eHealth (EHTH)

eHealth doesn’t excite us. Its poor revenue growth shows demand is soft and its cash burn makes us question its business model.― StockStory Analyst Team

1. News

2. Summary

Why We Think eHealth Will Underperform

Aiming to address a high-stakes and often confusing decision, eHealth (NASDAQ:EHTH) guides consumers through health insurance enrollment and related topics.

- Value proposition isn’t resonating strongly as its estimated membership averaged 2.7% drops over the last two years

- Projected sales decline of 4.4% for the next 12 months points to a tough demand environment ahead

- A silver lining is that its incremental sales over the last three years have been highly profitable as its earnings per share increased by 30.2% annually, topping its revenue gains

eHealth’s quality doesn’t meet our expectations. We’d rather invest in businesses with stronger moats.

Why There Are Better Opportunities Than eHealth

High Quality

Investable

Underperform

Why There Are Better Opportunities Than eHealth

eHealth’s stock price of $4.16 implies a valuation ratio of 2.6x forward EV/EBITDA. eHealth’s valuation may seem like a bargain, but we think there are valid reasons why it’s so cheap.

We’d rather pay up for companies with elite fundamentals than get a bargain on weak ones. Cheap stocks can be value traps, and as their performance deteriorates, they will stay cheap or get even cheaper.

3. eHealth (EHTH) Research Report: Q3 CY2025 Update

Online health insurance comparison site eHealth (NASDAQ:EHTH) reported Q3 CY2025 results beating Wall Street’s revenue expectations, but sales fell by 7.8% year on year to $53.87 million. The company expects the full year’s revenue to be around $545 million, close to analysts’ estimates. Its GAAP loss of $1.46 per share was 19.2% above analysts’ consensus estimates.

eHealth (EHTH) Q3 CY2025 Highlights:

- Revenue: $53.87 million vs analyst estimates of $51.69 million (7.8% year-on-year decline, 4.2% beat)

- EPS (GAAP): -$1.46 vs analyst estimates of -$1.81 (19.2% beat)

- Adjusted EBITDA: -$34.01 million vs analyst estimates of -$41.07 million (-63.1% margin, 17.2% beat)

- The company reconfirmed its revenue guidance for the full year of $545 million at the midpoint

- EBITDA guidance for the full year is $70 million at the midpoint, above analyst estimates of $66.81 million

- Operating Margin: -77.1%, down from -74% in the same quarter last year

- Free Cash Flow was -$28.94 million compared to -$47.05 million in the previous quarter

- Estimated Membership: 1.12 million, down 40,901 year on year

- Market Capitalization: $150.6 million

Company Overview

Aiming to address a high-stakes and often confusing decision, eHealth (NASDAQ:EHTH) guides consumers through health insurance enrollment and related topics.

The company was founded to provide customers with a convenient way to compare and purchase health insurance policies online by providing them with clear and concise information about plan options. The company's primary product is its online health insurance marketplace, where customers compare different health insurance plans, including Medicare Advantage, Medicare Supplement, and individual and family health insurance plans.

Buying health insurance is high stakes because it involves an individual, their entire family, or a workforce’s healthcare. It is also complex because of myriad plan options and their nuances - cost, coverage, provider networks, deductibles, etc. eHealth's online marketplace provides customers with transparency and clarity when selecting a health insurance plan. For example, an individual shopping for his/her family’s insurance may specify certain coverage needs and a certain budget, and the platform will surface and compare the best options based on those criteria.

eHealth’s customers include individuals and families, as well as small businesses and Medicare beneficiaries. The company generates revenue by earning commissions from insurance companies when customers purchase policies through its platform. Less significant sources of revenue include advertising and lead referral.

4. Online Marketplace

Marketplaces have existed for centuries. Where once it was a main street in a small town or a mall in the suburbs, sellers benefitted from proximity to one another because they could draw customers by offering convenience and selection. Today, a myriad of online marketplaces fulfill that same role, aggregating large customer bases, which attracts commission-paying sellers, generating flywheel scale effects that feed back into further customer acquisition.

Competitors either offering insurance products or digital healthcare management platforms include SelectQuote (NYSE:SLQT), HealthEquity (NASDAQ:HQY), and GoHealth (NASDAQ:GOCO).

5. Revenue Growth

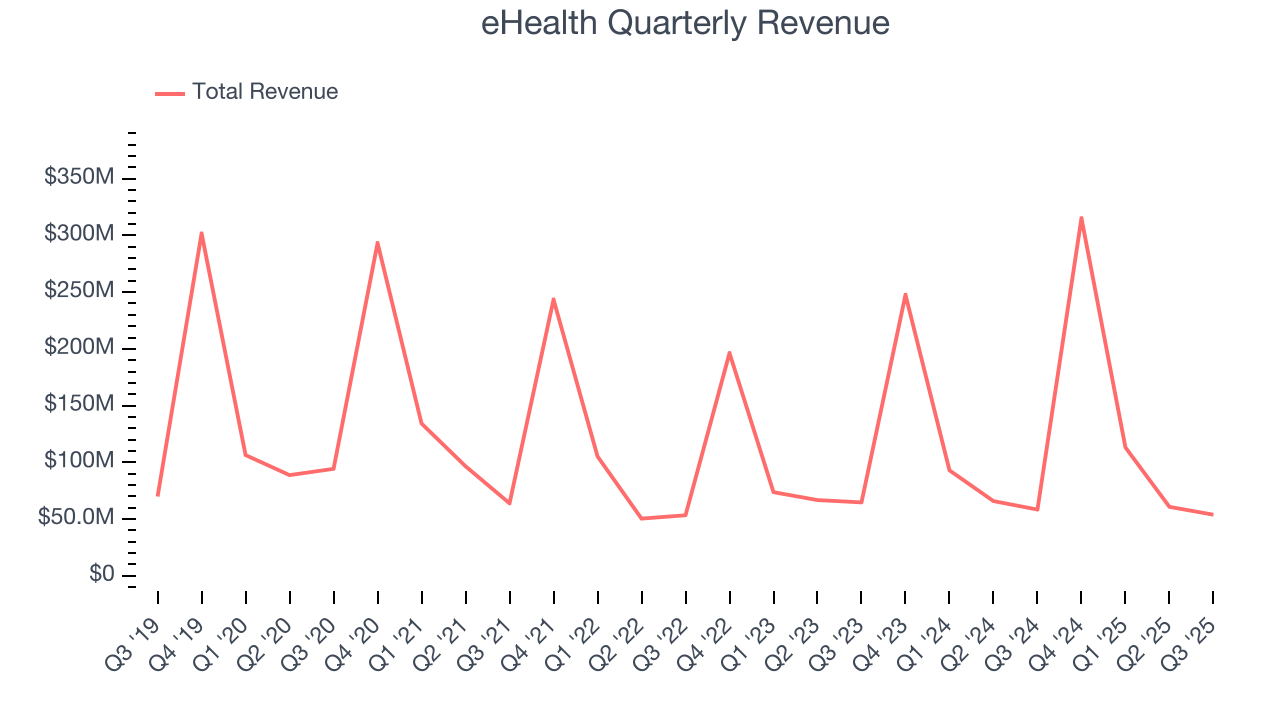

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last three years, eHealth grew its sales at a tepid 6.3% compounded annual growth rate. This was below our standard for the consumer internet sector and is a tough starting point for our analysis.

This quarter, eHealth’s revenue fell by 7.8% year on year to $53.87 million but beat Wall Street’s estimates by 4.2%.

Looking ahead, sell-side analysts expect revenue to decline by 1.3% over the next 12 months, a deceleration versus the last three years. This projection is underwhelming and implies its products and services will see some demand headwinds.

6. Estimated Membership

User Growth

As an online marketplace, eHealth generates revenue growth by increasing both the number of users on its platform and the average order size in dollars.

eHealth struggled with new customer acquisition over the last two years as its estimated membership have declined by 2.7% annually to 1.12 million in the latest quarter. This performance isn't ideal because internet usage is secular, meaning there are typically unaddressed market opportunities. If eHealth wants to accelerate growth, it likely needs to enhance the appeal of its current offerings or innovate with new products.

In Q3, eHealth’s estimated membership once again decreased by 40,901, a 3.5% drop since last year. The quarterly print isn’t too different from its two-year result, suggesting its new initiatives aren’t accelerating user growth just yet.

Revenue Per User

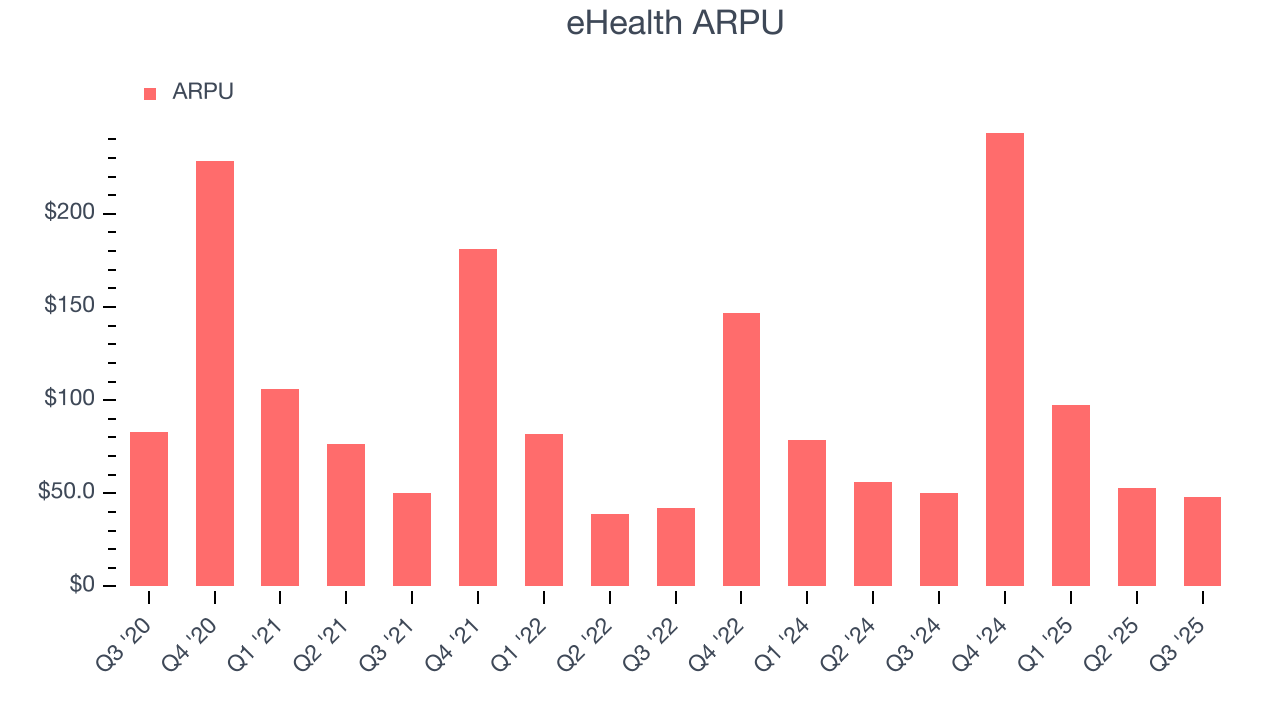

Average revenue per user (ARPU) is a critical metric to track because it measures how much the company earns in transaction fees from each user. ARPU also gives us unique insights into a user’s average order size and eHealth’s take rate, or "cut", on each order.

eHealth’s ARPU growth has been mediocre over the last two years, averaging 4.8%. This raises questions about its platform’s health when paired with its declining estimated membership. If eHealth wants to grow its users, it must either develop new features or lower its monetization of existing ones.

This quarter, eHealth’s ARPU clocked in at $48.16. It declined 4.4% year on year, mirroring the performance of its estimated membership.

7. User Acquisition Efficiency

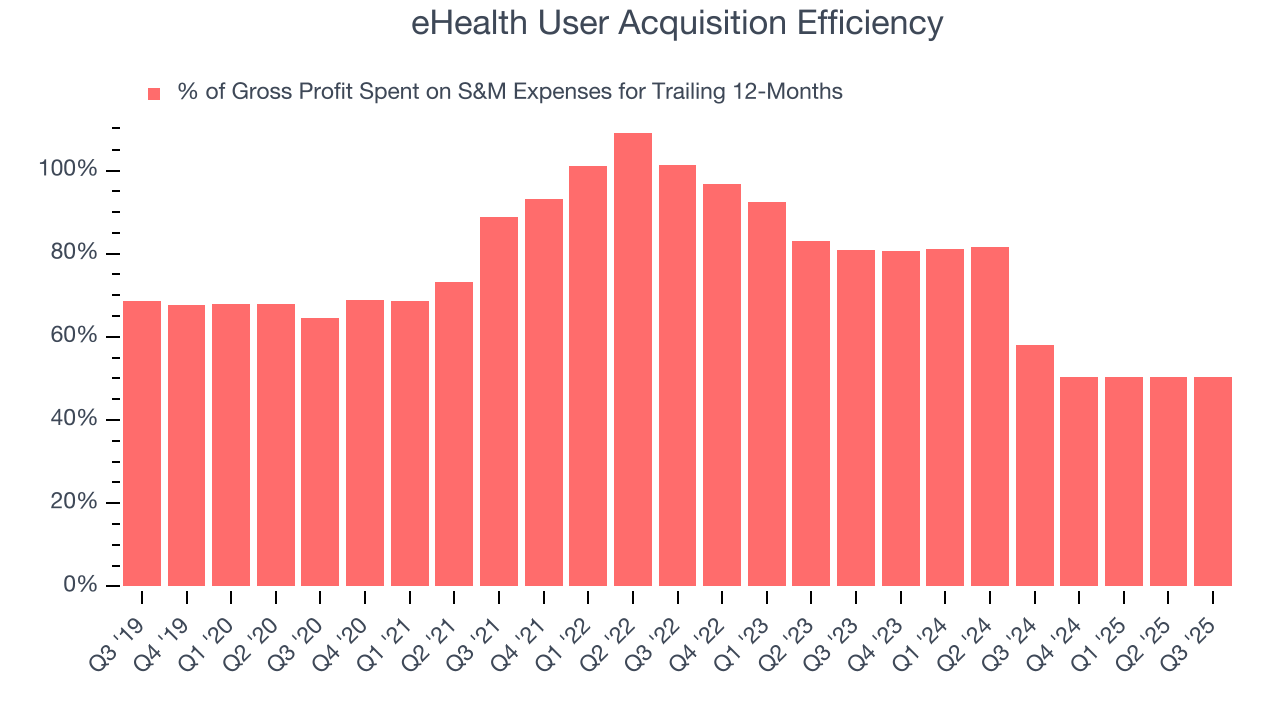

Consumer internet businesses like eHealth grow from a combination of product virality, paid advertisement, and incentives (unlike enterprise software products, which are often sold by dedicated sales teams).

It’s relatively expensive for eHealth to acquire new users as the company has spent 50.4% of its gross profit on sales and marketing expenses over the last year. This inefficiency indicates that eHealth operates in a competitive market and must continue investing to maintain an acceptable growth trajectory.

8. EBITDA

eHealth has been an efficient company over the last two years. It was one of the more profitable businesses in the consumer internet sector, boasting an average EBITDA margin of 10.2%.

Looking at the trend in its profitability, eHealth’s EBITDA margin rose by 29.7 percentage points over the last few years, as its sales growth gave it operating leverage.

This quarter, eHealth generated an EBITDA margin profit margin of negative 63.1%, down 3.5 percentage points year on year. This contraction shows it was less efficient because its expenses increased relative to its revenue.

9. Earnings Per Share

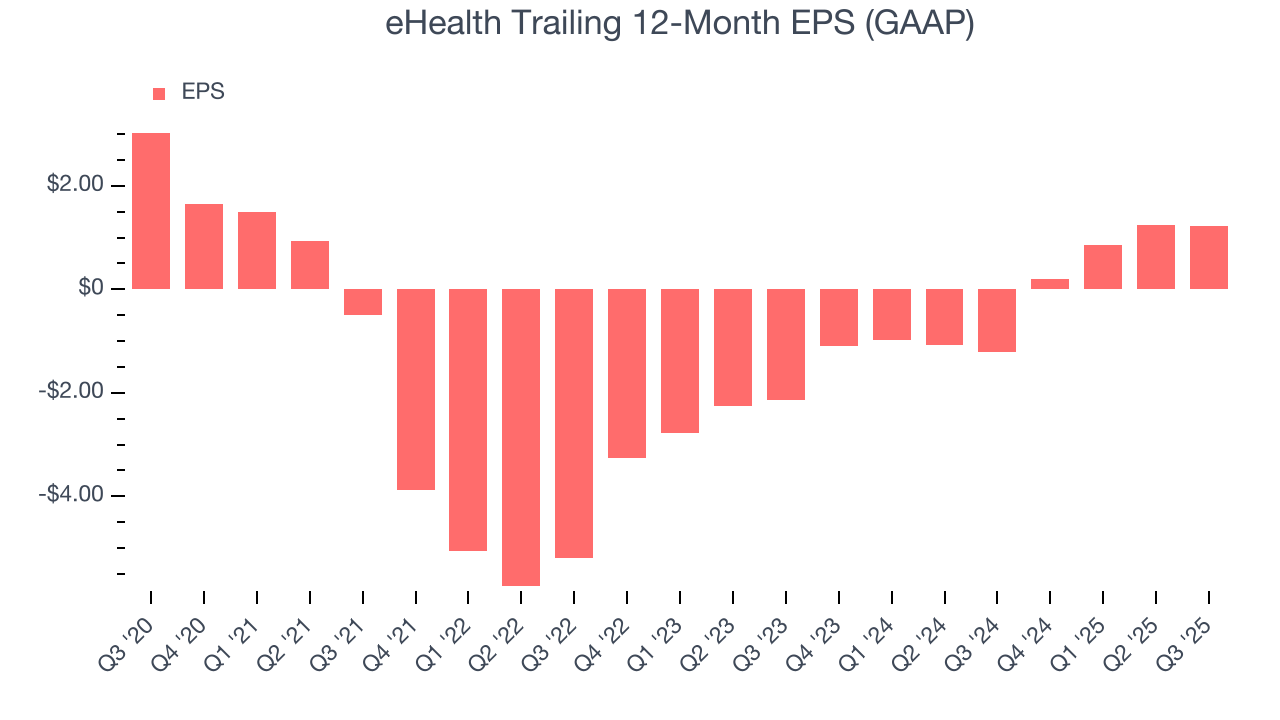

We track the change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

In Q3, eHealth reported EPS of negative $1.46, down from negative $1.44 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects eHealth to perform poorly. Analysts forecast its full-year EPS of $1.22 will invert to negative negative $1.31.

10. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

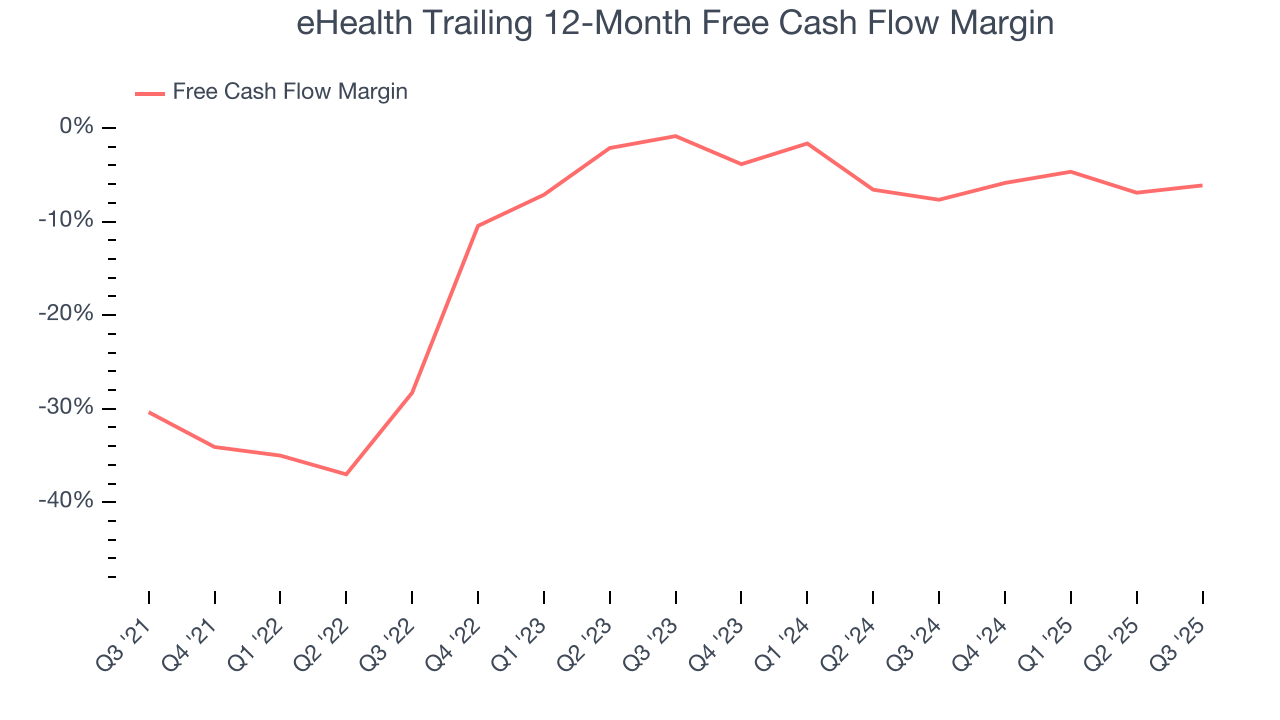

eHealth’s demanding reinvestments have consumed many resources over the last two years, contributing to an average free cash flow margin of negative 6.8%. This means it lit $6.84 of cash on fire for every $100 in revenue. This is a stark contrast from its EBITDA margin, and its investments (i.e., stocking inventory, building new facilities) are the primary culprit.

Taking a step back, an encouraging sign is that eHealth’s margin expanded by 22.2 percentage points over the last few years. We have no doubt shareholders would like to continue seeing its cash conversion rise.

eHealth burned through $28.94 million of cash in Q3, equivalent to a negative 53.7% margin. The company’s cash burn was similar to its $33.47 million of lost cash in the same quarter last year.

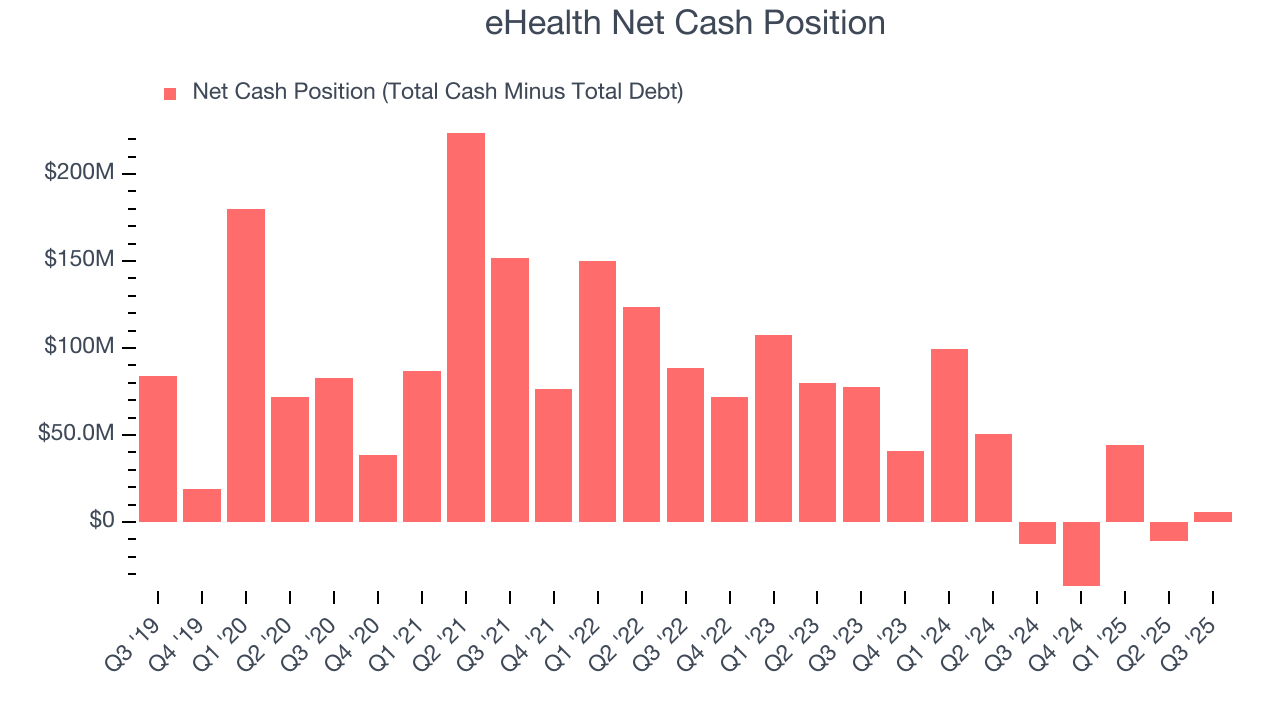

11. Balance Sheet Assessment

Companies with more cash than debt have lower bankruptcy risk.

eHealth is a well-capitalized company with $75.3 million of cash and $69.42 million of debt on its balance sheet. This $5.88 million net cash position is 3.9% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from eHealth’s Q3 Results

We were impressed by how significantly eHealth blew past analysts’ EBITDA expectations this quarter. We were also glad its full-year EBITDA guidance trumped Wall Street’s estimates. On the other hand, its number of users declined and its full-year revenue guidance was in line with Wall Street’s estimates. Overall, we think this was mixed quarter. The stock traded down 1.4% to $4.84 immediately after reporting.

13. Is Now The Time To Buy eHealth?

Updated: December 4, 2025 at 9:35 PM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

eHealth’s business quality ultimately falls short of our standards. First off, its revenue growth was uninspiring over the last three years, and analysts expect its demand to deteriorate over the next 12 months. And while its rising cash profitability gives it more optionality, the downside is its users have declined. On top of that, its cash burn raises the question of whether it can sustainably maintain growth.

eHealth’s EV/EBITDA ratio based on the next 12 months is 2.7x. While this valuation is optically cheap, the potential downside is big given its shaky fundamentals. We're fairly confident there are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $8.50 on the company (compared to the current share price of $4.15).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.