IPG Photonics (IPGP)

IPG Photonics faces an uphill battle. Its low returns on capital and plummeting sales suggest it struggles to generate demand and profits, a red flag.― StockStory Analyst Team

1. News

2. Summary

Why We Think IPG Photonics Will Underperform

Both a designer and manufacturer of its products, IPG Photonics (NASDAQ:IPGP) is a provider of high-performance fiber lasers used for cutting, welding, and processing raw materials.

- Products and services are facing significant end-market challenges during this cycle as sales have declined by 3.8% annually over the last five years

- Performance over the past five years shows each sale was less profitable as its earnings per share dropped by 20% annually, worse than its revenue

- Operating margin has declined over the last five years, and when paired with its track record of losses, suggests intense competition and a suboptimal cost structure

IPG Photonics doesn’t pass our quality test. We see more favorable opportunities in the market.

Why There Are Better Opportunities Than IPG Photonics

High Quality

Investable

Underperform

Why There Are Better Opportunities Than IPG Photonics

At $114.50 per share, IPG Photonics trades at 83.6x forward P/E. We consider this valuation aggressive considering the weaker revenue growth profile.

There are stocks out there similarly priced with better business quality. We prefer owning these.

3. IPG Photonics (IPGP) Research Report: Q4 CY2025 Update

Fiber laser manufacturer IPG Photonics (NASDAQ:IPGP) reported Q4 CY2025 results exceeding the market’s revenue expectations, with sales up 17.1% year on year to $274.5 million. Guidance for next quarter’s revenue was optimistic at $250 million at the midpoint, 2% above analysts’ estimates. Its non-GAAP profit of $0.46 per share was 85.2% above analysts’ consensus estimates.

IPG Photonics (IPGP) Q4 CY2025 Highlights:

- Revenue: $274.5 million vs analyst estimates of $249.6 million (17.1% year-on-year growth, 10% beat)

- Adjusted EPS: $0.46 vs analyst estimates of $0.25 (85.2% beat)

- Adjusted EBITDA: $41.23 million vs analyst estimates of $30.12 million (15% margin, 36.9% beat)

- Revenue Guidance for Q1 CY2026 is $250 million at the midpoint, above analyst estimates of $245 million

- Adjusted EPS guidance for Q1 CY2026 is $0.25 at the midpoint, below analyst estimates of $0.25

- EBITDA guidance for Q1 CY2026 is $32.5 million at the midpoint, above analyst estimates of $29.67 million

- Operating Margin: 1.2%, down from 6% in the same quarter last year

- Free Cash Flow Margin: 4%, down from 21.6% in the same quarter last year

- Inventory Days Outstanding: 163, down from 194 in the previous quarter

- Market Capitalization: $4.67 billion

Company Overview

Both a designer and manufacturer of its products, IPG Photonics (NASDAQ:IPGP) is a provider of high-performance fiber lasers used for cutting, welding, and processing raw materials.

IPG Photonics was founded in 1990 by Valentin Gapontsev, a Russian physicist. Gapontsev pioneered a proprietary all-fiber technology platform for fiber lasers and amplifiers. IPG went public in 2007 and was included in the S&P 500 in 2018.

A laser converts electrical energy to optical energy that can be focused and shaped, creating a concentrated beam that causes materials to melt, vaporize or otherwise change their character. In materials processing, lasers are gaining market share from traditional machine tools (e.g. saws, presses) because of the greater precision, processing speeds, and flexibility.

Semiconductor manufacturers employ lasers for key steps such as lithography (3D relief images on the substrate) and annealing (heating wafers to change electrical properties). With regards to annealing, for example, IPG Photonics’ lasers can create extremely localized heating with fine depth penetration control and precise positioning; this allows target structures to be heated without affecting other surrounding heat-sensitive materials. The company also offers complementary products used with IPG’s lasers such as optical cables and beam switches to deliver and apply the lasers. Other than semiconductor applications, the most common uses for IPG’s products are industrial cutting/welding, 3D printing, and marking/engraving.

Competitors offering laser products for materials processing include Coherent (NASDAQ:COHR), Laserline, Lumentum (NASDAQ:LITE), and Maxphotonics.

4. Revenue Growth

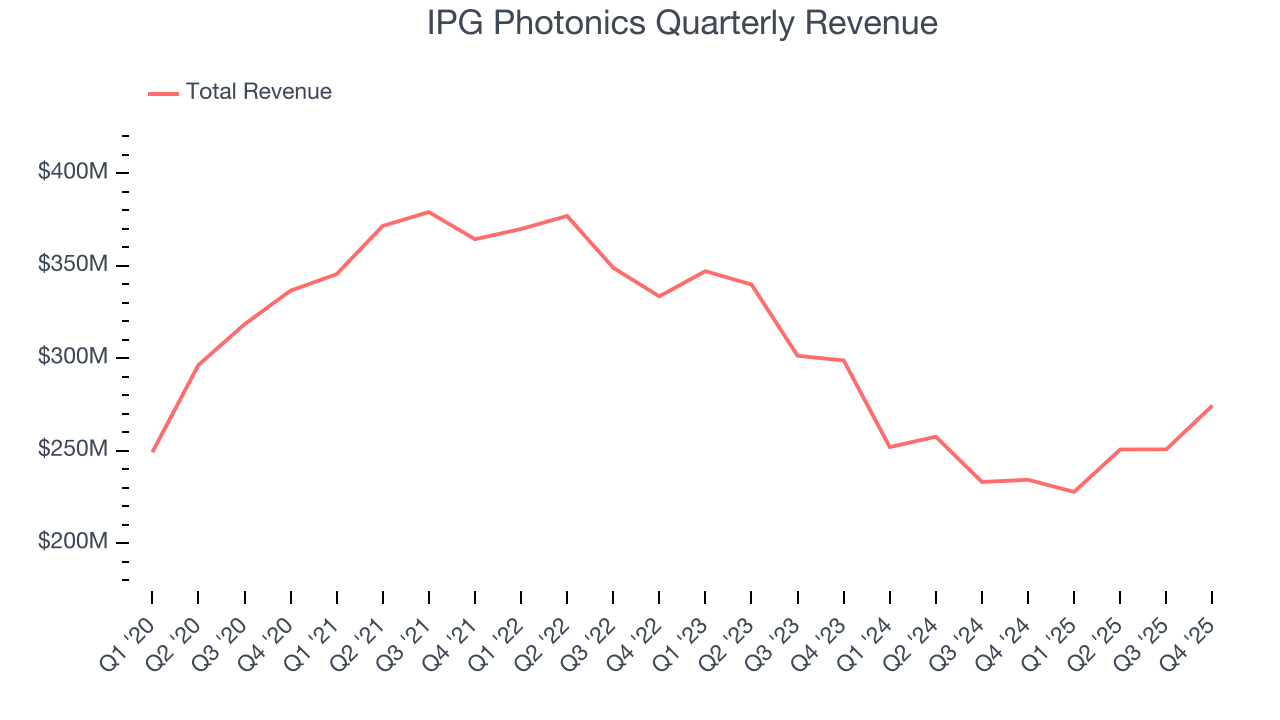

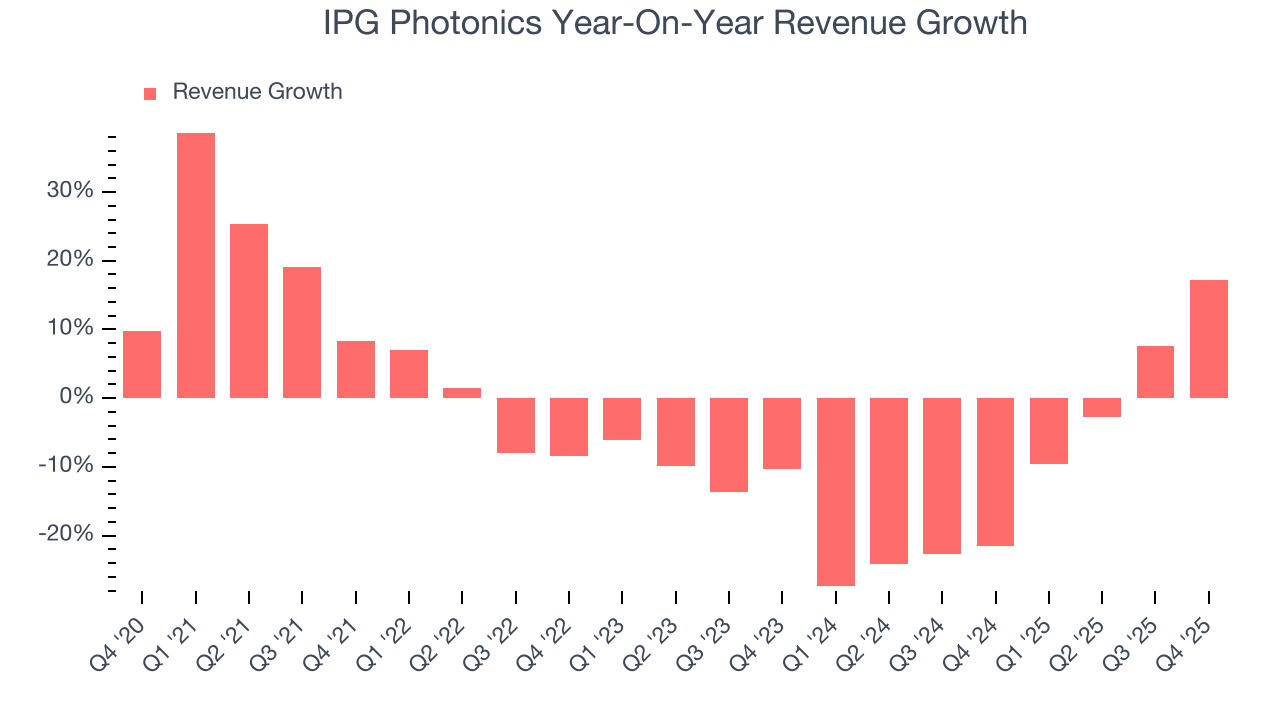

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. IPG Photonics struggled to consistently generate demand over the last five years as its sales dropped at a 3.5% annual rate. This was below our standards and suggests it’s a low quality business. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

Long-term growth is the most important, but short-term results matter for semiconductors because the rapid pace of technological innovation (Moore's Law) could make yesterday's hit product obsolete today. IPG Photonics’s recent performance shows its demand remained suppressed as its revenue has declined by 11.7% annually over the last two years.

This quarter, IPG Photonics reported year-on-year revenue growth of 17.1%, and its $274.5 million of revenue exceeded Wall Street’s estimates by 10%. Company management is currently guiding for a 9.7% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 4.2% over the next 12 months. While this projection indicates its newer products and services will catalyze better top-line performance, it is still below average for the sector.

5. Product Demand & Outstanding Inventory

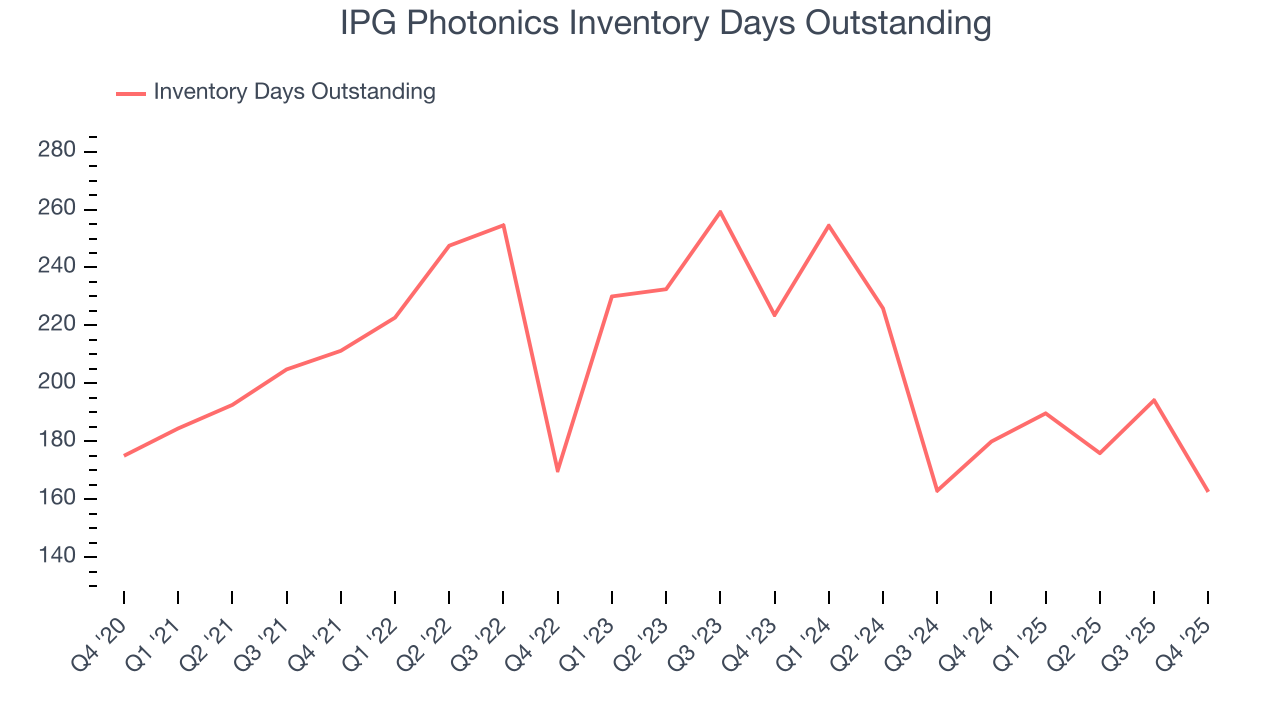

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business’ capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, IPG Photonics’s DIO came in at 163, which is 46 days below its five-year average. At the moment, these numbers show no indication of an excessive inventory buildup.

6. Gross Margin & Pricing Power

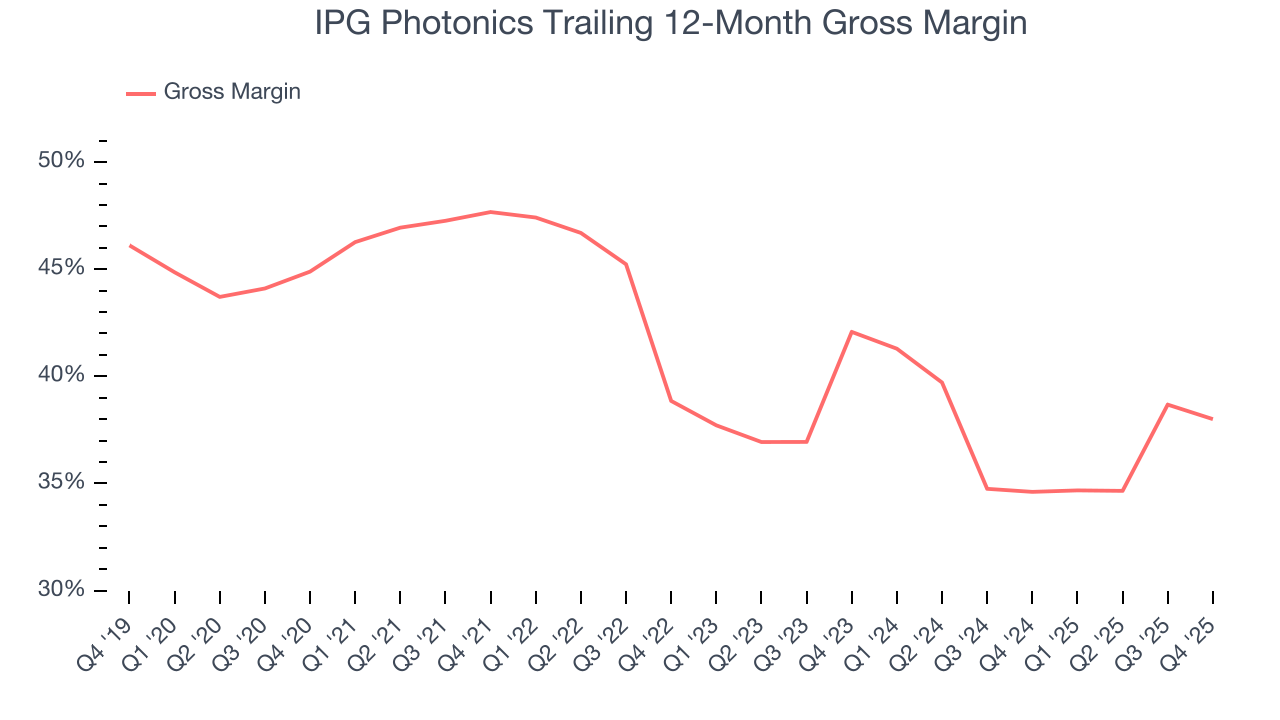

Gross profit margin is a key metric to track because it shows how much money a semiconductor company gets to keep after paying for its raw materials, manufacturing, and other input costs.

IPG Photonics’s gross margin is one of the worst in the semiconductor industry, signaling it operates in a competitive market and lacks pricing power. As you can see below, it averaged a 36.3% gross margin over the last two years. That means IPG Photonics paid its suppliers a lot of money ($63.67 for every $100 in revenue) to run its business.

IPG Photonics produced a 36.1% gross profit margin in Q4, down 2.5 percentage points year on year. On a wider time horizon, however, IPG Photonics’s full-year margin has been trending up over the past 12 months, increasing by 3.4 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as manufacturing expenses).

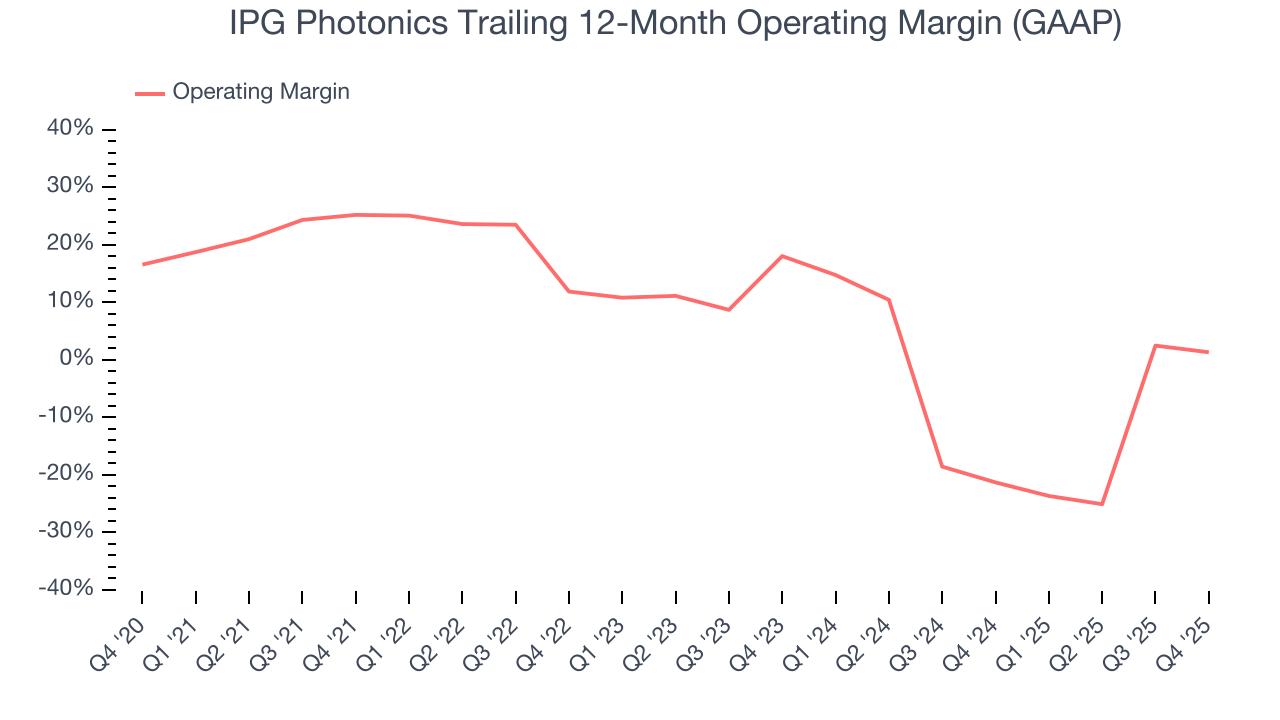

7. Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

Although IPG Photonics was profitable this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 9.9% over the last two years. Unprofitable semiconductor companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

Analyzing the trend in its profitability, IPG Photonics’s operating margin decreased by 23.9 percentage points over the last five years. IPG Photonics’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

In Q4, IPG Photonics generated an operating margin profit margin of 1.2%, down 4.7 percentage points year on year. Since IPG Photonics’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

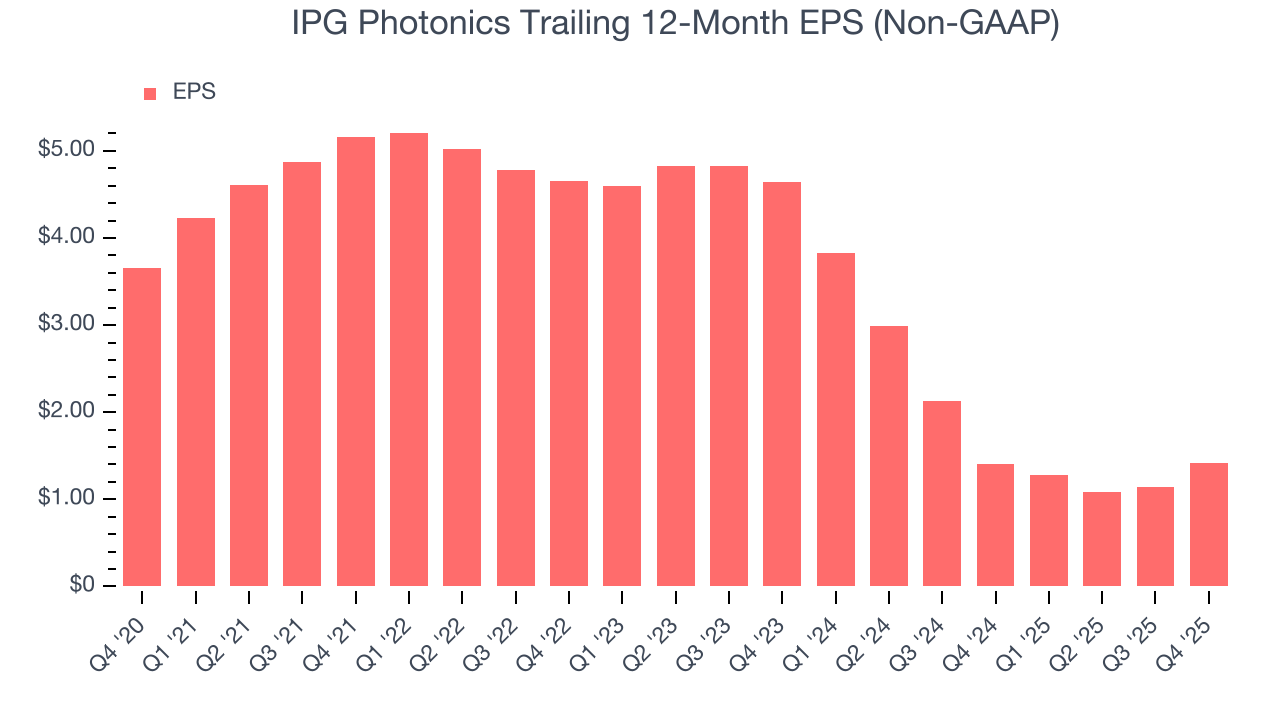

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for IPG Photonics, its EPS declined by 17.2% annually over the last five years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

Diving into the nuances of IPG Photonics’s earnings can give us a better understanding of its performance. As we mentioned earlier, IPG Photonics’s operating margin declined by 23.9 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, IPG Photonics reported adjusted EPS of $0.46, up from $0.18 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects IPG Photonics’s full-year EPS of $1.42 to grow 9.7%.

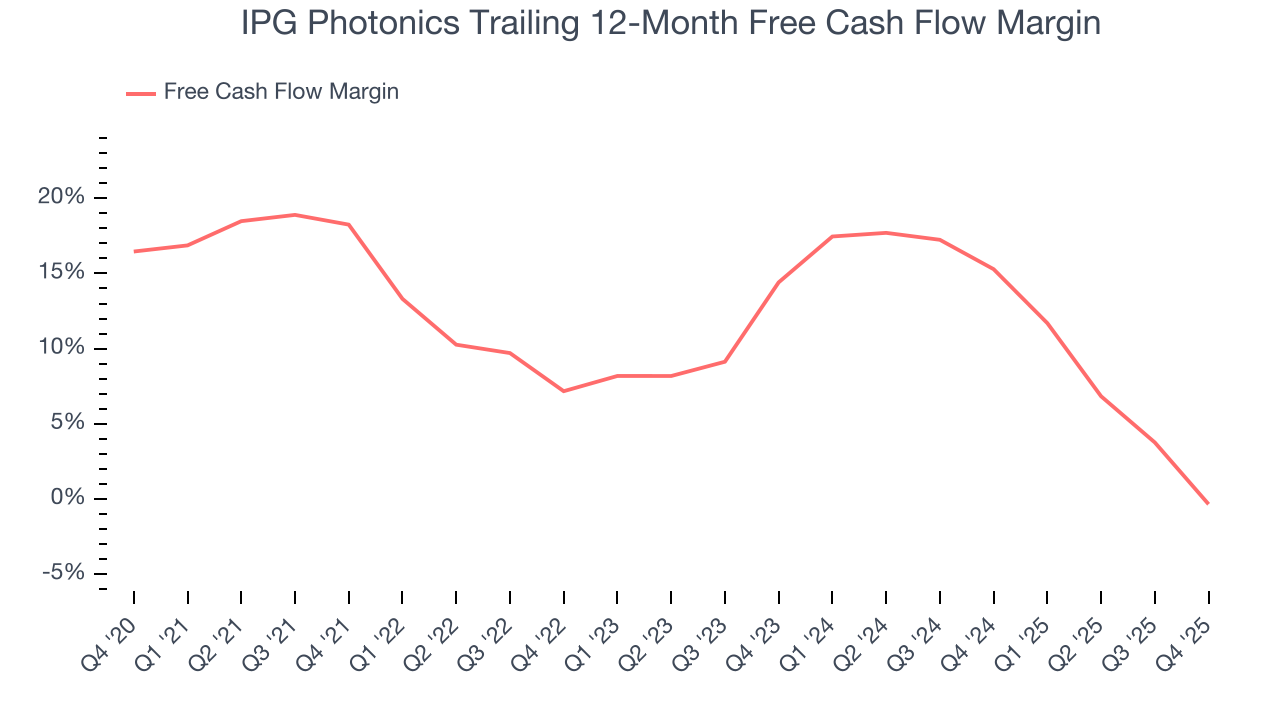

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

IPG Photonics has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 7.4%, lousy for a semiconductor business.

Taking a step back, we can see that IPG Photonics’s margin dropped by 18.6 percentage points over the last five years. This along with its unexciting margin put the company in a tough spot, and shareholders are likely hoping it can reverse course. If the trend continues, it could signal it’s in the middle of a big investment cycle.

IPG Photonics’s free cash flow clocked in at $10.92 million in Q4, equivalent to a 4% margin. The company’s cash profitability regressed as it was 17.6 percentage points lower than in the same quarter last year, suggesting its historical struggles have dragged on.

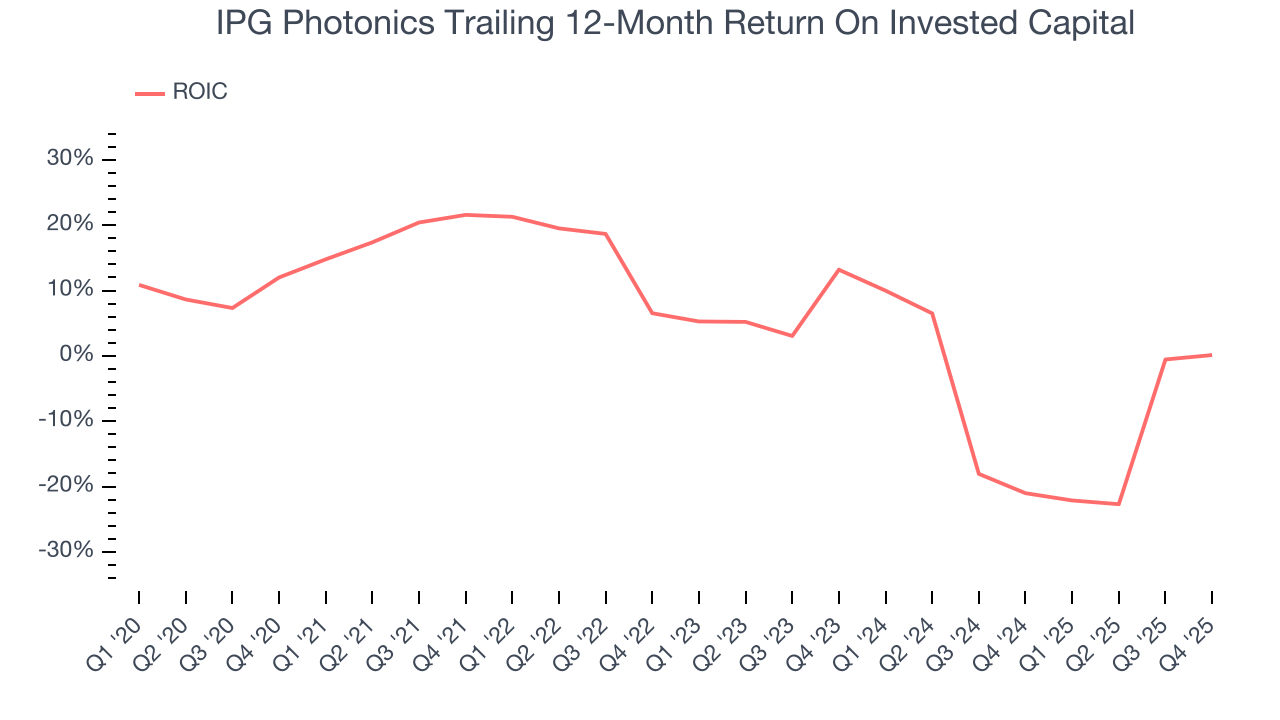

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

IPG Photonics historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 4.1%, lower than the typical cost of capital (how much it costs to raise money) for semiconductor companies.

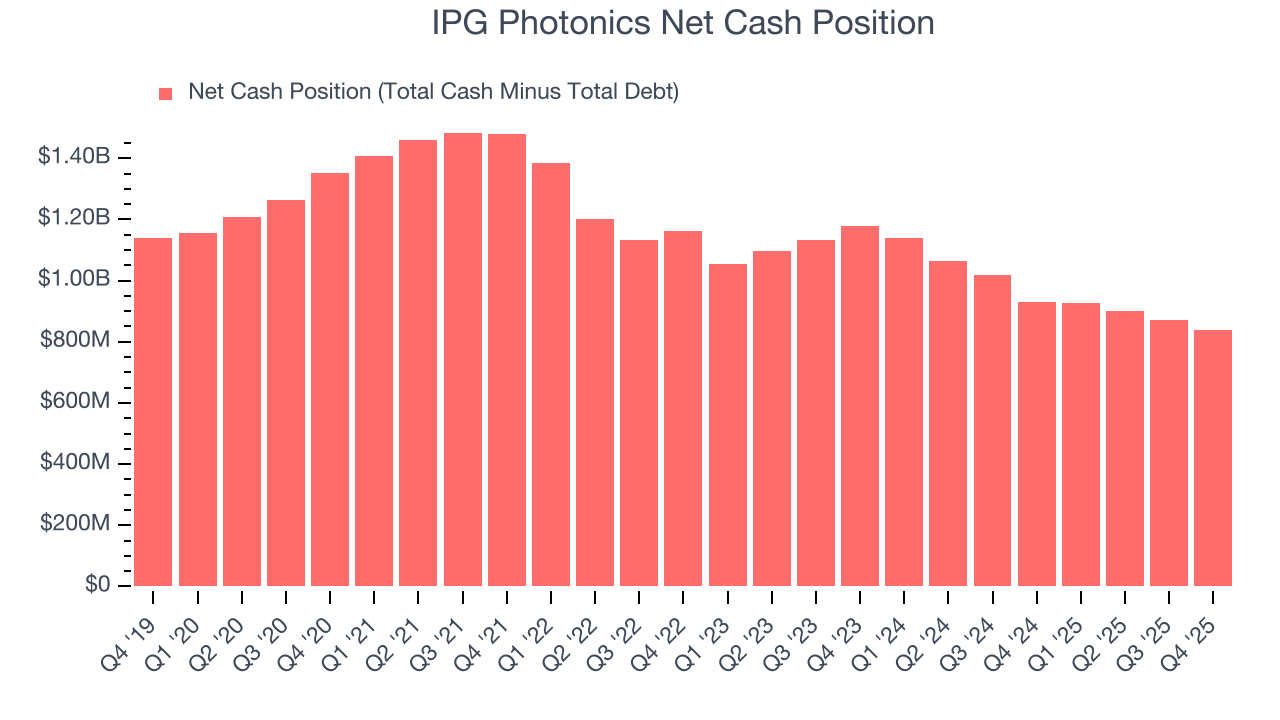

11. Balance Sheet Assessment

One of the best ways to mitigate bankruptcy risk is to hold more cash than debt.

IPG Photonics is a well-capitalized company with $839.3 million of cash and no debt. This position is 18% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from IPG Photonics’s Q4 Results

We were impressed by IPG Photonics’s strong improvement in inventory levels. We were also glad its EPS outperformed Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. The stock traded up 6.5% to $118.07 immediately following the results.

13. Is Now The Time To Buy IPG Photonics?

Updated: February 12, 2026 at 8:16 AM EST

Before making an investment decision, investors should account for IPG Photonics’s business fundamentals and valuation in addition to what happened in the latest quarter.

We see the value of companies furthering technological innovation, but in the case of IPG Photonics, we’re out. For starters, its revenue has declined over the last five years. On top of that, IPG Photonics’s declining EPS over the last five years makes it a less attractive asset to the public markets, and its declining operating margin shows the business has become less efficient.

IPG Photonics’s P/E ratio based on the next 12 months is 71.2x. At this valuation, there’s a lot of good news priced in - we think other companies feature superior fundamentals at the moment.

Wall Street analysts have a consensus one-year price target of $96.92 on the company (compared to the current share price of $118.07), implying they don’t see much short-term potential in IPG Photonics.