Shift4 (FOUR)

Not many stocks excite us like Shift4. Its rapid revenue growth gives it operating leverage, making it more profitable as it expands.― StockStory Analyst Team

1. News

2. Summary

Why We Like Shift4

Starting as a payment gateway provider in 1999 and now processing over $200 billion in annual payment volume, Shift4 Payments (NYSE:FOUR) provides integrated payment processing solutions and software that help businesses accept and manage transactions across in-store, online, and mobile channels.

- Market share has increased this cycle as its 38.6% annual revenue growth over the last five years was exceptional

- Incremental sales significantly boosted profitability as its annual earnings per share growth of 67.3% over the last five years outstripped its revenue performance

- Acceptable return on equity suggests management generated shareholder value by investing in profitable projects

Shift4 sets the bar. The valuation seems reasonable based on its quality, and we think now is a prudent time to invest.

Why Is Now The Time To Buy Shift4?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Shift4?

Shift4 is trading at $57.43 per share, or 9.6x forward P/E. This valuation is attractive, and we think the stock is likely trading below its intrinsic value when considering its fundamentals.

We at StockStory love when high-quality companies go on sale because it enables investors to profit from earnings growth and a potential re-rating - the coveted “double play”.

3. Shift4 (FOUR) Research Report: Q3 CY2025 Update

Payment processing company Shift4 Payments (NYSE:FOUR) met Wall Streets revenue expectations in Q3 CY2025, with sales up 29.4% year on year to $1.18 billion. Its non-GAAP profit of $1.47 per share was in line with analysts’ consensus estimates.

Shift4 (FOUR) Q3 CY2025 Highlights:

Company Overview

Starting as a payment gateway provider in 1999 and now processing over $200 billion in annual payment volume, Shift4 Payments (NYSE:FOUR) provides integrated payment processing solutions and software that help businesses accept and manage transactions across in-store, online, and mobile channels.

Shift4's technology ecosystem extends beyond basic payment processing to include a proprietary gateway that connects with over 500 software platforms, point-of-sale systems, and business intelligence tools. The company serves merchants ranging from small local businesses to multinational enterprises, with particular strength in hospitality, food and beverage, entertainment venues, and retail sectors.

The company's revenue model primarily consists of processing fees charged as a percentage of payment volume or per transaction, supplemented by subscription fees for its software solutions. For merchants, Shift4 offers two main service options: gateway-only services that connect to third-party processors, or comprehensive end-to-end payment solutions that consolidate multiple payment functions through a single vendor.

Shift4's product portfolio includes SkyTab POS workstations for restaurants and retailers, VenueNext technology for stadiums and entertainment venues, Lighthouse business intelligence tools for analytics and customer engagement, and Shift4Shop for eCommerce. The company also offers specialized solutions like The Giving Block, which facilitates cryptocurrency donations to charities.

Following its acquisition of Finaro in 2023, Shift4 expanded its international presence, particularly in Europe and the UK. This acquisition added cross-border payment capabilities and banking services through Finaro's licensed credit institution in Malta, allowing Shift4 to offer merchants localized settlement in multiple currencies and access to alternative payment methods popular in international markets.

4. Payment Processing

Payment processors facilitate transactions between merchants, consumers, and financial institutions. Growth comes from e-commerce expansion, declining cash usage globally, and value-added services beyond basic processing. Headwinds include margin pressure from merchant negotiating power, rapid technological change requiring investment, and emerging competition from technology companies entering the payments ecosystem.

Shift4 Payments competes with traditional payment processors like Chase Paymentech, Elavon, FIS, Fiserv, and Global Payments, as well as integrated payment providers such as Adyen, Lightspeed POS, Shopify, Square, and Toast. In the hospitality gateway space, its main competitors include Elavon and FreedomPay.

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Luckily, Shift4’s revenue grew at an incredible 38.6% compounded annual growth rate over the last five years. Its growth surpassed the average financials company and shows its offerings resonate with customers, a great starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. Shift4’s annualized revenue growth of 27.2% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Shift4’s year-on-year revenue growth of 29.4% was excellent, and its $1.18 billion of revenue was in line with Wall Street’s estimates.

6. Pre-Tax Profit Margin

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For Payment Processing companies, we look at pre-tax profit rather than the operating margin that defines sectors such as consumer, tech, and industrials.

The pre-tax profit margin includes interest because it's central to how financial institutions generate revenue and manage costs. Tax considerations are excluded since they represent government policy rather than operational performance, giving investors a clearer view of business fundamentals.

Over the last four years, Shift4’s pre-tax profit margin has fallen by 13.9 percentage points, going from negative 7.4% to 6.5%. However, fixed cost leverage was muted more recently as the company’s pre-tax profit margin was flat on a two-year basis.

Shift4’s pre-tax profit margin came in at 5.1% this quarter. This result was 28.1 percentage points better than the same quarter last year.

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

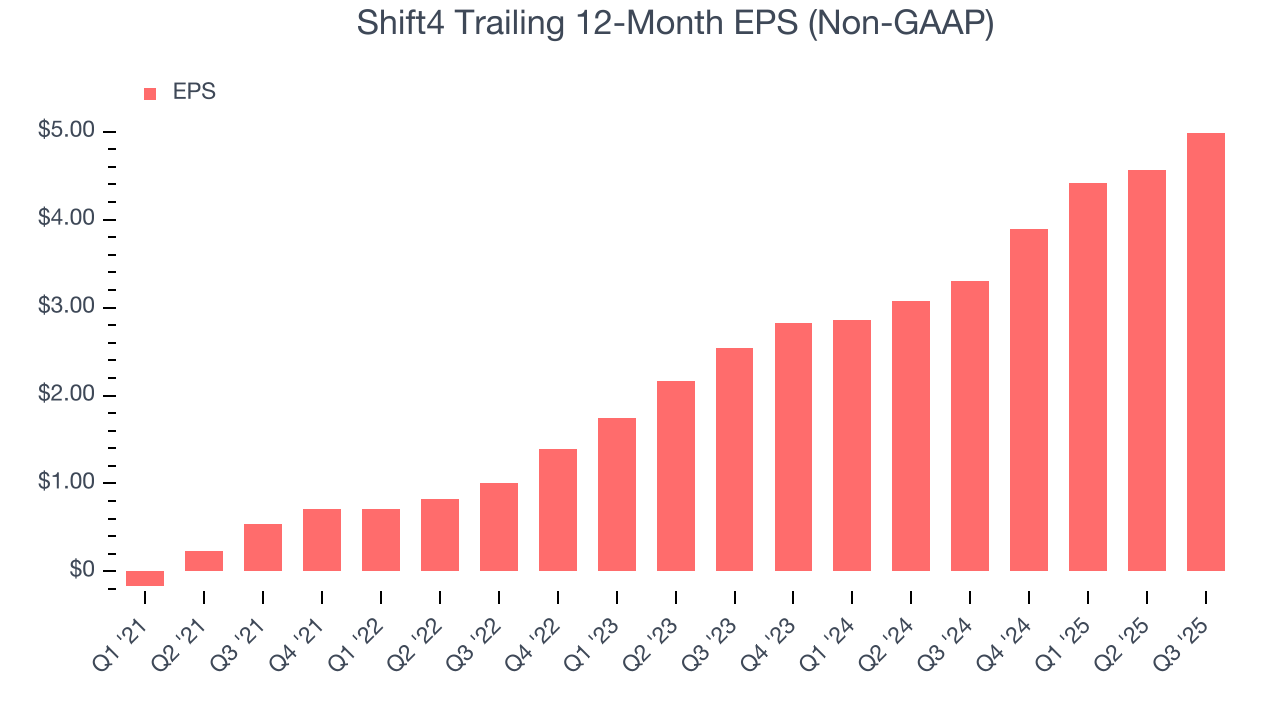

Shift4’s full-year EPS flipped from negative to positive over the last five years. This is a good sign and shows it’s at an inflection point.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

Shift4’s EPS grew at an astounding 40.2% compounded annual growth rate over the last two years, higher than its 27.2% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

In Q3, Shift4 reported adjusted EPS of $1.47, up from $1.04 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects Shift4’s full-year EPS of $4.99 to grow 22.8%.

8. Return on Equity

Return on equity (ROE) reveals the profit generated per dollar of shareholder equity, which represents a key source of bank funding. Banks maintaining elevated ROE levels tend to accelerate wealth creation for shareholders via earnings retention, buybacks, and distributions.

Over the last five years, Shift4 has averaged an ROE of 13.3%, healthy for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired. This shows Shift4 has a decent competitive moat.

9. Balance Sheet Assessment

The debt-to-equity ratio is a widely used measure to assess a company's balance sheet health. A higher ratio means that a business aggressively financed its growth with debt. This can result in higher earnings (if the borrowed funds are invested profitably) but also increases risk.

If debt levels are too high, there could be difficulties in meeting obligations, especially during economic downturns or periods of rising interest rates if the debt has variable-rate payments.

Shift4 currently has $4.79 billion of debt and $1.61 billion of shareholder's equity on its balance sheet, and over the past four quarters, has averaged a debt-to-equity ratio of 3.1×. We think this is safe and raises no red flags. In general, we’re comfortable with any ratio below 3.5× for a financials business.

10. Key Takeaways from Shift4’s Q3 Results

It was encouraging to see Shift4 beat analysts’ transaction volumes expectations this quarter. Despite this volume strength, revenue and EPS met expectations. The stock traded up 5.7% to $71 immediately after reporting.

11. Is Now The Time To Buy Shift4?

Updated: February 25, 2026 at 12:20 AM EST

Before making an investment decision, investors should account for Shift4’s business fundamentals and valuation in addition to what happened in the latest quarter.

There is a lot to like about Shift4. First of all, the company’s revenue growth was exceptional over the last five years. On top of that, its astounding EPS growth over the last five years shows its profits are trickling down to shareholders, and its expanding pre-tax profit margin shows the business has become more efficient.

Shift4’s P/E ratio based on the next 12 months is 9.6x. Looking across the spectrum of financials businesses, Shift4’s fundamentals clearly illustrate it’s a special business. We’re pounding the table at this bargain price.

Wall Street analysts have a consensus one-year price target of $88.39 on the company (compared to the current share price of $57.43), implying they see 53.9% upside in buying Shift4 in the short term.