European Wax Center (EWCZ)

We wouldn’t recommend European Wax Center. Its sales have underperformed and its low returns on capital show it has few growth opportunities.― StockStory Analyst Team

1. News

2. Summary

Why We Think European Wax Center Will Underperform

Founded by two siblings, European Wax Center (NASDAQ:EWCZ) is a beauty and waxing salon chain specializing in professional wax services and skincare products.

- Lackluster 14.5% annual revenue growth over the last five years indicates the company is losing ground to competitors

- Earnings per share lagged its peers over the last four years as they only grew by 4% annually

- Sales are projected to be flat over the next 12 months and imply weak demand

European Wax Center doesn’t check our boxes. There are more appealing investments to be made.

Why There Are Better Opportunities Than European Wax Center

High Quality

Investable

Underperform

Why There Are Better Opportunities Than European Wax Center

European Wax Center’s stock price of $5.72 implies a valuation ratio of 10.8x forward P/E. European Wax Center’s multiple may seem like a great deal among consumer discretionary peers, but we think there are valid reasons why it’s this cheap.

We’d rather pay up for companies with elite fundamentals than get a bargain on weak ones. Cheap stocks can be value traps, and as their performance deteriorates, they will stay cheap or get even cheaper.

3. European Wax Center (EWCZ) Research Report: Q3 CY2025 Update

Beauty and waxing service franchise European Wax Center (NASDAQ:EWCZ) reported Q3 CY2025 results beating Wall Street’s revenue expectations, but sales fell by 2.2% year on year to $54.19 million. The company expects the full year’s revenue to be around $207 million, close to analysts’ estimates. Its GAAP profit of $0.09 per share was significantly above analysts’ consensus estimates.

European Wax Center (EWCZ) Q3 CY2025 Highlights:

- Revenue: $54.19 million vs analyst estimates of $52.75 million (2.2% year-on-year decline, 2.7% beat)

- EPS (GAAP): $0.09 vs analyst estimates of $0.04 (significant beat)

- Adjusted EBITDA: $20.17 million vs analyst estimates of $15.66 million (37.2% margin, 28.8% beat)

- The company reconfirmed its revenue guidance for the full year of $207 million at the midpoint

- EBITDA guidance for the full year is $70 million at the midpoint, below analyst estimates of $71.06 million

- Operating Margin: 25.6%, up from 17.1% in the same quarter last year

- Free Cash Flow Margin: 30.4%, up from 26.6% in the same quarter last year

- Same-Store Sales were flat year on year, in line with the same quarter last year

- Market Capitalization: $158.3 million

Company Overview

Founded by two siblings, European Wax Center (NASDAQ:EWCZ) is a beauty and waxing salon chain specializing in professional wax services and skincare products.

European Wax Center recognized the need for a waxing experience focused on comfort and hygiene. The company aimed to provide a luxurious experience, prioritizing customer care and high-quality products. It began with a single salon and has since expanded into a prominent chain.

The company offers a wide range of waxing services for both men and women, including facial and body waxing. European Wax Center's appeal is in its proprietary Comfort Wax, made from natural beeswax. The popularity of Comfort Wax has incentivized the company to market other skincare products that complement its core services.

Revenue is generated through a combination of service fees and product sales. Its business model includes franchise and corporate-owned locations, allowing for scalability and flexibility in expansion. European Wax Center's revenue model is further bolstered by royalty fees from franchisees, which typically come with higher margins.

4. Leisure Facilities

Leisure facilities companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted their spending from "things" to "experiences". Leisure facilities seek to benefit but must innovate to do so because of the industry's high competition and capital intensity.

As a niche business, European Wax Center has no direct public competitors. Privately owned competitors include Bluemercury, Radiant Waxing, and Waxing the City.

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, European Wax Center grew its sales at a 14.5% compounded annual growth rate. Although this growth is acceptable on an absolute basis, it fell short of our standards for the consumer discretionary sector, which enjoys a number of secular tailwinds.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. European Wax Center’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 1.6% annually. Note that COVID hurt European Wax Center’s business in 2020 and part of 2021, and it bounced back in a big way thereafter.

European Wax Center also reports same-store sales, which show how much revenue its established locations generate. Over the last two years, European Wax Center’s same-store sales were flat. Because this number is better than its revenue growth, we can see its sales from existing locations are performing better than its sales from new locations.

This quarter, European Wax Center’s revenue fell by 2.2% year on year to $54.19 million but beat Wall Street’s estimates by 2.7%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. Although this projection suggests its newer products and services will catalyze better top-line performance, it is still below average for the sector.

6. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

European Wax Center’s operating margin has been trending up over the last 12 months and averaged 22.8% over the last two years. On top of that, its profitability was elite for a consumer discretionary business thanks to its efficient cost structure and economies of scale.

In Q3, European Wax Center generated an operating margin profit margin of 25.6%, up 8.6 percentage points year on year. This increase was a welcome development, especially since its revenue fell, showing it was more efficient because it scaled down its expenses.

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

European Wax Center’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

In Q3, European Wax Center reported EPS of $0.09, up from $0.07 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

European Wax Center has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the consumer discretionary sector, averaging 26.6% over the last two years.

European Wax Center’s free cash flow clocked in at $16.49 million in Q3, equivalent to a 30.4% margin. This result was good as its margin was 3.8 percentage points higher than in the same quarter last year, but we wouldn’t put too much weight on the short term because investment needs can be seasonal, causing temporary swings. Long-term trends are more important.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

European Wax Center historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 11.1%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, European Wax Center’s ROIC averaged 3.7 percentage point increases each year. This is a good sign, and if its returns keep rising, there’s a chance it could evolve into an investable business.

10. Balance Sheet Assessment

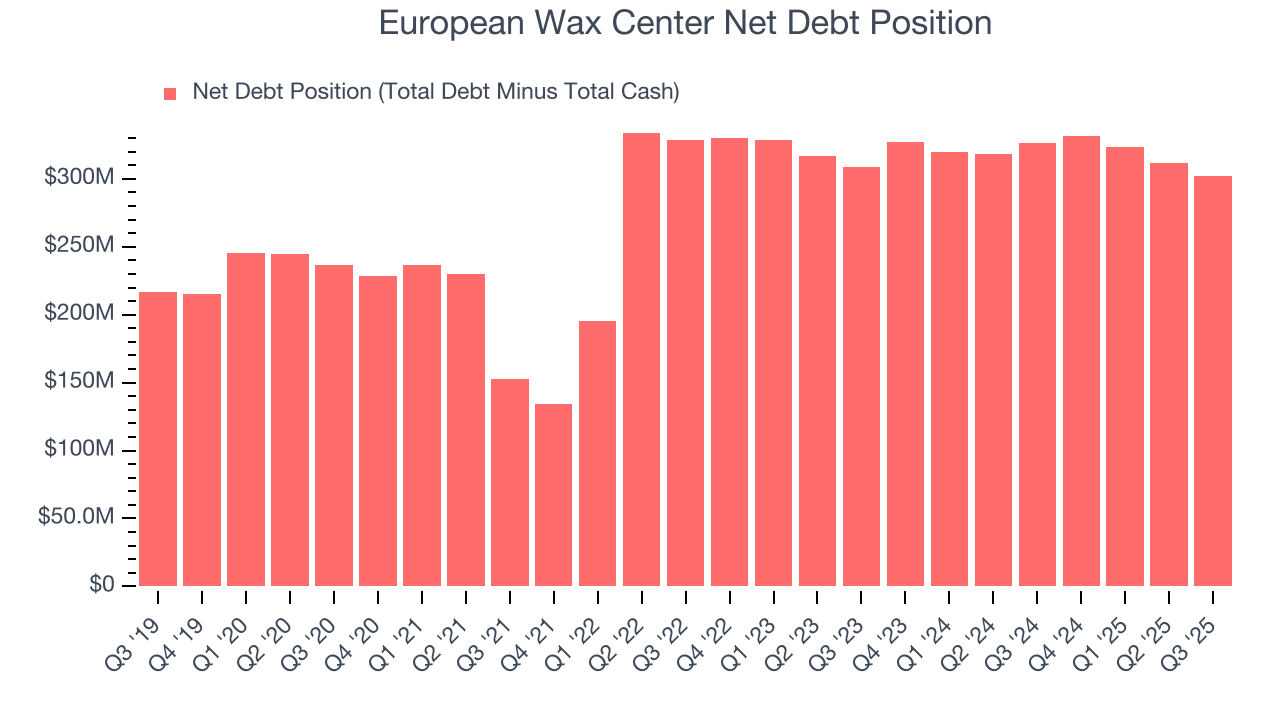

European Wax Center reported $80.02 million of cash and $382.2 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $79.49 million of EBITDA over the last 12 months, we view European Wax Center’s 3.8× net-debt-to-EBITDA ratio as safe. We also see its $13.16 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from European Wax Center’s Q3 Results

It was good to see European Wax Center beat analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. On the other hand, its full-year revenue guidance was in line and its full-year EBITDA guidance fell slightly short of Wall Street’s estimates. Overall, this print was mixed but still had some key positives. The stock traded up 3.3% to $3.77 immediately after reporting.

12. Is Now The Time To Buy European Wax Center?

Updated: February 28, 2026 at 10:15 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in European Wax Center.

We see the value of companies helping consumers, but in the case of European Wax Center, we’re out. On top of that, European Wax Center’s same-store sales performance has disappointed, and its weak EPS growth over the last four years shows it’s failed to produce meaningful profits for shareholders.

European Wax Center’s P/E ratio based on the next 12 months is 10.8x. This valuation multiple is fair, but we don’t have much confidence in the company. There are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $7.13 on the company (compared to the current share price of $5.72).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.