FuelCell Energy (FCEL)

We love companies like FuelCell Energy. Its revenue and EPS are projected to skyrocket next year, an optimistic sign for its share price.― StockStory Analyst Team

1. News

2. Summary

Why We Like FuelCell Energy

Founded in 1969, FuelCell Energy (NASDAQ: FCEL) is a leading manufacturer and developer of carbonate fuel cell technology for stationary power generation.

- Annual revenue growth of 17.4% over the last five years was superb and indicates its market share increased during this cycle

- Earnings per share grew by 25.9% annually over the last two years, massively outpacing its peers

- Market share is on track to rise over the next 12 months as its 19% projected revenue growth implies demand will accelerate from its two-year trend

FuelCell Energy is a top-tier company. The valuation seems reasonable when considering its quality, so this might be a prudent time to invest in some shares.

Why Is Now The Time To Buy FuelCell Energy?

High Quality

Investable

Underperform

Why Is Now The Time To Buy FuelCell Energy?

FuelCell Energy is trading at $8.21 per share, or 1.7x forward price-to-sales. Looking at the industrials landscape today, FuelCell Energy’s qualities really stand out, and we like it at this price.

It’s an opportune time to buy the stock if you like the business model.

3. FuelCell Energy (FCEL) Research Report: Q3 CY2025 Update

Carbonate fuel cell technology developer FuelCell Energy (NASDAQ:FCEL) reported Q3 CY2025 results topping the market’s revenue expectations, with sales up 11.5% year on year to $55.02 million. Its non-GAAP loss of $0.83 per share was 19.3% above analysts’ consensus estimates.

FuelCell Energy (FCEL) Q3 CY2025 Highlights:

- Revenue: $55.02 million vs analyst estimates of $43.96 million (11.5% year-on-year growth, 25.1% beat)

- Adjusted EPS: -$0.83 vs analyst estimates of -$1.03 (19.3% beat)

- Adjusted EBITDA: -$17.68 million (-32.1% margin, 30.2% year-on-year growth)

- Adjusted EBITDA Margin: -32.1%, up from -51.3% in the same quarter last year

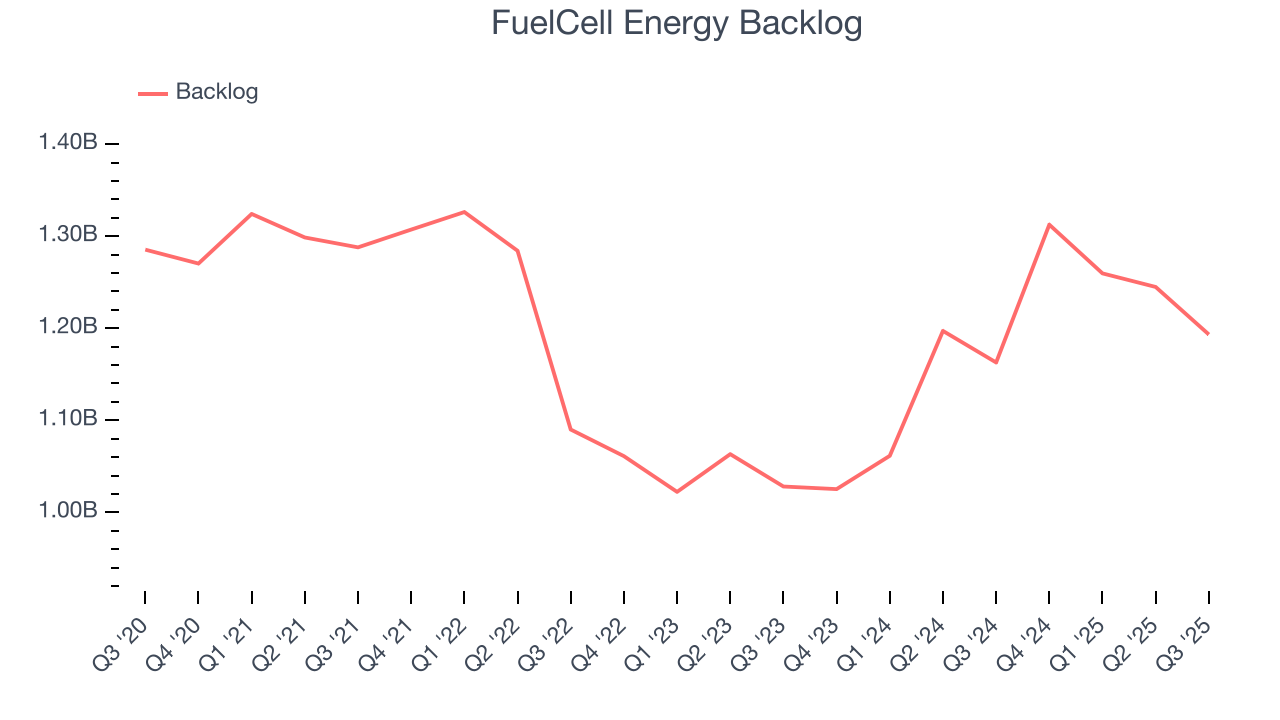

- Backlog: $1.19 billion at quarter end, up 2.6% year on year

- Market Capitalization: $376.6 million

Company Overview

Founded in 1969, FuelCell Energy (NASDAQ: FCEL) is a leading manufacturer and developer of carbonate fuel cell technology for stationary power generation.

The company focuses on designing, manufacturing, and selling fuel cell power plants for distributed power generation, offering products ranging from 250 kW to 3 MW in capacity. FuelCell Energy's primary technology is the Direct FuelCell (DFC), which generates electricity directly from a hydrocarbon fuel by reforming it inside the fuel cell to produce hydrogen.

FuelCell Energy's products are designed to meet the power requirements of various customers, including utilities, industrial facilities, data centers, and other commercial and institutional buildings. The company's fuel cells offer several advantages over traditional power generation methods, including higher fuel efficiency, lower emissions, and the ability to use multiple fuel sources such as natural gas, biogas, and coal gas.

FuelCell Energy operates a manufacturing facility in Torrington, Connecticut, with a production capacity of 50 MW per year. The company has plans to expand this capacity to 150 MW within its current facility and potentially up to 400 MW with additional land access. FuelCell Energy also maintains a testing and conditioning facility in Danbury, Connecticut, capable of processing 50 MW of fuel cell power plants annually.

FuelCell Energy's financial performance has historically been heavily dependent on government funding. The company is working to transition towards more commercial sales as its products move closer to widespread market adoption.

4. Renewable Energy

Renewable energy companies are buoyed by the secular trend of green energy that is upending traditional power generation. Those who innovate and evolve with this dynamic market can win share while those who continue to rely on legacy technologies can see diminishing demand, which includes headwinds from increasing regulation against “dirty” energy. Additionally, these companies are at the whim of economic cycles, as interest rates can impact the willingness to invest in renewable energy projects.

Competitors of FuelCell Energy include Bloom Energy Corporation (NYSE: BE), Plug Power (NASDAQ:PLUG), and Ballard Power Systems (NASDAQ: BLDP).

5. Revenue Growth

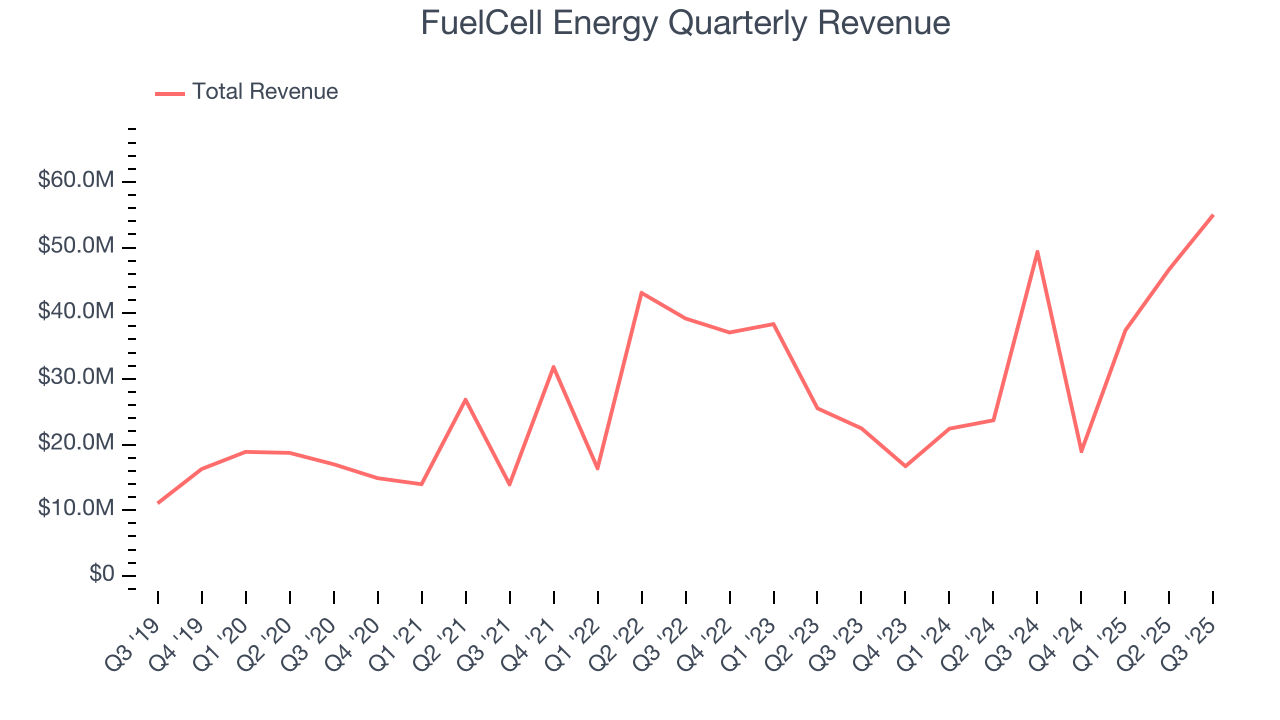

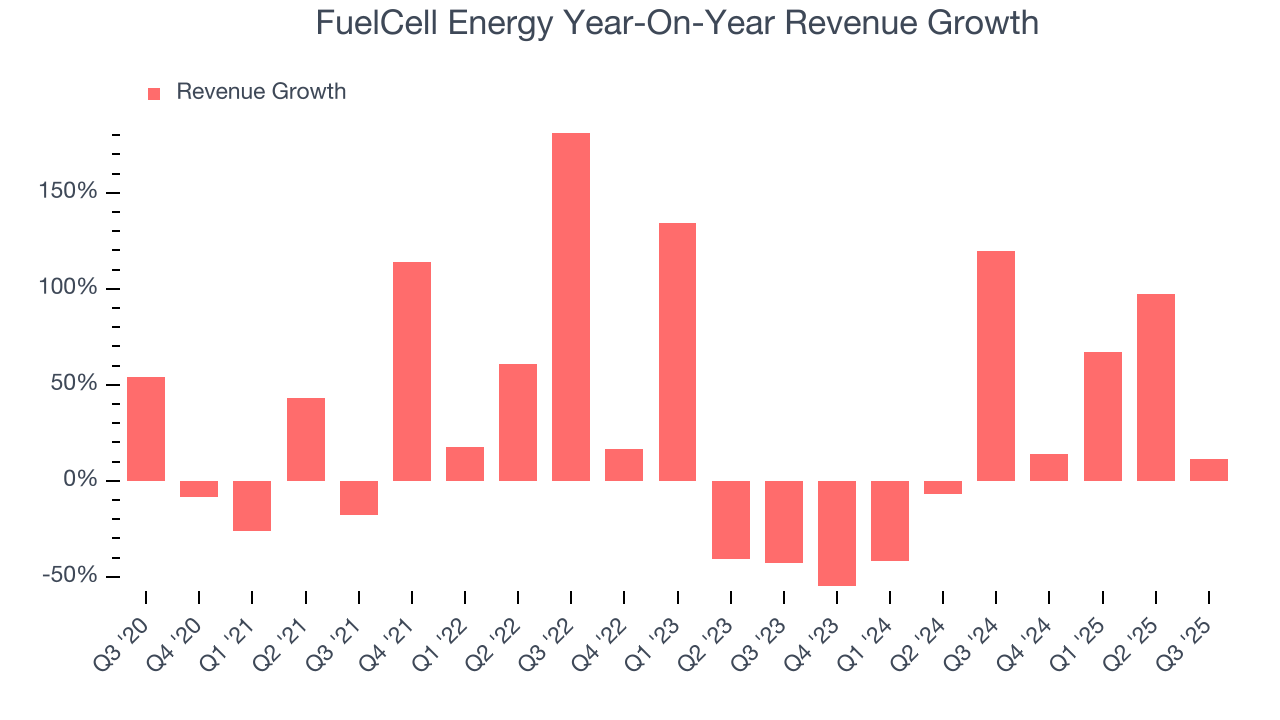

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Luckily, FuelCell Energy’s sales grew at an incredible 17.4% compounded annual growth rate over the last five years. Its growth beat the average industrials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. FuelCell Energy’s annualized revenue growth of 13.2% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

We can better understand the company’s revenue dynamics by analyzing its backlog, or the value of its outstanding orders that have not yet been executed or delivered. FuelCell Energy’s backlog reached $1.19 billion in the latest quarter and averaged 9.9% year-on-year growth over the last two years. Because this number is lower than its revenue growth, we can see the company fulfilled orders at a faster rate than it added new orders to the backlog. This implies FuelCell Energy was operating efficiently but raises questions about the health of its sales pipeline.

This quarter, FuelCell Energy reported year-on-year revenue growth of 11.5%, and its $55.02 million of revenue exceeded Wall Street’s estimates by 25.1%.

Looking ahead, sell-side analysts expect revenue to grow 15.3% over the next 12 months, an improvement versus the last two years. This projection is eye-popping and implies its newer products and services will spur better top-line performance.

6. Gross Margin & Pricing Power

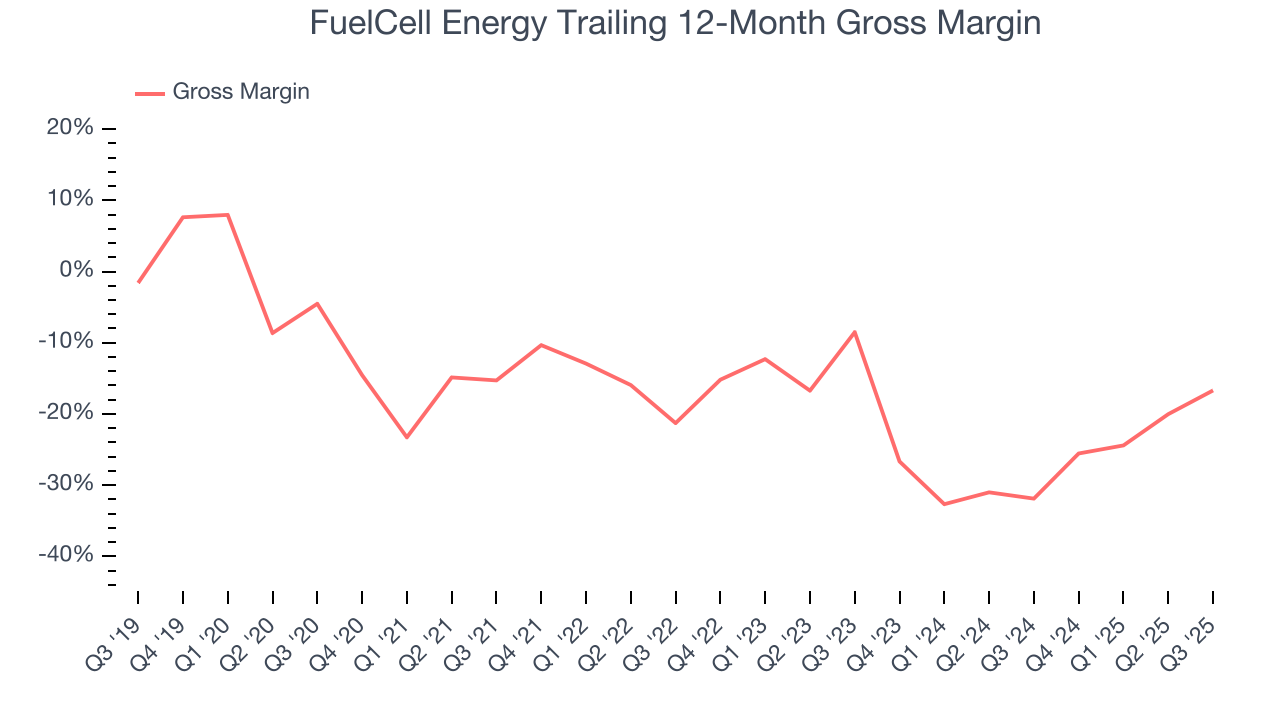

FuelCell Energy has bad unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a negative 18.7% gross margin over the last five years. That means FuelCell Energy lost $18.71 for every $100 in revenue.

This quarter, FuelCell Energy’s gross profit margin was negative 12.1%. The company’s full-year margin was also negative, suggesting it needs to change its business model quickly.

7. Operating Margin

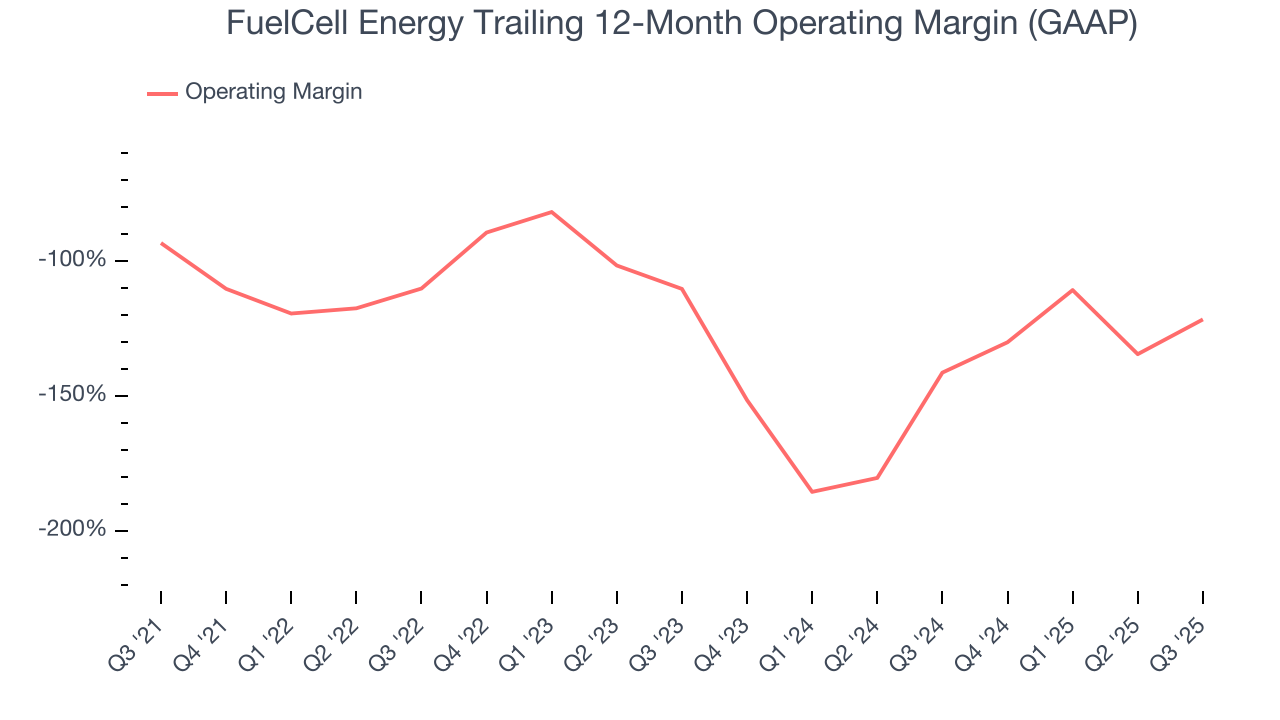

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

FuelCell Energy’s high expenses have contributed to an average operating margin of negative 117% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

Looking at the trend in its profitability, FuelCell Energy’s operating margin decreased by 28.3 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. FuelCell Energy’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

This quarter, FuelCell Energy generated a negative 51.5% operating margin.

8. Earnings Per Share

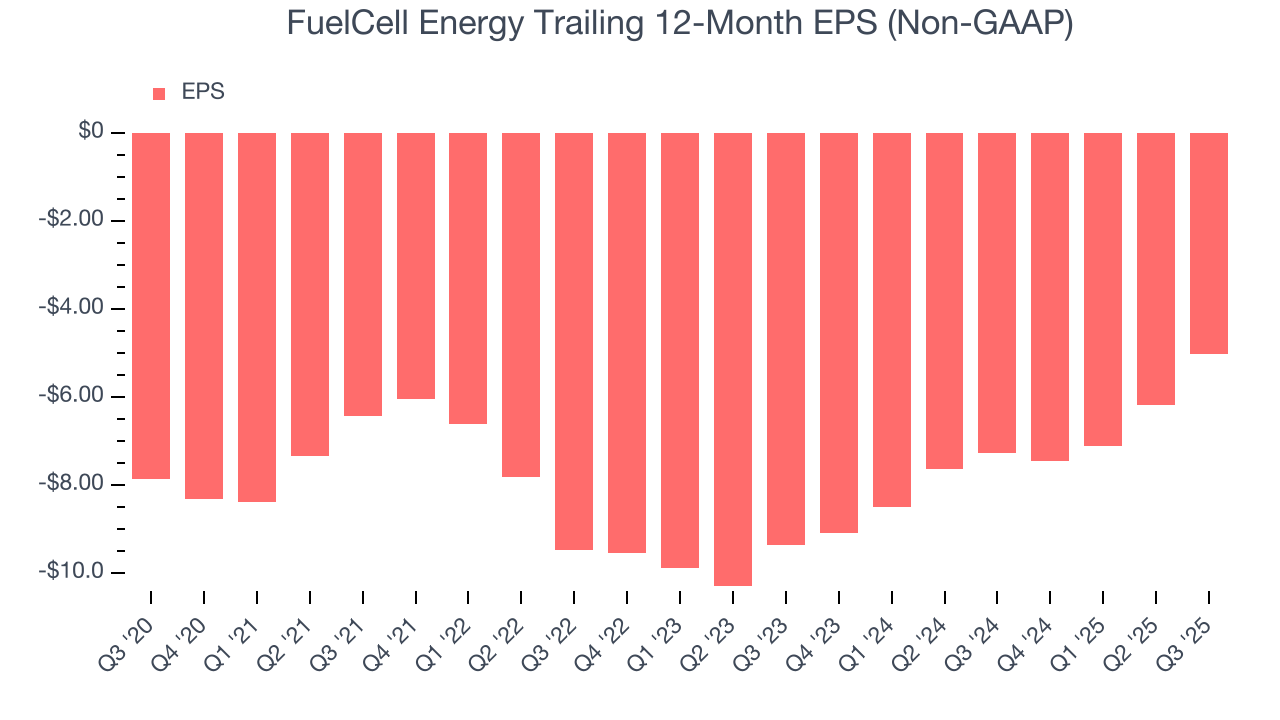

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Although FuelCell Energy’s full-year earnings are still negative, it reduced its losses and improved its EPS by 8.5% annually over the last five years. The next few quarters will be critical for assessing its long-term profitability. We hope to see an inflection point soon.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For FuelCell Energy, its two-year annual EPS growth of 26.6% was higher than its five-year trend. Its improving earnings is an encouraging data point, but a caveat is that its EPS is still in the red.

In Q3, FuelCell Energy reported adjusted EPS of negative $0.83, up from negative $1.99 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects FuelCell Energy to improve its earnings losses. Analysts forecast its full-year EPS of negative $5.04 will advance to negative $4.23.

9. Cash Is King

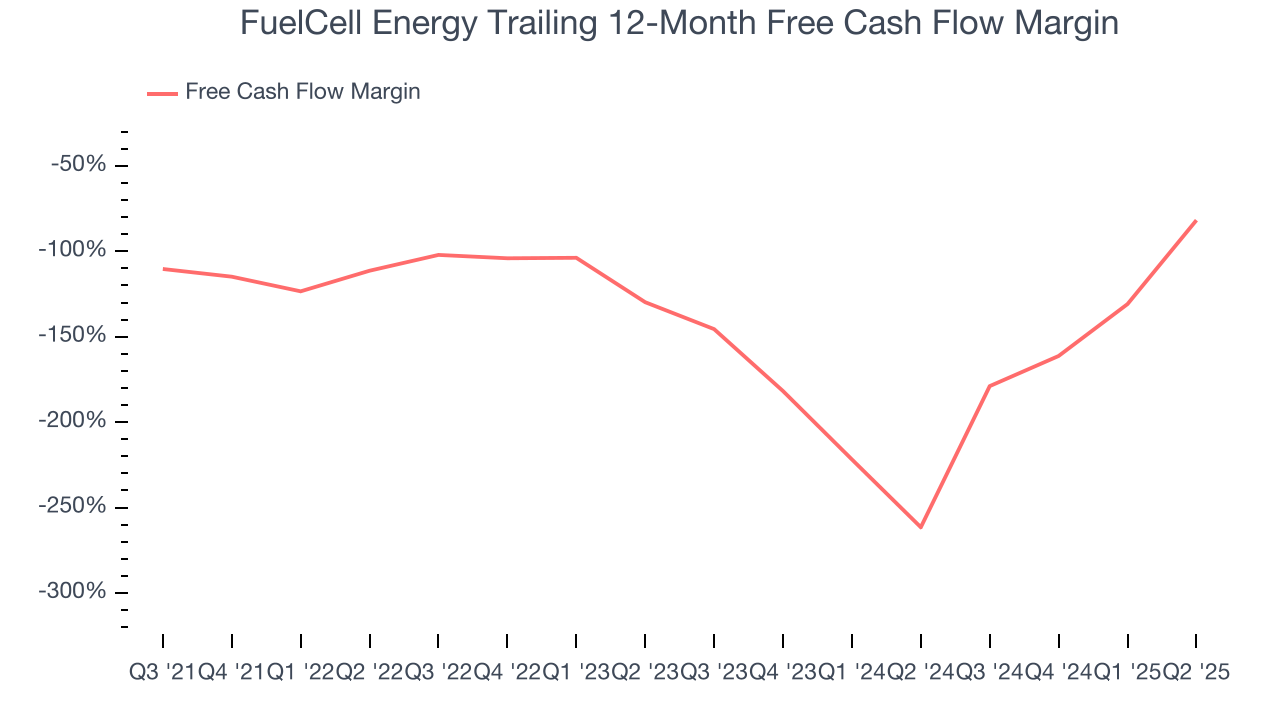

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

FuelCell Energy’s demanding reinvestments have drained its resources over the last five years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 132%, meaning it lit $131.84 of cash on fire for every $100 in revenue.

Taking a step back, we can see that FuelCell Energy’s margin dropped by 2.3 percentage points during that time. Almost any movement in the wrong direction is undesirable because it is already burning cash. If the trend continues, it could signal it’s in the middle of an investment cycle.

10. Balance Sheet Assessment

One of the best ways to mitigate bankruptcy risk is to hold more cash than debt.

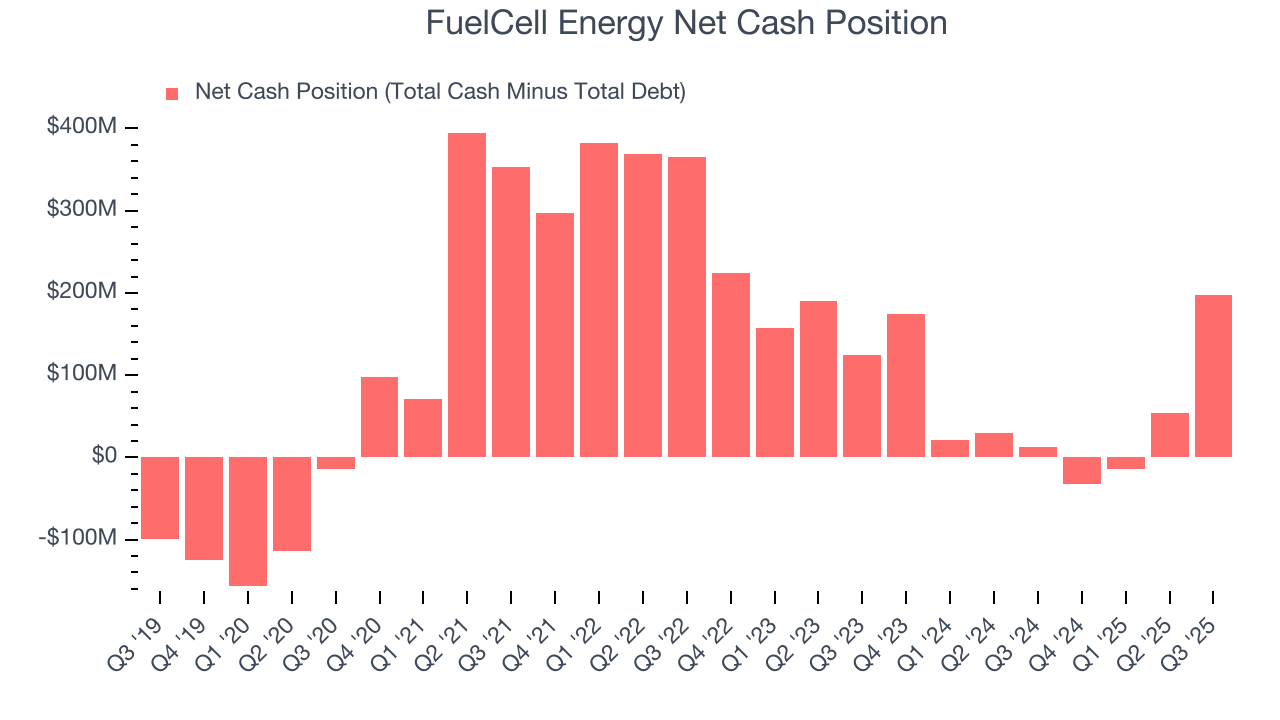

FuelCell Energy is a well-capitalized company with $341.8 million of cash and $144 million of debt on its balance sheet. This $197.8 million net cash position is 42.9% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

11. Key Takeaways from FuelCell Energy’s Q3 Results

We were impressed by how significantly FuelCell Energy blew past analysts’ revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its backlog fell short of Wall Street’s estimates. Overall, this was still a decent quarter. The stock traded up 5.3% to $8.32 immediately following the results.

12. Is Now The Time To Buy FuelCell Energy?

Updated: February 1, 2026 at 11:29 PM EST

When considering an investment in FuelCell Energy, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

There is a lot to like about FuelCell Energy. For starters, its revenue growth was exceptional over the last five years and is expected to accelerate over the next 12 months. And while its declining operating margin shows the business has become less efficient, its rising cash profitability gives it more optionality. Additionally, FuelCell Energy’s projected EPS for the next year implies the company’s fundamentals will improve.

FuelCell Energy’s forward price-to-sales ratio is 1.7x. Looking at the industrials landscape today, FuelCell Energy’s qualities really stand out, and we like it at this price.

Wall Street analysts have a consensus one-year price target of $8.71 on the company (compared to the current share price of $8.21), implying they see 6.1% upside in buying FuelCell Energy in the short term.