Five Below (FIVE)

Five Below doesn’t excite us. Its sales have underperformed and its low returns on capital show it has few growth opportunities.― StockStory Analyst Team

1. News

2. Summary

Why Five Below Is Not Exciting

Often facilitating a treasure hunt shopping experience, Five Below (NASDAQ:FIVE) is an American discount retailer that sells a variety of products from mobile phone cases to candy to sports equipment for largely $5 or less.

- Underwhelming 10.4% return on capital reflects management’s difficulties in finding profitable growth opportunities, and its falling returns suggest its earlier profit pools are drying up

- Commoditized inventory, bad unit economics, and high competition are reflected in its low gross margin of 35.4%

- A positive is that its market share will likely rise over the next 12 months as its expected revenue growth of 14.4% is robust

Five Below doesn’t check our boxes. We see more attractive opportunities in the market.

Why There Are Better Opportunities Than Five Below

Why There Are Better Opportunities Than Five Below

Five Below’s stock price of $225 implies a valuation ratio of 34.1x forward P/E. This multiple rich for the business quality. Not a great combination.

We’d rather pay up for companies with elite fundamentals than get a decent price on a poor one. High-quality businesses often have more durable earnings power, helping us sleep well at night.

3. Five Below (FIVE) Research Report: Q3 CY2025 Update

Discount retailer Five Below (NASDAQ:FIVE) reported Q3 CY2025 results beating Wall Street’s revenue expectations, with sales up 23.1% year on year to $1.04 billion. On top of that, next quarter’s revenue guidance ($1.60 billion at the midpoint) was surprisingly good and 3.6% above what analysts were expecting. Its non-GAAP profit of $0.68 per share was significantly above analysts’ consensus estimates.

Five Below (FIVE) Q3 CY2025 Highlights:

- Revenue: $1.04 billion vs analyst estimates of $973 million (23.1% year-on-year growth, 6.7% beat)

- Adjusted EPS: $0.68 vs analyst estimates of $0.24 (significant beat)

- Adjusted EBITDA: $99.94 million vs analyst estimates of $63.8 million (9.6% margin, 56.6% beat)

- Revenue Guidance for Q4 CY2025 is $1.60 billion at the midpoint, above analyst estimates of $1.54 billion

- Management raised its full-year Adjusted EPS guidance to $5.80 at the midpoint, a 16.9% increase

- Operating Margin: 4.2%, up from -0.1% in the same quarter last year

- Free Cash Flow was -$133.2 million compared to -$111 million in the same quarter last year

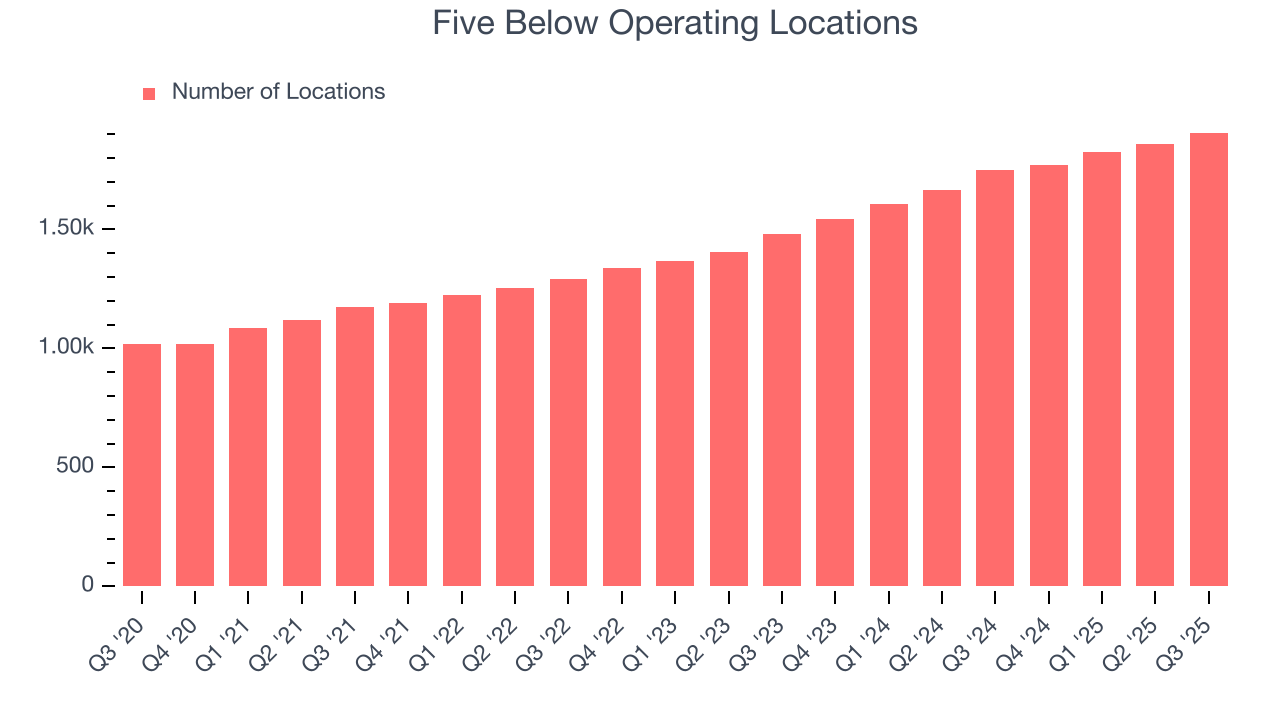

- Locations: 1,907 at quarter end, up from 1,749 in the same quarter last year

- Same-Store Sales rose 14.3% year on year (0.6% in the same quarter last year)

- Market Capitalization: $8.76 billion

Company Overview

Often facilitating a treasure hunt shopping experience, Five Below (NASDAQ:FIVE) is an American discount retailer that sells a variety of products from mobile phone cases to candy to sports equipment for largely $5 or less.

A typical store is around 8,000 square feet in size, located in a suburban shopping center or mall. Overall, stores are bright and colorful, with a layout that encourages customers to browse and discover new products. One prominent section in most stores is tech, where customers can find headphones, charging cables, and phone cases. There is also usually a section for beauty and personal care products. Toys and snacks are two other prominent sections, with the latter located near the checkout area to encourage impulse purchases.

The company's core customer base is young adults and teenagers who are looking for affordable yet trendy products. For example, when the colorful rubber ‘pop it’ or ‘push pop’ product became popular among children, Five Below jumped on the trend and featured the products prominently in its toy sections. This customer base also values the treasure hunt experience of walking a Five Below store. So while the store’s sections are consistent, the products sold in each section may vary over time and will depend on what’s hot and what the company can source and sell within its price and margin guardrails.

4. Discount Retailer

Discount retailers understand that many shoppers love a good deal, and they focus on providing excellent value to shoppers by selling general merchandise at major discounts. They can do this because of unique purchasing, procurement, and pricing strategies that involve scouring the market for trendy goods or buying excess inventory from manufacturers and other retailers. They then turn around and sell these snacks, paper towels, toys, clothes, and myriad other products at highly enticing prices. Despite the unique draw and lure of discounts, these discount retailers must also contend with the secular headwinds of online shopping and challenged retail foot traffic in places like suburban strip malls.

Retail competitors include TJX (NYSE:TJX), Urban Outfitters (NASDAQ:URBN), and Ollie’s Bargain Outlet (NASDAQ:OLLI).

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $4.43 billion in revenue over the past 12 months, Five Below is a small retailer, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with suppliers. On the bright side, it can grow faster because it has more white space to build new stores.

As you can see below, Five Below grew its sales at a solid 14.5% compounded annual growth rate over the last three years (we compare to 2019 to normalize for COVID-19 impacts) as it opened new stores and increased sales at existing, established locations.

This quarter, Five Below reported robust year-on-year revenue growth of 23.1%, and its $1.04 billion of revenue topped Wall Street estimates by 6.7%. Company management is currently guiding for a 14.7% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 8.6% over the next 12 months, a deceleration versus the last three years. Still, this projection is noteworthy and suggests the market is forecasting success for its products.

6. Store Performance

Number of Stores

A retailer’s store count often determines how much revenue it can generate.

Five Below sported 1,907 locations in the latest quarter. Over the last two years, it has opened new stores at a rapid clip by averaging 14.8% annual growth, among the fastest in the consumer retail sector. This gives it a chance to scale into a mid-sized business over time.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

Same-Store Sales

A company's store base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales gives us insight into this topic because it measures organic growth for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year.

Five Below’s demand has been spectacular for a retailer over the last two years. On average, the company has increased its same-store sales by an impressive 3.3% per year. This performance along with its meaningful buildout of new stores suggest it’s playing some aggressive offense.

In the latest quarter, Five Below’s same-store sales rose 14.3% year on year. This growth was an acceleration from its historical levels, which is always an encouraging sign.

7. Gross Margin & Pricing Power

Five Below has bad unit economics for a retailer, giving it less room to reinvest and grow its presence. As you can see below, it averaged a 35.4% gross margin over the last two years. That means Five Below paid its suppliers a lot of money ($64.58 for every $100 in revenue) to run its business.

Five Below’s gross profit margin came in at 33.8% this quarter, marking a 3.3 percentage point increase from 30.6% in the same quarter last year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting it strives to keep prices low for customers and has stable input costs (such as labor and freight expenses to transport goods).

8. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Five Below’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 9% over the last two years. This profitability was higher than the broader consumer retail sector, showing it did a decent job managing its expenses.

Looking at the trend in its profitability, Five Below’s operating margin might fluctuated slightly but has generally stayed the same over the last year. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q3, Five Below generated an operating margin profit margin of 4.2%, up 4.2 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, and administrative overhead.

9. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

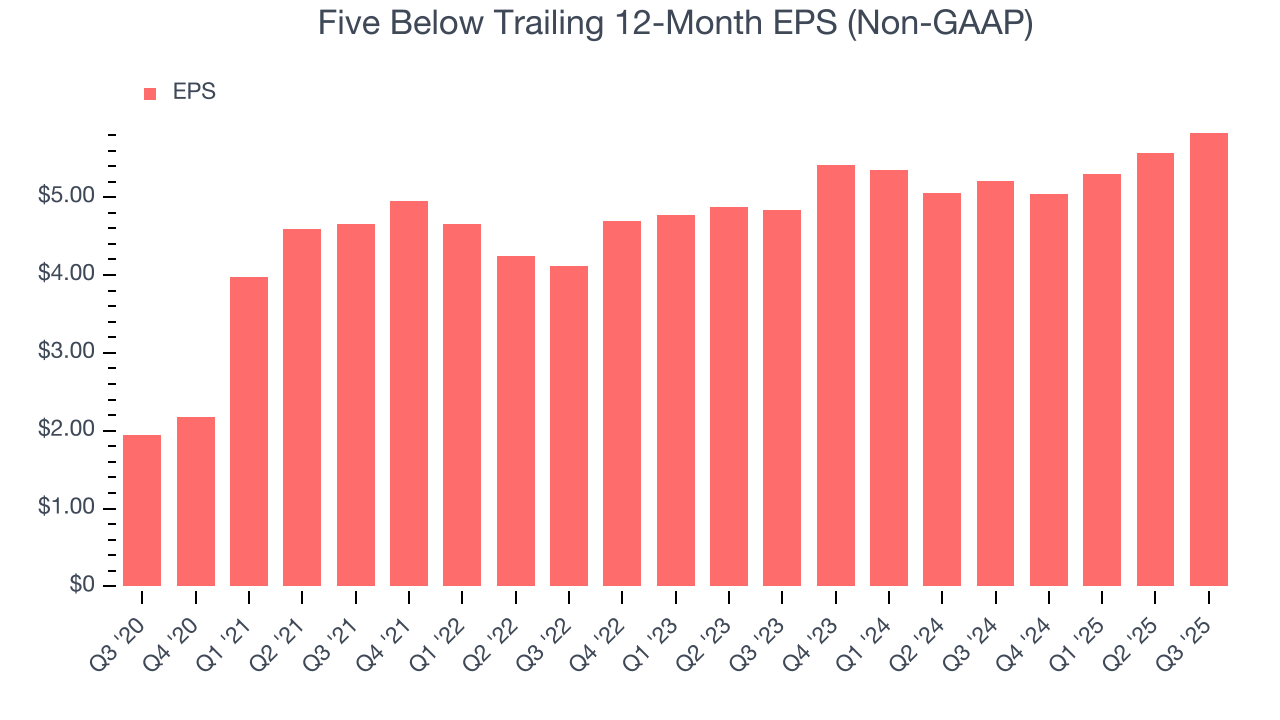

Five Below’s EPS grew at a decent 12.4% compounded annual growth rate over the last three years. However, this performance was lower than its 14.5% annualized revenue growth, telling us the company became less profitable on a per-share basis as it expanded.

In Q3, Five Below reported adjusted EPS of $0.68, up from $0.42 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Five Below’s full-year EPS of $5.83 to grow 12.4%.

10. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Five Below has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 5.1% over the last two years, better than the broader consumer retail sector.

Taking a step back, we can see that Five Below’s margin expanded by 4.7 percentage points over the last year. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability was flat.

Five Below burned through $133.2 million of cash in Q3, equivalent to a negative 12.8% margin. The company’s cash burn increased from $111 million of lost cash in the same quarter last year. These numbers deviate from its longer-term margin, indicating it is a seasonal business that must build up inventory during certain quarters.

11. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Five Below historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 10.4%, somewhat low compared to the best consumer retail companies that consistently pump out 25%+.

12. Balance Sheet Assessment

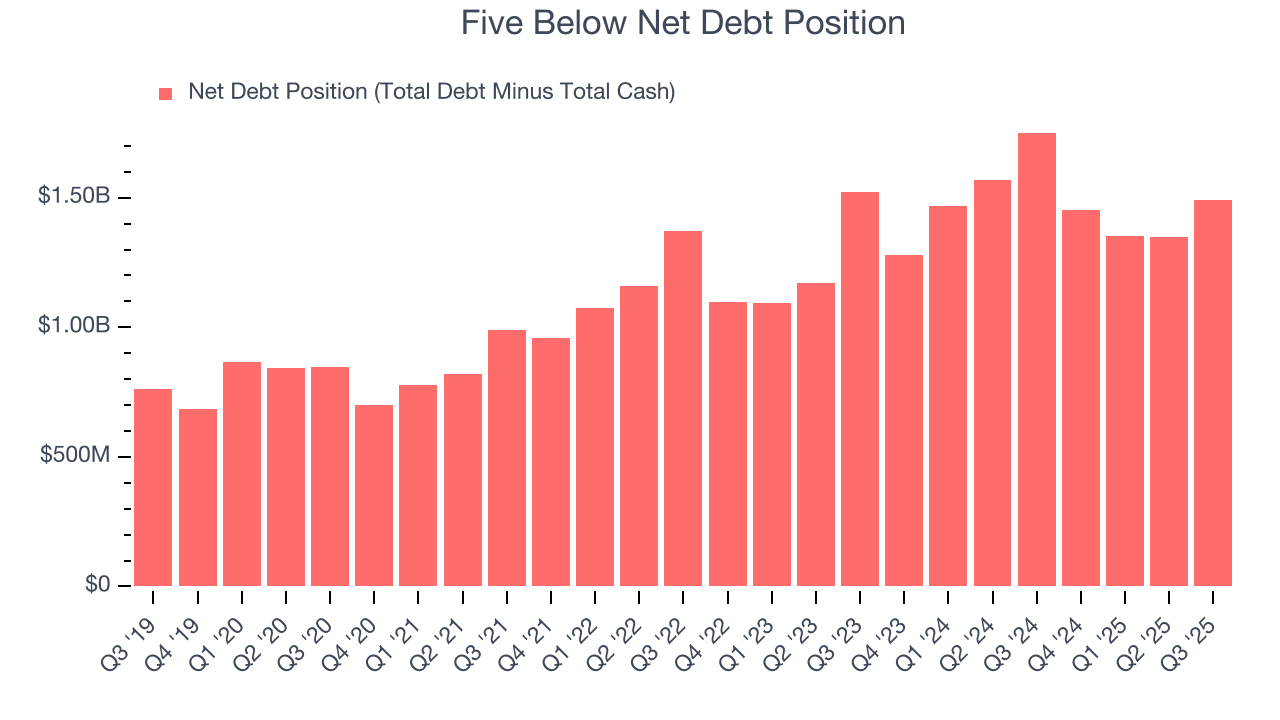

Five Below reported $524.5 million of cash and $2.01 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $607.7 million of EBITDA over the last 12 months, we view Five Below’s 2.5× net-debt-to-EBITDA ratio as safe. We also see its $21 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

13. Key Takeaways from Five Below’s Q3 Results

We were impressed by Five Below’s optimistic EPS guidance for next quarter, which blew past analysts’ expectations. We were also glad its EPS outperformed Wall Street’s estimates. Zooming out, we think this was a solid print. The stock remained flat at $164.59 immediately following the results.

14. Is Now The Time To Buy Five Below?

Updated: February 26, 2026 at 9:38 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Five Below.

Five Below has some positive attributes, but it isn’t one of our picks. To begin with, the its revenue growth was good over the last three years, and analysts believe it can continue growing at these levels. And while Five Below’s relatively low ROIC suggests management has struggled to find compelling investment opportunities, its new store openings have increased its brand equity.

Five Below’s P/E ratio based on the next 12 months is 34.1x. Beauty is in the eye of the beholder, but our analysis shows the upside isn’t great compared to the potential downside. We're fairly confident there are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $225.82 on the company (compared to the current share price of $225).