Electronic Arts (EA)

We see potential in Electronic Arts. Its stellar unit economics and marketing efficiency show its unique products generate organic demand.― StockStory Analyst Team

1. News

2. Summary

Why Electronic Arts Is Interesting

Best known for its Madden NFL and FIFA sports franchises, Electronic Arts (NASDAQ:EA) is one of the world’s largest video game publishers.

- Successful business model is illustrated by its impressive EBITDA margin

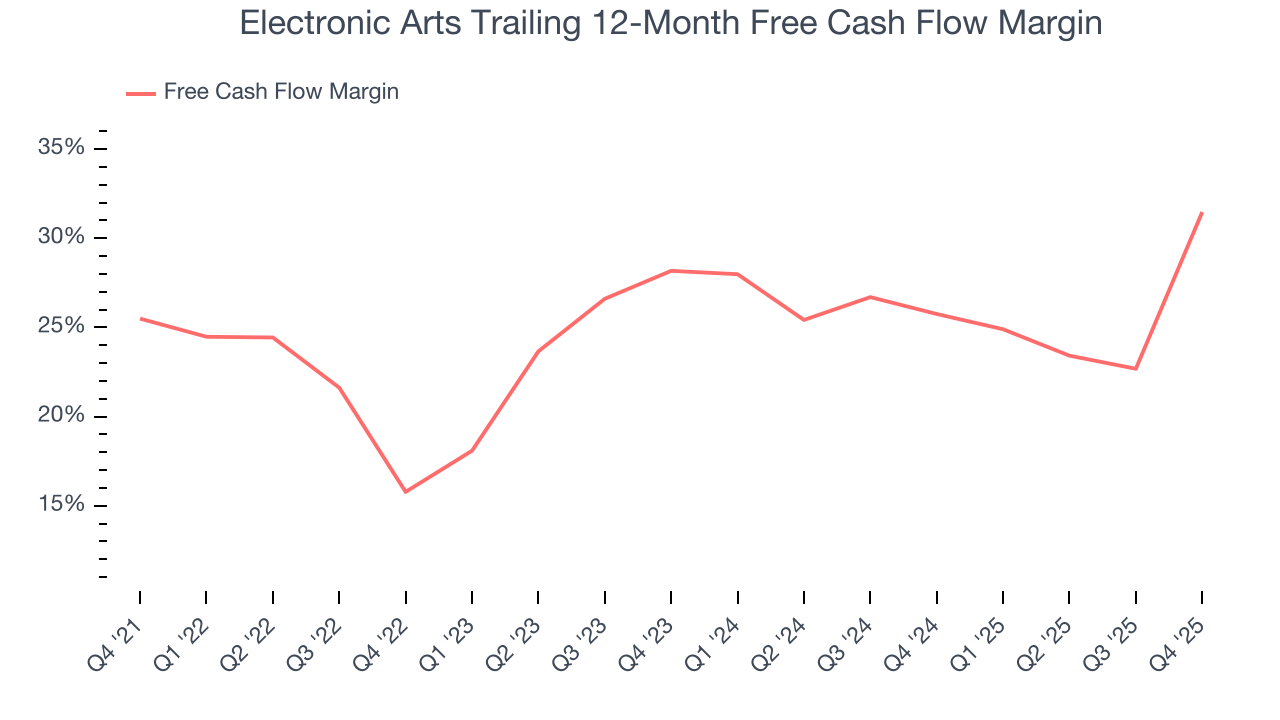

- Impressive free cash flow profitability enables the company to fund new investments or reward investors with share buybacks/dividends, and its rising cash conversion increases its margin of safety

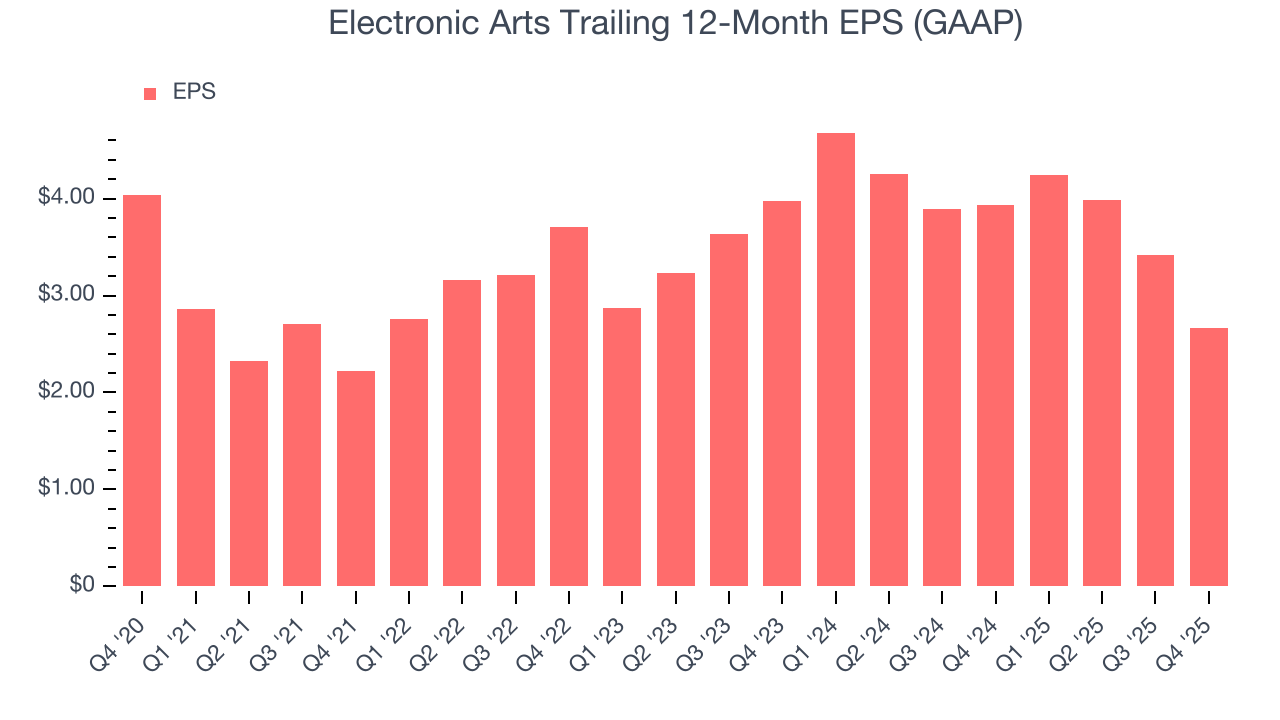

- One risk is its falling earnings per share over the last three years has some investors worried as stock prices ultimately follow EPS over the long term

Electronic Arts has some noteworthy aspects. This company is a good candidate for your watchlist.

Why Should You Watch Electronic Arts

High Quality

Investable

Underperform

Why Should You Watch Electronic Arts

At $203.32 per share, Electronic Arts trades at 15.7x forward EV/EBITDA. This valuation multiple hovers around the sector average.

We’re adding this to our watchlist for the time being. It has potential, but we’re not buyers here and now. We’d rather own higher-quality companies because they’re available at similar prices.

3. Electronic Arts (EA) Research Report: Q4 CY2025 Update

Video game publisher Electronic Arts (NASDAQ:EA) missed Wall Street’s revenue expectations in Q4 CY2025, with sales flat year on year at $1.90 billion. Its GAAP profit of $0.35 per share was 76.4% below analysts’ consensus estimates.

Electronic Arts (EA) Q4 CY2025 Highlights:

- Revenue: $1.90 billion vs analyst estimates of $2.35 billion (flat year on year, 19.2% miss)

- EPS (GAAP): $0.35 vs analyst expectations of $1.48 (76.4% miss)

- Adjusted EBITDA: $384 million vs analyst estimates of $1.51 billion (20.2% margin, 74.6% miss)

- Operating Margin: 6.7%, down from 20% in the same quarter last year

- Free Cash Flow Margin: 93.2%, up from 4.7% in the previous quarter

- Market Capitalization: $50.78 billion

Company Overview

Best known for its Madden NFL and FIFA sports franchises, Electronic Arts (NASDAQ:EA) is one of the world’s largest video game publishers.

Electronic Arts develops video games for consoles, PCs, and mobile devices across diverse genres, such as sports, racing, first-person shooter, action, role-playing, and simulation. Electronic Arts monetizes in multiple ways: the sale of full premium games, free-to-play games with in-game purchases, and subscription-style content. It also sells in-game advertising and operates e-sports leagues which generate revenue through sponsorship and franchise sales.

Where Electronic Arts differentiates itself from rivals is through its collection of long-running dominant sports franchises such as FIFA, NHL, and Madden NFL, whose annual releases provide the company with annuity-like revenue streams. Those titles, along with its Star Wars games, are all licensed, though the company also has a long track record of releasing its own innovative new games that become genre-defining, such as The Sims/SimCity, Need for Speed, Apex Legends, Battlefield, and Plants vs. Zombies.

4. Video Gaming

Since videogames were invented in the 1970s, they have gradually taken more share of entertainment time. Ubiquitous mobile devices have powered a surge in “snackable” games that can be played on the go. Over time, games have developed more social engagement features where friends can play games together over the internet. The business models of games publishers have become less volatile due to digitization of distribution, in game monetization, and like Hollywood, an increasing dependence on surefire hit franchises. Covid driven lockdowns accelerated adoption and usage of videogames – a trend that has not slowed.

Electronic Arts competes with other large video game companies including Take Two (NASDAQ:TTWO), Roblox (NYSE:RBLX), and Nintendo (TSE:7974).

5. Revenue Growth

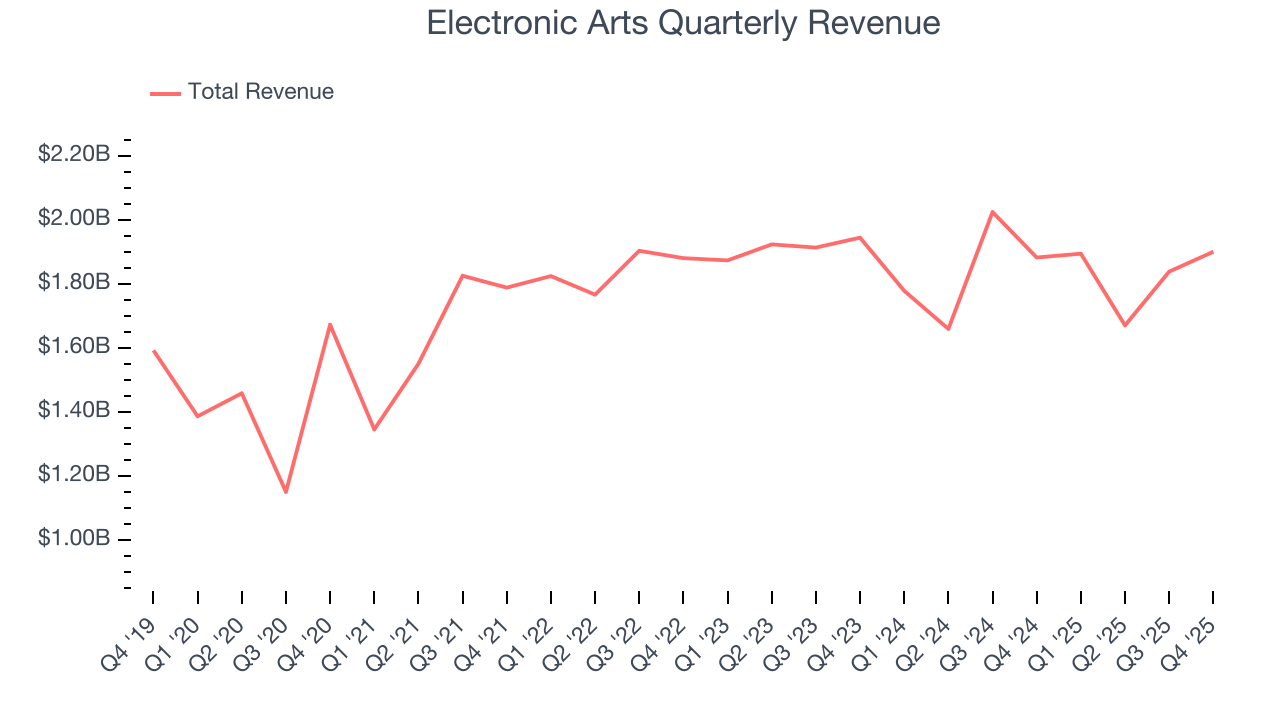

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, Electronic Arts struggled to consistently increase demand as its $7.31 billion of sales for the trailing 12 months was close to its revenue three years ago. This wasn’t a great result, but there are still things to like about Electronic Arts.

This quarter, Electronic Arts’s $1.90 billion of revenue was flat year on year, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 11.5% over the next 12 months, an acceleration versus the last three years. This projection is above the sector average and suggests its newer products and services will fuel better top-line performance.

6. Gross Margin & Pricing Power

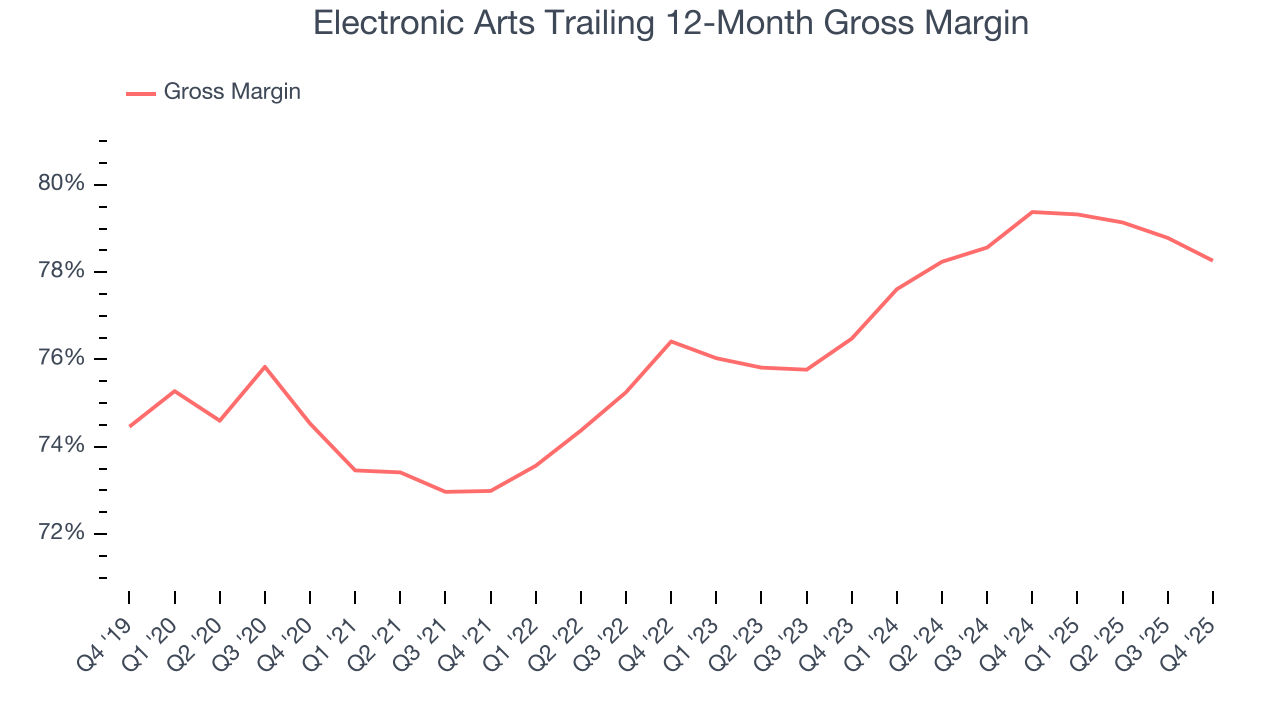

A company’s gross profit margin has a significant impact on its ability to exert pricing power, develop new products, and invest in marketing. These factors can determine the winner in a competitive market.

For gaming businesses like Electronic Arts, gross profit tells us how much money the company gets to keep after covering the base cost of its products and services, which typically include royalties to sports leagues or celebrities featured in games, fees paid to Alphabet or Apple for games downloaded in their digital app stores, and data center hosting expenses associated with delivering games over the internet.

Electronic Arts has robust unit economics, an output of its asset-lite business model and pricing power. Its margin is better than the broader consumer internet industry and enables the company to fund large investments in new products and marketing during periods of rapid growth to achieve higher profits in the future. As you can see below, it averaged an excellent 78.8% gross margin over the last two years. That means Electronic Arts only paid its providers $21.18 for every $100 in revenue.

This quarter, Electronic Arts’s gross profit margin was 73.8%, marking a 2 percentage point decrease from 75.8% in the same quarter last year. Electronic Arts’s full-year margin has also been trending down over the past 12 months, decreasing by 1.1 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs.

7. User Acquisition Efficiency

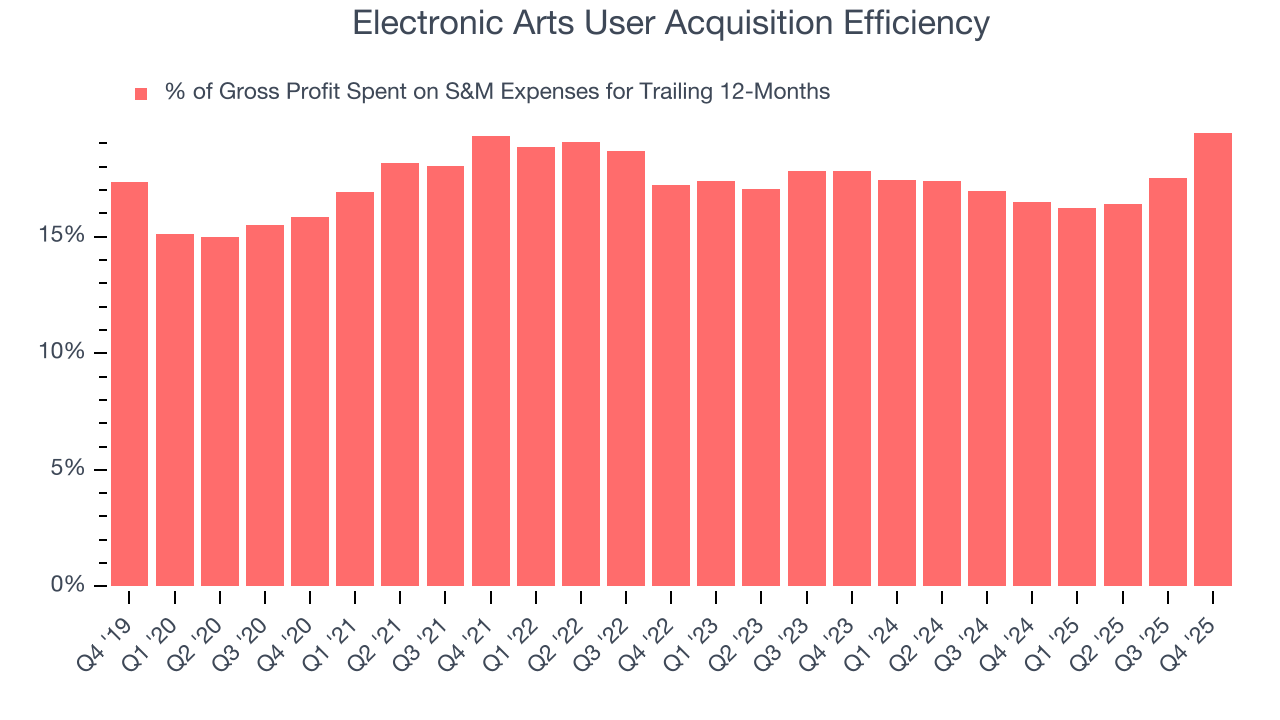

Unlike enterprise software that’s typically sold by dedicated sales teams, consumer internet businesses like Electronic Arts grow from a combination of product virality, paid advertisement, and incentives.

Electronic Arts is extremely efficient at acquiring new users, spending only 19.5% of its gross profit on sales and marketing expenses over the last year. This efficiency indicates that it has a highly differentiated product offering and strong brand reputation, giving Electronic Arts the freedom to invest its resources into new growth initiatives while maintaining optionality.

8. EBITDA

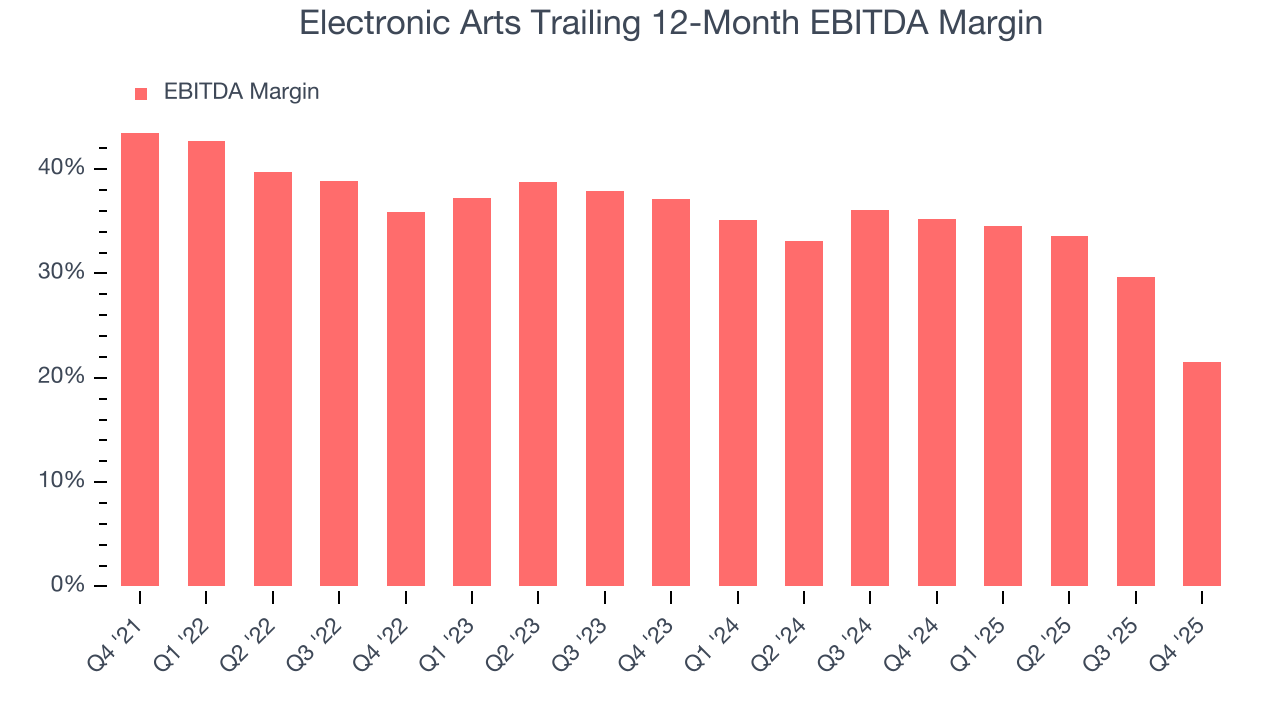

Operating income is often evaluated to assess a company’s underlying profitability. In a similar vein, EBITDA is used to analyze consumer internet companies because it excludes various one-time or non-cash expenses (depreciation), providing a clearer view of the business’s profit potential.

Electronic Arts has been a well-oiled machine over the last two years. It demonstrated elite profitability for a consumer internet business, boasting an average EBITDA margin of 28.4%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Electronic Arts’s EBITDA margin decreased by 14.4 percentage points over the last few years. Even though its historical margin was healthy, shareholders will want to see Electronic Arts become more profitable in the future.

In Q4, Electronic Arts generated an EBITDA margin profit margin of 20.2%, down 31.5 percentage points year on year. Since Electronic Arts’s EBITDA margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

9. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for Electronic Arts, its EPS declined by 10.5% annually over the last three years while its revenue was flat. This tells us the company struggled because its fixed cost base made it difficult to adjust to choppy demand.

Diving into the nuances of Electronic Arts’s earnings can give us a better understanding of its performance. As we mentioned earlier, Electronic Arts’s EBITDA margin declined by 14.4 percentage points over the last three years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, Electronic Arts reported EPS of $0.35, down from $1.11 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Electronic Arts’s full-year EPS of $2.66 to grow 123%.

10. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Electronic Arts has shown terrific cash profitability, driven by its lucrative business model and cost-effective customer acquisition strategy that enable it to stay ahead of the competition through investments in new products rather than sales and marketing. The company’s free cash flow margin was among the best in the consumer internet sector, averaging 28.6% over the last two years.

Taking a step back, we can see that Electronic Arts’s margin expanded by 15.7 percentage points over the last few years. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability fell.

Electronic Arts’s free cash flow clocked in at $1.77 billion in Q4, equivalent to a 93.2% margin. This result was good as its margin was 33.4 percentage points higher than in the same quarter last year, building on its favorable historical trend.

11. Balance Sheet Assessment

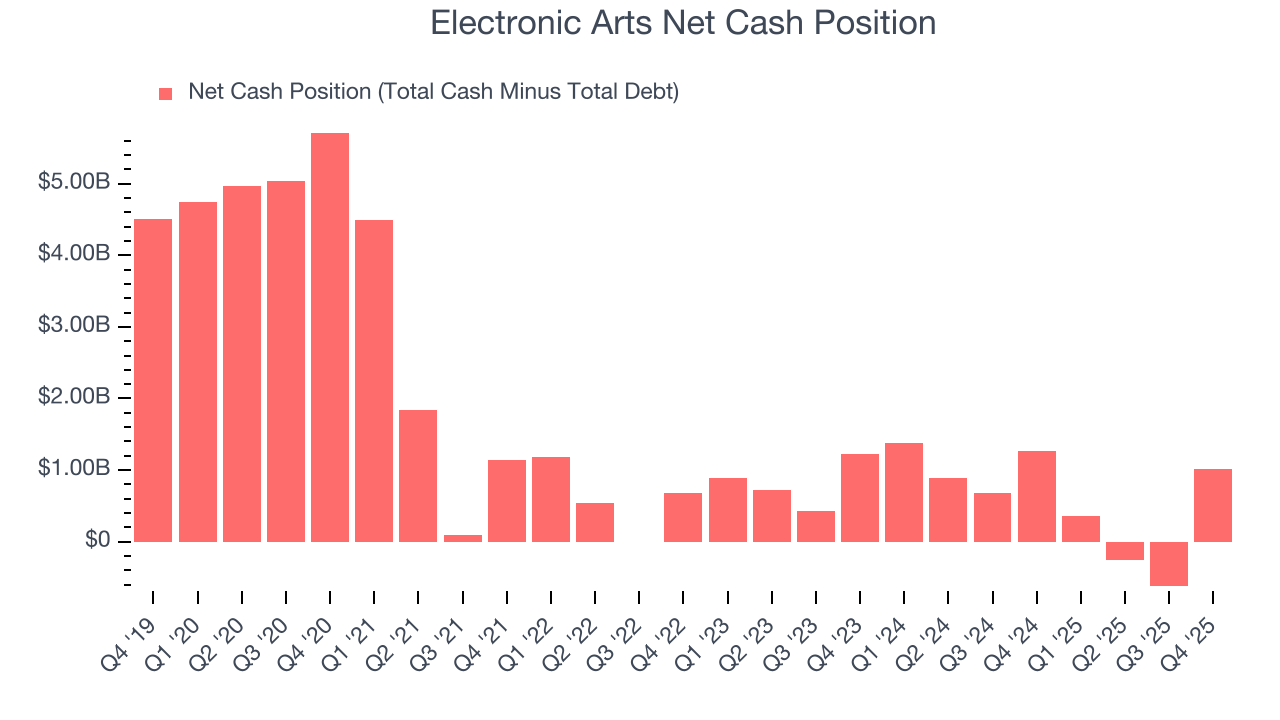

Businesses that maintain a cash surplus face reduced bankruptcy risk.

Electronic Arts is a profitable, well-capitalized company with $2.90 billion of cash and $1.89 billion of debt on its balance sheet. This $1.01 billion net cash position gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from Electronic Arts’s Q4 Results

We struggled to find many positives in these results. Its revenue missed and its EBITDA fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock remained flat at $202.05 immediately following the results.

13. Is Now The Time To Buy Electronic Arts?

Updated: February 3, 2026 at 4:25 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Electronic Arts.

There’s plenty to admire about Electronic Arts. Although its revenue was flat over the last three years, its growth over the next 12 months is expected to be higher. And while Electronic Arts’s declining EPS over the last three years makes it a less attractive asset to the public markets, its powerful free cash flow generation enables it to stay ahead of the competition through consistent reinvestment of profits. On top of that, its impressive EBITDA margins show it has a highly efficient business model.

Electronic Arts’s EV/EBITDA ratio based on the next 12 months is 15.8x. This valuation tells us it’s a bit of a market darling with a lot of good news priced in. Add this one to your watchlist and come back to it later.

Wall Street analysts have a consensus one-year price target of $204.16 on the company (compared to the current share price of $202.05).