Burlington (BURL)

Burlington doesn’t impress us. Its sales have underperformed and its low returns on capital show it has few growth opportunities.― StockStory Analyst Team

1. News

2. Summary

Why Burlington Is Not Exciting

Founded in 1972 as a discount coat and outerwear retailer, Burlington Stores (NYSE:BURL) is now an off-price retailer that has broadened into general apparel, footwear, and home goods.

- ROIC of 9% reflects management’s challenges in identifying attractive investment opportunities

- Poor free cash flow generation means it has few chances to reinvest for growth, repurchase shares, or distribute capital

- Aggressive strategy of rolling out new stores to gobble up whitespace is prudent given its same-store sales growth

Burlington doesn’t meet our quality standards. There are superior stocks for sale in the market.

Why There Are Better Opportunities Than Burlington

Why There Are Better Opportunities Than Burlington

Burlington is trading at $308.60 per share, or 29.4x forward P/E. This multiple expensive for its subpar fundamentals.

It’s better to pay up for high-quality businesses with strong long-term earnings potential rather than to buy lower-quality companies with open questions and big downside risks.

3. Burlington (BURL) Research Report: Q3 CY2025 Update

Off-price retail company Burlington Stores (NYSE:BURL) met Wall Streets revenue expectations in Q3 CY2025, with sales up 7.1% year on year to $2.71 billion. On the other hand, next quarter’s revenue guidance of $3.54 billion was less impressive, coming in 0.9% below analysts’ estimates. Its non-GAAP profit of $1.68 per share was 2.7% above analysts’ consensus estimates.

Burlington (BURL) Q3 CY2025 Highlights:

- Revenue: $2.71 billion vs analyst estimates of $2.72 billion (7.1% year-on-year growth, in line)

- Adjusted EPS: $1.68 vs analyst estimates of $1.64 (2.7% beat)

- Revenue Guidance for Q4 CY2025 is $3.54 billion at the midpoint, below analyst estimates of $3.57 billion

- Management raised its full-year Adjusted EPS guidance to $9.79 at the midpoint, a 4.3% increase

- Operating Margin: 9.3%, up from 5.4% in the same quarter last year

- Free Cash Flow was -$109.6 million compared to -$56.22 million in the same quarter last year

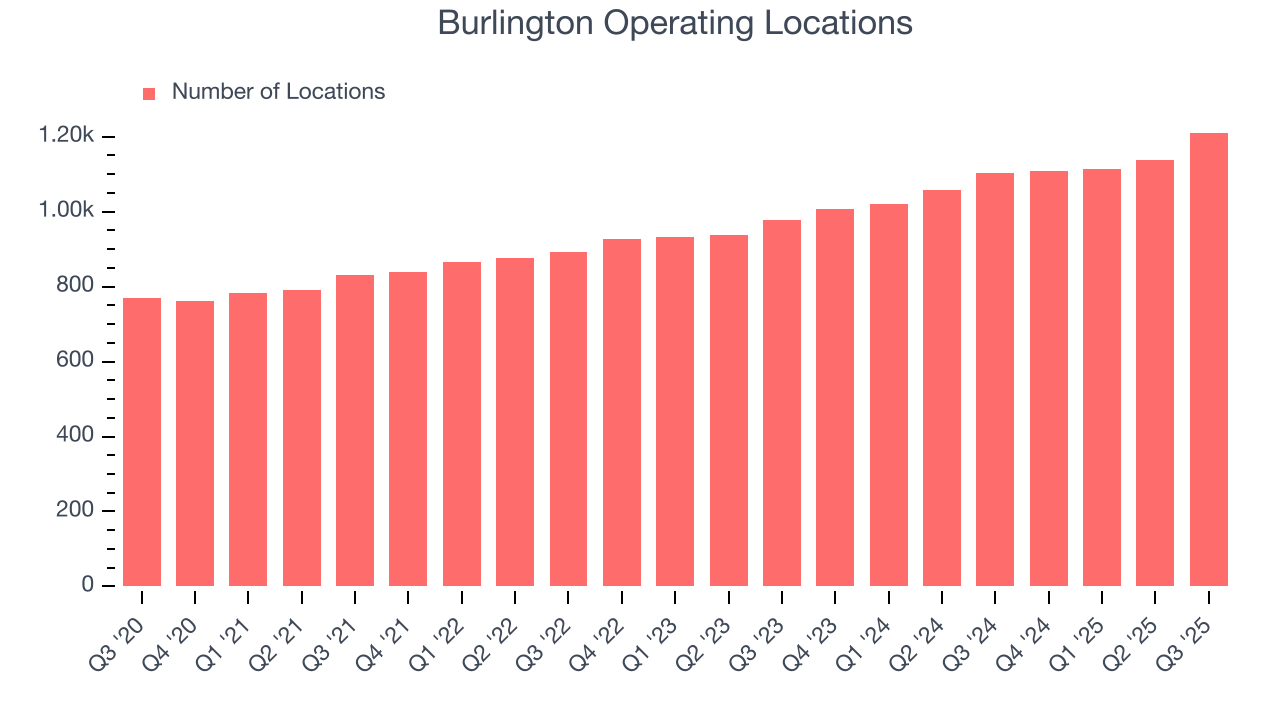

- Locations: 1,211 at quarter end, up from 1,103 in the same quarter last year

- Same-Store Sales rose 1% year on year, in line with the same quarter last year

- Market Capitalization: $17.71 billion

Company Overview

Founded in 1972 as a discount coat and outerwear retailer, Burlington Stores (NYSE:BURL) is now an off-price retailer that has broadened into general apparel, footwear, and home goods.

For example, if department store Kohl’s is left with a glut of swimsuits because of unusually cold weather, Kohl’s may sell those in bulk to Burlington at pennies on the dollar rather than discount the items and try to sell them individually. This is often done to clear floor space for a new season.

Burlington’s buying approach focuses on finding excess inventory or overstocked items from other retailers, so selection can change quickly and be varied. Shopping at Burlington is often a treasure hunt–what the consumer loses in reliable selection or the latest trends is made up for with very low prices. Prices of Burlington merchandise can be significantly lower than those of department stores. Over time, the company’s size and buying power has led to a more consistent selection of items from brands such as Tommy Hilfiger, Champion, and Dyson to name a few.

The core customer is the value-conscious shopper who enjoys the thrill of the hunt. This customer is typically a middle-aged, middle-income woman. This customer is willing to spend more time going through less organized racks and shopping exclusively in person–since Burlington has a very limited online presence–in exchange for meaningful discounts.

4. Discount Retailer

Discount retailers understand that many shoppers love a good deal, and they focus on providing excellent value to shoppers by selling general merchandise at major discounts. They can do this because of unique purchasing, procurement, and pricing strategies that involve scouring the market for trendy goods or buying excess inventory from manufacturers and other retailers. They then turn around and sell these snacks, paper towels, toys, clothes, and myriad other products at highly enticing prices. Despite the unique draw and lure of discounts, these discount retailers must also contend with the secular headwinds of online shopping and challenged retail foot traffic in places like suburban strip malls.

Off-price and discount retail competitors include TJX (NYSE:TJX), Ross Stores (NASDAQ:ROST), and Ollie’s Bargain Outlet (NASDAQ:OLLI).

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $11.2 billion in revenue over the past 12 months, Burlington is a mid-sized retailer, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

As you can see below, Burlington’s sales grew at a mediocre 9.3% compounded annual growth rate over the last three years (we compare to 2019 to normalize for COVID-19 impacts), but to its credit, it opened new stores and increased sales at existing, established locations.

This quarter, Burlington grew its revenue by 7.1% year on year, and its $2.71 billion of revenue was in line with Wall Street’s estimates. Company management is currently guiding for a 8% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 9.4% over the next 12 months, similar to its three-year rate. This projection is eye-popping for a company of its scale and suggests the market is baking in success for its products.

6. Store Performance

Number of Stores

The number of stores a retailer operates is a critical driver of how quickly company-level sales can grow.

Burlington sported 1,211 locations in the latest quarter. Over the last two years, it has opened new stores at a rapid clip by averaging 10% annual growth, among the fastest in the consumer retail sector. This gives it a chance to become a large, scaled business over time.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

Same-Store Sales

A company's store base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales gives us insight into this topic because it measures organic growth for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year.

Burlington’s demand has been healthy for a retailer over the last two years. On average, the company has grown its same-store sales by a robust 2.7% per year. This performance gives it the confidence to meaningfully expand its store base.

In the latest quarter, Burlington’s same-store sales rose 1% year on year. This was a meaningful deceleration from its historical levels. We’ll be watching closely to see if Burlington can reaccelerate growth.

7. Gross Margin & Pricing Power

Burlington has good unit economics for a retailer, giving it the opportunity to invest in areas such as marketing and talent to stay competitive. As you can see below, it averaged an impressive 43.5% gross margin over the last two years. That means for every $100 in revenue, $56.49 went towards paying for inventory, transportation, and distribution.

In Q3, Burlington produced a 44.3% gross profit margin, in line with the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting it strives to keep prices low for customers and has stable input costs (such as labor and freight expenses to transport goods).

8. Operating Margin

Burlington was profitable over the last two years but held back by its large cost base. Its average operating margin of 7.5% was weak for a consumer retail business. This result is surprising given its high gross margin as a starting point.

On the plus side, Burlington’s operating margin rose by 1.4 percentage points over the last year, as its sales growth gave it operating leverage.

This quarter, Burlington generated an operating margin profit margin of 9.3%, up 4 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, and administrative overhead.

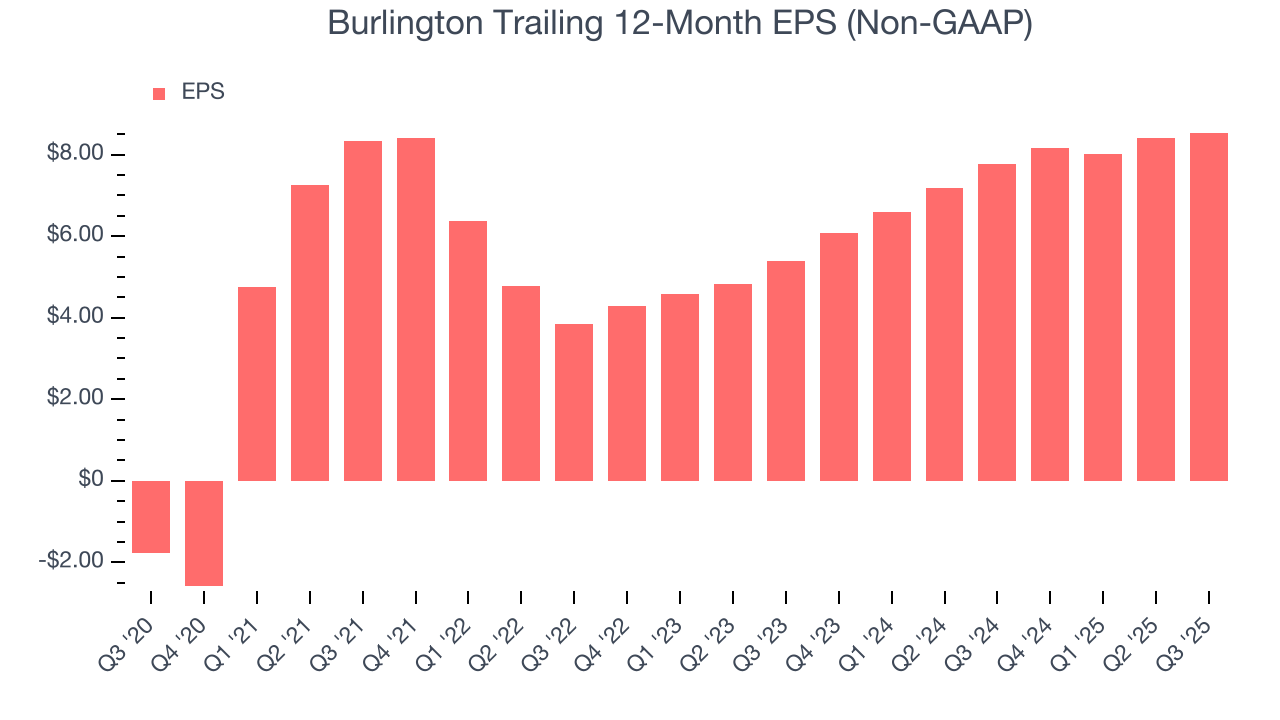

9. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Burlington’s EPS grew at a remarkable 30.4% compounded annual growth rate over the last three years, higher than its 9.3% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

In Q3, Burlington reported adjusted EPS of $1.68, up from $1.55 in the same quarter last year. This print beat analysts’ estimates by 2.7%. Over the next 12 months, Wall Street expects Burlington’s full-year EPS of $8.54 to grow 22.5%.

10. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Burlington broke even from a free cash flow perspective over the last two years, giving the company limited opportunities to return capital to shareholders.

Taking a step back, we can see that Burlington’s margin dropped by 5.1 percentage points over the last year. This decrease came from the higher costs associated with opening more stores.

Burlington burned through $109.6 million of cash in Q3, equivalent to a negative 4% margin. The company’s cash burn increased from $56.22 million of lost cash in the same quarter last year.

11. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Burlington historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 9.3%, somewhat low compared to the best consumer retail companies that consistently pump out 25%+.

12. Balance Sheet Assessment

Burlington reported $584.1 million of cash and $5.94 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $1.19 billion of EBITDA over the last 12 months, we view Burlington’s 4.5× net-debt-to-EBITDA ratio as safe. We also see its $27.14 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

13. Key Takeaways from Burlington’s Q3 Results

We enjoyed seeing Burlington beat analysts’ EPS expectations this quarter. We were also glad its full-year EPS guidance exceeded Wall Street’s estimates. On the other hand, its revenue guidance for next quarter slightly missed and its EPS guidance for next quarter fell slightly short of Wall Street’s estimates. Overall, this print was mixed but still had some key positives. Investors were likely hoping for more, and shares traded down 4.6% to $271.40 immediately following the results.

14. Is Now The Time To Buy Burlington?

Updated: February 27, 2026 at 9:41 PM EST

Before making an investment decision, investors should account for Burlington’s business fundamentals and valuation in addition to what happened in the latest quarter.

Burlington isn’t a bad business, but we’re not clamoring to buy it here and now. Although its revenue growth was mediocre over the last three years, its new store openings have increased its brand equity. We advise investors to be cautious with this one, however, as its relatively low ROIC suggests management has struggled to find compelling investment opportunities.

Burlington’s P/E ratio based on the next 12 months is 29.5x. Beauty is in the eye of the beholder, but we don’t really see a big opportunity at the moment. We're fairly confident there are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $351.50 on the company (compared to the current share price of $306.84).