Kimball Electronics (KE)

We wouldn’t buy Kimball Electronics. Its sales have underperformed and its low returns on capital show it has few growth opportunities.― StockStory Analyst Team

1. News

2. Summary

Why We Think Kimball Electronics Will Underperform

Founded in 1961, Kimball Electronics (NYSE:KE) is a global contract manufacturer specializing in electronics and manufacturing solutions for automotive, medical, and industrial markets.

- Products and services are facing significant end-market challenges during this cycle as sales have declined by 10.9% annually over the last two years

- Earnings per share have contracted by 5.6% annually over the last five years, a headwind for returns as stock prices often echo long-term EPS performance

- Projected sales for the next 12 months are flat and suggest demand will be subdued

Kimball Electronics’s quality doesn’t meet our bar. There are more promising prospects in the market.

Why There Are Better Opportunities Than Kimball Electronics

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Kimball Electronics

Kimball Electronics’s stock price of $26.52 implies a valuation ratio of 19.1x forward P/E. This multiple is lower than most industrials companies, but for good reason.

We’d rather pay up for companies with elite fundamentals than get a bargain on weak ones. Cheap stocks can be value traps, and as their performance deteriorates, they will stay cheap or get even cheaper.

3. Kimball Electronics (KE) Research Report: Q4 CY2025 Update

Global electronics contract manufacturer Kimball Electronics (NYSE:KE) reported Q4 CY2025 results beating Wall Street’s revenue expectations, but sales fell by 4.5% year on year to $341.3 million. The company’s full-year revenue guidance of $1.43 billion at the midpoint came in 1.9% above analysts’ estimates. Its non-GAAP profit of $0.28 per share was 9.8% above analysts’ consensus estimates.

Kimball Electronics (KE) Q4 CY2025 Highlights:

- Revenue: $341.3 million vs analyst estimates of $339.3 million (4.5% year-on-year decline, 0.6% beat)

- Adjusted EPS: $0.28 vs analyst estimates of $0.26 (9.8% beat)

- The company lifted its revenue guidance for the full year to $1.43 billion at the midpoint from $1.4 billion, a 2.1% increase

- Operating Margin: 3.2%, in line with the same quarter last year

- Market Capitalization: $755.9 million

Company Overview

Founded in 1961, Kimball Electronics (NYSE:KE) is a global contract manufacturer specializing in electronics and manufacturing solutions for automotive, medical, and industrial markets.

The company operates in the electronics manufacturing services industry, focusing on three primary end markets: automotive, medical, and industrial. In the automotive sector, Kimball Electronics produces electronic components for applications such as steering, braking, and safety systems. The medical division focuses on devices and equipment for various healthcare applications, while the industrial segment covers climate control systems, industrial controls, and automation equipment.

Kimball Electronics's services span the entire product lifecycle, including design engineering, manufacturing, testing, distribution, and aftermarket support. Kimball Electronics operates manufacturing facilities across several countries, including the United States, China, Mexico, Poland, Romania, Thailand, and Vietnam.

4. Electrical Systems

Like many equipment and component manufacturers, electrical systems companies are buoyed by secular trends such as connectivity and industrial automation. More specific pockets of strong demand include Internet of Things (IoT) connectivity and the 5G telecom upgrade cycle, which can benefit companies whose cables and conduits fit those needs. But like the broader industrials sector, these companies are also at the whim of economic cycles. Interest rates, for example, can greatly impact projects that drive demand for these products.

Competitors of Kimball Electronics include Plexus Corp. (NASDAQ:PLXS), Benchmark Electronics, Inc. (NYSE:BHE), and Celestica Inc. (NYSE:CLS).

5. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, Kimball Electronics grew its sales at a sluggish 3.5% compounded annual growth rate. This was below our standard for the industrials sector and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Kimball Electronics’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 10.9% annually.

This quarter, Kimball Electronics’s revenue fell by 4.5% year on year to $341.3 million but beat Wall Street’s estimates by 0.6%.

Looking ahead, sell-side analysts expect revenue to decline by 1.3% over the next 12 months. While this projection is better than its two-year trend, it’s tough to feel optimistic about a company facing demand difficulties.

6. Gross Margin & Pricing Power

Gross profit margin is a critical metric to track because it sheds light on its pricing power, complexity of products, and ability to procure raw materials, equipment, and labor.

Kimball Electronics has bad unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 8% gross margin over the last five years. Said differently, Kimball Electronics had to pay a chunky $91.97 to its suppliers for every $100 in revenue.

This quarter, Kimball Electronics’s gross profit margin was 8.2%, up 1.6 percentage points year on year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

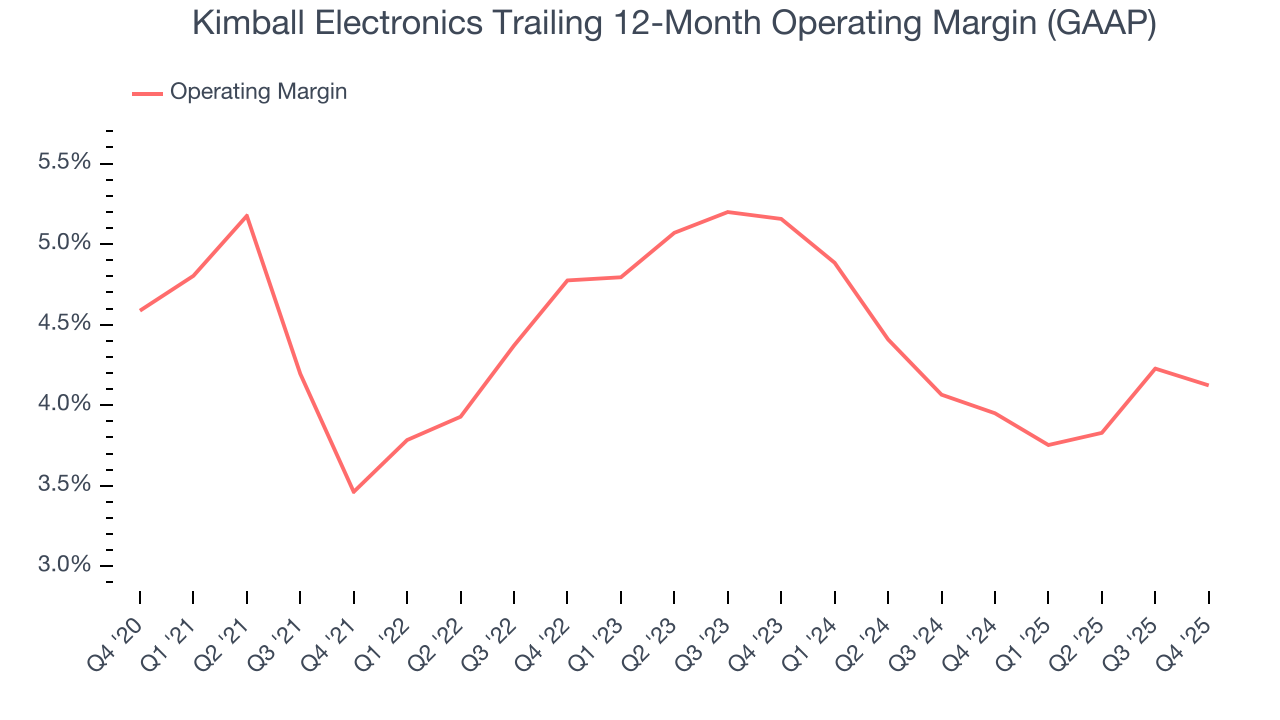

7. Operating Margin

Kimball Electronics’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 4.4% over the last five years. This profitability was lousy for an industrials business and caused by its suboptimal cost structureand low gross margin.

Looking at the trend in its profitability, Kimball Electronics’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q4, Kimball Electronics generated an operating margin profit margin of 3.2%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

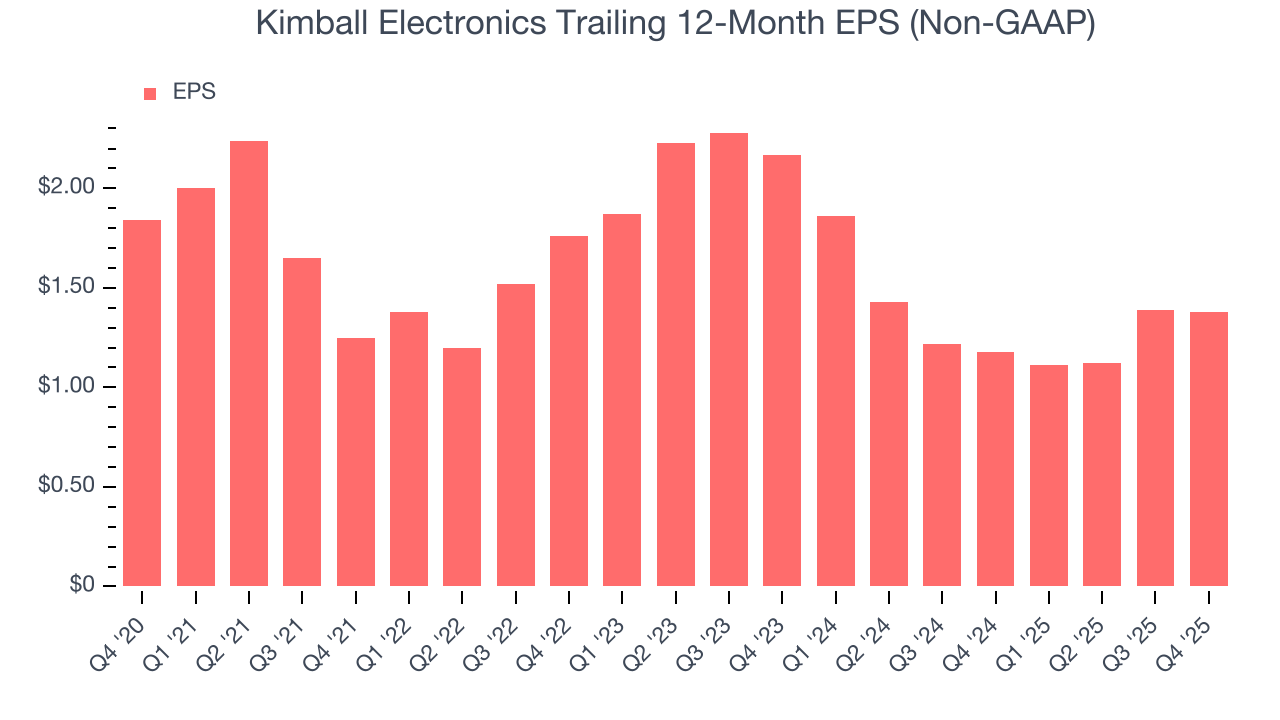

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Kimball Electronics, its EPS declined by 5.6% annually over the last five years while its revenue grew by 3.5%. However, its operating margin didn’t change during this time, telling us that non-fundamental factors such as interest and taxes affected its ultimate earnings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Kimball Electronics, its two-year annual EPS declines of 20.3% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q4, Kimball Electronics reported adjusted EPS of $0.28, in line with the same quarter last year. This print beat analysts’ estimates by 9.8%. Over the next 12 months, Wall Street expects Kimball Electronics’s full-year EPS of $1.38 to shrink by 1.8%.

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Kimball Electronics broke even from a free cash flow perspective over the last five years, giving the company limited opportunities to return capital to shareholders.

Taking a step back, an encouraging sign is that Kimball Electronics’s margin expanded by 6.9 percentage points during that time. The company’s improvement shows it’s heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability was flat.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Kimball Electronics historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 9.1%, somewhat low compared to the best industrials companies that consistently pump out 20%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Kimball Electronics’s ROIC averaged 1.4 percentage point decreases each year over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

11. Balance Sheet Assessment

Kimball Electronics reported $77.85 million of cash and $153.8 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $70.71 million of EBITDA over the last 12 months, we view Kimball Electronics’s 1.1× net-debt-to-EBITDA ratio as safe. We also see its $9.35 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Kimball Electronics’s Q4 Results

It was great to see Kimball Electronics’s full-year revenue guidance top analysts’ expectations. We were also glad its EPS outperformed Wall Street’s estimates. Overall, we think this was a decent quarter with some key metrics above expectations. The stock remained flat at $30.70 immediately following the results.

13. Is Now The Time To Buy Kimball Electronics?

Updated: February 25, 2026 at 10:53 PM EST

Before making an investment decision, investors should account for Kimball Electronics’s business fundamentals and valuation in addition to what happened in the latest quarter.

We see the value of companies helping their customers, but in the case of Kimball Electronics, we’re out. To kick things off, its revenue growth was weak over the last five years, and analysts expect its demand to deteriorate over the next 12 months. While its rising cash profitability gives it more optionality, the downside is its projected EPS for the next year is lacking. On top of that, its declining EPS over the last five years makes it a less attractive asset to the public markets.

Kimball Electronics’s P/E ratio based on the next 12 months is 19.1x. While this valuation is fair, the upside isn’t great compared to the potential downside. There are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $33 on the company (compared to the current share price of $26.52).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.