Itron (ITRI)

Itron is interesting. Its rising free cash flow margin gives it more chips to play with.― StockStory Analyst Team

1. News

2. Summary

Why Itron Is Interesting

Founded by a small group of engineers who wanted to build a more efficient way to read utility meters, Itron (NASDAQ:ITRI) offers energy and water management products for the utility industry, municipalities, and industrial customers.

- Incremental sales over the last five years have been highly profitable as its earnings per share increased by 25.6% annually, topping its revenue gains

- Above-average gross margin of 32.3% gives it the ability to invest in R&D and run marketing campaigns

- A downside is its projected sales decline of 2.1% for the next 12 months points to a tough demand environment ahead

Itron is solid, but not perfect. If you like the company, the valuation seems reasonable.

Why Is Now The Time To Buy Itron?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Itron?

Itron is trading at $90.79 per share, or 13.5x forward P/E. The current valuation is below that of most industrials companies, but this isn’t a bargain. Instead, the price is appropriate for the quality you get.

Now could be a good time to invest if you believe in the story.

3. Itron (ITRI) Research Report: Q4 CY2025 Update

Resource management provider Itron (NASDAQ:ITRI) reported revenue ahead of Wall Street’s expectations in Q4 CY2025, but sales fell by 6.7% year on year to $571.7 million. On the other hand, next quarter’s revenue guidance of $570 million was less impressive, coming in 1.8% below analysts’ estimates. Its non-GAAP profit of $2.46 per share was 12.4% above analysts’ consensus estimates.

Itron (ITRI) Q4 CY2025 Highlights:

- Revenue: $571.7 million vs analyst estimates of $562 million (6.7% year-on-year decline, 1.7% beat)

- Adjusted EPS: $2.46 vs analyst estimates of $2.19 (12.4% beat)

- Adjusted EBITDA: $98.78 million vs analyst estimates of $85.67 million (17.3% margin, 15.3% beat)

- Revenue Guidance for Q1 CY2026 is $570 million at the midpoint, below analyst estimates of $580.6 million

- Adjusted EPS guidance for the upcoming financial year 2026 is $6 at the midpoint, beating analyst estimates by 1.3%

- Operating Margin: 13.8%, up from 10.2% in the same quarter last year

- Free Cash Flow Margin: 19.5%, up from 11.4% in the same quarter last year

- Market Capitalization: $4.01 billion

Company Overview

Founded by a small group of engineers who wanted to build a more efficient way to read utility meters, Itron (NASDAQ:ITRI) offers energy and water management products for the utility industry, municipalities, and industrial customers.

Itron traces its roots back to 1977 when it was founded as a small business unit within a division of Washington Water Power Company. It evolved and expanded through various acquisitions and mergers, becoming an independent company in 1996. Today, Itron provides solutions for managing energy and water resources efficiently.

Its product portfolio includes smart meters, communication networks, software, and services designed to improve the management of energy and water. For example, Itron’s smart meters and communication networks help utility companies collect real-time data on energy consumption, detect leaks, and improve distribution networks.

Itron reaches its customers through direct sales as well as partnerships with distributors and system integrators. The company engages in long-term contracts and provides ongoing services alongside the initial sale. Additionally, Itron offers subscription-based models for its software, providing customers with access to continuous updates and support. These contractual arrangements enable Itron to establish stable revenue streams while fostering long-term relationships.

4. Inspection Instruments

Measurement and inspection instrument companies may enjoy more steady demand because products such as water meters are non-discretionary and mandated for replacement at predictable intervals. In the last decade, digitization and data collection have driven innovation in the space, leading to incremental sales. But like the broader industrials sector, measurement and inspection instrument companies are at the whim of economic cycles. Interest rates, for example, can greatly impact civil, commercial, and residential construction projects that drive demand.

Competitors offering similar products include Badger Meter (NYSE:BMI), A.O. Smith (NYSE:AOS), and Honeywell (NASDAQ:HON).

5. Revenue Growth

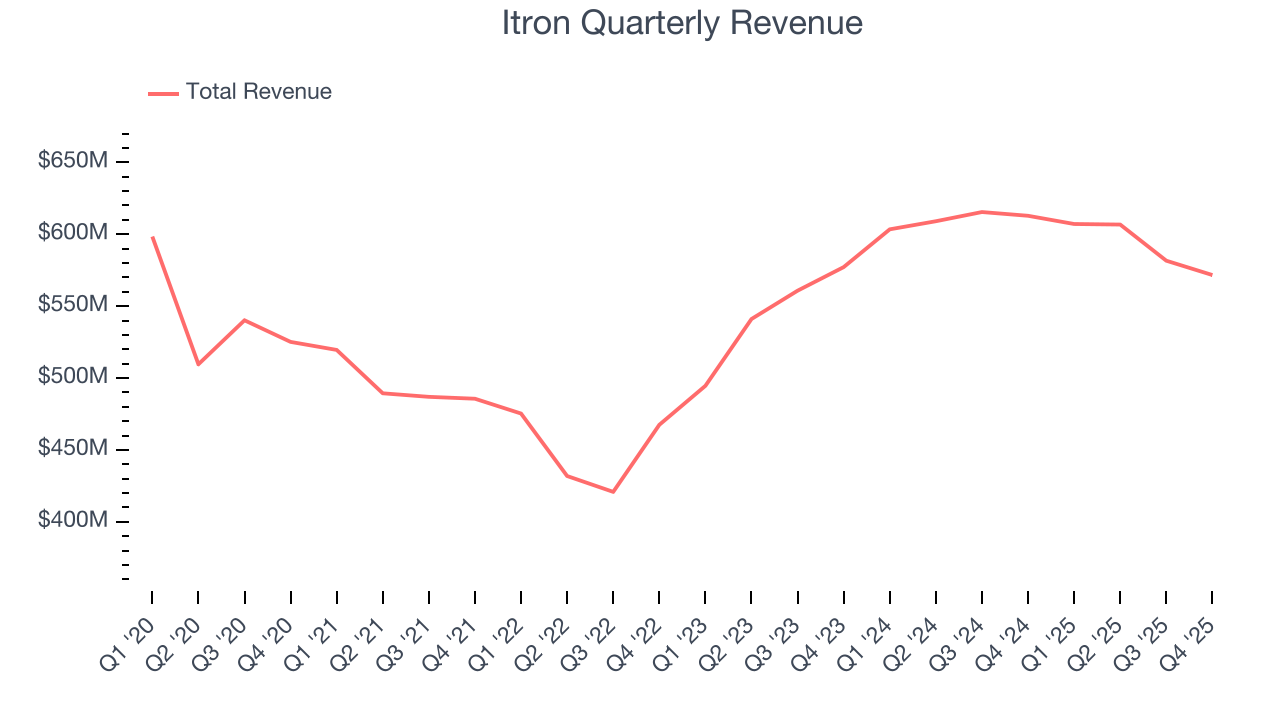

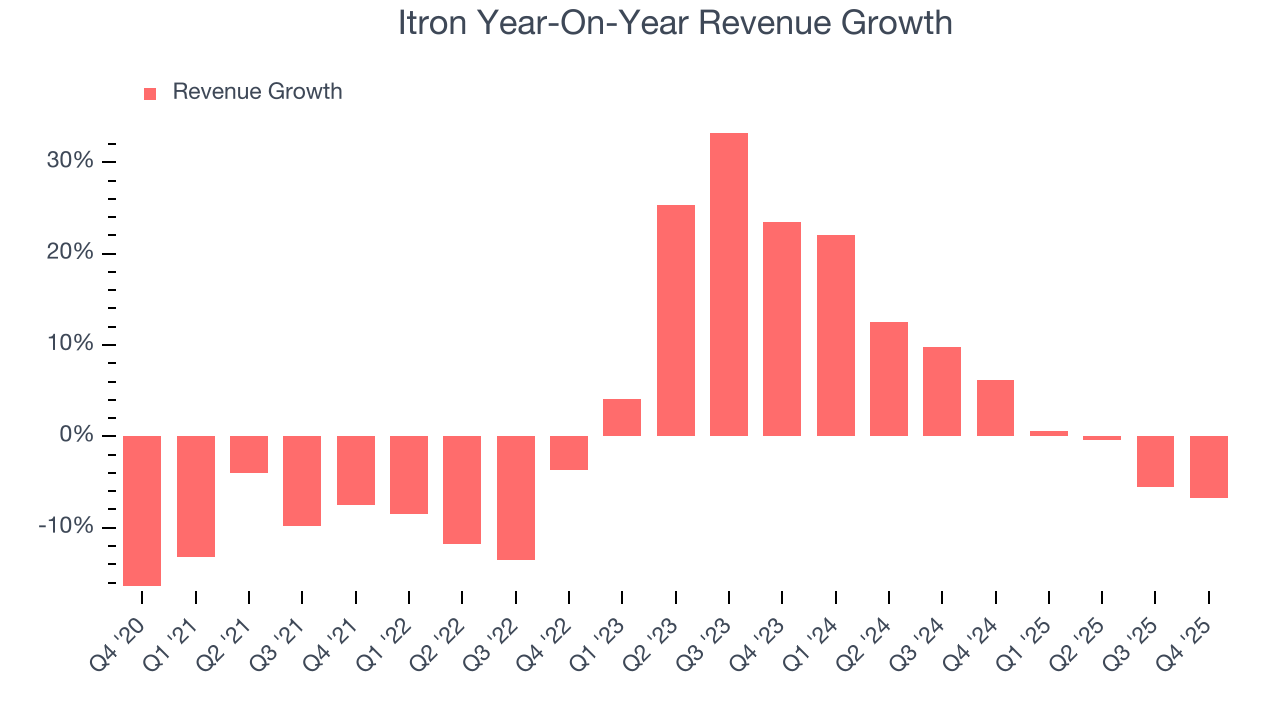

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Unfortunately, Itron’s 1.7% annualized revenue growth over the last five years was sluggish. This wasn’t a great result, but there are still things to like about Itron.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Itron’s annualized revenue growth of 4.4% over the last two years is above its five-year trend, which is encouraging.

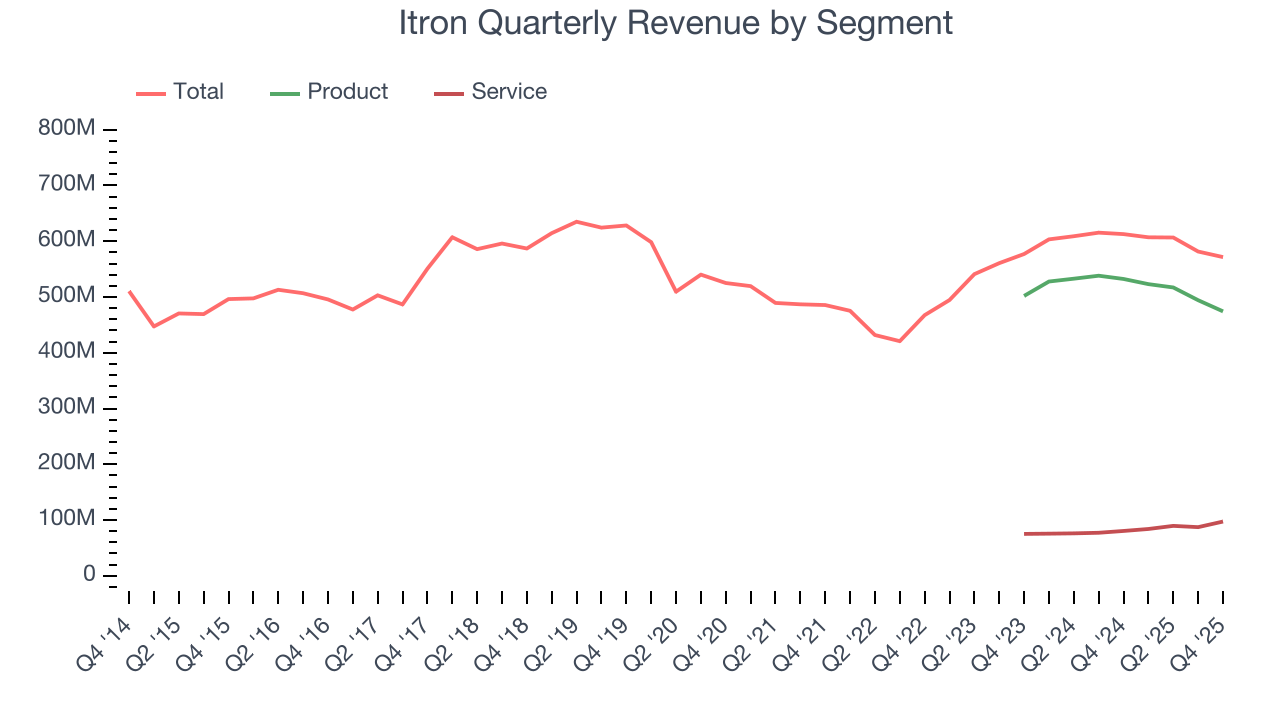

We can dig further into the company’s revenue dynamics by analyzing its most important segments, Product and Service, which are 83% and 17% of revenue. Over the last two years, Itron’s Product revenue (measurement and control equipment) averaged 3.4% year-on-year declines. On the other hand, its Service revenue ( project management, installation, consulting) averaged 14% growth.

This quarter, Itron’s revenue fell by 6.7% year on year to $571.7 million but beat Wall Street’s estimates by 1.7%. Company management is currently guiding for a 6.1% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 1.7% over the next 12 months, a slight deceleration versus the last two years. This projection is underwhelming and suggests its products and services will face some demand challenges. At least the company is tracking well in other measures of financial health.

6. Gross Margin & Pricing Power

All else equal, we prefer higher gross margins because they usually indicate that a company sells more differentiated products and commands stronger pricing power.

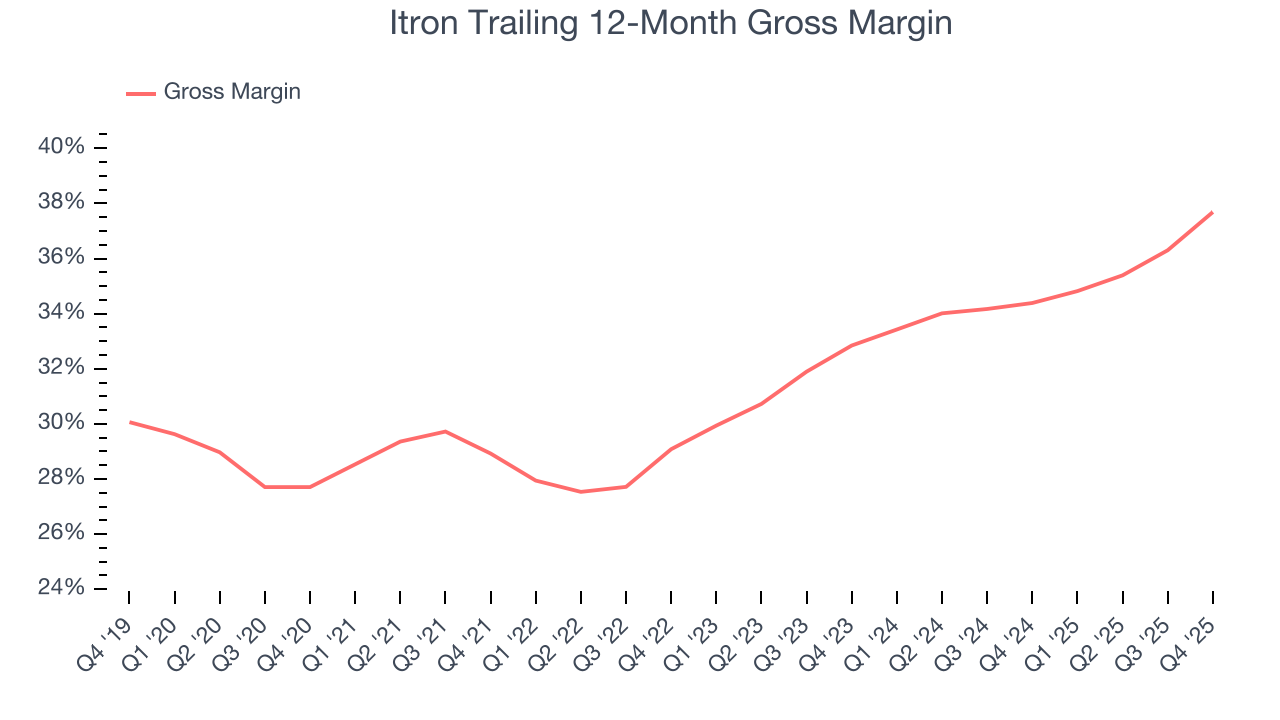

Itron’s unit economics are better than the typical industrials business, signaling its products are somewhat differentiated through quality or brand.As you can see below, it averaged a decent 32.9% gross margin over the last five years. Said differently, Itron paid its suppliers $67.09 for every $100 in revenue.

Itron produced a 40.5% gross profit margin in Q4 , marking a 5.6 percentage point increase from 34.9% in the same quarter last year. Itron’s full-year margin has also been trending up over the past 12 months, increasing by 3.3 percentage points. If this move continues, it could suggest better unit economics due to some combination of stable to improving pricing power and input costs (such as raw materials).

7. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

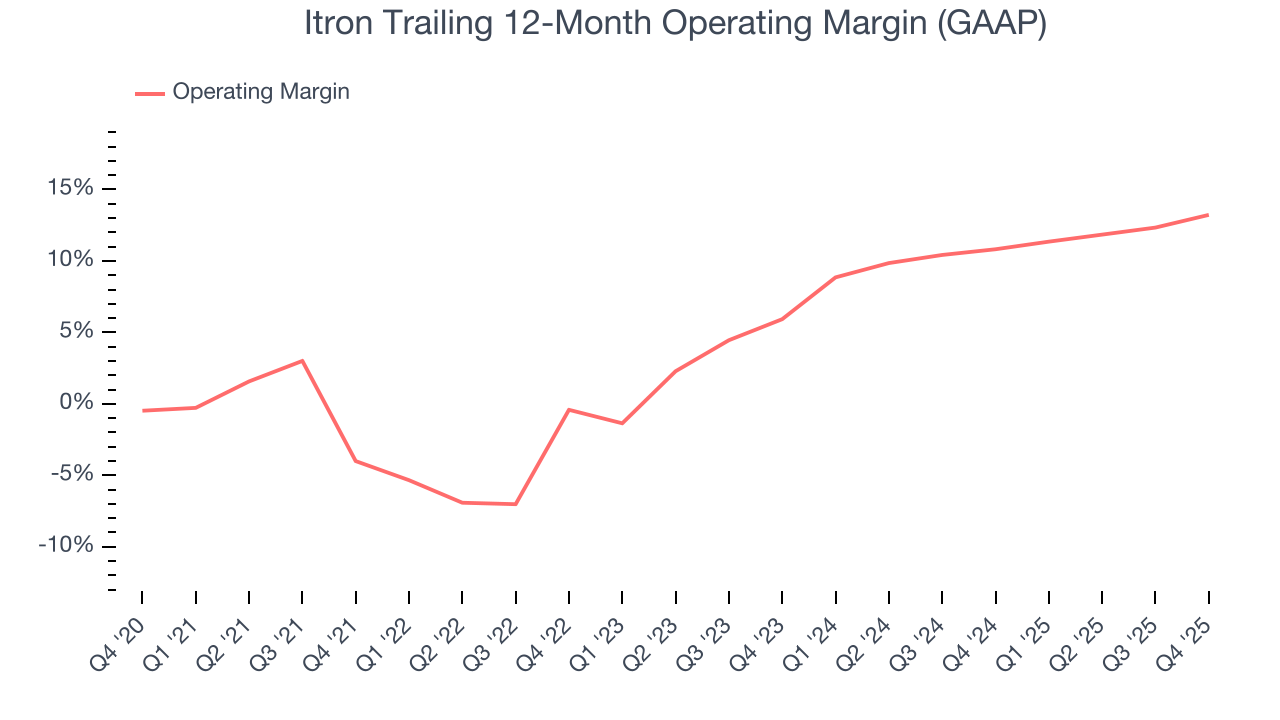

Itron was profitable over the last five years but held back by its large cost base. Its average operating margin of 5.8% was weak for an industrials business.

On the plus side, Itron’s operating margin rose by 17.2 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q4, Itron generated an operating margin profit margin of 13.8%, up 3.5 percentage points year on year. Since its gross margin expanded more than its operating margin, we can infer that leverage on its cost of sales was the primary driver behind the recently higher efficiency.

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

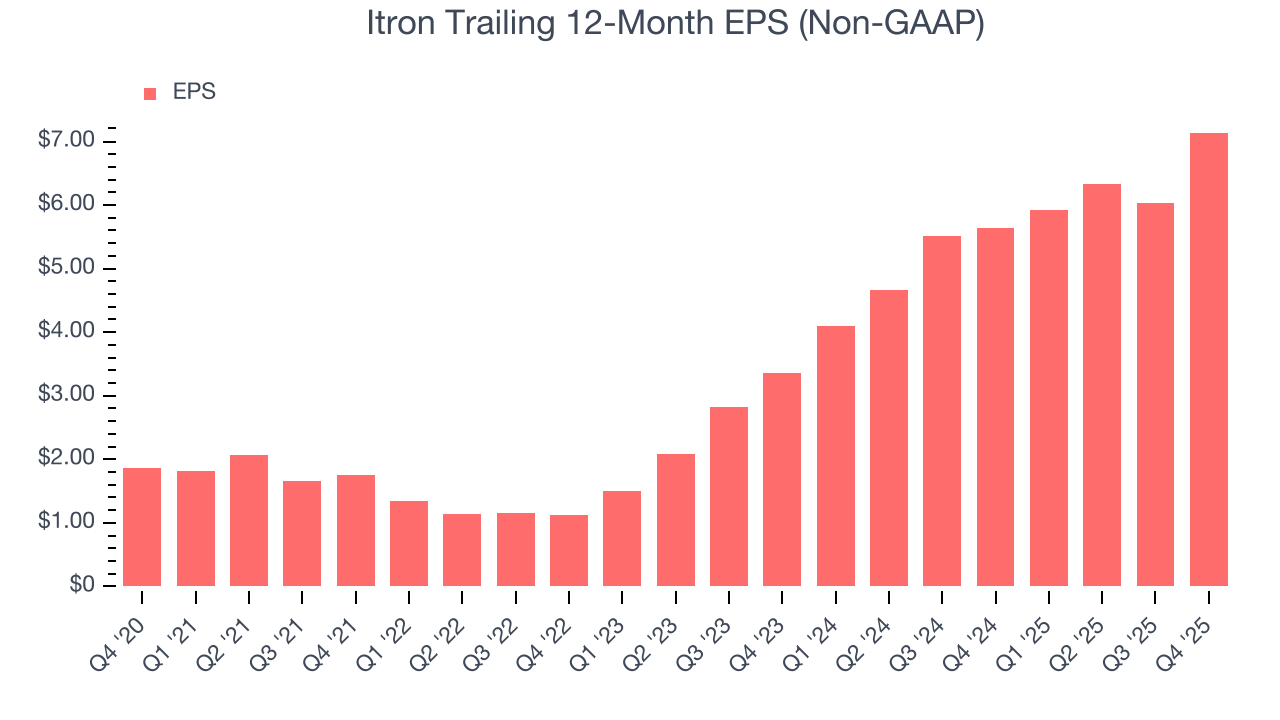

Itron’s EPS grew at an astounding 30.9% compounded annual growth rate over the last five years, higher than its 1.7% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into Itron’s earnings to better understand the drivers of its performance. As we mentioned earlier, Itron’s operating margin expanded by 17.2 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Itron, its two-year annual EPS growth of 46% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q4, Itron reported adjusted EPS of $2.46, up from $1.35 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Itron’s full-year EPS of $7.14 to shrink by 17%.

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

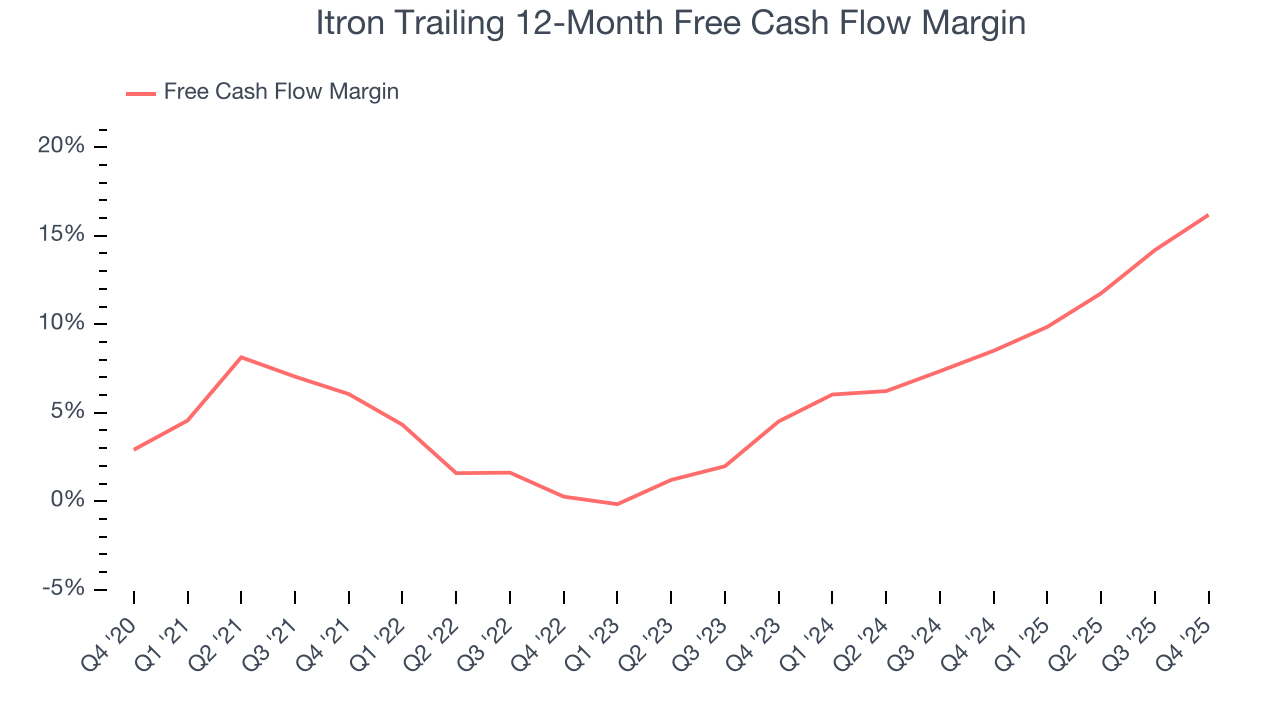

Itron has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 7.6% over the last five years, slightly better than the broader industrials sector.

Taking a step back, we can see that Itron’s margin expanded by 10.1 percentage points during that time. This is encouraging because it gives the company more optionality.

Itron’s free cash flow clocked in at $111.5 million in Q4, equivalent to a 19.5% margin. This result was good as its margin was 8.1 percentage points higher than in the same quarter last year, building on its favorable historical trend.

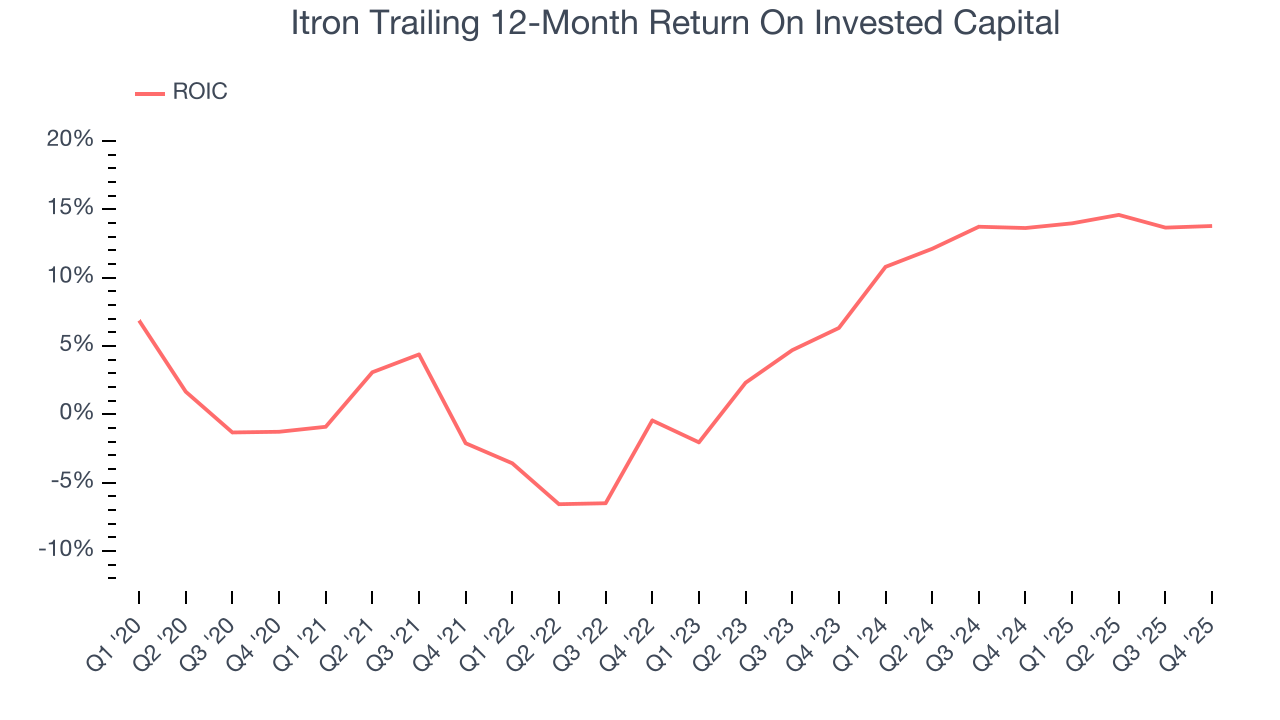

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Although Itron has shown solid fundamentals lately, it historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 6.2%, somewhat low compared to the best industrials companies that consistently pump out 20%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Itron’s ROIC has increased. This is a good sign, but we recognize its lack of profitable growth during the COVID era was the primary reason for the change.

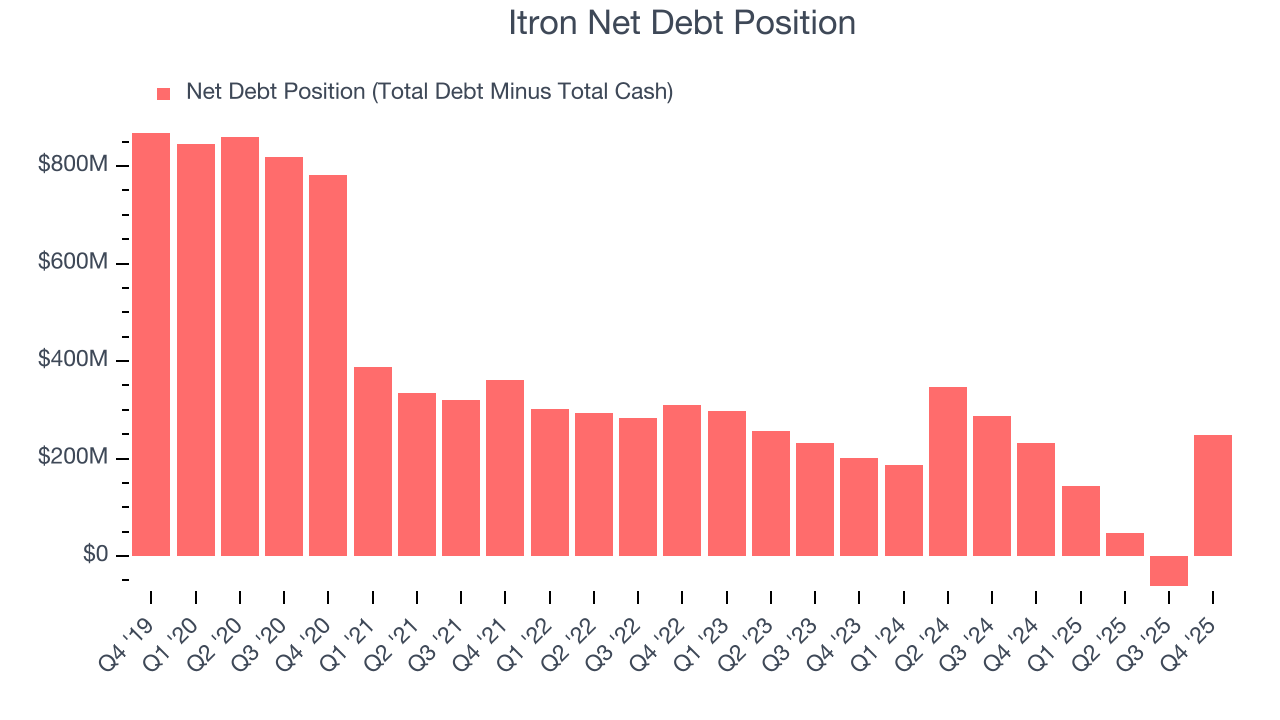

11. Balance Sheet Assessment

Itron reported $1.02 billion of cash and $1.27 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $373.8 million of EBITDA over the last 12 months, we view Itron’s 0.7× net-debt-to-EBITDA ratio as safe. We also see its $15.46 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Itron’s Q4 Results

We were impressed by how significantly Itron blew past analysts’ EBITDA expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its EPS guidance for next quarter missed and its full-year revenue guidance fell slightly short of Wall Street’s estimates. Overall, this print was mixed but still had some key positives. The stock traded up 4.3% to $93.23 immediately following the results.

13. Is Now The Time To Buy Itron?

Updated: February 17, 2026 at 8:42 AM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Itron.

Itron is a fine business. Although its revenue growth was weak over the last five years, its rising cash profitability gives it more optionality. We advise investors to be cautious with this one, however, as its projected EPS for the next year is lacking.

Itron’s EV-to-EBITDA ratio based on the next 12 months is 0.7x. When scanning the industrials space, Itron trades at a fair valuation. For those confident in the business and its management team, this is a good time to invest.

Wall Street analysts have a consensus one-year price target of $136.22 on the company (compared to the current share price of $93.23), implying they see 46.1% upside in buying Itron in the short term.