Sea (SE)

We admire Sea. Its rare blend of high growth, robust profitability, and a strong outlook makes it a wonderful asset.― StockStory Analyst Team

1. News

2. Summary

Why We Like Sea

Founded in 2009 and a publicly traded company since 2017, Sea (NYSE:SE) started as a gaming platform and has since expanded to offer a variety of services such as e-commerce, digital payments, and financial services across Southeast Asia.

- Paying Users have increased by an average of 21.9% annually, giving it the potential for margin-accretive growth if it can develop valuable complementary products and features

- Performance over the past three years shows its incremental sales were extremely profitable, as its annual earnings per share growth of 42.6% outpaced its revenue gains

- Platform’s growing usage and its ability to increase user spending by 9.9% annually showcases its high switching costs

Sea is a market leader. The valuation looks reasonable based on its quality, so this might be a favorable time to invest in some shares.

Why Is Now The Time To Buy Sea?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Sea?

At $113.98 per share, Sea trades at 17.8x forward EV/EBITDA. Looking at the consumer internet space, we think the valuation is fair - potentially even too low - for the business quality.

Entry price matters far less than business fundamentals if you’re investing for a multi-year period. But if you can get a bargain price it’s certainly icing on the cake.

3. Sea (SE) Research Report: Q3 CY2025 Update

E-commerce and gaming company Sea (NYSE:SE) reported Q3 CY2025 results topping the market’s revenue expectations, with sales up 36.5% year on year to $5.99 billion. Its GAAP profit of $0.59 per share was 20.6% below analysts’ consensus estimates.

Sea (SE) Q3 CY2025 Highlights:

- Revenue: $5.99 billion vs analyst estimates of $5.64 billion (36.5% year-on-year growth, 6.1% beat)

- EPS (GAAP): $0.59 vs analyst expectations of $0.74 (20.6% miss)

- Adjusted EBITDA: $874.3 million vs analyst estimates of $825.4 million (14.6% margin, 5.9% beat)

- Operating Margin: 8%, up from 4.6% in the same quarter last year

- Paying Users: 65.9 million, up 15.7 million year on year

- Market Capitalization: $91.79 billion

Company Overview

Founded in 2009 and a publicly traded company since 2017, Sea (NYSE:SE) started as a gaming platform and has since expanded to offer a variety of services such as e-commerce, digital payments, and financial services across Southeast Asia.

Garena, the initial product offering, is not just a single game but an ecosystem that allows users to play and socialize with other gamers from around the world. Whether players prefer action-packed shooters or strategy games, Garena seemingly has something for everyone, with additional features such as real-time chat to enhance engagement.

After gaming, Sea expanded into e-commerce with its Shopee platform, which is one of the largest digital marketplaces in Southeast Asia. Shopee allows users to buy and sell a wide variety of products, from electronics to groceries. Sea’s approach to e-commerce is a hybrid one–it acts as a marketplace but also holds inventory for some product categories. The company also offers financial services such as money transfers, bill payments, and pre-paid mobile phone top-ups through its SeaMoney platform.

In e-commerce, Sea generates revenue by taking a cut of the sale price when it acts as a marketplace and makes money on the actual sale price when it holds inventory. Gaming revenue primarily makes money through in-game purchases, where players can buy virtual goods such as skins, weapons, and other enhancements to improve the gaming experience.

4. Online Marketplace

Marketplaces have existed for centuries. Where once it was a main street in a small town or a mall in the suburbs, sellers benefitted from proximity to one another because they could draw customers by offering convenience and selection. Today, a myriad of online marketplaces fulfill that same role, aggregating large customer bases, which attracts commission-paying sellers, generating flywheel scale effects that feed back into further customer acquisition.

Competitors offering e-commerce platforms include Amazon.com (NASDAQ:AMZN) and Alibaba (NYSE:BABA), and competitors offering digital gaming include Sony (TSE:6758) and Nintendo (TSE:7974).

5. Revenue Growth

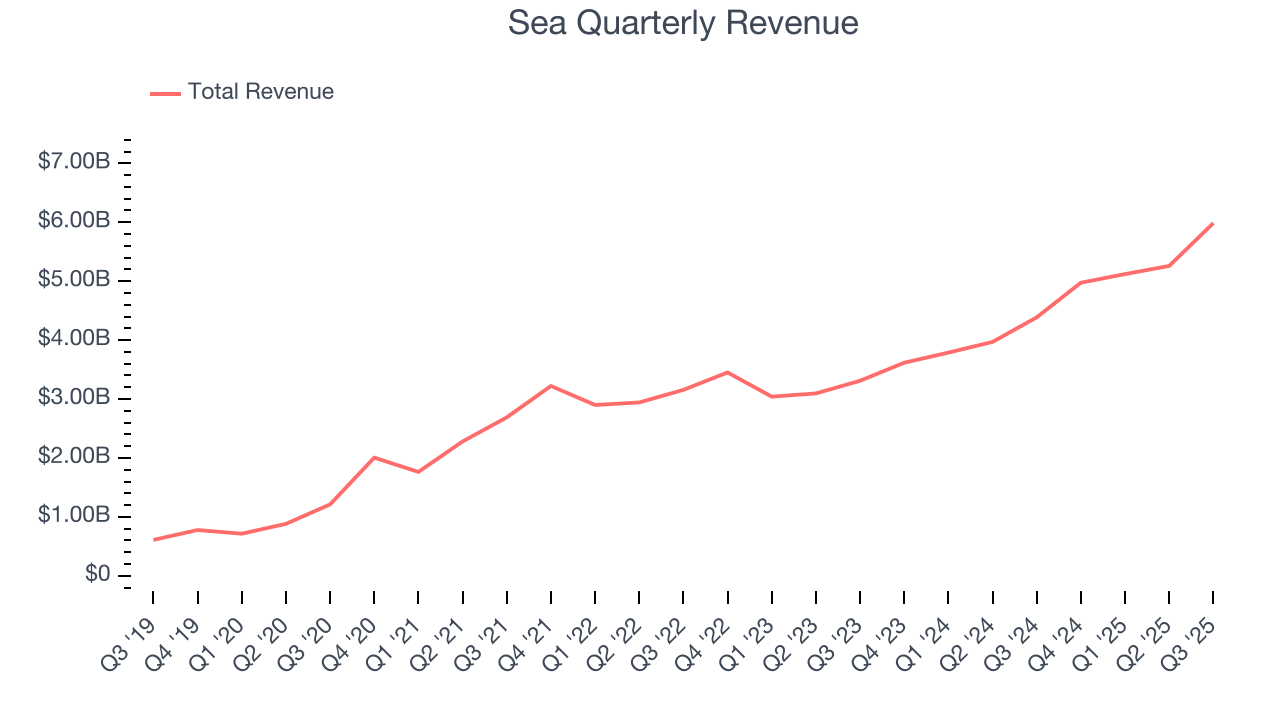

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last three years, Sea grew its sales at an impressive 20.4% compounded annual growth rate. Its growth surpassed the average consumer internet company and shows its offerings resonate with customers, a great starting point for our analysis.

This quarter, Sea reported wonderful year-on-year revenue growth of 36.5%, and its $5.99 billion of revenue exceeded Wall Street’s estimates by 6.1%.

Looking ahead, sell-side analysts expect revenue to grow 18.8% over the next 12 months, a slight deceleration versus the last three years. We still think its growth trajectory is attractive given its scale and suggests the market is forecasting success for its products and services.

6. Paying Users

User Growth

As an online marketplace, Sea generates revenue growth by increasing both the number of users on its platform and the average order size in dollars.

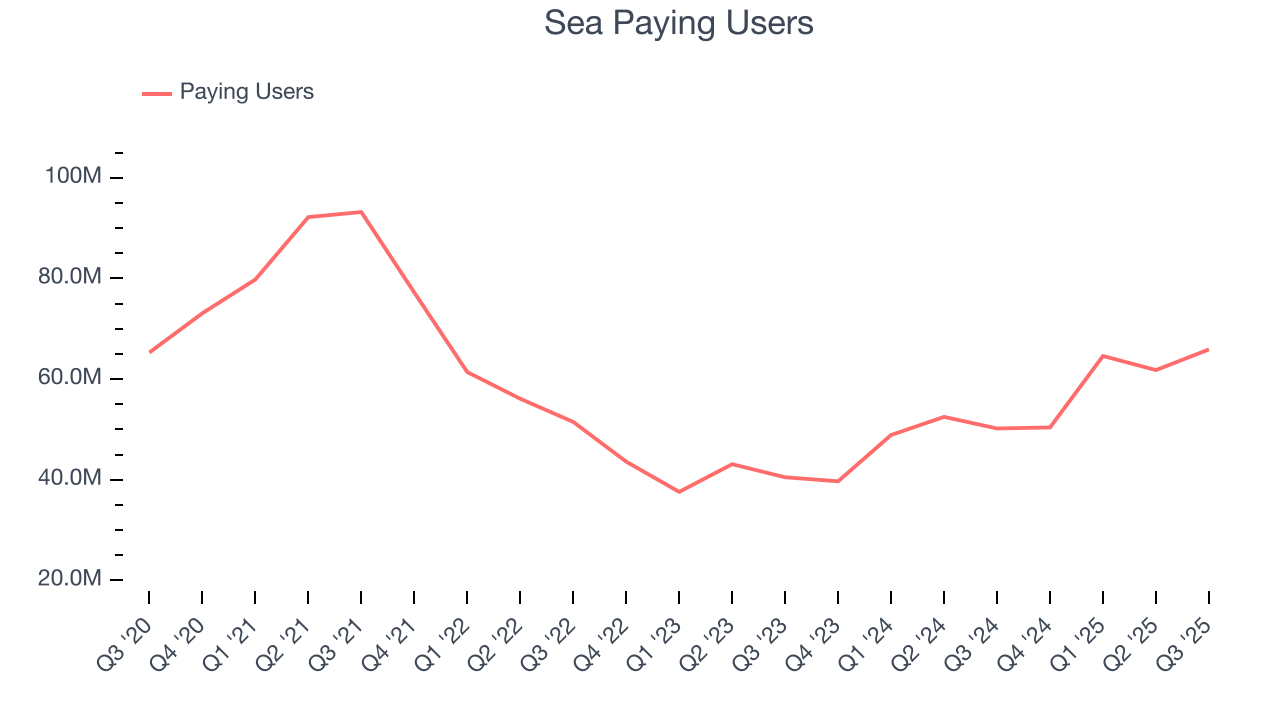

Over the last two years, Sea’s paying users, a key performance metric for the company, increased by 21.9% annually to 65.9 million in the latest quarter. This growth rate is among the fastest of any consumer internet business and indicates its offerings have significant traction.

In Q3, Sea added 15.7 million paying users, leading to 31.3% year-on-year growth. The quarterly print was higher than its two-year result, suggesting its new initiatives are accelerating user growth.

Revenue Per User

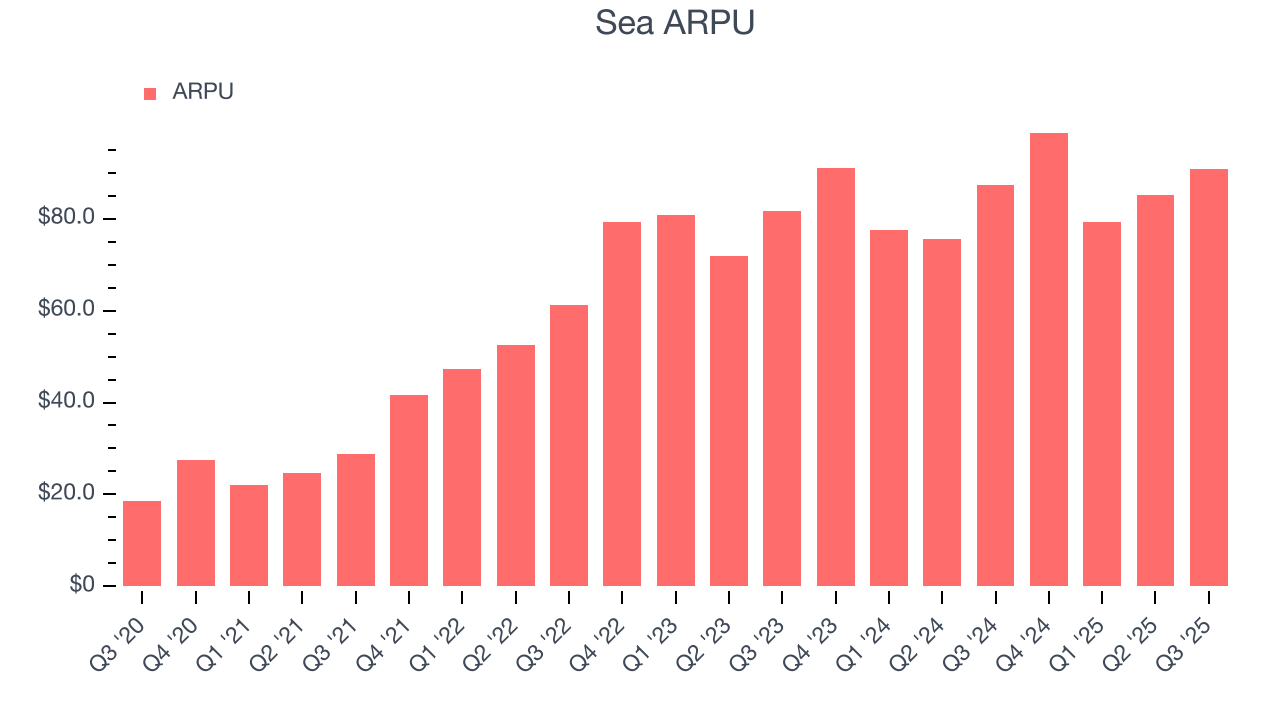

Average revenue per user (ARPU) is a critical metric to track because it measures how much the company earns in transaction fees from each user. ARPU also gives us unique insights into a user’s average order size and Sea’s take rate, or "cut", on each order.

Sea’s ARPU growth has been strong over the last two years, averaging 6.3%. Its ability to increase monetization while quickly growing its paying users reflects the strength of its platform, as its users continue to spend more each year.

This quarter, Sea’s ARPU clocked in at $90.83. It grew by 3.9% year on year, slower than its user growth.

7. Gross Margin & Pricing Power

For online marketplaces like Sea, gross profit tells us how much money the company gets to keep after covering the base cost of its products and services, which typically include payment processing, hosting, and bandwidth fees in addition to the costs necessary to onboard buyers and sellers, such as identity verification.

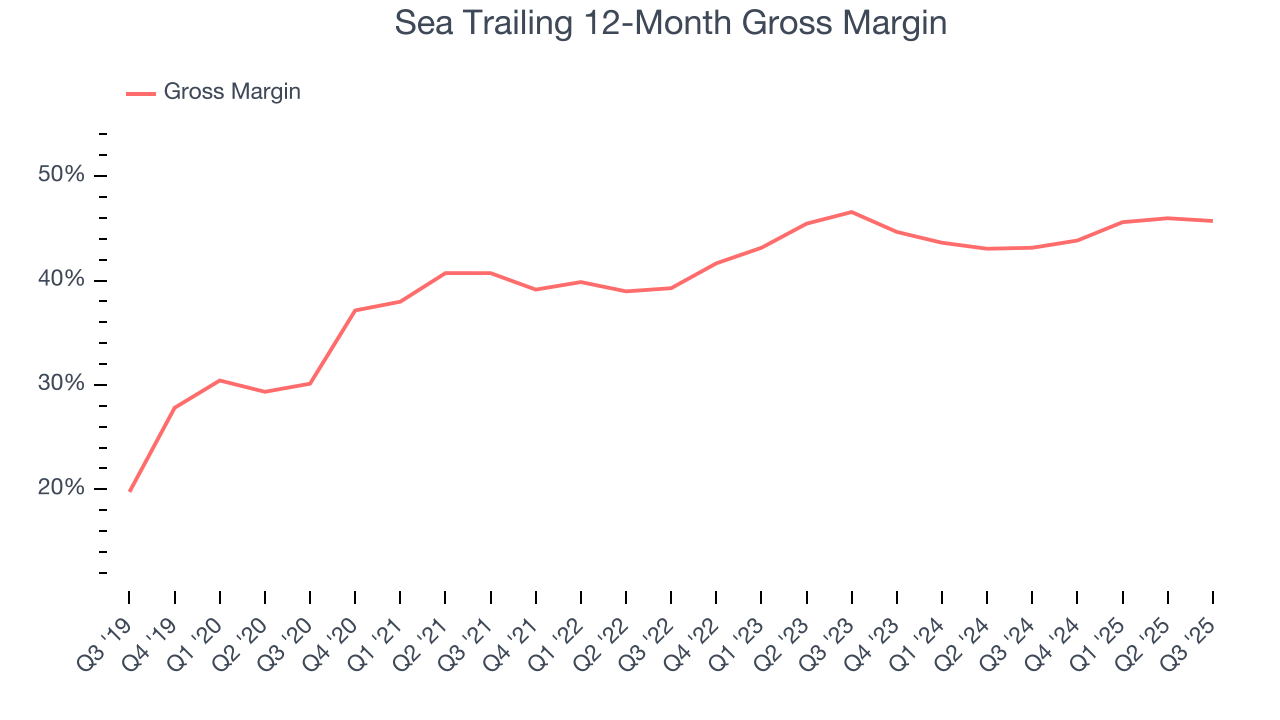

Sea’s gross margin is below the broader consumer internet industry, giving it less room to hire engineering talent that can develop new products and services. As you can see below, it averaged a 44.6% gross margin over the last two years. That means Sea paid its providers a lot of money ($55.38 for every $100 in revenue) to run its business.

Sea produced a 43.4% gross profit margin in Q3, in line with the same quarter last year. Zooming out, Sea’s full-year margin has been trending up over the past 12 months, increasing by 2.6 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as servers).

8. User Acquisition Efficiency

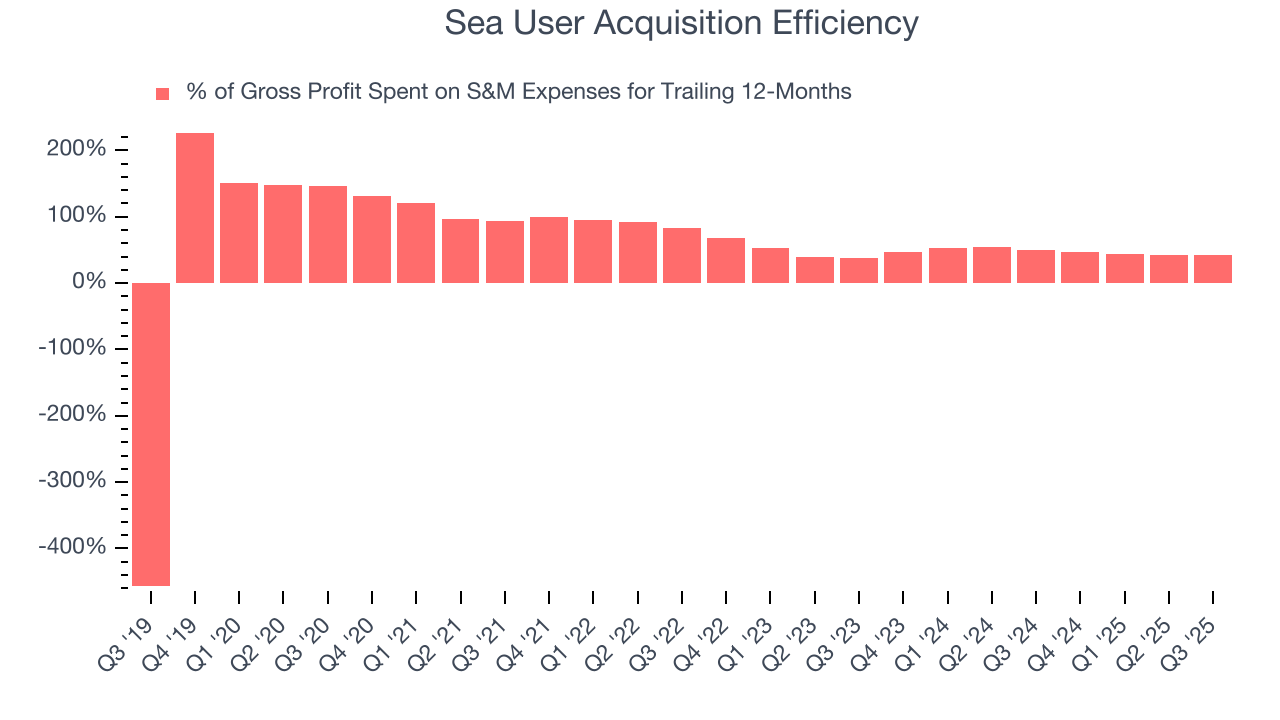

Consumer internet businesses like Sea grow from a combination of product virality, paid advertisement, and incentives (unlike enterprise software products, which are often sold by dedicated sales teams).

Sea does a decent job acquiring new users, spending 42.5% of its gross profit on sales and marketing expenses over the last year. This decent efficiency indicates relatively solid competitive positioning, giving Sea the freedom to invest its resources into new growth initiatives.

9. EBITDA

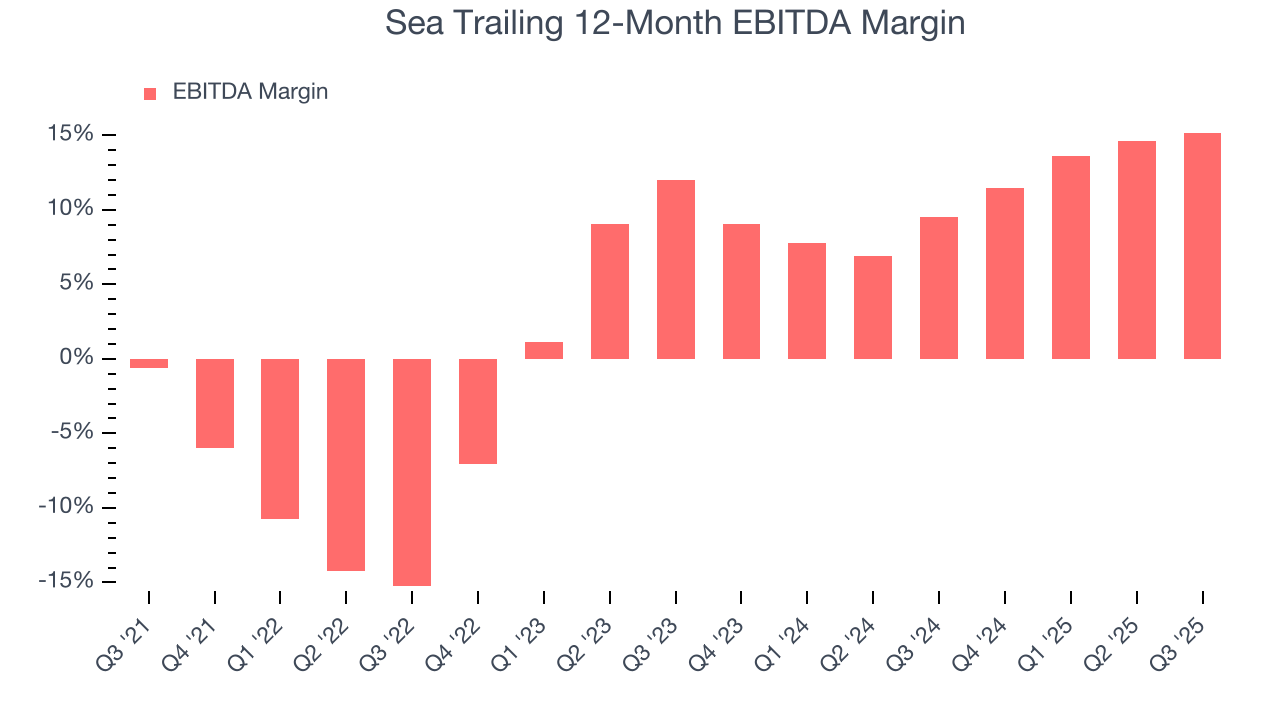

Sea has been an efficient company over the last two years. It was one of the more profitable businesses in the consumer internet sector, boasting an average EBITDA margin of 12.8%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Analyzing the trend in its profitability, Sea’s EBITDA margin rose by 30.5 percentage points over the last few years, as its sales growth gave it immense operating leverage.

This quarter, Sea generated an EBITDA margin profit margin of 14.6%, up 2.7 percentage points year on year. The increase was encouraging, and because its EBITDA margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

10. Earnings Per Share

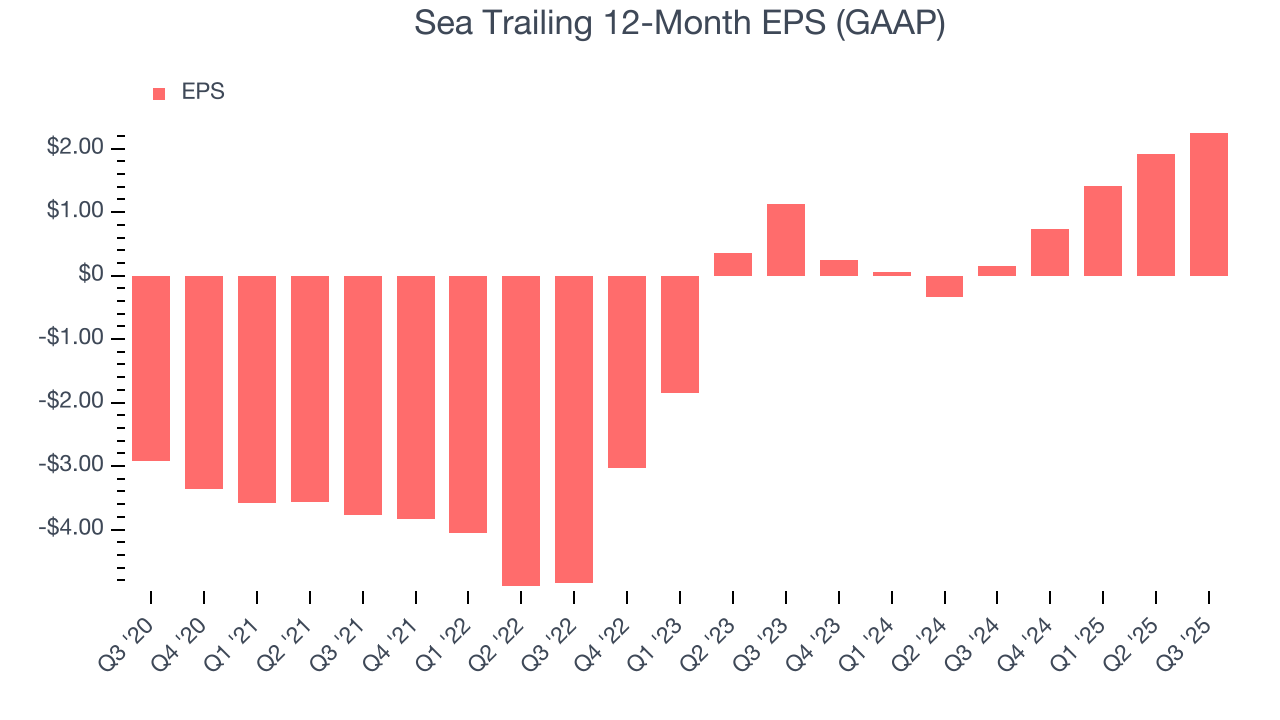

Revenue trends explain a company’s historical growth, but the change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

In Q3, Sea reported EPS of $0.59, up from $0.25 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects Sea’s full-year EPS of $2.25 to grow 60.7%.

11. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

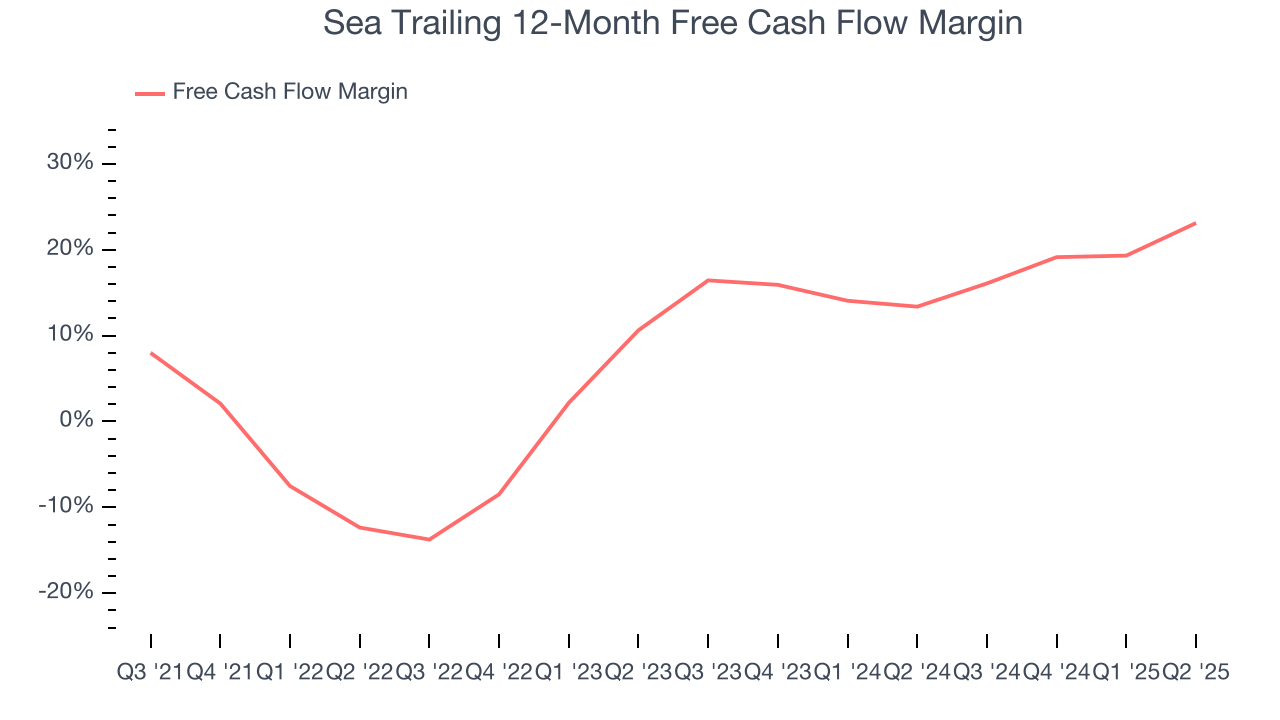

Sea has shown robust cash profitability, giving it an edge over its competitors and the ability to reinvest or return capital to investors. The company’s free cash flow margin averaged 19.1% over the last two years, quite impressive for a consumer internet business.

Taking a step back, we can see that Sea’s margin expanded by 38.8 percentage points over the last few years. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

12. Balance Sheet Assessment

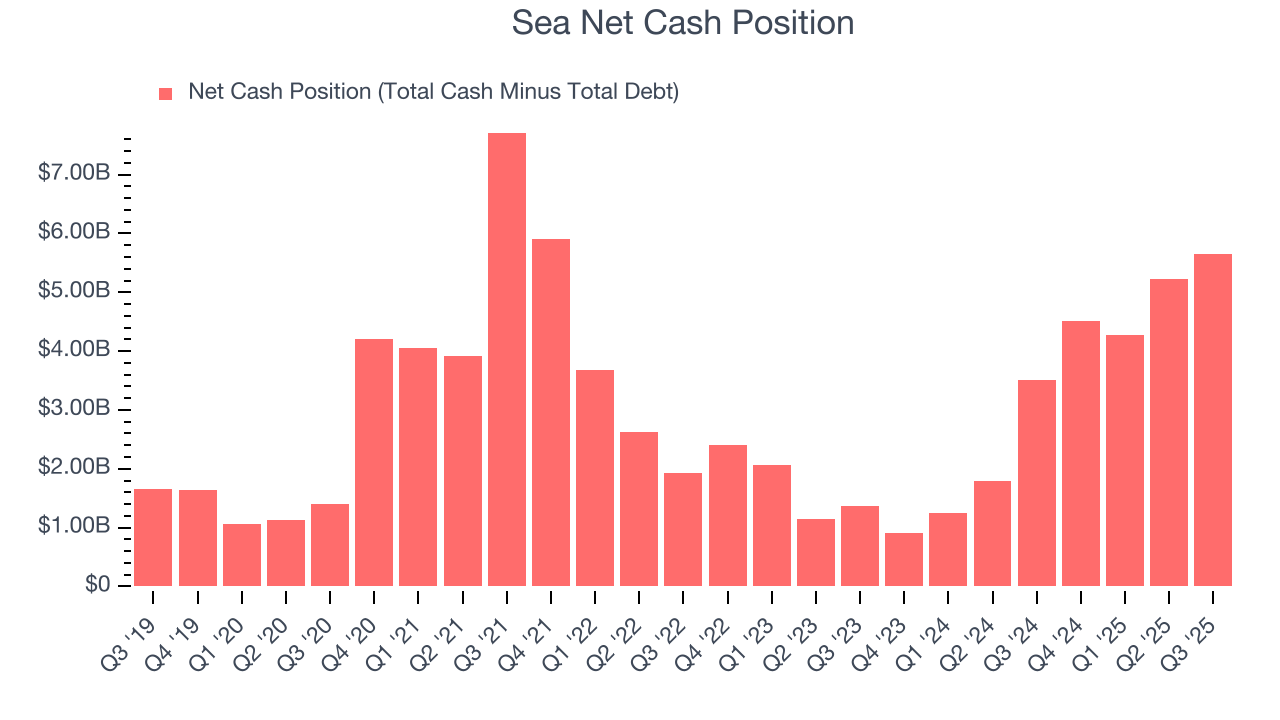

Businesses that maintain a cash surplus face reduced bankruptcy risk.

Sea is a profitable, well-capitalized company with $9.90 billion of cash and $4.24 billion of debt on its balance sheet. This $5.66 billion net cash position is 6.7% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

13. Key Takeaways from Sea’s Q3 Results

We enjoyed seeing Sea beat analysts’ EBITDA expectations this quarter. We were also glad it expanded its number of users. Zooming out, we think this was a good print with some key areas of upside. Investors were likely hoping for more, and shares traded down 7.6% to $143.35 immediately following the results.

14. Is Now The Time To Buy Sea?

Updated: February 2, 2026 at 9:39 PM EST

Are you wondering whether to buy Sea or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

There are several reasons why we think Sea is a great business. First, the company’s revenue growth was impressive over the last three years, and analysts believe it can continue growing at these levels. And while its gross margins make it more difficult to reach positive operating profits compared to other consumer internet businesses, its rising cash profitability gives it more optionality. Additionally, Sea’s expanding EBITDA margin shows the business has become more efficient.

Sea’s EV/EBITDA ratio based on the next 12 months is 17.8x. Looking across the spectrum of consumer internet companies today, Sea’s fundamentals shine bright. We like the stock at this price.

Wall Street analysts have a consensus one-year price target of $190.04 on the company (compared to the current share price of $113.98), implying they see 66.7% upside in buying Sea in the short term.