Jack Henry (JKHY)

We see potential in Jack Henry. Its remarkable ROE underscores its knack for targeting and investing in highly profitable growth initiatives.― StockStory Analyst Team

1. News

2. Summary

Why Jack Henry Is Interesting

Founded in 1976 by two entrepreneurs who saw the need for specialized banking software in the early days of financial computing, Jack Henry & Associates (NASDAQ:JKHY) provides technology solutions that help banks and credit unions innovate, differentiate, and compete while serving the evolving needs of their accountholders.

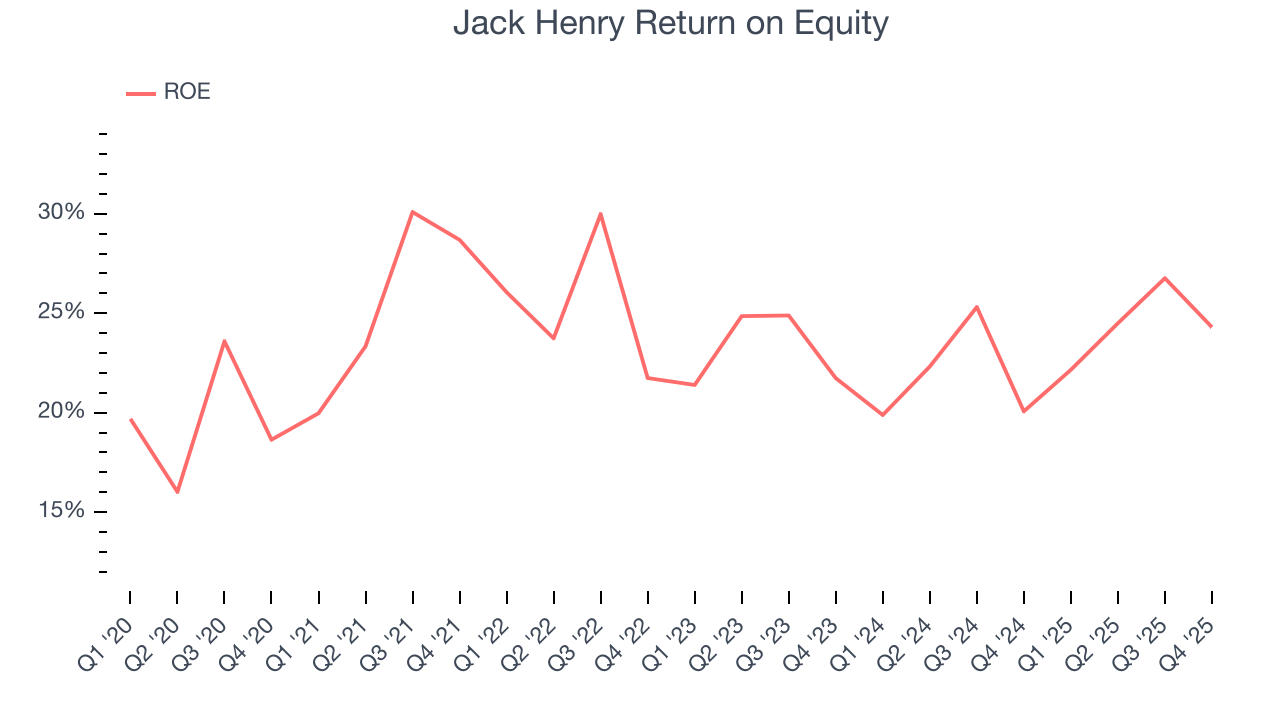

- Industry-leading 23.8% return on equity demonstrates management’s skill in finding high-return investments

- Incremental sales were more profitable as its annual earnings per share growth of 11.4% outstripped its revenue performance

- A drawback is its annual revenue growth of 7.4% over the last five years was below our standards for the financials sector

Jack Henry has the potential to be a high-quality business. This company has a place on your watchlist.

Why Should You Watch Jack Henry

High Quality

Investable

Underperform

Why Should You Watch Jack Henry

Jack Henry’s stock price of $179.25 implies a valuation ratio of 28x forward P/E. Jack Henry’s valuation represents a premium to other names in the financials sector.

Jack Henry could improve its business quality by stringing together a few solid quarters. We’d be more open to buying the stock when that time comes.

3. Jack Henry (JKHY) Research Report: Q4 CY2025 Update

Financial technology provider Jack Henry & Associates (NASDAQ:JKHY) reported Q4 CY2025 results topping the market’s revenue expectations, with sales up 7.9% year on year to $619.3 million. The company expects the full year’s revenue to be around $2.52 billion, close to analysts’ estimates. Its GAAP profit of $1.72 per share was 20% above analysts’ consensus estimates.

Jack Henry (JKHY) Q4 CY2025 Highlights:

- Revenue: $619.3 million vs analyst estimates of $603.6 million (7.9% year-on-year growth, 2.6% beat)

- Pre-tax Profit: $164.2 million (26.5% margin)

- EPS (GAAP): $1.72 vs analyst estimates of $1.43 (20% beat)

- The company slightly lifted its revenue guidance for the full year to $2.52 billion at the midpoint from $2.50 billion

- EPS (GAAP) guidance for the full year is $6.67 at the midpoint, beating analyst estimates by 2.6%

- Market Capitalization: $12.97 billion

Company Overview

Founded in 1976 by two entrepreneurs who saw the need for specialized banking software in the early days of financial computing, Jack Henry & Associates (NASDAQ:JKHY) provides technology solutions that help banks and credit unions innovate, differentiate, and compete while serving the evolving needs of their accountholders.

Jack Henry operates at the intersection of banking and technology, offering a comprehensive suite of solutions primarily to community and regional financial institutions. The company's product portfolio includes core processing systems—the technological backbone that handles essential banking functions like processing deposits, loans, and maintaining customer information—along with more than 140 complementary products that extend these capabilities.

For banks, Jack Henry offers three distinct core systems: SilverLake for larger commercial banks, CIF 20/20 for mid-sized institutions, and Core Director for smaller banks. Credit unions are served by the company's Symitar platform, which has been implemented by approximately 720 credit unions ranging from small operations to those with billions in assets.

Financial institutions can either install these systems on-premise or leverage Jack Henry's private cloud environment, with most cloud clients signing six-year contracts. Beyond core processing, the company provides digital banking platforms, electronic payment solutions, fraud detection systems, and data analytics tools that help financial institutions deliver modern services to their customers.

A community bank might use Jack Henry's core system to process daily transactions while simultaneously employing its Banno Digital Platform to offer customers a competitive mobile banking experience and its payment solutions to facilitate real-time transfers. This integrated approach allows smaller financial institutions to compete with larger banks despite having fewer resources.

Jack Henry generates revenue through software licensing, ongoing maintenance fees, transaction-based payment processing fees, and implementation services. The company's business model emphasizes long-term client relationships, with a focus on cross-selling additional products to existing clients while continuously enhancing its offerings to address evolving regulatory requirements and technological trends.

4. Payment Processing

Payment processors facilitate transactions between merchants, consumers, and financial institutions. Growth comes from e-commerce expansion, declining cash usage globally, and value-added services beyond basic processing. Headwinds include margin pressure from merchant negotiating power, rapid technological change requiring investment, and emerging competition from technology companies entering the payments ecosystem.

Jack Henry & Associates competes with several major financial technology providers, including Fidelity National Information Services (NYSE:FIS), Fiserv (NASDAQ:FISV), Finastra (private), and Corelation (private), all of which offer core processing systems and complementary solutions to banks and credit unions.

5. Revenue Growth

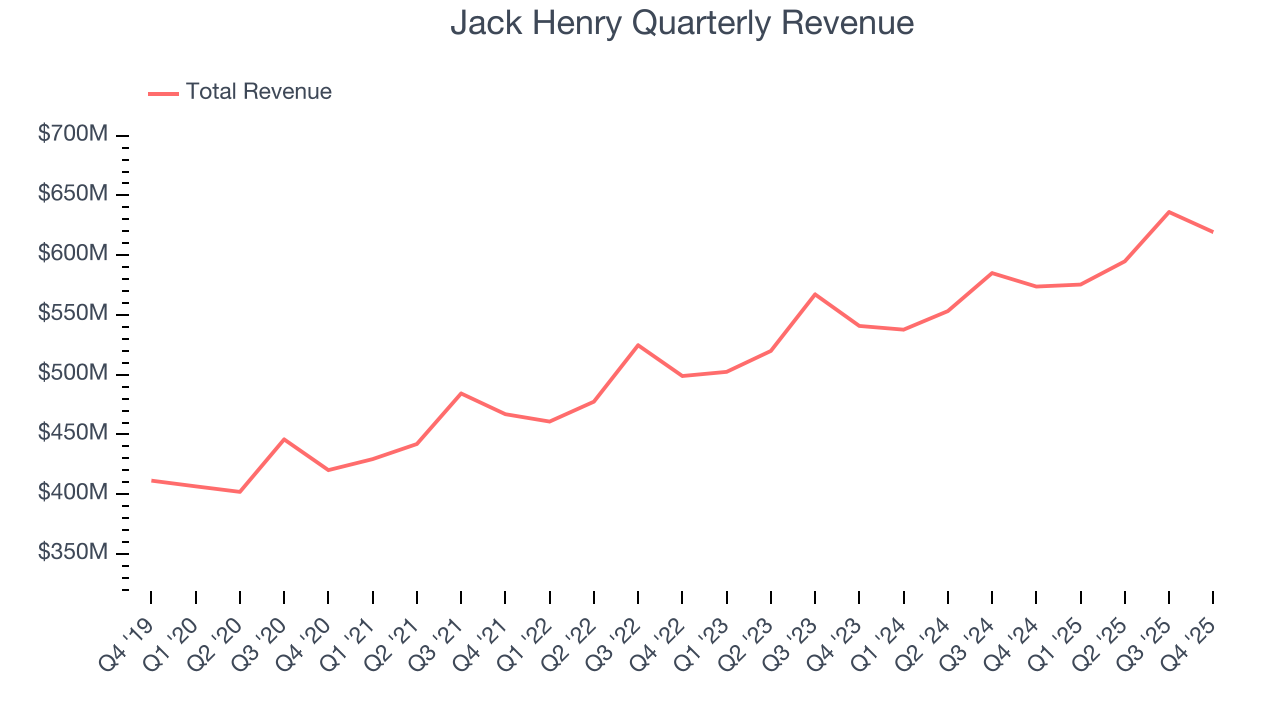

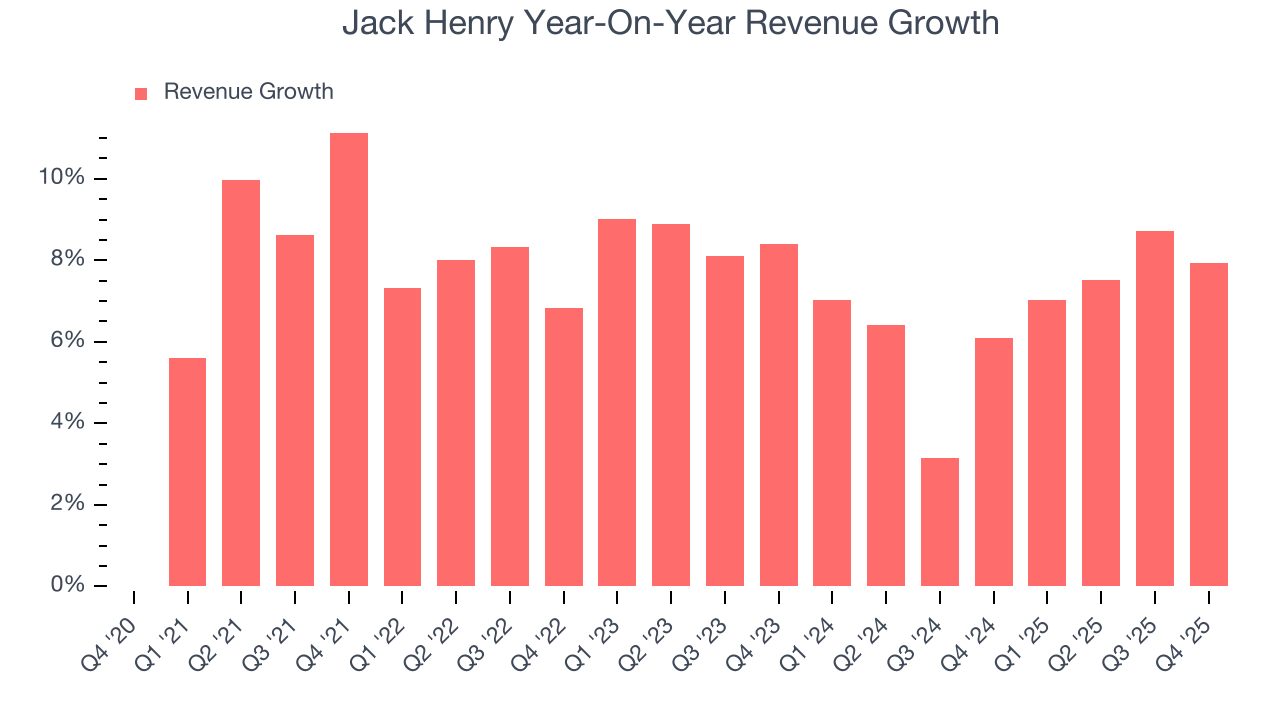

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Jack Henry grew its revenue at a decent 7.7% compounded annual growth rate. Its growth was slightly above the average financials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Jack Henry’s annualized revenue growth of 6.7% over the last two years aligns with its five-year trend, suggesting its demand was consistently weak.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

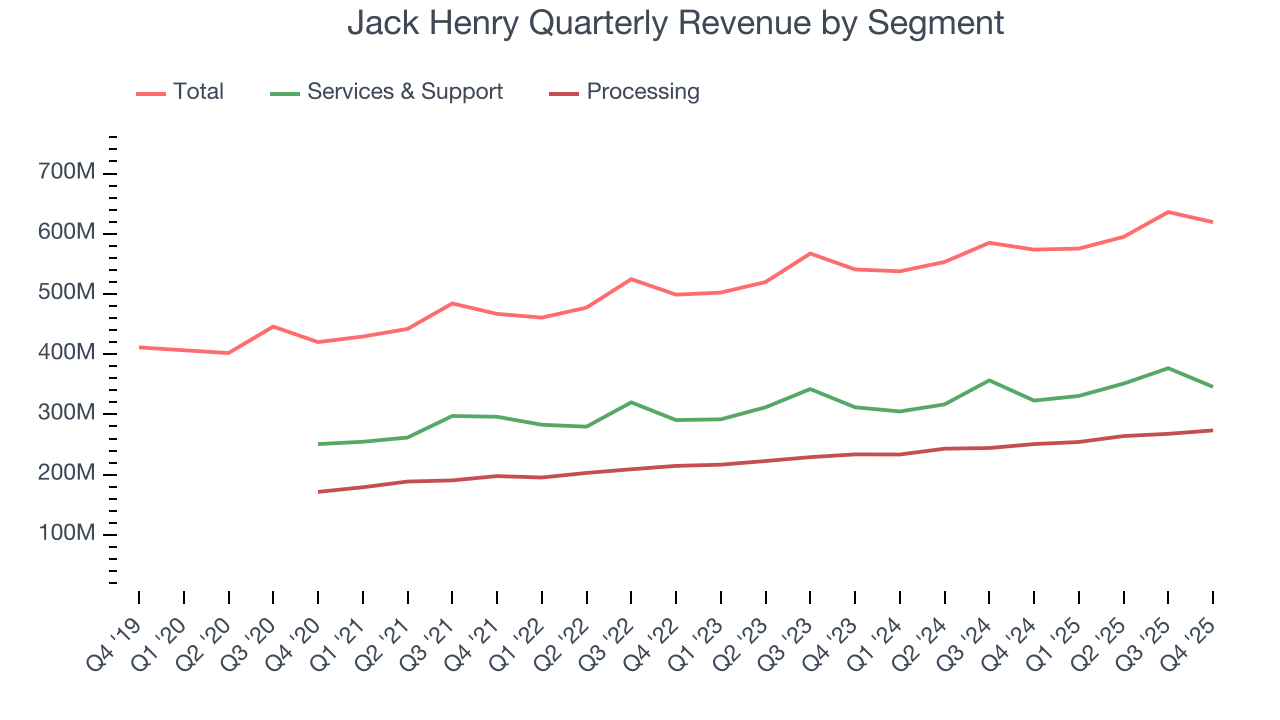

We can dig further into the company’s revenue dynamics by analyzing its most important segments, Services & Support and Processing, which are 55.8% and 44.2% of total revenue. Services & Support revenue grew by 6% and 5.7% annually over the past five and two years, respectively. At the same time, Processing revenue increased by 9.8% and 8.4% per year over the past five and two years, respectively. These results outperformed its total revenue.

This quarter, Jack Henry reported year-on-year revenue growth of 7.9%, and its $619.3 million of revenue exceeded Wall Street’s estimates by 2.6%.

6. Pre-Tax Profit Margin

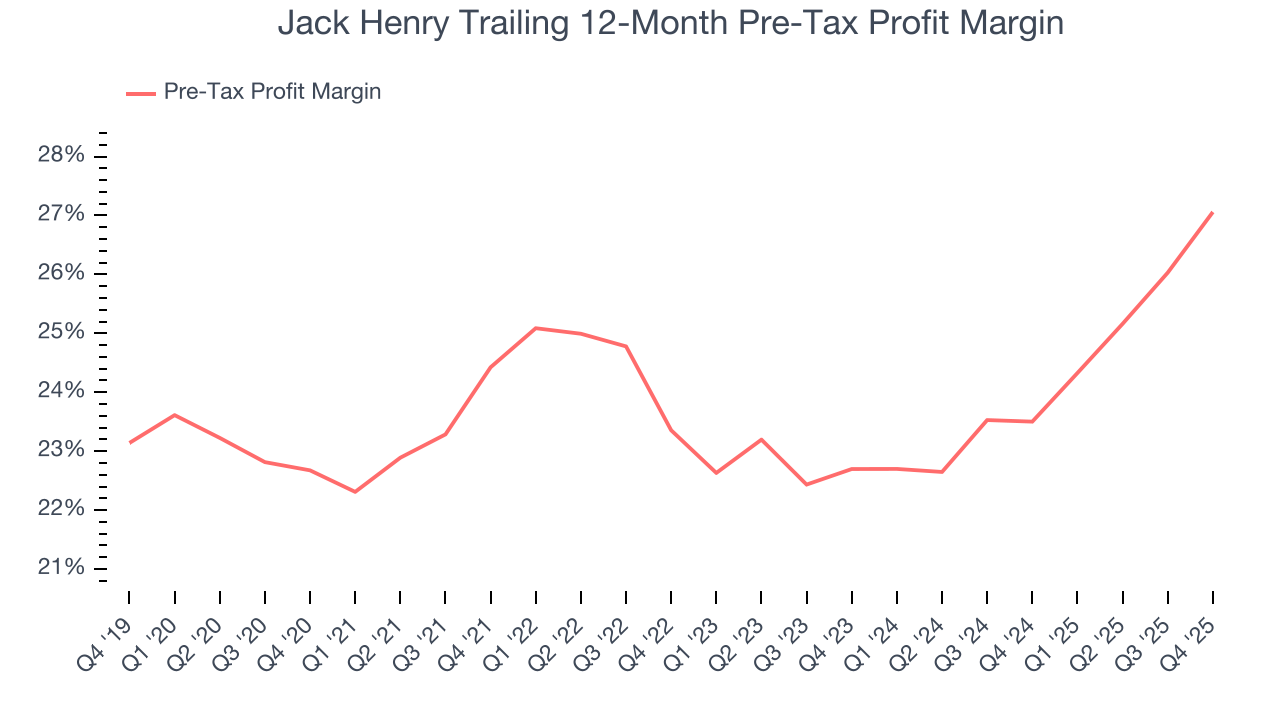

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For Payment Processing companies, we look at pre-tax profit rather than the operating margin that defines sectors such as consumer, tech, and industrials.

Interest income and expenses play a big role in financial institutions' profitability, so they should be factored into the definition of profit. Taxes, however, should not as they are largely out of a company's control. This is pre-tax profit by definition.

Over the last five years, Jack Henry’s pre-tax profit margin has fallen by 4.4 percentage points, going from 24.4% to 27.1%. It has also expanded by 4.4 percentage points on a two-year basis, showing its expenses have consistently grown at a slower rate than revenue. This typically signals prudent management.

Jack Henry’s pre-tax profit margin came in at 26.5% this quarter. This result was 4.3 percentage points better than the same quarter last year.

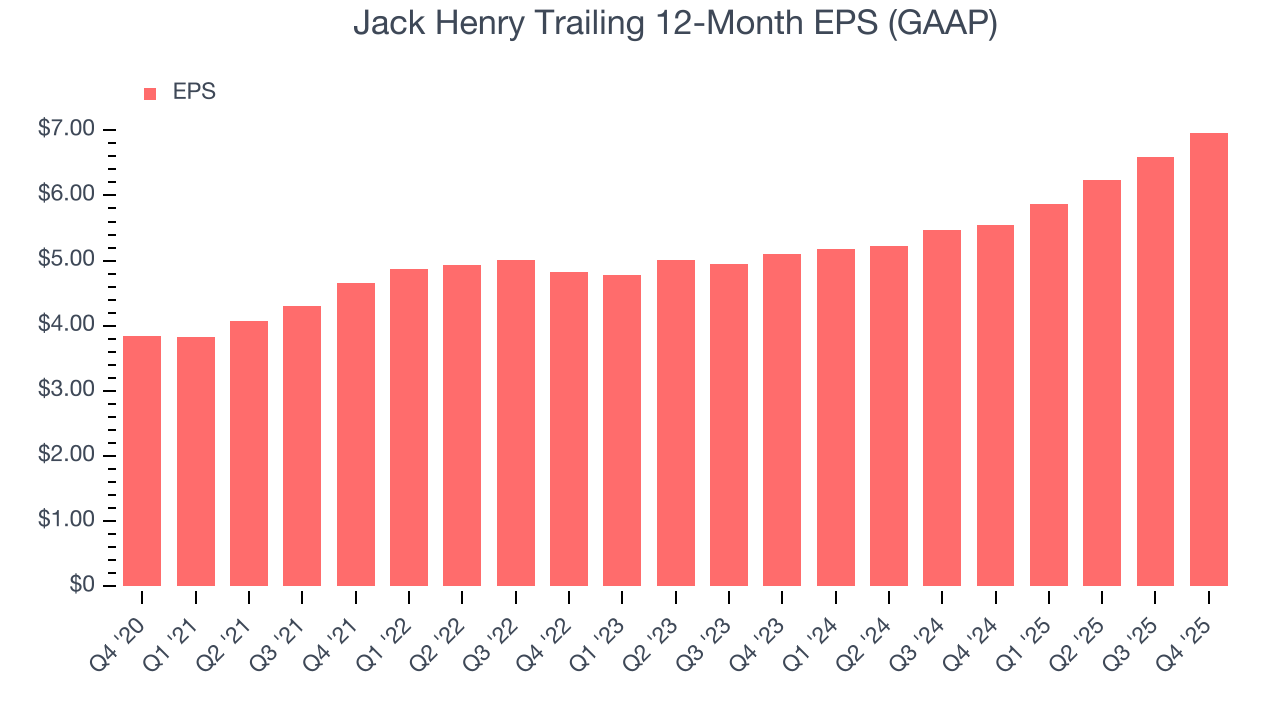

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Jack Henry’s EPS grew at a decent 12.6% compounded annual growth rate over the last five years, higher than its 7.7% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Jack Henry, its two-year annual EPS growth of 16.8% was higher than its five-year trend. This acceleration made it one of the faster-growing financials companies in recent history.

In Q4, Jack Henry reported EPS of $1.72, up from $1.34 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Jack Henry’s full-year EPS of $6.96 to shrink by 4.6%.

8. Return on Equity

Return on equity (ROE) measures how effectively banks generate profit from each dollar of shareholder equity - a critical funding source. High-ROE institutions typically compound shareholder wealth faster over time through retained earnings, share repurchases, and dividend payments.

Over the last five years, Jack Henry has averaged an ROE of 24.1%, exceptional for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired. This shows Jack Henry has a strong competitive moat.

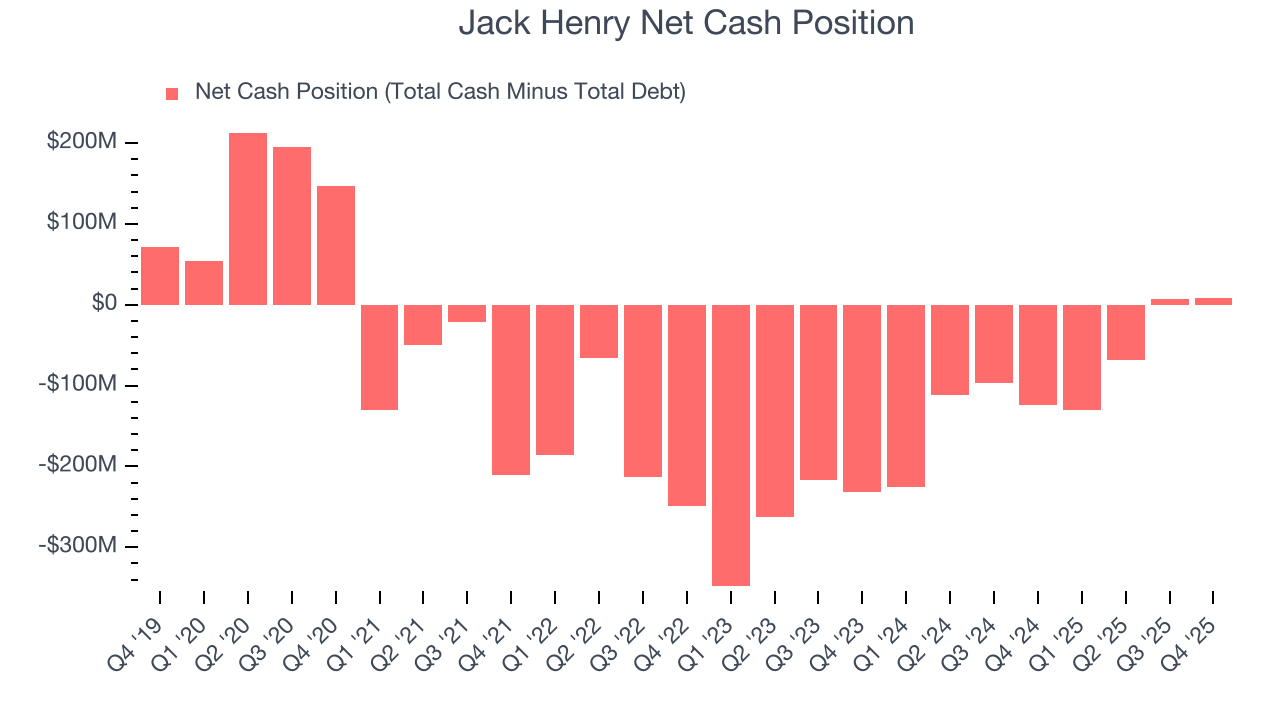

9. Balance Sheet Assessment

Jack Henry reported $28.22 million of cash and $20 million of debt on its balance sheet in the most recent quarter.

Given the company has more cash than debt, leverage is not an issue here.

10. Key Takeaways from Jack Henry’s Q4 Results

We were impressed by how significantly Jack Henry blew past analysts’ EBITDA expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Overall, we think this was a solid quarter with some key areas of upside. The stock traded up 2% to $169.37 immediately following the results.

11. Is Now The Time To Buy Jack Henry?

Updated: February 3, 2026 at 5:09 PM EST

Before making an investment decision, investors should account for Jack Henry’s business fundamentals and valuation in addition to what happened in the latest quarter.

First of all, the company’s revenue growth was decent over the last five years. On top of that, its stellar ROE suggests it has been a well-run company historically, and its expanding pre-tax profit margin shows the business has become more efficient.

Jack Henry’s P/E ratio based on the next 12 months is 25.3x. This valuation tells us it’s a bit of a market darling with a lot of good news priced in. This is a good one to add to your watchlist - there are better opportunities elsewhere at the moment.

Wall Street analysts have a consensus one-year price target of $200.13 on the company (compared to the current share price of $169.37).