L.B. Foster (FSTR)

We’re cautious of L.B. Foster. Its low returns on capital and plummeting sales suggest it struggles to generate demand and profits, a red flag.― StockStory Analyst Team

1. News

2. Summary

Why We Think L.B. Foster Will Underperform

Founded with a $2,500 loan, L.B. Foster (NASDAQ:FSTR) is a provider of products and services for the transportation and energy infrastructure sectors, including rail products, construction materials, and coating solutions.

- Sales were flat over the last five years, indicating it’s failed to expand this cycle

- Below-average returns on capital indicate management struggled to find compelling investment opportunities

- On the bright side, its sales outlook for the upcoming 12 months calls for 11.6% growth, an acceleration from its two-year trend

L.B. Foster doesn’t check our boxes. Better stocks can be found in the market.

Why There Are Better Opportunities Than L.B. Foster

High Quality

Investable

Underperform

Why There Are Better Opportunities Than L.B. Foster

L.B. Foster is trading at $31.66 per share, or 9.2x forward EV-to-EBITDA. This valuation is fair for the quality you get, but we’re on the sidelines for now.

We’d rather pay up for companies with elite fundamentals than get a bargain on poor ones. Cheap stocks can be value traps, and as their performance deteriorates, they will stay cheap or get even cheaper.

3. L.B. Foster (FSTR) Research Report: Q3 CY2025 Update

Railway infrastructure company L.B. Foster (NASDAQ:FSTR) fell short of the markets revenue expectations in Q3 CY2025, with sales flat year on year at $138.3 million. On the other hand, the company’s outlook for the full year was close to analysts’ estimates with revenue guided to $540 million at the midpoint. Its GAAP profit of $0.40 per share was 35% below analysts’ consensus estimates.

L.B. Foster (FSTR) Q3 CY2025 Highlights:

- Revenue: $138.3 million vs analyst estimates of $154.4 million (flat year on year, 10.4% miss)

- EPS (GAAP): $0.40 vs analyst expectations of $0.62 (35% miss)

- Adjusted EBITDA: $11.36 million vs analyst estimates of $14.55 million (8.2% margin, 21.9% miss)

- The company dropped its revenue guidance for the full year to $540 million at the midpoint from $545 million, a 0.9% decrease

- EBITDA guidance for the full year is $41 million at the midpoint, in line with analyst expectations

- Operating Margin: 6%, in line with the same quarter last year

- Free Cash Flow Margin: 19.1%, up from 15.8% in the same quarter last year

- Backlog: $247.4 million at quarter end, up 18.4% year on year

- Market Capitalization: $290.4 million

Company Overview

Founded with a $2,500 loan, L.B. Foster (NASDAQ:FSTR) is a provider of products and services for the transportation and energy infrastructure sectors, including rail products, construction materials, and coating solutions.

L.B. Foster initially capitalized on the resale of used rail from abandoned and replaced railroads to serve transportation needs. Over the decades, the company expanded, entering new markets like steel sheet piling in 1926 and later bridge component fabrication in 1967. Significant growth occurred through strategic acquisitions, such as the purchase of Portec Rail Products in 2010, enhancing its rail product offerings and international presence. In recent years, L.B. Foster has continued to diversify, acquiring companies like Skratch Enterprises and Intelligent Video in 2022 to expand into digital display and security solutions to complement its traditional infrastructure and coating businesses.

For the rail industry, L.B. Foster manufactures and distributes a variety of rail products, including track components, track lubricant for friction management, and digital technology services across global markets. This segment includes engineering solutions and aftermarket services that enhance rail and industrial operations, ensuring ongoing demand for maintenance and upgrades.

In the infrastructure industry, the company delivers advanced technologies for the built environment, focusing on precast concrete products, bridge components, and protective coatings for pipelines. L.B. Foster’s precast concrete offerings include buildings for public use, sound walls, and structural components that support civil infrastructure. Additionally, its steel products business provides engineered solutions that maintain and construct critical infrastructure.

Revenue for L.B. Foster is generated from the sale of these engineered products and bolstered by aftermarket services, which provide a steady stream of recurring revenue. These services include maintenance, parts replacement, and system upgrades, which are critical for the longevity and efficiency of the infrastructure supported by their products.

4. General Industrial Machinery

Automation that increases efficiency and connected equipment that collects analyzable data have been trending, creating new demand for general industrial machinery companies. Those who innovate and create digitized solutions can spur sales and speed up replacement cycles, but all general industrial machinery companies are still at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

Competitors offering similar products include Trinity Industries (NYSE:TRN), Quanta Services (NYSE:PWR), and Aegion (NASDAQ:AEGN).

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, L.B. Foster struggled to consistently increase demand as its $507.8 million of sales for the trailing 12 months was close to its revenue five years ago. This was below our standards and is a sign of lacking business quality.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. L.B. Foster’s recent performance shows its demand remained suppressed as its revenue has declined by 3.6% annually over the last two years.

L.B. Foster also reports its backlog, or the value of its outstanding orders that have not yet been executed or delivered. L.B. Foster’s backlog reached $247.4 million in the latest quarter and averaged 18.4% year-on-year growth over the last two years. Because this number is better than its revenue growth, we can see the company accumulated more orders than it could fulfill and deferred revenue to the future. This could imply elevated demand for L.B. Foster’s products and services but raises concerns about capacity constraints.

This quarter, L.B. Foster’s $138.3 million of revenue was flat year on year, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 12% over the next 12 months, an improvement versus the last two years. This projection is healthy and suggests its newer products and services will catalyze better top-line performance.

6. Gross Margin & Pricing Power

All else equal, we prefer higher gross margins because they make it easier to generate more operating profits and indicate that a company commands pricing power by offering more differentiated products.

L.B. Foster has bad unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 19.9% gross margin over the last five years. Said differently, L.B. Foster had to pay a chunky $80.11 to its suppliers for every $100 in revenue.

This quarter, L.B. Foster’s gross profit margin was 22.5%, down 1.4 percentage points year on year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

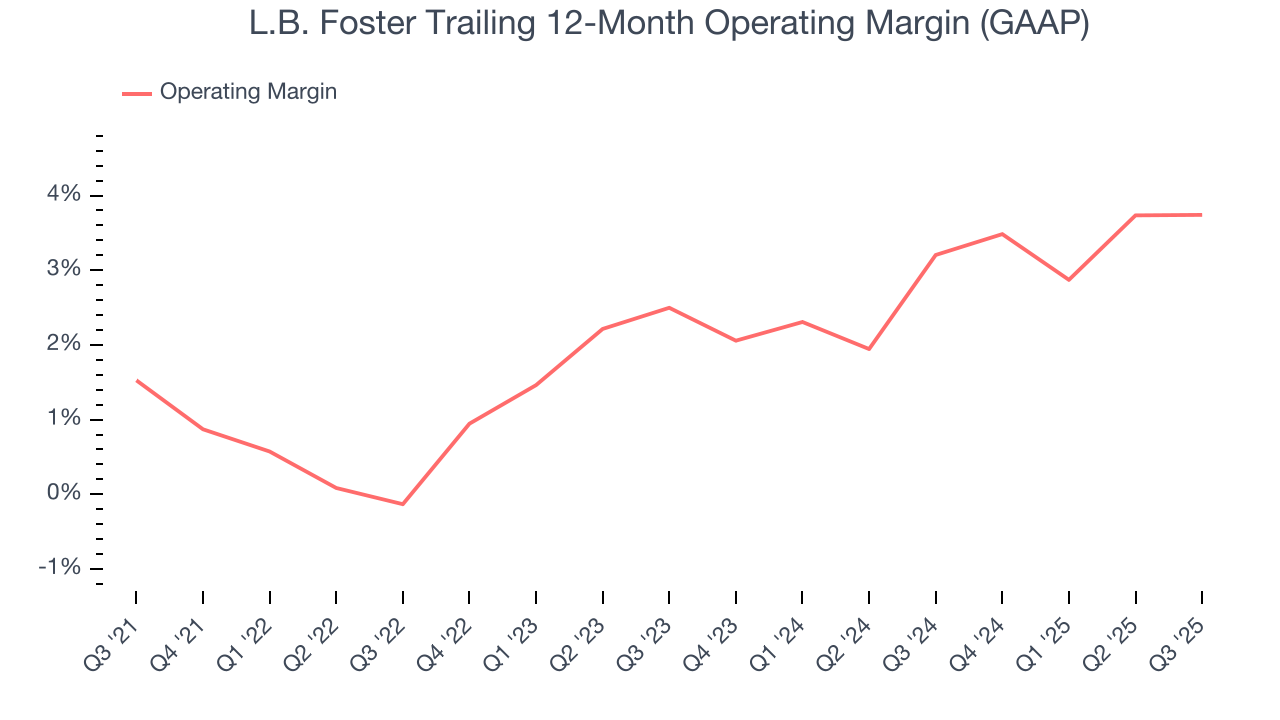

7. Operating Margin

L.B. Foster was profitable over the last five years but held back by its large cost base. Its average operating margin of 2.2% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

On the plus side, L.B. Foster’s operating margin rose by 2.2 percentage points over the last five years.

In Q3, L.B. Foster generated an operating margin profit margin of 6%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for L.B. Foster, its EPS declined by 31.4% annually over the last five years while its revenue was flat. However, its operating margin actually improved during this time, telling us that non-fundamental factors such as interest expenses and taxes affected its ultimate earnings.

Diving into the nuances of L.B. Foster’s earnings can give us a better understanding of its performance. A five-year view shows L.B. Foster has diluted its shareholders, growing its share count by 2.1%. This dilution overshadowed its increased operational efficiency and has led to lower per share earnings. Taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For L.B. Foster, its two-year annual EPS growth of 45.4% was higher than its five-year trend. This acceleration made it one of the faster-growing industrials companies in recent history.

In Q3, L.B. Foster reported EPS of $0.40, down from $3.27 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects L.B. Foster’s full-year EPS of $0.45 to grow 333%.

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

L.B. Foster has shown poor cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 1.1%, lousy for an industrials business.

Taking a step back, an encouraging sign is that L.B. Foster’s margin expanded by 7.1 percentage points during that time. The company’s improvement shows it’s heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

L.B. Foster’s free cash flow clocked in at $26.37 million in Q3, equivalent to a 19.1% margin. This result was good as its margin was 3.3 percentage points higher than in the same quarter last year, building on its favorable historical trend.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

L.B. Foster historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 3.5%, lower than the typical cost of capital (how much it costs to raise money) for industrials companies.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Fortunately, L.B. Foster’s ROIC has increased significantly over the last few years. This is a good sign, and we hope the company can continue improving.

11. Balance Sheet Assessment

L.B. Foster reported $3.43 million of cash and $84.43 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $32.65 million of EBITDA over the last 12 months, we view L.B. Foster’s 2.5× net-debt-to-EBITDA ratio as safe. We also see its $2.40 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from L.B. Foster’s Q3 Results

We struggled to find many positives in these results. Its revenue missed and its EBITDA fell short of Wall Street’s estimates. The company also dropped its full-year revenue guidance Overall, this was a weaker quarter. The stock traded down 1.7% to $27.05 immediately following the results.

13. Is Now The Time To Buy L.B. Foster?

Updated: February 26, 2026 at 11:04 PM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

L.B. Foster isn’t a terrible business, but it doesn’t pass our bar. To begin with, its revenue growth was weak over the last five years. While its rising cash profitability gives it more optionality, the downside is its relatively low ROIC suggests management has struggled to find compelling investment opportunities. On top of that, its declining EPS over the last five years makes it a less attractive asset to the public markets.

L.B. Foster’s EV-to-EBITDA ratio based on the next 12 months is 9.2x. This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're fairly confident there are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $30 on the company (compared to the current share price of $31.66).