FormFactor (FORM)

We’re skeptical of FormFactor. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think FormFactor Will Underperform

With customers across the foundry and fabless markets, FormFactor (NASDAQ:FORM) is a US-based provider of test and measurement technologies for semiconductors.

- Lacking free cash flow margin got worse over the last five years as its investment needs accelerated

- Low returns on capital reflect management’s struggle to allocate funds effectively, and its falling returns suggest its earlier profit pools are drying up

- On the bright side, its estimated revenue growth of 16.4% for the next 12 months implies demand will accelerate from its two-year trend

FormFactor’s quality is lacking. We believe there are better businesses elsewhere.

Why There Are Better Opportunities Than FormFactor

High Quality

Investable

Underperform

Why There Are Better Opportunities Than FormFactor

FormFactor’s stock price of $93.24 implies a valuation ratio of 49.8x forward P/E. We consider this valuation aggressive considering the weaker revenue growth profile.

We’d rather invest in similarly-priced but higher-quality companies with more reliable earnings growth.

3. FormFactor (FORM) Research Report: Q4 CY2025 Update

Semiconductor testing company FormFactor (NASDAQ:FORM) reported Q4 CY2025 results topping the market’s revenue expectations, with sales up 13.6% year on year to $215.2 million. On top of that, next quarter’s revenue guidance ($225 million at the midpoint) was surprisingly good and 10.3% above what analysts were expecting. Its non-GAAP profit of $0.46 per share was 30.6% above analysts’ consensus estimates.

FormFactor (FORM) Q4 CY2025 Highlights:

- Revenue: $215.2 million vs analyst estimates of $210.4 million (13.6% year-on-year growth, 2.3% beat)

- Adjusted EPS: $0.46 vs analyst estimates of $0.35 (30.6% beat)

- Adjusted Operating Income: $36.92 million vs analyst estimates of $30.34 million (17.2% margin, 21.7% beat)

- Revenue Guidance for Q1 CY2026 is $225 million at the midpoint, above analyst estimates of $203.9 million

- Adjusted EPS guidance for Q1 CY2026 is $0.45 at the midpoint, above analyst estimates of $0.32

- Operating Margin: 10.9%, up from 4.1% in the same quarter last year

- Free Cash Flow Margin: 16.1%, up from 14.9% in the same quarter last year

- Inventory Days Outstanding: 81, in line with the previous quarter

- Market Capitalization: $5.79 billion

Company Overview

With customers across the foundry and fabless markets, FormFactor (NASDAQ:FORM) is a US-based provider of test and measurement technologies for semiconductors.

FormFactor was founded in 1993 by former IBM researcher, Igor Khandros. The initial products served three semiconductor applications: sockets, packaging, and probe cards. FormFactor went public in June of 2003.

Designing semiconductors involves modeling, reliability testing, and design de-bug followed by qualification and production assessments. Along the way, testing and measurement occurs to ensure compliance with industry standards and to ensure accuracy. Since semiconductor manufacturing is a complex and resource-intensive process, detecting flaws early in the process means saving money and time. As such, testing and measurement impact yields, time-to-market, and overall quality.

FormFactor’s products – often customized to meet customers’ unique wafer and chip designs – address these testing and measurement needs through products such as probe cards, probe stations, thermal systems, and cryogenic systems. Probe cards, for example, ensure that a customer’s composite contact elements used in manufacturing are precise to length scales of a few microns and reliable across various compression levels. Thermal systems ensure precise temperature management during certain steps in semiconductor manufacturing.

Competitors in the market for probe cards, FormFactor’s largest product category, include Advanced Micro Silicon Technology, Chungwa Precision Test Technology, Feinmetall, and Japan Electronic Materials Corporation (TYO:6855).

4. Revenue Growth

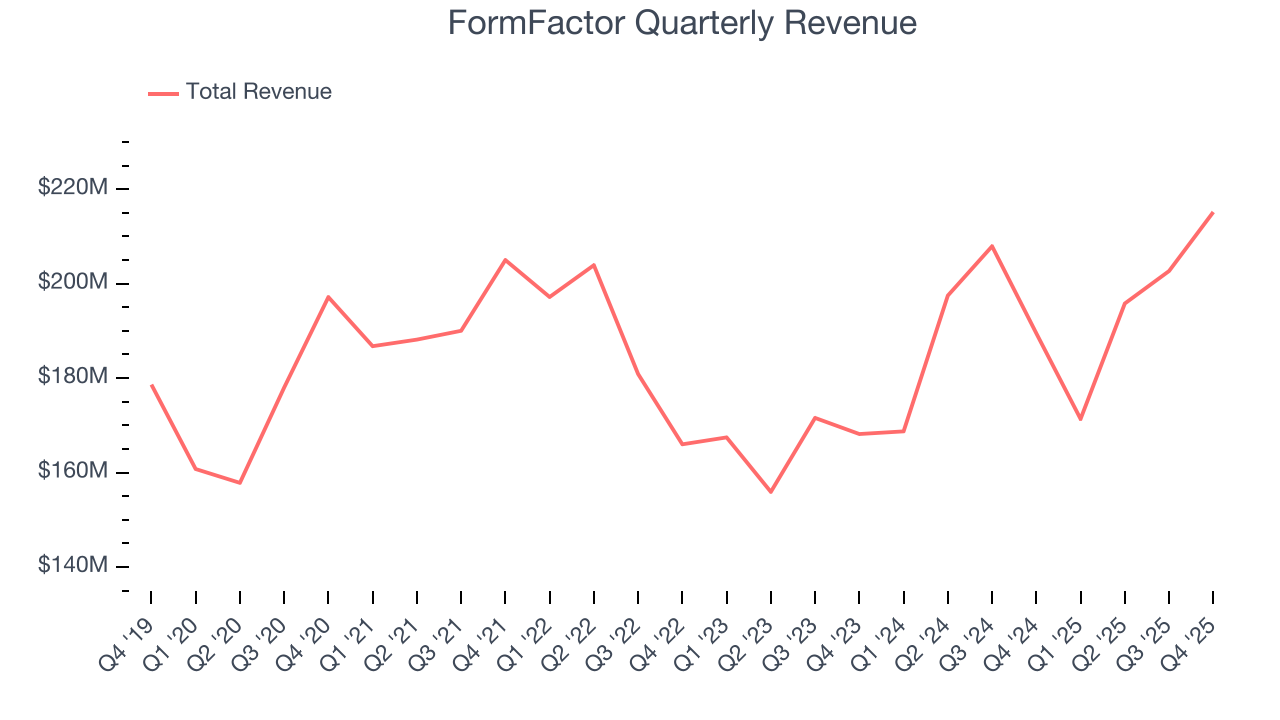

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, FormFactor’s 2.5% annualized revenue growth over the last five years was tepid. This was below our standards and is a tough starting point for our analysis. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

We at StockStory place the most emphasis on long-term growth, but within semiconductors, a half-decade historical view may miss new demand cycles or industry trends like AI. FormFactor’s annualized revenue growth of 8.8% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

This quarter, FormFactor reported year-on-year revenue growth of 13.6%, and its $215.2 million of revenue exceeded Wall Street’s estimates by 2.3%. Adding to the positive news, FormFactor’s growth inflected positively this quarter, news that will likely give some shareholders hope. Company management is currently guiding for a 31.3% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 10.4% over the next 12 months. While this projection suggests its newer products and services will catalyze better top-line performance, it is still below the sector average.

5. Product Demand & Outstanding Inventory

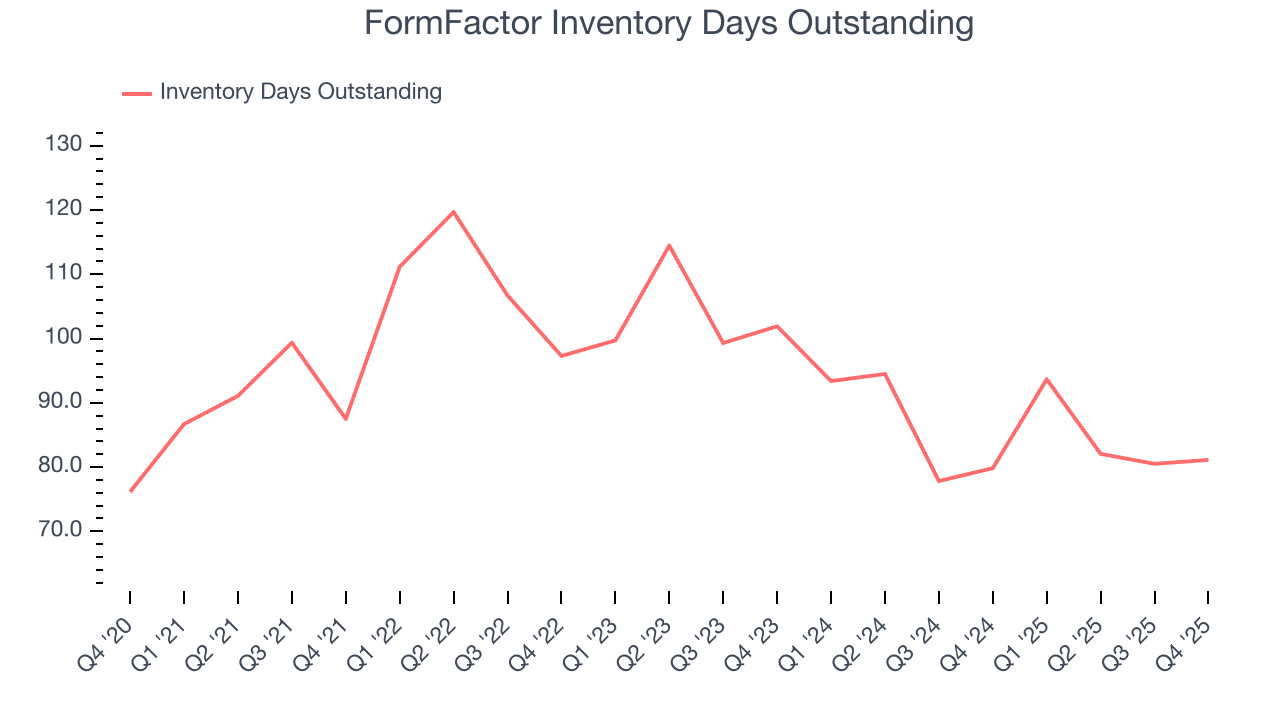

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business’ capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, FormFactor’s DIO came in at 81, which is 14 days below its five-year average. Flat versus last quarter, there’s no indication of an excessive inventory buildup.

6. Gross Margin & Pricing Power

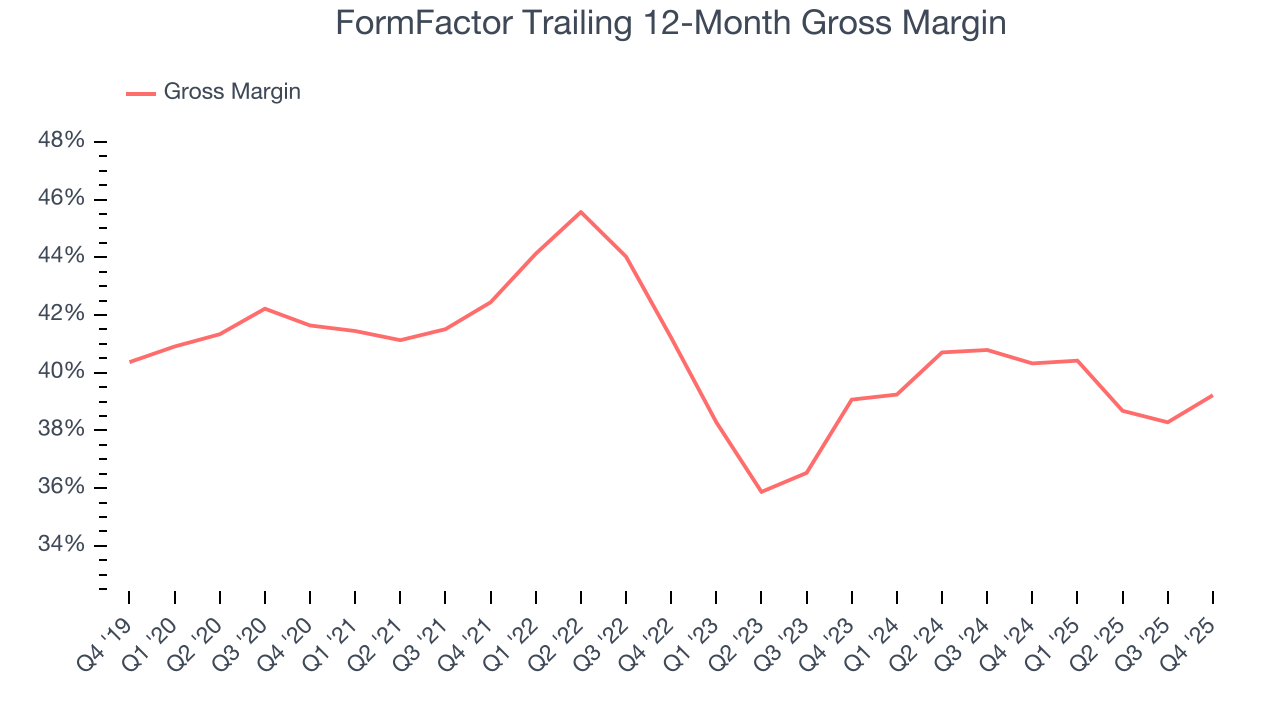

Gross profit margin is a key metric to track because it shows how much money a semiconductor company gets to keep after paying for its raw materials, manufacturing, and other input costs.

FormFactor’s gross margin is well below other semiconductor companies, indicating a lack of pricing power and a competitive market. As you can see below, it averaged a 39.8% gross margin over the last two years. Said differently, FormFactor had to pay a chunky $60.23 to its suppliers for every $100 in revenue.

This quarter, FormFactor’s gross profit margin was 42.2%, up 3.4 percentage points year on year. Zooming out, however, FormFactor’s full-year margin has been trending down over the past 12 months, decreasing by 1.1 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs (such as raw materials and manufacturing expenses).

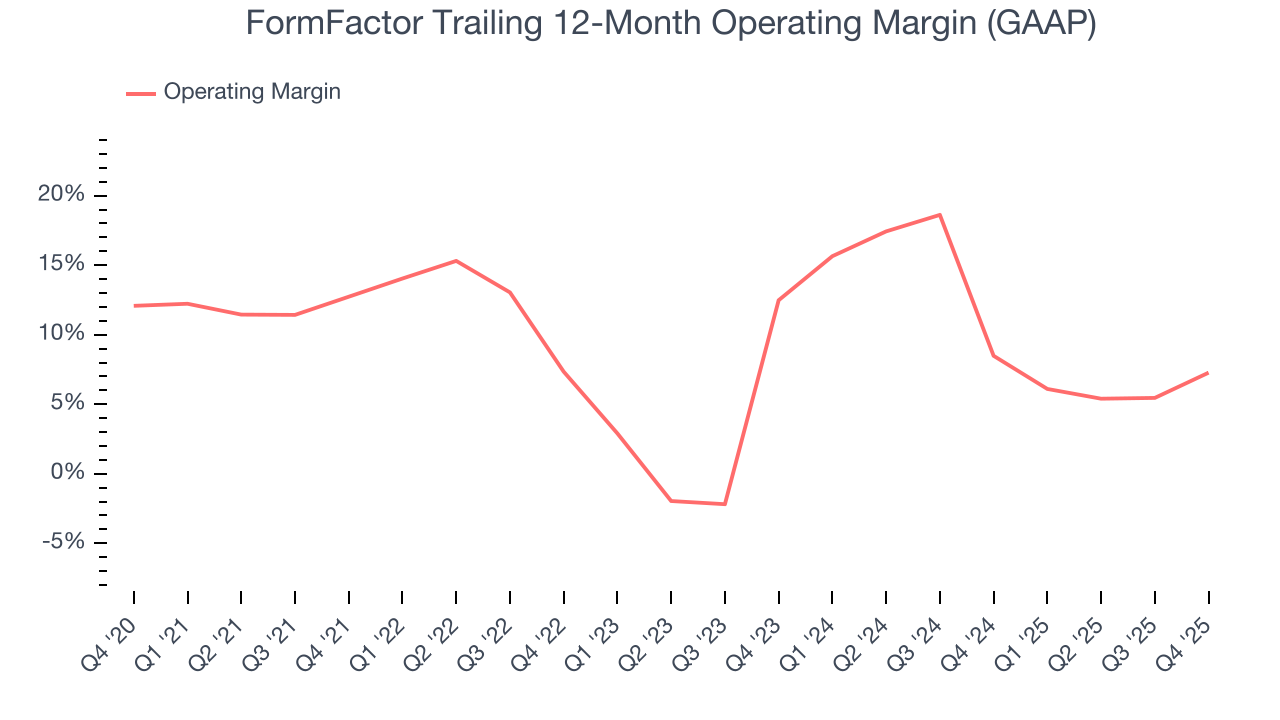

7. Operating Margin

FormFactor’s operating margin has shrunk over the last 12 months and averaged 7.9% over the last two years. The company’s profitability was mediocre for a semiconductor business and shows it couldn’t pass its higher operating expenses onto its customers. This result isn’t too surprising given its low gross margin as a starting point.

Analyzing the trend in its profitability, FormFactor’s operating margin decreased by 5.5 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. FormFactor’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

In Q4, FormFactor generated an operating margin profit margin of 10.9%, up 6.8 percentage points year on year. The increase was solid, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

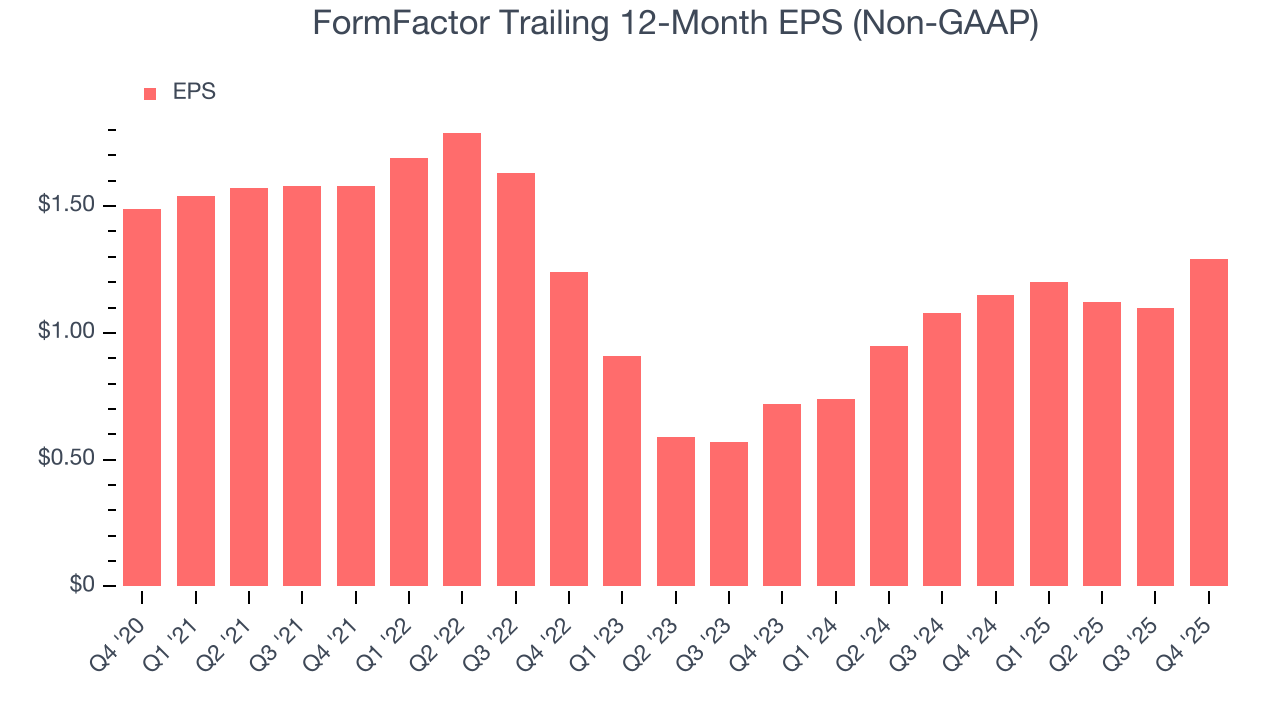

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for FormFactor, its EPS declined by 2.8% annually over the last five years while its revenue grew by 2.5%. This tells us the company became less profitable on a per-share basis as it expanded.

Diving into the nuances of FormFactor’s earnings can give us a better understanding of its performance. As we mentioned earlier, FormFactor’s operating margin expanded this quarter but declined by 5.5 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, FormFactor reported adjusted EPS of $0.46, up from $0.27 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects FormFactor’s full-year EPS of $1.29 to grow 21.3%.

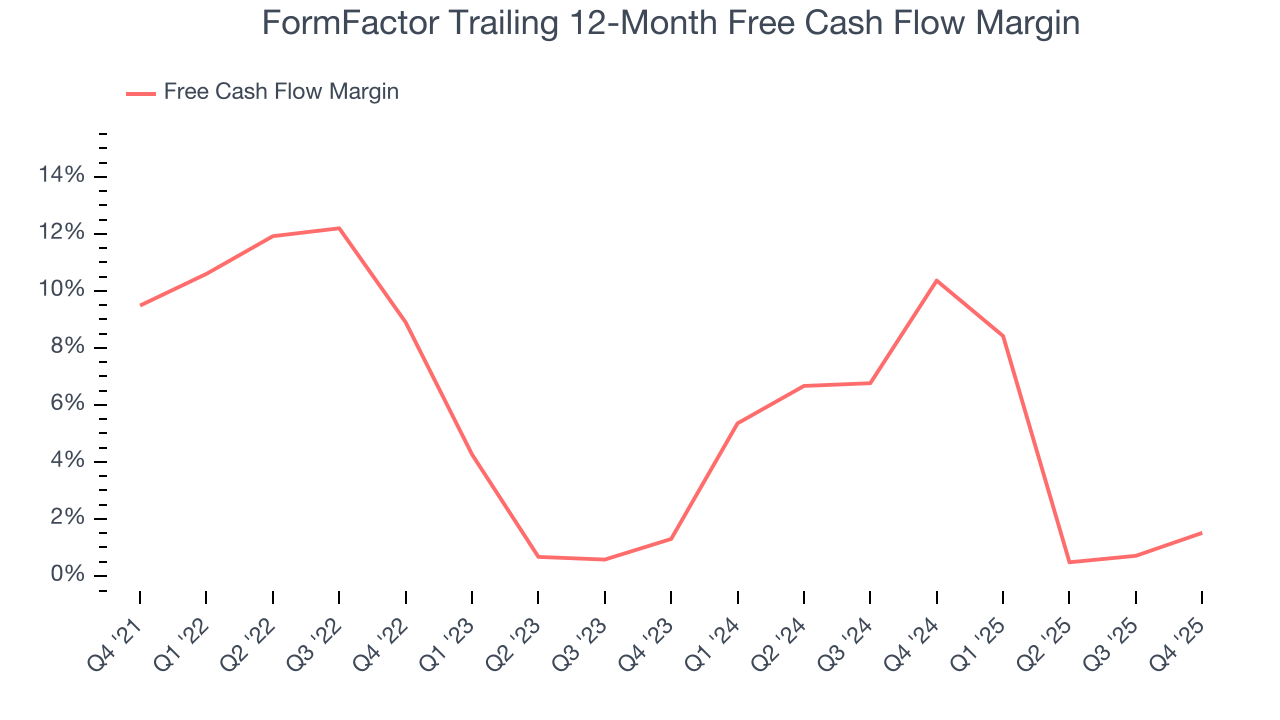

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

FormFactor has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 5.9%, lousy for a semiconductor business.

Taking a step back, we can see that FormFactor’s margin dropped by 8 percentage points over the last five years. This along with its unexciting margin put the company in a tough spot, and shareholders are likely hoping it can reverse course. If the trend continues, it could signal it’s becoming a more capital-intensive business.

FormFactor’s free cash flow clocked in at $34.75 million in Q4, equivalent to a 16.1% margin. This result was good as its margin was 1.2 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, leading to temporary swings. Long-term trends carry greater meaning.

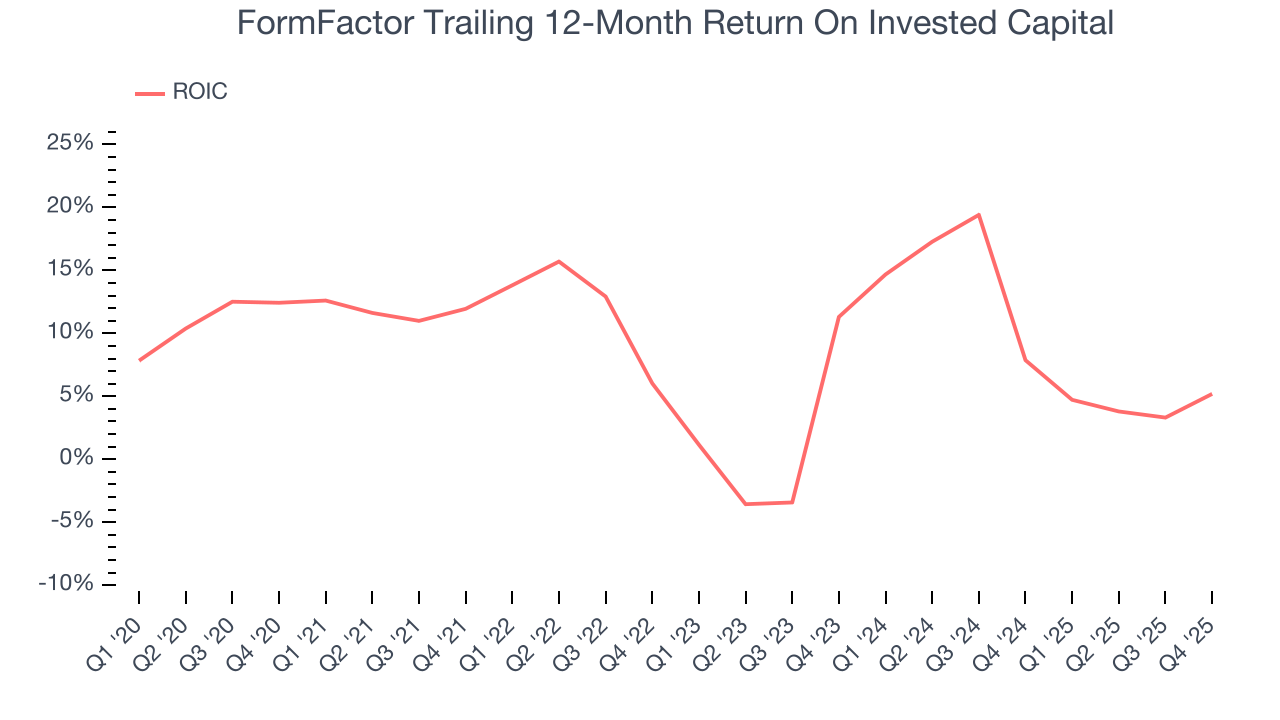

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

FormFactor historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 8.5%, somewhat low compared to the best semiconductor companies that consistently pump out 35%+.

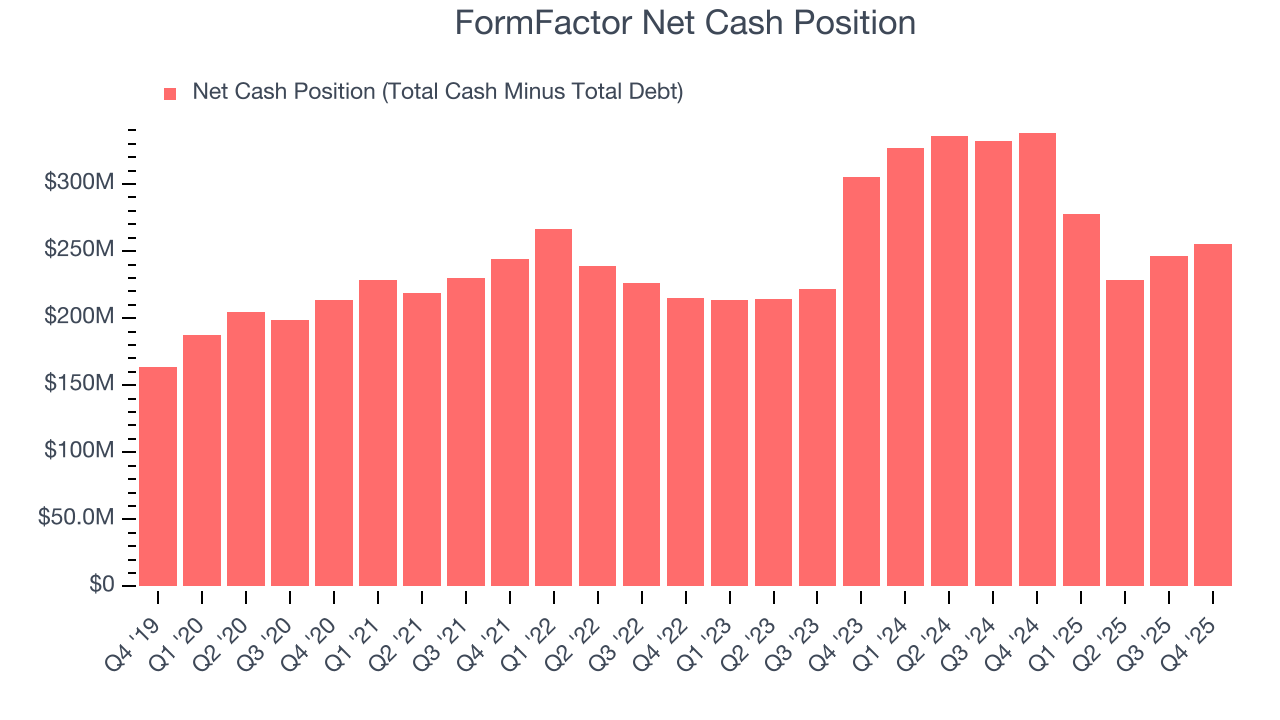

11. Balance Sheet Assessment

One of the best ways to mitigate bankruptcy risk is to hold more cash than debt.

FormFactor is a profitable, well-capitalized company with $275.2 million of cash and $19.87 million of debt on its balance sheet. This $255.3 million net cash position is 3.9% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from FormFactor’s Q4 Results

It was good to see FormFactor beat analysts’ EPS expectations this quarter. We were also excited its adjusted operating income outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a solid print. The stock traded up 8.9% to $77.91 immediately following the results.

13. Is Now The Time To Buy FormFactor?

Updated: February 20, 2026 at 9:45 PM EST

Before making an investment decision, investors should account for FormFactor’s business fundamentals and valuation in addition to what happened in the latest quarter.

FormFactor isn’t a terrible business, but it doesn’t pass our quality test. To begin with, its revenue growth was uninspiring over the last five years. While its projected EPS for the next year implies the company’s fundamentals will improve, the downside is its low free cash flow margins give it little breathing room. On top of that, its cash profitability fell over the last five years.

FormFactor’s P/E ratio based on the next 12 months is 49.8x. At this valuation, there’s a lot of good news priced in - you can find more timely opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $84.11 on the company (compared to the current share price of $93.24), implying they don’t see much short-term potential in FormFactor.