Jamf (JAMF)

We’re wary of Jamf. Its revenue growth has decelerated and its historical operating losses don’t give us confidence in a turnaround.― StockStory Analyst Team

1. News

2. Summary

Why We Think Jamf Will Underperform

With its name playfully derived from "Just Another Management Framework," Jamf (NASDAQ:JAMF) provides software that helps organizations deploy, manage, and secure Apple devices across their workforce while maintaining a seamless user experience.

- Estimated sales growth of 9.4% for the next 12 months implies demand will slow from its two-year trend

- Persistent operating margin losses suggest the business manages its expenses poorly

- A consolation is that its billings have averaged 20.4% growth over the last year, showing it’s securing new contracts that could potentially increase in value over time

Jamf’s quality doesn’t meet our expectations. More profitable opportunities exist elsewhere.

Why There Are Better Opportunities Than Jamf

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Jamf

At $13.04 per share, Jamf trades at 2.3x forward price-to-sales. This is a cheap valuation multiple, but for good reason. You get what you pay for.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Jamf (JAMF) Research Report: Q3 CY2025 Update

Apple device management company Jamf (NASDAQ:JAMF) reported Q3 CY2025 results beating Wall Street’s revenue expectations, with sales up 15.2% year on year to $183.5 million. Its non-GAAP profit of $0.25 per share was 7.7% above analysts’ consensus estimates.

Jamf (JAMF) Q3 CY2025 Highlights:

- Revenue: $183.5 million vs analyst estimates of $177.4 million (15.2% year-on-year growth, 3.4% beat)

- Adjusted EPS: $0.25 vs analyst estimates of $0.23 (7.7% beat)

- Adjusted Operating Income: $47.24 million vs analyst estimates of $42.17 million (25.7% margin, 12% beat)

- Operating Margin: -1.9%, up from -10% in the same quarter last year

- Free Cash Flow Margin: 35.4%, up from 20.9% in the previous quarter

- Market Capitalization: $1.71 billion

Company Overview

With its name playfully derived from "Just Another Management Framework," Jamf (NASDAQ:JAMF) provides software that helps organizations deploy, manage, and secure Apple devices across their workforce while maintaining a seamless user experience.

Jamf's platform addresses the entire lifecycle of Apple products in enterprise environments, from initial setup to ongoing management and security. Its flagship product, Jamf Pro, allows IT departments to configure devices remotely, distribute apps, manage updates, and enforce security policies without compromising the intuitive Apple experience users expect. For smaller organizations, Jamf offers simpler solutions like Jamf Now, which provides essential management capabilities through an easy-to-use interface.

The company serves a diverse customer base ranging from small businesses to large enterprises, educational institutions, and healthcare organizations. For example, a university might use Jamf to automatically configure thousands of iPads with specific educational apps and security settings before distributing them to incoming students. A hospital could use Jamf to ensure medical staff's iPhones can securely access patient records while complying with healthcare regulations.

Jamf monetizes its technology through subscription-based pricing models. Its close relationship with Apple allows it to support new Apple features and operating system updates immediately upon release, giving it a competitive edge in the Apple ecosystem. The company enhances its community engagement through Jamf Nation, an online forum where IT professionals share knowledge and best practices for Apple device management.

4. Automation Software

The whole purpose of software is to automate tasks to increase productivity. Today, innovative new software techniques, often involving AI and machine learning, are finally allowing automation that has graduated from simple one- or two-step workflows to more complex processes integral to enterprises. The result is surging demand for modern automation software.

Jamf's competitors include cross-platform enterprise management providers such as VMware (now part of Broadcom), Microsoft Intune (NASDAQ: MSFT), and IBM (NYSE: IBM), as well as mobile device management companies like Kandji, Addigy, and Mosyle that also focus on Apple environments.

5. Revenue Growth

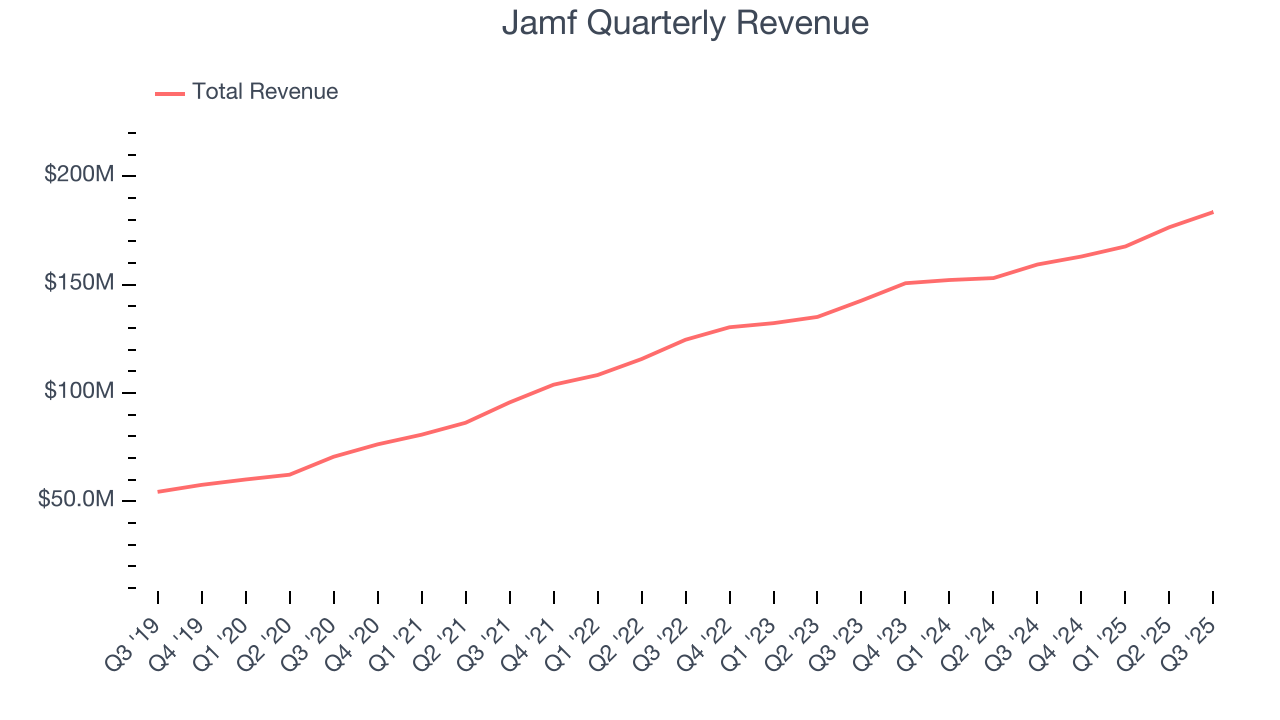

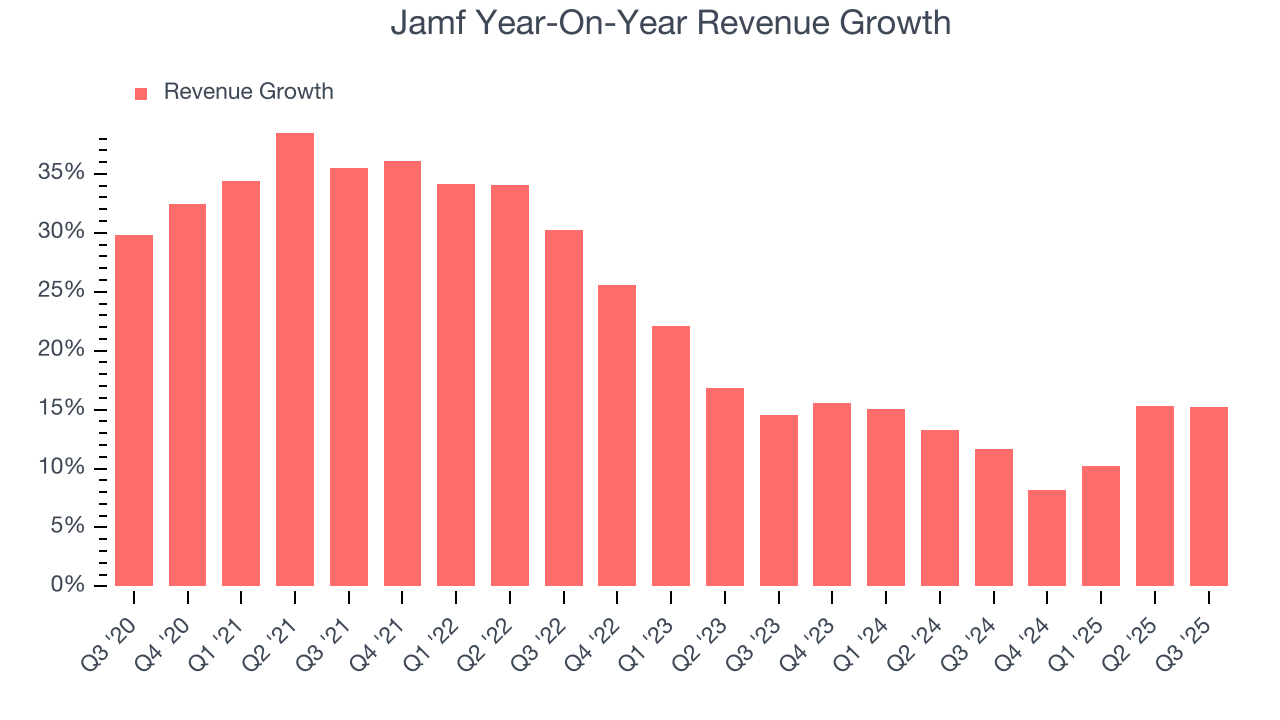

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Thankfully, Jamf’s 22.5% annualized revenue growth over the last five years was solid. Its growth beat the average software company and shows its offerings resonate with customers.

Long-term growth is the most important, but within software, a half-decade historical view may miss new innovations or demand cycles. Jamf’s recent performance shows its demand has slowed as its annualized revenue growth of 13.1% over the last two years was below its five-year trend.

This quarter, Jamf reported year-on-year revenue growth of 15.2%, and its $183.5 million of revenue exceeded Wall Street’s estimates by 3.4%.

Looking ahead, sell-side analysts expect revenue to grow 8.9% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and indicates its products and services will see some demand headwinds.

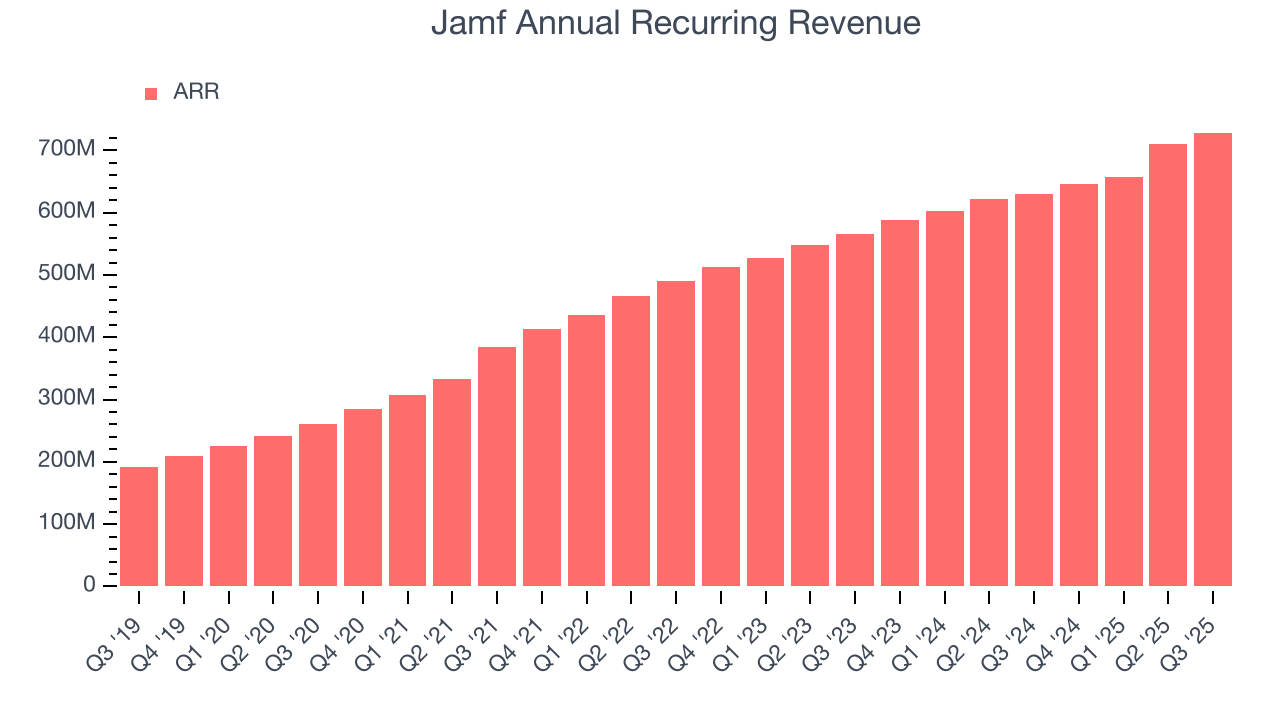

6. Annual Recurring Revenue

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

Jamf’s ARR came in at $728.6 million in Q3, and over the last four quarters, its growth was underwhelming as it averaged 12.2% year-on-year increases. This performance mirrored its total sales and suggests that increasing competition is causing challenges in securing longer-term commitments.

7. Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

Jamf does a decent job acquiring new customers, and its CAC payback period checked in at 43.5 months this quarter. The company’s relatively fast recovery of its customer acquisition costs gives it the option to accelerate growth by increasing its sales and marketing investments.

8. Gross Margin & Pricing Power

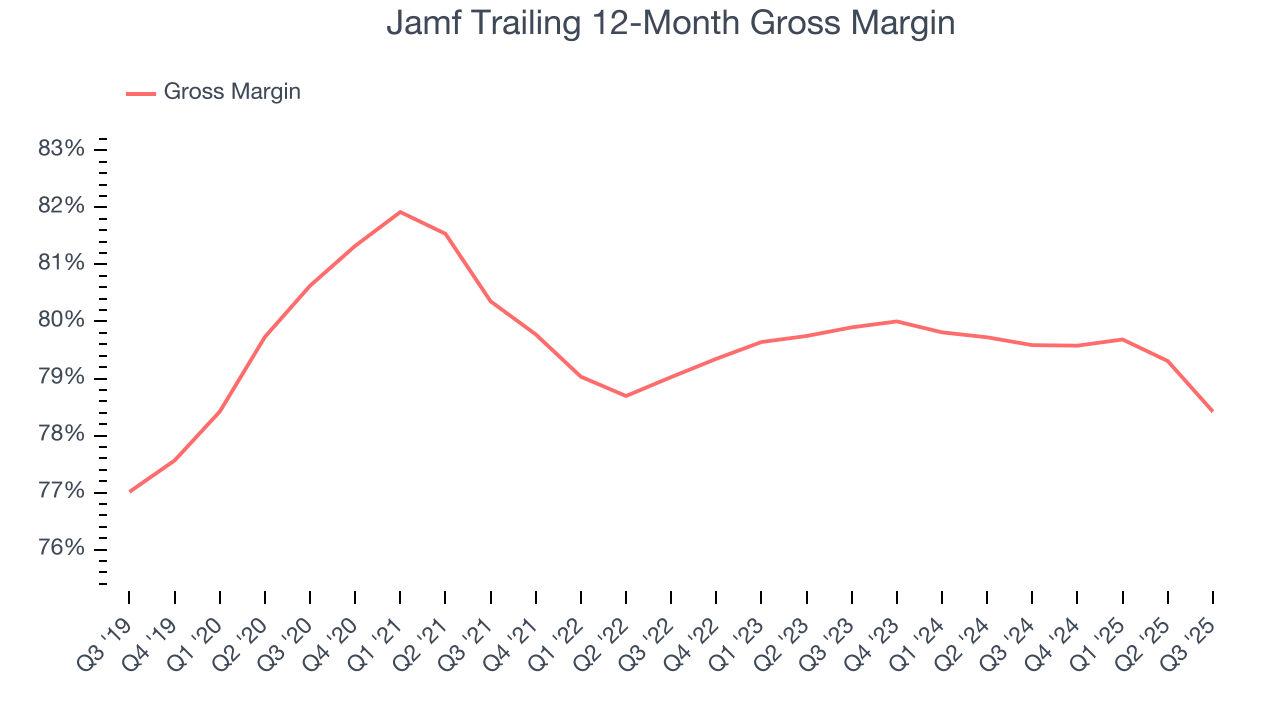

For software companies like Jamf, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

Jamf’s robust unit economics are better than the broader software industry, an output of its asset-lite business model and pricing power. They also enable the company to fund large investments in new products and sales during periods of rapid growth to achieve outsized profits at scale. As you can see below, it averaged an excellent 78.4% gross margin over the last year. That means Jamf only paid its providers $21.58 for every $100 in revenue.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. Jamf has seen gross margins decline by 1.5 percentage points over the last 2 year, which is poor compared to software peers.

Jamf’s gross profit margin came in at 76% this quarter, marking a 3.3 percentage point decrease from 79.4% in the same quarter last year. Jamf’s full-year margin has also been trending down over the past 12 months, decreasing by 1.2 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs.

9. Operating Margin

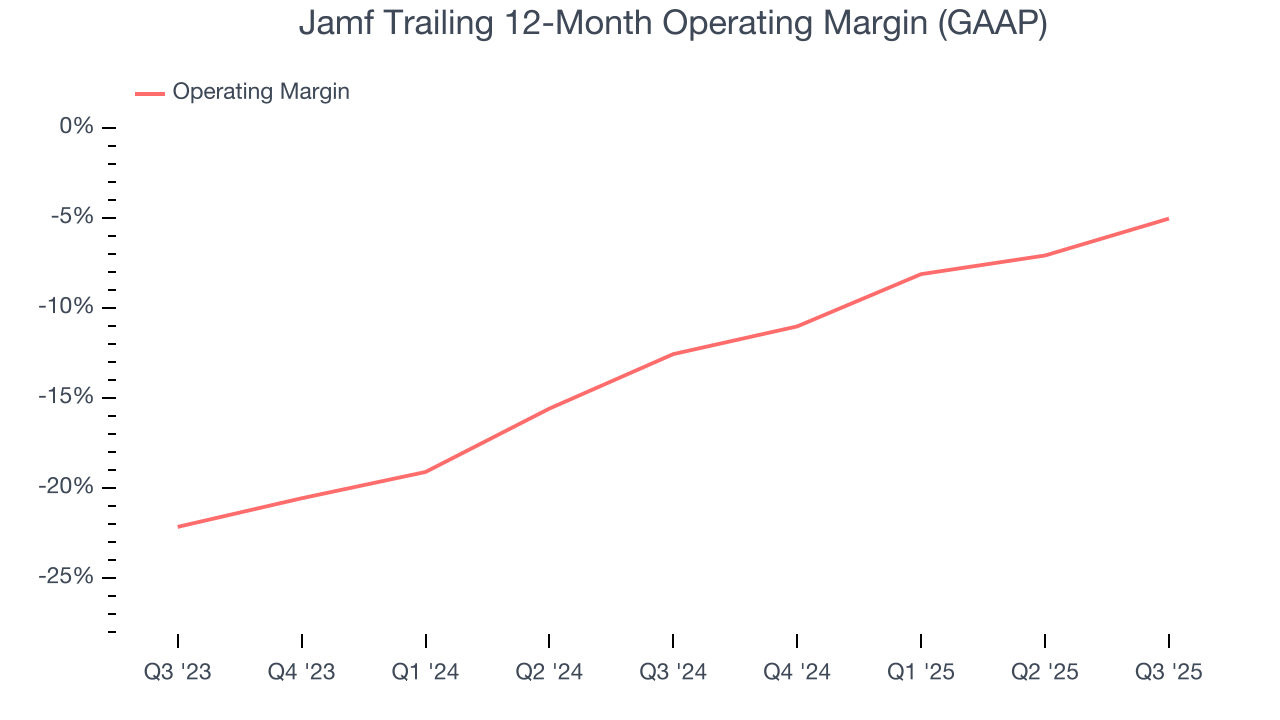

Jamf’s expensive cost structure has contributed to an average operating margin of negative 5% over the last year. Unprofitable, high-growth software companies require extra attention because they spend heaps of money to capture market share. As seen in its fast historical revenue growth, this strategy seems to have worked so far, but it’s unclear what would happen if Jamf reeled back its investments. Wall Street seems to think it will face some obstacles, and we tend to agree.

Over the last two years, Jamf’s expanding sales gave it operating leverage as its margin rose by 7.5 percentage points. Still, it will take much more for the company to reach long-term profitability.

This quarter, Jamf generated a negative 1.9% operating margin.

10. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

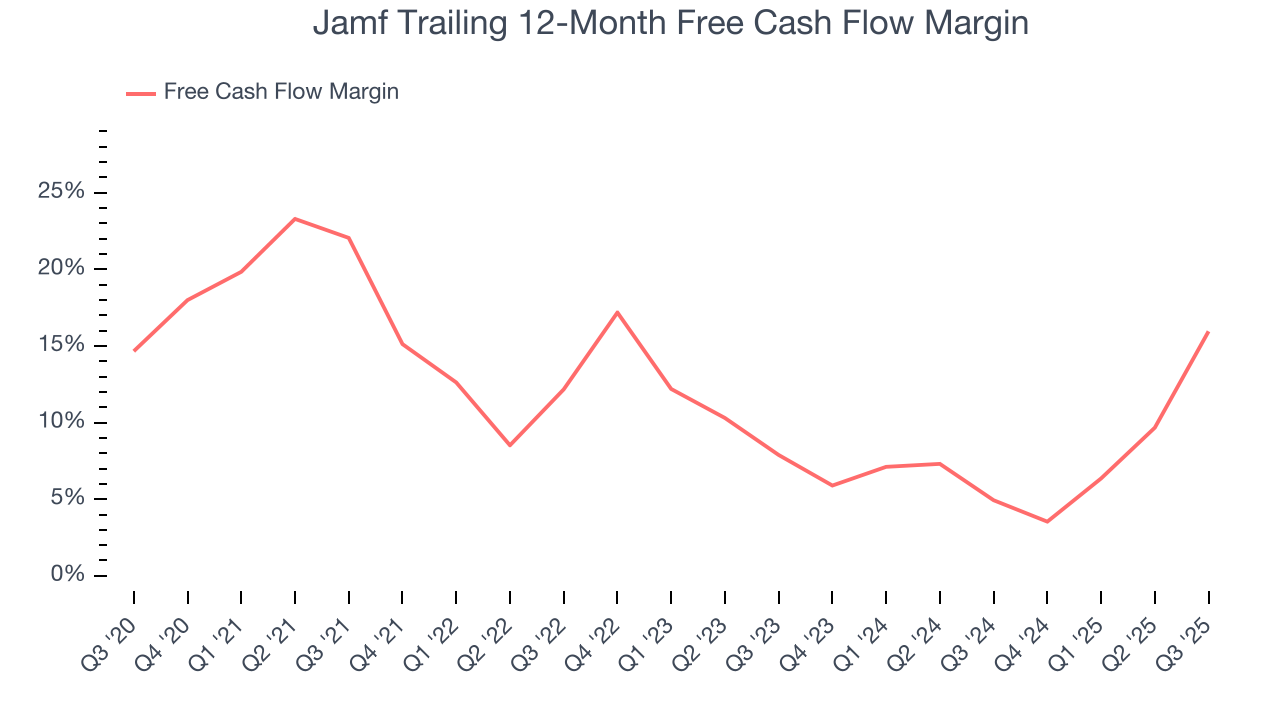

Jamf has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 16% over the last year, slightly better than the broader software sector.

Jamf’s free cash flow clocked in at $64.93 million in Q3, equivalent to a 35.4% margin. This result was good as its margin was 23.4 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, leading to temporary swings. Long-term trends carry greater meaning.

Over the next year, analysts predict Jamf’s cash conversion will improve. Their consensus estimates imply its free cash flow margin of 16% for the last 12 months will increase to 19.8%, it options for capital deployment (investments, share buybacks, etc.).

11. Balance Sheet Assessment

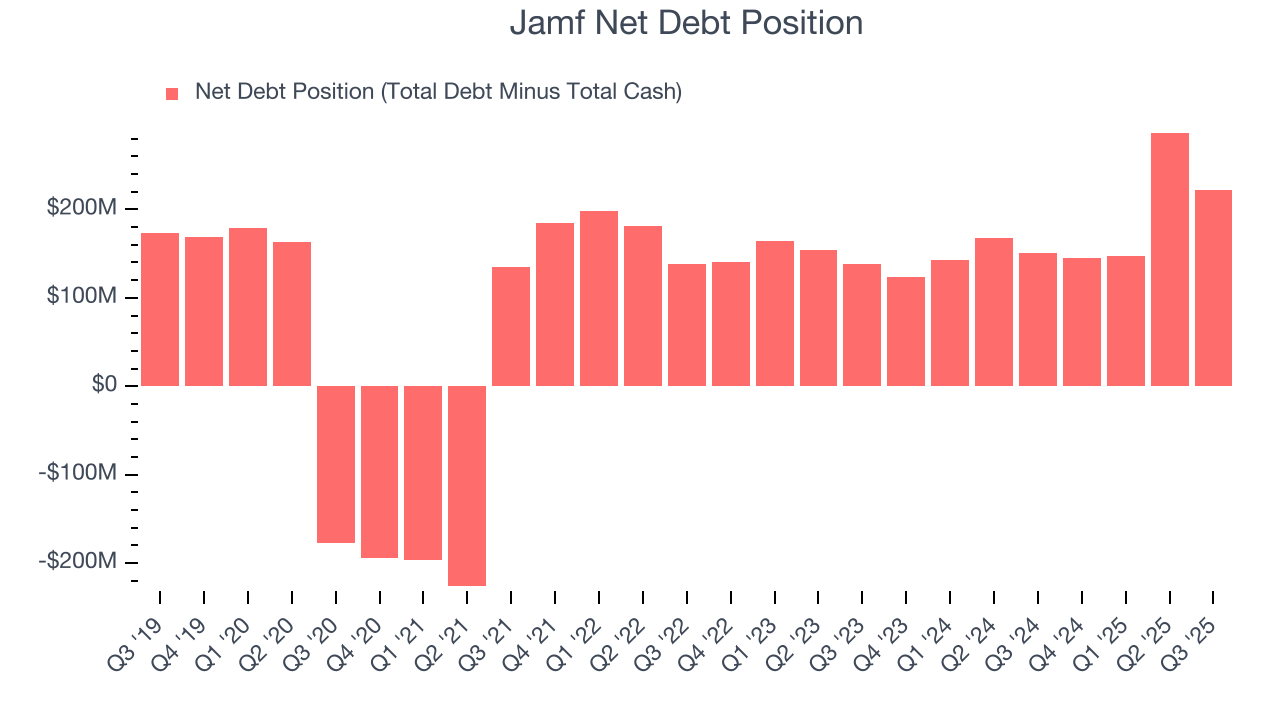

Jamf reported $547.2 million of cash and $769.3 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $155.6 million of EBITDA over the last 12 months, we view Jamf’s 1.4× net-debt-to-EBITDA ratio as safe. We also see its $2.69 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Jamf’s Q3 Results

We were impressed by how significantly Jamf blew past analysts’ EBITDA expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. Zooming out, we think this was a good print with some key areas of upside. The stock remained flat at $12.87 immediately following the results.

13. Is Now The Time To Buy Jamf?

Updated: January 16, 2026 at 9:13 PM EST

Are you wondering whether to buy Jamf or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

Jamf’s business quality ultimately falls short of our standards. Although its revenue growth was solid over the last five years, it’s expected to deteriorate over the next 12 months and its operating margins are low compared to other software companies. And while the company’s admirable gross margin indicates excellent unit economics, the downside is its ARR has disappointed and shows the company is having difficulty retaining customers and their spending.

Jamf’s price-to-sales ratio based on the next 12 months is 2.3x. While this valuation is fair, the upside isn’t great compared to the potential downside. We're fairly confident there are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $12.44 on the company (compared to the current share price of $13.04).