Halozyme Therapeutics (HALO)

Halozyme Therapeutics piques our interest. Its high revenue growth, robust profitability, and strong outlook make it an attractive asset.― StockStory Analyst Team

1. News

2. Summary

Why Halozyme Therapeutics Is Interesting

Known for transforming hours-long intravenous infusions into minutes-long subcutaneous injections, Halozyme Therapeutics (NASDAQ:HALO) develops and licenses its proprietary ENHANZE technology that enables subcutaneous delivery of injectable drugs that would otherwise require intravenous administration.

- Annual revenue growth of 44.2% over the last five years was superb and indicates its market share increased during this cycle

- Exciting sales outlook for the upcoming 12 months calls for 36.9% growth, an acceleration from its two-year trend

- A blemish is its smaller revenue base of $1.24 billion means it hasn’t achieved the economies of scale that some industry juggernauts enjoy (but also enables it to grow faster if it executes properly)

Halozyme Therapeutics has the potential to be a high-quality business. If you’re a believer, the price looks fair.

Why Is Now The Time To Buy Halozyme Therapeutics?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Halozyme Therapeutics?

Halozyme Therapeutics’s stock price of $79.34 implies a valuation ratio of 9.5x forward P/E. Halozyme Therapeutics’s current price appears to be a good deal for the revenue growth you get.

This could be a good time to invest if you think there are underappreciated aspects of the business.

3. Halozyme Therapeutics (HALO) Research Report: Q3 CY2025 Update

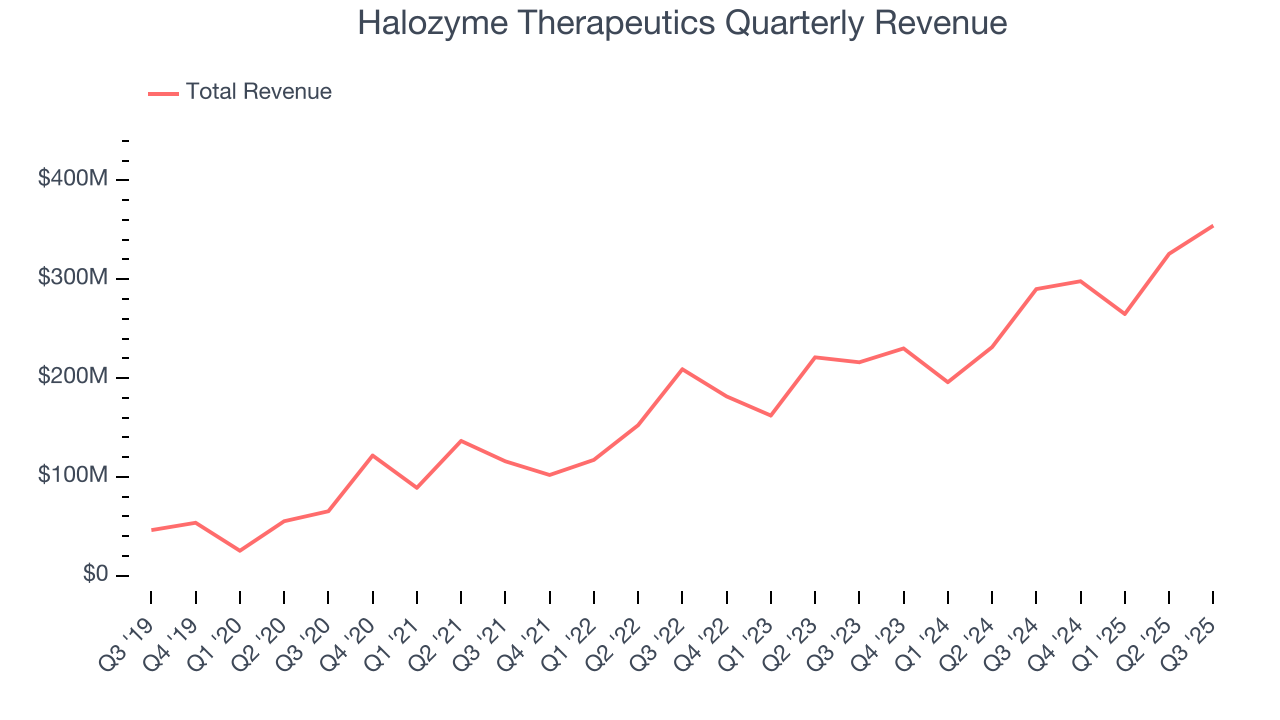

Biopharmaceutical drug delivery company Halozyme Therapeutics (NASDAQ:HALO) reported Q3 CY2025 results beating Wall Street’s revenue expectations, with sales up 22.1% year on year to $354.3 million. The company’s full-year revenue guidance of $1.34 billion at the midpoint came in 1.5% above analysts’ estimates. Its non-GAAP profit of $1.72 per share was 5.5% above analysts’ consensus estimates.

Halozyme Therapeutics (HALO) Q3 CY2025 Highlights:

- Revenue: $354.3 million vs analyst estimates of $343.8 million (22.1% year-on-year growth, 3.1% beat)

- Adjusted EPS: $1.72 vs analyst estimates of $1.63 (5.5% beat)

- Adjusted EBITDA: $238.3 million vs analyst estimates of $233.7 million (67.3% margin, 2% beat)

- Adjusted EPS guidance for the full year is $6.30 at the midpoint, beating analyst estimates by 22.5%

- EBITDA guidance for the full year is $910 million at the midpoint, above analyst estimates of $699.2 million

- Operating Margin: 61.5%, up from 56.3% in the same quarter last year

- Free Cash Flow Margin: 49.6%, up from 39.3% in the same quarter last year

- Market Capitalization: $7.91 billion

Company Overview

Known for transforming hours-long intravenous infusions into minutes-long subcutaneous injections, Halozyme Therapeutics (NASDAQ:HALO) develops and licenses its proprietary ENHANZE technology that enables subcutaneous delivery of injectable drugs that would otherwise require intravenous administration.

Halozyme's ENHANZE technology is built around rHuPH20, a recombinant human enzyme that temporarily breaks down hyaluronan, a structural component found in tissues beneath the skin. This temporary degradation creates a pathway for large volume or viscous drug formulations to be administered subcutaneously instead of through time-consuming intravenous infusions.

The company operates primarily through partnerships with major pharmaceutical companies, who pay Halozyme licensing fees, milestone payments, and royalties to incorporate ENHANZE into their products. Notable partners include Roche, Takeda, Janssen, Bristol Myers Squibb, and argenx, who use the technology to develop subcutaneous versions of established intravenous drugs. For example, Roche's breast cancer treatment Herceptin can be administered in 2-5 minutes subcutaneously rather than 30-90 minutes intravenously when formulated with ENHANZE.

Beyond its flagship ENHANZE platform, Halozyme also develops and commercializes auto-injector technologies for pharmaceutical companies. The company markets two proprietary products: Hylenex, a formulation of rHuPH20 used to increase the absorption and dispersion of other injected drugs, and XYOSTED, an auto-injector testosterone replacement therapy product for men with conditions associated with testosterone deficiency.

Halozyme's business model leverages its specialized technology across multiple therapeutic areas through partnerships while maintaining a relatively focused internal commercial operation. This approach allows pharmaceutical companies to extend patent life, improve patient convenience, and potentially enable home administration of therapies that previously required clinical settings for intravenous delivery.

4. Therapeutics

Over the next few years, therapeutic companies, which develop a wide variety of treatments for diseases and disorders, face strong tailwinds from advancements in precision medicine (including the use of AI to improve hit rates) and growing demand for treatments targeting rare diseases. However, headwinds such as rising scrutiny over drug pricing, regulatory unknowns, and competition from larger, more resourced pharmaceutical companies could weigh on growth.

Halozyme's competitors in the drug delivery technology space include Antares Pharma (acquired by Halozyme), West Pharmaceutical Services (NYSE: WST), Becton Dickinson (NYSE: BDX), and several private companies developing alternative delivery systems for injectable medications.

5. Revenue Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With just $1.24 billion in revenue over the past 12 months, Halozyme Therapeutics is a small company in an industry where scale matters. This makes it difficult to build trust with customers because healthcare is heavily regulated, complex, and resource-intensive. On the bright side, Halozyme Therapeutics’s smaller revenue base allows it to grow faster if it can execute well.

6. Revenue Growth

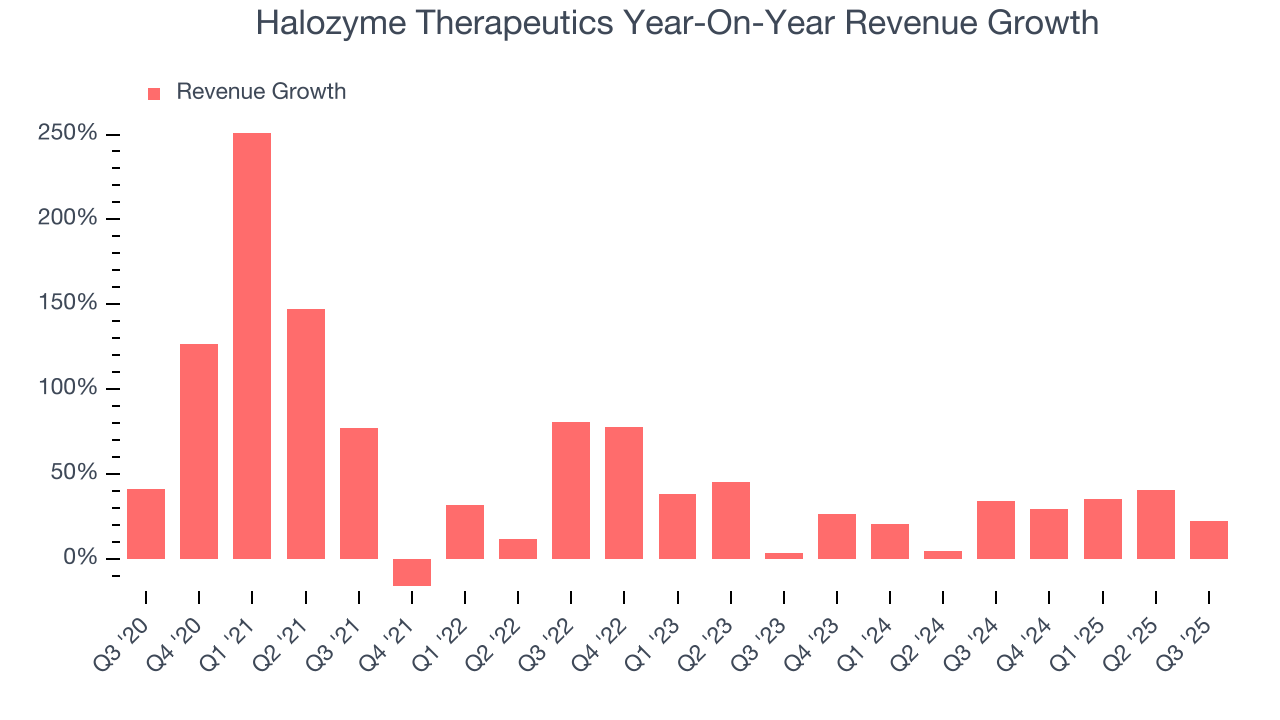

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Luckily, Halozyme Therapeutics’s sales grew at an incredible 44.2% compounded annual growth rate over the last five years. Its growth beat the average healthcare company and shows its offerings resonate with customers, a helpful starting point for our analysis.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Halozyme Therapeutics’s annualized revenue growth of 26.2% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Halozyme Therapeutics reported robust year-on-year revenue growth of 22.1%, and its $354.3 million of revenue topped Wall Street estimates by 3.1%.

Looking ahead, sell-side analysts expect revenue to grow 28.1% over the next 12 months, an improvement versus the last two years. This projection is eye-popping and suggests its newer products and services will catalyze better top-line performance.

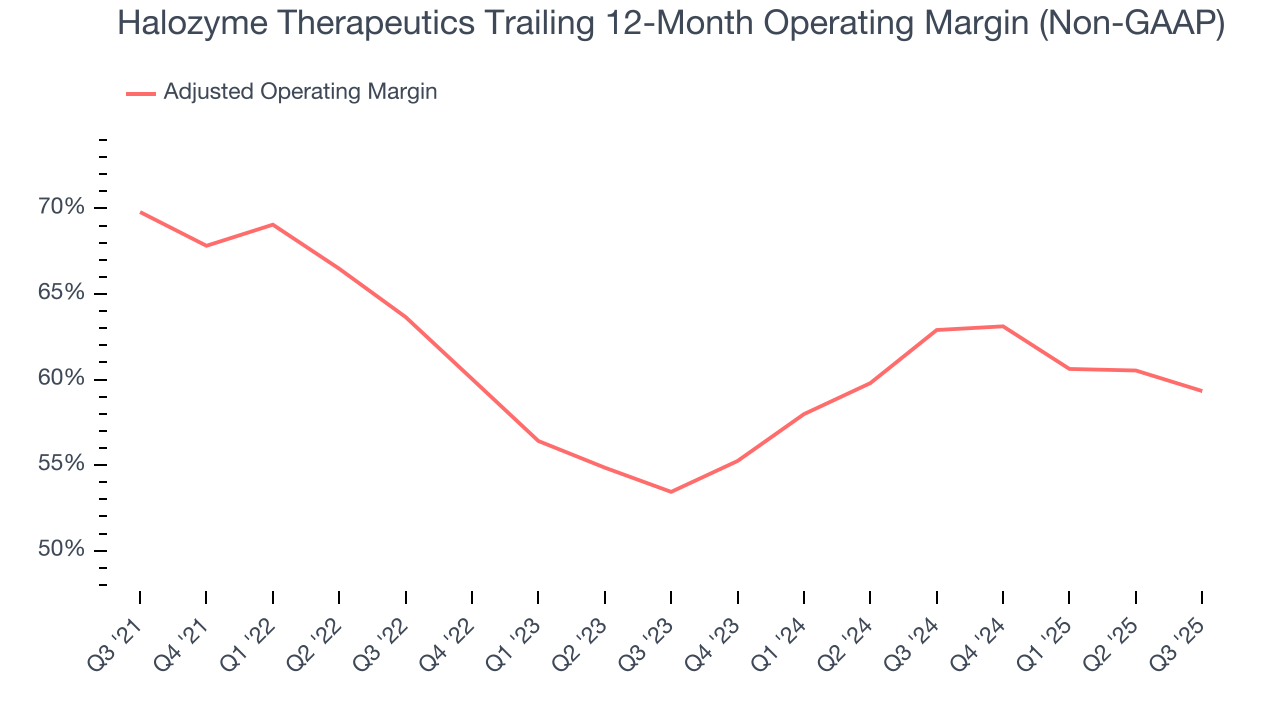

7. Adjusted Operating Margin

Adjusted operating margin is a key measure of profitability. Think of it as net income (the bottom line) excluding the impact of non-recurring expenses, taxes, and interest on debt - metrics less connected to business fundamentals.

Halozyme Therapeutics has been a well-oiled machine over the last five years. It demonstrated elite profitability for a healthcare business, boasting an average adjusted operating margin of 60.9%.

Looking at the trend in its profitability, Halozyme Therapeutics’s adjusted operating margin decreased by 10.5 percentage points over the last five years, but it rose by 5.9 percentage points on a two-year basis. We like Halozyme Therapeutics and hope it can right the ship.

In Q3, Halozyme Therapeutics generated an adjusted operating margin profit margin of 61.5%, down 5.4 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

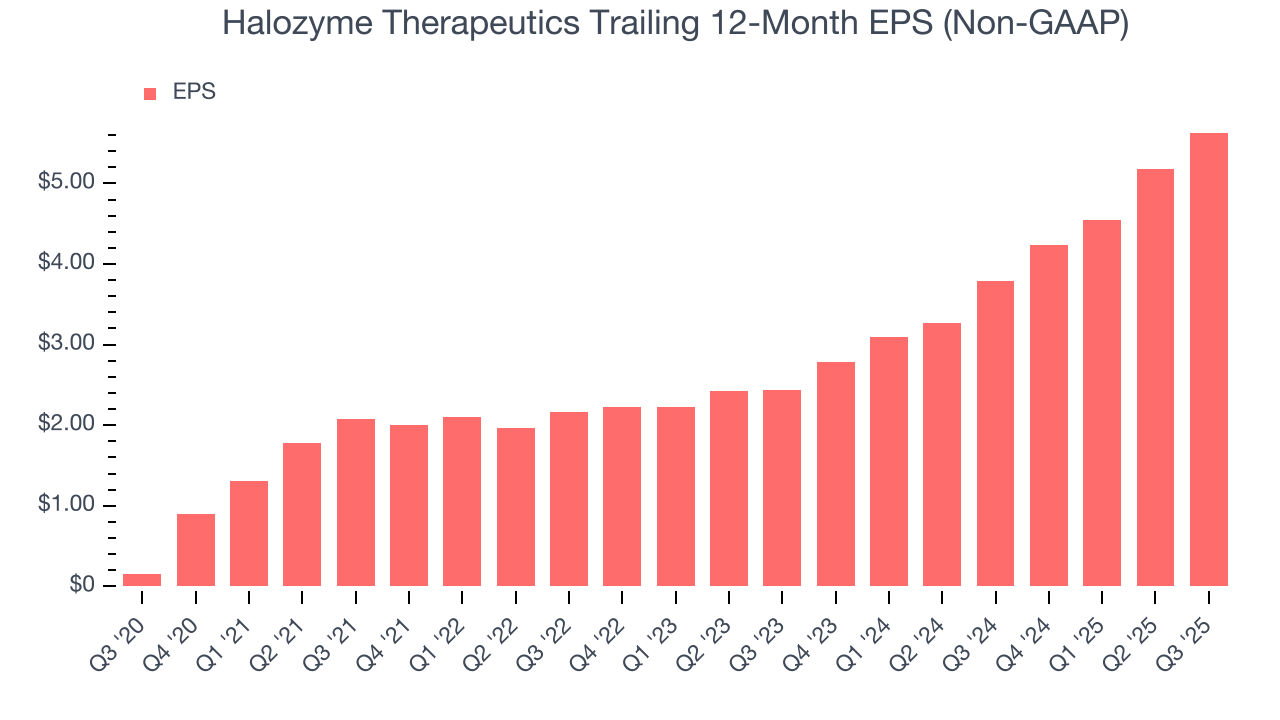

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

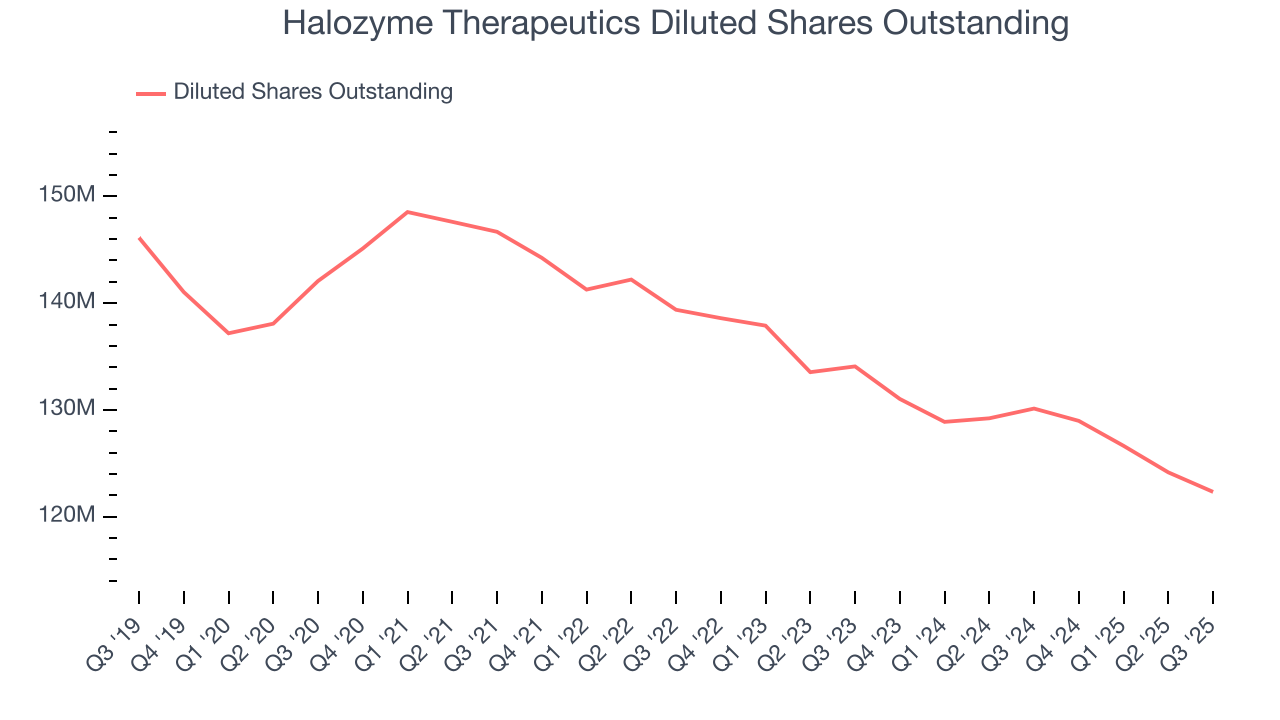

Halozyme Therapeutics’s EPS grew at an astounding 104% compounded annual growth rate over the last five years, higher than its 44.2% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its adjusted operating margin didn’t improve.

Diving into the nuances of Halozyme Therapeutics’s earnings can give us a better understanding of its performance. A five-year view shows that Halozyme Therapeutics has repurchased its stock, shrinking its share count by 13.9%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

In Q3, Halozyme Therapeutics reported adjusted EPS of $1.72, up from $1.27 in the same quarter last year. This print beat analysts’ estimates by 5.5%. Over the next 12 months, Wall Street expects Halozyme Therapeutics’s full-year EPS of $5.63 to grow 35.1%.

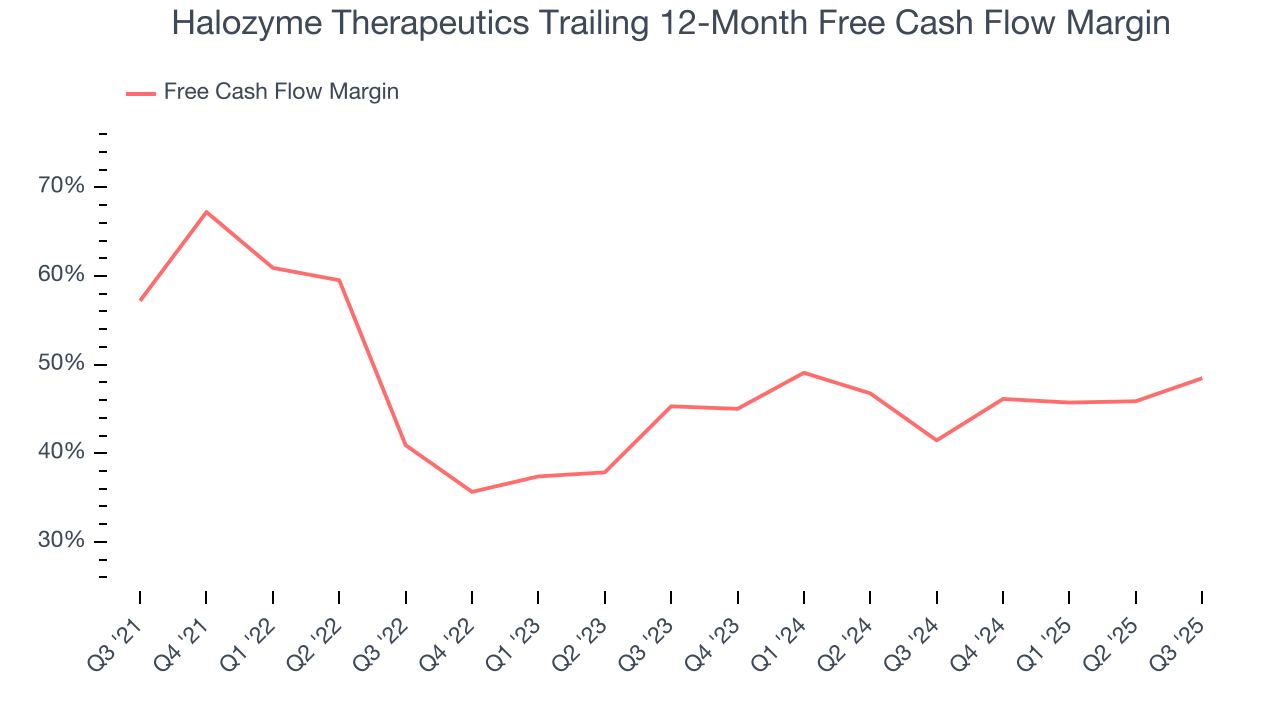

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Halozyme Therapeutics has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the healthcare sector, averaging an eye-popping 46.1% over the last five years.

Taking a step back, we can see that Halozyme Therapeutics’s margin dropped by 8.7 percentage points during that time. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. If the longer-term trend returns, it could signal it is in the middle of an investment cycle.

Halozyme Therapeutics’s free cash flow clocked in at $175.6 million in Q3, equivalent to a 49.6% margin. This result was good as its margin was 10.3 percentage points higher than in the same quarter last year. Its cash profitability was also above its five-year level, and we hope the company can build on this trend.

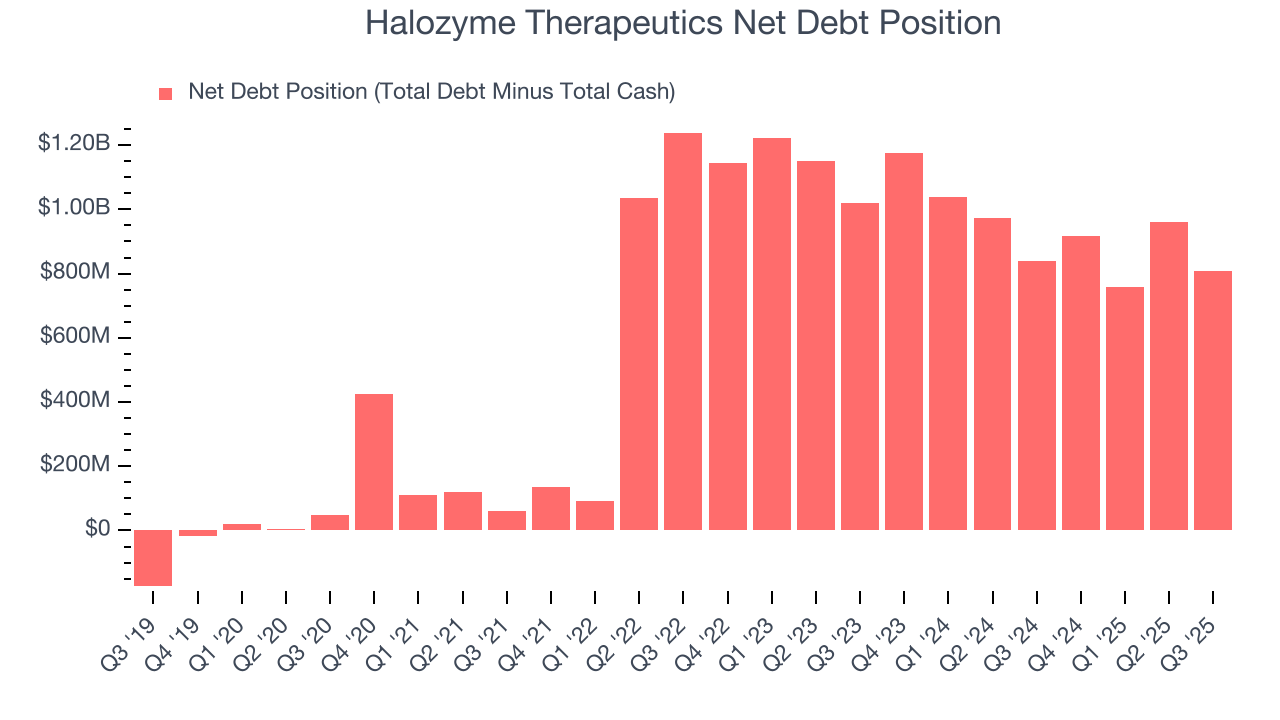

10. Balance Sheet Assessment

Halozyme Therapeutics reported $702 million of cash and $1.51 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $819.1 million of EBITDA over the last 12 months, we view Halozyme Therapeutics’s 1.0× net-debt-to-EBITDA ratio as safe. We also see its $801,000 of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Halozyme Therapeutics’s Q3 Results

We were impressed by Halozyme Therapeutics’s optimistic full-year EBITDA guidance, which blew past analysts’ expectations. We were also excited its full-year EPS guidance outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this quarter featured some important positives. Investors were likely hoping for more, and shares traded down 1.6% to $66.25 immediately after reporting.

12. Is Now The Time To Buy Halozyme Therapeutics?

Updated: February 16, 2026 at 12:05 AM EST

Are you wondering whether to buy Halozyme Therapeutics or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

There are things to like about Halozyme Therapeutics. First off, its revenue growth was exceptional over the last five years. And while its declining adjusted operating margin shows the business has become less efficient, its powerful free cash flow generation enables it to stay ahead of the competition through consistent reinvestment of profits. On top of that, its impressive operating margins show it has a highly efficient business model.

Halozyme Therapeutics’s P/E ratio based on the next 12 months is 9.5x. When scanning the healthcare space, Halozyme Therapeutics trades at a fair valuation. If you trust the business and its direction, this is an ideal time to buy.

Wall Street analysts have a consensus one-year price target of $78 on the company (compared to the current share price of $79.34).