FTAI Infrastructure (FIP)

FTAI Infrastructure is a sound business. Although it has burned cash, its growth shows it’s deploying the Jeff Bezos reinvestment strategy.― StockStory Analyst Team

1. News

2. Summary

Why FTAI Infrastructure Is Interesting

Spun off from FTAI Aviation in 2021, FTAI Infrastructure (NASDAQ:FIP) invests in and operates infrastructure and related assets across the transportation and energy sectors.

- Market share has increased this cycle as its 49.1% annual revenue growth over the last four years was exceptional

- Projected revenue growth of 73.5% for the next 12 months is above its two-year trend, pointing to accelerating demand

- On the other hand, its historical operating margin losses point to an inefficient cost structure

FTAI Infrastructure shows some potential. If you like the stock, the price seems reasonable.

Why Is Now The Time To Buy FTAI Infrastructure?

High Quality

Investable

Underperform

Why Is Now The Time To Buy FTAI Infrastructure?

At $6.38 per share, FTAI Infrastructure trades at 12x forward EV-to-EBITDA. Looking across the industrials landscape, we think the valuation is justified for the top-line growth characteristics.

This could be a good time to invest if you believe in the long-term prospects of the business and its offerings.

3. FTAI Infrastructure (FIP) Research Report: Q4 CY2025 Update

Infrastructure investment and operations firm FTAI Infrastructure (NASDAQ:FIP) missed Wall Street’s revenue expectations in Q4 CY2025, but sales rose 77.7% year on year to $143.5 million. Its GAAP loss of $1.08 per share was significantly below analysts’ consensus estimates.

FTAI Infrastructure (FIP) Q4 CY2025 Highlights:

- Revenue: $143.5 million vs analyst estimates of $169.2 million (77.7% year-on-year growth, 15.2% miss)

- EPS (GAAP): -$1.08 vs analyst estimates of -$0.43 (significant miss)

- Adjusted EBITDA: $89.16 million vs analyst estimates of $77.73 million (62.1% margin, 14.7% beat)

- Operating Margin: 88.9%, up from 24.4% in the same quarter last year

- Free Cash Flow was -$68.64 million compared to -$35.93 million in the same quarter last year

- Market Capitalization: $744.3 million

Company Overview

Spun off from FTAI Aviation in 2021, FTAI Infrastructure (NASDAQ:FIP) invests in and operates infrastructure and related assets across the transportation and energy sectors.

The company’s operations are diversified across four strategic business units: Railroad, Ports and Terminals, Power and Gas, and Sustainability and Energy Transition. For instance, its Railroad business operates short lines and regional railroads, providing service to manufacturing facilities, while its Ports and Terminals business manages facilities like the Jefferson Terminal in Texas, which stores and handles various energy products. Additionally, the Power and Gas segment includes investments in facilities like power plants.

FTAI Infrastructure’s revenue primarily comes from fees generated through the operation and management of assets, structured around long-term contracts that provide stable, recurring income. It operates with a blend of fixed costs associated with infrastructure maintenance and variable costs driven by project-specific demands. This business model, emphasizing sectors with high entry barriers and critical services, enables FTAI Infrastructure to maintain dependable revenue streams.

4. Energy Products and Services

Areas like the energy transition and emission reduction are thematic and front of mind today. This can be a double-edged sword for the energy products and services industry. Those who innovate and build new expertise can jolt demand while those who cling to legacy technologies or fall behind in the trending areas could see their market shares diminish. Bigger picture, energy products and services companies are still at the whim of construction and infrastructure project volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates.

Public competitors in the infrastructure sector include Brookfield Infrastructure (NYSE:BIP), Macquarie Infrastructure (NYSE:MIC), and AECOM (NYSE:ACM).

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Thankfully, FTAI Infrastructure’s 43% annualized revenue growth over the last four years was incredible. Its growth beat the average industrials company and shows its offerings resonate with customers, a helpful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a stretched historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. FTAI Infrastructure’s annualized revenue growth of 25.2% over the last two years is below its four-year trend, but we still think the results suggest healthy demand.

This quarter, FTAI Infrastructure achieved a magnificent 77.7% year-on-year revenue growth rate, but its $143.5 million of revenue fell short of Wall Street’s lofty estimates.

Looking ahead, sell-side analysts expect revenue to grow 65.7% over the next 12 months, an improvement versus the last two years. This projection is eye-popping and indicates its newer products and services will spur better top-line performance.

6. Gross Margin & Pricing Power

Cost of sales for an industrials business is usually comprised of the direct labor, raw materials, and supplies needed to offer a product or service. These costs can be impacted by inflation and supply chain dynamics.

FTAI Infrastructure’s gross margin is good compared to other industrials businesses and signals it sells differentiated products, not commodities. As you can see below, it averaged an impressive 33.3% gross margin over the last five years. That means for every $100 in revenue, roughly $33.33 was left to spend on selling, marketing, R&D, and general administrative overhead.

In Q4, FTAI Infrastructure produced a 100% gross profit margin, up 73.2 percentage points year on year. FTAI Infrastructure’s full-year margin has also been trending up over the past 12 months, increasing by 31.6 percentage points. If this move continues, it could suggest a less competitive environment where the company has better pricing power and leverage from its growing sales on the fixed portion of its cost of goods sold (such as manufacturing expenses).

7. Operating Margin

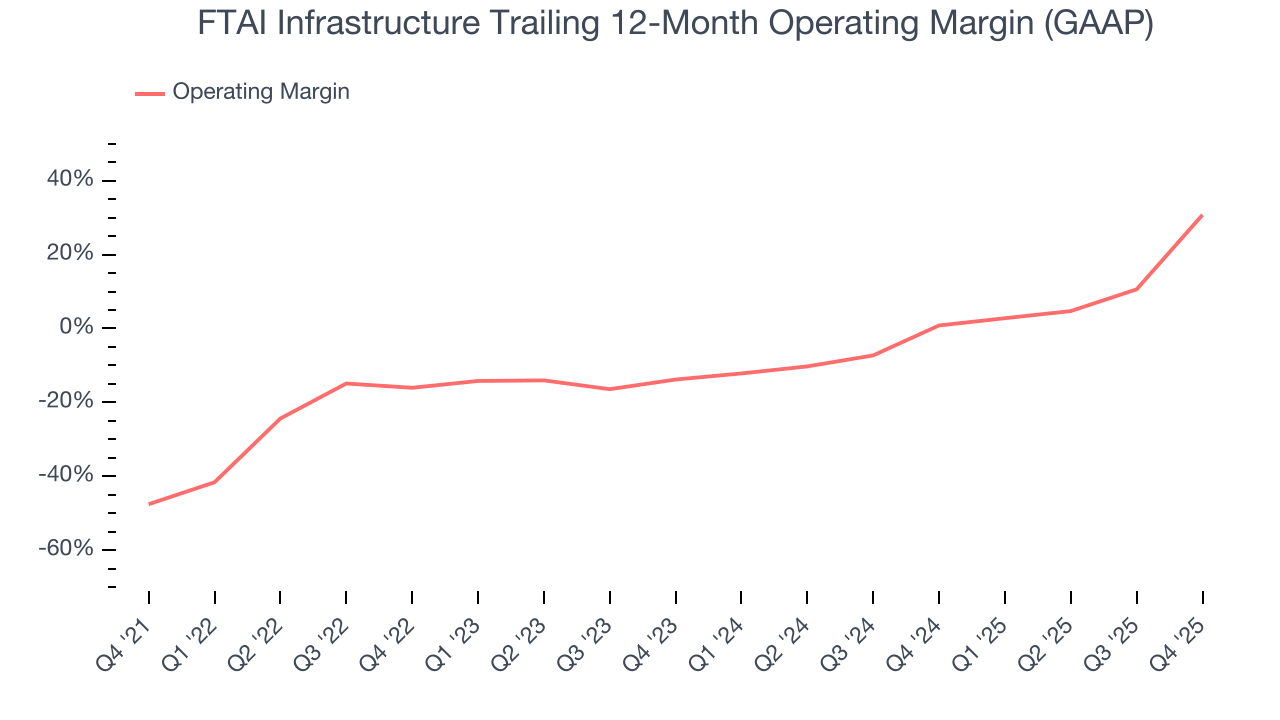

FTAI Infrastructure was roughly breakeven when averaging the last five years of quarterly operating profits, inadequate for an industrials business. This result is surprising given its high gross margin as a starting point.

On the plus side, FTAI Infrastructure’s operating margin rose by 78.3 percentage points over the last five years, as its sales growth gave it immense operating leverage.

This quarter, FTAI Infrastructure generated an operating margin profit margin of 88.9%, up 64.5 percentage points year on year. The increase was driven by stronger leverage on its cost of sales (not higher efficiency with its operating expenses), as indicated by its larger rise in gross margin.

8. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

FTAI Infrastructure’s demanding reinvestments have drained its resources over the last five years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 68.7%, meaning it lit $68.68 of cash on fire for every $100 in revenue.

Taking a step back, an encouraging sign is that FTAI Infrastructure’s margin expanded by 89 percentage points during that time. In light of its glaring cash burn, however, this improvement is a bucket of hot water in a cold ocean.

FTAI Infrastructure burned through $68.64 million of cash in Q4, equivalent to a negative 47.8% margin. The company’s cash burn increased from $35.93 million of lost cash in the same quarter last year.

9. Key Takeaways from FTAI Infrastructure’s Q4 Results

We were impressed by how significantly FTAI Infrastructure blew past analysts’ EBITDA expectations this quarter. On the other hand, its revenue missed and its EPS fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 1.6% to $6.34 immediately following the results.

10. Is Now The Time To Buy FTAI Infrastructure?

Updated: February 26, 2026 at 10:54 PM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own FTAI Infrastructure, you should also grasp the company’s longer-term business quality and valuation.

FTAI Infrastructure possesses a number of positive attributes. First off, its revenue growth was exceptional over the last four years and is expected to accelerate over the next 12 months. And while its declining EPS over the last two years makes it a less attractive asset to the public markets, its rising cash profitability gives it more optionality. On top of that, its expanding operating margin shows the business has become more efficient.

FTAI Infrastructure’s EV-to-EBITDA ratio based on the next 12 months is 11.2x. Looking at the industrials space right now, FTAI Infrastructure trades at a compelling valuation. If you trust the business and its direction, this is an ideal time to buy.

Wall Street analysts have a consensus one-year price target of $11.67 on the company (compared to the current share price of $6.28), implying they see 85.8% upside in buying FTAI Infrastructure in the short term.