Grid Dynamics (GDYN)

Grid Dynamics is a sound business. Its impressive revenue growth indicates the value of its offerings.― StockStory Analyst Team

1. News

2. Summary

Why Grid Dynamics Is Interesting

With engineering centers across the Americas, Europe, and India serving Fortune 1000 companies, Grid Dynamics (NASDAQ:GDYN) provides technology consulting, engineering, and analytics services to help large enterprises modernize their technology systems and business processes.

- Annual revenue growth of 29.1% over the last five years was superb and indicates its market share increased during this cycle

- Earnings growth has massively outpaced its peers over the last five years as its EPS has compounded at 22.2% annually

- On the flip side, its negative returns on capital show management lost money while trying to expand the business

Grid Dynamics is close to becoming a high-quality business. If you’ve been itching to buy the stock, the price looks fair.

Why Is Now The Time To Buy Grid Dynamics?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Grid Dynamics?

At $6.77 per share, Grid Dynamics trades at 16.1x forward P/E. A number of business services companies feature higher multiples, but that doesn’t make Grid Dynamics a bargain. In fact, we think the current price justly reflects the top-line growth.

This could be a good time to invest if you think there are underappreciated aspects of the business.

3. Grid Dynamics (GDYN) Research Report: Q3 CY2025 Update

Digital transformation consultancy Grid Dynamics (NASDAQ:GDYN) met Wall Streets revenue expectations in Q3 CY2025, with sales up 19.1% year on year to $104.2 million. On the other hand, next quarter’s revenue guidance of $106 million was less impressive, coming in 3.8% below analysts’ estimates. Its non-GAAP profit of $0.09 per share was in line with analysts’ consensus estimates.

Grid Dynamics (GDYN) Q3 CY2025 Highlights:

- Revenue: $104.2 million vs analyst estimates of $103.7 million (19.1% year-on-year growth, in line)

- Adjusted EPS: $0.09 vs analyst estimates of $0.09 (in line)

- Adjusted EBITDA: $12.7 million vs analyst estimates of $12.42 million (12.2% margin, 2.2% beat)

- Revenue Guidance for Q4 CY2025 is $106 million at the midpoint, below analyst estimates of $110.2 million

- EBITDA guidance for Q4 CY2025 is $13.5 million at the midpoint, above analyst estimates of $12.71 million

- Operating Margin: -0.2%, down from 2.4% in the same quarter last year

- Market Capitalization: $685.8 million

Company Overview

With engineering centers across the Americas, Europe, and India serving Fortune 1000 companies, Grid Dynamics (NASDAQ:GDYN) provides technology consulting, engineering, and analytics services to help large enterprises modernize their technology systems and business processes.

Grid Dynamics operates at the intersection of business transformation and advanced technology, helping companies implement solutions in four key areas: cloud engineering, AI/machine learning, digital engagement, and supply chain optimization. The company builds custom platforms and applications that enable businesses to leverage cloud computing, data analytics, and artificial intelligence to gain competitive advantages.

For example, Grid Dynamics might help a retailer develop an omnichannel commerce platform that integrates online and in-store shopping experiences, or assist a financial services firm in implementing real-time fraud detection systems using machine learning algorithms. These solutions allow clients to improve customer experiences, optimize operations, and make data-driven decisions.

The company employs a "land and expand" business model, often starting with smaller projects that demonstrate value before expanding into broader transformation initiatives. Grid Dynamics typically deploys technology leaders at client sites who identify new opportunities while delivering current projects. This approach has helped the company deepen relationships with existing clients while attracting new ones.

Grid Dynamics serves clients across several industry verticals, including technology, media and telecom, retail, consumer packaged goods, manufacturing, and financial services. The company's delivery model combines on-site, off-site, and offshore staffing, with engineering teams located in multiple countries to provide flexibility and cost efficiency.

Through acquisitions of companies like Tacit Knowledge, Mutual Mobile, and NextSphere Technologies, Grid Dynamics has expanded its geographic presence and service capabilities. The company maintains ISO 27001:2013 certification for information security management, which is particularly important for its financial services clients who operate in highly regulated environments.

4. IT Services & Consulting

IT Services & Consulting companies stand to benefit from increasing enterprise demand for digital transformation, AI-driven automation, and cybersecurity resilience. Many enterprises can't attack these topics alone and need IT services and consulting on everything from technical advice to implementation. Challenges in meeting these needs will include finding talent in specialized and evolving IT fields. While AI and automation can enhance productivity, they also threaten to commoditize certain consulting functions. Another ongoing challenge will be pricing pressures from offshore IT service providers, which have lower labor costs and increasingly equal access to advanced technology like AI.

Grid Dynamics competes with emerging digital services companies like Globant, Endava, EPAM Systems, and Thoughtworks; large global consulting firms such as Accenture and Capgemini; and India-based IT services providers including Cognizant, Infosys, and Wipro.

5. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

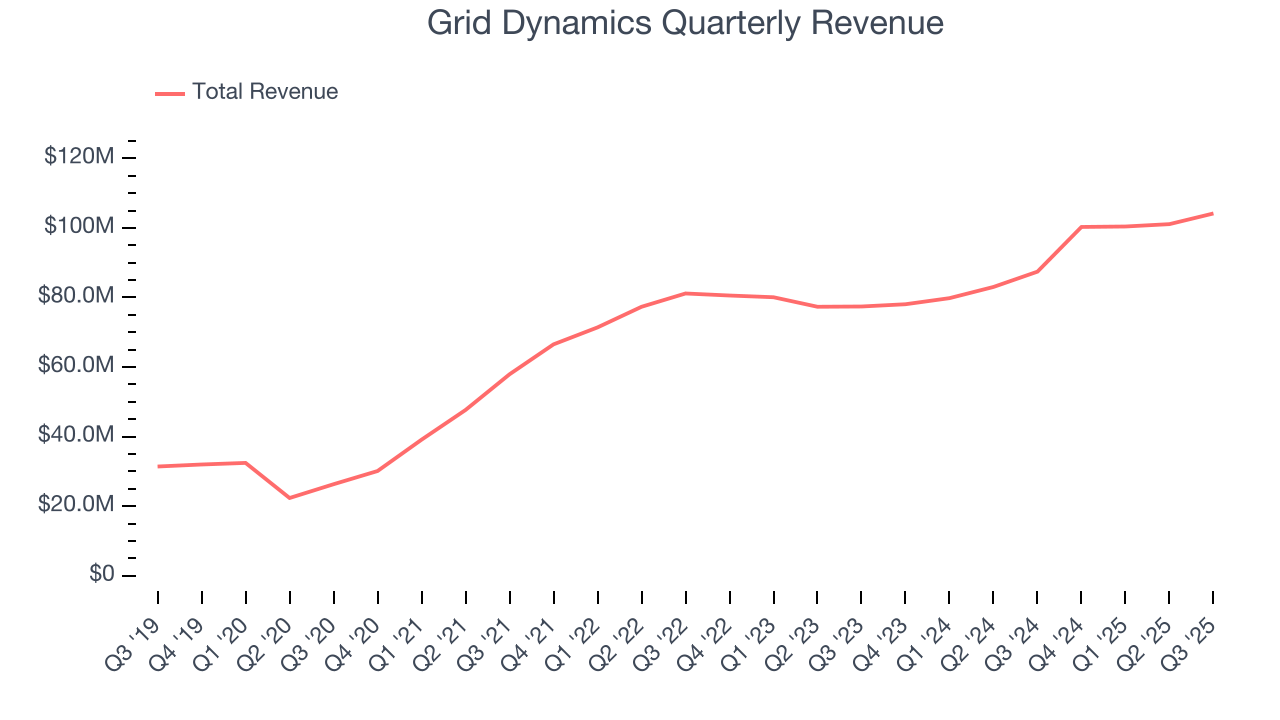

With $406 million in revenue over the past 12 months, Grid Dynamics is a small player in the business services space, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and numerous distribution channels. On the bright side, it can grow faster because it has more room to expand.

As you can see below, Grid Dynamics grew its sales at an incredible 29.1% compounded annual growth rate over the last five years. This shows it had high demand, a useful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. Grid Dynamics’s annualized revenue growth of 13.4% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Grid Dynamics’s year-on-year revenue growth was 19.1%, and its $104.2 million of revenue was in line with Wall Street’s estimates. Company management is currently guiding for a 5.7% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 11.2% over the next 12 months, a slight deceleration versus the last two years. Despite the slowdown, this projection is healthy and indicates the market sees success for its products and services.

6. Operating Margin

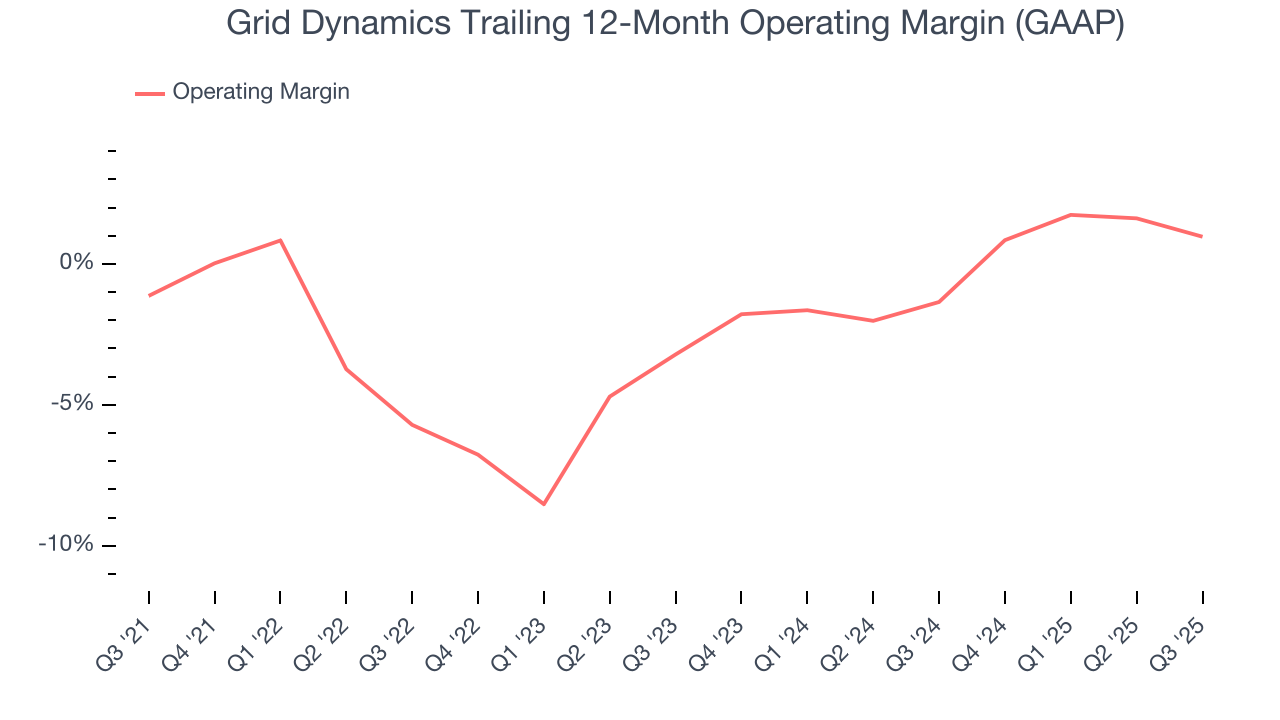

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D.

Although Grid Dynamics broke even this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 1.9% over the last five years. Unprofitable business services companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, Grid Dynamics’s operating margin rose by 2.1 percentage points over the last five years, as its sales growth gave it operating leverage. Still, it will take much more for the company to reach long-term profitability.

In Q3, Grid Dynamics generated a negative 0.2% operating margin.

7. Earnings Per Share

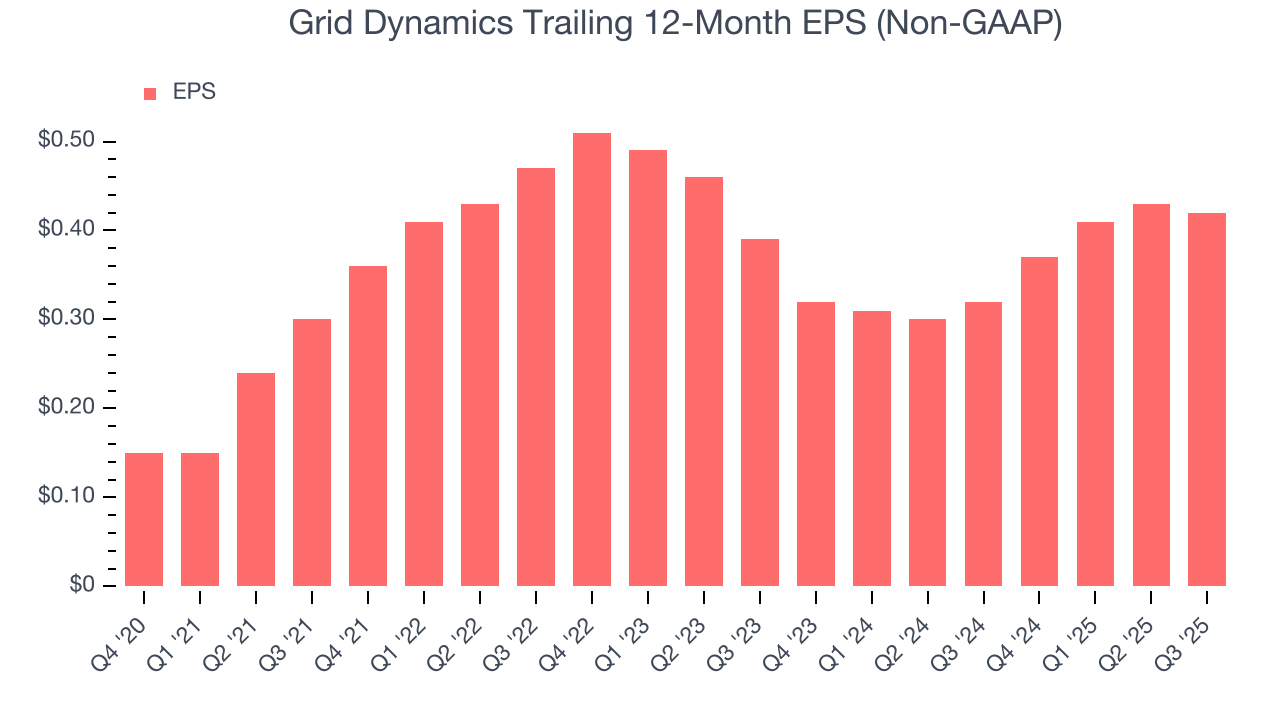

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Grid Dynamics’s EPS grew at an astounding 22.2% compounded annual growth rate over the last five years. Despite its operating margin improvement during that time, this performance was lower than its 29.1% annualized revenue growth, telling us that non-fundamental factors such as interest and taxes affected its ultimate earnings.

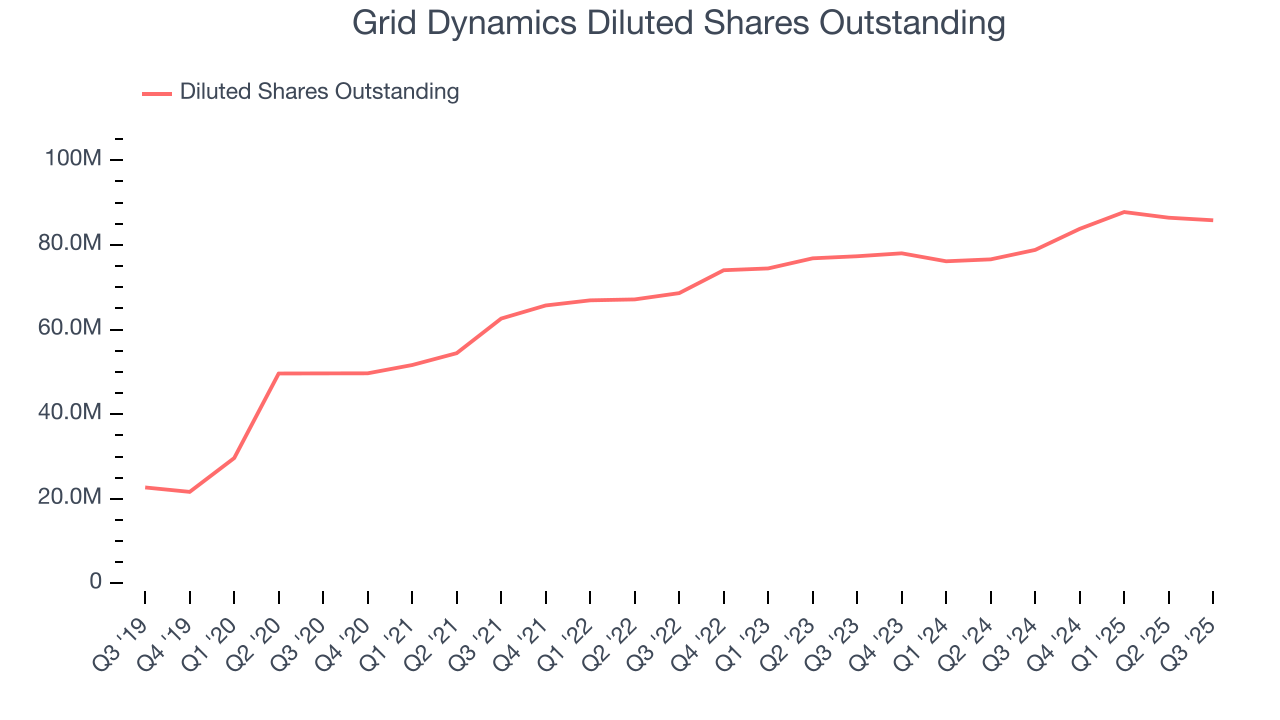

We can take a deeper look into Grid Dynamics’s earnings quality to better understand the drivers of its performance. A five-year view shows Grid Dynamics has diluted its shareholders, growing its share count by 72.9%. This dilution overshadowed its increased operational efficiency and has led to lower per share earnings. Taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Grid Dynamics, its two-year annual EPS growth of 3.8% was lower than its five-year trend. We hope its growth can accelerate in the future.

In Q3, Grid Dynamics reported adjusted EPS of $0.09, down from $0.10 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term adjusted EPS growth than short-term movements. Over the next 12 months, Wall Street expects Grid Dynamics’s full-year EPS of $0.42 to shrink by 1.1%.

8. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

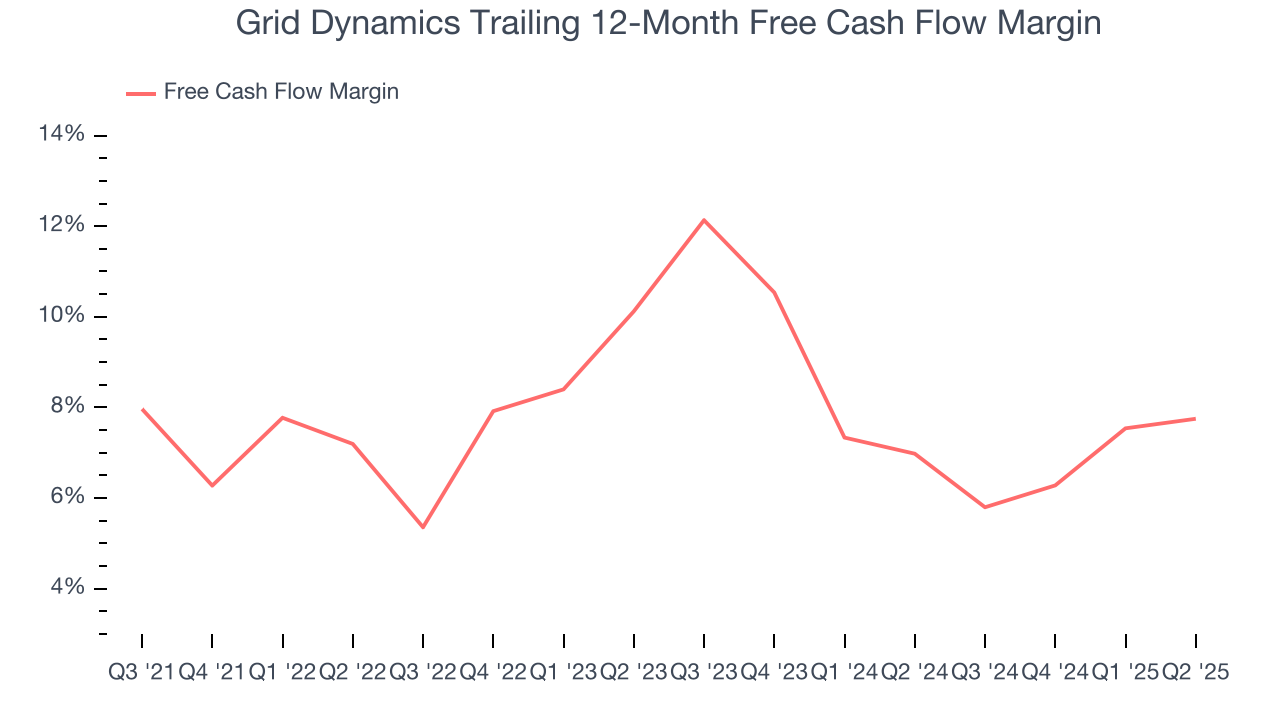

Grid Dynamics has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 7.9% over the last five years, better than the broader business services sector. The divergence from its underwhelming operating margin stems from the add-back of non-cash charges like depreciation and stock-based compensation. GAAP operating profit expenses these line items, but free cash flow does not.

Taking a step back, we can see that Grid Dynamics’s margin expanded by 2 percentage points during that time. This is encouraging because it gives the company more optionality.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Grid Dynamics’s five-year average ROIC was negative 17.2%, meaning management lost money while trying to expand the business. Its returns were among the worst in the business services sector.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Fortunately, Grid Dynamics’s ROIC has increased significantly over the last few years. This is a good sign, and if its returns keep rising, there’s a chance it could evolve into an investable business.

10. Balance Sheet Assessment

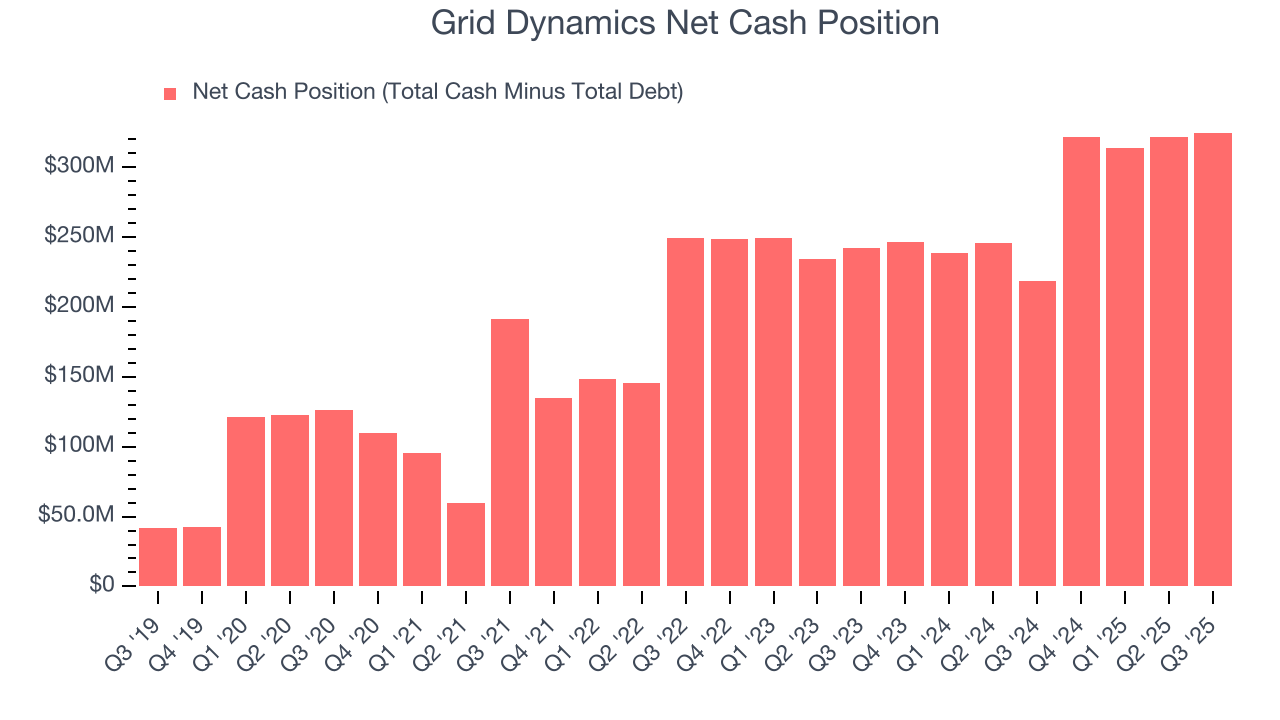

Businesses that maintain a cash surplus face reduced bankruptcy risk.

Grid Dynamics is a well-capitalized company with $338.6 million of cash and $13.65 million of debt on its balance sheet. This $324.9 million net cash position is 41.1% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

11. Key Takeaways from Grid Dynamics’s Q3 Results

Both revenue and EPS were in line. The company's revenue guidance for next quarter missed but EPS guidance beat. Overall, this was a mixed quarter. The stock remained flat at $7.60 immediately after reporting.

12. Is Now The Time To Buy Grid Dynamics?

Updated: March 1, 2026 at 11:14 PM EST

Before deciding whether to buy Grid Dynamics or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

We think Grid Dynamics is a solid business. To kick things off, its revenue growth was exceptional over the last five years. And while its relatively low ROIC suggests management has struggled to find compelling investment opportunities, its astounding EPS growth over the last five years shows its profits are trickling down to shareholders. On top of that, its rising returns show management's prior bets are starting to pay off.

Grid Dynamics’s P/E ratio based on the next 12 months is 16.1x. When scanning the business services space, Grid Dynamics trades at a fair valuation. If you believe in the company and its growth potential, now is an opportune time to buy shares.

Wall Street analysts have a consensus one-year price target of $12.30 on the company (compared to the current share price of $6.77), implying they see 81.8% upside in buying Grid Dynamics in the short term.