Incyte (INCY)

Incyte piques our interest. It generates heaps of cash that are reinvested into the business, creating a virtuous cycle of returns.― StockStory Analyst Team

1. News

2. Summary

Why Incyte Is Interesting

Founded in 1991 and evolving from a genomics research firm to a commercial-stage drug developer, Incyte (NASDAQ:INCY) is a biopharmaceutical company that discovers, develops, and commercializes proprietary therapeutics for cancer and inflammatory diseases.

- ROIC punches in at 39.9%, illustrating management’s expertise in identifying profitable investments

- Incremental sales significantly boosted profitability as its annual earnings per share growth of 60.8% over the last five years outstripped its revenue performance

- The stock is trading at a reasonable price if you like its story and growth prospects

Incyte shows some potential. If you’ve been itching to buy the stock, the valuation seems fair.

Why Is Now The Time To Buy Incyte?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Incyte?

At $101.98 per share, Incyte trades at 14.2x forward P/E. Incyte’s valuation is lower than that of many in the healthcare space. Even so, we think it is justified for the revenue growth characteristics.

Now could be a good time to invest if you believe in the story.

3. Incyte (INCY) Research Report: Q3 CY2025 Update

Biopharmaceutical company Incyte Corporation (NASDAQ:INCY) reported Q3 CY2025 results beating Wall Street’s revenue expectations, with sales up 20% year on year to $1.37 billion. Its non-GAAP profit of $2.26 per share was 38% above analysts’ consensus estimates.

Incyte (INCY) Q3 CY2025 Highlights:

- Revenue: $1.37 billion vs analyst estimates of $1.26 billion (20% year-on-year growth, 8.5% beat)

- Adjusted EPS: $2.26 vs analyst estimates of $1.64 (38% beat)

- Operating Margin: 32.5%, up from 12.8% in the same quarter last year

- Market Capitalization: $18.18 billion

Company Overview

Founded in 1991 and evolving from a genomics research firm to a commercial-stage drug developer, Incyte (NASDAQ:INCY) is a biopharmaceutical company that discovers, develops, and commercializes proprietary therapeutics for cancer and inflammatory diseases.

Incyte's portfolio is organized into two main therapeutic areas: Hematology/Oncology and Inflammation and Autoimmunity (IAI). The company's flagship product is JAKAFI (ruxolitinib), an oral JAK1 and JAK2 inhibitor approved for several blood disorders including myelofibrosis, polycythemia vera, and graft-versus-host disease. This drug represents a significant revenue source for the company and was the first FDA-approved JAK inhibitor for any indication.

Beyond JAKAFI, Incyte markets several other oncology products including MONJUVI/MINJUVI (tafasitamab) for diffuse large B-cell lymphoma, PEMAZYRE (pemigatinib) for cholangiocarcinoma and myeloid/lymphoid neoplasms, ZYNYZ (retifanlimab) for Merkel cell carcinoma, and NIKTIMVO (axatilimab) for chronic graft-versus-host disease. In dermatology, the company sells OPZELURA, a topical formulation of ruxolitinib approved for atopic dermatitis and vitiligo.

Incyte employs a dual business model that combines internal drug discovery with strategic collaborations. The company maintains partnerships with pharmaceutical companies like Novartis, which markets ruxolitinib outside the US as JAKAVI, and Eli Lilly, which commercializes baricitinib (OLUMIANT) globally for conditions including rheumatoid arthritis and alopecia areata.

Research and development remain central to Incyte's strategy, with a robust pipeline targeting various cancers and inflammatory conditions. The company is exploring novel compounds such as INCB123667, a selective CDK2 inhibitor showing promise in certain cancer types, and povorcitinib, an oral JAK1 inhibitor being evaluated for multiple dermatological conditions.

Incyte distributes its medications primarily through specialty pharmacy providers and wholesalers in the United States, with similar distribution networks established internationally. The company has built marketing, medical, and operational infrastructure both domestically and abroad to support commercialization of its growing product portfolio.

4. Immuno-Oncology

Over the next few years, immuno-oncology companies, which harness the immune system to fight illnesses such as cancer, faces strong tailwinds from advancements in precision medicine (including the use of AI to improve hit rates) and growing demand for treatments targeting rare diseases. However, headwinds such as rising scrutiny over drug pricing, regulatory unknowns, and competition from larger, more resourced pharmaceutical companies could weigh on growth.

Incyte's competitors in the oncology and hematology space include Novartis (NYSE:NVS), Bristol Myers Squibb (NYSE:BMY), and AbbVie (NYSE:ABBV). In the dermatology and inflammation markets, the company competes with Pfizer (NYSE:PFE), Eli Lilly (NYSE:LLY), AbbVie's Allergan, and Regeneron Pharmaceuticals (NASDAQ:REGN).

5. Economies of Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $4.81 billion in revenue over the past 12 months, Incyte has decent scale. This is important as it gives the company more leverage in a heavily regulated, competitive environment that is complex and resource-intensive.

6. Revenue Growth

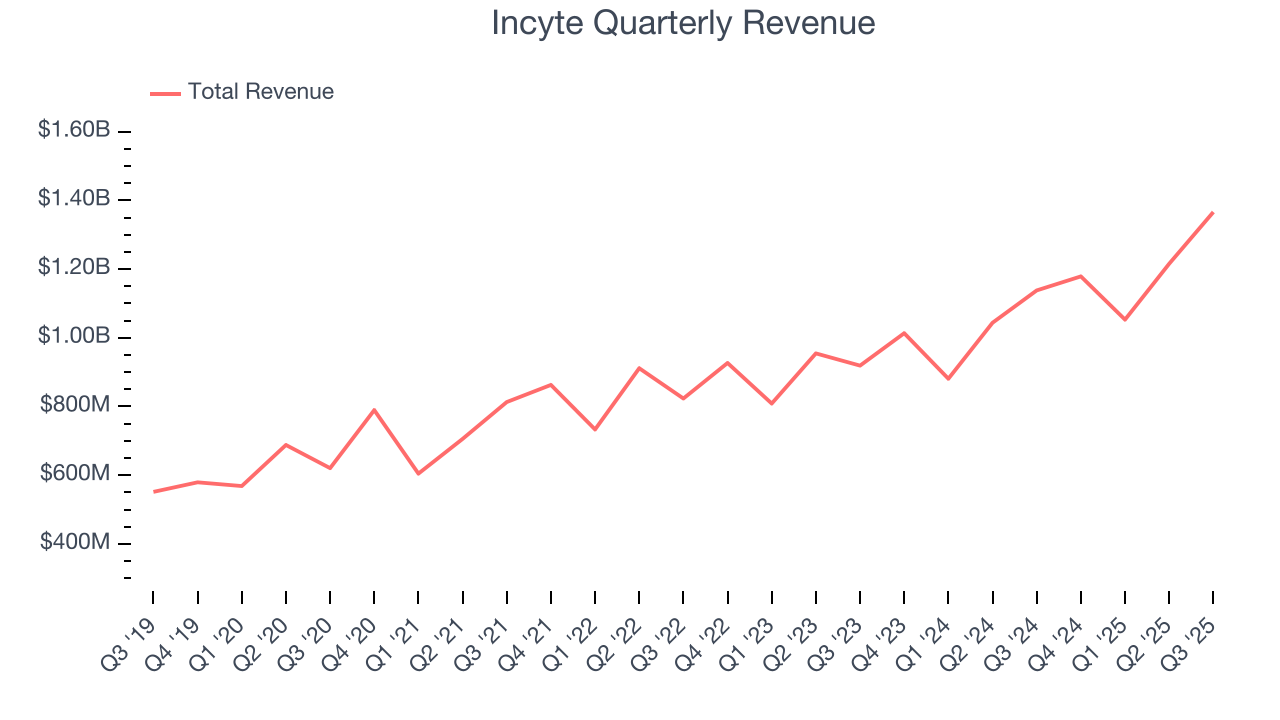

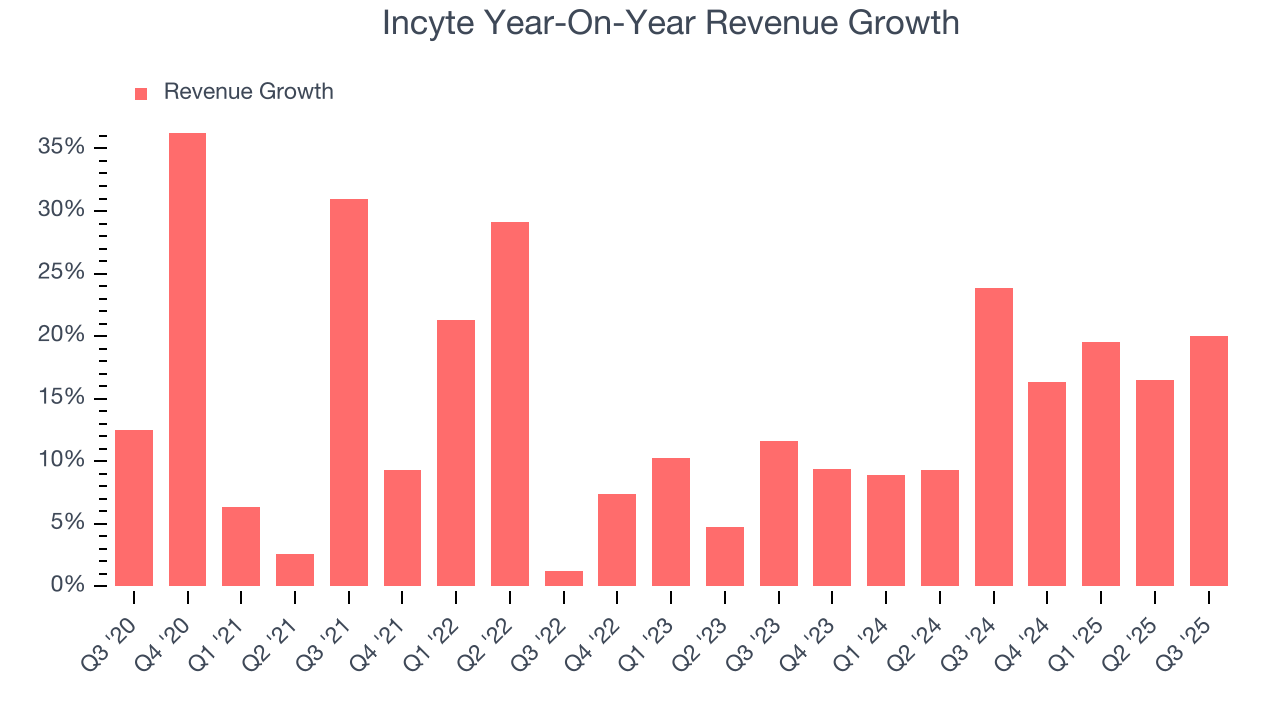

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Incyte grew its sales at a solid 14.4% compounded annual growth rate. Its growth beat the average healthcare company and shows its offerings resonate with customers, a helpful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Incyte’s annualized revenue growth of 15.5% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, Incyte reported robust year-on-year revenue growth of 20%, and its $1.37 billion of revenue topped Wall Street estimates by 8.5%.

Looking ahead, sell-side analysts expect revenue to grow 7.6% over the next 12 months, a deceleration versus the last two years. Still, this projection is above the sector average and indicates the market sees some success for its newer products and services.

7. Operating Margin

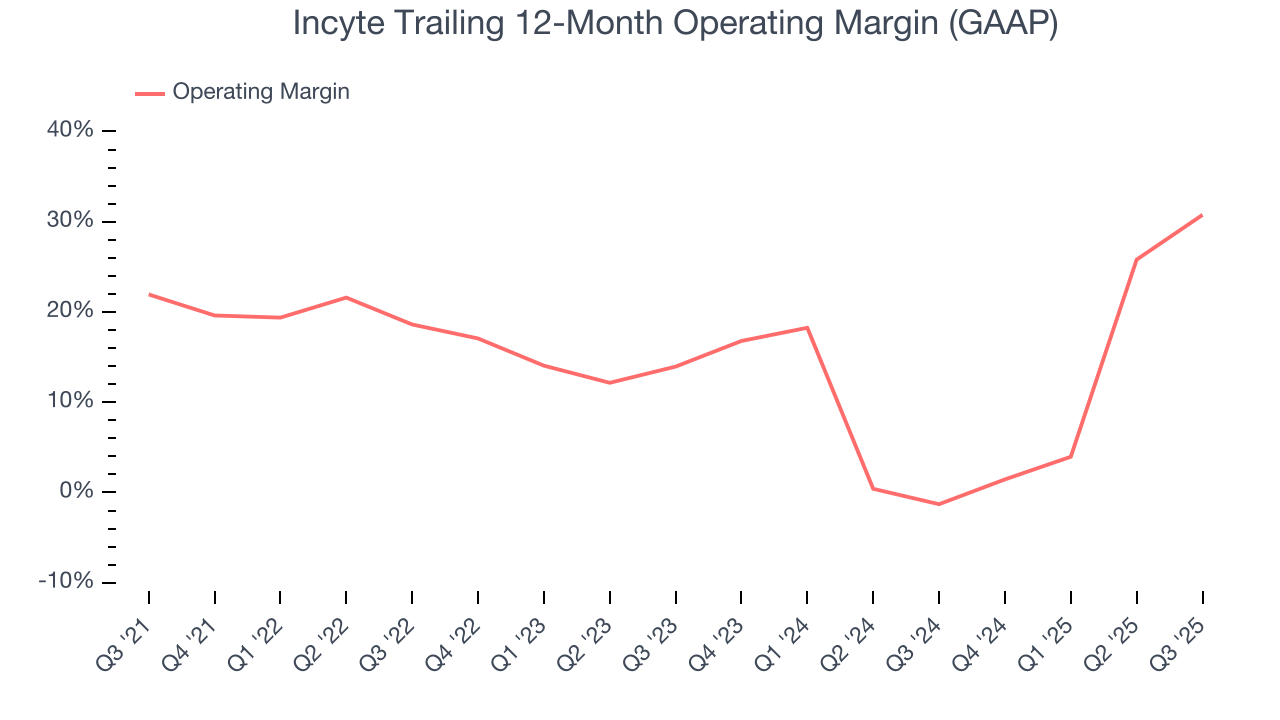

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Incyte has managed its cost base well over the last five years. It demonstrated solid profitability for a healthcare business, producing an average operating margin of 17%.

Analyzing the trend in its profitability, Incyte’s operating margin rose by 8.8 percentage points over the last five years, as its sales growth gave it operating leverage. This performance was mostly driven by its recent improvements as the company’s margin has increased by 16.8 percentage points on a two-year basis. These data points are very encouraging and show momentum is on its side.

This quarter, Incyte generated an operating margin profit margin of 32.5%, up 19.6 percentage points year on year. This increase was a welcome development and shows it was more efficient.

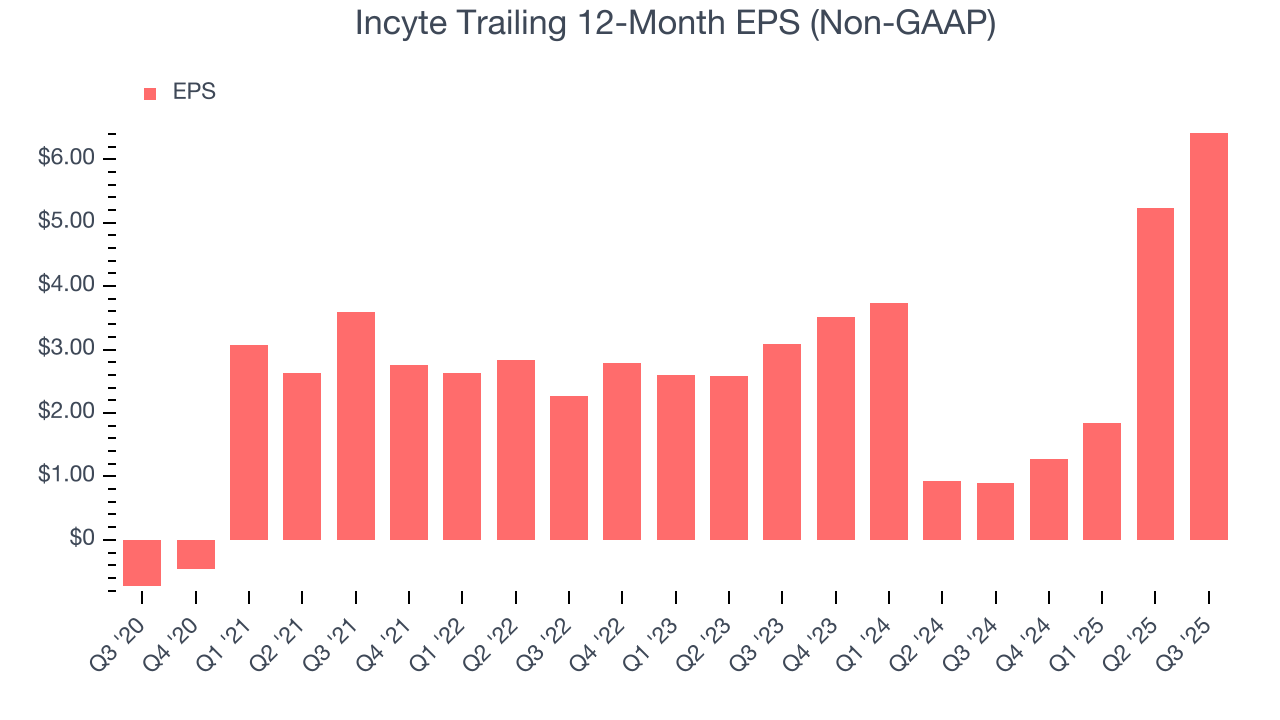

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Incyte’s full-year EPS flipped from negative to positive over the last five years. This is a good sign and shows it’s at an inflection point.

In Q3, Incyte reported adjusted EPS of $2.26, up from $1.07 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Incyte’s full-year EPS of $6.42 to grow 4.3%.

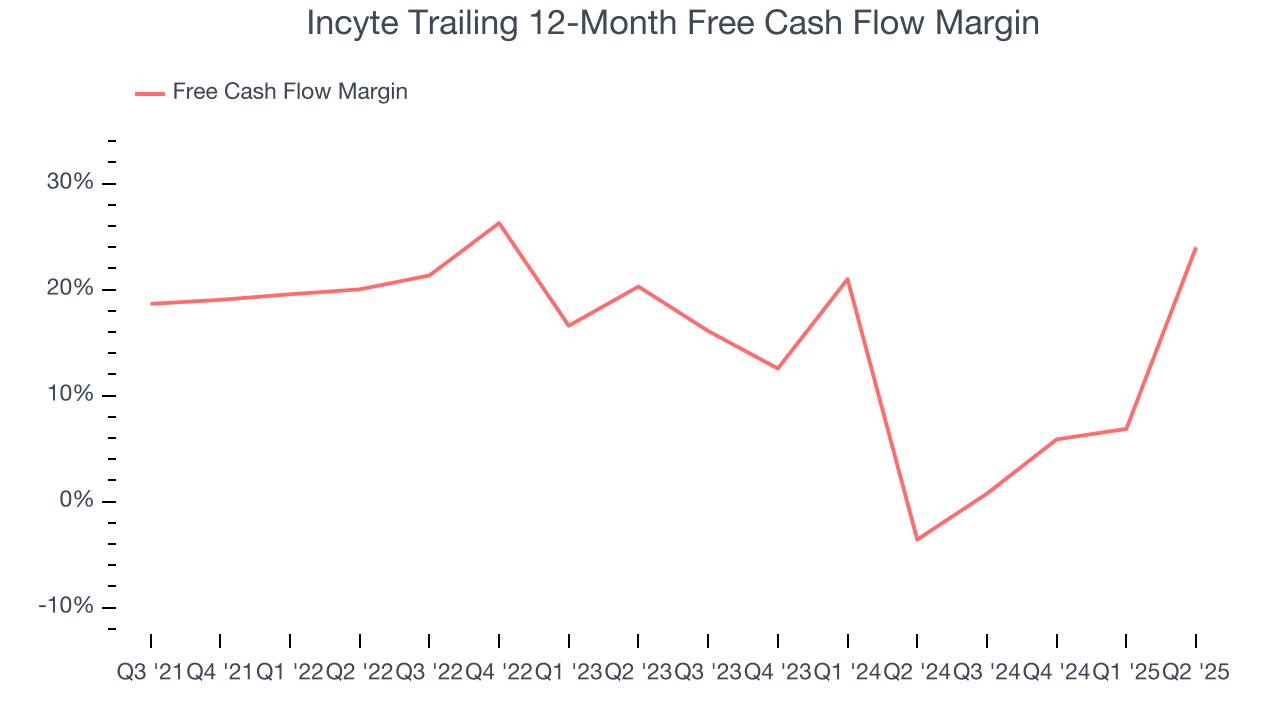

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Incyte has shown robust cash profitability, giving it an edge over its competitors and the ability to reinvest or return capital to investors. The company’s free cash flow margin averaged 15.3% over the last five years, quite impressive for a healthcare business.

Taking a step back, we can see that Incyte’s margin expanded by 7.8 percentage points during that time. This is encouraging because it gives the company more optionality.

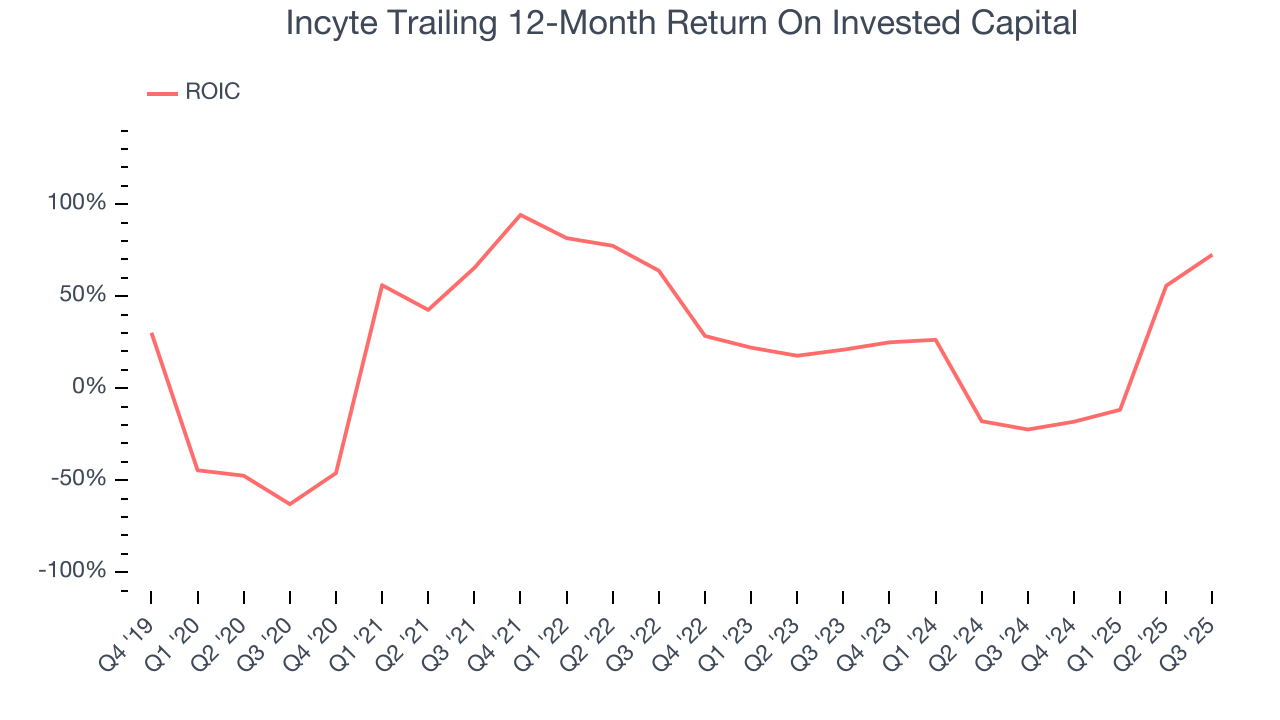

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Incyte’s five-year average ROIC was 40.1%, placing it among the best healthcare companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Incyte’s ROIC has unfortunately decreased significantly. Only time will tell if its new bets can bear fruit and potentially reverse the trend.

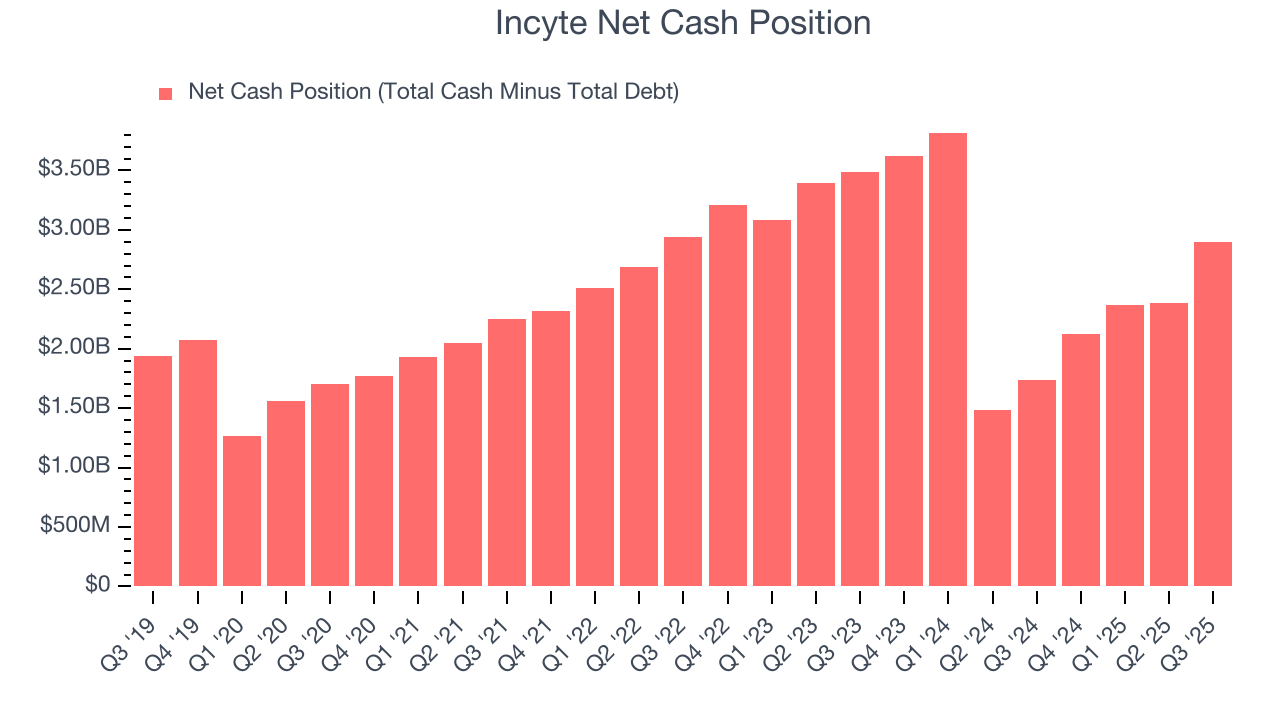

11. Balance Sheet Assessment

One of the best ways to mitigate bankruptcy risk is to hold more cash than debt.

Incyte is a profitable, well-capitalized company with $2.93 billion of cash and $35.37 million of debt on its balance sheet. This $2.89 billion net cash position is 16.2% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from Incyte’s Q3 Results

It was good to see Incyte beat analysts’ EPS expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this quarter featured some important positives. The stock remained flat at $93.15 immediately following the results.

13. Is Now The Time To Buy Incyte?

Updated: January 24, 2026 at 10:48 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Incyte.

There are definitely a lot of things to like about Incyte. First off, its revenue growth was solid over the last five years. And while its diminishing returns show management's recent bets still have yet to bear fruit, its rising cash profitability gives it more optionality. On top of that, its astounding EPS growth over the last five years shows its profits are trickling down to shareholders.

Incyte’s P/E ratio based on the next 12 months is 14.2x. When scanning the healthcare space, Incyte trades at a fair valuation. If you believe in the company and its growth potential, now is an opportune time to buy shares.

Wall Street analysts have a consensus one-year price target of $102.33 on the company (compared to the current share price of $101.98).