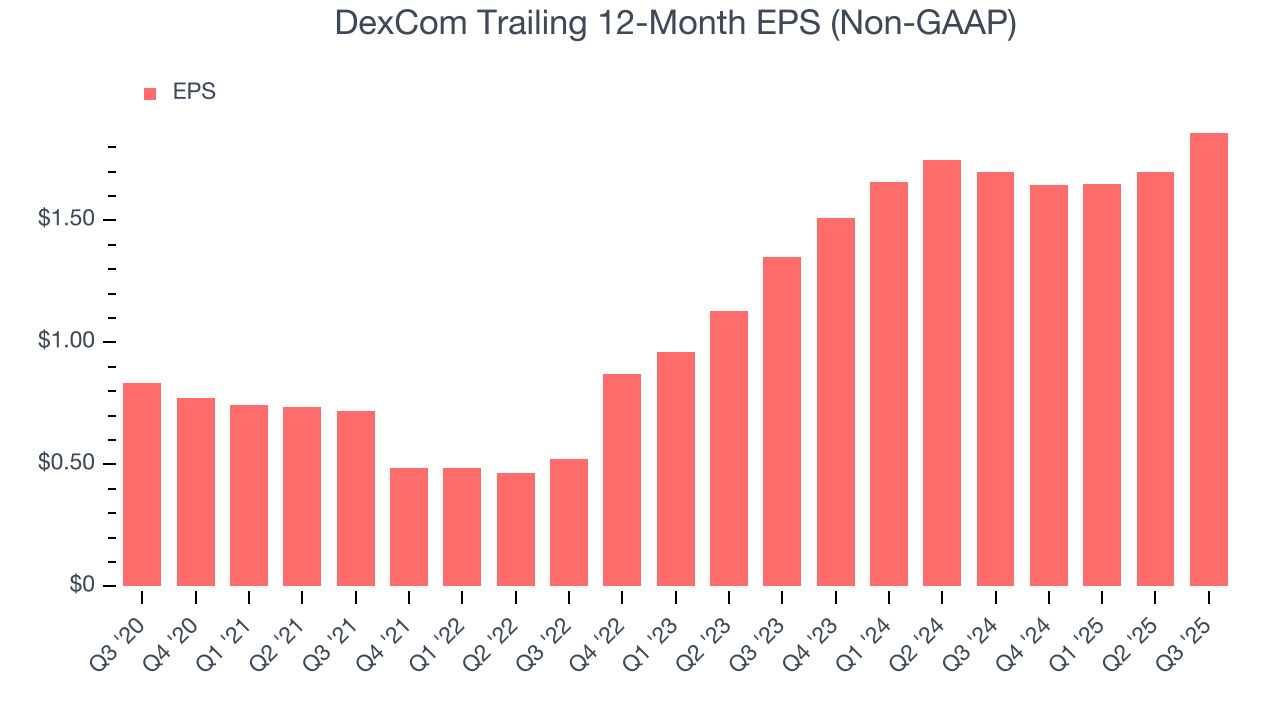

DexCom’s EPS grew at an astounding 17.5% compounded annual growth rate over the last five years. Despite its operating margin improvement during that time, this performance was lower than its 19.9% annualized revenue growth, telling us that non-fundamental factors such as interest and taxes affected its ultimate earnings.

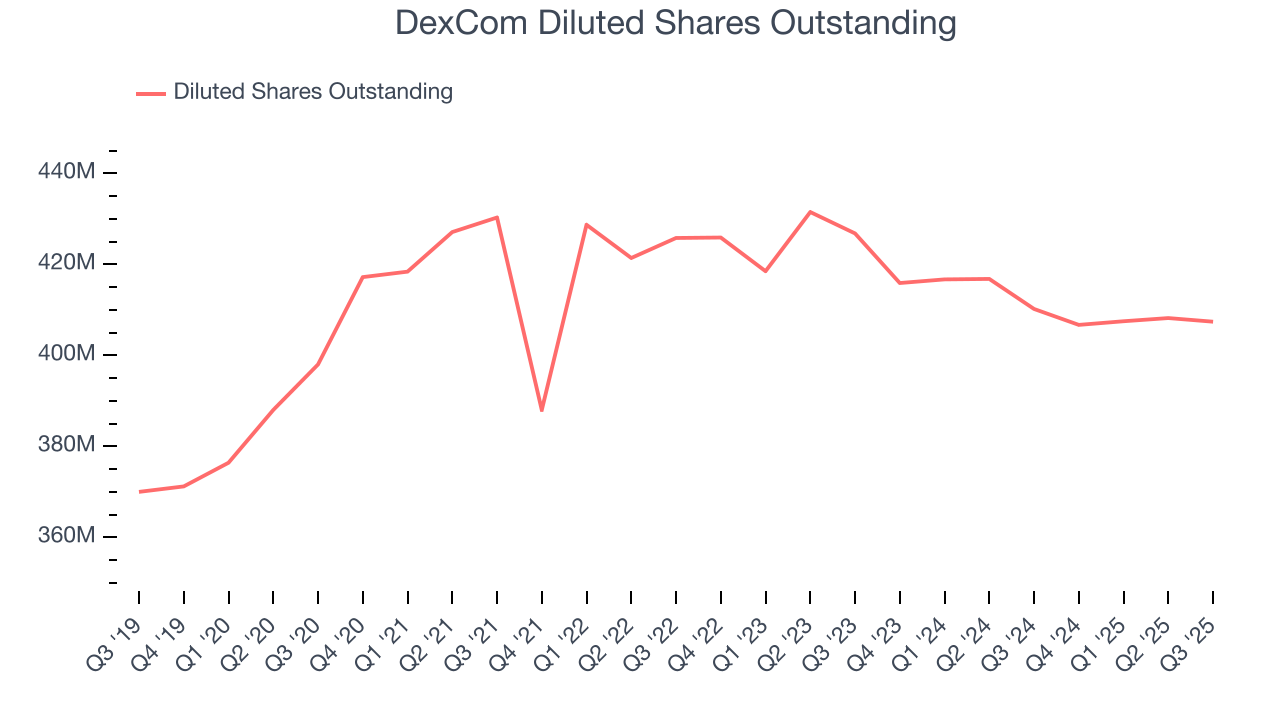

Diving into the nuances of DexCom’s earnings can give us a better understanding of its performance. A five-year view shows DexCom has diluted its shareholders, growing its share count by 2.4%. This dilution overshadowed its increased operational efficiency and has led to lower per share earnings. Taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q3, DexCom reported adjusted EPS of $0.61, up from $0.45 in the same quarter last year. This print beat analysts’ estimates by 7.5%. Over the next 12 months, Wall Street expects DexCom’s full-year EPS of $1.86 to grow 31.6%.

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

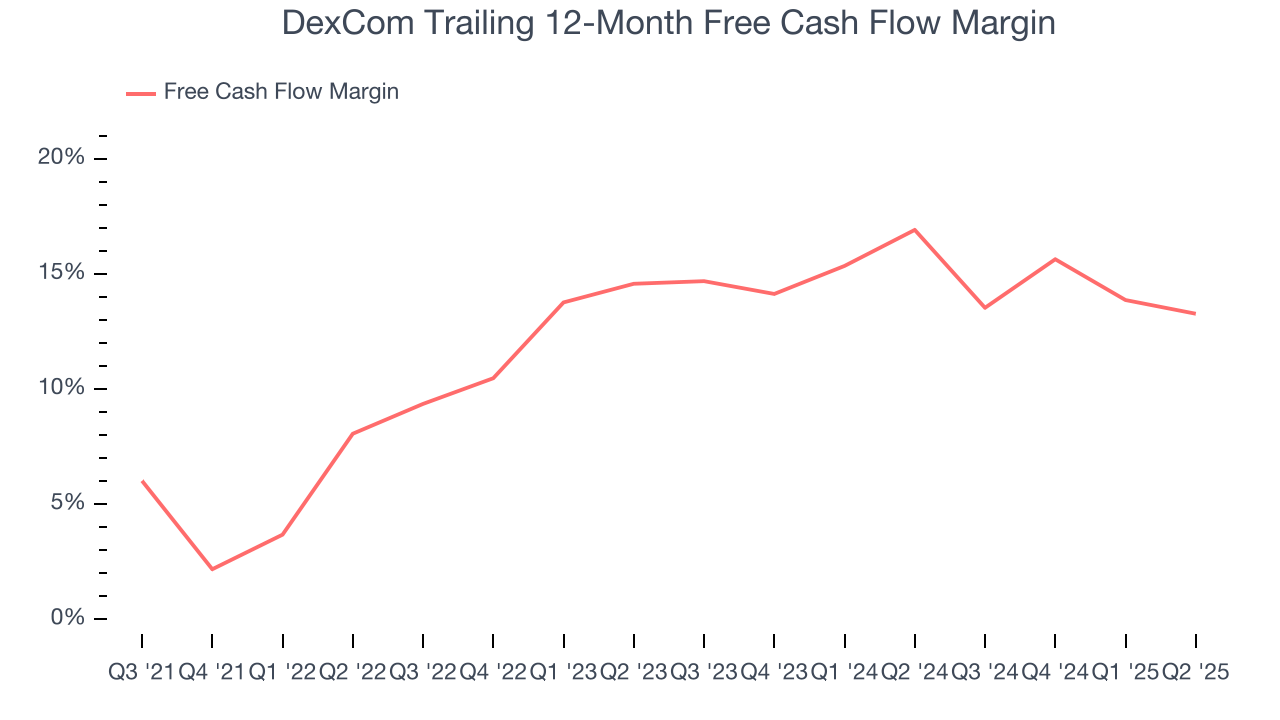

DexCom has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 12.2% over the last five years, better than the broader healthcare sector.

Taking a step back, we can see that DexCom’s margin expanded by 14.6 percentage points during that time. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

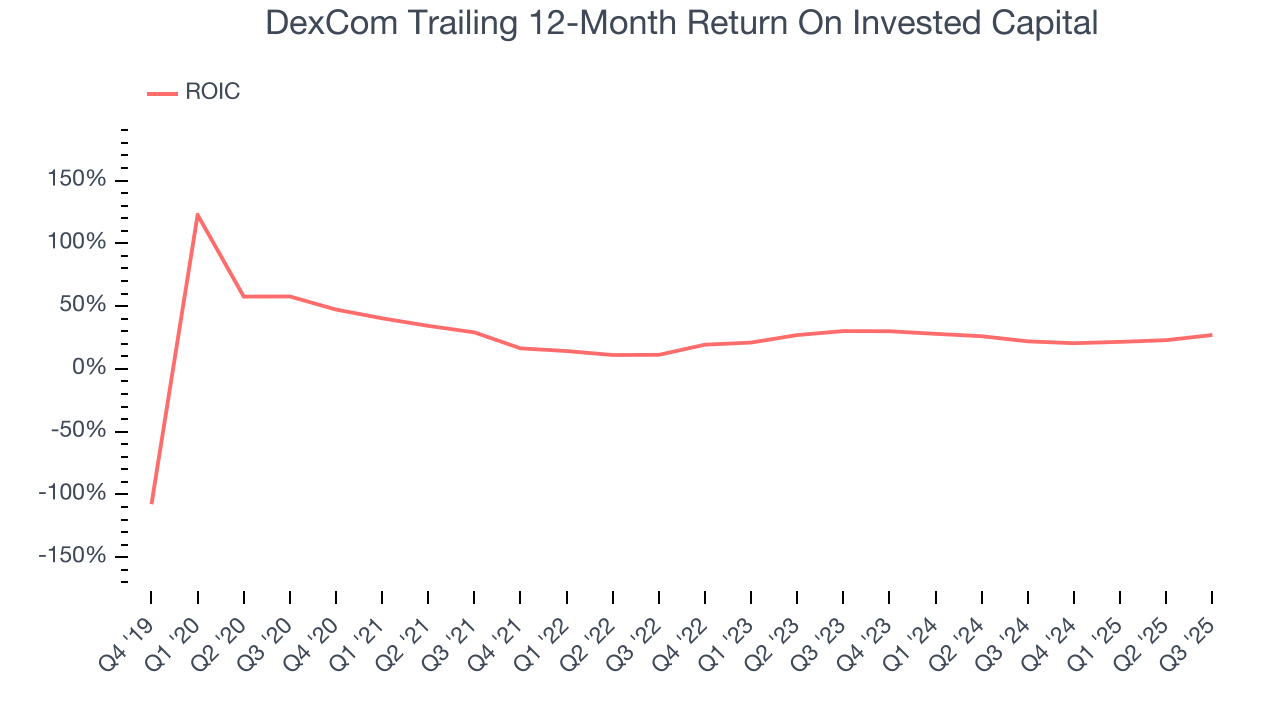

DexCom’s five-year average ROIC was 23.9%, placing it among the best healthcare companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Fortunately, DexCom’s ROIC averaged 4.3 percentage point increases over the last few years. This is a great sign when paired with its already strong returns. It could suggest its competitive advantage or profitable growth opportunities are expanding.

11. Balance Sheet Assessment

Businesses that maintain a cash surplus face reduced bankruptcy risk.

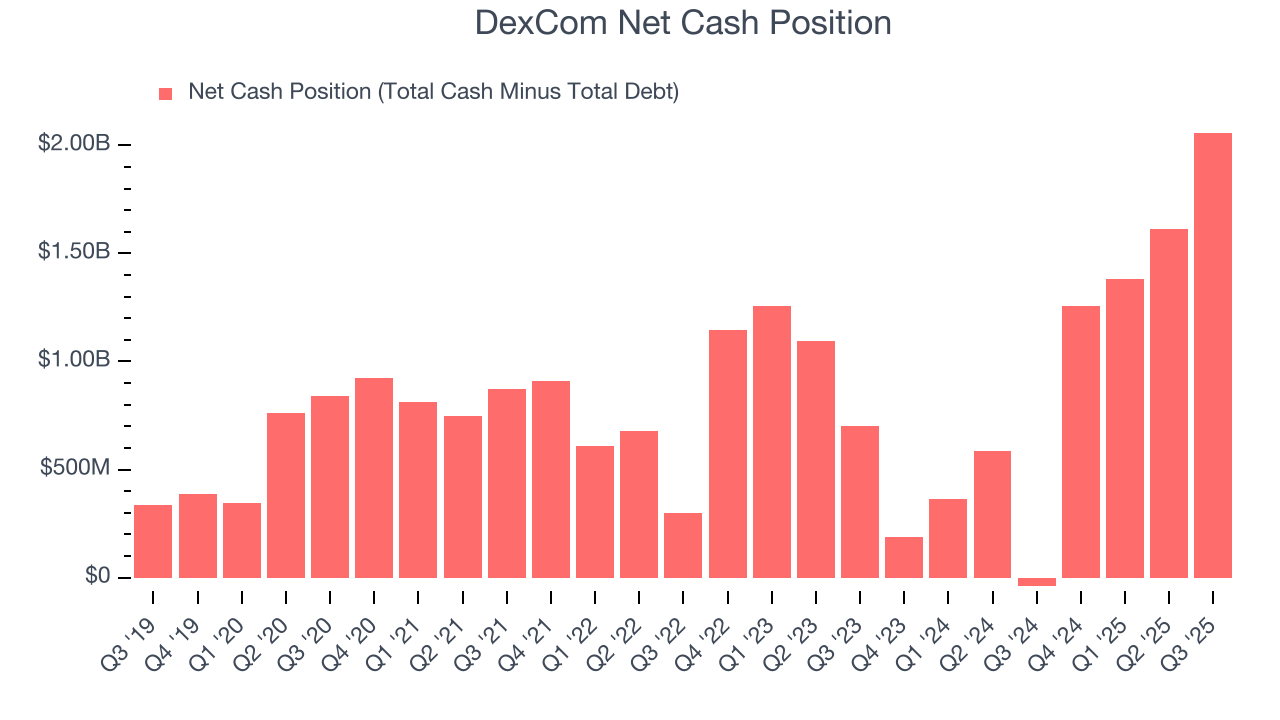

DexCom is a profitable, well-capitalized company with $3.32 billion of cash and $1.26 billion of debt on its balance sheet. This $2.06 billion net cash position is 9.1% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from DexCom’s Q3 Results

We enjoyed seeing DexCom beat analysts’ revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Overall, this print had some key positives. Investors were likely hoping for more, and shares traded down 8.8% to $62.20 immediately after reporting.

13. Is Now The Time To Buy DexCom?

Updated: January 23, 2026 at 10:52 PM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

There is a lot to like about DexCom. For starters, its revenue growth was impressive over the last five years. On top of that, its rising cash profitability gives it more optionality, and its astounding EPS growth over the last five years shows its profits are trickling down to shareholders.

DexCom’s P/E ratio based on the next 12 months is 30.8x. Scanning the healthcare space today, DexCom’s fundamentals really stand out, and we like it at this price.

Wall Street analysts have a consensus one-year price target of $85.19 on the company (compared to the current share price of $72.87), implying they see 16.9% upside in buying DexCom in the short term.