First Advantage (FA)

First Advantage doesn’t impress us. Its sales have underperformed and its low returns on capital show it has few growth opportunities.― StockStory Analyst Team

1. News

2. Summary

Why First Advantage Is Not Exciting

Processing approximately 100 million background checks annually across more than 200 countries and territories, First Advantage (NASDAQ:FA) provides employment background screening, identity verification, and compliance solutions to help companies manage hiring risks.

- Below-average returns on capital indicate management struggled to find compelling investment opportunities, and its falling returns suggest its earlier profit pools are drying up

- Flat earnings per share over the last four years underperformed the sector average

- A consolation is that its annual revenue growth of 25.3% over the past five years was outstanding, reflecting market share gains this cycle

First Advantage’s quality is not up to our standards. You should search for better opportunities.

Why There Are Better Opportunities Than First Advantage

High Quality

Investable

Underperform

Why There Are Better Opportunities Than First Advantage

First Advantage is trading at $12.14 per share, or 10.2x forward P/E. This multiple is lower than most business services companies, but for good reason.

Our advice is to pay up for elite businesses whose advantages are tailwinds to earnings growth. Don’t get sucked into lower-quality businesses just because they seem like bargains. These mediocre businesses often never achieve a higher multiple as hoped, a phenomenon known as a “value trap”.

3. First Advantage (FA) Research Report: Q4 CY2025 Update

Background screening provider First Advantage (NASDAQ:FA) reported Q4 CY2025 results beating Wall Street’s revenue expectations, with sales up 36.8% year on year to $420 million. The company’s full-year revenue guidance of $1.66 billion at the midpoint came in 2.4% above analysts’ estimates. Its non-GAAP profit of $0.30 per share was 13.7% above analysts’ consensus estimates.

First Advantage (FA) Q4 CY2025 Highlights:

- Revenue: $420 million vs analyst estimates of $391.3 million (36.8% year-on-year growth, 7.3% beat)

- Adjusted EPS: $0.30 vs analyst estimates of $0.26 (13.7% beat)

- Adjusted EBITDA: $116.8 million vs analyst estimates of $110 million (27.8% margin, 6.2% beat)

- Adjusted EPS guidance for the upcoming financial year 2026 is $1.20 at the midpoint, beating analyst estimates by 1.3%

- EBITDA guidance for the upcoming financial year 2026 is $472.5 million at the midpoint, in line with analyst expectations

- Operating Margin: 10.7%, up from -26.3% in the same quarter last year

- Free Cash Flow was $65.94 million, up from -$96.16 million in the same quarter last year

- Market Capitalization: $1.66 billion

Company Overview

Processing approximately 100 million background checks annually across more than 200 countries and territories, First Advantage (NASDAQ:FA) provides employment background screening, identity verification, and compliance solutions to help companies manage hiring risks.

First Advantage's comprehensive suite of pre-onboarding services includes criminal background checks, drug testing, education and employment verification, identity checks, and specialized screenings for regulated industries. The company's technology platform integrates with over 75 human capital management systems, creating a seamless workflow for employers while providing a user-friendly experience for job applicants through its mobile-optimized Profile Advantage interface.

The company maintains proprietary databases containing over 765 million records, including approximately 655 million criminal records and nearly 110 million education and work history verifications. This vast repository allows First Advantage to deliver faster results than competitors who rely solely on external data sources. For example, about 90% of U.S. criminal searches are completed within one day.

Beyond initial screening, First Advantage offers post-onboarding monitoring solutions that continuously check for new criminal records, sanctions, license status changes, or other issues that might affect an employee's eligibility to work. This ongoing surveillance helps employers maintain compliance with industry regulations and protect workplace safety throughout the employment lifecycle.

The company serves more than 30,000 customers across diverse industries, with particular strength in sectors with high-volume hiring needs such as retail, transportation, warehousing, and healthcare. A human resources director at a national retail chain might use First Advantage to screen thousands of seasonal workers before the holiday rush, verifying their identities, checking for criminal histories, and confirming previous employment claims.

First Advantage generates revenue through a transaction-based model, charging fees for each background check or verification service performed. The company's business is subject to various regulations including the Fair Credit Reporting Act, which governs how consumer information can be collected, used, and shared for employment purposes.

4. Professional Staffing & HR Solutions

The Professional Staffing & HR Solutions subsector within Business Services is set to benefit from evolving workforce trends, including the rise of remote work and the gig economy. With companies casting a wider net to find talent due to remote work, the expertise of staffing and recruiting companies is even more valuable. For those who invest wisely, the use of predictive AI in recruitment and screening as well as automation in HR workflows can enhance efficiency and scalability. On the other hand, digitization means that talent discovery is less of a manual process, opening the door for tech-first platforms. Additionally, regulatory scrutiny around data privacy in HR is evolving and may require companies in this sector to change their go-to-market strategies over time.

First Advantage competes with other background screening providers including HireRight (NYSE:HRT), Sterling Check (NASDAQ:STER), and Accurate Background, as well as with broader human capital management companies that offer screening as part of their services, such as ADP (NASDAQ:ADP) and Equifax (NYSE:EFX).

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $1.57 billion in revenue over the past 12 months, First Advantage is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale. On the bright side, it can still flex high growth rates because it’s working from a smaller revenue base.

As you can see below, First Advantage grew its sales at an incredible 25.3% compounded annual growth rate over the last five years. This shows it had high demand, a useful starting point for our analysis.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. First Advantage’s annualized revenue growth of 43.6% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, First Advantage reported wonderful year-on-year revenue growth of 36.8%, and its $420 million of revenue exceeded Wall Street’s estimates by 7.3%.

Looking ahead, sell-side analysts expect revenue to grow 3.1% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and indicates its products and services will face some demand challenges.

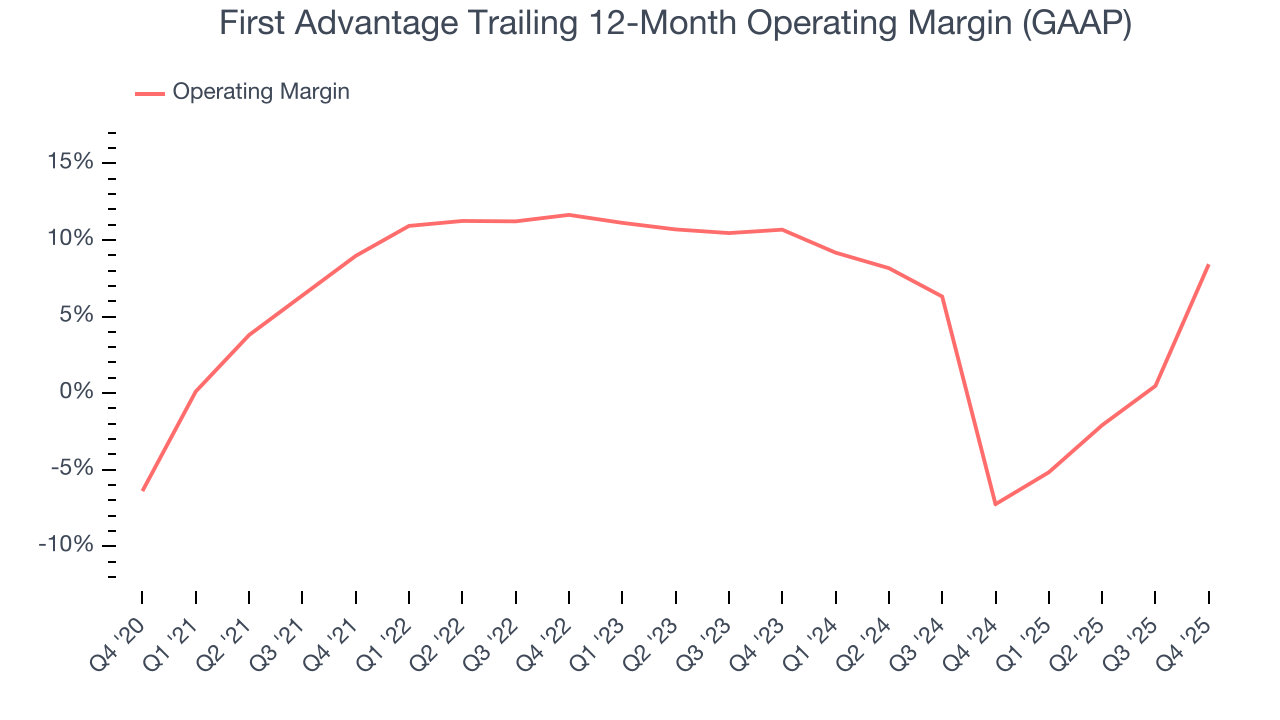

6. Operating Margin

First Advantage’s operating margin has been trending up over the last 12 months and averaged 6.6% over the last five years. The company’s higher efficiency is a breath of fresh air, but its suboptimal cost structure means it still sports paltry profitability for a business services business.

Analyzing the trend in its profitability, First Advantage’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, First Advantage generated an operating margin profit margin of 10.7%, up 37 percentage points year on year. This increase was a welcome development and shows it was more efficient.

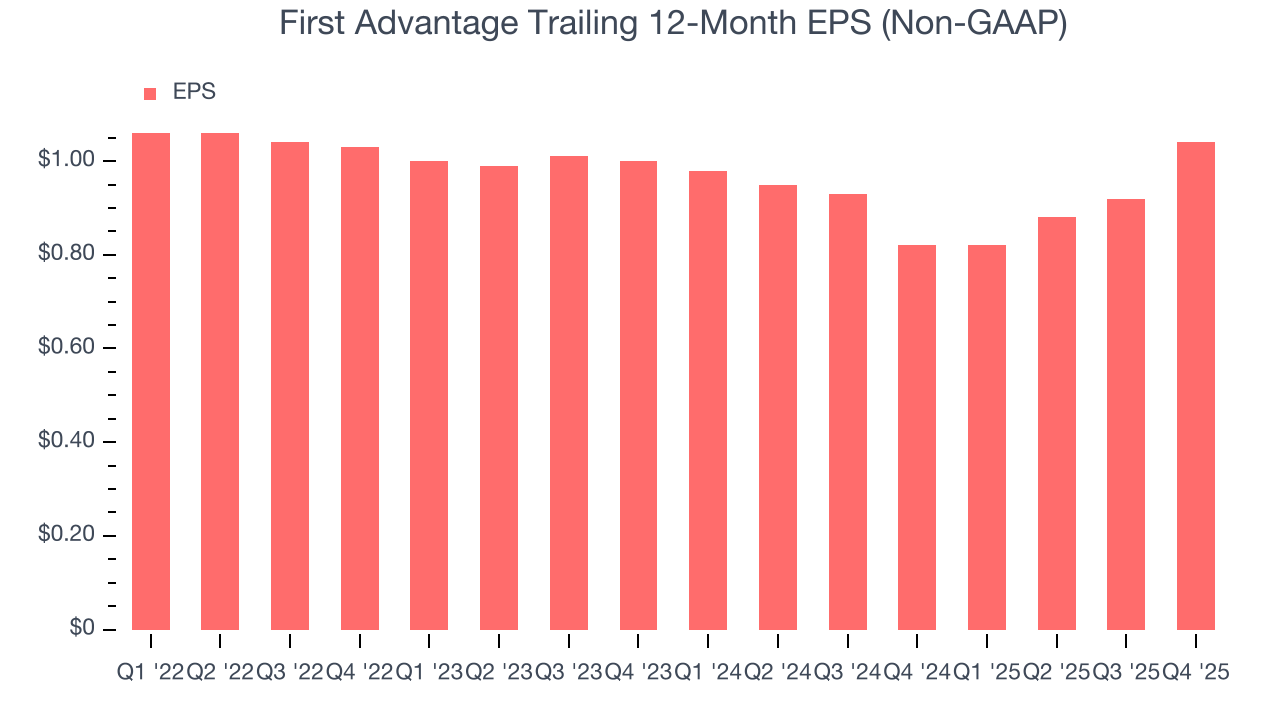

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

First Advantage’s full-year EPS was flat over the last four years, worse than the broader business services sector.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

First Advantage’s EPS grew at a weak 2% compounded annual growth rate over the last two years, lower than its 43.6% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

Diving into the nuances of First Advantage’s earnings can give us a better understanding of its performance. We mentioned earlier that First Advantage’s operating margin expanded this quarter, but a two-year view shows its margin has declinedwhile its share count has grown 20.8%. This means the company not only became less efficient with its operating expenses but also diluted its shareholders.

In Q4, First Advantage reported adjusted EPS of $0.30, up from $0.18 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects First Advantage’s full-year EPS of $1.04 to grow 15.8%.

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

First Advantage has shown robust cash profitability, giving it an edge over its competitors and the ability to reinvest or return capital to investors. The company’s free cash flow margin averaged 12.7% over the last five years, quite impressive for a business services business. The divergence from its underwhelming operating margin stems from the add-back of non-cash charges like depreciation and stock-based compensation. GAAP operating profit expenses these line items, but free cash flow does not.

Taking a step back, we can see that First Advantage’s margin dropped by 7.5 percentage points during that time. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. If the longer-term trend returns, it could signal increasing investment needs and capital intensity.

First Advantage’s free cash flow clocked in at $65.94 million in Q4, equivalent to a 15.7% margin. Its cash flow turned positive after being negative in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, leading to temporary swings. Long-term trends are more important.

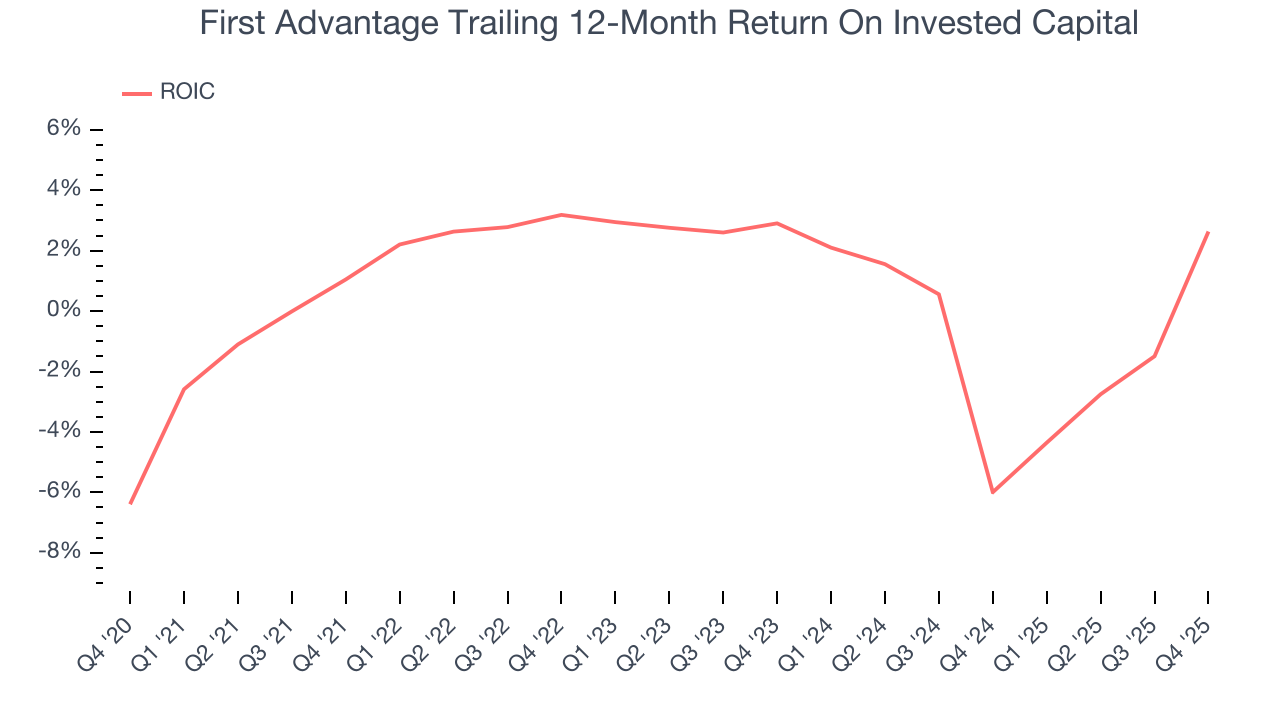

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

First Advantage historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 0.8%, lower than the typical cost of capital (how much it costs to raise money) for business services companies.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, First Advantage’s ROIC averaged 3.8 percentage point decreases each year over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

10. Balance Sheet Assessment

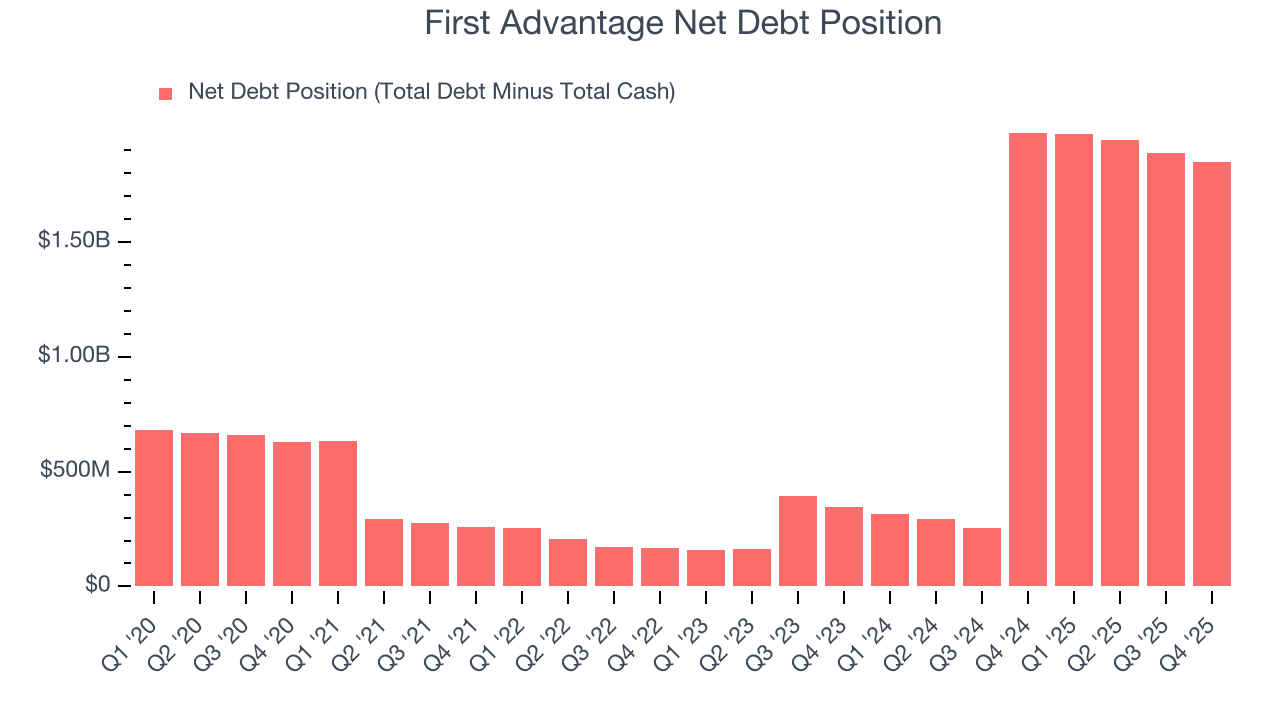

First Advantage reported $240.1 million of cash and $2.09 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $441.4 million of EBITDA over the last 12 months, we view First Advantage’s 4.2× net-debt-to-EBITDA ratio as safe. We also see its $94.15 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from First Advantage’s Q4 Results

We were impressed by how significantly First Advantage blew past analysts’ revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. The stock remained flat at $9.52 immediately following the results.

12. Is Now The Time To Buy First Advantage?

Updated: March 6, 2026 at 11:21 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in First Advantage.

First Advantage doesn’t top our investment wishlist, but we understand that it’s not a bad business. First off, its revenue growth was exceptional over the last five years. And while First Advantage’s relatively low ROIC suggests management has struggled to find compelling investment opportunities, its projected EPS for the next year implies the company’s fundamentals will improve.

First Advantage’s P/E ratio based on the next 12 months is 10.1x. This valuation multiple is fair, but we don’t have much faith in the company. We're pretty confident there are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $15 on the company (compared to the current share price of $12.07).