Exact Sciences (EXAS)

We’re not sold on Exact Sciences. Its negative returns on capital show it destroyed value by losing money on unprofitable business ventures.― StockStory Analyst Team

1. News

2. Summary

Why Exact Sciences Is Not Exciting

With a mission to detect cancer earlier when it's more treatable, Exact Sciences (NASDAQ:EXAS) develops and markets cancer screening and diagnostic tests, including its flagship Cologuard stool-based colorectal cancer screening test.

- Suboptimal cost structure is highlighted by its history of adjusted operating margin losses

- Negative returns on capital show management lost money while trying to expand the business

- A silver lining is that its incremental sales significantly boosted profitability as its annual earnings per share growth of 31.3% over the last five years outstripped its revenue performance

Exact Sciences falls short of our quality standards. There are superior stocks for sale in the market.

Why There Are Better Opportunities Than Exact Sciences

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Exact Sciences

Exact Sciences is trading at $103.44 per share, or 90.6x forward P/E. The current multiple is quite expensive, especially for the fundamentals of the business.

There are stocks out there featuring similar valuation multiples with better fundamentals. We prefer to invest in those.

3. Exact Sciences (EXAS) Research Report: Q4 CY2025 Update

Diagnostic company Exact Sciences Corporation (NASDAQ:EXAS) reported Q4 CY2025 results topping the market’s revenue expectations, with sales up 23.1% year on year to $878.4 million. Its non-GAAP loss of $0.21 per share was significantly below analysts’ consensus estimates.

Exact Sciences (EXAS) Q4 CY2025 Highlights:

- Revenue: $878.4 million vs analyst estimates of $860.3 million (23.1% year-on-year growth, 2.1% beat)

- Adjusted EPS: -$0.21 vs analyst estimates of $0.08 (significant miss)

- Adjusted EBITDA: $63.44 million vs analyst estimates of $117.2 million (7.2% margin, 45.9% miss)

- Operating Margin: -9.4%, up from -123% in the same quarter last year

- Free Cash Flow Margin: 13.7%, up from 1.5% in the same quarter last year

- Market Capitalization: $19.71 billion

Company Overview

With a mission to detect cancer earlier when it's more treatable, Exact Sciences (NASDAQ:EXAS) develops and markets cancer screening and diagnostic tests, including its flagship Cologuard stool-based colorectal cancer screening test.

Exact Sciences operates at the intersection of clinical laboratory testing and medical device manufacturing, focusing on innovative cancer detection technologies. The company's product portfolio spans screening tests for early detection and precision oncology tests that guide treatment decisions after diagnosis.

The company's Cologuard test, which received FDA approval in 2014, analyzes stool samples for DNA and blood biomarkers associated with colorectal cancer and pre-cancerous lesions. Patients collect samples at home using a kit, then ship them to Exact Sciences' laboratories for analysis. The test is covered by Medicare for average-risk individuals aged 45-85 and is included in major medical guidelines as an alternative to colonoscopy for routine screening.

In precision oncology, Exact Sciences offers several genomic tests under the Oncotype DX brand that help determine the likelihood of cancer recurrence and guide treatment decisions. The Oncotype DX Breast Recurrence Score test, for example, examines 21 genes in breast tumor tissue to predict which patients will benefit from chemotherapy and which can safely avoid it. These tests are widely recognized in treatment guidelines globally.

The company is also developing new technologies, including a multi-cancer early detection (MCED) blood test called Cancerguard, designed to detect signals from multiple cancer types with a single blood draw. Additionally, Exact Sciences is working on minimal residual disease (MRD) testing with its Oncodetect test to monitor cancer patients after treatment for potential recurrence.

Exact Sciences processes its tests in CLIA-certified, CAP-accredited laboratories in Wisconsin, California, Arizona, and Washington. The company manufactures its Cologuard test components in Wisconsin facilities, while maintaining a global commercial infrastructure to market its tests to healthcare providers and patients.

4. Immuno-Oncology

Over the next few years, immuno-oncology companies, which harness the immune system to fight illnesses such as cancer, faces strong tailwinds from advancements in precision medicine (including the use of AI to improve hit rates) and growing demand for treatments targeting rare diseases. However, headwinds such as rising scrutiny over drug pricing, regulatory unknowns, and competition from larger, more resourced pharmaceutical companies could weigh on growth.

Exact Sciences faces competition from various diagnostic companies in different segments of its business. In colorectal cancer screening, competitors include Guardant Health (NASDAQ:GH) with its blood-based Shield test, Freenome, and traditional screening methods offered by Laboratory Corporation of America (NYSE:LH) and Quest Diagnostics (NYSE:DGX). In precision oncology, the company competes with Veracyte (NASDAQ:VCYT), Myriad Genetics (NASDAQ:MYGN), Natera (NASDAQ:NTRA), and Hologic (NASDAQ:HOLX).

5. Economies of Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $3.25 billion in revenue over the past 12 months, Exact Sciences has decent scale. This is important as it gives the company more leverage in a heavily regulated, competitive environment that is complex and resource-intensive.

6. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Thankfully, Exact Sciences’s 16.8% annualized revenue growth over the last five years was impressive. Its growth beat the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Exact Sciences’s annualized revenue growth of 14% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Exact Sciences reported robust year-on-year revenue growth of 23.1%, and its $878.4 million of revenue topped Wall Street estimates by 2.1%.

Looking ahead, sell-side analysts expect revenue to grow 13% over the next 12 months, similar to its two-year rate. This projection is admirable and suggests the market sees success for its products and services.

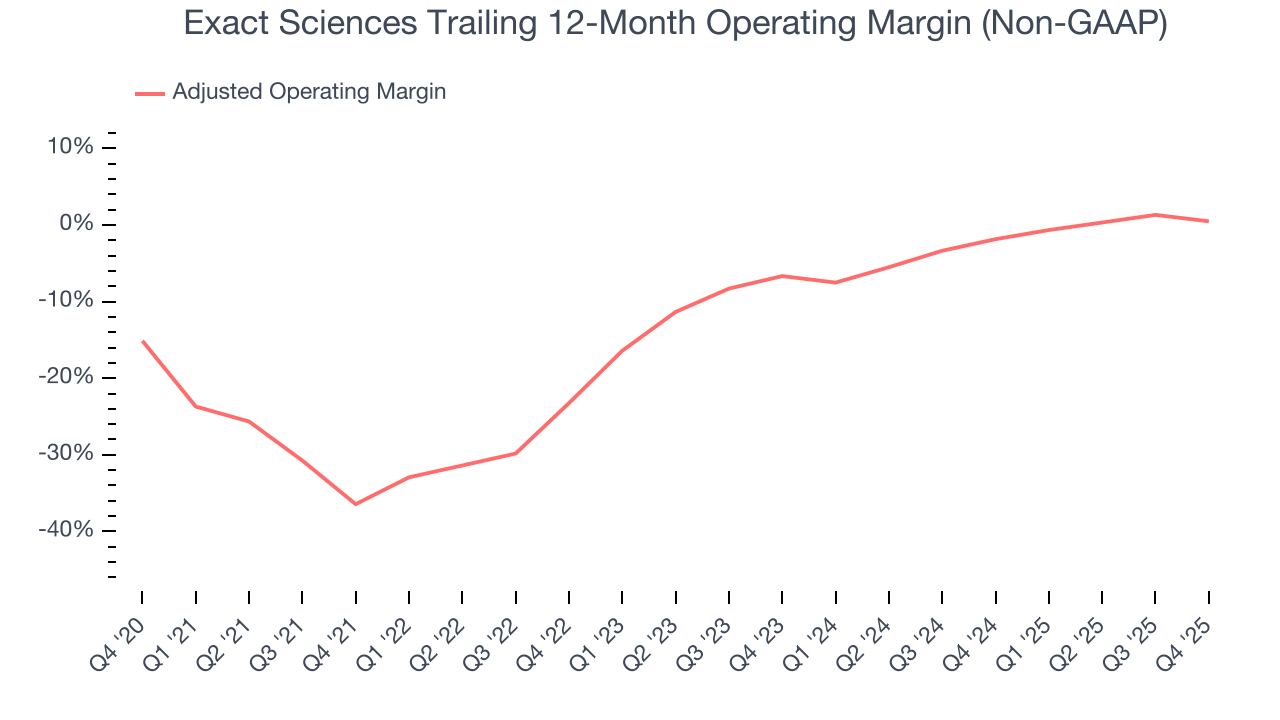

7. Adjusted Operating Margin

Adjusted operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D. It also removes various one-time costs to paint a better picture of normalized profits.

Exact Sciences’s high expenses have contributed to an average adjusted operating margin of negative 10.8% over the last five years. Unprofitable healthcare companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, Exact Sciences’s adjusted operating margin rose by 36.9 percentage points over the last five years, as its sales growth gave it operating leverage. Zooming in on its more recent performance, we can see the company’s trajectory is intact as its margin has also increased by 7.1 percentage points on a two-year basis.

In Q4, Exact Sciences generated a negative 4.1% adjusted operating margin.

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Although Exact Sciences’s full-year earnings are still negative, it reduced its losses and improved its EPS by 31.3% annually over the last five years. The next few quarters will be critical for assessing its long-term profitability.

In Q4, Exact Sciences reported adjusted EPS of negative $0.21, down from negative $0.06 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Exact Sciences’s full-year EPS of negative $0.23 will flip to positive $1.18.

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

While Exact Sciences posted positive free cash flow this quarter, the broader story hasn’t been so clean. Exact Sciences’s demanding reinvestments have consumed many resources over the last five years, contributing to an average free cash flow margin of negative 1.7%. This means it lit $1.72 of cash on fire for every $100 in revenue.

Taking a step back, an encouraging sign is that Exact Sciences’s margin expanded by 24.5 percentage points during that time. We have no doubt shareholders would like to continue seeing its cash conversion rise.

Exact Sciences’s free cash flow clocked in at $120.4 million in Q4, equivalent to a 13.7% margin. This result was good as its margin was 12.2 percentage points higher than in the same quarter last year, building on its favorable historical trend.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Exact Sciences’s five-year average ROIC was negative 12.5%, meaning management lost money while trying to expand the business. Its returns were among the worst in the healthcare sector.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Exact Sciences’s ROIC averaged 2.3 percentage point decreases each year. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

11. Balance Sheet Assessment

Exact Sciences reported $964.7 million of cash and $2.49 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $400.3 million of EBITDA over the last 12 months, we view Exact Sciences’s 3.8× net-debt-to-EBITDA ratio as safe. We also see its $4.90 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Exact Sciences’s Q4 Results

It was encouraging to see Exact Sciences beat analysts’ revenue expectations this quarter. On the other hand, its EPS missed. Overall, this was a weaker quarter. The stock remained flat at $102.92 immediately following the results.

13. Is Now The Time To Buy Exact Sciences?

Updated: February 22, 2026 at 11:08 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Exact Sciences.

There are some bright spots in Exact Sciences’s fundamentals, but its business quality ultimately falls short. First off, its revenue growth was impressive over the last five years. And while Exact Sciences’s relatively low ROIC suggests management has struggled to find compelling investment opportunities, its rising cash profitability gives it more optionality.

Exact Sciences’s P/E ratio based on the next 12 months is 90.6x. This multiple tells us a lot of good news is priced in - we think other companies feature superior fundamentals at the moment.

Wall Street analysts have a consensus one-year price target of $105.81 on the company (compared to the current share price of $103.44).