Icahn Enterprises (IEP)

We aren’t fans of Icahn Enterprises. Its sales have underperformed and its low returns on capital show it has few growth opportunities.― StockStory Analyst Team

1. News

2. Summary

Why We Think Icahn Enterprises Will Underperform

Founded in 1987, Icahn Enterprises (NASDAQ: IEP) is a diversified holding company primarily engaged in investment and asset management across various sectors.

- Sales are expected to decline once again over the next 12 months as it continues working through a challenging demand environment

- Gross margin of 10.5% is below its competitors, leaving less money to invest in areas like marketing and R&D

- The good news is that its earnings per share grew by 39.7% annually over the last five years, outpacing its peers

Icahn Enterprises’s quality is insufficient. There are more profitable opportunities elsewhere.

Why There Are Better Opportunities Than Icahn Enterprises

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Icahn Enterprises

Icahn Enterprises is trading at $8.25 per share, or 0.5x forward price-to-sales. The market typically values companies like Icahn Enterprises based on their anticipated profits for the next 12 months, but there aren’t enough published estimates to arrive at a reliable number. You should avoid this stock for now - better opportunities lie elsewhere.

We’d rather pay a premium for quality. Cheap stocks can look like a great deal at first glance, but they can be value traps. Less earnings power means more reliance on a re-rating to generate good returns; this can be an unlikely scenario for low-quality companies.

3. Icahn Enterprises (IEP) Research Report: Q4 CY2025 Update

Holding company and industrial conglomerate Icahn (NYSE:IEP) reported Q4 CY2025 results beating Wall Street’s revenue expectations, with sales up 5.2% year on year to $2.7 billion. Its GAAP loss of $0 per share was significantly below analysts’ consensus estimates.

Icahn Enterprises (IEP) Q4 CY2025 Highlights:

- Revenue: $2.7 billion vs analyst estimates of $2.46 billion (5.2% year-on-year growth, 9.6% beat)

- EPS (GAAP): $0 vs analyst estimates of $0.17 (miss)

- Adjusted EBITDA: $281 million (10.4% margin, 2,242% year-on-year growth)

- Adjusted EBITDA Margin: 10.4%, up from 0.5% in the same quarter last year

- Market Capitalization: $4.64 billion

Company Overview

Founded in 1987, Icahn Enterprises (NASDAQ: IEP) is a diversified holding company primarily engaged in investment and asset management across various sectors.

Icahn Enterprises, initially known as American Real Estate Partners, has evolved into a diversified conglomerate under the leadership of Carl Icahn, one of Wall Street’s most influential investors. The company’s strategy has been characterized by its aggressive approach to acquiring and turning around struggling companies across various sectors. Over the years, Icahn Enterprises has made significant entries into industries ranging from automotive to pharmaceuticals.

Today, Icahn Enterprises operates a diversified portfolio across multiple industries including automotive, energy, food packaging, entertainment, and real estate. The company generates revenue primarily through the sale of products and services within these segments, alongside recurring revenue streams from maintenance services, long-term contracts, and leases associated with its real estate and automotive services. For example, in the energy sector, CVR Energy produces petroleum products like gasoline and diesel fuel, and has recently expanded into renewable diesel production. Additionally, its food packaging subsidiary, Viskase, is known for manufacturing casings for meat processing, contributing significantly to international sales. In the Automotive segment, through subsidiaries like Icahn Automotive and AEP PLC, the company offers a full range of automotive repair and maintenance services, alongside aftermarket parts, reinforcing the company's revenue base.

Central to the company’s growth throughout the years has been the Icahn Strategy, rooted in identifying and investing in undervalued companies, employing an activist approach that goes beyond traditional value investing. By taking significant stakes in these companies, Icahn Enterprises often actively engages with management to drive strategic changes. This might involve anything from advocating for operational improvements to pursuing complete buyouts for direct operational control. Moving forward, the company plans to continue to capitalize on its resources to acquire and enhance businesses where management sees substantial unrealized value, often stepping in as a buyer to integrate these companies into its operational fold.

4. General Industrial Machinery

Automation that increases efficiency and connected equipment that collects analyzable data have been trending, creating new demand for general industrial machinery companies. Those who innovate and create digitized solutions can spur sales and speed up replacement cycles, but all general industrial machinery companies are still at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

Competitors offering similar products include Berkshire Hathaway (NYSE:BRK.A), Brookfield Asset Management (NYSE:BN), and KKR (NYSE:KKR).

5. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years. Thankfully, Icahn Enterprises’s 8.8% annualized revenue growth over the last five years was decent. Its growth was slightly above the average industrials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Icahn Enterprises’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 7.2% over the last two years.

This quarter, Icahn Enterprises reported year-on-year revenue growth of 5.2%, and its $2.7 billion of revenue exceeded Wall Street’s estimates by 9.6%.

Looking ahead, sell-side analysts expect revenue to decline by 1.1% over the next 12 months. While this projection is better than its two-year trend, it’s tough to feel optimistic about a company facing demand difficulties.

6. Gross Margin & Pricing Power

Icahn Enterprises has bad unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 10.7% gross margin over the last five years. Said differently, Icahn Enterprises had to pay a chunky $89.31 to its suppliers for every $100 in revenue.

Icahn Enterprises’s gross profit margin came in at 19.9% this quarter, up 11.5 percentage points year on year. Icahn Enterprises’s full-year margin has also been trending up over the past 12 months, increasing by 2.2 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as manufacturing expenses).

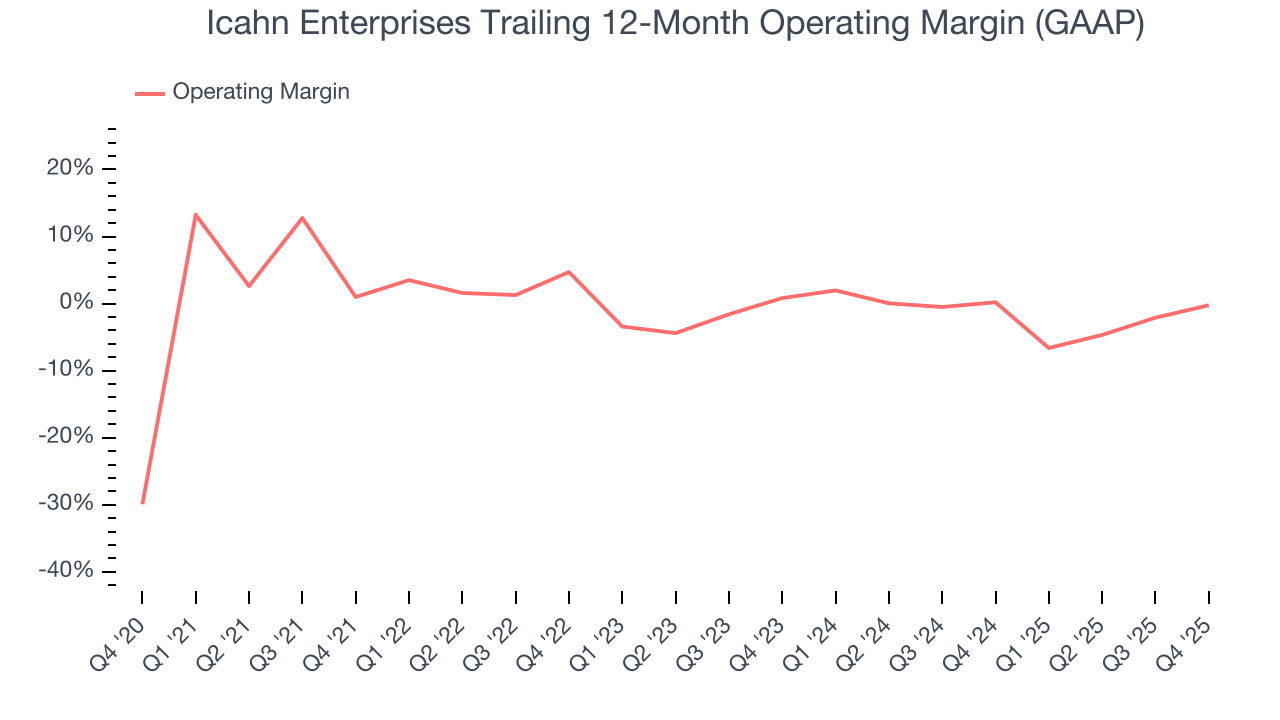

7. Operating Margin

Icahn Enterprises was profitable over the last five years but held back by its large cost base. Its average operating margin of 1.6% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

Looking at the trend in its profitability, Icahn Enterprises’s operating margin decreased by 1.2 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Icahn Enterprises’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

In Q4, Icahn Enterprises generated an operating margin profit margin of 6.8%, up 6.3 percentage points year on year. The increase was driven by stronger leverage on its cost of sales (not higher efficiency with its operating expenses), as indicated by its larger rise in gross margin.

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Although Icahn Enterprises’s full-year earnings are still negative, it reduced its losses and improved its EPS by 39.7% annually over the last five years. The next few quarters will be critical for assessing its long-term profitability.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Icahn Enterprises, its two-year annual EPS growth of 42.4% was higher than its five-year trend. We love it when earnings improve, but a caveat is that its EPS is still in the red.

In Q4, Icahn Enterprises reported EPS of $0, up from negative $0.19 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Icahn Enterprises’s full-year EPS of negative $0.60 will flip to positive $0.68.

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Icahn Enterprises has shown impressive cash profitability, enabling it to ride out cyclical downturns more easily while maintaining its investments in new and existing offerings. The company’s free cash flow margin averaged 8.6% over the last five years, better than the broader industrials sector. The divergence from its underwhelming operating margin stems from the add-back of non-cash charges like depreciation and stock-based compensation. GAAP operating profit expenses these line items, but free cash flow does not.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Icahn Enterprises historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 1.7%, lower than the typical cost of capital (how much it costs to raise money) for industrials companies.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Icahn Enterprises’s ROIC averaged 4.5 percentage point decreases each year over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

11. Balance Sheet Assessment

Icahn Enterprises reported $5.67 billion of cash and $6.62 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $334 million of EBITDA over the last 12 months, we view Icahn Enterprises’s 2.8× net-debt-to-EBITDA ratio as safe. We also see its $254 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Icahn Enterprises’s Q4 Results

We were impressed by how significantly Icahn Enterprises blew past analysts’ revenue expectations this quarter. On the other hand, its EPS missed. Overall, this quarter was mixed. Still, the stock traded up 3% to $7.98 immediately after reporting.

13. Is Now The Time To Buy Icahn Enterprises?

Updated: March 5, 2026 at 10:30 PM EST

Before deciding whether to buy Icahn Enterprises or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

Icahn Enterprises isn’t a terrible business, but it doesn’t pass our bar. Although its revenue growth was good over the last five years, it’s expected to deteriorate over the next 12 months and its relatively low ROIC suggests management has struggled to find compelling investment opportunities. And while the company’s astounding EPS growth over the last five years shows its profits are trickling down to shareholders, the downside is its cash profitability fell over the last five years.

Icahn Enterprises’s forward price-to-sales ratio is 0.5x. The market typically values companies like Icahn Enterprises based on their anticipated profits for the next 12 months, but there aren’t enough published estimates to arrive at a reliable number. You should avoid this stock for now - better opportunities lie elsewhere.

Wall Street analysts have a consensus one-year price target of $12 on the company (compared to the current share price of $8.25).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.