Inspired (INSE)

We wouldn’t recommend Inspired. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think Inspired Will Underperform

Specializing in digital casino gaming, Inspired (NASDAQ:INSE) is a provider of gaming hardware, virtual sports platforms, and server-based gaming systems.

- Lackluster 9.6% annual revenue growth over the last five years indicates the company is losing ground to competitors

- Sales are projected to tank by 10.3% over the next 12 months as its demand continues evaporating

- Poor expense management has led to an operating margin that is below the industry average

Inspired doesn’t pass our quality test. We’ve identified better opportunities elsewhere.

Why There Are Better Opportunities Than Inspired

Why There Are Better Opportunities Than Inspired

Inspired’s stock price of $9.12 implies a valuation ratio of 15.4x forward P/E. This multiple is cheaper than most consumer discretionary peers, but we think this is justified.

We’d rather pay up for companies with elite fundamentals than get a bargain on weak ones. Cheap stocks can be value traps, and as their performance deteriorates, they will stay cheap or get even cheaper.

3. Inspired (INSE) Research Report: Q3 CY2025 Update

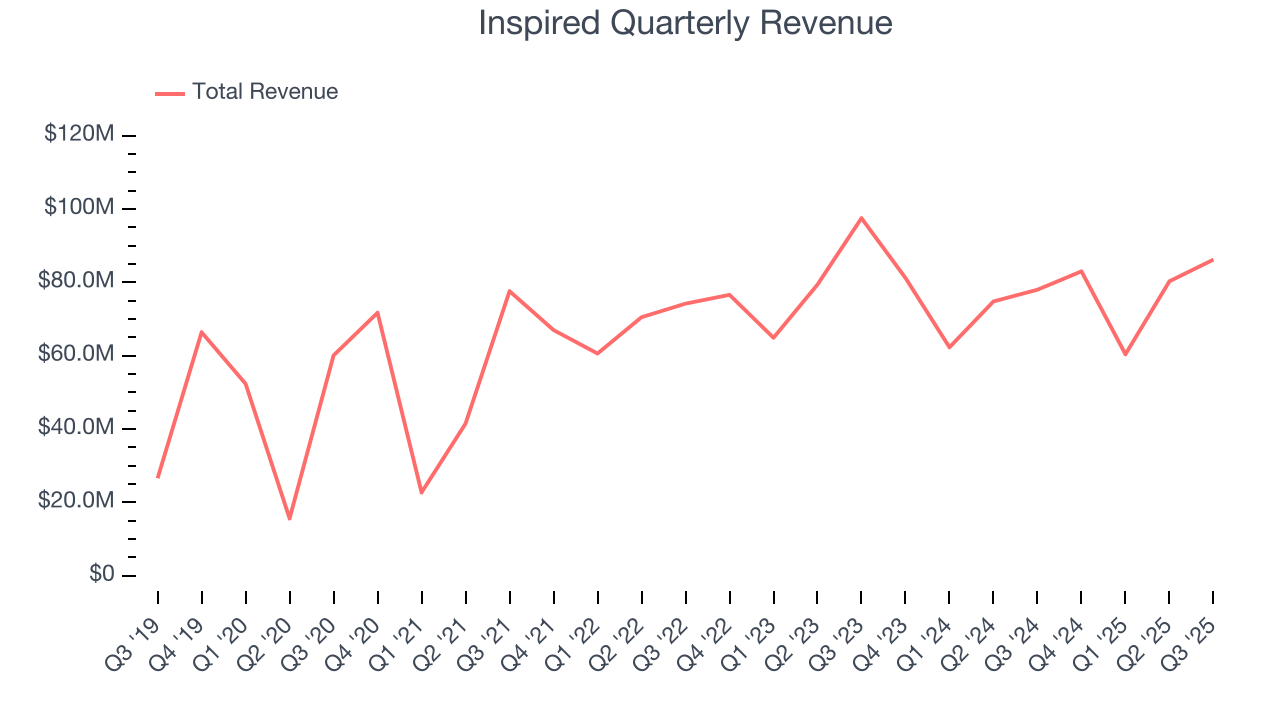

Gaming company Inspired (NASDAQ:INSE) reported Q3 CY2025 results topping the market’s revenue expectations, with sales up 10.5% year on year to $86.2 million. Its non-GAAP profit of $0.28 per share was 41% above analysts’ consensus estimates.

Inspired (INSE) Q3 CY2025 Highlights:

- Revenue: $86.2 million vs analyst estimates of $82.98 million (10.5% year-on-year growth, 3.9% beat)

- Adjusted EPS: $0.28 vs analyst estimates of $0.20 (41% beat)

- Adjusted EBITDA: $32.3 million vs analyst estimates of $30.53 million (37.5% margin, 5.8% beat)

- Operating Margin: 11.3%, down from 15.3% in the same quarter last year

- Free Cash Flow Margin: 1.6%, down from 17.7% in the same quarter last year

- Market Capitalization: $204.3 million

Company Overview

Specializing in digital casino gaming, Inspired (NASDAQ:INSE) is a provider of gaming hardware, virtual sports platforms, and server-based gaming systems.

The company was founded to create advanced digital games with engaging user experiences and realistic graphics. Its products include physical machines like interactive gaming terminals that are placed on casino floors as well as online games.

Inspired generates revenue through the sale and leasing of gaming systems to operators along with service fees. Its customers include casino operators and online casinos.

4. Gaming Solutions

Gaming solution companies operate in a dynamic and evolving market, and the digital transformation of the gaming industry presents significant opportunities for innovation and growth, whether it be immersive slot machine terminals or mobile sports betting. However, the gaming solution industry is not without its challenges. Regulatory compliance is a crucial consideration as companies must navigate a complex and often fragmented regulatory landscape across different jurisdictions. Changes in regulations can impact product offerings, operational practices, and market access, requiring companies to maintain flexibility and adaptability in their business strategies. Additionally, the competitive nature of the industry necessitates continuous investment in research and development to stay ahead of competitors and meet evolving consumer demands.

Competitors in the gaming technology and entertainment sector include Everi (NYSE:EVRI), PlayAGS (NYSE:AGS), and Light & Wonder (NASDAQ:LNW).

5. Revenue Growth

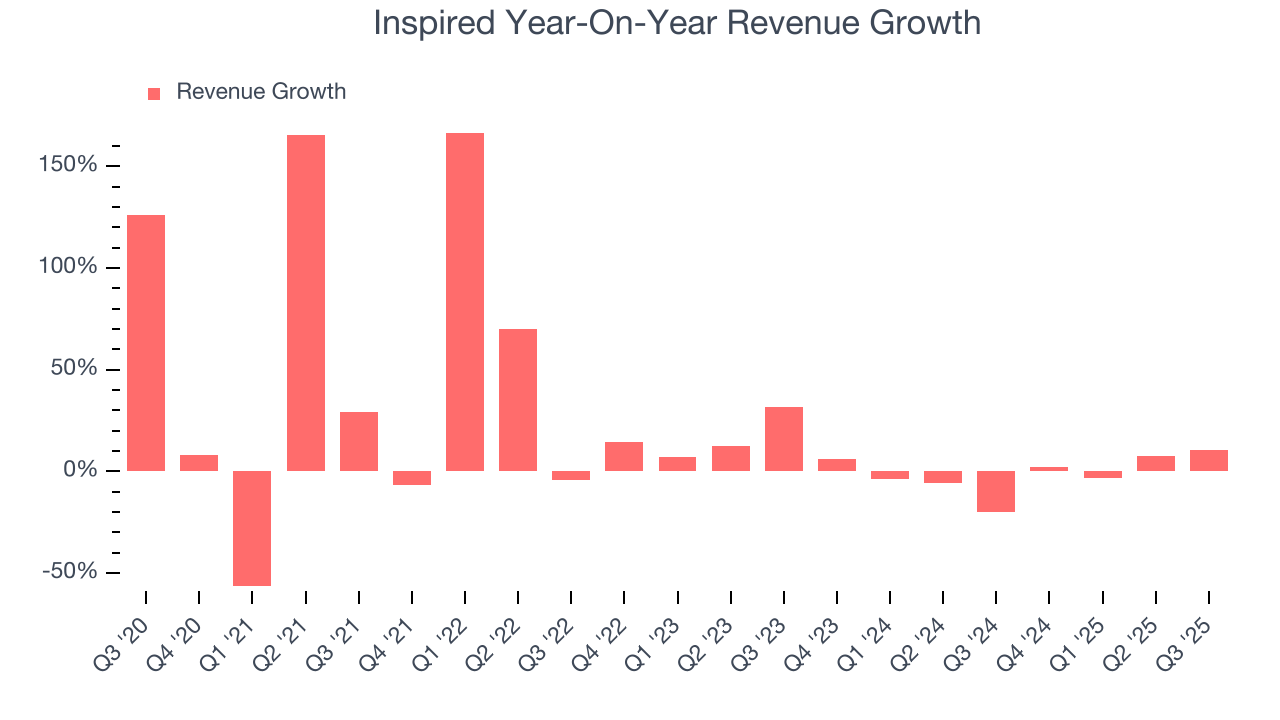

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Inspired grew its sales at a tepid 9.8% compounded annual growth rate. This was below our standard for the consumer discretionary sector and is a rough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Inspired’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 1.3% annually.

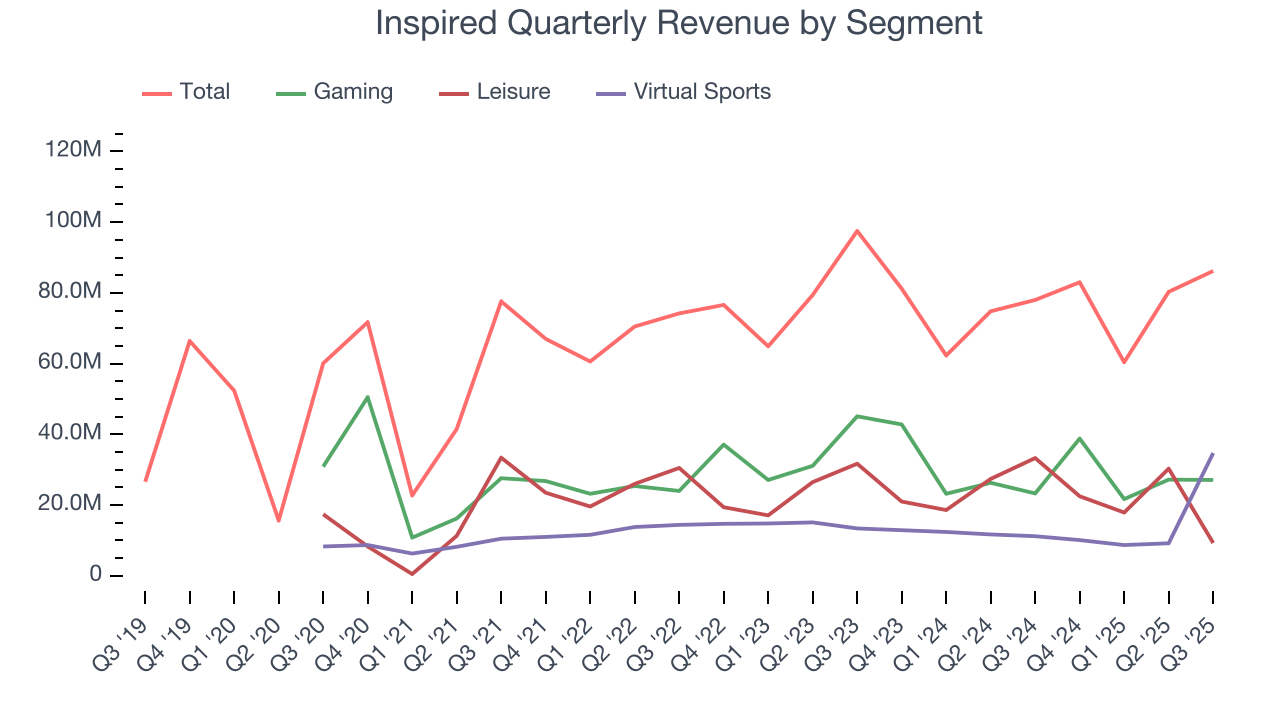

Inspired also breaks out the revenue for its three most important segments: Gaming, Leisure, and Virtual Sports, which are 31.4%, 10.8%, and 40.3% of revenue. Over the last two years, Inspired’s Gaming (land-based casino games) and Leisure (gaming terminals and amusement machines) revenues averaged year-on-year declines of 7.4% and 4.1% while its Virtual Sports revenue (digital gaming and sports betting) averaged 8.7% growth.

This quarter, Inspired reported year-on-year revenue growth of 10.5%, and its $86.2 million of revenue exceeded Wall Street’s estimates by 3.9%.

Looking ahead, sell-side analysts expect revenue to decline by 11.6% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and implies its products and services will face some demand challenges.

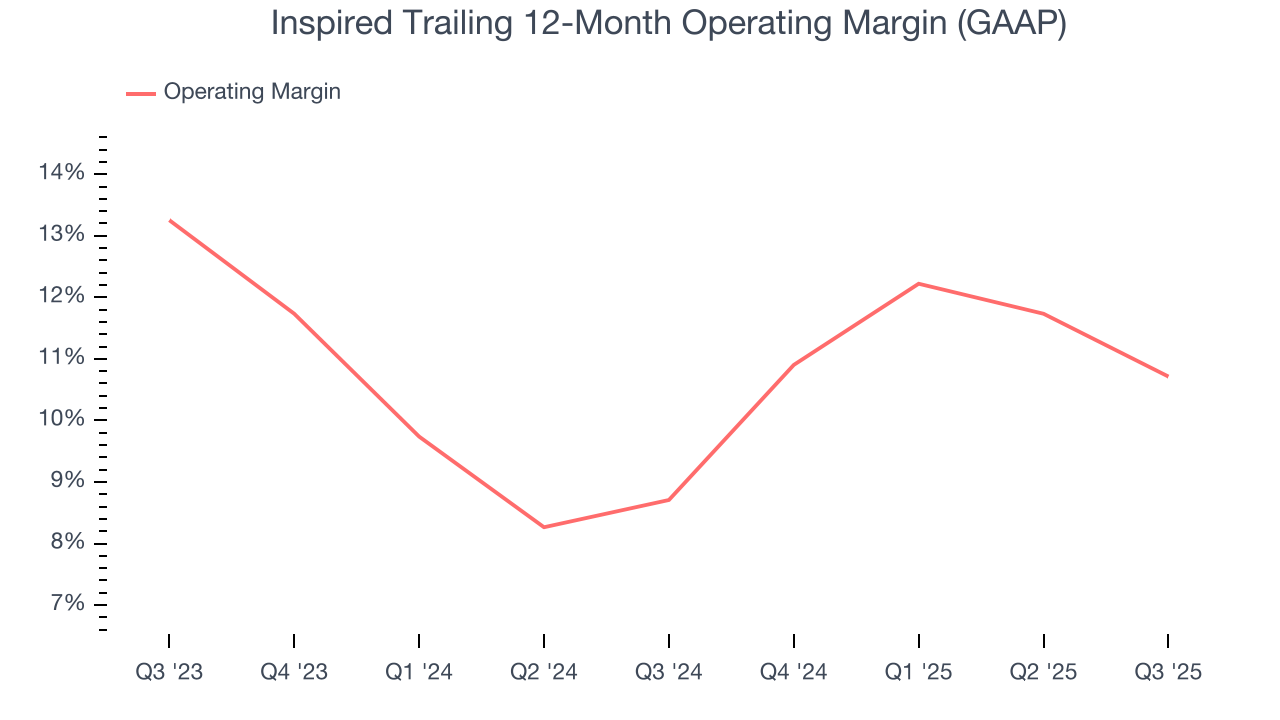

6. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Inspired’s operating margin has risen over the last 12 months and averaged 9.7% over the last two years. The company’s higher efficiency is a breath of fresh air, but its suboptimal cost structure means it still sports mediocre profitability for a consumer discretionary business.

This quarter, Inspired generated an operating margin profit margin of 11.3%, down 4 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

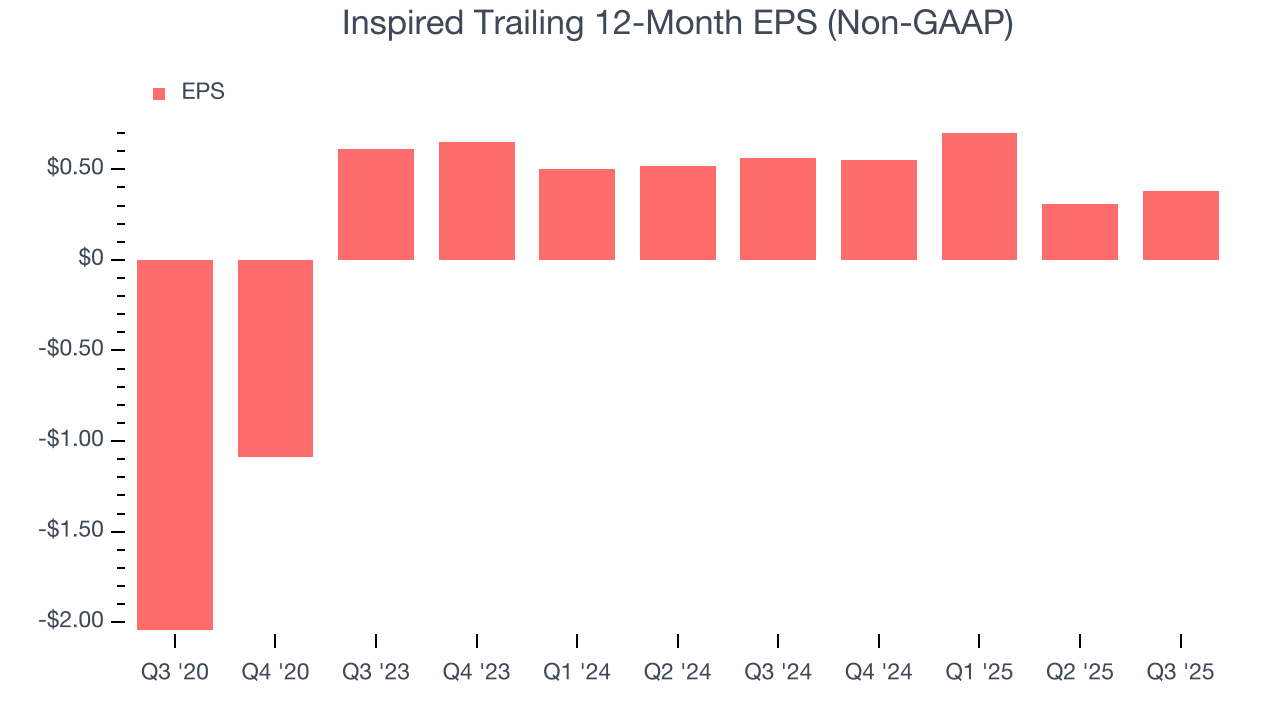

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Inspired’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

In Q3, Inspired reported adjusted EPS of $0.28, up from $0.21 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Inspired’s full-year EPS of $0.38 to shrink by 11.8%.

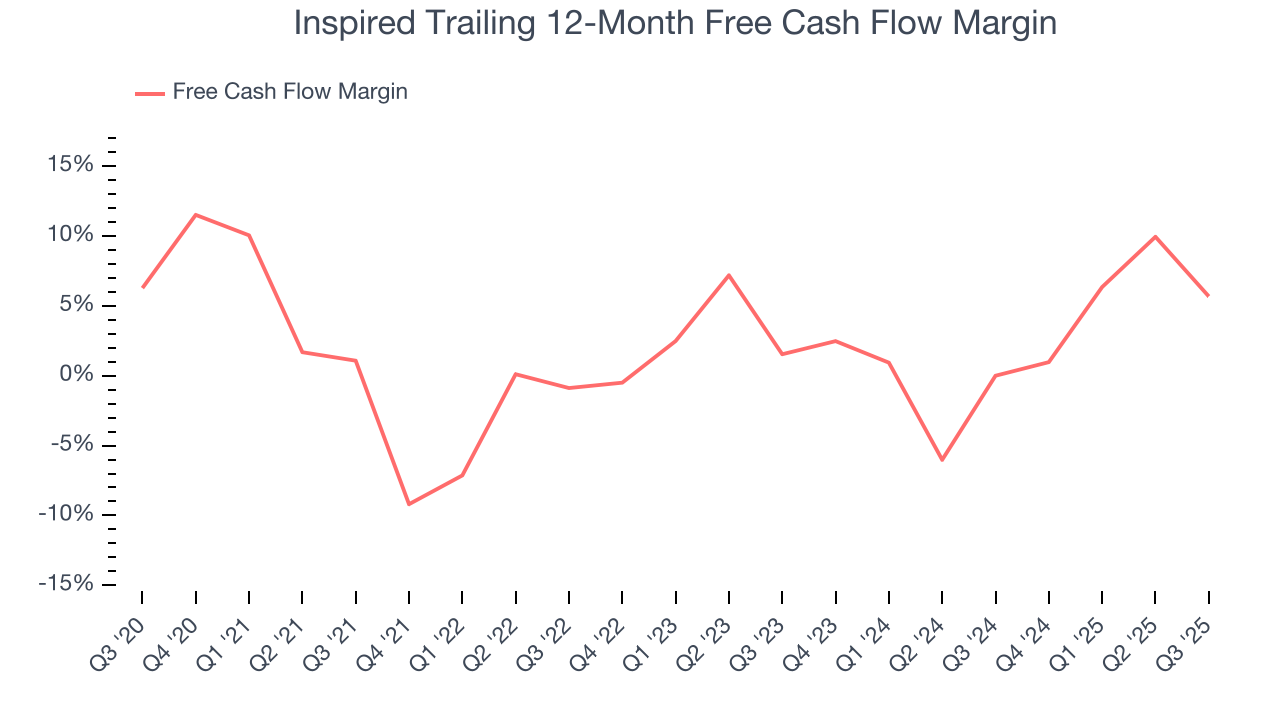

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Inspired has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 2.9%, lousy for a consumer discretionary business.

Inspired’s free cash flow clocked in at $1.4 million in Q3, equivalent to a 1.6% margin. The company’s cash profitability regressed as it was 16.1 percentage points lower than in the same quarter last year, prompting us to pay closer attention. Short-term fluctuations typically aren’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

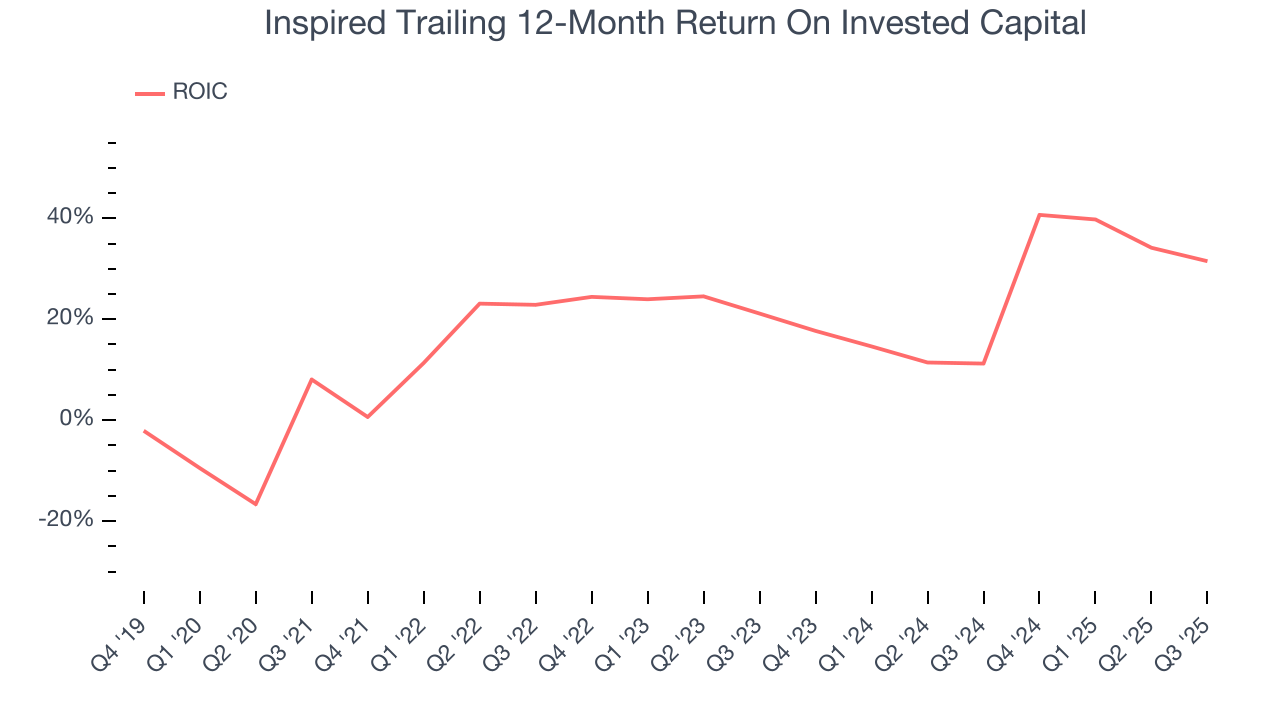

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Although Inspired hasn’t been the highest-quality company lately, it historically found a few growth initiatives that worked. Its five-year average ROIC was 19%, higher than most consumer discretionary businesses.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Inspired’s ROIC has increased over the last few years. This is a good sign, and we hope the company can keep improving.

10. Balance Sheet Assessment

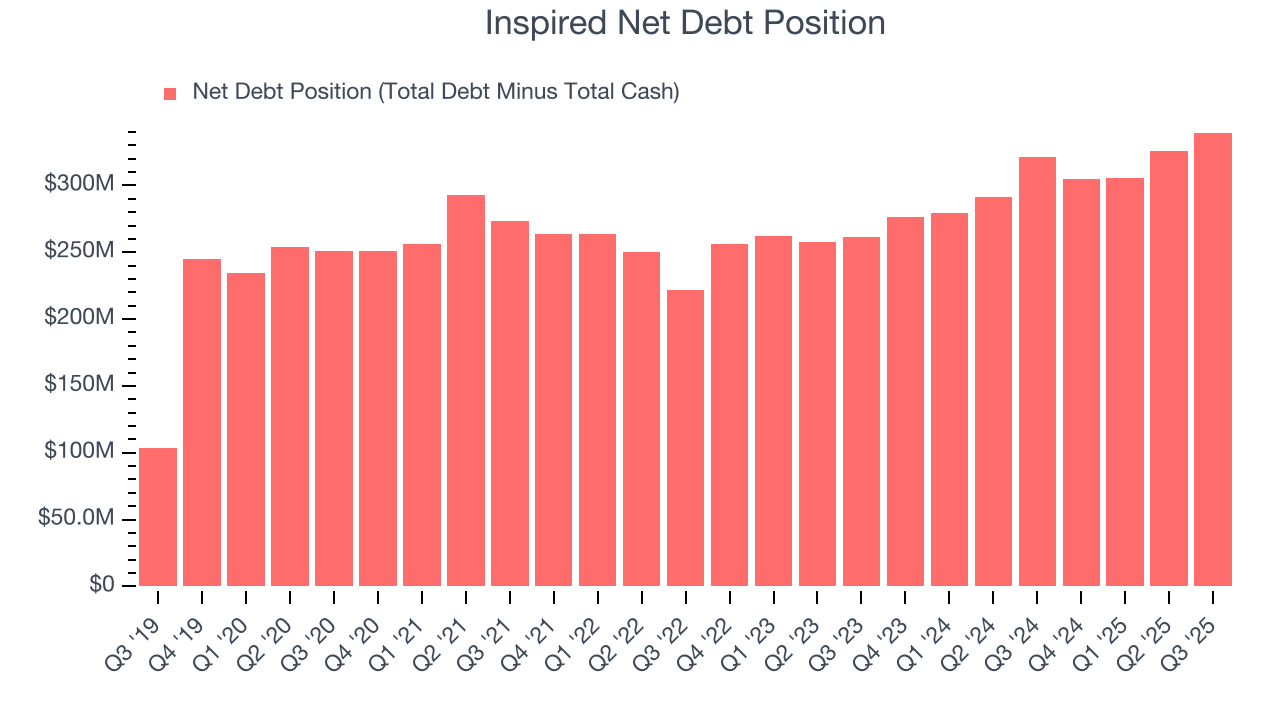

Inspired reported $36.3 million of cash and $375.8 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $110 million of EBITDA over the last 12 months, we view Inspired’s 3.1× net-debt-to-EBITDA ratio as safe. We also see its $35.1 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Inspired’s Q3 Results

It was good to see Inspired beat analysts’ EPS expectations this quarter. We were also glad its Virtual Sports revenue outperformed Wall Street’s estimates. On the other hand, its Leisure revenue missed. Zooming out, we think this was a solid print. The stock remained flat at $7.59 immediately following the results.

12. Is Now The Time To Buy Inspired?

Updated: January 24, 2026 at 9:57 PM EST

Are you wondering whether to buy Inspired or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

We see the value of companies helping consumers, but in the case of Inspired, we’re out. To kick things off, its revenue growth was weak over the last five years, and analysts expect its demand to deteriorate over the next 12 months. And while its projected EPS for the next year implies the company’s fundamentals will improve, the downside is its relatively low ROIC suggests management has struggled to find compelling investment opportunities. On top of that, its low free cash flow margins give it little breathing room.

Inspired’s P/E ratio based on the next 12 months is 15.4x. This valuation multiple is fair, but we don’t have much confidence in the company. There are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $13.50 on the company (compared to the current share price of $9.12).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.