Live Nation (LYV)

We’re wary of Live Nation. Its weak returns on capital suggest it doesn’t generate sufficient profits, a sign of value destruction.― StockStory Analyst Team

1. News

2. Summary

Why We Think Live Nation Will Underperform

Owner of Ticketmaster and operator of music festival EDC, Live Nation (NYSE:LYV) is a company specializing in live event promotion, venue management, and ticketing services for concerts and shows.

- Operating margin falls short of the industry average, and the smaller profit dollars make it harder to react to unexpected market developments

- Ability to fund investments or reward shareholders with increased buybacks or dividends is restricted by its weak free cash flow margin of 6.6% for the last two years

- A positive is that its annual revenue growth of 68.4% over the past five years was outstanding, reflecting market share gains

Live Nation doesn’t meet our quality standards. We’ve identified better opportunities elsewhere.

Why There Are Better Opportunities Than Live Nation

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Live Nation

Live Nation is trading at $160.74 per share, or 119.9x forward P/E. This valuation is extremely expensive, especially for the quality you get.

We prefer to invest in similarly-priced but higher-quality companies with superior earnings growth.

3. Live Nation (LYV) Research Report: Q4 CY2025 Update

Live events and entertainment company Live Nation (NYSE:LYV) announced better-than-expected revenue in Q4 CY2025, with sales up 11.1% year on year to $6.31 billion.

Live Nation (LYV) Q4 CY2025 Highlights:

- Revenue: $6.31 billion vs analyst estimates of $6.10 billion (11.1% year-on-year growth, 3.5% beat)

- Operating Margin: -2.3%, up from -4.3% in the same quarter last year

- Free Cash Flow was -$5.3 million compared to -$39.6 million in the same quarter last year

- Market Capitalization: $36.17 billion

Company Overview

Owner of Ticketmaster and operator of music festival EDC, Live Nation (NYSE:LYV) is a company specializing in live event promotion, venue management, and ticketing services for concerts and shows.

The company was formed from the 2010 merger of Live Nation, a concert promotion firm, and Ticketmaster, a leading online ticketing platform. This strategic combination aimed to simplify event management and ticketing processes by providing comprehensive services, including organizing live concerts, managing venues, and ticketing solutions, under one umbrella.

The core Live Nation business is unique in that it addresses the challenge of coordinating different aspects of event management, offering integrated solutions for artists to connect with their audiences in a live setting. On the other hand, Ticketmaster is a digital-first marketplace where fans can buy and sell tickets for events ranging from baseball games to music festivals.

Live Nation generates revenue from concert promotions, ticket sales, sponsorships, and advertising. Its integrated approach to live events benefits artists seeking full-service event management and fans looking for hassle-free access to live entertainment.

4. Consumer Discretionary - Leisure Facilities

The Consumer Discretionary sector, by definition, is made up of companies selling non-essential goods and services. When economic conditions deteriorate or tastes shift, consumers can easily cut back or eliminate these purchases. For long-term investors with five-year holding periods, this creates a structural challenge: the sector is inherently hit-driven, with low switching costs and fickle customers. As a result, only a handful of companies can reliably grow demand and compound earnings over long periods, which is why our bar is high and High Quality ratings are rare.

Leisure facilities companies own and operate theme parks, fitness centers, bowling alleys, and other venue-based entertainment destinations, generating revenue from admissions, memberships, and on-site spending. Tailwinds include consumer preference for experiential spending, tourism recovery, and technology-enhanced guest experiences that support premium pricing. Headwinds are notable: high fixed costs, such as real estate, labor, and maintenance, make profitability highly sensitive to attendance fluctuations during economic slowdowns. Weather, pandemics, and safety incidents can disrupt operations unpredictably. Rising construction and labor costs inflate expansion budgets, while competition from at-home entertainment alternatives and other experiential options limits pricing power in many markets.

Competitors in the live event promotion and management sector include Endeavor (NYSE:EDR), Disney (NYSE:DIS), and MSG Entertainment (NYSE:MSGE).

5. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Thankfully, Live Nation’s 68.4% annualized revenue growth over the last five years was exceptional. Its growth beat the average consumer discretionary company and shows its offerings resonate with customers.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Live Nation’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 5.3% over the last two years was well below its five-year trend. Note that COVID hurt Live Nation’s business in 2020 and part of 2021, and it bounced back in a big way thereafter.

This quarter, Live Nation reported year-on-year revenue growth of 11.1%, and its $6.31 billion of revenue exceeded Wall Street’s estimates by 3.5%.

Looking ahead, sell-side analysts expect revenue to grow 8.1% over the next 12 months. Although this projection implies its newer products and services will spur better top-line performance, it is still below average for the sector.

6. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Live Nation’s operating margin has risen over the last 12 months and averaged 4.3% over the last two years. The company’s higher efficiency is a breath of fresh air, but its suboptimal cost structure means it still sports inadequate profitability for a consumer discretionary business.

This quarter, Live Nation generated an operating margin profit margin of negative 2.3%, up 2 percentage points year on year. This increase was a welcome development and shows it was more efficient.

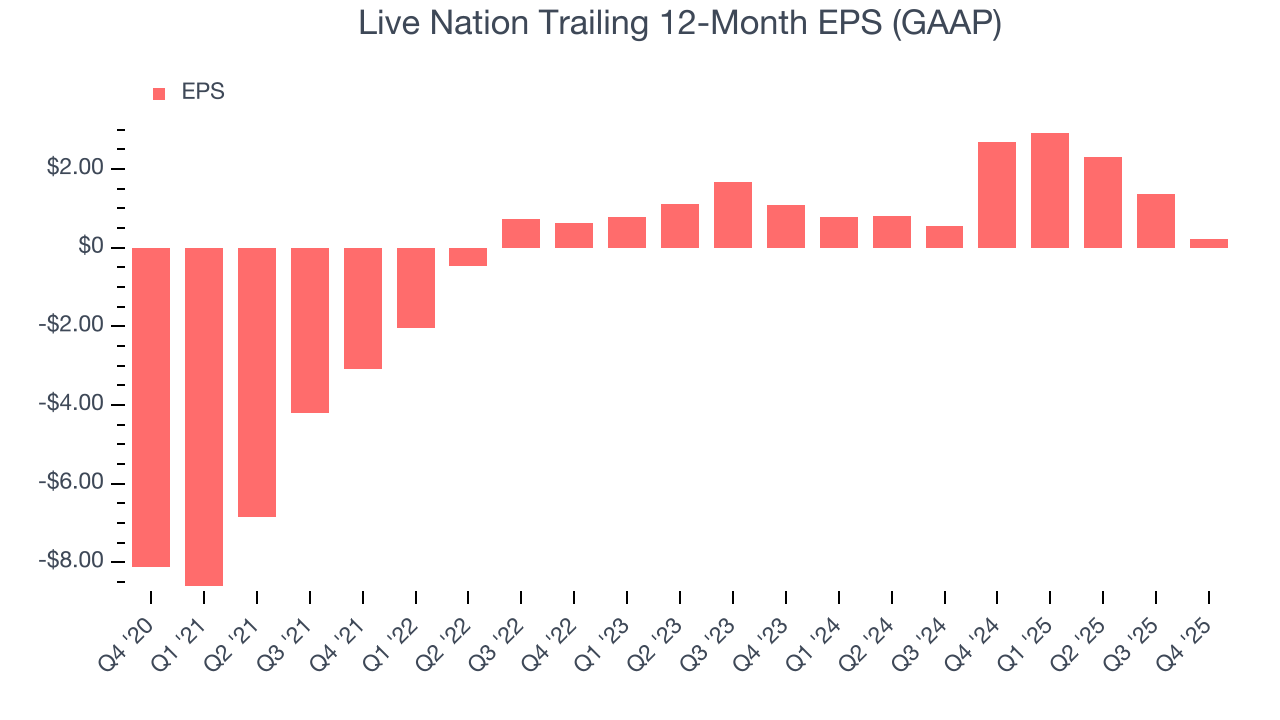

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Live Nation’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

In Q4, Live Nation reported EPS of negative $0.59, down from $0.56 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects Live Nation’s full-year EPS of $0.23 to grow 870%.

8. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Live Nation has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 6.4%, lousy for a consumer discretionary business.

Live Nation broke even from a free cash flow perspective in Q4. This cash profitability was in line with the comparable period last year but below its two-year average. In a silo, this isn’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

Over the next year, analysts’ consensus estimates show they’re expecting Live Nation’s free cash flow margin of 6.2% for the last 12 months to remain the same.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Live Nation historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 32.8%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Live Nation’s ROIC has increased. This is a good sign, but we recognize its lack of profitable growth during the COVID era was the primary reason for the change.

10. Balance Sheet Assessment

Live Nation reported $7.09 billion of cash and $10.24 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $2.70 billion of EBITDA over the last 12 months, we view Live Nation’s 1.2× net-debt-to-EBITDA ratio as safe. We also see its $124.1 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Live Nation’s Q4 Results

It was good to see Live Nation beat analysts’ EPS expectations this quarter. We were also excited its adjusted operating income outperformed Wall Street’s estimates by a wide margin. On the other hand, its EBITDA missed. Overall, we think this was a solid quarter with some key areas of upside. The stock traded up 3.2% to $162.45 immediately after reporting.

12. Is Now The Time To Buy Live Nation?

Updated: March 3, 2026 at 10:12 PM EST

When considering an investment in Live Nation, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

Live Nation isn’t a terrible business, but it doesn’t pass our bar. Although its revenue growth was exceptional over the last five years, it’s expected to deteriorate over the next 12 months and its Forecasted free cash flow margin suggests the company will ramp up its investments next year. And while the company’s projected EPS for the next year implies the company’s fundamentals will improve, the downside is its low free cash flow margins give it little breathing room.

Live Nation’s P/E ratio based on the next 12 months is 119.9x. Beauty is in the eye of the beholder, but we don’t really see a big opportunity at the moment. We're fairly confident there are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $181.27 on the company (compared to the current share price of $160.74).