Kulicke and Soffa (KLIC)

We wouldn’t buy Kulicke and Soffa. Its low returns on capital and plummeting sales suggest it struggles to generate demand and profits, a red flag.― StockStory Analyst Team

1. News

2. Summary

Why We Think Kulicke and Soffa Will Underperform

Headquartered in Singapore, Kulicke & Soffa (NASDAQ: KLIC) is a provider of production equipment and tools used to assemble semiconductor devices

- Earnings per share decreased by more than its revenue over the last five years, showing each sale was less profitable

- Historical operating margin losses have deepened over the last five years, hinting at increased competitive pressures and an inefficient cost structure

- Customers postponed purchases of its products and services this cycle as its revenue declined by 1.6% annually over the last five years

Kulicke and Soffa’s quality isn’t great. We’re looking for better stocks elsewhere.

Why There Are Better Opportunities Than Kulicke and Soffa

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Kulicke and Soffa

Kulicke and Soffa is trading at $58.48 per share, or 35x forward P/E. This multiple expensive for its subpar fundamentals.

Paying up for elite businesses with strong earnings potential is better than investing in lower-quality companies with shaky fundamentals. That’s how you avoid big downside over the long term.

3. Kulicke and Soffa (KLIC) Research Report: Q4 CY2025 Update

Semiconductor production equipment company Kulicke & Soffa (NASDAQ: KLIC) reported Q4 CY2025 results topping the market’s revenue expectations, with sales up 20.2% year on year to $199.6 million. On top of that, next quarter’s revenue guidance ($230 million at the midpoint) was surprisingly good and 22.6% above what analysts were expecting. Its non-GAAP profit of $0.44 per share was 33.3% above analysts’ consensus estimates.

Kulicke and Soffa (KLIC) Q4 CY2025 Highlights:

- Revenue: $199.6 million vs analyst estimates of $190 million (20.2% year-on-year growth, 5% beat)

- Adjusted EPS: $0.44 vs analyst estimates of $0.33 (33.3% beat)

- Adjusted Operating Income: $25.15 million vs analyst estimates of $18.3 million (12.6% margin, 37.4% beat)

- Revenue Guidance for Q1 CY2026 is $230 million at the midpoint, above analyst estimates of $187.6 million

- Adjusted EPS guidance for Q1 CY2026 is $0.67 at the midpoint, above analyst estimates of $0.35

- Operating Margin: 8.9%, down from 52.2% in the same quarter last year

- Free Cash Flow was -$11.61 million, down from $8.7 million in the same quarter last year

- Inventory Days Outstanding: 160, up from 152 in the previous quarter

- Market Capitalization: $2.99 billion

Company Overview

Headquartered in Singapore, Kulicke & Soffa (NASDAQ: KLIC) is a provider of production equipment and tools used to assemble semiconductor devices

Kulicke & Soffa was founded in 1951 by Frederick Kulicke Jr. and Albert Soffa, and the company was incorporated in 1956. With a 1971 NASDAQ listing, Kulicke & Soffa became one of the first technology companies on the exchange.

The company’s key products are equipment and tools used in the interconnect processes of semiconductor manufacturing. The interconnect process is the wiring system that connects transistors and other components on a chip. This step in manufacturing is important because these connections can be a limiting factor to chip performance, as electrical resistance of wires increases as they are made smaller and thinner to accommodate more transistors.

KLIC’s products therefore aim to improve performance and increase power efficiency amid smaller form factors. One example is the company’s ball bonder, which enables precise electrical interconnections between a bare silicon die and the lead frame of the package it is placed in during semiconductor fabrication. Another example is the company’s wedge bonder, which uses ultrasonic power and force to form resilient bonds.

Competitors offering semiconductor equipment and packaging materials products include ASM Pacific Technology (SEHK:522), BE Semiconductor Industries (ENXTAM:BESI), and Hanwha Precision Machinery.

4. Revenue Growth

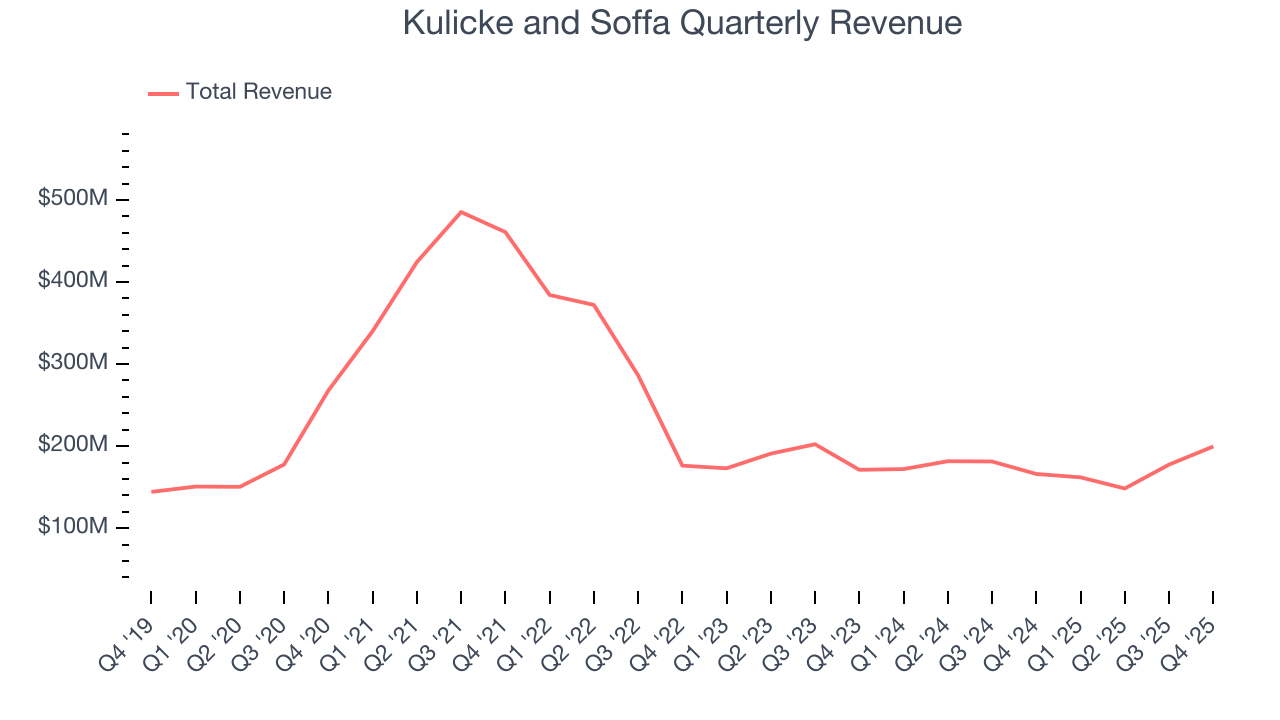

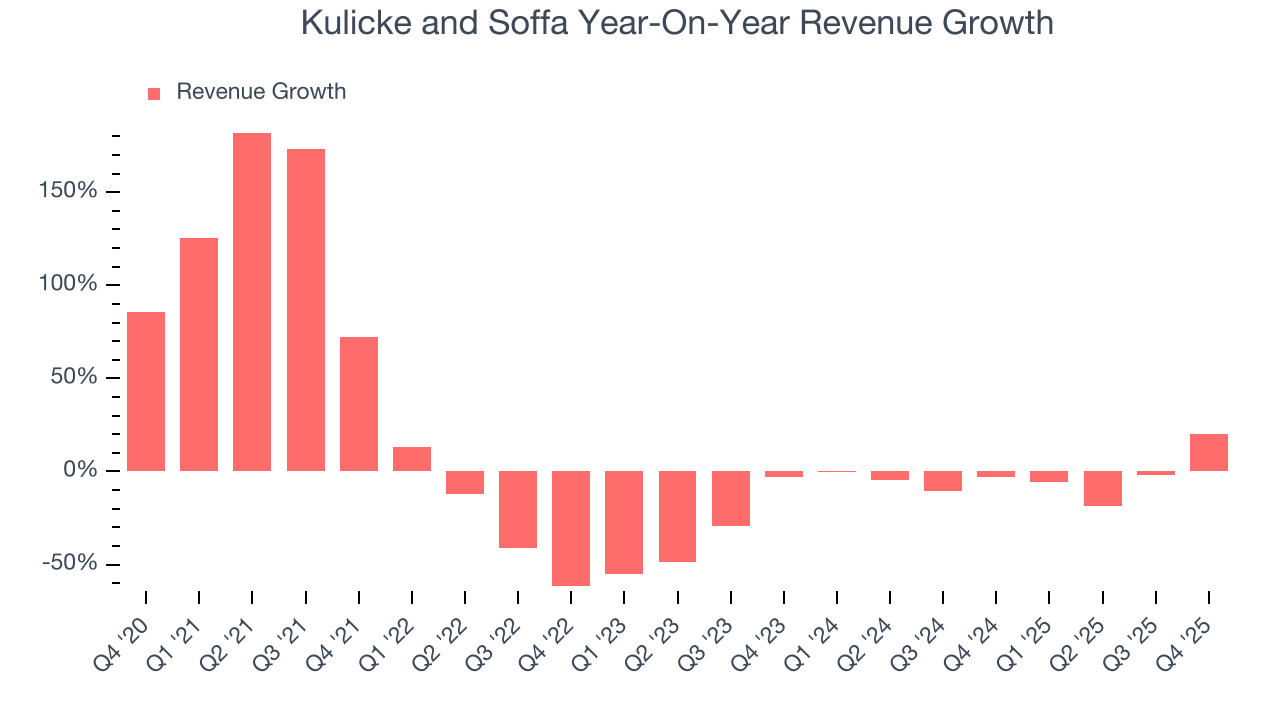

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Kulicke and Soffa’s demand was weak and its revenue declined by 1.6% per year. This wasn’t a great result and is a sign of poor business quality. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

We at StockStory place the most emphasis on long-term growth, but within semiconductors, a half-decade historical view may miss new demand cycles or industry trends like AI. Kulicke and Soffa’s recent performance shows its demand remained suppressed as its revenue has declined by 3.4% annually over the last two years.

This quarter, Kulicke and Soffa reported robust year-on-year revenue growth of 20.2%, and its $199.6 million of revenue topped Wall Street estimates by 5%. Adding to the positive news, Kulicke and Soffa’s growth inflected positively this quarter, indicating that the recent cyclical downturn is likely in the rearview mirror. Company management is currently guiding for a 42% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 16.3% over the next 12 months, an improvement versus the last two years. This projection is healthy and implies its newer products and services will catalyze better top-line performance.

5. Product Demand & Outstanding Inventory

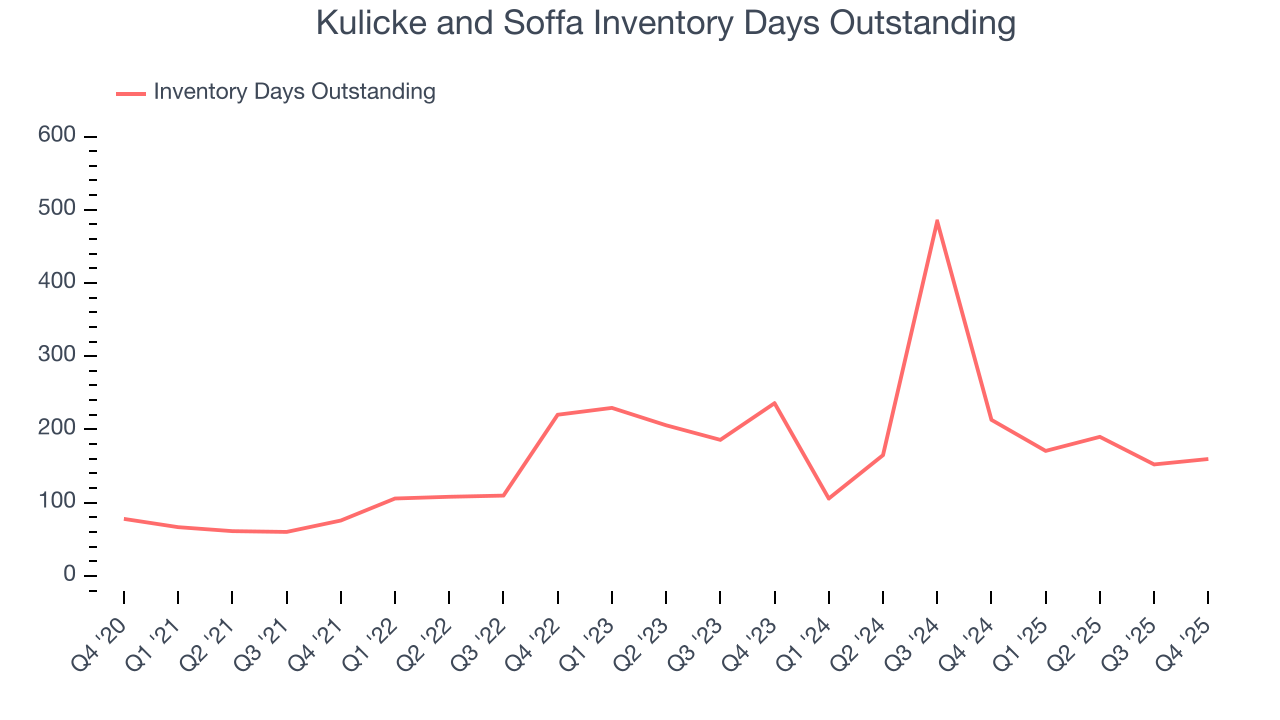

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business’ capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, Kulicke and Soffa’s DIO came in at 160, which is 6 days below its five-year average. These numbers show that despite the recent increase, there’s no indication of an excessive inventory buildup.

6. Gross Margin & Pricing Power

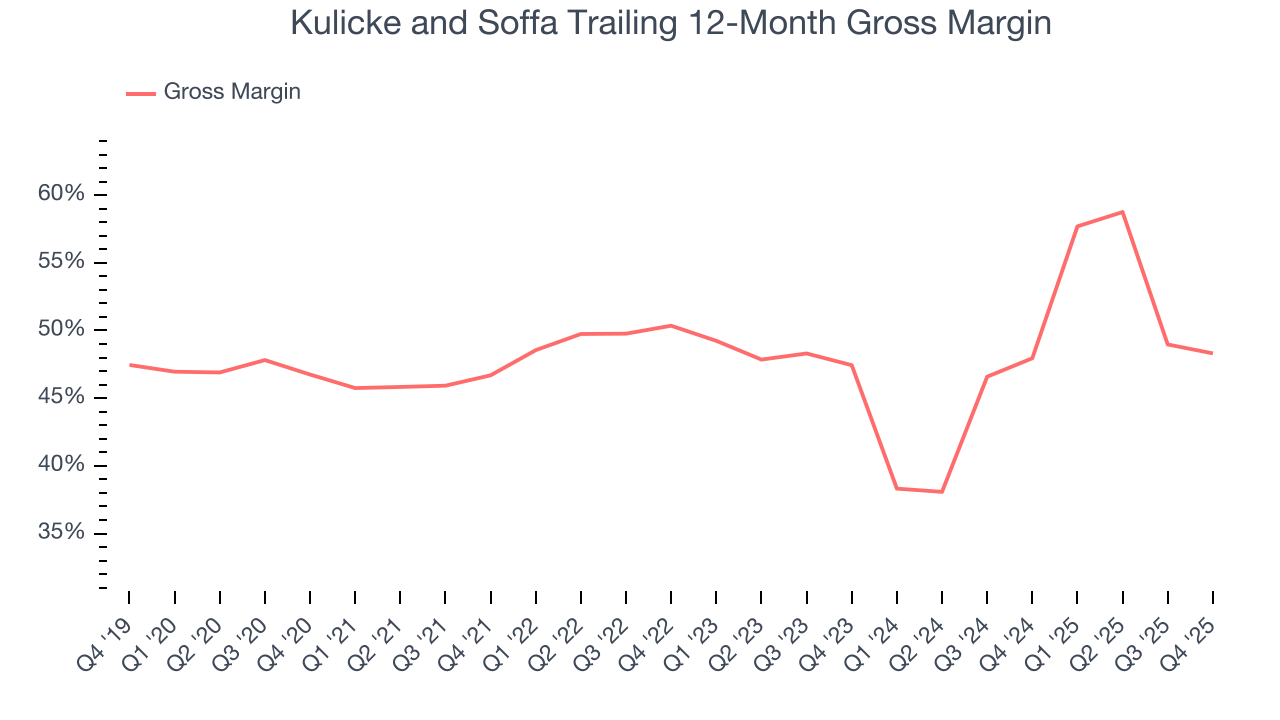

Gross profit margin is a key metric to track because it shows how much money a semiconductor company gets to keep after paying for its raw materials, manufacturing, and other input costs.

Kulicke and Soffa’s gross margin is slightly below the average semiconductor company, indicating its products aren’t as mission-critical as its competitors. As you can see below, it averaged a 48.1% gross margin over the last two years. That means Kulicke and Soffa paid its suppliers a lot of money ($51.87 for every $100 in revenue) to run its business.

In Q4, Kulicke and Soffa produced a 49.6% gross profit margin, marking a 2.9 percentage point decrease from 52.4% in the same quarter last year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

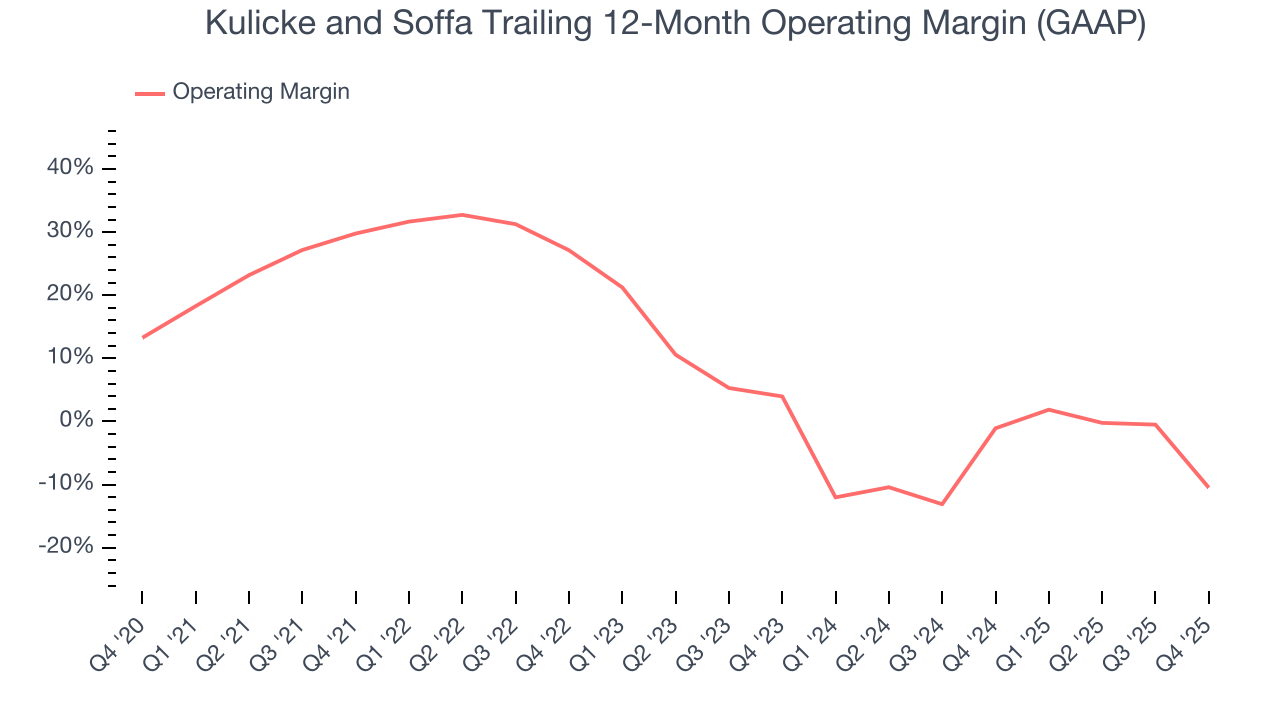

7. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Although Kulicke and Soffa was profitable this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 5.7% over the last two years. Unprofitable semiconductor companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

Analyzing the trend in its profitability, Kulicke and Soffa’s operating margin decreased by 40.3 percentage points over the last five years. Kulicke and Soffa’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

This quarter, Kulicke and Soffa generated an operating margin profit margin of 8.9%, down 43.2 percentage points year on year. Since Kulicke and Soffa’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

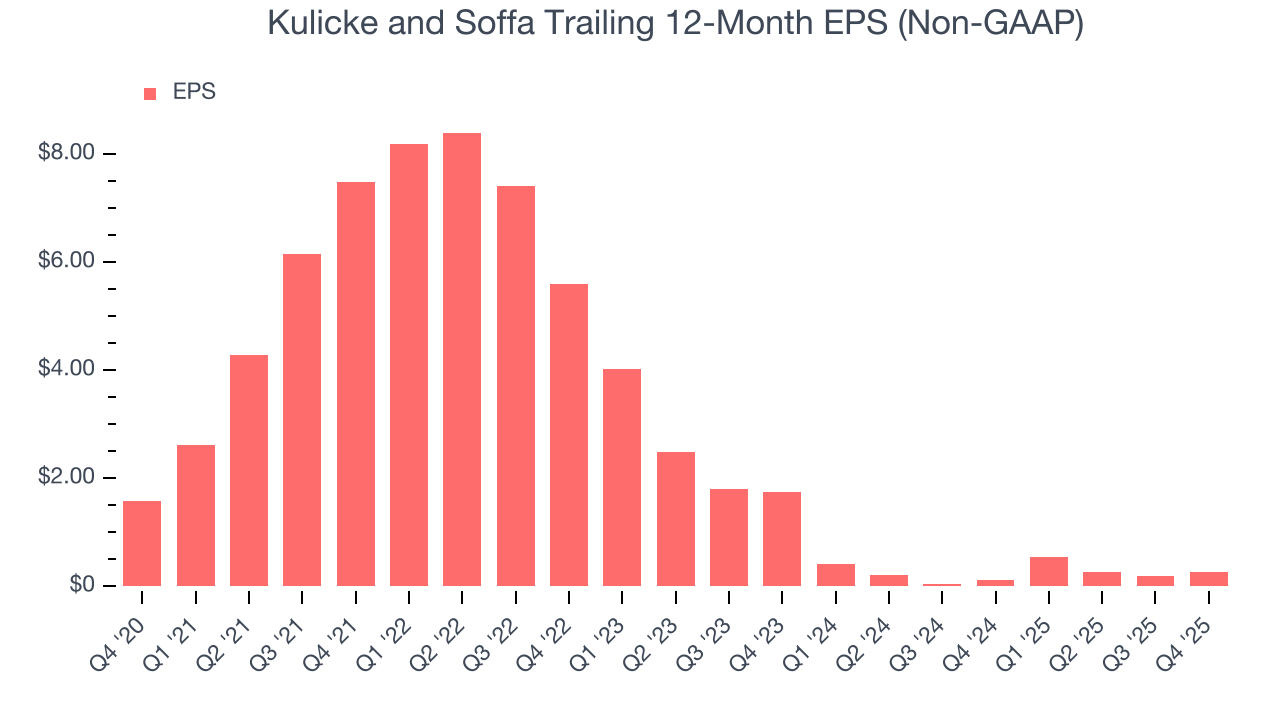

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Kulicke and Soffa, its EPS declined by 29.8% annually over the last five years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

Diving into the nuances of Kulicke and Soffa’s earnings can give us a better understanding of its performance. As we mentioned earlier, Kulicke and Soffa’s operating margin declined by 40.3 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, Kulicke and Soffa reported adjusted EPS of $0.44, up from $0.37 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Kulicke and Soffa’s full-year EPS of $0.27 to grow 505%.

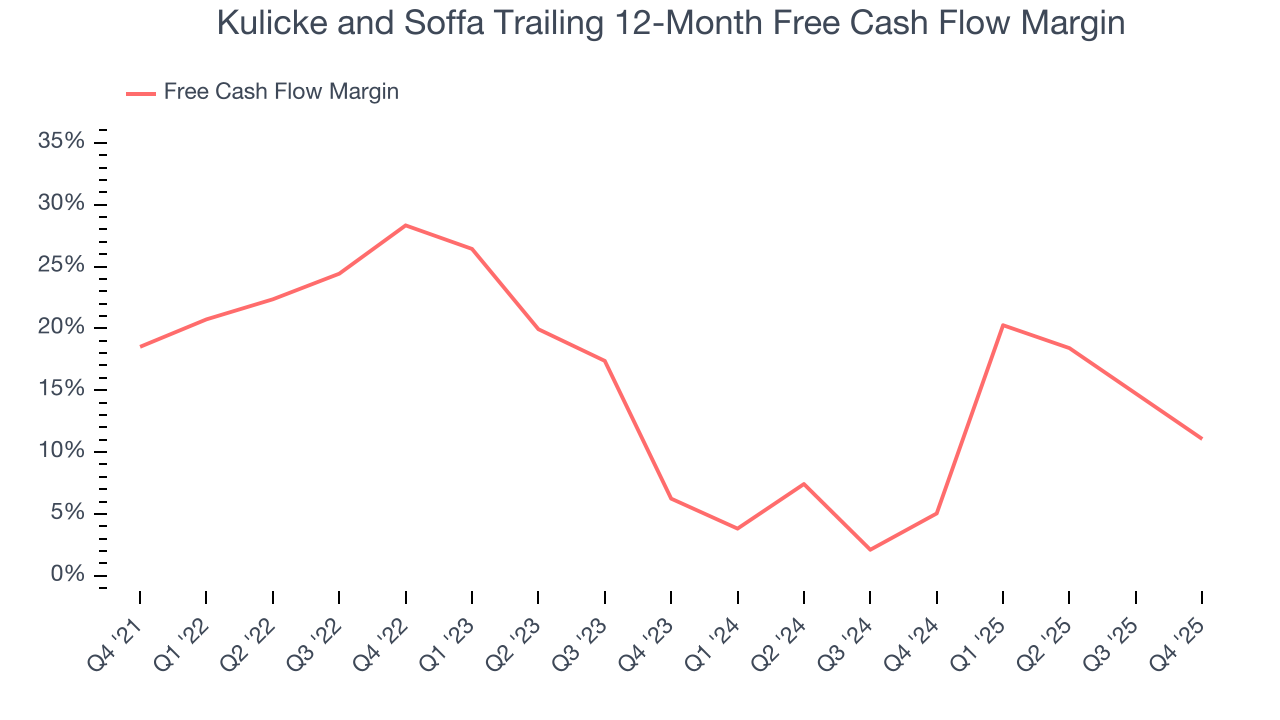

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Kulicke and Soffa has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 8%, lousy for a semiconductor business.

Taking a step back, we can see that Kulicke and Soffa’s margin dropped by 7.5 percentage points over the last five years. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. Almost any movement in the wrong direction is undesirable because of its relatively low cash conversion. If the longer-term trend returns, it could signal it’s in the middle of a big investment cycle.

Kulicke and Soffa burned through $11.61 million of cash in Q4, equivalent to a negative 5.8% margin. The company’s cash flow turned negative after being positive in the same quarter last year, suggesting its historical struggles have dragged on.

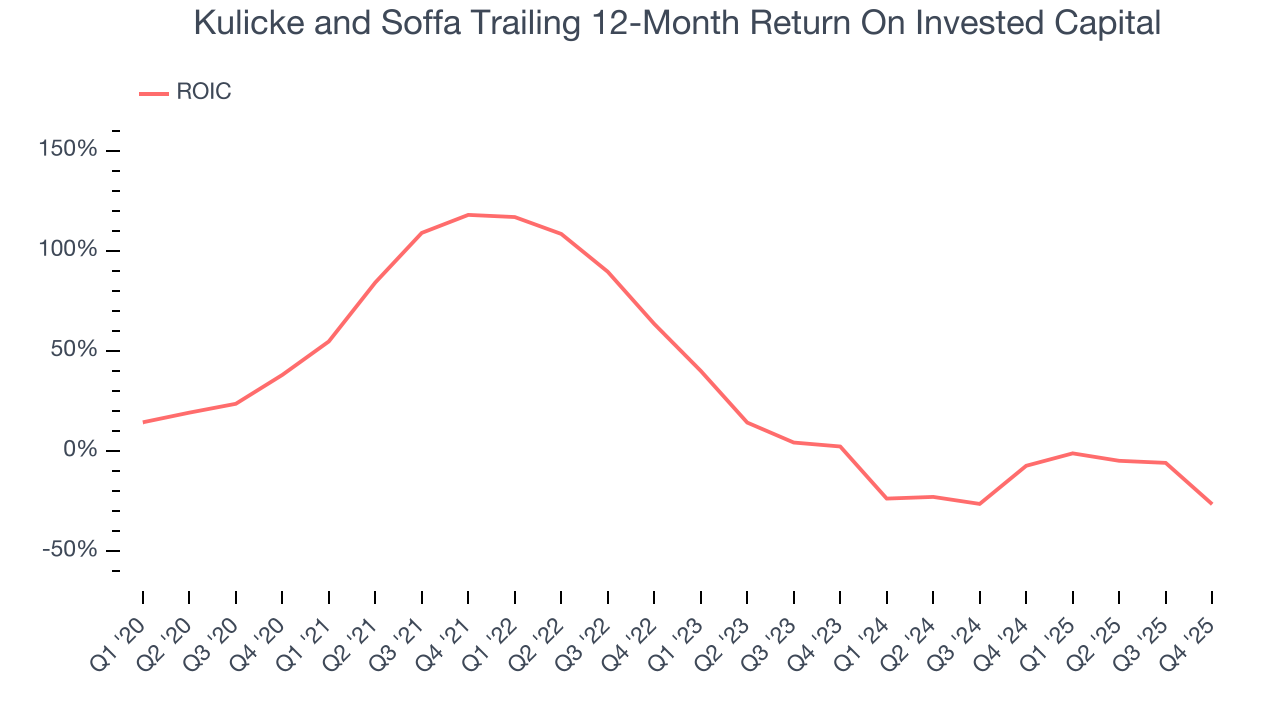

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Kulicke and Soffa historically did a mediocre job investing in profitable growth initiatives. Its four-year average ROIC was 8%, somewhat low compared to the best semiconductor companies that consistently pump out 35%+.

11. Key Takeaways from Kulicke and Soffa’s Q4 Results

It was good to see Kulicke and Soffa beat analysts’ EPS expectations this quarter. We were also excited its adjusted operating income outperformed Wall Street’s estimates by a wide margin. On the other hand, its inventory levels increased. Zooming out, we think this quarter featured some important positives. The stock traded up 3.5% to $57.60 immediately after reporting.

12. Is Now The Time To Buy Kulicke and Soffa?

Updated: February 4, 2026 at 9:38 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Kulicke and Soffa.

We cheer for all companies solving complex technology issues, but in the case of Kulicke and Soffa, we’ll be cheering from the sidelines. For starters, its revenue has declined over the last five years. And while its projected EPS for the next year implies the company’s fundamentals will improve, the downside is its declining EPS over the last five years makes it a less attractive asset to the public markets. On top of that, its declining operating margin shows the business has become less efficient.

Kulicke and Soffa’s P/E ratio based on the next 12 months is 35x. This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think there are better opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $52.67 on the company (compared to the current share price of $58.48), implying they don’t see much short-term potential in Kulicke and Soffa.