Henry Schein (HSIC)

We aren’t fans of Henry Schein. Its poor sales growth and falling returns on capital suggest its growth opportunities are shrinking.― StockStory Analyst Team

1. News

2. Summary

Why Henry Schein Is Not Exciting

With a vast inventory of over 300,000 products stocked in distribution centers spanning more than 5.3 million square feet worldwide, Henry Schein (NASDAQ:HSIC) is a global distributor of healthcare products and services primarily to dental practices, medical offices, and other healthcare facilities.

- Core business is underperforming as its organic revenue has disappointed over the past two years, suggesting it might need acquisitions to stimulate growth

- Responsiveness to unforeseen market trends is restricted due to its substandard adjusted operating margin profitability

- The good news is that its earnings growth was above the peer group average over the last five years as its EPS compounded at 10.8% annually

Henry Schein doesn’t pass our quality test. We see more favorable opportunities in the market.

Why There Are Better Opportunities Than Henry Schein

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Henry Schein

Henry Schein is trading at $77.64 per share, or 15.1x forward P/E. Henry Schein’s multiple may seem like a great deal among healthcare peers, but we think there are valid reasons why it’s this cheap.

It’s better to pay up for high-quality businesses with higher long-term earnings potential rather than to buy lower-quality stocks because they appear cheap. These challenged businesses often don’t re-rate, a phenomenon known as a “value trap”.

3. Henry Schein (HSIC) Research Report: Q4 CY2025 Update

Dental and medical products company Henry Schein (NASDAQ:HSIC) reported revenue ahead of Wall Street’s expectations in Q4 CY2025, with sales up 7.7% year on year to $3.44 billion. Its GAAP profit of $0.85 per share was 16.4% below analysts’ consensus estimates.

Henry Schein (HSIC) Q4 CY2025 Highlights:

- Revenue: $3.44 billion vs analyst estimates of $3.34 billion (7.7% year-on-year growth, 2.8% beat)

- EPS (GAAP): $0.85 vs analyst expectations of $1.02 (16.4% miss)

- Adjusted EBITDA: $291 million vs analyst estimates of $284.1 million (8.5% margin, 2.4% beat)

- Operating Margin: 4.7%, in line with the same quarter last year

- Free Cash Flow Margin: 9.8%, up from 5.3% in the same quarter last year

- Organic Revenue rose 4.9% year on year (beat)

- Market Capitalization: $9.49 billion

Company Overview

With a vast inventory of over 300,000 products stocked in distribution centers spanning more than 5.3 million square feet worldwide, Henry Schein (NASDAQ:HSIC) is a global distributor of healthcare products and services primarily to dental practices, medical offices, and other healthcare facilities.

Henry Schein serves as a critical link in the healthcare supply chain, connecting manufacturers with practitioners. The company's business is divided into two main segments: Health Care Distribution and Technology and Value-Added Services. The Health Care Distribution segment handles everything from dental and medical consumables to equipment, pharmaceuticals, surgical products, and personal protective equipment. Many of these products are available under Henry Schein's own corporate brand, and the company even manufactures certain dental specialty products.

Beyond product distribution, Henry Schein offers technology solutions through its Technology and Value-Added Services segment. Henry Schein One, the largest contributor to this segment, provides practice management software for dental and medical professionals. The company also offers electronic health records, patient communication services, and marketing tools to help practitioners grow their businesses.

A dental office might rely on Henry Schein for everything from basic supplies like gloves and masks to specialized equipment such as dental chairs and imaging systems, while also using the company's practice management software to schedule appointments and process billing. Similarly, a physician's office might order examination tables, diagnostic equipment, and pharmaceuticals from Henry Schein while utilizing its electronic health record system.

Henry Schein generates revenue primarily through product sales to its customer base of over one million healthcare providers across dental practices, laboratories, physician offices, ambulatory surgery centers, and institutional clinics. The company's global infrastructure includes 36 distribution centers and 22 manufacturing facilities, enabling rapid order fulfillment across North America, Europe, and Asia-Pacific regions.

4. Dental Equipment & Technology

The dental equipment and technology industry encompasses companies that manufacture orthodontic products, dental implants, imaging systems, and digital tools for dental professionals. These companies benefit from recurring revenue streams tied to consumables, ongoing maintenance, and growing demand for aesthetic and restorative dentistry. However, high R&D costs, significant capital investment requirements, and reliance on discretionary spending make them vulnerable to economic cycles. Over the next few years, tailwinds for the sector include innovation in digital workflows, such as 3D printing and AI-driven diagnostics, which enhance the efficiency and precision of dental care. However, headwinds include economic uncertainty, which could reduce patient spending on elective procedures, regulatory challenges, and potential pricing pressures from consolidated dental service organizations (DSOs).

Henry Schein's primary competitors in the dental market include Patterson Companies (NASDAQ:PDCO) and Benco Dental Supply Company, while in the medical market, it competes with McKesson Corporation (NYSE:MCK) and Medline Industries. In the healthcare software space, competitors include Carestream Dental, CareStack, and Curve Dental.

5. Economies of Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $13.18 billion in revenue over the past 12 months, Henry Schein has decent scale. This is important as it gives the company more leverage in a heavily regulated, competitive environment that is complex and resource-intensive.

6. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Regrettably, Henry Schein’s sales grew at a mediocre 5.4% compounded annual growth rate over the last five years. This was below our standard for the healthcare sector and is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Henry Schein’s recent performance shows its demand has slowed as its annualized revenue growth of 3.4% over the last two years was below its five-year trend. We’re wary when companies in the sector see decelerations in revenue growth, as it could signal changing consumer tastes aided by low switching costs.

We can dig further into the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Henry Schein’s organic revenue averaged 1.3% year-on-year growth. Because this number is lower than its two-year revenue growth, we can see that some mixture of acquisitions and foreign exchange rates boosted its headline results.

This quarter, Henry Schein reported year-on-year revenue growth of 7.7%, and its $3.44 billion of revenue exceeded Wall Street’s estimates by 2.8%.

Looking ahead, sell-side analysts expect revenue to grow 2.8% over the next 12 months, similar to its two-year rate. This projection is underwhelming and implies its newer products and services will not accelerate its top-line performance yet.

7. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

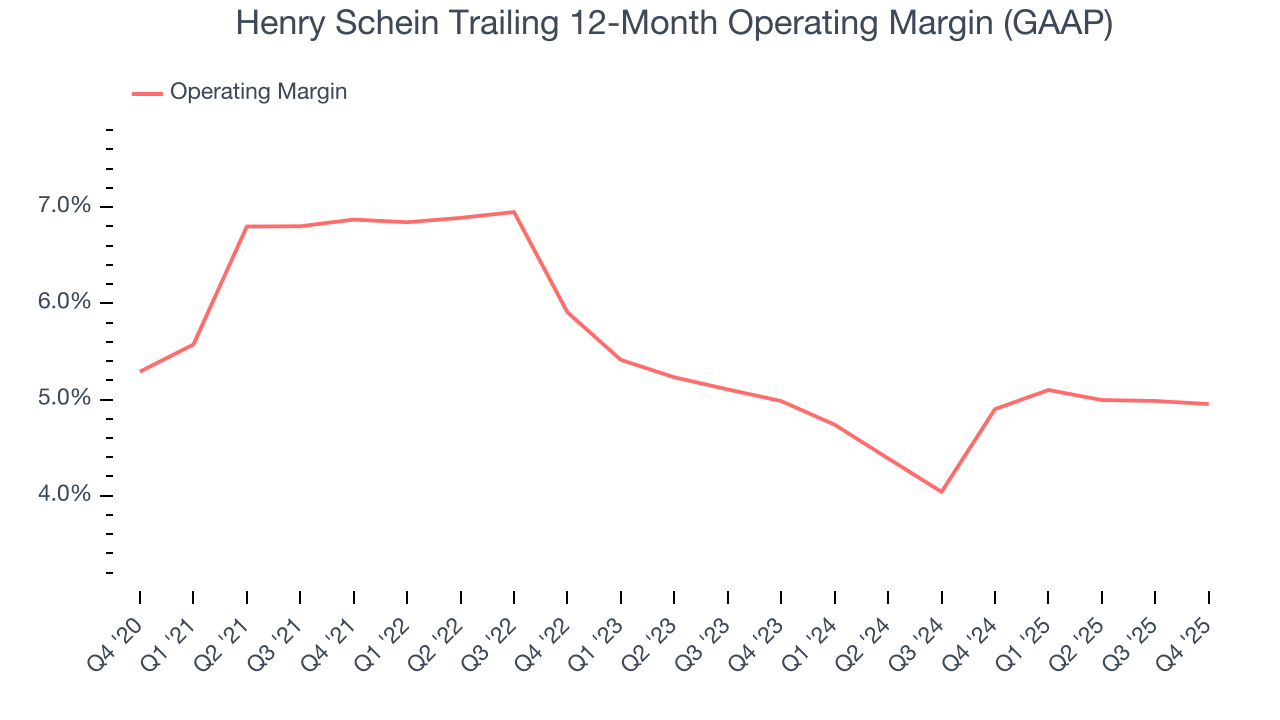

Henry Schein was profitable over the last five years but held back by its large cost base. Its average operating margin of 5.5% was weak for a healthcare business.

Analyzing the trend in its profitability, Henry Schein’s operating margin decreased by 1.9 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Henry Schein’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

In Q4, Henry Schein generated an operating margin profit margin of 4.7%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

8. Earnings Per Share

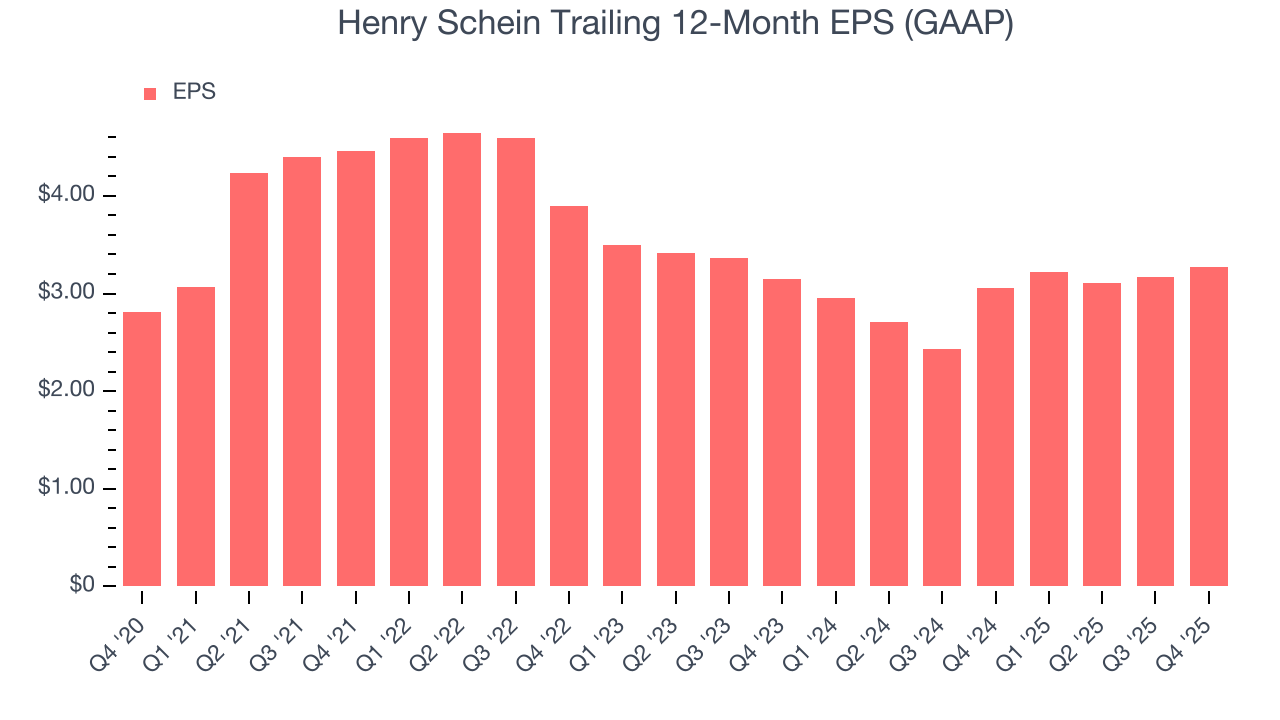

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Henry Schein’s EPS grew at an unimpressive 3.1% compounded annual growth rate over the last five years, lower than its 5.4% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded due to non-fundamental factors such as interest expenses and taxes.

Diving into the nuances of Henry Schein’s earnings can give us a better understanding of its performance. As we mentioned earlier, Henry Schein’s operating margin was flat this quarter but declined by 1.9 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, Henry Schein reported EPS of $0.85, up from $0.75 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street expects Henry Schein’s full-year EPS of $3.27 to grow 31.9%.

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Henry Schein has shown mediocre cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 4.4%, subpar for a healthcare business.

Henry Schein’s free cash flow clocked in at $338 million in Q4, equivalent to a 9.8% margin. This result was good as its margin was 4.6 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, leading to temporary swings. Long-term trends are more important.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Henry Schein’s management team makes decent investment decisions and generates value for shareholders. Its five-year average ROIC was 10.2%, slightly better than typical healthcare business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Henry Schein’s ROIC has decreased over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

11. Balance Sheet Assessment

Henry Schein reported $156 million of cash and $3.44 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $1.1 billion of EBITDA over the last 12 months, we view Henry Schein’s 3.0× net-debt-to-EBITDA ratio as safe. We also see its $57 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Henry Schein’s Q4 Results

We enjoyed seeing Henry Schein beat analysts’ revenue expectations this quarter. We were also glad its organic revenue outperformed Wall Street’s estimates. On the other hand, its EPS missed. Zooming out, we think this was a mixed quarter. The stock traded up 1.2% to $81.55 immediately after reporting.

13. Is Now The Time To Buy Henry Schein?

Updated: March 7, 2026 at 11:28 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Henry Schein.

Henry Schein isn’t a terrible business, but it doesn’t pass our quality test. To kick things off, its revenue growth was mediocre over the last five years, and analysts expect its demand to deteriorate over the next 12 months. While its remarkable EPS growth over the last five years shows its profits are trickling down to shareholders, the downside is its diminishing returns show management's prior bets haven't worked out. On top of that, its organic revenue growth has disappointed.

Henry Schein’s P/E ratio based on the next 12 months is 15.1x. While this valuation is fair, the upside isn’t great compared to the potential downside. We're fairly confident there are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $89.79 on the company (compared to the current share price of $77.64).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.