EXL (EXLS)

EXL sets the gold standard. Its ability to balance growth and profitability while maintaining a bright outlook makes it a gem.― StockStory Analyst Team

1. News

2. Summary

Why We Like EXL

Originally founded as an outsourcing company in 1999 before evolving into a technology-focused enterprise, EXL (NASDAQ:EXLS) provides data analytics and AI-powered digital operations solutions that help businesses transform their operations and make better decisions.

- Annual revenue growth of 16.8% over the past five years was outstanding, reflecting market share gains this cycle

- Additional sales over the last five years increased its profitability as the 22.6% annual growth in its earnings per share outpaced its revenue

- Successful business model is illustrated by its impressive adjusted operating margin

EXL is a top-tier company. The price seems fair relative to its quality, and we think now is a good time to invest.

Why Is Now The Time To Buy EXL?

High Quality

Investable

Underperform

Why Is Now The Time To Buy EXL?

EXL is trading at $32.51 per share, or 14.9x forward P/E. Valuation is lower than most companies in the business services space, and we believe EXL is attractively-priced for its quality.

Entry price matters much less than business quality when investing for the long term, but hey, it certainly doesn’t hurt to get in at an attractive price.

3. EXL (EXLS) Research Report: Q4 CY2025 Update

Data analytics and digital solutions company ExlService Holdings (NASDAQ:EXLS) reported revenue ahead of Wall Street’s expectations in Q4 CY2025, with sales up 12.7% year on year to $542.6 million. On the other hand, the company’s full-year revenue guidance of $2.3 billion at the midpoint came in 0.8% below analysts’ estimates. Its non-GAAP profit of $0.50 per share was 7.5% above analysts’ consensus estimates.

EXL (EXLS) Q4 CY2025 Highlights:

- Revenue: $542.6 million vs analyst estimates of $533.4 million (12.7% year-on-year growth, 1.7% beat)

- Adjusted EPS: $0.50 vs analyst estimates of $0.47 (7.5% beat)

- Adjusted EBITDA: $80.08 million vs analyst estimates of $114.3 million (14.8% margin)

- Adjusted EPS guidance for the upcoming financial year 2026 is $2.17 at the midpoint, missing analyst estimates by 1.3%

- Operating Margin: 14.4%, in line with the same quarter last year

- Market Capitalization: $4.48 billion

Company Overview

Originally founded as an outsourcing company in 1999 before evolving into a technology-focused enterprise, EXL (NASDAQ:EXLS) provides data analytics and AI-powered digital operations solutions that help businesses transform their operations and make better decisions.

EXL operates through four strategic business units: Insurance, Healthcare, Analytics, and Emerging Business. Each unit delivers specialized solutions tailored to industry-specific challenges. For insurance companies, EXL handles everything from claims processing to policy administration using AI and automation. In healthcare, the company manages care delivery, utilization management, and payment integrity services for payers and providers. The Analytics unit, employing approximately 9,100 data scientists and specialists, builds predictive models that help clients make data-driven decisions.

The company's technology stack includes proprietary platforms like Xtrakto.AI for managing unstructured data, PayMentor for collections management, and EXLClarity for healthcare risk adjustment. These solutions leverage artificial intelligence, machine learning, and cloud technology to extract insights from complex data sets and automate manual processes.

A typical client engagement might involve a property insurance company using EXL's subrogation platform to manage recovery workflows while simultaneously employing the company's analytics team to build predictive models for fraud detection. Or a healthcare payer might use EXL's care management platform to improve patient outcomes while reducing costs.

EXL generates revenue through long-term service agreements (typically three to five years for digital operations), shorter-term analytics projects, and consulting engagements. The company maintains delivery centers across multiple countries, with significant operations in India and the Philippines, allowing it to provide services around the clock.

Beyond just processing transactions, EXL positions itself as a strategic partner that helps clients reinvent their business models. The company's approach combines domain expertise in specific industries with technical capabilities in data science and AI to deliver measurable business outcomes.

4. Data & Business Process Services

A combination of increasing reliance on data and analytics across various industries and the desire for cost efficiency through outsourcing could mean that companies in this space gain. As functions such as payroll, HR, and credit risk assessment rely on more digitization, key players in the data & business process services industry could be increased demand. On the other hand, the sector faces headwinds from growing regulatory scrutiny on data privacy and security, with laws like GDPR and evolving U.S. regulations potentially limiting data collection and monetization strategies. Additionally, rising cyber threats pose risks to firms handling sensitive personal and financial information, creating outsized headline risk when things go wrong in this area.

EXL competes with large global technology and business process outsourcing firms including Accenture, Cognizant, Genpact, and Tata Consultancy Services. In specialized areas like healthcare analytics, the company faces competition from industry-specific providers such as Cotiviti and Optum Health.

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $2.09 billion in revenue over the past 12 months, EXL is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale. On the bright side, it can still flex high growth rates because it’s working from a smaller revenue base.

As you can see below, EXL’s sales grew at an incredible 16.8% compounded annual growth rate over the last five years. This is a great starting point for our analysis because it shows EXL’s demand was higher than many business services companies.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. EXL’s annualized revenue growth of 13.1% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, EXL reported year-on-year revenue growth of 12.7%, and its $542.6 million of revenue exceeded Wall Street’s estimates by 1.7%.

Looking ahead, sell-side analysts expect revenue to grow 11% over the next 12 months, a slight deceleration versus the last two years. Still, this projection is noteworthy and suggests the market is baking in success for its products and services.

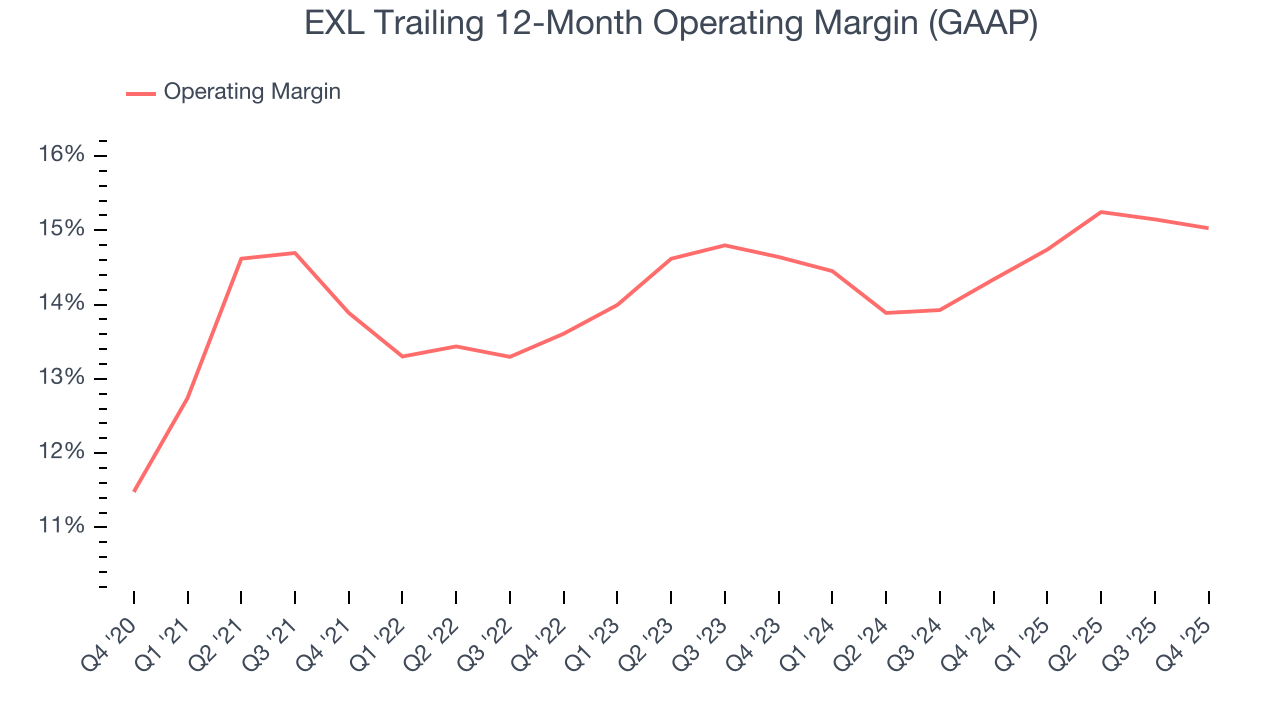

6. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

EXL has been an efficient company over the last five years. It was one of the more profitable businesses in the business services sector, boasting an average operating margin of 14.4%.

Analyzing the trend in its profitability, EXL’s operating margin rose by 1.1 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, EXL generated an operating margin profit margin of 14.4%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

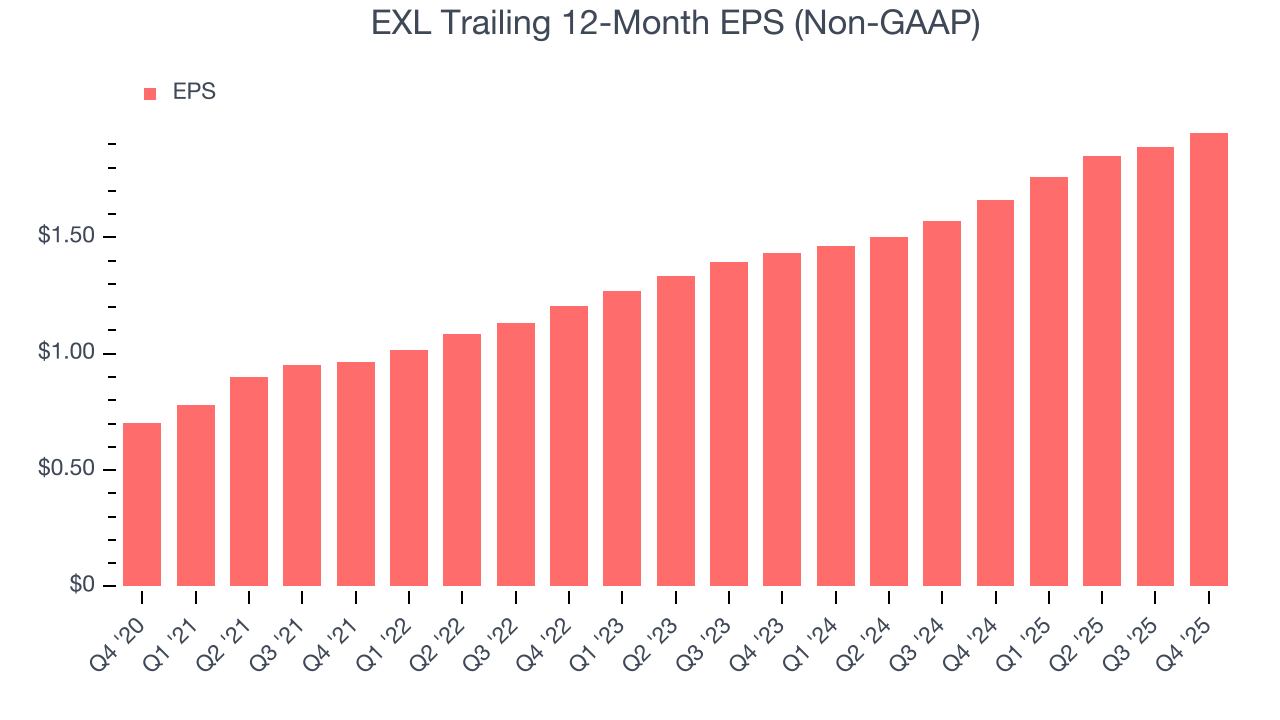

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

EXL’s EPS grew at an astounding 22.6% compounded annual growth rate over the last five years, higher than its 16.8% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into EXL’s earnings quality to better understand the drivers of its performance. As we mentioned earlier, EXL’s operating margin was flat this quarter but expanded by 1.1 percentage points over the last five years. On top of that, its share count shrank by 7.2%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For EXL, its two-year annual EPS growth of 16.7% was lower than its five-year trend. We still think its growth was good and hope it can accelerate in the future.

In Q4, EXL reported adjusted EPS of $0.50, up from $0.44 in the same quarter last year. This print beat analysts’ estimates by 7.5%. Over the next 12 months, Wall Street expects EXL’s full-year EPS of $1.95 to grow 12.6%.

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

EXL has shown robust cash profitability, giving it an edge over its competitors and the ability to reinvest or return capital to investors. The company’s free cash flow margin averaged 11.2% over the last five years, quite impressive for a business services business.

Taking a step back, we can see that EXL’s margin expanded by 2.2 percentage points during that time. This shows the company is heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

EXL’s five-year average ROIC was 21.3%, beating other business services companies by a wide margin. This illustrates its management team’s ability to invest in attractive growth opportunities and produce tangible results for shareholders.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Uneventfully, EXL’s ROIC has stayed the same over the last few years. Rising returns would be ideal, but this is still a noteworthy feat since they're already high.

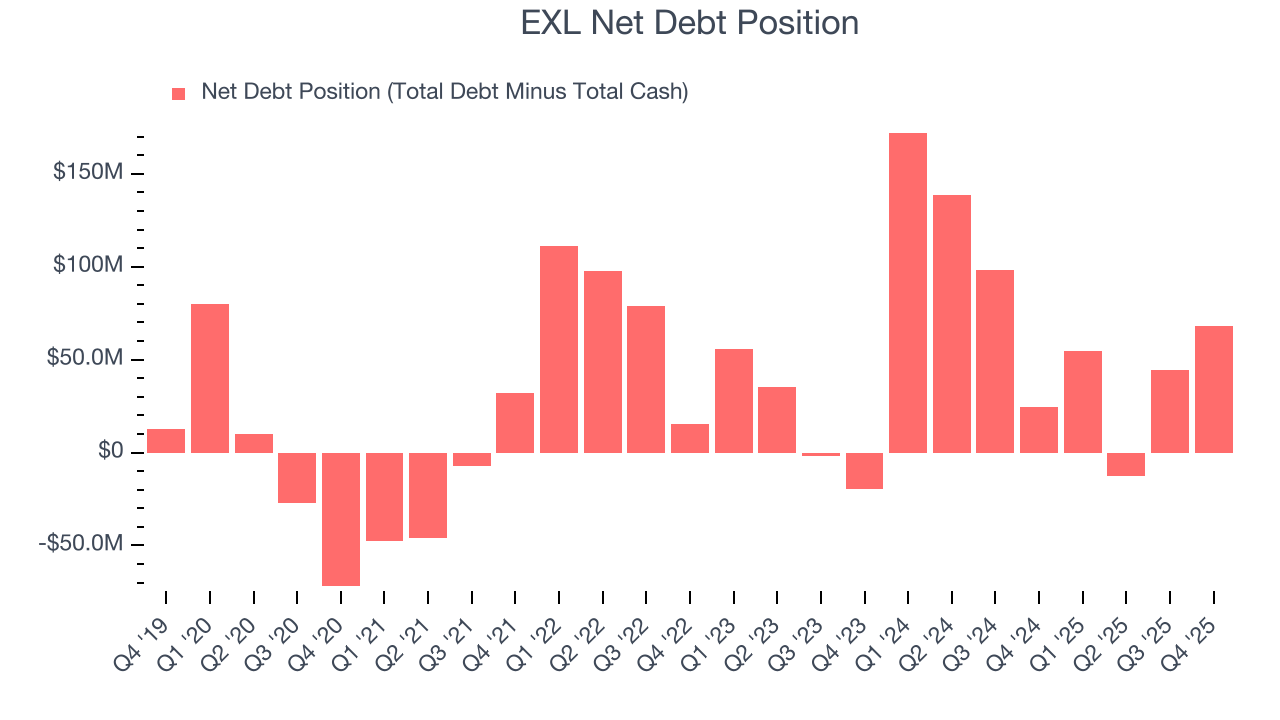

10. Balance Sheet Assessment

EXL reported $335.6 million of cash and $403.6 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $417.3 million of EBITDA over the last 12 months, we view EXL’s 0.2× net-debt-to-EBITDA ratio as safe. We also see its $1.65 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from EXL’s Q4 Results

It was good to see EXL beat analysts’ EPS expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. On the other hand, its full-year EPS guidance slightly missed and its full-year revenue guidance fell slightly short of Wall Street’s estimates. Zooming out, we think this was a mixed quarter. Investors were likely hoping for more, and shares traded down 2.8% to $27.94 immediately after reporting.

12. Is Now The Time To Buy EXL?

Updated: March 9, 2026 at 12:55 AM EDT

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in EXL.

EXL is one of the best business services companies out there. First of all, the company’s revenue growth was exceptional over the last five years. On top of that, its astounding EPS growth over the last five years shows its profits are trickling down to shareholders, and its impressive operating margins show it has a highly efficient business model.

EXL’s P/E ratio based on the next 12 months is 14.9x. Looking across the spectrum of business services businesses, EXL’s fundamentals clearly illustrate it’s a special business. We like the stock at this price.

Wall Street analysts have a consensus one-year price target of $41.71 on the company (compared to the current share price of $32.51), implying they see 28.3% upside in buying EXL in the short term.